Russia Attacks Ukraine Grain Export Terminal; U.S. Says Russia Trying to Sell Stolen Grain from Ukraine

Several actions today re: Biden trade and oil policy

|

In Today’s Digital Newspaper |

Vladimir Putin said that if the West sends Ukraine longer-range missiles, Russia will strike targets it has thus far avoided — without saying which. Last week President Joe Biden said the U.S. will supply Ukraine with M142 High Mobility Artillery Rocket Systems, after receiving assurances that they would not be fired into Russia. Britain has promised to send similar weapons. Meanwhile on Sunday Russian forces fired a volley of cruise missiles into Kyiv, the first strike there in weeks.

On Sunday, Russian missiles struck the Ukrainian capital Kyiv for the first time in more than a month. Russia and Ukraine have both claimed different targets were hit: Russia said it targeted newly delivered tanks, while Ukraine said a rail car repair works was hit.

Russia attacked a major Ukraine grain export terminal. Over the weekend, Russia destroyed a major Ukrainian grain export terminal in Mykolaiv (southern Ukraine). Russia’s attack on Ukraine’s grain infrastructure came after last week saying it was open to allowing grain exports via “humanitarian corridors” from Ukrainian ports has heightened global supply concerns.

Treasury Sec. Janet Yellen denied advocating for a smaller American Rescue Plan than the $1.9 trillion package proposed by the Biden administration and passed by Congress in early 2021, after an advance copy of a book about the Treasury secretary showed she initially urged scaling it back by a third.

Bank of Japan Governor Haruhiko Kuroda said the Japanese central bank will keep its easy monetary policy actions, noting no need for a tightening of monetary policy at this point.

Commerce Chief Gina Raimondo said it “may make sense” to lift some tariffs. “Steel and aluminum — we’ve decided to keep some of those tariffs because we need to protect American workers and we need to protect our steel industry; it’s a matter of national security,” Raimondo said in an interview Sunday on CNN’s State of the Union. “There are other products — household goods, bicycles —it may make sense,” she said, when asked if the administration would consider ending duties on billions of dollars of imports from China.

President Biden will take executive action to boost the U.S. solar sector, seeking to revive clean energy projects stalled by a trade dispute and bolster domestic manufacturing so the nation’s climate efforts are less reliant on foreign suppliers. He plans to invoke the Defense Production Act to provide support for U.S.-made solar panels. A public announcement expected as soon as today.

Biden administration has made a final decision against inviting the governments of Cuba, Venezuela and Nicaragua to a regional summit this week, bucking calls from Mexico’s president to include all countries or risk him staying home.

The U.S. may allow more sanctioned Iranian oil onto global markets even without a revival of the 2015 nuclear accord, said Mike Muller, head of Asia at Vitol Group, the biggest independent crude trader. “If the midterms are dominated by the need to get gas prices lower in America, turning a somewhat greater blind eye to the sanctioned barrels flowing out is probably something you might expect to see,” Muller said on a podcast Sunday.

Abbott restarted infant formula production at a facility in Michigan, months after its closure on health grounds exacerbated a national shortage of food for very young children. The company met the Food and Drug Administration’s initial requirements under a pact reached last month, Abbott said in a blog post Saturday.

Carl Icahn is ending a proxy fight with Kroger focused on the treatment of pregnant pigs at the grocery chain after concluding he is likely to lose, as he did a similar campaign at McDonald’s.

Boris Johnson, Britain’s prime minister, will address MPs this afternoon as he attempts to rally support in a vote of no-confidence that will be held in the evening.

North Korea fired eight short-range ballistic missiles Sunday, hitting a record number of launches in a single year under Kim Jong Un. The U.S. and South Korea said they fired eight surface-to-surface missiles today. According to South Korea’s army, the joint exercise was meant to demonstrate “the capability and readiness to carry out precision strikes.” Japan and the U.S. also conducted a joint exercise on Sunday in response to North Korea’s actions.

Pope Francis to step down? Rumors gain new steam as Vatican watchers speculate on the meaning of recent announcements by 85-year-old pontiff.

|

MARKET FOCUS |

Equities today: Global stock markets were mostly up overnight. U.S. stock indexes are pointed toward higher openings. Chinese stocks rose today and foreign investors have returned to emerging Asian equities after several weeks of outflows.

Ag markets today: Grain and soy futures rallied sharply overnight amid renewed global supply concerns, led by the wheat market. As of 7:30 a.m. ET, wheat futures were trading mostly 35 to 40 cents higher, corn was 8 to 10 cents higher and soybeans were 11 to 14 cents higher. Front-month U.S. crude oil futures were around 40 cents higher and the U.S. dollar index was around 135 points lower this morning.

On tap today:

• Conference Board Employment Trends Index is due at 10 a.m. ET.

• USDA Grain Export Inspections report, 11 a.m. ET.

• USDA Crop Progress report, 4 p.m. ET.

• The Americas Summit will kick off in Los Angeles. President Joe Biden, who has excluded Cuba, Venezuela, and Nicaragua from the meeting, is coming under close scrutiny as leaders gather to discuss policy issues including migration and inflation. Biden will attend the event on Wednesday. On Friday, Biden will speak at the Port of Los Angeles and continue participating in the summit.

Yellen denies urging smaller Biden relief plan in early 2021. Treasury Secretary Janet Yellen denied advocating for a smaller American Rescue Plan than the $1.9 trillion package proposed by the Biden administration and passed by Congress in early 2021, after an advance copy of a book about the Treasury secretary showed she initially urged scaling it back by a third. Her statement was issued on Saturday following a Friday report by Bloomberg News on excerpts from the book. “When President Biden assumed office, the nation was facing acute economic challenges. It was a time of great economic uncertainty, with legitimate risks of a downturn that could match the Great Depression,” Yellen said in the statement. “I never urged adoption of a smaller American Rescue Plan package, and I believe that ARP played a central role in driving strong growth throughout 2021 and afterwards.”

The book, Empathy Economics by veteran Washington journalist Owen Ullmann, is due out Sept. 27. It says that Yellen privately agreed with former Treasury Secretary Lawrence Summers — who severely criticized the size of the aid plan — “that too much government money was flowing into the economy too quickly.”

Elon Musk won’t cut Tesla jobs after all. After calling for a 10% reduction in the car company’s staff, Musk said employee numbers will increase, but the number of salaried employees “should be fairly flat.”

Heavy-duty truck orders are retreating amid parts shortages and production delays, according to Dow Jones Newswires. FTR Transportation Intelligence says preliminary net orders for Class 8 trucks dropped to 13,300 in May, down 13% from April and the lowest level for orders since November 2021. ACT Research says its measure shows North American fleets ordered 14,000 big rigs last month, extending a run of low order levels. Analysts say the depressed orders aren't for lack of demand but the result of parts shortages and supply-chain disruptions that are hampering assembly lines. Manufacturers "are not confident they can increase production in the second half of the year," says FTR's Don Ake, "therefore, they are not able to take more orders."

Market perspectives:

• Outside markets: The U.S. dollar index fell, while the 10-year Treasury yield rose close to 3 basis points to 2.9607%. Bitcoin climbed above $31,000. Fedspeak is absent during the blackout period before the June 14-15 meeting. Copper hit the highest price since April. Gold and silver futures were higher ahead of U.S. trading, with gold around $1,857 per troy ounce and silver around $22.40 per troy ounce.

• Oil prices rose after Saudi Aramco hiked crude oil prices for customers in Asia and after Saudi Arabia signaled confidence in demand with a bigger-than-expected price increase of its crude for Asia in July as China — the world’s top crude importer — cautiously emerges from lockdowns. West Texas Intermediate traded at $120 a barrel, near the highest level in almost three months. Oil has rallied almost 60% this year as rebounding demand from economies recovering from the pandemic coincided with a tightening market after Russia’s invasion of Ukraine.

• U.S. may allow more Iranian crude to flow to global markets, even without a revived nuclear deal, as Biden aims to ease the energy crunch, Mike Muller, head of Asia at Vitol Group, said Sunday on a podcast produced by Dubai-based Gulf Intelligence. He may also let Eni and Repsol ship Venezuelan supply to Europe to help replace Russian oil, Reuters said.

• Transportation/Logistics nuggets:

- CSX CEO Jim Foote says the railroad has been turning away freight as it struggles to hire workers.

- Port of Houston is expanding gate hours as import volumes stretch terminal handling capacity.

- Container line CMA CGM more than tripled its first-quarter profit to $7.2 billion despite a 2.8% drop in container volumes.

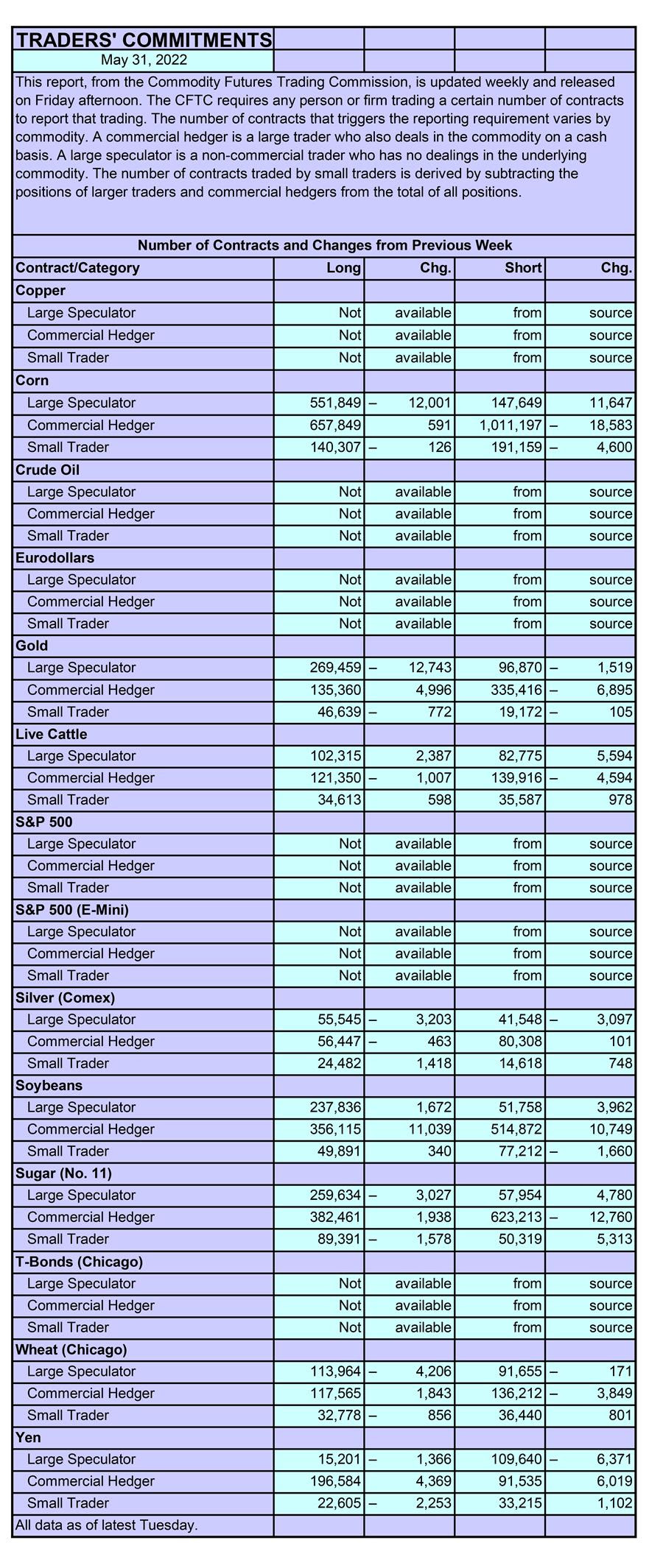

• CFTC Commitments of Traders report (Source: Barron’s):

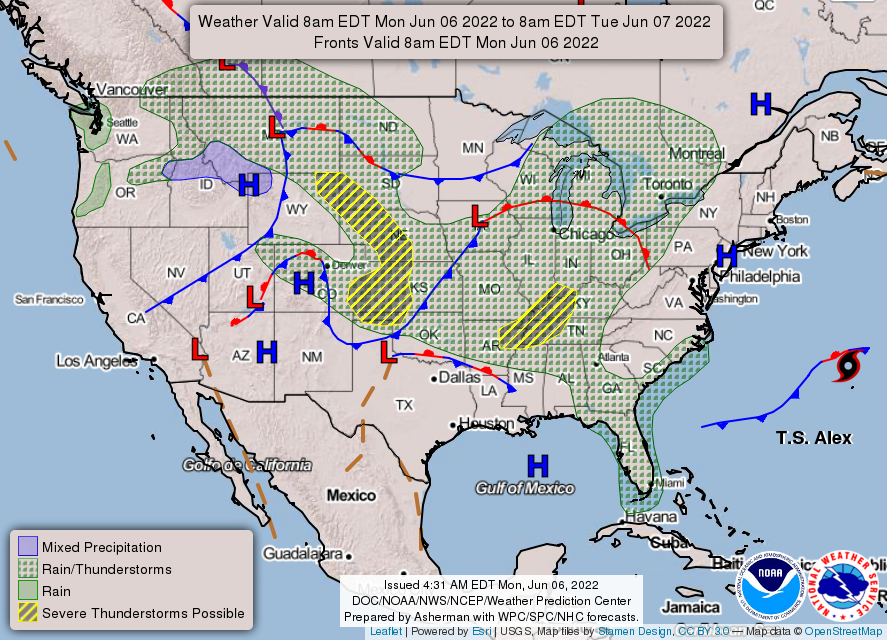

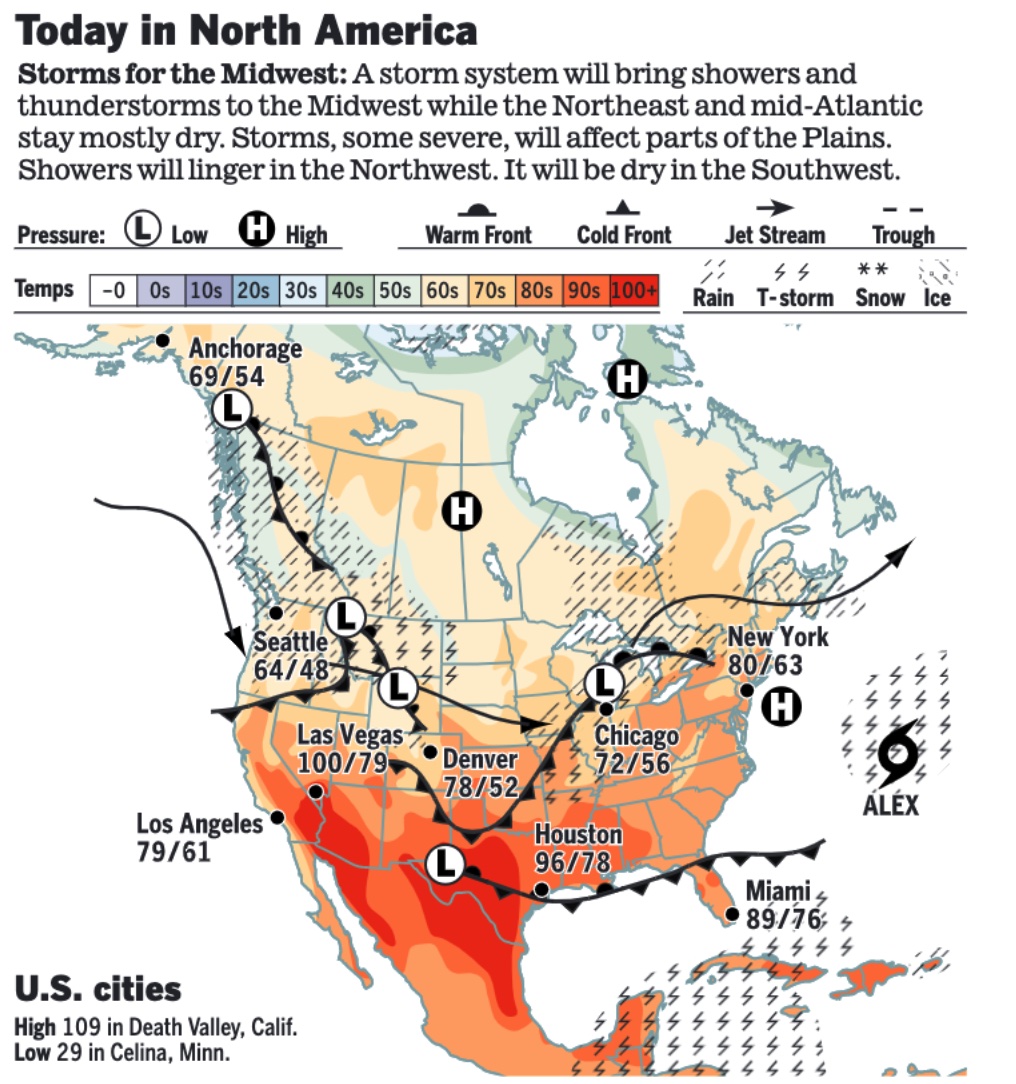

• Tropical Storm Alex formed early Sunday after bringing heavy rain and flooding to South Florida a day prior, becoming the first named storm of this year's Atlantic hurricane season.

• NWS weather: There is a Slight Risk of severe thunderstorms and a Marginal Risk of excessive rainfall over parts of the Northern/Central High Plains and the Great Lakes and Ohio/Tennessee/Lower Mississippi Valleys through Tuesday morning... ...There is a Slight Risk of excessive rainfall over parts of the Central/Southern Plains and the Middle/Lower Mississippi Valley Tuesday into Wednesday morning... ...Record high temperatures will be across portions of Texas.

Items in Pro Farmer's First Thing Today include:

• Wheat leads strong price rally overnight

• Generally favorable weather for major U.S. crop areas

• U.S. warns Russia trying to sell stolen grain from Ukraine (details below)

• Rice traders ramping up purchases from India

• Brazil testing GMO wheat variety

• Beef movement will be watched again this week

• Big jump in cash hog index

|

RUSSIA/UKRAINE |

— Summary: Russia attacked Kyiv. The airstrikes followed days after the U.S. announced $700 million in aid to Ukraine, as President Vladimir Putin warned the West against sending more arms. Meanwhile, the U.K. will also send Ukraine longer-range missiles. Delivering new arms to Kyiv would only "drag out the armed conflict for as long as possible," Putin said yesterday. In Ukraine, some of the "fiercest battles" are being fought in the eastern city of Severodonetsk, the region’s top official said today, adding that the evacuation of 15,000 civilians remains impossible because of intense fighting

- Russian President Vladimir Putin warned that Moscow would strike new targets if the U.S. supplied long-range missiles to Ukraine, according to Russian state media.

- Putin claims Russia's actions in Ukraine "have nothing to do" with the looming global energy and food crisis and has instead blamed Western economic policies. He also blamed European countries for not listening "to our urgent requests to preserve long-term contracts for the supply [of natural gas]" — another factor that he said led to inflation.

- U.S. must sanction enablers of Russia’s war on Ukraine, Senators say. A bipartisan group of U.S. senators are asking for sanctions against “lower-tier enablers” of Russia’s invasion of Ukraine. The senators — including Sens. Mark Warner (D-Va.), Marco Rubio (R-Fla.), Ron Wyden (D-Ore.) and John Cornyn (R-Texas) — wrote to Treasury Secretary Janet Yellen, asking her to take into account a list of 6,000 Russian officials and regime enablers compiled by Anti-Corruption Foundation of Russian opposition leader Alexey Navalny.

- Volodymyr Zelenskyy, Ukraine’s president, visited two cities close to the frontline in the Donbas region. He travelled to Lysychansk, just south of Severodonetsk, where Ukrainian forces are engaged in heavy fighting, and also to Soledar. The Ukrainians claim to have repulsed seven attacks across the whole of the region over the past 24 hours.

— Market impacts:

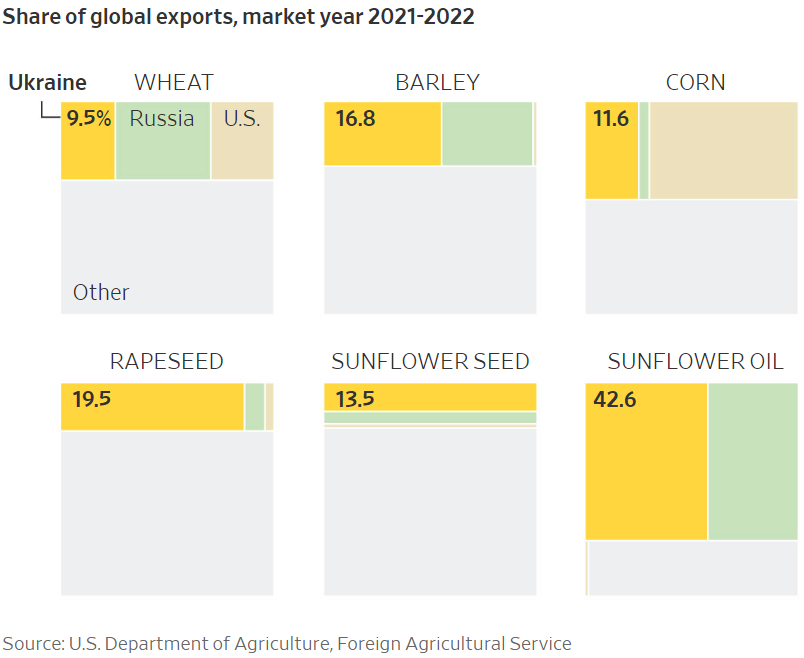

- Ukraine is struggling to export its grain. Before Russia’s invasion, around 98% of Ukraine’s grain exports would flow from ports on the Black Sea. But those ports have been shut by a Russian naval blockade, and warehouses, rail yards and other key export infrastructure have been targeted and damaged by Russian attacks. Despite the war, Ukraine’s farms are expected to produce around 30 million tons of wheat, corn and other food commodities this year, the Wall Street Journal reports (link). Traders and farmers, with the support of the Ukrainian government and neighboring nations, are seeking alternative routes to export those grains to stave off global food shortages and relieve soaring prices. But the new routes are longer, often backlogged and more expensive. The challenge is complicated by stretched infrastructure and continued Russian attacks on bridges and railways.

- U.S. warns Russia trying to sell stolen grain from Ukraine. The U.S. has warned the Kremlin is trying to profit by selling stolen wheat from Ukraine to drought-stricken countries in Africa. The New York Times reports in mid-May, the U.S. sent an alert to 14 countries, mostly in Africa, that Russian cargo vessels were leaving ports near Ukraine laden with what a State Department cable described as “stolen Ukrainian grain.” The cable identified, by name, three Russian cargo vessels it said were suspected of transporting it. The American alert about the grain has only sharpened the dilemma for African countries, many already feeling trapped between East and West, as they potentially face a hard choice between benefiting from possible war crimes and displeasing a powerful Western ally, and on the other, refusing cheap food at a time when wheat prices are soaring, and people are starving.

- 65% is how much of Hungary’s crude oil it imports from Russia. Hungary is the member of the EU most opposed to embargoes against Russia. Meanwhile, Russian Foreign Minister Sergey Lavrov on Wednesday visits his Turkish counterpart Mevlut Cavusoglu in Ankara.

|

PERSONNEL |

— Senate Banking Committee will vote on Michael Barr’s nomination to be vice chair for supervision of the Federal Reserve on June 8, according to a statement. The committee will also vote that day on the nominations of Jaime Lizarraga and Mark Uyeda to be members of the Securities and Exchange Commission.

— TVA nominations. White House Friday announced Biden’s intent to nominate Adam Wade White and William Renick to be members of the Tennessee Valley Authority (TVA) board of directors.

|

CHINA UPDATE |

— Starbucks is reopening its stores in Shanghai after a wave of Covid-19 infections and government lockdowns.

— China-Australia tensions. Australian defense officials have complained that a Chinese fighter jet executed a “dangerous maneuver” late last month in intercepting an Australian surveillance plane undertaking “routine maritime surveillance activity” in international airspace. Australian Prime Minister Anthony Albanese has said his government has made “appropriate representations to the Chinese government expressing our concern.”

|

TRADE POLICY |

— Lifting tariffs on some goods to tame price pressures "may make sense," Gina Raimondo said. The Commerce Secretary told CNN President Biden is open to ideas that may help American families but said it will keep levies on steel and aluminum to protect workers.

— White House may announce today that it won’t impose any new tariffs on solar imports for two years, in a move that is aimed at getting stalled solar-power projects on track, according to reports. The decision would be a win for U.S. solar developers and utilities — which are highly dependent on imported solar panels — and a loss for manufacturers trying to build up a domestic solar supply chain

|

LIVESTOCK, FOOD & BEVERAGE INDUSTRY |

— A U.S. baby formula factory will resume production. Abbott, whose February shutdown contributed to severe formula shortages, will restart operations after meeting government sanitary requirements. Abbott, located in Sturgis, Michigan, said in a statement it has started with the production of specialty formulas for babies who can't tolerate more common ones, with the first batches expected to be available to consumers around June 20. Similac and other products made at the plant will take longer to become available, the company said. The Sturgis plant has been shut down for months following an FDA inspection that found dangerous bacteria — which can be deadly to infants — in several areas at the facility.

— Schools and child-feeding sites are bracing for rising costs and supply disruptions as federal meal subsidies run out in weeks. The food assistance, in the form of USDA waivers authorized since the start of the Covid-19 pandemic, allows schools and child-feeding programs to distribute meals free to kids regardless of family income, and receive federal reimbursement. The waivers expire June 30 — barring congressional action to renew them.

— Dept. of Justice is launching its third attempt at convincing a jury that some chicken manufacturing executives violated federal antitrust law by colluding to fix prices. The trial against current and former executives of Tyson Foods, Pilgrim’s Pride, and other companies, which starts today in the U.S. District Court for the District of Colorado, underscores the DOJ antitrust regulators’ insistence on seeing their claims through to the end — despite skepticism from industry proponents and even the court’s judge.

|

CORONAVIRUS UPDATE |

— Summary:

- Global cases at 531,960,771 with 6,299,074 deaths.

- U.S. case count is at 84,762,022 with 1,008,585 deaths.

- Johns Hopkins University Coronavirus Resource Center says there have been 589,110,077 doses administered, 221,492,058 have been fully vaccinated, or 67.22% of the U.S. population.

|

POLITICS & ELECTIONS |

— Pennsylvania’s Democratic Senate nominee John Fetterman released a letter from his cardiologist saying he’s fit to run and serve in the US Senate if he follows health advice after a stroke sidelined him for the final days of his primary campaign. Meanwhile, as previously noted, former Bridgewater Associates Chief Executive David McCormick conceded the Republican U.S. Senate race in Pennsylvania to celebrity physician Mehmet Oz, saying an automatic recount underway wouldn’t change the outcome. McCormick said at an event in Pittsburgh on Friday that he called Oz to congratulate him on being the winner of the fiercely contested primary.

— Bass slightly ahead of Caruso in new poll, both appear headed for Los Angeles mayoral runoff. Days before Los Angeles' first open mayoral primary in nearly a decade, Rep. Karen Bass and developer Rick Caruso appear headed toward a November runoff, with Bass building a small edge as the campaign moves toward a close, according to a new poll cited by the Los Angeles Times. Bass has support of 38% of likely voters in the poll, which was conducted May 24-31. Caruso, who has bombarded L.A.'s airwaves with millions of dollars of advertising, has 32%, the UC Berkeley Institute of Governmental Studies poll, co-sponsored by the LAT, indicates. Link for details.

— U.K. prime minister Boris Johnson will face a vote of no confidence. It will take place later today, after at least 15% of conservative MPs agreed to a vote. Johnson made clear he plans to come out fighting. Ousting him requires a majority of the party's 359 members of parliament and several factors may help Johnson retain power, including a lack of obvious successors.

— Student debt forgiveness. Members of the Congressional Black Caucus met with senior aides to Biden on Friday to press their case for canceling at least some federal student loan debt, according to a person familiar with the matter. The Black Caucus publicly called on Biden last month to use executive authority to forgive student loan debt, joining many Democratic lawmakers that have lobbied the president to act before the midterm elections.

— Former White House Chief of Staff Mark Meadows won’t be indicted for defying subpoenas by the special congressional committee investigating the deadly Jan. 6 assault on the U.S. Capitol, a major blow to the panel as it seeks cooperation of associates of former President Donald Trump.

|

CONGRESS |

— The House is scheduled to vote on two bills under an expedited process requiring a two-thirds majority: the bipartisan Water Resources Development Act (WRDA) and the reauthorization of Food and Drug Administration user fees. Under the bill, the U.S. Army Corps of Engineers would be authorized to begin construction of 16 pending water infrastructure projects. The measure also would authorize the Corps to conduct 72 feasibility studies for future projects. A two-thirds majority would be required for passage or adoption of the proposals.

|

OTHER ITEMS OF NOTE |

— North Korea fired eight short-range ballistic missiles into the waters off its east coast on Sunday, South Korea's Joint Chiefs of Staff said, a move that Japan has called "unprecedented." North Korea's launch yesterday was its 17th missile test this year. As a response, the U.S. and South Korea test-fired eight rockets in response to more provocation by Kim Jong Un.