With attention being given to the expected increase of worldwide wheat supplies, now is a good opportunity to review how the relationship between price and stocks-to-use (STU) normally correlate, and how wheat prices might move in the near-term.

The STU ratio is a metric that compares supply with demand. It measures how much of the world consumption in a year could be met by relying solely on existing stored grain if no new production occurs, based off current demand expectations. This means in theory a lower STU is likely to cause a higher price of a commodity, and a higher STU would reflect a lower price.

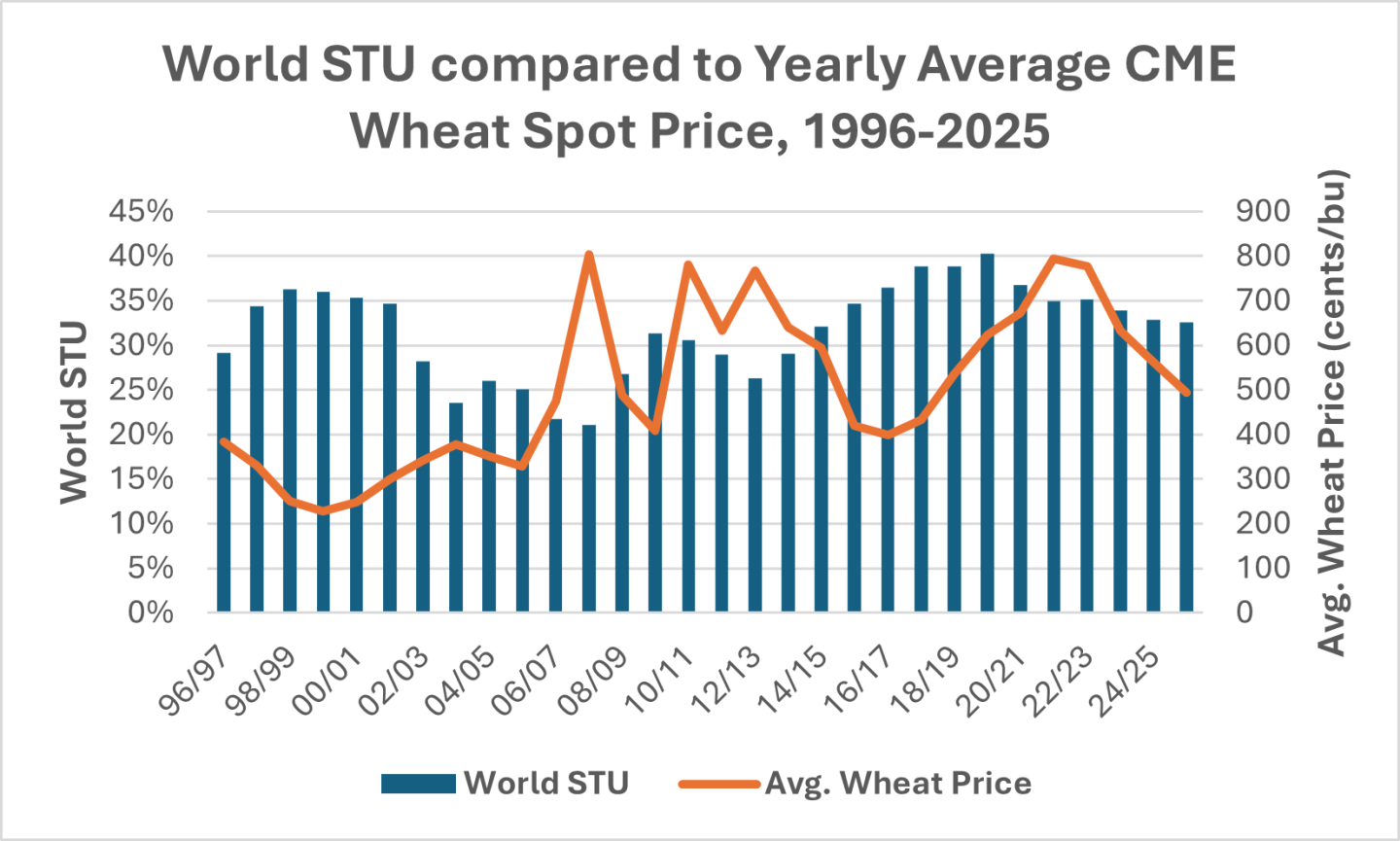

The chart below shows the WASDE estimate for worldwide STU ratios overlaid with a line showing the yearly average value of spot wheat prices at the CME. It shows that STU does have a loose but not exact relationship with price. Reality often distorts the perfectly linear relationships we would expect from economic theory alone.

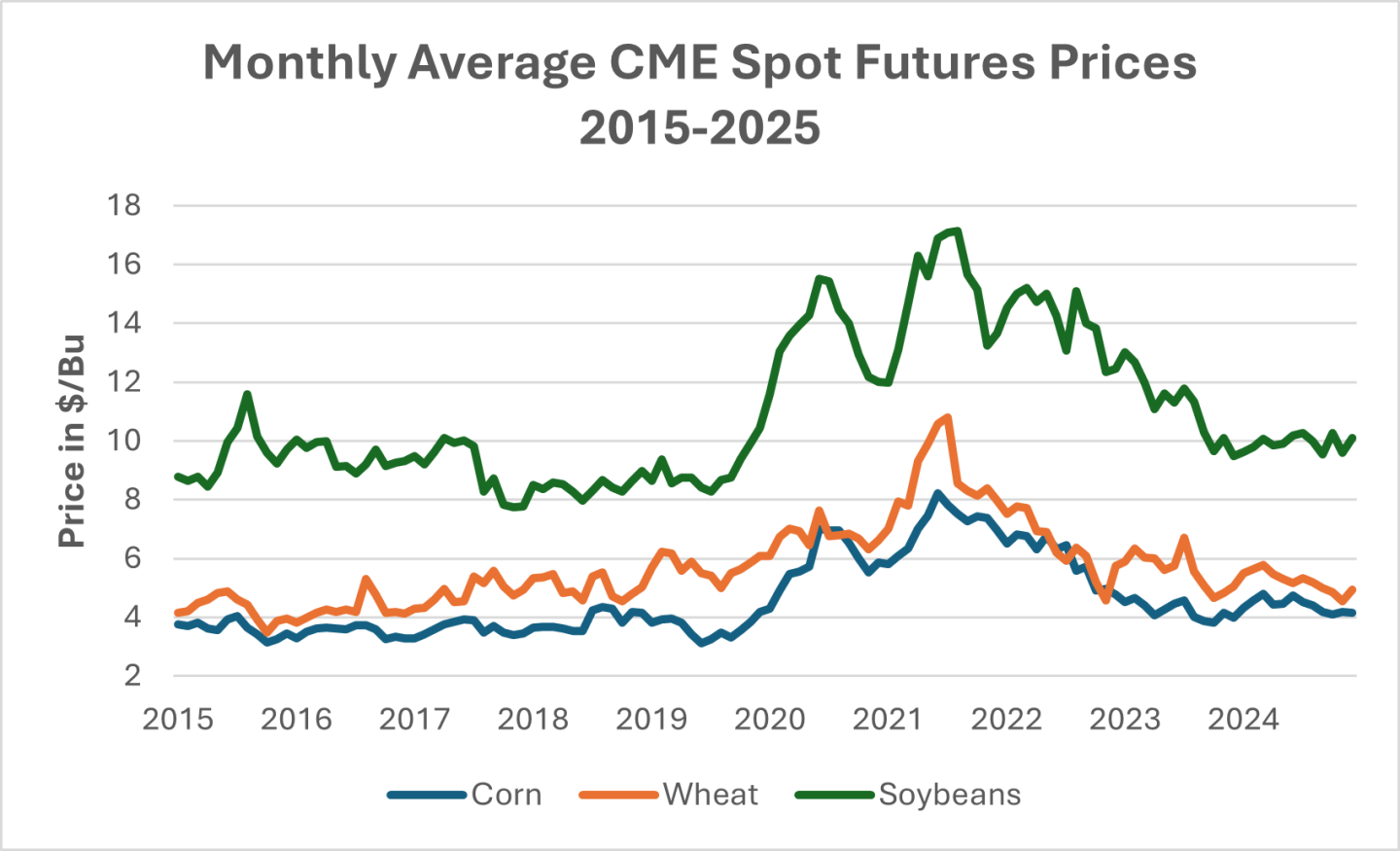

While it may seem that wheat prices are overreacting to stocks remaining relatively steady from last year at first glance, prices in corn have also declined which impacts wheat.

Consideration must also be given that the current WASDE is now out of date, and does not factor in the most recent production forecasts from around the globe. The STU is likely to push higher once the next WASDE arrives. More recent forecasts, like the International Grain Council’s October report, already point to increased carryout. This potential increase in supply is also reflected in the prices of wheat at major ports around the world. Wheat prices in Argentina as of October 24th continue to drop, falling below bids at both U.S. Gulf and Black Sea ports, showing expectations that they will soon realize the record-tying wheat production that has been forecast.

After factoring in the subdued tones in the grain complex and bigger worldwide production, wheat prices don’t seem too out of place from years with similar STU’s. In order for wheat to see a sustained rally and push through key resistance, a substantial weather event in one of the major production regions will likely need to occur. Another potential route for wheat prices to improve is continued trade deals promoting agricultural goods in general. If corn and soybeans were to rally, wheat would likely look to follow them on the way up as demonstrated in the chart below.