The current state of the cattle market and beef industry has been described as chaotic. “There’s chaos in cattle,” as Chip Flory, AgriTalk host, put it.

The industry turmoil follows recent statements made by President Donald Trump regarding the need to lower beef prices as well as his request for the Department of Justice to immediately begin an investigation into meatpackers for driving up the price of beef.

Derrell Peel, Extension livestock marketing specialist from Oklahoma State University, affirms these are unique times, emphasizing while political factors have always indirectly influenced agriculture, it’s unprecedented for the cattle and beef markets to be at the center of direct political debate.

On a recent AgriTalk segment, Peel points out the inherent biological and production constraints of the cattle industry — particularly the fixed timeline to raise cattle — make quick fixes impossible. Both Flory and Peel stress that no political policy can shorten the cattle production process; any effective supply response requires patience and long-term adjustment.

Packers Under Fire

The concept of industry consolidation and foreign packer ownership has long drawn scrutiny with frequent government investigations. Peel says highly concentrated industries such as beef packing have been targets for skepticism and regulatory attention for over a century, to the point suspicion of packers is almost “a cultural thing” within segments of the industry.

He characterizes the latest call as another attempt to target convenient scapegoats rather than addressing deeper systemic realities of supply and demand.

“The reason we have the industry structure we do is because the economies of size and cost efficiencies are such a powerful economic force,” Peels explains.

He confirms researchers have long studied market power, and while concentration does have a small negative price impact for producers, the efficiency and cost-savings from large-scale firms more than compensate. These benefits, he says, keep cattle prices higher for producers and beef prices lower for consumers than they would be with a less efficient structure.

Dissecting the economics of margin markets Peels explains why price changes in different parts of the beef supply chain — cow-calf, feeders, packers and retailers — don’t move in lockstep. He uses a “bungee cord” analogy to illustrate the complex, dynamic and time-lagged interactions linking cattle prices at the farm with retail beef prices.

“All cattle prices and beef prices are ultimately connected, but they’re not connected with a stick or a chain,” Peel summarizes.” They’re connected with a bungee cord. There’s just an enormous amount of dynamics in this thing.”

Regarding the foreign ownership debate, Peel says there is no evidence foreign ownership alters packer behavior within the U.S. marketplace. He emphasizes foreign firms have made large investments in U.S. facilities and continue to operate them by the same market logic that would govern domestic ownership.

He also points out it is unclear who else would be in a position to make such significant investments if these foreign companies were not involved. This pragmatic view suggests the ownership issue might be less important than is commonly believed, at least concerning everyday operations and market outcomes.

A Lot Hinges on Rebuilding the Cow Herd

In his latest article, “All Bets are Off,” Peel says: “The latest edition in the torrent of recent political attentions directed at the cattle and beef industry includes allegations of market manipulation against the beef packing industry. Beef packers are the one segment that has been most negatively impacted in the current market, incurring huge losses due to poor margins and limited cattle supplies.”

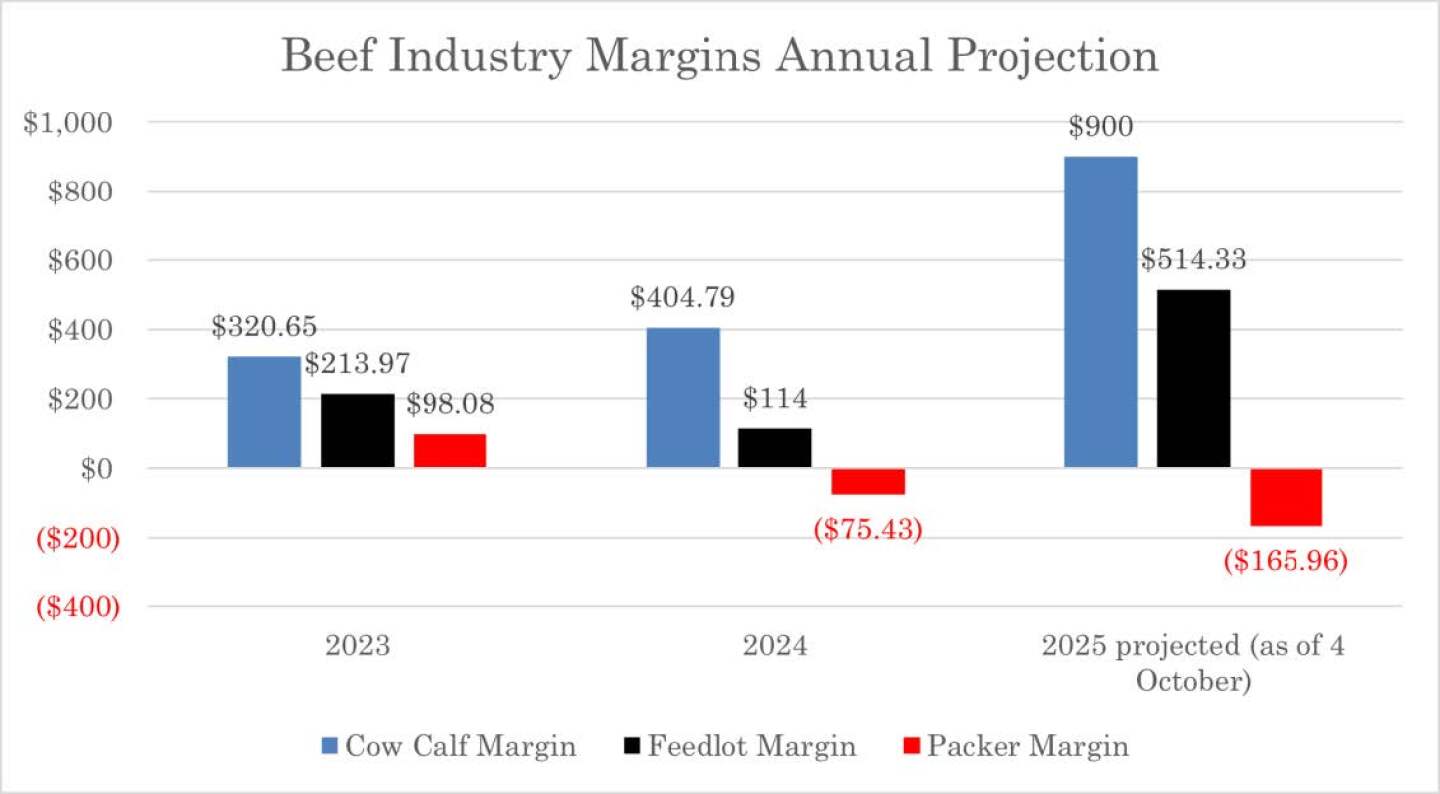

Peel reports packers have been losing enormous amounts of money for about the past 18 to 24 months. According to the Meat Institute, packer margins slipped into the red in September 2024. Through the week ending Oct. 4, 2025, packer margins were a negative $126.50 per head, up slightly from a year earlier at a negative $125.65 per head, according to Sterling Profit Tracker. The outlook for the year is a negative $165.96 per head packer margin.

“There’s just simply not enough cattle for them to operate at cost efficient capacities,” Peel explains.

This negative trend was anticipated — the reduced supply of cattle has made it difficult for packing plants to function at cost-efficient capacities, leading to the accumulation of operating losses. Peel points out the combination of low unit margins and insufficient cattle supplies challenges the economic viability of packers, further illustrating the complexity of the current environment.

This decline in inventory is not the result of a single factor but is driven by several years of drought and other market pressures. It is clear high beef and cattle prices are a result of these tight supplies and, according to Peel, these high prices are likely to persist for several years. The industry simply cannot turn around production levels quickly, and it will take time — a matter of years, not months — for conditions to normalize.

“Using logic that only works in the office of a politician, packers are supposedly wielding unacceptable market power while paying record high cattle prices and artificially raising beef prices … but not enough to avoid losing a couple hundred dollars on every animal they process — certainly many millions of dollars,” Peel says. “If beef packers had any significant ability to exercise market power, I am certain that we would not have record high cattle prices and packers would not be losing money.”

Peel suggests the federal government attacks on beef packers are aided and supported by a vocal minority of the cattle industry and a few sympathetic politicians who view packers as a perennial villain and always worthy of attack anytime the opportunity is presented.

“The timing of such attacks this time is particularly puzzling as dismantling the packing industry would certainly jeopardize current record high cattle prices and the best economic returns most producers have ever enjoyed,” Peels says. “I guess some cowboys just can’t stand prosperity.”

R-CALF CEO Bill Bullard says the cattle market is fundamentally broken citing years of an inverse relationship between falling cattle prices and increasing retail beef prices when the only ingredient in beef is cattle. Read more about his perspective.

Patience not Politics

Beef and cattle prices, Peel notes, are historically high, a result of industry-wide low cattle inventory. Rebuilding the nation’s cow herd will be a long, slow process, keeping prices elevated for an extended period. And Peel says there is no definitive evidence producers are saving heifers to start the rebuilding process.

“2025 may prove to be technically the cyclical low, but 2026 is going to be barely bigger, if it is, and no growth in 2026 and probably none in 2027 ... it’s 2028 into 2029 before that turns into increased beef production,” Peel predicts.

He summarizes neither regulatory nor political action will can speed up the rebuilding process. It will take years of concerted effort, market healing and stability before the industry can expect a meaningful rebound in herd numbers and production — a reality that requires patience across the industry.

“There is absolutely nothing anybody can do to make beef prices go down, or cattle prices, other than maybe tear up the industry completely,” Peels says. “And if we tear up the industry, it’ll make cattle prices go down, but it won’t make beef prices go down. It’ll make beef prices go even higher for consumers and the only way to fix this is to give the industry time to rebuild, and that’s going to take two to four years if we ever get started.”

He says a majority of cattle producers understand the beef industry is extremely complex and all segments are critical and essential.

“Though the outcome of current political actions is uncertain, the potential for long-term harm to the industry is substantial,” Peel says. “Anytime politics trumps economics, the strong supply and demand fundamentals that have determined the outlook for the industry to this point become irrelevant. Expectations for prices and production going forward are now completely clouded…therefore… all bets are off.”

Your Next Read: You Be The Judge: The Big Bad Beef Packers Are On Trial