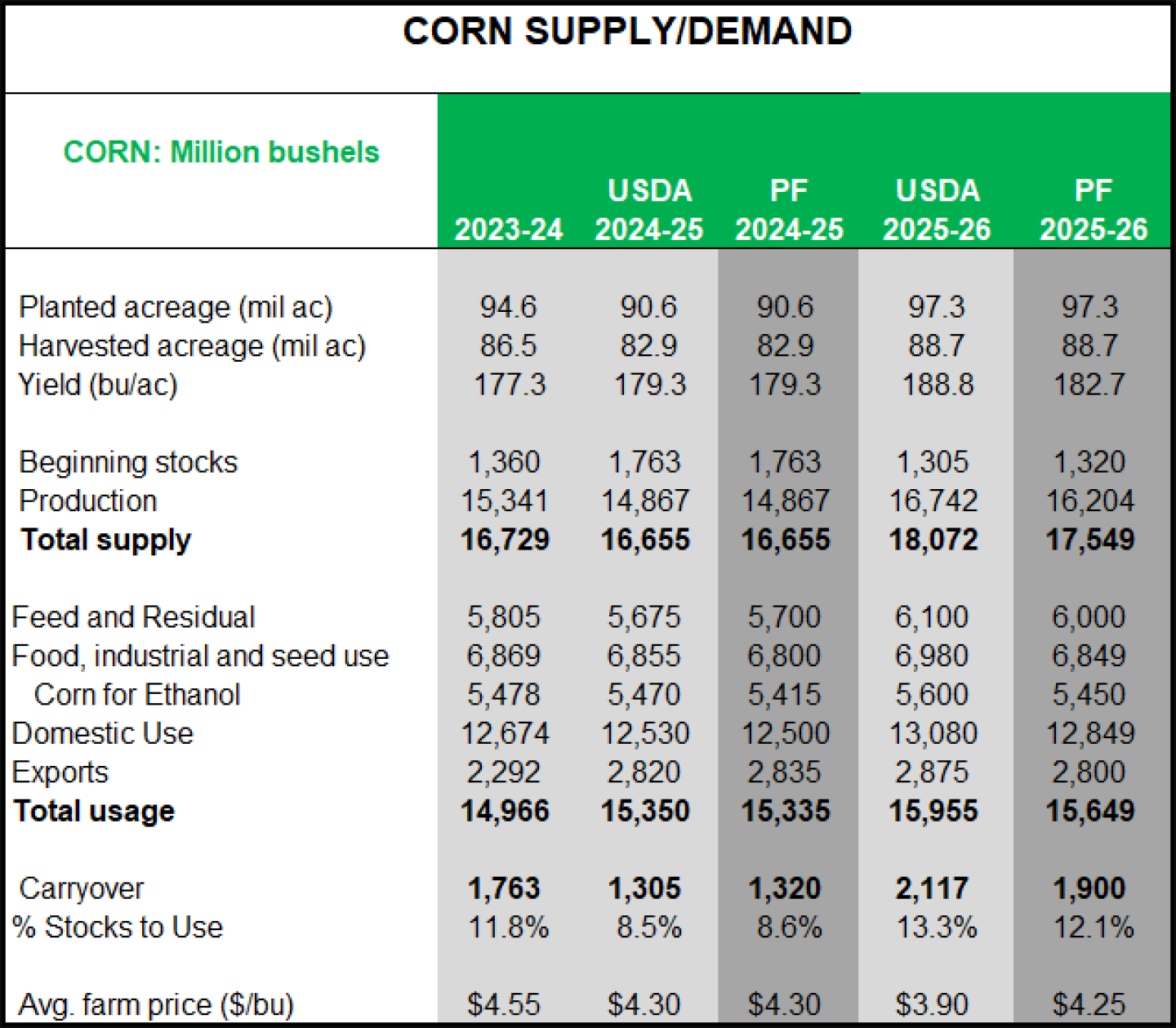

Corn: We see old-crop corn carryover 15 million bu. above USDA’s August estimate. We continue to see feed & residual use coming in above what USDA anticipates as low corn prices spurs high use. Exports are likely to come within 20 million bushels of USDA’s August estimate as inspections remained quite strong through August. Meanwhile, ethanol use slowed in the final months of the marketing year despite strong ethanol demand, both domestically and through exports.

That means slightly higher beginning stocks for the 2025-26 marketing year at 1.32 billion bushels. That is more than offset by what we expect will be a half-billion-bu. cut to the corn crop estimate. USDA will not cut as low as our estimate in the upcoming Crop Production report. In fact, our analysis points to USDA potentially raising their yield estimate upwards of 189.9 bushels per acre. USDA will use objective yield data, including ear counts and ear size, but will not estimate ear weights, which we believe will be the main yield dropper in the 2025 crop. Using our production estimate, total corn supplies for 2025-26 at 17.549 billion bu. are nearly 900 million bu. more than last year. That will encourage more use with the bulk of the increase in feed & residual. Historically, feed & residual use tracks well as a proportion of total supply, which is to say the smallest cattle herd in decades should not have much of an effect on feed & residual use. Corn-for-ethanol use will expand slightly and exports would do well to be within 50 million bu. of last year. New-crop export sales are the highest on record for before the beginning of the new-crop marketing year.

Bottom line is a nearly 600-million-bu. year-to-year increase in carryover and an expansion of the stocks-to-use ratio to a “comfortable” 12.1%. Prices are likely to be higher than USDA’s August projection of $3.90, but only modestly.

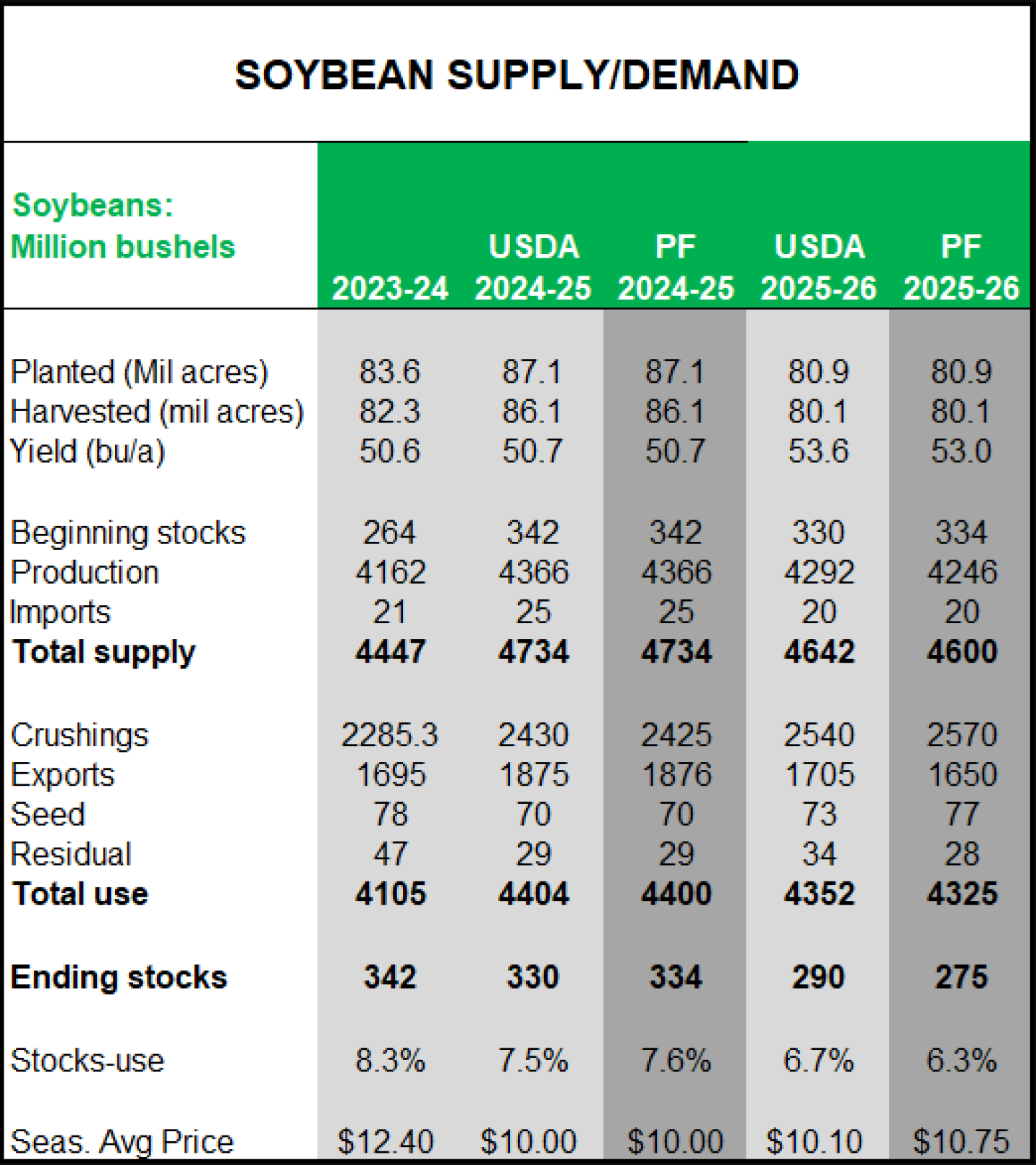

Soybeans: We expect just slight adjustments to the demand-side of the balance sheet for old-crop soybeans in the September 12 update. Updated data over the past month points to USDA’s August estimates as being reasonable for the crop year.

The supply side for new-crop soybeans is still in question, but the drop in acres will result in lower supplies even if our estimate of a record national average bean yield is realized. Our analysis says USDA could print a yield as high as 53.9 bushels per acre, as their methodology is unlikely to show the effect of late season disease and dryness yet. Using our production estimate, total supply for 2025-26 is expected to be down nearly 135 million bu. from last year. How the crop finishes and the potential yield drag of late-season diseases in the central and western Belt and too-dry conditions in the eastern Belt still have the potential to influence price action.

On the demand side, soybean crush is expanding but that is likely to be offset by a significant cut to export demand. China still has not booked any soybeans for 2025-26 delivery. Odds are China will make some purchases, but the pace is already far-enough behind to anticipate significantly lower exports than USDA’s August estimate. Slow exports will drag total use down about 75 million bu. from last year. With bean carryover expected to be down about 60 million bu. year-to-year and the stocks-to-use dropping under 6.5%, we’ll be patient on new-crop marketings in anticipation of better selling opportunities in a post-harvest rally. We continue to feel soybeans are undervalued and will look to take advantage of a rally.