Timeline and Issues in Getting Baltimore Port Channel Reopened

Exxon Mobil and SAF | Fed governor says ‘no rush’ to lower rates | Russia aids Cuba | Key USDA reports today

|

Today’s Digital Newspaper |

MARKET FOCUS

- ‘No rush’ for U.S. central bank to start cutting interest rates: Fed Governor Waller

- Sevens Report: Bridge collapse has potential to impact markets re: economic data

- U.S. GDP revised slightly up to 3.4%

- Yen on intervention watch

- Ag markets today

- Weekly wheat sales exceed expectations, while soybeans miss

- USDA March planting intentions, grain stocks data out at noon ET

- Malaysia to request more rice supplies from India

- Indonesia to double palm tree replanting subsidy

- Ag trade update

- NWS weather outlook

- Pro Farmer First Thing Today items

BALTIMORE BRIDGE COLLAPSE

- Updates on reconstruction, costs, clearing the channel and shipping adjustments

ISRAEL/HAMAS CONFLICT

- Netanyahu foresees Gaza victory amid tensions with Biden

RUSSIA & UKRAINE

- EU reaches significant agreement regarding Ukrainian grain

POLICY

- Podcast: Demystifying ag policy

PERSONNEL

- Joe Lieberman, longtime U.S. senator and 2000 vice-presidential candidate, dies at 82

CHINA

- Soybeans, cotton, sorghum, beef, pork main sales to China

- President Xi Jinping expresses optimism about future of U.S./China relations

- China liftes punitive tariffs on Australia’s wine exports

- Economist: China’s banks have a bad-debt problem

ENERGY & CLIMATE CHANGE

- DOE rejects API appeal on LNG export suspension, ensures review continues

- Is Trump losing energy in fuel sector?

- Exxon Mobil Corp. urging Biden administration to establish clearer SAF policies

- Russia send Cuba first oil shipment in a year to alleviate country's ongoing crises

LIVESTOCK, NUTRITION & FOOD INDUSTRY

- U.S. hog herd expected to be virtually unchanged

- Vilsack assures consumers U.S. milk supply is safe

POLITICS & ELECTIONS

- Rep. Ann Kuster (D-N.H.) joins rank of retirees

- Marilyn Lands, a Democrat, secures victory in special election for Alabama Legislature

OTHER ITEMS OF NOTE

- USDA, USA Rice, and Sec. Vilsack unveil rice as first 'climate smart' commodity

- Report: 13.7 million illegal immigrants in U.S., and 51.4 million immigrants overall

|

MARKET FOCUS |

— U.S. markets will trade normal hours today except for the bond market which will close at 2 pm ET. U.S. financial and commodity markets will be closed Friday in observance of Good Friday, but U.S. gov’t offices will be open. No USDA reports are scheduled to be released Friday, but economic data is scheduled to be released.

— Equities today: Asian and European stock indexes were mixed overnight. U.S. Dow opened around 60 points higher but is now slightly lower. In Asia, Japan -1.6%. Hong Kong +0.9%. China +0.6%. India +0.9%. In Europe, at midday, London +0.2%. Paris +0.2%. Frankfurt flat.

U.S. equities yesterday: The Dow gained 477.75 points, 1.22%, at 39,760.08. The Nasdaq was up 83.82 points, 0.51%, at 16,399.52. The S&P 500 rose 44.91 points 0.86%, at 5,248.49. With one trading session to go, the S&P 500 is up 10% in the first quarter, set for its best start to the year since 2019 when it rose 13.1%. Any weakness in the stock market hasn’t lasted more than a few sessions, with investors buying the dip and sending the index to 21 all-time closing highs. Meanwhile, the Dow is headed for a 5.5% gain during the period and the Nasdaq is up 9.3%.

Of note: According to Dow Jones Market Data, when the S&P 500 notches an 8% gain or more in Q1, it is nearly assured to finish the rest of the year on the right foot with an average advance of 9.7% in the following three quarters. Also: this is a presidential election year, which is usually positive for the market regardless of who is declared the winner.

— Brent crude prices on Wednesday edged down 0.3%, settling at $85.41 a barrel after a Wednesday report from the U.S. Energy Information Administration showed that commercial crude oil inventories rose by 3.2 million barrels in the week ending March 22 from the previous week. Meanwhile, a report from J.P. Morgan Global Commodities Research said oil prices could go up to $100 a barrel later this year due to Moscow's recent decision to reduce oil production.

— Ag markets today: Corn, soybeans and wheat traded in narrow ranges during the overnight session ahead of USDA’s reports later this morning. As of 7:30 a.m. ET, corn futures were trading steady to fractionally higher, soybeans were 3 to 4 cents lower and wheat futures were fractionally to 2 cents higher. Front-month crude oil futures were more than $1.00 higher, and the U.S. dollar index was up nearly 200 points this morning.

Signs of a top in wholesale beef. Wholesale beef prices dropped $2.51 for Choice and $1.83 for Select on Wednesday. Choice beef has declined $5.15 since March 21, suggesting a short-term top is in place. Given recent heavy pressure on cattle futures and wholesale beef values, cash cattle prices will likely be down notably from last week’s all-time high.

Bigger moves in cash hog index, pork cutout. The CME lean hog index increased another 56 cents to $84.25 as of March 26, the biggest daily gain since Feb. 21 and the highest level since Oct. 3, 2023. The pork cutout value dropped $1.27 on Wednesday, the largest daily decline since March 5. Despite yesterday’s drop, the pork cutout value remains on its seasonal climb.

— Agriculture markets yesterday:

- Corn: May corn extended 5 3/4 cents lower to $4.26 3/4, marking a more than three-week low close.

- Soy complex: May soybeans fell 6 1/2 cents before settling at $11.92 1/2, nearer session lows. May meal futures dropped 80 cents to $339.0. May bean oil futures slipped 75 cents to 47.67 cents, nearer session lows.

- Wheat: May SRW wheat rose 4 cents to $5.47 1/2. May HRW wheat closed up 1 cent at $5.78 1/4. Prices closed nearer their session highs. May spring wheat futures rose 3 3/4 cents to $6.51.

- Cotton: May cotton futures dropped 264 points before settling at 90.77 cents to mark the lowest close since Feb. 8.

- Cattle: June live cattle rose 30 cents to $178.675 and near the session high. May feeder cattle closed up $1.025 at $248.275 and near the session high.

- Hogs: Nearby April hog futures led the summer contracts higher Wednesday. It climbed 52.5 cents to $86.10, while most-active June rose 25 cents to $101.60.

— Quotes of note:

- Fedspeak. Christopher Waller, a prominent Federal Reserve official, in a speech on Wednesday expressed concern over recent inflation data, suggesting that it necessitates a reconsideration of the timing of interest rate cuts by the U.S. central bank. Waller, a Fed governor, highlighted that despite progress in reducing inflation over the past year, the latest readings have been disappointing. He emphasized that shorter-term inflation measures indicate a slowdown or potential stall in progress. In response to the underwhelming inflation figures, Waller proposed either reducing the overall number of rate cuts or delaying them further into the future. This adjustment, he argued, would be appropriate given the current economic circumstances. The February consumer price index, including the core CPI which excludes volatile food and energy costs, rose by 0.4% from the previous month, falling short of expectations. Waller reiterated the Fed's inflation target of 2% per year, stating that the recent readings were not indicative of progress towards this goal. However, he did not specify whether his recommendation pertained to rate cuts for the year 2024 or for the entire forecast horizon extending until 2026. Regarding timing, Waller indicated that he would need to observe "at least a couple months of better inflation data" before becoming confident that inflation could sustainably reach the 2 percent target. He suggested that unless there is an unexpected and significant downturn in the economy, he would require further evidence before advocating for rate cuts. Waller's stance contrasts with projections from a slim minority of nine Federal Open Market Committee officials who favor three rate cuts this year. Nevertheless, their expectations align with market participants' predictions.

- Baltimore bridge collapse: "We don’t expect that the increase in transportation costs and disruptions will be widespread or large enough to lift either headline or core consumer prices." — Ryan Sweet of Oxford Economics, on trucking detours around Baltimore.

- Barring a bar: “We made it through Covid. Now we’ve got to make it through this mess.” — Donna Kondylas, owner of the Sail Inn, a bar and restaurant in Edgemere, Md., near the Port of Baltimore.

- China: “If the leadership doesn’t execute a beautiful deleveraging, China will have a Japanese-style lost decade with Marxist characteristics.” — Ray Dalio, the founder of Bridgewater Associates. In a lengthy post on LinkedIn, the hedge fund billionaire agreed with President Xi Jinping of China about an imminent century of extraordinary change and offered suggestions to help Beijing deal with its economic problems. Link for more via Bloomberg.

— Baltimore bridge collapse isn’t likely to result in a spike in inflation, but it does have the potential to impact markets from a different angle: Economic data. So says the Sevens Report. Details: “Economic growth is the key to the longevity of this bull market, be-cause if the economy begins to lose momentum, then Fed rate cuts won’t have the positive impact that’s currently priced into stocks and as such, we should expect sharp declines. Economic data is the key to monitoring growth and the port closure could make some economic data very “noisy” for the next few months. Specific reports to watch include weekly jobless claims (we’re likely to see a spike from Maryland as dock workers and port employees file claims), the monthly employment statics (although the survey week has passed for March so it won’t impact next week’s reading), industrial production and exports. Now, the ‘noise’ from this data will be backed out by economists but they’ll be tinkering with data that’s already heavily influenced by seasonal adjustments and other factors, so the validity of certain readings will come into question. That matters because during a time when accurate economic data is critical to seeing any economic slowdown coming, an event has occurred that will skew some of that data and that leaves the Fed and the markets at risk of potentially not seeing economic warning signs as early as possible.”

— U.S. economy experienced a slight upward revision in its growth rate for the fourth quarter of 2023, as reported by the Bureau of Economic Analysis (BEA). The third estimate indicated an annualized expansion of 3.4%, up from the previously reported 3.2%. This growth was primarily driven by increased consumer spending, particularly in services, which saw a revision from 3% to 3.3%. However, the growth in goods consumption was slightly lower, shifting from 3.2% to 3%. Non-residential investment also saw an upward revision, rising from 2.4% to 3.7%, attributed to higher investment in intellectual property products and structures, though there was a decrease in equipment investment.

Residential investment continued to grow, albeit at a slightly slower pace than anticipated, with a revised rate of 2.8% compared to the previously estimated 2.9%. Government spending exhibited significant growth, surpassing expectations with a revised increase of 4.6% versus the previous estimate of 4.2%. However, both exports and imports grew less than initially reported, with exports at 5.1% compared to 6.4% and imports at 2.2% versus 2.7%.

Additionally, the negative impact from private inventories on economic growth was greater than previously estimated, subtracting 0.47 percentage points from growth compared to the earlier estimate of -0.27 percentage points.

Looking at the full year of 2023, the U.S. economy grew by 2.5%, maintaining the same growth rate as the previous estimate and marking an improvement from the 1.9% growth recorded in 2022.

Market perspectives:

— Outside markets: The U.S. dollar index was firmer, with the euro, British pound, and yen all weaker against the U.S. currency. The yield on the 10-year U.S. Treasury note was higher, trading around 4.22%, with a mixed tone in global government bond yields. Crude oil futures have gained, with U.S. crude around $82.45 per barrel and Brent around $86.35 per barrel. Gold and silver futures were mixed, with gold higher around $2,235 per troy ounce and silver lower around $24.71 per troy ounce.

— Yen on intervention watch. Japanese officials held an emergency meeting to discuss the weak yen and suggested they were ready to intervene to stop what they described as disorderly and speculative moves in the currency. In a sign of growing urgency to put a floor under the yen after the currency fell to a 34-year low against the U.S. dollar, the Bank of Japan (BOJ), the Finance Ministry and Japan’s Financial Services Agency held a meeting. In a briefing afterwards, top currency diplomat Masato Kanda said he “won’t rule out any steps to respond to disorderly FX moves.” Kanda also said BOJ would respond through monetary policy if currency moves affected the economy and price trends.

— Weekly wheat sales exceed expectations, while soybeans miss. Weekly wheat sales were just above the pre-report range for the week ended March 21, while soybean sales missed the expected range by 36,000 MT. Corn sales held steady at 1.21 MMT.

— USDA March planting intentions, grain stocks data out at noon ET. USDA will release its Prospective Plantings and Quarterly Grain Stocks Reports at noon ET. Much of the pre-report attention is on planting intentions, but quarterly stocks have proven to be strongly market-moving, especially for corn.

For planting intentions, analysts expect the following: corn at 91.776 million acres; soybeans at 86.530 million acres; all wheat at 47.330 million acres, including 34.870 million acres of winter wheat, 10.891 million acres of other spring wheat and 1.652 million acres of durum; and cotton at 10.906 million acres.

Grain stocks: Analysts expect March 1 stocks of 8.427 billion bu. for corn, 1.828 billion bu. for soybeans and 1.044 billion bu. for wheat.

— Malaysia to request more rice supplies from India. Malaysia will submit a request to India to procure an additional 500,000 MT of white rice, its agriculture minister said. The request would be in addition to the 170,000 MT of white rice India has previously allocated to Malaysia for this year.

— Indonesia to double palm tree replanting subsidy. Indonesia aims to double subsidies for palm tree replanting to 60 million rupiah ($3,785.49) per hectare from May to boost farmers’ participation, Chief Economic Minister Airlangga Hartarto said. The government aims to get 180,000 hectares (444,790 acres) of smallholders’ plantations replanted every year, but the program has been lagging due to administrative hurdles and farmers’ concerns over loss of income while they wait for the trees to mature. Only 331,000 hectares have been approved for replanting so far, of the total 2.5 million hectares targeted.

— Ag trade update: South Korea bought 134,000 MT of corn via two separate tenders, with all of the purchases expected to be sourced from South America or South Africa. Saudi Arabia tendered to buy 595,000 MT of optional origin milling wheat.

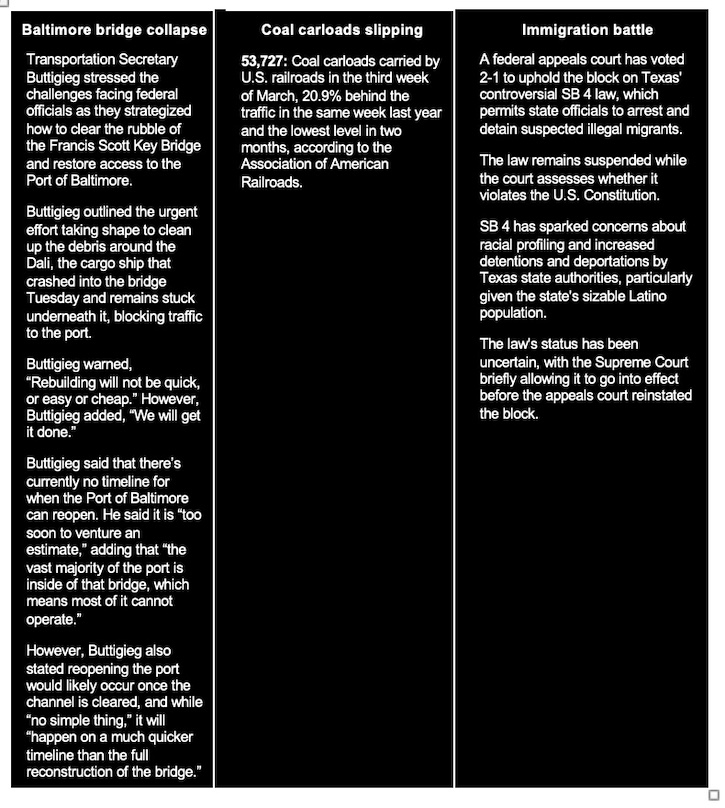

— NWS weather outlook: Rainy, stormy weather continues along the East Coast through today, lingering in New England Friday... ...Unsettled weather for the West, with a late season Atmospheric River impacting California Friday... ...Warming trend begins over Central U.S. today.

Items in Pro Farmer's First Thing Today include:

• Grains quiet overnight trade

• EU forecasts 2024 wheat production falling to four-year low

• Data confirms UK economy fell into recession to end 2023

• Eurozone bank lending stagnates

|

BALTIMORE BIDGE COLLAPSE |

— Updates:

- National Transportation Safety Board has recovered the black box voyage data recorder from the Dali and has it at a lab. The ship itself is stable, but it has more than 1.5 million gallons of fuel and lubricating oil on board along with 4,700 cargo containers, including boxes holding hazardous materials. According to U.S. Coast Guard Vice Admiral Peter Gautier, 56 of them had hazardous materials. However, he said that there was no public threat. Two containers fell from the ship during the crash, and Gautier said those did not contain any hazardous materials. The ship also was carrying 1.5 million gallons of fuel. However, some of the hazardous materials were breached. “We have seen sheen on the waterway,” said Jennifer Homendy, the chair of the National Transportation Safety Board leading the investigation, adding that the hazardous materials on the cargo ship included lithium-ion batteries.

About a dozen ships are still in the port — mostly foreign-flagged vessels — that can’t get out because of the blocked waterway - Legal fight over Baltimore’s destroyed bridge is coming. In the next few days, the Singaporean owner of the cargo ship that took down the Francis Scott Key Bridge is expected to invoke a law — similar to one used by the Titanic’s owners —t hat limits the liability of ships’ owners. That will set in motion a lengthy legal fight, but most claims are expected to move forward and get resolved in the meantime, the Wall Street Journal reports (link). Some claims may take longer than others, including those by the families of people killed in the crash.

- Price tag. Federal officials told Maryland lawmakers that replacing the Francis Scott Key Bridge in Baltimore would cost at least $2 billion, according to Bloomberg, citing a person familiar with the matter. That figure includes the cost of recovery as well as clean up. Maryland lawmakers have said they will pursue supplemental funding for the reconstruction of the bridge that collapsed after a cargo vessel slammed into it early Tuesday. President Joe Biden said on Tuesday that the federal government should pay for the rebuild and he’d work with Congress on it. When asked about the company behind the ship being held responsible, Biden said “that could be, but we’re not going to wait for that to happen, we’re going to pay for it to get the bridge rebuilt and open.”

Baltimore bridge insurance payouts may be among the largest ever in marine insurance, Lloyd’s of London CEO John Neal said. “It’s a multi-billion-dollar loss. I think it has to be.”

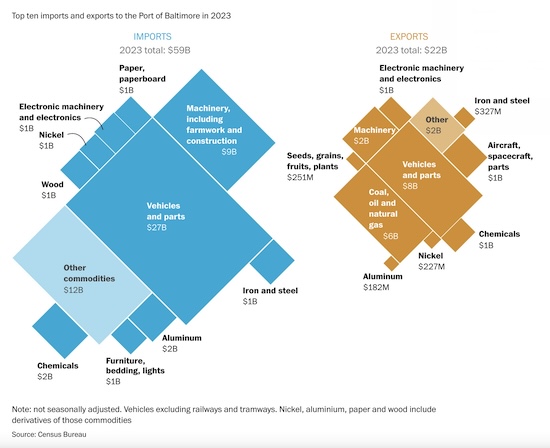

Debris from the collapsed bridge is blocking the shipping channel connecting the port to the Chesapeake Bay and the Atlantic Ocean. The remains of the bridge must be cleared before the port can restart operations.

Experts say the shipping channel from the Port of Baltimore could be cleared in months. Ben Schafer, a structural engineer and professor at the Johns Hopkins University, said that while a timeline is still speculative, it would likely take “weeks and months” just to remove the debris and reopen the shipping channel.

Clearing channel has begun. “While the Army Corps is already actively engaged in clearing the channel — and has the funding it needs to do so – we are working with State of Maryland to determine what funding they will be seeking from the federal government,” Sen. Chris Van Hollen (D-Md.) said in a statement. “Once those determinations are made, I’ll be laser-focused on providing any federal resources necessary as quickly as possible.” The U.S. Coast Guard is also leading efforts to clear debris from the site to reopen operations.

- Transportation Secretary Pete Buttigieg says he will meet shippers and other supply chain partners Thursday to promote a coordinated approach following Baltimore’s bridge collapse. “If they discover or determine anything that should be considered in the regulation, inspection design or funding of bridges in the future, we will be ready to apply those findings,” said Buttigieg. Buttigieg said he is concerned about the local economic impact, as some 8,000 jobs are directly associated with port activities. Buttigieg said the Biden administration was focused on reopening the port and rebuilding the bridge, but he avoided putting a timeline on those efforts. He noted that the original bridge took five years to complete.

Buttigieg said that the infrastructure law’s emergency relief account has $950 million in it. During a White House briefing, Buttigieg said: “The infrastructure law did authorize funding into the emergency relief account, which is the mechanism that is most likely to come into play here. Last I checked, there was about $950 million available but also a long line of needs and projects behind that. “So it is certainly possible, I would go so far as to say likely, that we may be turning to Congress in order to help top up those funds. But that shouldn’t be a barrier to the immediate next few days beginning to get the ball rolling.”

The administration could ease regulatory requirements to speed bridge construction, Buttigieg said, though he noted it was too early to know what regulations would be at play. “We have a clear direction from the president to tear down any barriers, bureaucratic as well as financial, that could affect the timeline of this project,” he said. - Treasury Secretary Janet Yellen said she expects insurance payouts to help finance the rebuilding, but added: “We don’t want to allow worrying about where the financing is coming to hold up reconstruction.” Yellen made the comments in an interview on MSNBC Wednesday. “I’m not sure what the details are” on funding, Yellen said. “We have the money from the bipartisan infrastructure law that could potentially be helpful,” she said, referring to 2021 legislation. The Treasury chief said that authorities are “trying to evaluate now what the impact may be of the bridge collapse.” She added that the administration’s supply-chain task force met Wednesday afternoon to assess the potential economic impact. That panel was established in mid-2021 to help strengthen and unsnarl supply chains.

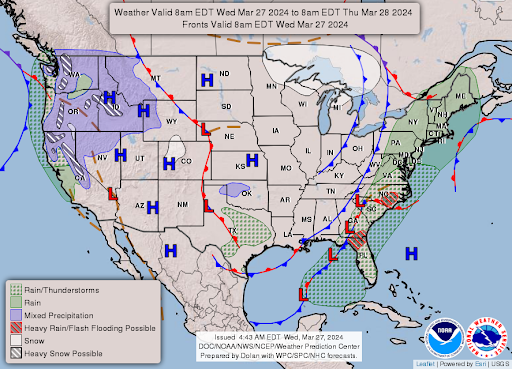

- In 2023, the Port of Baltimore handled $80.8 billion in trade, including 1.1 million twenty-foot equivalent units, 1.3 million tons of roll-on/roll-off farm and construction machinery, 11.7 million tons of general cargo, and 847,158 shipments of cars and light trucks. It has five public and 12 private terminals to handle port traffic.

Baltimore is also a niche port for the soybean trade, focusing mostly on high-value soy used in tofu, miso, tempeh and organic products, Mike Steenhoek, executive director of the Soy Transportation Coalition, told the Washington Post. Most of those exports are destined for Asia, but Steenhoek doesn’t expect a big spike in tofu prices because several other U.S. ports also ship this sort of soy, including Norfolk, Va., Savannah, Ga. and Charleston, S.C.

- In Maryland, most of the freight is regional, with about 36% of trucking tender volume staying in the state. An additional 22% goes to Pennsylvania and 15% goes to Virginia.

- Adjustments. Rachel Shames, vice president of pricing and procurement for CV International, a Norfolk, Virginia-based international logistics and transportation company, wrote in a market update that the collision is expected to create a temporary increase in cargo volume at other East Coast ports. “The full impacts of this disaster are not yet known, but it’s likely that nearby East Coast ports, including Norfolk, Philadelphia, New York and others will absorb cargo traffic from Baltimore in the short term,” Shames wrote. “This sudden increase in volume may strain operations at other ports.”

Ryan Petersen, chief executive of the logistics company Flexport, posted on X that the company currently has 800 containers on a slew of ships heading for the port that will need to be rerouted, likely to Philadelphia or Norfolk.

A facility on the other side of the bridge called Sparrows Point can handle at least some cargo shipping. A large car carrier, the Liberia-flagged Wolfsburg, arrived Wednesday at a vehicles terminal there with a load for Volkswagen. It was the first cargo delivery at the Port of Baltimore since the bridge collapse.

New York and New Jersey governors issued a joint statement today on minimizing supply chain issues. Gov. Hochul of New York and Gov. Murphy of New Jersey wrote: “The Port Authority of New York and New Jersey can take on additional cargo, and we have directed the Authority to further evaluate all available resources to minimize supply chain disruptions.” - All deep-water ships, vessels with a controlling depth of 50 feet, will have to be diverted to ports such as Norfolk and New York/New Jersey.

- Port of Baltimore stands out for diverse cargo handling: Sanne Manders, president of international at Flexport, told FreightWaves that what makes the Port of Baltimore unique is the volume of roll-on/roll-off cargo it handles, such as passenger vehicles, along with agricultural and industrial equipment… Then you’re also getting into agricultural exports — rice, sugar, fertilizers, forestry products. It’s pretty big in Baltimore. Then there’s also a big paper industry there and construction materials. I do think in other commodities and cars, this will have a major impact. There are also some metal exchange warehouses for nickel, tin and copper in Baltimore. Now those can also be moved to other ports, but those are bulky materials, and they don’t move them very easily.”

- Perspective when reconstruction is in process. There is a difference of opinion as to whether shipping through a cleared channel will be halted during reconstruction of the bridge. Some predict intermittent stoppages. But transportation analyst Ken Ericksen of Polaris Analytics and Consulting says: “There may be limited transits or restrictions during certain hours, but one stipulation is that trade cannot be disrupted. All Maryland elected officials and DOT Secretary Pete Buttigieg have essentially said navigation is too important not only for the Baltimore area but for the United States.”

|

ISRAEL/HAMAS CONFLICT |

— Netanyahu foresees Gaza victory amid tensions with Biden, denies genocide allegations. Israeli Prime Minister Benjamin Netanyahu asserted to members of the U.S. Congress that victory in Gaza was imminent, estimating it to be a matter of weeks, as Israel continued its offensive in the region. Netanyahu emphasized that Israel's move into Rafah, where a significant number of people were taking shelter, was necessary due to the existential threat faced by the country. However, this stance has strained relations between Netanyahu and President Joe Biden due to disagreements over the impending invasion of Rafah. Concurrently, a UN expert in the Palestinian territories has suggested there are substantial grounds to believe that Israel is committing genocide in Gaza. Israel has vehemently denied these allegations, labeling the report as bringing disgrace to the UN Human Rights Council.

|

RUSSIA/UKRAINE |

— European Union (EU) reached a significant agreement regarding Ukrainian grain, extending tariff-free trade until June 2025. However, this extension comes with stricter conditions compared to previous agreements, reflecting a more hardened stance by EU member states. Certain agricultural products, including poultry, eggs, sugar, oats, corn, groats (grain kernels), and honey, will now face tariffs if their exports surpass average volumes from the past three years. Additionally, measures were introduced to address market disruptions, potentially allowing individual member states to implement bans if needed.

Wheat will crucially be exempt from the curbs after Italy extracted a pledge from the European Commission where it committed to intervene if prices dropped too far, including by buying surplus Ukrainian cereals using public money.

This decision comes amid protests from European farmers who claim unfair competition from Ukrainian imports. Initially, opposition to these imports came from Eastern European countries like Poland, Hungary, and Slovakia but has since spread to France and other nations. The disagreement reached a critical point in April 2023 when several countries imposed sudden bans on Ukrainian agricultural products, leading to tensions within the EU.

The responsibility to resolve this impasse fell on Belgium, the current holder of the Council's rotating presidency, which presented a compromise text facilitating the agreement. However, certain key changes failed to satisfy demands from Poland, France, and their allies, leading to the collapse of the initial provisional deal.

The newly reached compromise extends the reference period to the second half of 2021 and excludes wheat from the list of sensitive products, potentially deepening economic losses for Ukrainian producers. Despite this agreement, further negotiations with the European Parliament and ratification are still required. If approved, this extension will be the final one, as EU leaders have tasked the Commission with finding a long-term solution within the framework of the EU/Ukraine Association Agreement. The curbs are due to start on June 6, when tariff-free access for Ukrainian imports is renewed for a further year.

The move will cost Ukraine about €330 million (around $357 million) in annual revenue if it cannot find alternative markets, up from about €240 million (around $260 million) under an original commission proposal, according to EU diplomats.

|

POLICY UPDATE |

— Demystifying Ag Policy with Jim Wiesemeyer is the header for a podcast I did with Jim Morris for Redox Bio-Nutrients. Link to podcast.

|

PERSONNEL |

— Joe Lieberman, longtime U.S. senator and 2000 vice-presidential candidate, dies at 82. Lieberman’s death Wednesday afternoon in New York City followed complications from a fall, a statement said. Lieberman most recently was the founding co-chair of No Labels, an independent group laying the groundwork for a potential centrist “unity ticket” for this year’s presidential election. As Al Gore's running mate in 2000, he became the first Jewish American on a presidential ticket for a major party. His centrist politics often angered Democrats. In 2006, he lost a Democratic Senate primary but won re-election as an Independent.

|

CHINA UPDATE |

— Soybeans, cotton, sorghum, beef, pork main sales to China. Weekly data from USDA for the week ended March 21 showed sales activity to China for 2023-24 that included net reduction of 1,000 metric tons of wheat, net sales of 9,000 metric tons of corn, 77,887 metric tons of sorghum, 347,276 metric tons of soybeans, and 13,408 running bales of upland cotton. Activity for 2024 of net sales of 1,992 metric tons of beef and 353 metric tons of pork were also reported.

— President Xi Jinping expressed optimism about the future of U.S./China relations, signaling potential progress in resolving the protracted trade war. During a meeting with CEOs of American companies in Beijing, Xi emphasized the importance of cooperation between the two nations in various areas such as trade, agriculture, climate change, and artificial intelligence. Xi's remarks likely aim to bolster foreign investment in China, which has seen declines recently. The mention of artificial intelligence may be significant for U.S. chip makers like Nvidia, especially given previous export restrictions imposed by the U.S. government. Despite past expressions of goodwill between Xi and U.S. President Joe Biden, tangible results in improving relations are yet to materialize, indicating the need for concrete actions moving forward.

— China lifted punitive tariffs on Australia’s wine exports, signaling an end to a three-year campaign of trade pressure on Canberra and raising hopes for a revival of the billion-dollar industry. Beijing had imposed heavy tariffs on Australian wines in 2020, over a dispute about Covid-19.

— Economist: China’s banks have a bad-debt problem. And this is becoming increasingly obvious. Link for details.

|

ENERGY & CLIMATE CHANGE |

— DOE rejects API appeal on LNG export suspension, ensures review continues. The Department of Energy (DOE) has declined a request by the American Petroleum Institute (API) and others to lift the suspension on new liquefied natural gas (LNG) export approvals. DOE stated that the request did not meet the requirements for a rehearing and that the decision did not qualify for review as it was not an order. The agency emphasized that their decision was part of ongoing updates to prior environmental reviews and economic analyses. Despite concerns raised by the groups about violations of administrative and natural gas laws, DOE reiterated that their review process would be completed by the end of the year and that existing LNG exports have not been affected. Legal action may be pursued by those seeking to restore approvals for new or pending LNG export applications.

— Is Trump losing energy in fuel sector? As president, Donald Trump vowed U.S. “energy dominance.” Yet his potential re-election isn’t delighting oil and gas executives as much as one might expect, the Washington Post writes (link).

— Exxon Mobil Corp. is urging the Biden administration to establish clearer policies regarding sustainable aviation fuel (SAF) to stimulate investment and reduce emissions in the aviation sector. While the White House aims to boost production of SAF, it has faced challenges in defining rules for tax credits, particularly for crop-based forms of the fuel. The administration has delayed setting these rules due to conflicting interests from environmentalists and farmers, especially during an election year.

Exxon Mobil believes that implementing a market-driven policy would encourage innovation and incentivize profit-seeking investments in green technologies. This sentiment was echoed by Jack Williams, a senior vice president at Exxon. He emphasized that such policies are essential for projects like the company's Baytown hydrogen project to qualify for tax credits.

Exxon Mobil has committed over $20 billion to low-carbon technologies, including ventures such as producing renewable diesel in Alberta from crops like canola. SAF, which is derived from waste oils or agricultural feedstock, is seen as crucial for the aviation industry to achieve its goal of net zero emissions by 2050.

Various approaches are being explored to produce SAF, including using corn-based ethanol or integrating captured carbon in refining processes. Exxon is evaluating potential SAF projects, with a particular focus on locations like Joliet, Illinois, where the company operates a refinery.

Meanwhile, Illinois has introduced a credit of $1.50 per gallon of SAF purchased in the state. However, as of March 18, no applications had been submitted for this credit. Williams highlighted the need for longer-term policy certainty to support major projects, as SAF initiatives typically involve lengthy engineering and construction processes. That credit expires at the end of 2032 — not long enough to provide certainty for major projects that take years to engineer and construct, according to Williams.

— Russia is sending Cuba its first oil shipment in a year in an effort to alleviate the country's ongoing crises, including blackouts and food shortages, Bloomberg reports (link). The delivery, consisting of 715,000 barrels of crude oil, is seen as a crucial lifeline for Cuba, which has been experiencing mass migration and protests due to deteriorating living conditions.

Cuban officials attribute their country's hardships to the longstanding U.S. trade embargo, which has been in place since the 1959 revolution. While other regional allies like Brazil and the Caribbean Community have urged the U.S. to ease sanctions, political dynamics, particularly in an election year with discussions of regime change, complicate such efforts.

The article highlights Cuba's deepening economic troubles, reminiscent of the hardships faced during the Soviet Union's collapse in the early 1990s. The government's social safety net is strained, leading to unprecedented requests for international assistance such as powdered milk from the United Nations.

Although a deal between Cuba and Russia was signed last year to alleviate some of these challenges, its implementation has been slow due to Russia's involvement in the war in Ukraine. However, the recent oil shipment from Russia is expected to provide temporary relief, helping to mitigate widespread blackouts caused by fuel shortages.

The article also notes shifts in Cuba's alliances, with traditional supporters like Venezuela reducing fuel deliveries while Russia increases its economic presence on the island. Brazil, under President Luiz Inácio Lula da Silva, is also stepping up efforts to aid Cuba, alongside the United Arab Emirates.

Of note: Despite ongoing efforts to ease restrictions and provide assistance, Cuba's inclusion on the U.S. list of state sponsors of terrorism continues to deter foreign investment and financial support. Cuban President Miguel Diaz-Canel attributes his country's challenges to U.S. policies, particularly restrictions on business transactions.

|

LIVESTOCK, NUTRITION & FOOD INDUSTRY |

— U.S. hog herd expected to be virtually unchanged. Analysts expect this afternoon’s Hogs & Pigs Report to show the U.S. hog herd was virtually the same size as year-ago at 74.136 million head as of March 1. The breeding herd is expected to be down 3.5%, while the market hog inventory is anticipated to be up 0.3% from last year. The winter pig crop is expected to be up 1.4% amid a 3.4% jump in pigs per litter. Spring and summer farrowing intentions are anticipated to be down 2.3% and 2.2%, respectively.

— USDA Secretary Tom Vilsack assured consumers the U.S. milk supply is safe and there is no risk of a milk shortage relative to HPAI in some dairy cattle. All U.S. dairy farms are required to only send milk from healthy animals to processing for human consumption. The secretary said affected dairy farmers have seen their cows fully recover from the virus after about a week. “It emphasizes the importance of biosecurity,” Vilsack said. “Doing what you can to maintain and make sure that your dairy herds are not sharing water supplies with waterfowl, for example, or things of that nature so that we can reduce the risk.”

|

POLITICS & ELECTIONS |

— Rep. Ann Kuster (D-N.H.), who leads the New Democrat Coalition of center-left House members, joined the rank of retirees Wednesday, saying she’d decline to seek another term. Her 2nd District, which includes Nashua and Concord, is rated “likely Democrat” by the Cook Political Report with Amy Walter — so it may become competitive in the Nov. 5 general election. The district backed Joe Biden over Donald Trump by 54%-45% in the 2020 election and Kuster was re-elected by 56%-44% in 2022. Kuster was first elected to Congress in 2012 after flipping a GOP-held seat. She is a member of the House Ag Committee. Kuster is the 11th House Democrat to announce her retirement, and the 25th to be leaving the House at the end of the year because they resigned early or are seeking another office. An additional 21 Republicans have announced plans to either retire or seek another office.

— Marilyn Lands, a Democrat, secured a victory in a special election for the Alabama Legislature by running on a platform supporting abortion rights. Lands defeated her Republican opponent by a substantial margin, despite the district's conservative leanings. The election, triggered by the resignation of the previous Republican incumbent due to voter fraud, occurred in House District 10, a suburban area in northern Alabama. While Lands' win does not alter the Republican supermajority in the state legislature, it underscores the potential impact of reproductive rights as an electoral issue. Lands capitalized on voter dissatisfaction with Alabama's strict abortion laws and a recent controversial ruling by the state Supreme Court regarding frozen embryos. This victory is seen as a positive sign for Democrats aiming to challenge Republican dominance in Southern state legislatures. National Democratic organizations, including Planned Parenthood and the Democratic Legislative Campaign Committee, supported Lands' campaign, highlighting the significance of messaging and financial backing in electoral success.

|

OTHER ITEMS OF NOTE |

— USDA, USA Rice, and Sec. Vilsack unveil rice as first 'climate smart' commodity. In Fountain City, Wisconsin, USA Rice joined USDA Secretary Tom Vilsack at Great River Organic Milling, a part of Columbia Grain International, and Enrich Foods, to celebrate the debut of the inaugural 'Climate Smart' rice on store shelves.

Background. Beginning in 2022, USDA initiated the Partnerships for Climate-Smart Commodities Program, granting funds to projects aiming for climate-friendly agricultural practices. Among the recipients was AgriCapture, a USA Rice Enterprise Partner, receiving $7.5 million to establish a market for eco-friendly rice. This endeavor involved pioneering a measurement and verification process, resulting in the certification of reduced greenhouse gas emissions, known as 'Climate-Friendly Certified by AgriCapture.'

AgriCapture collaborated with around 30 rice growers across Arkansas, Missouri, and Mississippi, cultivating rice under their Climate-Friendly Rice Standard, covering an estimated 20,000 acres in 2023. Subsequently, the rice was preserved with its identity intact and distributed to buyers like Columbia Grain International. Great River Organic Milling repackaged it into retail and wholesale packaging, clearly indicating its Climate-Friendly Certified status by AgriCapture.

The “climate-friendly” rice has so far been produced by a farm in southern Arkansas through a growing technique that uses about half of the water that’s normally needed. Farm owner Jim Whitaker said during the secretary’s visit that the method has also halved the amount of methane produced on his farm.

Vilsack proudly displayed the first bag of rice packaged by Great River Organic Milling, heralding it as a pivotal moment for U.S. farmers and the inaugural product from the $3 billion Partnerships for Climate-Smart Commodities Program.

Peter Bachmann, President & CEO of USA Rice, expressed enthusiasm for AgriCapture's swift market entry and highlighted the industry's eagerness to embrace sustainability through innovative practices. He thanked Vilsack for acknowledging AgriCapture's efforts and anticipated further innovative marketing endeavors funded by USDA's Climate Smart grants involving rice.

— There are now 13.7 million illegal immigrants in the U.S., and 51.4 million immigrants overall — an increase of 6.4 million in three years since Biden took office, the Center for Immigration Studies reported. That averages 172,000 new immigrants each month, or roughly four times the rate in the Trump years and nearly three times the rate in the Obama years. This marks a 37% increase and has led to demographic shifts in immigration patterns, notably impacting overall education levels. Most newcomers are from Latin America, with 3.7 million entering illegally. Some 44% of these immigrants lack education beyond high school, with a notable portion not even completing high school.

|

KEY LINKS |

WASDE | Crop Production | USDA weekly reports | Crop Progress | Food prices | Farm income | Export Sales weekly | ERP dashboard | California phase-out of gas-powered vehicles | RFS | IRA: Biofuels | IRA: Ag | | Russia/Ukraine war, lessons learned | | SCOTUS on WOTUS | SCOTUS on Prop 12 pork | New farm bill primer | | Gov’t payments to farmers by program | Farmer working capital | USDA Ag Outlook Forum |