In Biden Reversal, U.S. Will Send Advanced Rocket Systems to Ukraine

Vilsack to detail over $2 billion in funding to transform U.S. food system

|

In Today’s Digital Newspaper |

Private exporters reported sales of 132,000 metric tons of soybeans for delivery to China. Of the total, 66,000 metric tons is for delivery during the 2021-2022 marketing year and 66,000 metric tons is for delivery during the 2022-2023 marketing year.

President Joe Biden said he’ll give Ukraine advanced rocket systems and other U.S. weaponry to better hit targets in its war with Russia, ramping up military support as the conflict drags into its fourth month. The package of weapons includes missiles that will allow Ukraine to strike locations nearly 50 miles away. A senior administration official said Ukraine provided the U.S. with assurances it would not use the HIMARS to attack Russian territory. HIMARS (High Mobility Artillery Rocket System) can fire the same family of munitions as MLRS (multiple-launch rocket system) launchers but with one key difference – a wheeled chassis instead of tracks. This design offers a unique shoot and scoot capability that enables users to position, engage and rapidly relocate after firing. President Biden, in a New York Times op-ed, writes about what the U.S. will and will not do in Ukraine.

European leaders announced a 9-billion-euro (around $9.7 billion) aid package for Ukraine and moved to tackle a blockade of Ukrainian crops that is threatening a global food crisis.

Ukraine’s food blockade. Ukraine is looking for ways to start exporting agricultural products. On Tuesday, Foreign Minister Dmytro Kuleba said work was underway on an “international U.N.-led operation with navies of partners” to secure its food exports. Turkish President Recep Tayyip Erdogan, whose country controls entry and exit from the Black Sea, placed “particular importance” on establishing a safe trade route during a call with Ukrainian President Volodymyr Zelensky on Tuesday. While Ukraine’s exports are still under discussion, Russia has already restarted cargo shipping from the captured port city of Mariupol, as a ship laden with 2,500 tons of metal headed for the Russian port of Rostov on Tuesday. The Ukrainian government has described the shipment as a form of looting.

The city of Sievierodonetsk in Ukraine’s east has largely fallen under Russian control, Ukrainian officials said on Tuesday, following a concentrated Russian effort in recent days.

Per the WSJ, OPEC is reportedly discussing exempting Russia from an agreement gradually to boost oil production, which could free up other oil-producing countries to increase their exports.

Transforming the U.S. food system by improving supply chains and addressing issues exposed by the Covid-19 pandemic will be detailed today by USDA Secretary Tom Vilsack during a speech at Georgetown University. The over $2 billion package includes previously announced funding to expand meat and poultry processing, but there is $600 million in new aid to support food supply chain infrastructure outside meat processing. We have details.

Janet Yellen admits she was ‘wrong’ about inflation threat. The Treasury secretary conceded she was “wrong” last year about the threat posed by rising inflation while insisting that Joe Biden’s administration has quickly focused on taming soaring prices. “I think I was wrong then about the path that inflation would take,” Yellen told CNN on Tuesday, in a rare admission of error from a senior U.S. official. “There have been unanticipated and large shocks to the economy that have boosted energy and food prices and supply bottlenecks that have affected our economy badly that I didn’t — at the time — didn’t fully understand, but we recognize that now,” she added.

The beginning of so-called quantitative tightening commences today as the Fed lets bonds mature off its nearly $9 trillion balance sheet without replacement.

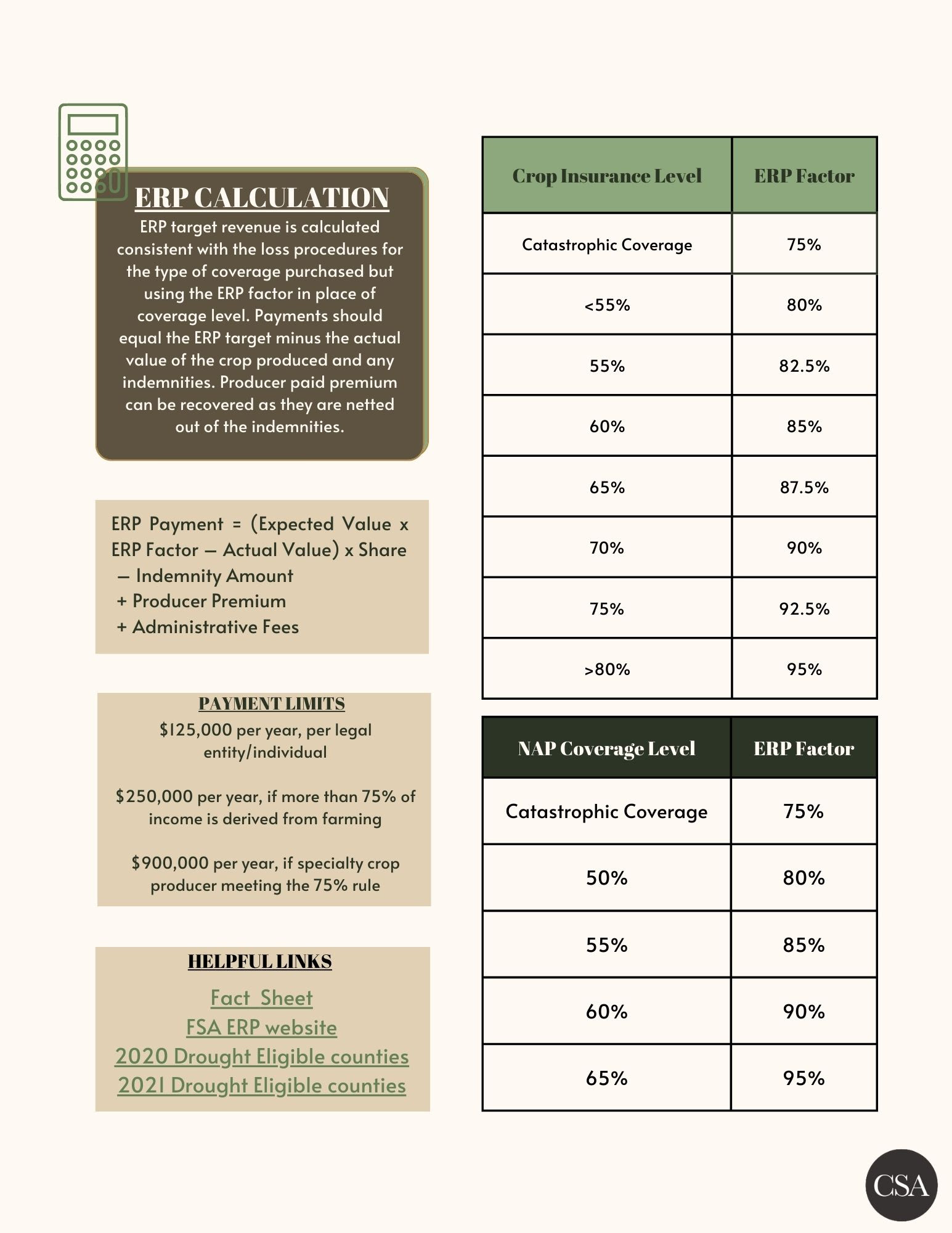

Regarding the ERP (formerly WHIP+), Combest, Sell & Associates put together a handy way of calculating payments, which are expected this month for Phase 1.

In China news, Shanghai reopens from its lengthy lockdown and a private gauge of China’s manufacturing sector showed activity contracted at a slower pace in May.

On the trade policy front, (1) U.S. removes U.K. metals tariffs, (2) The White House is considering efforts to mitigate inflation, including easing tariffs, and (3) Republicans want a fertilizer trade fix. Meanwhile, the U.S. Trade Representative’s office unveiled a new pact with Taipei to promote bilateral trade in areas such as digital trade, clean energy and labor rights.

In energy related news, 6.6% is the electric vehicles’ share of total cars sold in recent weeks as gasoline prices rise to their highest levels in years; a Sustainable Aviation Fuels (SAF) summit begins today; and the OMB signed off on a proposed rule on alternative RIN retirement plan for small refiners which means EPA is getting set to release by Friday details on several years of the RFS, including any waivers.

Supermarkets and distributors are pushing back on higher prices from food makers, as escalating inflation drives more consumers to rethink their spending. Details below.

A lawyer for the 2016 Clinton campaign was acquitted on a charge of lying to the FBI about his motives for turning over research allegedly linking Donald Trump to Russia.

The Supreme Court temporarily blocked a Texas law that would restrict social media platforms’ ability to moderate users’ content.

Senate: Out until June 6. House: Out until June 7.

Election Day 2022 is 160 days away. Election Day 2024 is 888 days away.

|

MARKET FOCUS |

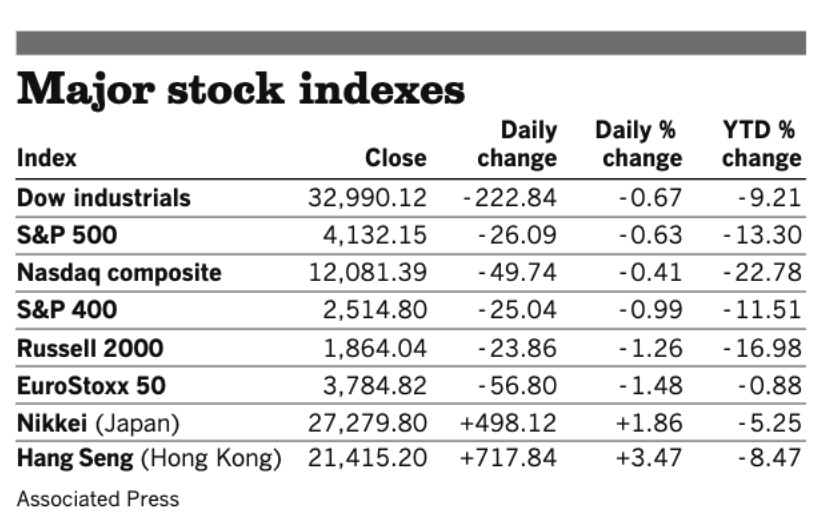

Equities today: Global stock markets were mostly lower overnight. The Dow opened around 240 points higher. In Asia, trading was mixed. China’s Shanghai Composite lost 0.1%, as Covid-19 lockdowns eased in China’s financial capital. Hong Kong’s Hang Seng fell 0.6%. Japan’s Nikkei 225, in contrast, rose about 0.7%. Europe’s Stoxx 600 Index pared back declines in the wake of euro-zone figures Tuesday that showed a record jump in consumer prices. The data strengthen the case for the European Central Bank to lift interest rates by a half-point in July, according to Austrian central bank chief and Governing Council member Robert Holzmann.

U.S. equities yesterday: The Dow opened the holiday-shortened week with a loss of 222.84 points, 0.67%, at 32,990.12. The Nasdaq fell 49.74 points, 0.41%, at 12,081.39. The S&P 500 was down 26.09 points, 0.63%, at 4,132.15.

For the month of May, the Dow and the S&P 500 finished the month essentially flat. The Nasdaq slid 2.05% in May, its fourth negative month in five, as investors balance concerns about high inflation, the Federal Reserve's response to it and the pace of economic growth. The major U.S. stock indexes are down considerably from their all-time highs. The Nasdaq is 25.5% below its November peak. The S&P 500 and Dow, which both notched their records in early January, are down 14.25% and 10.7%, respectively, from those highs.

Fed Atlanta President Raphael Bostic said his suggestion last week that the central bank take a September “pause” from raising interest rates shouldn't be construed as a “Fed put,” or belief that the central bank would come to the rescue of markets.

Agriculture markets yesterday:

- Corn: July corn futures sank 23 3/4 cents to $7.53 1/2, the contract’s lowest closing price since April 4. December corn futures fell 18 1/2 cents to $7.11 1/2, a three-week low.

- Soy complex: July soybeans tumbled 49 cents to $16.83 1/4 after posting a contract high overnight. November soybeans fell 34 1/2 cents to $15.09 1/2. July soymeal fell $17.50 to $414.80, while July soyoil dropped 165 points to 77.92 cents, near a seven-week low.

- Wheat: July SRW wheat plunged the 70-cent daily trading limit to $10.87 1/2, the lowest close since May 4. July HRW wheat fell 69 3/4 cents to $11.65 1/2. July spring wheat fell 57 1/4 cents to $12.47 1/2.

- Cotton: July cotton fell 44 points to 138.98 cents per pound, while December fell 50 points to 122.45 cents.

- Cattle: August live cattle fell $2.025 to $130.375 and August feeders fell $1.20 to $165.125.

- Hogs: July lean hog futures plunged $3.725 to $108.00, while August futures fell $4.025 to $106.425.

Ag markets today: Two-sided trade was seen overnight, with wheat and soybeans firmer amid corrective buying this morning, while corn is trading just below unchanged. As of 7:30 a.m. ET, SRW wheat futures were trading mostly 1 to 3 cents higher, HRW wheat was 5 to 7 cents higher, HRS wheat was mostly 6 to 8 cents higher, corn futures were 1 to 2 cents lower and soybeans were 2 to 6 cents higher. Front-month U.S. crude oil futures were around $1.50 higher and the U.S. dollar index was about 275 points higher this morning.

Technical viewpoints from Jim Wyckoff:

On tap today:

• European Central Bank President Christine Lagarde speaks at a Bank for International Settlements conference at 7 a.m. ET.

• S&P Global's U.S. manufacturing index for May is expected to tick down to 57.3 from a preliminary reading of 57.5. (9:45 a.m. ET)

• Institute for Supply Management's manufacturing index is expected to fall to 54.5 in May from 55.4 one month earlier. (10 a.m. ET)

• U.S. construction spending for April is expected to increase 0.5% from the prior month. (10 a.m. ET)

• U.S. job openings are expected to tick down to 11.4 million in April from 11.5 million one month earlier. (10 a.m. ET)

• Bank of Canada releases a policy statement at 10 a.m. ET.

• USDA Secretary Tom Vilsack delivers remarks at Georgetown University announcing a new USDA framework to transform the food system, 11:30 a.m. ET. See details below.

• Federal Reserve releases its Beige Book report on regional economic conditions at 2 p.m. ET.

• Fed speakers: New York's John Williams opening remarks at a New York Fed event at 11:30 a.m. ET, and St. Louis's James Bullard on the economy and monetary policy at 2:10 p.m. ET.

• President Biden at 2 p.m. ET will meet virtually with administration officials and infant formula manufacturers (CEOs of Gerber, Perrigo, Reckitt, and other baby formula manufacturers) to discuss efforts to accelerate infant formula production and ramp up imports.

President Joe Biden used a rare meeting with Federal Reserve Chair Jerome Powell to declare that he’s respecting the central bank’s independence — while simultaneously shifting responsibility for taming decades-high inflation ahead of the November midterms. Biden seized on the Oval Office session to argue that while fighting price increases is his top priority, that work was primarily the purview of the U.S. central bank. Meanwhile, the Fed is set to start shrinking its $8.9 trillion balance sheet and will release its Beige Book report.

Treasury Secretary Janet Yellen gave her most direct admission yet that she made an incorrect call last year in predicting that elevated inflation wouldn’t pose a continuing problem. “There have been unanticipated and large shocks to the economy that have boosted energy and food prices and supply bottlenecks that have affected our economy badly that at the time I didn’t fully understand,” Yellen said in an interview aired Tuesday on CNN.

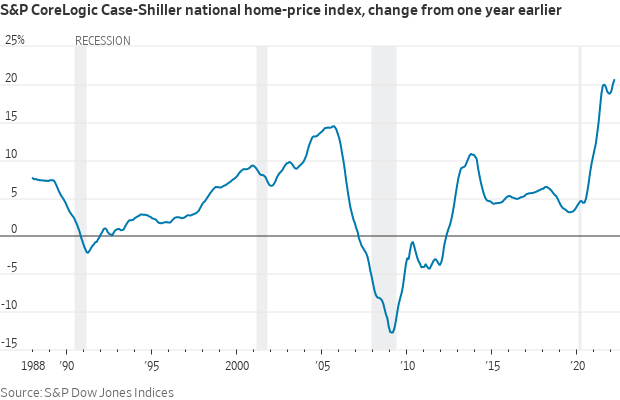

Home prices rose 20.6% year-over-year. The S&P CoreLogic Case-Shiller National Home Price Index, which measures average home prices in major metropolitan areas across the nation, set a new record in the year that ended in March, up from a 20% annual rate the prior month. March marked the highest annual rate of price growth since the index began in 1987.

Efforts to relieve a shortfall in shipping containers are stuck at sea and on the docks. Ship operators have been adding millions of boxes to international operations over the past two years, but the Wall Street Journal reports (link) the added capacity is effectively trapped in congested distribution networks as shipping moves into its busiest period. An early start to the peak season is adding to the problem as importers order and ship goods early to get ahead of feared bottlenecks later this year. The result is that some 12% of the world’s container ships are backed up outside ports for weeks longer than normal while backups in inland distribution networks are growing. The average time boxes wait at the ports of Los Angeles and Long Beach has surged recently, and reached 9.6 days in April, the highest level since July 2021, according to the Pacific Merchant Shipping Association.

Market perspectives:

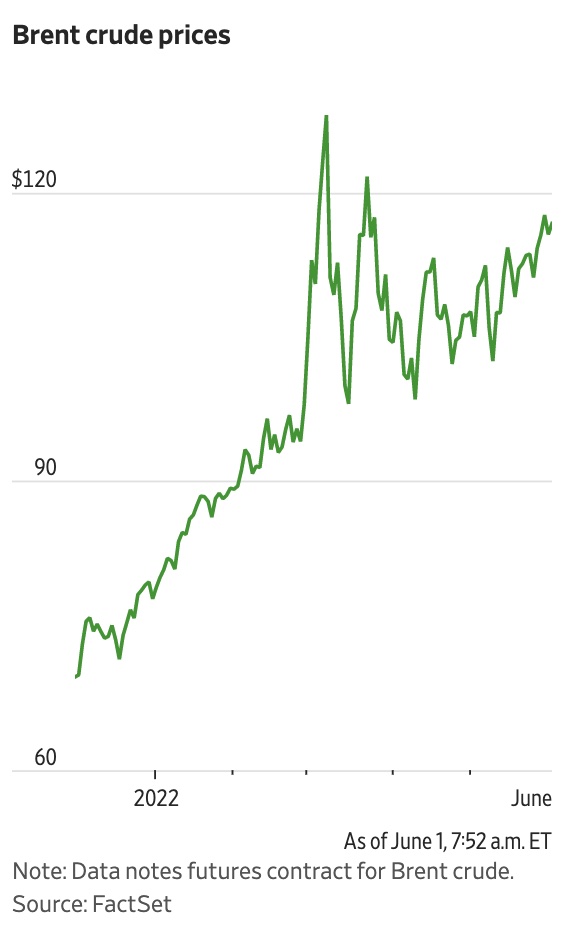

• Outside markets: The U.S. dollar index was higher in early trading. The yield on the 10-year U.S. Treasury note is fetching 2.869%. Brent crude, the international benchmark for oil prices, rose 1.4% to $117.19 a barrel. West Texas Intermediate, the U.S. marker, advanced 1.2% to $116.01. Gold futures fell 0.4% to $1,840.80 an ounce.

• Supply and demand imbalances pushed the price of Brent crude, the global benchmark, up more than 10% in May, the biggest rise since January. Brent for July delivery hit a high of $123 yesterday, compared with less than $80 at the start of the year.

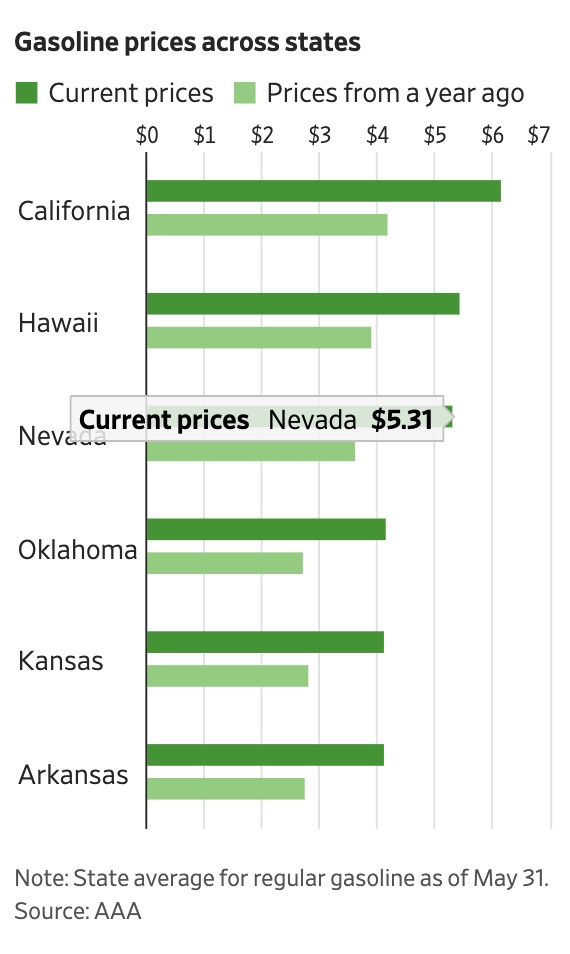

• National average price for a gallon of regular unleaded gas hit $4.62 Monday, up 11% in the past month and 52% in the past year. Yet many motorists have stuck with their summer road-trip plans, in part because of pent-up demand for travel after Covid-related restrictions. That may change if the price climbs much more. A survey by AAA in March found that at $5 — already hit on the West Coast — three-quarters of American drivers said they would need to adjust.

• Though oil prices are up more than 70% over the last year, American producers have been slow to respond. Weekly domestic production is up roughly 7% over the same span, and it remains 8% below where it ended in 2019.

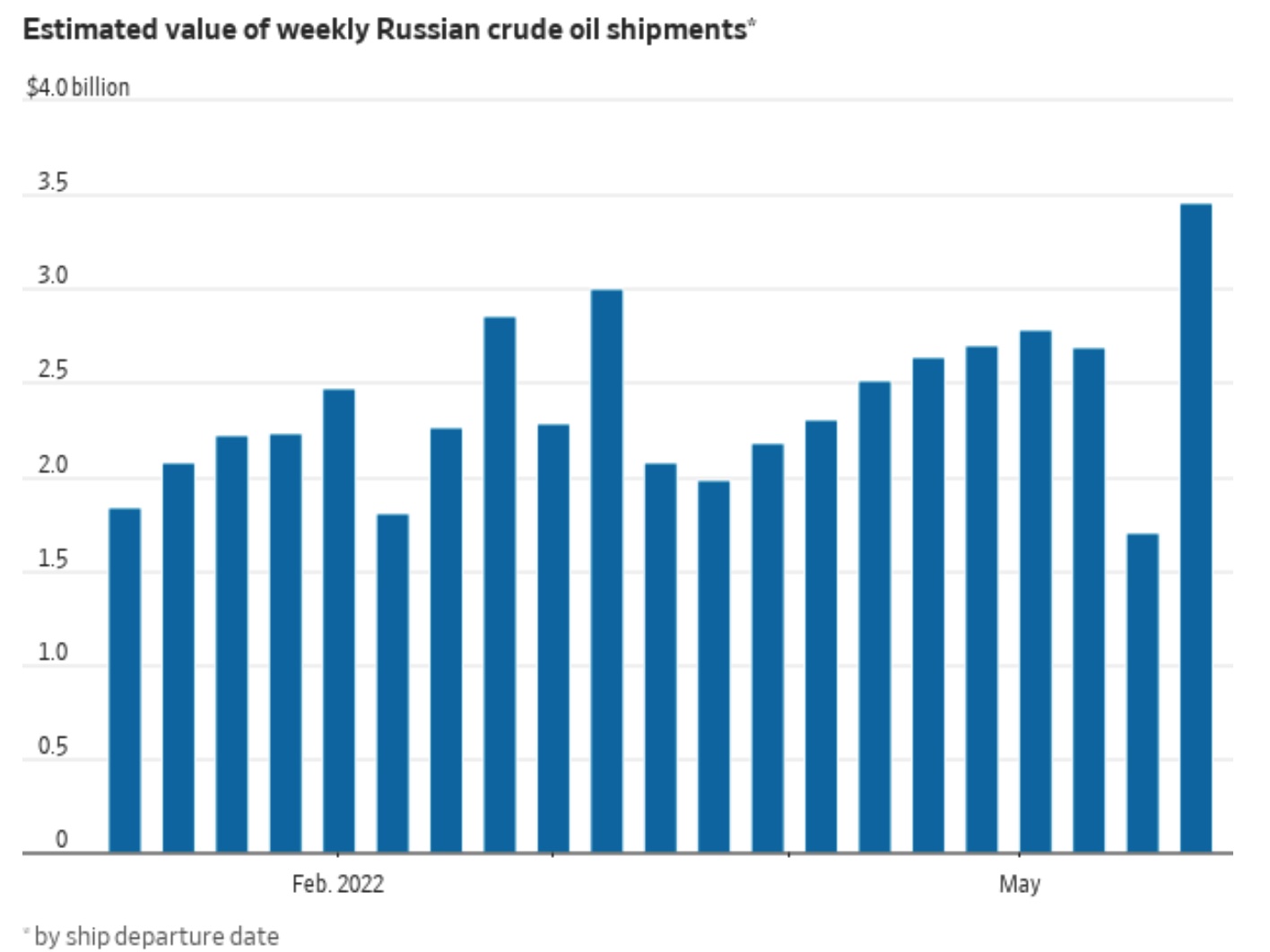

• OPEC+ seen sticking with supply plan even as EU sanctions Russia. The OPEC+ coalition will likely hold firm to its oil production plans this week even as the European Union moves to sanction group member Russia, delegates said. Global oil supply and demand levels remain stable, with no severe disruption yet to Russian exports, and thus require little action from the 23-nation alliance, according to observers. Meanwhile, the Wall Street Journal reported on Tuesday that OPEC is contemplating suspending Russia from the coalition’s quota system, as sanctions prevent Moscow from increasing output. The Saudis and the United Arab Emirates might fill the resulting supply gap, the WSJ said.

• Shipping costs to rise at busiest U.S. ports. The record rally of California’s diesel prices is pushing up costs for shippers to transport goods from the country’s busiest sea ports. California’s production of CARB diesel, mandated by the state, has fallen to the lowest level for this time of year since 2004, in part because regulations have incentivized the transition toward renewable alternatives. Supply could tighten further next month when one of the state’s largest refineries, Chevron Corp.’s Richmond plant in the San Francisco Bay Area, undergoes maintenance that had to be postponed from April due to a labor strike.

• Ag trade: Egypt tendered for an unspecified amount of optional origin milling wheat; results of the tender will be known later this morning.

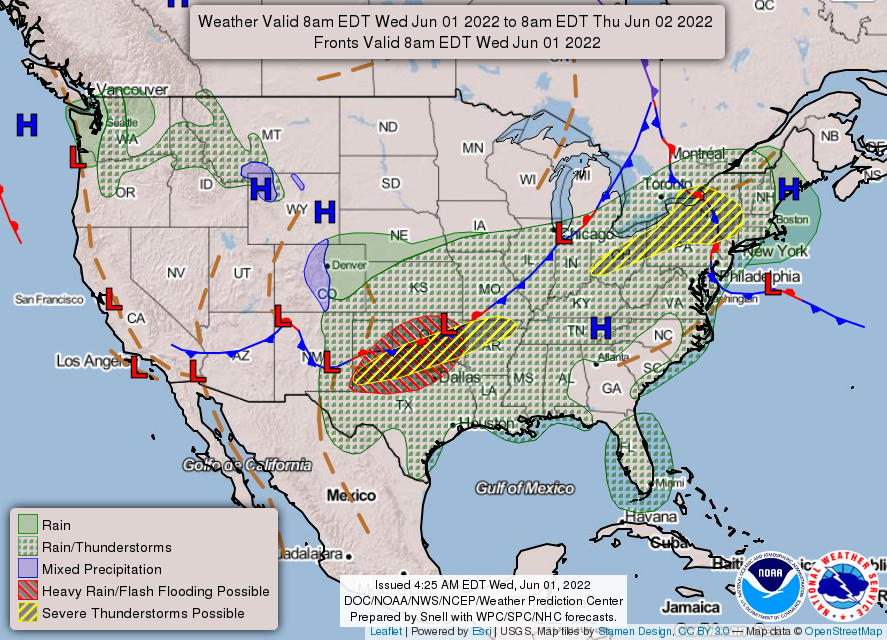

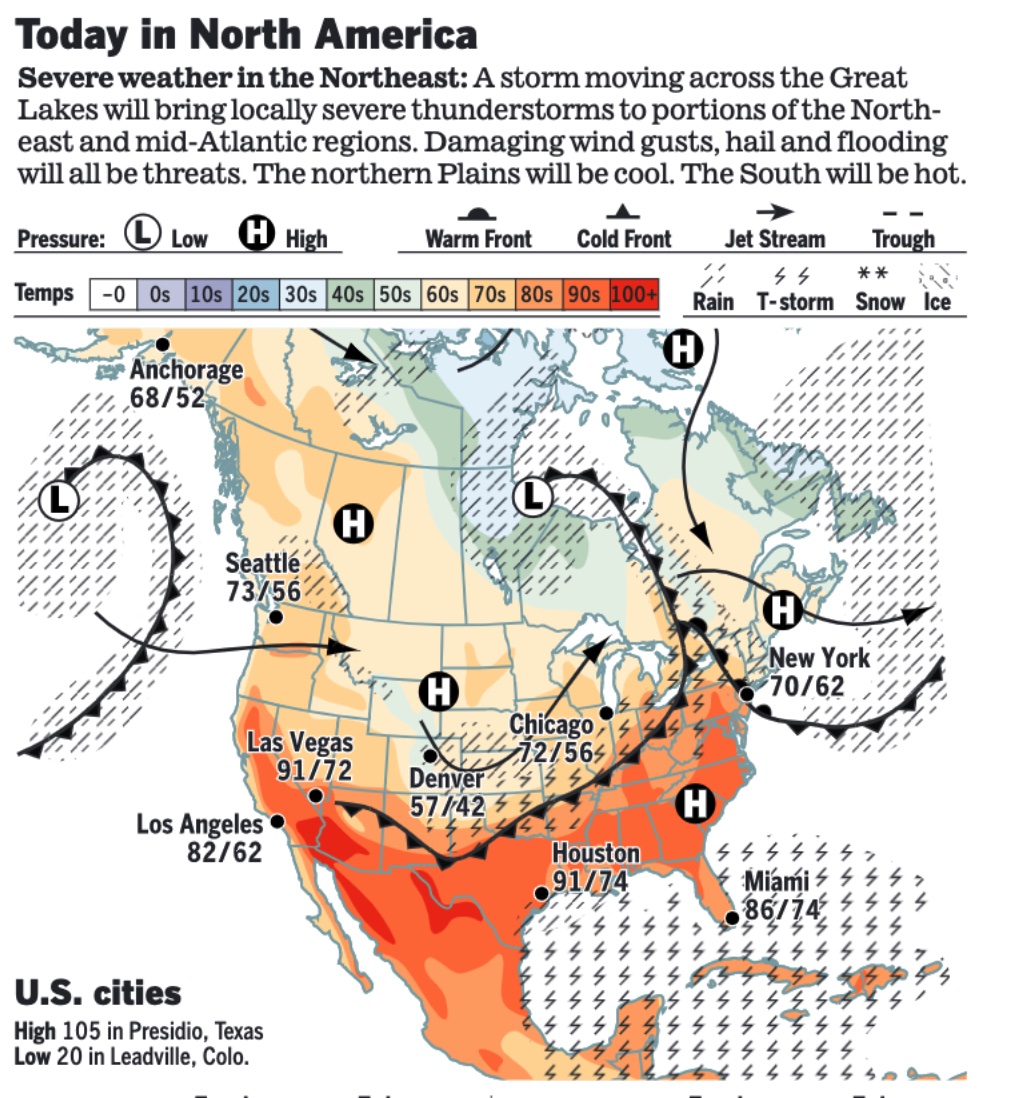

• The six-month Atlantic hurricane season begins today, June 1. And there's already a potential storm brewing to start the season, forecasters say.

• NWS weather: A frontal system advancing southeast across the central and eastern U.S. will continue to drive the threat for severe weather and heavy rainfall... ...Cooler temperatures over the Plains and Midwest will slowly advance toward the eastern U.S. by later this week... ...Some scattered showers expected but mostly tranquil, seasonal conditions to continue west of the Rockies.

Items in Pro Farmer's First Thing Today include:

• Wheat and beans bounce, corn struggles to find buying

• Limited change in winter wheat CCI ratings as the growing season winds down

• April soy crush, corn-for-ethanol data out later this morning

• Cash cattle trade starts at lower prices

• Strong start for wholesale meat trade

|

RUSSIA/UKRAINE |

— Summary: Fighting raged in Sievierodonetsk on Tuesday as Russian troops advanced toward the center of the city, which is the last in the Luhansk region of eastern Ukraine to remain outside Russian control. A new Russian commander, Gen. Aleksandr Dvornikov, was sent to Ukraine in April to oversee a refocused invasion in the east.

- European Commission promised an aid package of around $9.7 billion over the rest of this year to cover Ukraine’s reconstruction, with losses inflicted on the country by Russian aggression estimated by Ukrainian authorities to now be at least $650 billion.

- Push to get Ukraine grain exported. As European leaders finished a two-day summit in Brussels, Ursula von der Leyen, the president of the European Commission, said the developing global food crisis was “only the fault of Russia,” which has seized or blockaded all of Ukraine’s Black Sea ports, preventing 22 million tons of grain from leaving. Russia’s foreign minister will visit Turkey next week to discuss possibly releasing the grain. Ukraine used to be a major global food exporter: it produced 12% of the world’s wheat, 15% of its corn, and 50% of its sunflower oil. Russia is currently blocking 22 million tons of grain in Ukraine, bombarding houses where wheat is stored, and mining fields, von der Leyen said. It is also seeking to blame Western sanctions for the food crisis, an accusation von der Leyen vehemently rejected. Getting the wheat out of Ukraine will be “tedious and expensive,” she said, but it is “necessary.” Prime minister Mario Draghi of Italy, who said Tuesday that if the West were to “lose the war on food security,” African countries “will feel betrayed.” That, in turn, he added, could have “strategic consequences that are very serious.”

The commission previously announced measures to ramp up Ukraine’s exports of blocked grain and oilseed through existing land routes, mainly through Poland and Romania. But there are complex challenges, including the difference in the gauge of railway tracks between Ukraine and its neighbors. Even without that hurdle, railway travel is significantly slower than sending grain by sea.

President Biden and Prime Minister Jacinda Ardern of New Zealand discussed aid to Ukraine and expressed concerns about global food security during a meeting at the White House on Tuesday, a joint statement said. - Biden reverses course, says U.S. will send rockets to Ukraine. President Biden announced in an op-ed Tuesday (link) that his administration will send advanced missile systems to Ukraine — reversing course from a day earlier when he said the U.S. would not deliver the rockets to the war-torn country. “We have moved quickly to send Ukraine a significant amount of weaponry and ammunition so it can fight on the battlefield and be in the strongest possible position at the negotiating table,” Biden wrote in a New York Times op-ed. “That’s why I’ve decided that we will provide the Ukrainians with more advanced rocket systems and munitions that will enable them to more precisely strike key targets on the battlefield in Ukraine.” Biden’s reversal came after several officials criticized the president’s refusal to send Ukraine missiles as the country continues to fight off Russia’s brutal invasion that began on Feb. 24.

“The package will contain longer-range systems, specifically HIMARS, and munitions that will enable Ukraine to more precisely strike targets on the battlefield from a greater distance inside Ukraine and to help them to repel Russian advances,” an official said. A different kind of multiple-launch rocket system, or MLRS, can travel further than the ones the U.S. will be giving Ukraine. A senior administration official said Ukraine provided the U.S. with assurances it would not use the HIMARS to attack Russian territory.

— Market impacts:

- European Union is set to ban imports of its oil and blocking insurers from covering its cargoes of crude, officials and diplomats say, as the West seeks to deprive Moscow of cash it needs to fund the war on Ukraine. The ban on insurers will cover tankers carrying Russian oil anywhere in the world. These sanctions could undercut Russia’s efforts to sell its oil in Asia. European companies insure most of the world’s oil trade. The embargo forces the bloc to break its dependency on cheap Russian energy. It is likely to fuel inflation already running at the highest pace in decades on both sides of the Atlantic. Bottom line: The insurance bar will have a more meaningful impact on Russian exports as Moscow relies heavily on European insurers and carriers when transporting its oil around the world. The move seems likely to reduce Russian exports. But it also will push up global prices, blunting the hit to Moscow’s cash flows and exacerbating inflationary pressures.

- Russia could impose negative interest rates on the dollar and euro deposits to elevate China's yuan and other currencies. The country's central bank said sanctions have already decreased the appeal of the two top currencies.

- Pope: Don’t use wheat as ‘weapon of war’. Pope Francis appealed to authorities on Wednesday to lift a block on exports of wheat from Ukraine, saying it could not be used as a “weapon of war.” He said, “The blocking of exports of wheat from Ukraine is very worrying because the lives of millions of people depend on it, especially in poorer countries. I make a heartfelt appeal so that every effort is made to resolve this problem, to guarantee the universal right to nutrition. Please! Do not use wheat, a basic foodstuff, as a weapon of war.” The pope has often condemned Russia’s invasion, but this was the first time he spoke in detail of the global food crisis it has brought.

- Russia will provide world with food and fertilizer. Russia’s Deputy Foreign Minister Sergei Ryabkov said Moscow will find ways to supply markets with Russian grain and fertilizers despite Western sanctions, RIA news agency reported. Meanwhile, Russia’s foreign minister will visit Turkey next week to discuss possibly allowing Ukrainian grain to be shipped from ports.

|

POLICY UPDATE |

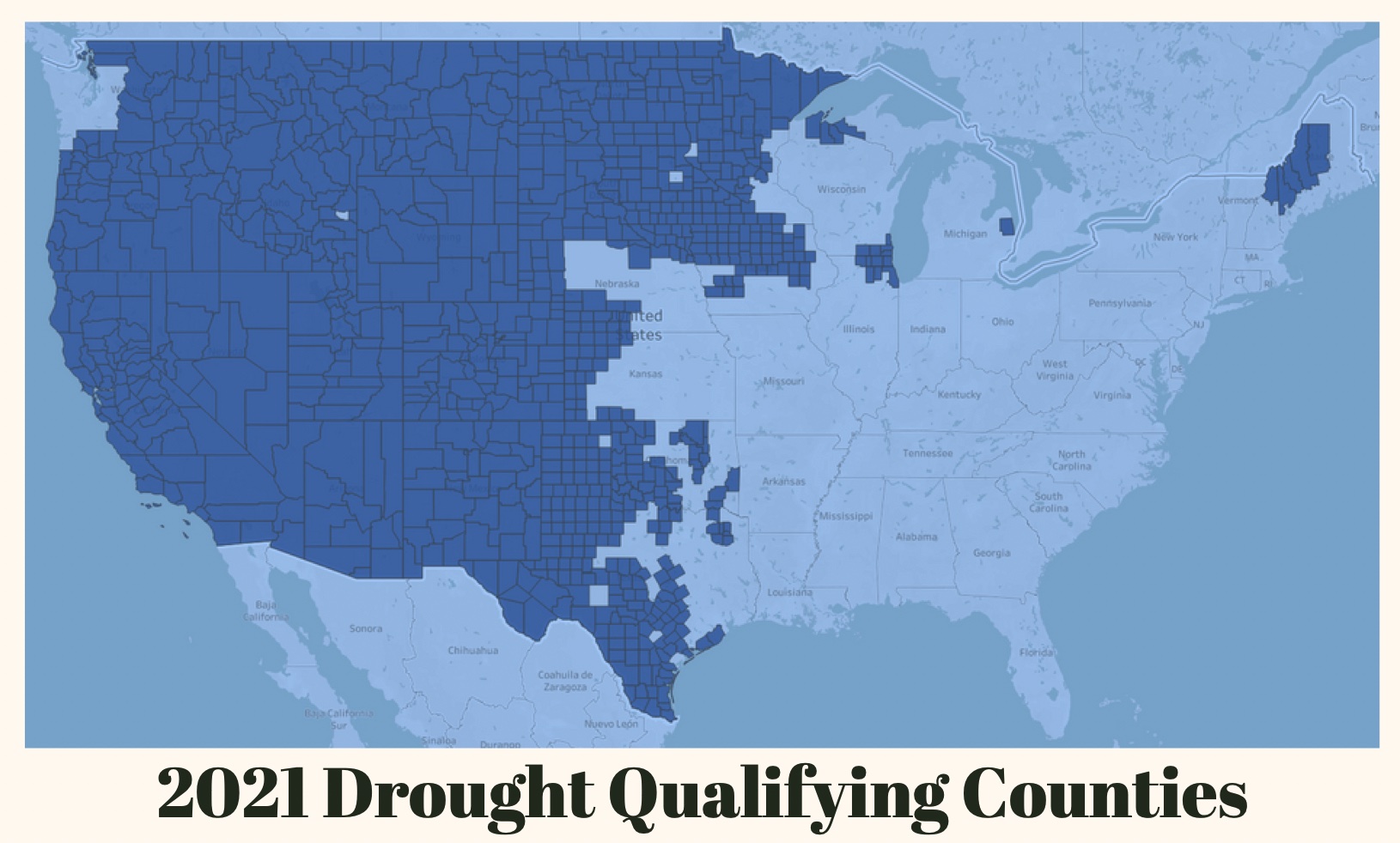

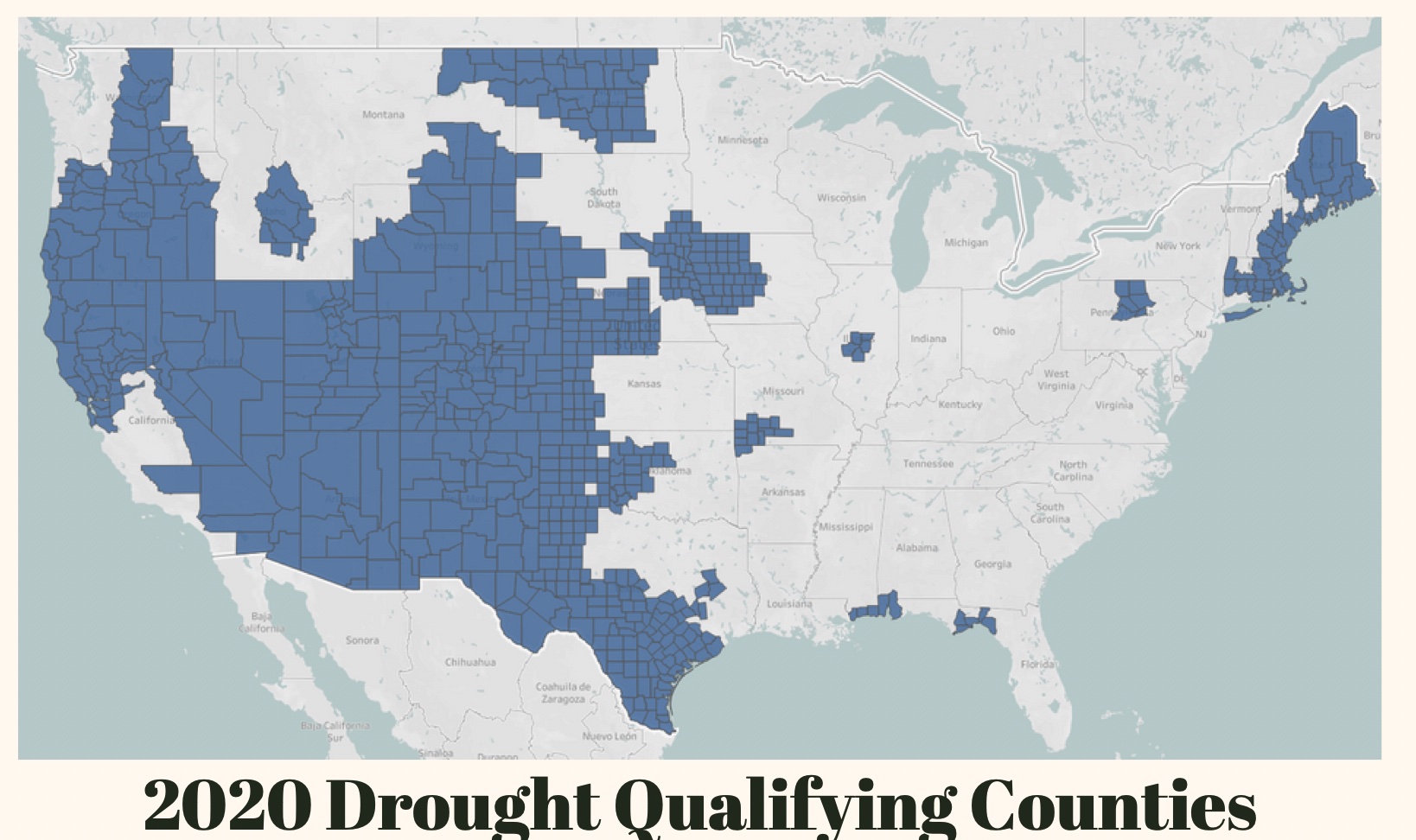

— Combest, Sell & Associates put together handy information about the Emergency Relief Program (ERP). Many producers are receiving letters and worksheets from USDA’s Farm Service Agency (FSA) that calculate the losses by unit. That has raised some questions. The ag consulting group created a simplified cheat sheet to help producers through the process. It is available below with the firm’s permission (link).

|

PERSONNEL |

— Treasury tax official leaving Biden administration. The Treasury Department’s deputy assistant secretary of tax analysis, Kimberly Clausing, is leaving the Biden administration. Clausing is returning to academia, a Treasury spokeswoman said.

— The White House named Stephen Lyon, a retired general who led the U.S. Transportation Command, as its port and supply chain envoy.

|

CHINA UPDATE |

— Shanghai reopens from lockdown. China’s financial capital is rolling out its most significant easing of Covid-19 restrictions since it was sealed more than two months ago after authorities said public transport would resume and shops reopen today. Beginning today, Shanghai’s businesses will no longer need to obtain government approval, or get on the government’s priority resumption list, to re-open.

— A private gauge of China’s manufacturing sector showed activity contracted at a slower pace in May as more cities across the country emerged from the lockdowns that had brought daily life and economic activity to a near-standstill. The Caixin China purchasing managers index rose to 48.1 in May from April’s 46.0 — a 26-month low, according to Caixin Media and S&P Global. A reading below 50 indicates activity is contracting, above 50 expanding.

— U.S. launches initiatives to boost economic ties with Taiwan. As tensions grow with China, the Biden administration is forging closer ties to Taiwan in areas such as trade and supply chains. The U.S. Trade Representative’s office on Wednesday unveiled a new pact with Taipei to promote bilateral trade in areas such as digital trade, clean energy and labor rights. The two partners will also collaborate to address nonmarket practices and policies, including those conducted by state-owned enterprises, an issue representing Washington’s leading complaint about China’s trade policy. Separately, Commerce Secretary Gina Raimondo is launching a separate dialogue with Taiwan to address technology trade and investments, citing the importance of Taiwan as a leading supplier of advanced semiconductors. According to the White House’s supply-chain report, 92% of the world’s supply of advanced semiconductors came from the island’s Taiwan Semiconductor Manufacturing Co. in 2021. Link for details.

The USTR’s trade pact with Taiwan followed USTR Katherine Tai’s meeting with John Deng, Taiwan’s minister without portfolio responsible for trade, in Bangkok last month to discuss ways to strengthen economic ties between the two trading partners. The trade pact, as it is written currently, doesn’t require Congressional approval because it doesn’t include tariff cuts and other traditional market-opening measures, the senior administration officials said.

U.S. trade with Taiwan has expanded sharply in the wake of tariffs on Chinese imports imposed by the former Trump administration. The U.S. exported $3.94 billion worth of U.S. ag commodities to Taiwan in 2021, an 18% jump from 2020, making Taiwan the sixth largest foreign market for U.S. ag products. The U.S. shipped a record $668 million worth of beef to Taiwan in 2021, a 21% increase from 2020. Taiwan imported a record $167 million worth of U.S. dairy products, a 15% increase from 2020.

|

TRADE POLICY |

— U.S. removes U.K. metals tariffs. Washington will scrap Trump-era tariffs of 25% on steel and aluminum exports, replacing them with quotas. In return, London will suspend extra taxes on U.S. products such as bourbon and Levi’s jeans.

— White House is considering efforts to mitigate inflation, including easing tariffs, White House Council of Economic Advisers Chair Cecilia Rouse said. “Easing tariffs can potentially ease inflation, a least the level of inflation, at least by a few basis points, if not more,” Rouse told Bloomberg TV. Meanwhile, the Treasury Department’s No. 2 official highlighted the importance of U.S. tariffs on Chinese goods as a tool to aid American jobs and competitiveness, amid a debate over scaling them back to quell inflation. President Biden said last week he’s considering removing some of the tariffs and would take up the topic with Treasury Secretary Janet Yellen.

The Biden administration recently began a review process for Trump-era duties on imports from China as lawmakers consider legislation that could address tariff exclusions. Meanwhile, trade is one of the sticking points in legislation to boost competitiveness with China, including a Senate proposal to reinstate the tariff exclusions and create a new exclusion process.

— Republicans want fertilizer trade fix. Republican senators asked U.S. Trade Representative Katherine Tai to establish a long-term plan for fertilizer trade, as prices skyrocket following the Russian invasion of Ukraine. In the letter (link), Sens. Roger Marshall (Kan.), Chuck Grassley (Iowa), Joni Ernst (Iowa), and Deb Fischer (Neb.) called on the Biden administration to enhance the U.S.’s trading relationship with Canada and work with China to reduce or eliminate its fertilizer export restrictions.

|

ENERGY & CLIMATE CHANGE |

— 6.6% is the electric vehicles’ share of total cars sold in recent weeks as gasoline prices rise to their highest levels in years, according to Atlas Public Policy, a Washington, D.C., research firm that tracks the electric-vehicle industry. U.S. efforts to build a national network of charging stations have proceeded sluggishly as states figure out how to dole out public funding fairly. Global passenger EV sales are slated to reach roughly 21 million in 2025, up from 6.6 million last year. Van and truck sales are also growing.

— SAF summit begins. Top Federal Aviation Administration officials will gather with the industry in a summit this week to talk about sustainable aviation fuels (SAF). The summit, hosted by the Commercial Aviation Alternative Fuels Initiative, starts today. Billy Nolen, acting administrator of the FAA, and DOT Assistant Secretary for Aviation and International Affairs Annie Petsonk are among those set to appear at the event. Link for details.

— OMB signs off on proposed rule on alternative RIN retirement plan for small refiners. The Office of Management and Budget (OMB) accepted a proposed rule from EPA establishing an alternate renewable identification number (RIN) retirement schedule for small refineries under the Renewable Fuel Standard (RFS). EPA is expected to deny more than 60 small refinery exemptions (SREs) pending before the agency. EPA by Friday is expected to announce its final RFS levels for the 2020, 2021 and 2022 compliance years.

|

LIVESTOCK, FOOD & BEVERAGE INDUSTRY |

— Transforming the U.S. food system by improving supply chains and addressing issues exposed by the Covid-19 pandemic will be detailed today by USDA Secretary Tom Vilsack during a speech at Georgetown University (link for details). The over $2 billion package includes previously announced funding to expand meat and poultry processing and to finance new infrastructure such as cold storage facilities, but there $600 million in new aid to support food supply chain infrastructure outside meat processing. The plan also includes $400 million for regional food business centers, up to $300 million for a new organic transition initiative and $75 million to support urban agriculture. The initiatives are funded through the American Rescue Plan that was enacted in March 2021 and other relief legislation. On Thursday, Vilsack will be in Ohio with Democratic Rep. Marcy Kaptur to visit a full-service grocery store in central Toledo called Market on the Green.

The package includes $650 million in funding and loan assistance for meat and poultry processing projects, including $275 million to help entrepreneurs who have had trouble getting credit. Another $100 million would go toward training workers in meat processing. Another $600 million is earmarked for improving food supply chain infrastructure, including cold storage and refrigerated trucks, outside of meat and processing.

Other funding in the plan:

- $200 million to help fruit and vegetable growers comply with food safety regulations.

- $400 million to create regional food business centers that will provide coordination and technical assistance and other support to small and mid-size businesses involved in processing, distribution and aggregation.

- $155 million to expand USDA’s Healthy Food Financing Initiative, which is aimed at reducing food deserts.

- $90 million to prevent and reduce food loss and waste.

- $60 million farm-to-school programs that increase markets for smaller-scale farmers through child nutrition programs.

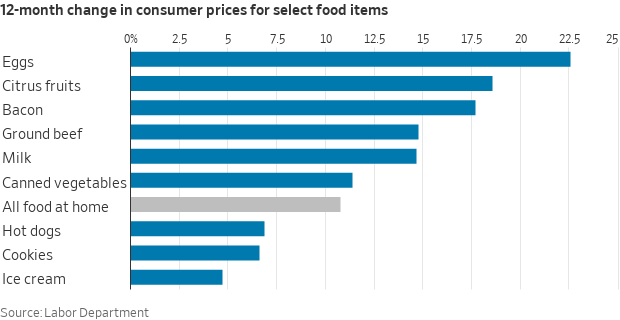

— Supermarkets and distributors are pushing back on higher prices from food makers, as escalating inflation drives more consumers to rethink their spending. The Wall Street Journal reports (link) that Kroger Co. and other grocery chains said they are asking brands to prove why higher prices are necessary before accepting them, and warning manufacturers that they will stop carrying products if food companies won’t negotiate prices. Some companies said they are switching to new meat suppliers with cheaper products and are delaying price changes for items like canned goods. Retailers generally have been passing price increases along to consumers, and executives have said that for months shopper demand has remained strong. Industry executives said that is starting to change, as consumers increasingly look for ways to stretch their dollars.

— A $1.1-billion high-tech meat processing plant will be built in western South Dakota. Kingsbury & Associates, along with Sirius Realty, plan on constructing an 8 thousand head per day packing plant off Highway 79 just south of Rapid City. It will process beef and will have a bison line as well. CEO Megan Kingsbury says the aim is to restore competition in meat processing in the state. ”We want to create competition in the free market system in America, and we’re able to do that by putting this facility right in our backyard.” Kingsbury says the project is in the research and development stage and is expected to provide 2,500 new jobs. (Source: KEVN)

|

CORONAVIRUS UPDATE |

— Summary:

- Global cases at 530,094,480 with 6,292,854 deaths.

- U.S. case count is at 84,215,080 with 1,007,047 deaths.

- Johns Hopkins University Coronavirus Resource Center says 587,360,320 doses have been administered, 221,292,360 have been fully vaccinated, or 67.16% of the U.S. population.

— Travel industry leaders are pressing the Biden administration to end its requirements that vaccinated international travelers take a Covid-19 test before flying to the U.S. Groups representing several major U.S. air carriers — including American Airlines, United Airlines, Southwest Airlines and Delta Air Lines — said yesterday the requirement does not match the current threat from Covid-19.

— Secretary of Labor Marty Walsh said in a Twitter post he has tested positive for Covid-19. Walsh said he is vaccinated and boosted and experiencing mild symptoms

|

POLITICS & ELECTIONS |

— A jury found Hillary Clinton campaign lawyer Michael Sussmann not guilty of lying to the FBI about his motives in sharing a tip in 2016 about alleged ties between Donald Trump and Russia — a major loss for Special Counsel John Durham’s Trump-era probe.

|

CONGRESS |

— Senate negotiators are looking at striking a narrow deal on gun-control measures. Meanwhile, President Biden said he would meet with lawmakers facing a deadline to show progress before Congress returns from break next week.

|

OTHER ITEMS OF NOTE |

— WOTUS update. The EPA Science Advisory Board is poised to affirm the scientific underpinnings of the agency’s “significant nexus” test for determining what streams and wetlands are protected under the Clean Water Act ahead of a U.S. Supreme Court case expected to question the standard. The board met Tuesday to discuss the science behind the Environmental Protection Agency’s draft rule for waters of the U.S., or WOTUS, that would ensure navigable streams and their tributaries are protected from the environmental consequences of development that might pollute those waters.

— A federal maritime investigator recommended more consistent regulation of shipping containers following a two-year probe into the disruption of ocean transportation stemming from the coronavirus pandemic. The Federal Maritime Commission (FMC) report, released Tuesday by FMC Commissioner Rebecca Dye, proposed a dozen recommendations to address the recent supply chain woes plaguing the ocean shipping industry.

— Supreme Court blocked Texas from immediately enforcing a law that would allow people to sue online platforms if they are blocked because of their viewpoints. Tech companies said the law violated their First Amendment rights and limited their ability to moderate content. The 5-to-4 decision does not necessarily mean that the justices would ultimately agree with the tech industry’s claims in a full review, analysts note, with some saying it does mean that a majority disagreed with an appeals court ruling last month that allowed the law to go into effect while challenges were pending. There was an unlikely coalition of justices dissenting: conservatives Samuel Alito, Neil Gorsuch, and Clarence Thomas, plus liberal Elena Kagan. However, Kagan did not join Alito’s dissent and did not offer the reasoning behind her stance.

— Today the White House is launching an "Action Plan on Global Water Security," citing increasing threats worldwide that range from poor management to accelerating climate change. The plan VP Kamala Harris is announcing "elevates water security as a foreign policy priority" for the first time, per a White House official.