Basis for corn and soybeans across the Midwest continue to decline as a record harvest is running head on into extraordinarily tight storage capacity.

“Due to the risk of lost export demand, some elevators across the Northern Plains that lack local crush demand may not accept soybeans over fears of not being able to access the export market later,” says Tanner Ehmke, grains and oilseeds economist with CoBank in his latest report. “For elevators reluctant to take delivery and short soybean basis, basis is being set at historically low levels with storage fees set at higher rates.”

While domestic soybean crush build out provides a destination — and improved regional basis — for some of the soybeans, it does not offset the big crop and the missing exports to China.

Additionally, Ehmke points out with stronger corn demand and it being a bit easier to store in piles or bunkers, elevators will be incentivized toward corn over soybeans.

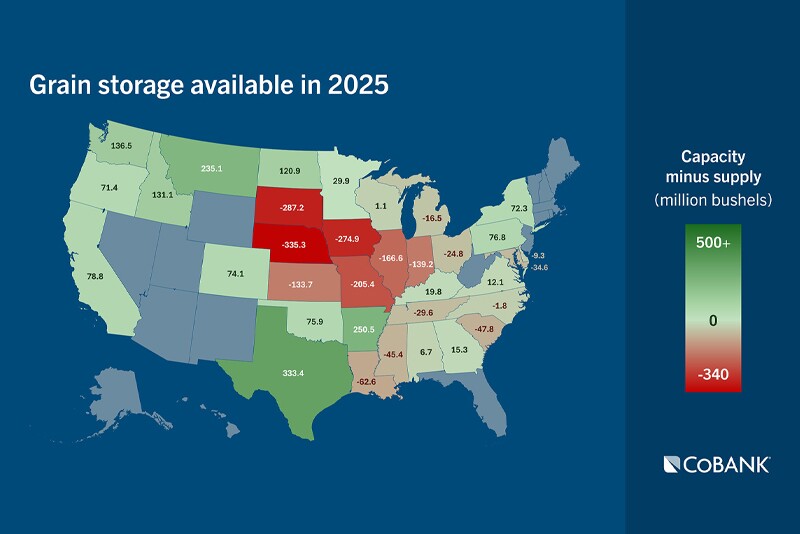

“The challenge for elevators will be prioritizing scarce grain storage,” Ehmke says. “Among the top 12 corn-producing states, the U.S. is facing a 1.4-billion-bushel shortage of upright grain storage this year with elevators relying more on bunkers and emergency storage like ground piles. This year’s shortage stands in stark contrast to last year when those states had a combined 361 million bushels of excess storage.”

The tight storage situation translates to higher storage fees. A trend emerging this harvest is elevators not offering delayed pricing (DP) programs. Ehmke notes some elevators are offering cash-only programs for farmers, or they are offering minimum price contracts and extended price contracts.

“The risk to elevators will be farmers not selling and opting instead for DP programs,” Ehmke says. “Fees on DP programs that are appropriately structured ahead of harvest may encourage farmers to sell. DP programs will need to be well-structured and limited to account for higher risk of carrying unpriced grain in a carry market.”

As Ehmke points out, grain elevators can benefit from buying cheaper basis and capturing wider carries in the futures markets, however the profit opportunities are not without risk.

“Grain merchandisers will benefit from bigger carries for corn, soybeans and wheat that continue to widen, giving elevators ample opportunity to profit on storage,” Ehmke says. “But elevators will need to prioritize scarce storage space. Soybeans will have the highest cost of carry versus corn, wheat or grain sorghum. Storing soybeans indefinitely amid a slow export pace also comes with the risk of quality degradation over time.”

Read more, including details about the infrastructure strain: Grain Logistics Outlook: Record Crop Meets Trade Uncertainty