Since President Donald Trump’s comments last week, a lot has been discussed on social media and at the coffee shop about increasing beef imports from Argentina, beef retail prices, the cattle market and beef processing concentration.

“It is complicated,” the Meat Institute posted on LinkedIn regarding the current state of the beef industry and the dialog about beef prices. In response, the Meat Institute released a nine-page document — The Reality of Beef and Cattle Markets — addressing import trends, market conditions, industry concentration, ground beef production, policy proposals and international trade challenges.

Key discussion points include:

1. Argentine Beef Imports

The report summarizes increasing beef imports from Argentina is unlikely to significantly lower ground beef prices in the U.S. If Argentina fills the proposed 80,000 metric ton quota, it will only increase its share of U.S. beef imports from 2% to 5%, which is unlikely to significantly impact retail or restaurant beef prices.

Argentina primarily exports grass-fed frozen lean trim for ground beef production, with limited impact on overall U.S. beef imports. In 2024, Argentina was the eighth-largest beef supplier to the U.S., exporting 32,798 metric tons, while the U.S. imported 1.56 million metric tons overall.

2. Beef and Cattle Market Conditions

The report summarizes current market conditions with these six statements:

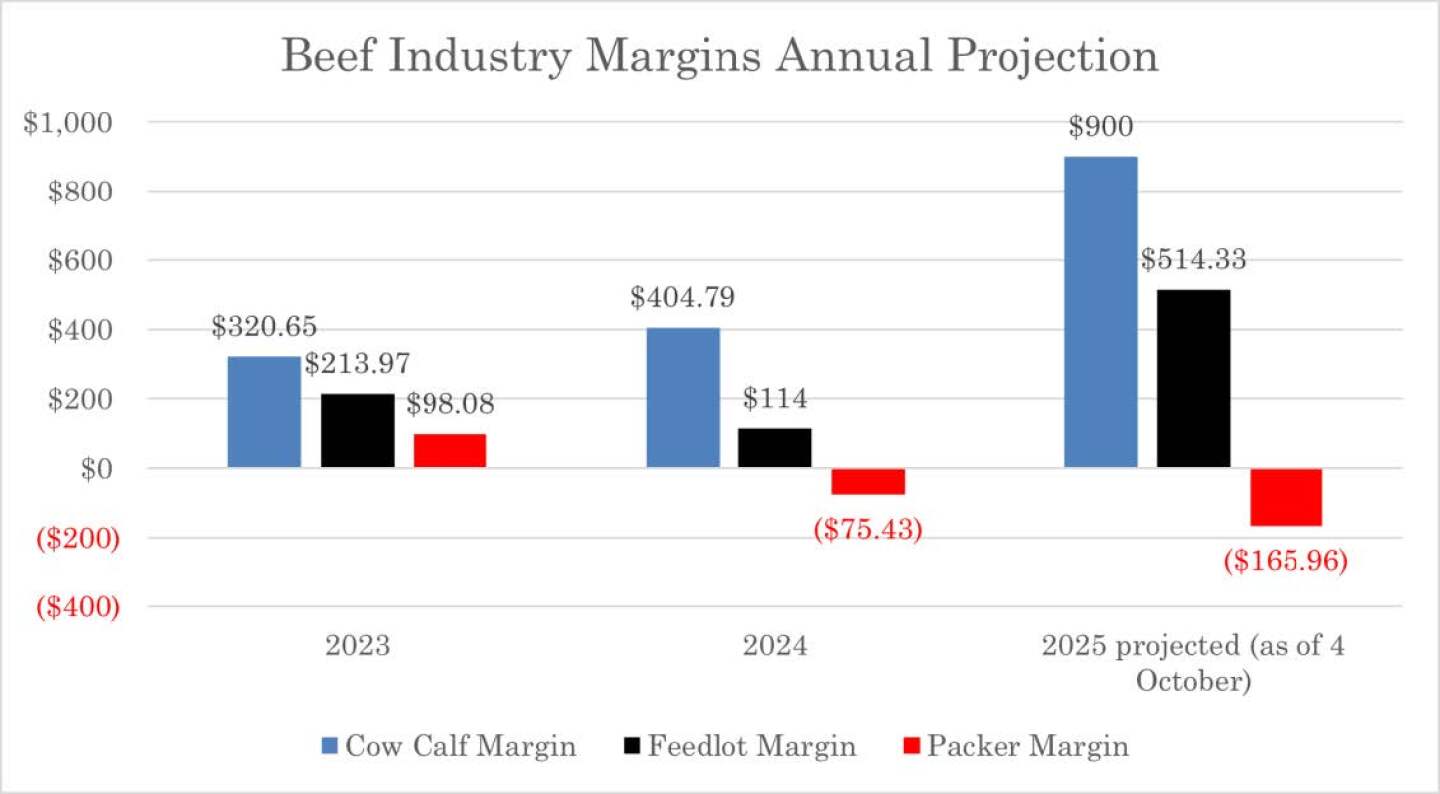

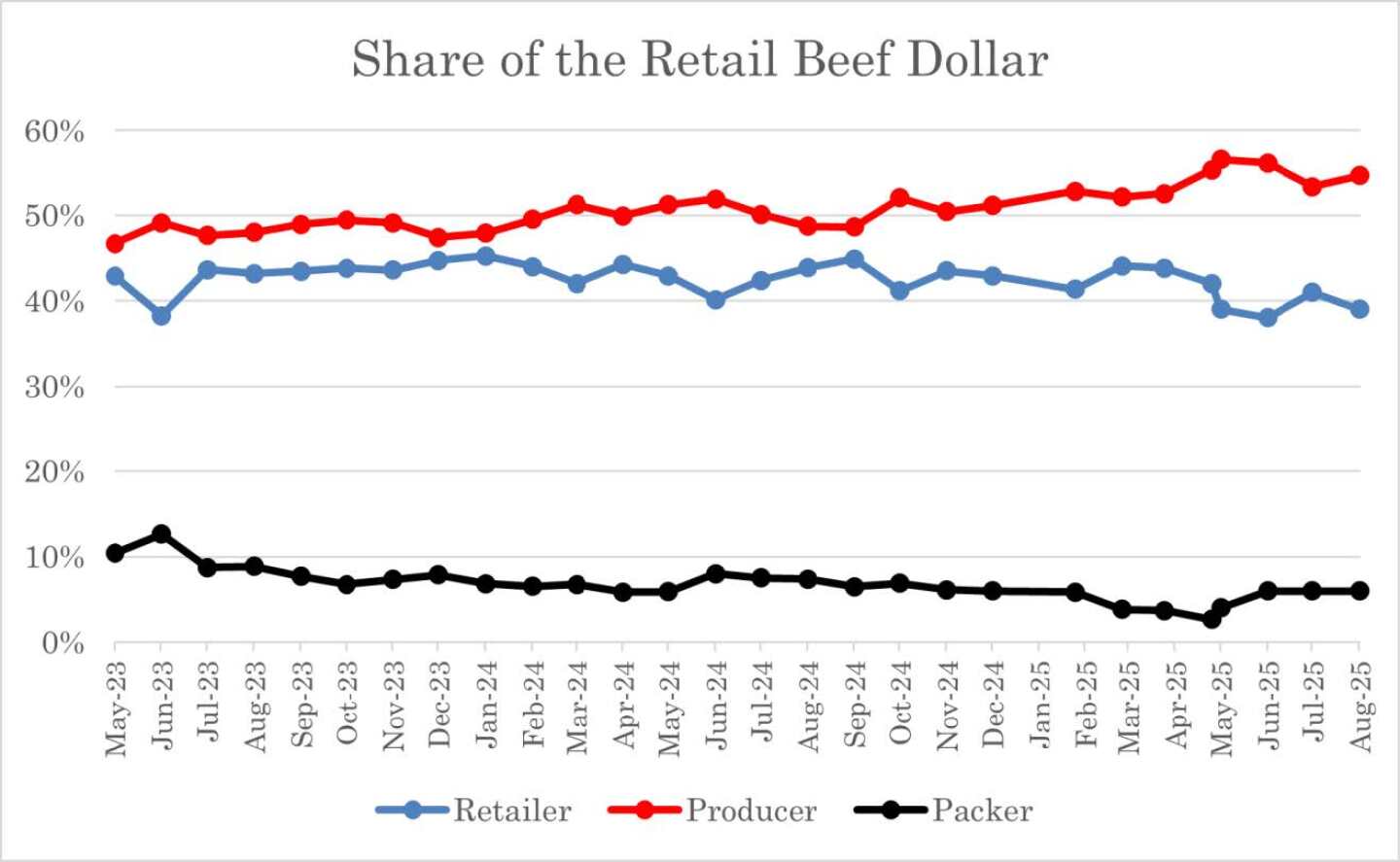

- Cattle producers are enjoying record prices, while beef packers are suffering under negative margins.

- The shortage of market-ready cattle continues, adding further pressure to packers’ margins, which first dropped to negative values in September 2024.

- Packing plant utilization rates have dipped, and some facilities are scaling back operations, including reduced shifts and shortened workweeks. Uncertain immigration policy moving forward can have an impact here as well.

- Trade policy uncertainty from proposed tariffs adds to the cost pressures on the cattle market.

- Additionally, foreign animal disease import restrictions — particularly on Mexican feeder cattle — are another contributing factor to increasing costs.

- Consumer demand has remained resilient with improved beef quality. However, prospects for elevated cattle prices and the beef those cattle yield remain directly tied to the extent end-user consumer demand can remain robust.

“Cattle prices were at record levels for most of 2023, surpassing the 2014-2015 previous record highs as the cattle herd rebuilt from the previous low points of the cattle cycle,” the report says. “Through 2024, prices continued at new record levels and increased further into 2025, exceeding an average of $242 cwt. in August, the highest nominal price on record.

“Cash prices have declined to $232 cwt. in the first two weeks of October, but futures contracts are at record levels, even after adjusted for inflation. The previous highs in October 2015 would be $222 cwt. in today’s dollars, a full $10 cwt. below the current prices as of Oct. 14.”

The report goes on to say: “This has put U.S. beef packers under financial pressure. Packer margins slipped into the red in September 2024. Through the week ending Oct. 4, 2025, packer margins were a negative $126.50 per head, up slightly from a year earlier at a negative $125.65 per head, according to Sterling Profit Tracker. The outlook for the year is a packer margin of negative $165.96 per head.”

For 2025, cow-calf producer margins are estimated to be up 122.3% from 2024 and 180.67% from 2023 to $900 per head. Feedlot margins are estimated to be up 351% from 2024 to $514.33 per head. But packer margins have declined 120% from already negative margins in 2024 and are estimated to be down 269% from 2023.

“With fewer market-ready cattle available, plant utilization rates have dipped and some facilities are scaling back operations, including reduced shifts and shortened workweeks. Packing plants were operating at 77% capacity for the week of Oct. 4, down from 85% a year ago. Uncertain immigration policy moving forward can have an impact here as well,” the report summarizes.

The share of the retail beef dollar also indicates producers have been faring well. The producers’ share of the retail beef dollar was 55% in August 2025 and has averaged 54% so far in 2025. The packers’ share has dropped from 13% to 5%, reflecting the negative packer margins.

Download the Meat Institute’s full Cattle and Beef Market Update.

3. Concentration in the Beef Packing Sector

“The U.S. meat packing sector is a dynamic, resilient and highly competitive industry with a long history of providing an abundant supply of high quality, safe and affordable products to American consumers and serving as a vital economic engine that supports America’s farmers and ranchers,” the report says.

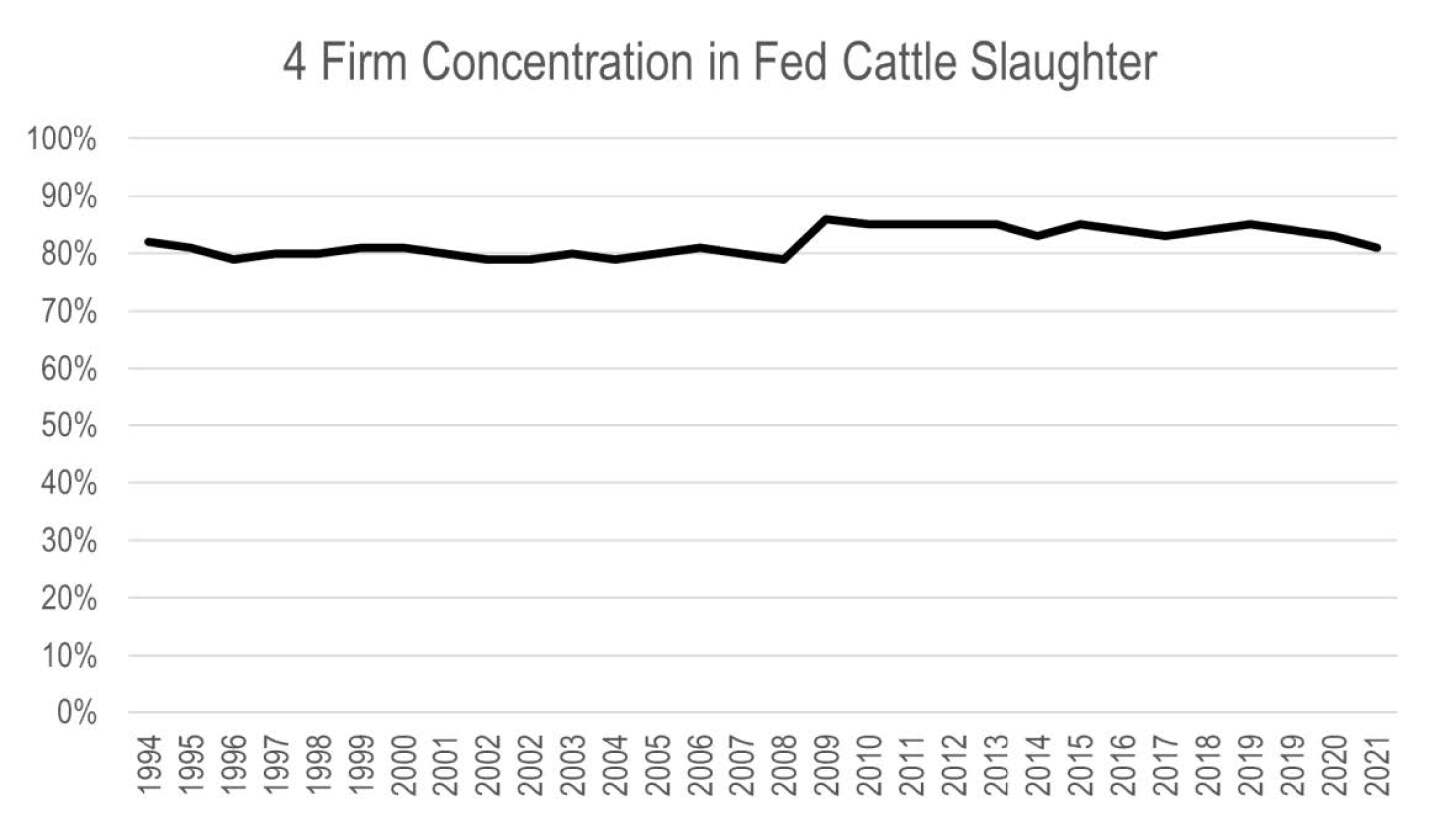

The top four beef packers in the U.S. account for the purchase and slaughter of about 81% of all fed cattle in the U.S., according to the most recent report from the USDA’s Packers and Stockyards Division. But those fed cattle make up only about 78% of the Federally Inspected cattle slaughtered in the U.S. The other 22% is made up of cows, both dairy and beef and some bulls.

“Much of the rhetoric about beef industry concentration implies that consolidation in the beef packing sector is ongoing and that market power is becoming increasingly concentrated. That is not the case,” the report says. “The four-firm concentration ratio in the beef cattle industry has not changed appreciably over the past 30 years. According to USDA, in 1994, for example, that ratio was 82%, compared with 81% today.”

4. Ground Beef

Ground beef accounts for approximately 50% of U.S. beef consumption. Imported lean trim complements U.S. beef production from cull cows, helping maintain affordability without directly competing with domestic beef.

“Without imported lean trim, more highly marbled quality U.S. beef would be used, and ground beef would be more expensive,” the report explains.

5. Policy Issues

Despite record cattle prices and the smallest cattle herd in 75 years, there are increasing calls for mandatory country-of-origin (COOL) labeling for beef.

“The mandatory COOL experiment was implemented and it failed,” the report says. “From 2002 through Congress repealing the law in 2015, we learned that mandatory COOL adds massive compliance costs — the industry incurred implementation costs of approximately $1.5 billion, plus $200 million in additional annual compliance costs thereafter — yet by USDA’s own analysis, it did not increase consumer demand. Mandatory COOL simply adds cost, not value.”

On Jan. 1, 2026, USDA’s Food Safety and Inspection Service will begin implementing its voluntary COOL rule.

“Let the rule and the free market work: if consumers demand ‘Product of the U.S.’ labels on their meat, then processors can and will provide it,” the report says.

For more info, download the Meat Institute’s mCOOL paper.

The reports also explains proposals like the PRIME Act and interstate shipment of state-inspected meat are seen as threats to food safety and international trade relationships.

“The concept in the PRIME Act is even worse,” the report explains. “Under Rep. Thomas Massie’s legislation, custom exempt meat establishments would be allowed to slaughter animals, process the meat and sell it directly to consumers or to restaurants, hotels or grocery stores within the state, without any inspection. It is a recipe for foodborne illnesses, and consumers in restaurants and hotels would have no idea they would be eating uninspected meat (and grocery store consumers would only know if they look for and can’t find the USDA inspection symbol). Food safety should be the top priority, not something legislated away.”

6. China Beef Exports

The Meat Institute urges action as China blocks more than 415 U.S. beef facilities from exporting.

“In 2024, China was the U.S.’s third largest market, by value, for beef, at over $1.5 billion,” the paper summarizes. “The strong beef exports to China were thanks to President Trump’s leadership in securing the U.S.-China Phase One Agreement during his first term. However, since the beginning of 2025 — and in contravention of the terms of the Phase One Agreement — China has failed to renew the registrations for more than 415 U.S. beef establishments, making them ineligible to export to China. This is a massive market loss for the U.S. that Brazil and other countries have been eager to fill.”