Ag Economists Monthly Monitor

The Ag Economists’ Monthly Monitor survey, administered by Farm Journal, is sent monthly to agricultural economists nationwide to gauge perspectives on important drivers of agriculture.

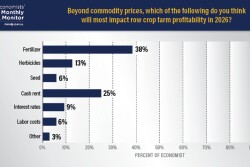

The December Ag Economists’ Monthly Monitor shows the farm economy will likely stay strained into 2026. As crops face tight margins, biofuels policy — especially E15 and biomass-based diesel — could influence recovery.

With a New World screwworm case now less than 200 miles from the U.S. border, Seth Meyer says the growing threat adds risk and uncertainty for cattle producers making critical calving-season decisions.

Research and polling suggests the money will go toward operating costs, paying down debt, and not be eyed for machinery purchases.

China’s pledge to buy 12 MMT of U.S. soybeans is facing questions over timing, storage capacity and price competitiveness, leaving markets uncertain whether the full promise can be met before year-end.

Wheat acres are expected to decline, and little change is anticipated for cotton acres after a drop in 2025.

Going into the final weeks of the year, many growers across the country are shouldering significant financial strain from land rent payments, rising input costs, and efforts to stay in business and viable until commodity prices improve.

USDA says anticipated trade aid could be announced the first week of December, but ag economists are split on whether payments would provide relief or worsen lingering risks such as high input costs and market distortions.

Although warning signs are emerging, economists say record-high beef prices could hold for up to two more years. Tight supplies and strong demand continue to drive the market, but economists and producers are apprehensive with talks of reopening the border.

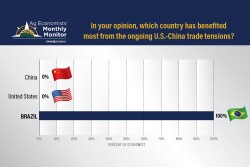

Beijing’s refusal to buy American and its pivot to Brazil could be less about economics and more to do with politics. “It’s a calculated decision about control and national leverage, not about getting the cheapest beans,” says one ag economist.

Here’s how accelerated consolidation could change the way agriculture looks in the future.