As October draws to a close, U.S. officials are reportedly going to meet with Mexican counterparts this week to talk about reopening the border. The possibility of trade resuming, coupled with President Donald Trump’s comments on lowering beef prices and Agriculture Secretary Brooke Rollins’ announcement to “fortify the beef industry,” sent the cattle market spiraling in recent days.

Despite the downturn, the fundamentals haven’t changed: reduced supply and strong consumer demand are fueling record-high market prices.

“The reduction in available supply and robust beef demand to-date has clearly provided price support,” says Glynn Tonsor, Kansas State University professor of agricultural economics. “Tied to that is the biggest risk in my opinion — beef demand. Anything that erodes beef demand strength, most likely macroeconomic and consumer income in nature in my opinion, will put downward pressure on cattle of all weight classes.”

Tonsor says he never gave $4 much thought until the past couple of years.

“If we adjust for inflation or consider production costs, $4 feeders aren’t what they used to be. It takes $4-plus feeders to generate the net returns we used to get from lower prices,” he explains. “These are profitable prices for ranchers — and it’s about time.”

Tonsor predicts feeder cattle prices to continue under current conditions but does not predict increased profitability due to increasing operating costs.

“The 2025 bull market has been exceptional by every measure,” summarizes Lance Zimmerman, RaboResearch Food & Agribusiness senior beef industry analyst. “500-lb. steer prices are now more than 50% higher than last year, and 800-lb. steer prices are nearly there at just under a 50% price increase year-over-year.”

As a frame of reference, the CME feeder cattle cash index, which captures the average 700 lb. to 899 lb. steer price, averaged $367.08/cwt. the week of Oct. 20. This fall, livestock auction markets across the country have reported lightweight feeder cattle surpassing the $4 mark.

“I think it is entirely possible for feeder cattle to get to $4,” says Don Close, Terrain Ag senior animal protein analyst. “However, I think it will be late summer and fall 2026.”

According to Close, there are three critical components for feeder prices today:

1. Mexican border reopening

2. What disruptions could come to the beef-on-dairy supply

3. Feed prices

“Of that list, Mexico border closure is the real wild card,” he explains. “I don’t see a measurable disruption to beef-on-dairy or feed costs in the near term.”

When Will We Hit the High?

Oklahoma State University’s Derrell Peel, Extension livestock marketing specialist, explains the highest average prices are likely a year or more after heifer retention begins.

“We don’t have any confirmation heifer retention has started to any significant level in 2025,” Peel says. “We have already pushed off any signs of herd rebuilding by one to two years longer than I earlier expected, and we are looking at extending it another year if heifer retention does not start in the fourth quarter. Because the response has been much slower this time than previous cattle cycles, prices have certainly gone higher than I would have expected a year or two ago — though I did expect record-high prices.”

Peel predicts the next expansion phase will be different than the 2014-19 expansion cycle.

“The 2014-19 herd expansion was historically rapid, this current one is historically slow,” he says. “It is a combination of a lengthy list of factors that combine to make this a slow response, and it looks like it will remain a slow, lengthy process.”

Close shares his thoughts on the complexities of the current cycle:

- Drought and economic stress. “As an industry, we didn’t fully recognize the severity of the drought as well as the degree of economic stress to the sector,” he says. “The fallout of the 2014 to 2015 price drop is still fresh on producers’ minds, so they have been using the prices of the past three years to get balance sheets in order, pay down debt and now are starting to make capital improvements.”

- Producer age. “The average age of cow owners is a factor, so many have used current prices to liquidate and retire,” he says.

- Female costs. “Replacement female prices that range from $3,000 to $5,000 restricts and scares some away,” he says. “That is only compounded with the addition of current interest rates.”

- Cow size. The escalation in average cow size limits how many cows can run on a given unit of pasture.“

- Land. “You hear producers make comments on the difficulty to find additional pasture in order to expand,” he says.

“This cycle has been driven or limited from a combination of all the above,” he says. “Our view is we need to rebuild by 2 to 2.5 million head. Keep in mind, given the escalation in carcass weights, we don’t need as many cattle to produce an equal quantity of beef.”

Close adds his thoughts regarding the impact of last week.

“Given all of the turmoil over the past week it is going to be even more difficult to trigger expansion,” he says. “There is no work around for destroyed producer confidence. I think current market action will further delay expansion.”

Ag Economists’ Monthly Monitor Predicts Bull Market to Continue

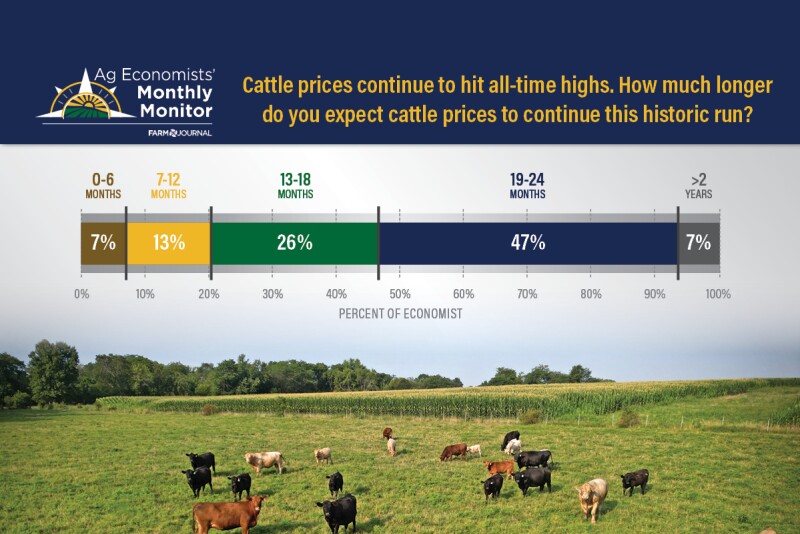

Cattle prices are expected to stay high well into 2026, according to the latest Ag Economists’ Monthly Monitor from Farm Journal. Nearly half of agricultural economists surveyed (47%) believe the current bull market in cattle could continue another 19 to 24 months, while another 27% say it could last 13 to 18 months. Only 7% expect prices to peak within the next six months.

“This run isn’t over,” one economist wrote. “At current prices we will see no or little herd expansion.” Another adds the fundamental supply side remains tight: “Clear signals that domestic beef production is increasing may be the key catalyst for a market top.”

“This is a nature of biology to some extent, it takes a while once you even start to retain a heifer for that heifer to produce a calf that then becomes a feeder calf that then becomes a fed calf that then becomes beef at the grocery store itself,” says Ben Brown, an Extension economist with the University of Missouri. “I don’t think we’ve seen necessarily the top of this cattle market yet.”

Even if cattle prices are close to seeing a top, that doesn’t mean prices will crash, he adds.

What Could End the Rally?

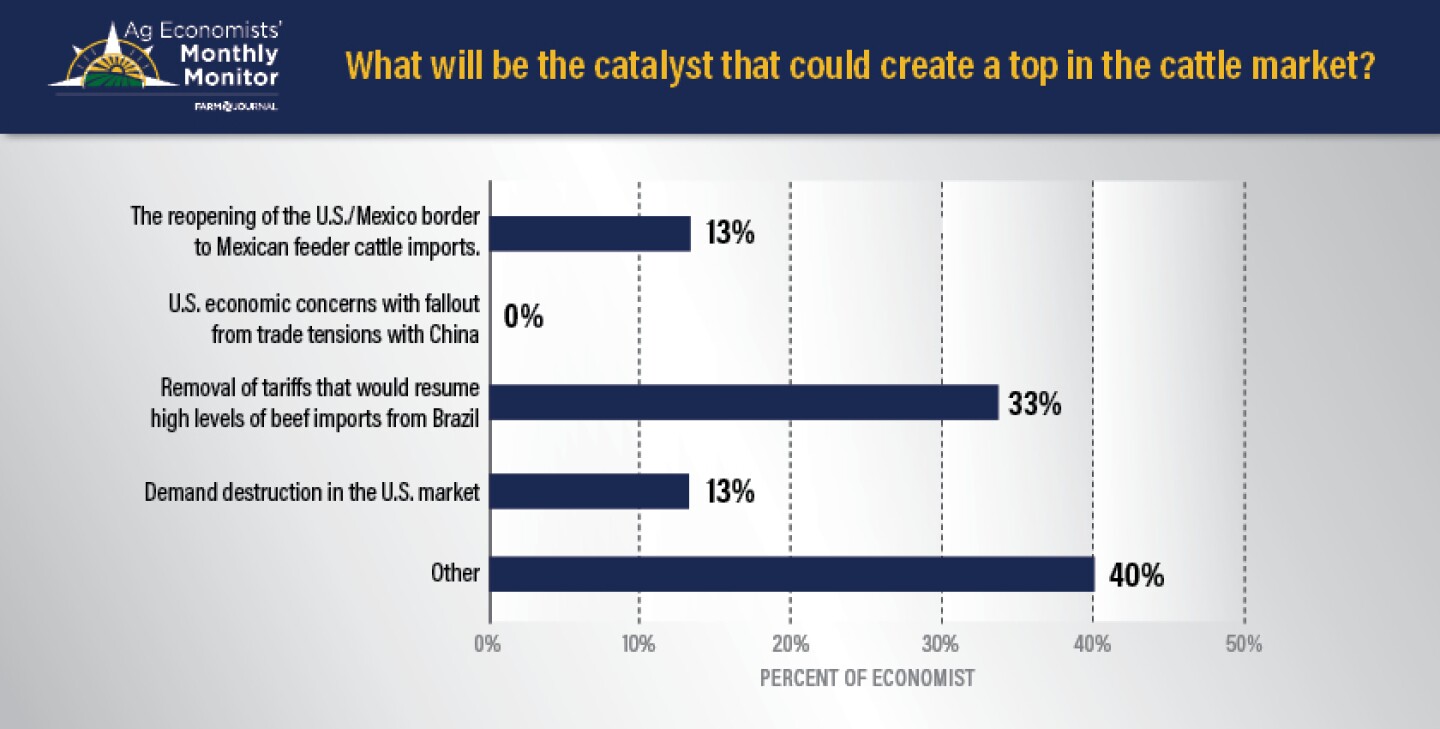

When asked what might trigger a peak in cattle prices, responses to the Ag Economists’ Monthly Monitor were mixed — but demand destruction and herd rebuilding topped the list. Economists were asked to choose between five options, including:

- The reopening of the U.S./Mexico border to Mexican feeder cattle imports

- U.S. economic concerns with fallout from trade tensions with China

- Removal of tariffs that would resume high levels of beef imports from Brazil

- Demand destruction in the U.S. market

One respondent notes, “All of the above are relevant, but clear signals that domestic beef production is increasing may be more important.” Others pointed to a slowing U.S. economy or producers “beginning to hold back replacement heifers” as potential turning points.

“I have no idea what creates the top, but at current prices, we will see no/little herd expansion,” adds yet another economist.

“Beef Prices Can Stay High Longer Than Most Expect”

Economists agree the U.S. cattle market remains fundamentally strong, supported by limited supplies, robust export demand and solid retail prices. However, they caution the same forces keeping prices high — tight herds, high feed costs and inflation — could eventually cool the rally.

As one economist sums it up: “Beef prices can stay high longer than most expect — until consumers finally say ‘enough.’ That’s when we’ll see the turn.”