Biden Signs Second Spending Package; Congress Departs for Two Week Easter Recess

Next up in Congress: Aid for Ukraine & Israel; House farm bill focus in April and/or May

Washington Focus

The House and Senate are out for their two-week Easter break. The Senate returns April 8. The House is in recess until April 9.

— Following months of negotiations to fund the gov’t, President Joe Biden on Saturday signed a $1.2 trillion spending bill that will provide funding through the rest of the fiscal year, while also increasing defense spending and setting spending guidelines for several government agencies. The signing came two weeks after Congress approved the first set of six spending bills, including funding for USDA. Though the president signed the bill after Friday’s midnight deadline, the Office of Management and Budget ceased shutdown preparations when it became clear the bill would reach Biden’s desk imminently. “Because obligations of federal funds are incurred and tracked on a daily basis, agencies will not shut down and may continue their normal operations,” the White House said.

Voting details: After six months into fiscal year (FY) 2024, the Senate approved a $1.2 trillion package funding federal agencies in the early hours of Saturday morning, missing its midnight deadline but averting a partial gov’t shutdown. Though the vote came two hours after a midnight deadline, there will now be no gov’t shutdown after the Senate approved a second package of six spending bills in a 74-24 vote. Earlier on Friday, the House voted 286-134 to pass the package of $460 billion spending bills, barely exceeding the two-thirds supermajority needed to approve the bill under a special procedure (suspension of the rules) used by House Speaker Mike Johnson (R-La.) to bypass internal GOP divisions in his razor-thin majority. “The reality is that on many pieces of legislation, you need Republicans and Democrats to get it across the line,” said Johnson. “That’s the reality of the modern Congress, and we work with what we have.”

In the House, most Republicans (112 of 213 voting) opposed the bill. Of note: nine of 34 GOP appropriators and eight of 22 committee chairs voted no on Friday. Among Democrats, only one appropriator, Barbara Lee (D-Calif.), and two ranking members, Jim McGovern (D-Mass.) of Rules and Nydia Velasquez (D-N.Y.) of Small Business, opposed it.

Of note: While the broad outlines of the House Republicans’ predicament are well known, an analysis (link) by the Wall Street Journal of six major government-funding bills signed into law during this Congress reveals the key components of this de facto coalition — based on ideology, relative electoral dominance in their districts and other factors. The group has remained largely stable over the half-dozen votes, including the one Friday, needed to keep the government open.

In the Senate, 22 of the 24 no votes were from Republicans. Aspiring GOP leaders John Cornyn (R-Texas) and John Thune (R-S.D.) stuck with current leader Mitch McConnell (R-Ky.) and voted for the bill, while John Barrasso (R-Wyo.) and Steve Daines (R-Mont.) voted against it.

Some spending bill details of the second package:

- The package establishes spending guidelines for the Departments of Defense, Homeland Security, Labor, Health and Human Services and State through September, the end of the fiscal year.

- Defense spending was increased to $824 billion, an increase of nearly $27 billion (3%) from the previous fiscal year, while basic military pay was increased by 5.2%, the largest boost in over 20 years.

- Nondefense funding is roughly flat, compared to the previous fiscal year.

- An additional $200 million for a new FBI headquarters in Maryland is included in the package, in addition to a $1 billion increase in funding for Child Care and Head Start programs.

- The package does not include new border wall funding, though it includes funding for 2,000 new Border Patrol agents and 8,000 additional detention beds for Immigration and Customs Enforcement.

- Also included in the package is a one-year ban on funding for the United Nations Relief and Works Agency for Palestine Refugees, $300 million in security assistance for Ukraine and $300 million in military funding for Taiwan.

- The spending bill includes a provision that prohibits State Department facilities from displaying flags other than the American flag and other eligible flags, like the POW/MIA flag, flags of Indian tribal governments and flags of official U.S. agencies, among others.

- The bill, as expected, rescinds $20.2 billion of the nearly $80 billion that the Internal Revenue Service received in 2022. That implements a fiscal deal that Biden and Republicans reached last year, in which Biden agreed to the IRS cuts to protect other agencies.

- Budget negotiators discussed, but ultimately rejected, giving federal lawmakers an increase in their $174,000 annual salary, which has remained flat since 2009. Some had argued for an $8,000 raise via a cost-of-living adjustment to be included in the bill that funds the legislative branch’s operations.

— GOP rebel Rep. Marjorie Taylor Greene (R-Ga.) made a new and some say expected bid to oust Speaker Mike Johnson (R-La.). But Greene did not immediately move to force a vote on her resolution, which means it didn’t trigger action on removing Johnson right away. Some Republicans are aiming their anger at Greene, slamming her attention-causing maneuver that has the potential to thrust the conference into more tumult, again.

Greene said she does not have “a timeline” for when she will trigger a vote on ousting Johnson, telling reporters it would be a “rolling issue that we’ll be judging and making decisions by… I’m not saying that it won’t happen in two weeks, or it won’t happen in a month or who knows when, but I am saying the clock has started,” Greene said. “It’s time for our conference to choose a new Speaker.”

Greene said she is not yet forcing a vote on Johnson’s ouster because she does not want to “throw the House in chaos,” but she said, “we started the clock to start the process to elect a new Speaker.”

Of note: Some Democrats signaled they could be willing to step in to save Johnson if a removal vote is held. That could include a pledge to hold a vote on aid to Ukraine.

— A one-seat House GOP majority coming. After Friday, when Rep. Ken Buck (R-Colo.) resigned, Republicans have a 218-213 majority, with four vacancies. Rep. Mike Gallagher (R-Wis.), retiring chair of the House China Select Committee, announced he'll leave Congress April 19 — leaving Republicans with a majority of just one seat on a party-line vote (Under Wisconsin law, Gallagher’s seat is expected to remain vacant until January, with the November general election to determine who wins; If he were to resign prior to the second Tuesday in April, the state would be able hold a special election before November to fill his vacant seat). Rep. Kevin McCarthy (R-Calif.) left the House with a five-seat Republican majority (221-212). It likely won’t bump up to a three-seat majority until after the June 11 election to replace Bill Johnson of Ohio. And this assumes there won’t be any further GOP departures. Republicans held a 222-213 majority after the 2022 midterm elections.

— Rep. Kay Granger (R-Texas), who is retiring this year, announced she is quitting early as chair of House Appropriations. Granger has been the top Republican on the committee since 2019. Without Granger, only three Texans will chair committees in Congress: Rep. Jodey Arrington chairs the Budget Committee, Rep. Michael McCaul chairs Foreign Affairs and Rep. Roger Williams chairs Small Business. Texas sends more Republicans to Congress than any other state.

Of note: Granger said in her letter she would remain chairwoman until the Republican Steering Committee, which determines committee assignments for the conference, selects a new chair. She said she plans to remain on the committee, offering advice to the next chair. "My goal for the next nine months is to return to where I began my career, as an educator," she wrote. "I will remain on the Committee as Chair Emeritus to lead as a teacher would, providing advice and counsel for my colleagues when it is needed." Granger has served on the committee for 25 years. Her own successor is likely the winner of the GOP primary runoff between state Rep. Craig Goldman and Fort Worth business owner John O'Shea. A Democrat Trey Hunt will face the winning Republican in November; however, the district is solidly Republican. Granger hasn't endorsed in the race, but Fort Worth business and politically leaders close to Granger are backing Goldman.

— Future congressional agenda. When lawmakers return from their long Easter recess break, the focus will likely be a push for aid to Ukraine and Israel. Rep. Michael McCaul (R-Texas) said Speaker Mike Johnson (R-La.) is committed to putting a vote for Ukraine funding on the House floor sometime after Easter. He will again need votes from Democrats and that will more than upset some rebel GOP and other conservative Republicans.

As for a new farm bill, the House may finally release details of its proposals late April into May, with several “creative ideas” regarding generating $40 billion to $50 billion in additional spending beyond the $1.51 trillion ten-year baseline. Key will be whether any of those creative plans will meet with stiff Democratic Party resistance, which would mean a farm bill stalemate would continue and the process likely kicked into a new Congress in 2025. House farm bill policy proposals will likely include a variable percentage increase for farm program crop reference prices, crop insurance improvements, back-loaded funding for trade promotion programs (MAP, FMD), and funding for biosecurity.

— On Tuesday, independent presidential candidate Robert F. Kennedy Jr. will announce his running mate in Oakland, California.

— New Jersey first lady Tammy Murphy to end Senate campaign to replace Bob Menendez, according to Politico (link), citing a source with knowledge of her decision. Murphy has been in a heated primary with Rep. Andy Kim for the Democratic nomination. While she's gained wide support from county leadership, crucial in New Jersey, she's faced a revolt among grassroots Democrats since announcing her bid in November.

— Waiting on SAF details: Week 3 as of this Friday. USDA Secretary Tom Vilsack at the Commodity Classic in Houston said it would be “weeks, not months” when detailed information comes out regarding the Sustainable Aviation Fuel (SAF) program after the initial by March 1 date was not met. The Treasury Department will release tax credit details for SAF. An updated Greenhouse Gases, Regulated Emissions and Energy Use in Technologies (GREET) model will come from USDA, EPA and the departments of Transportation and Energy.

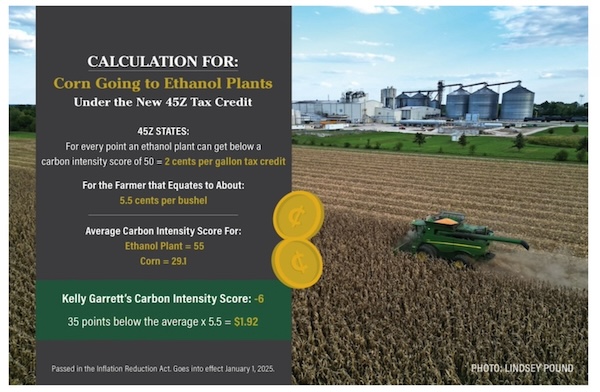

Of note: In an item in Friday’s Updates (link), we noted several analysts’ observations regarding the impact of the coming decisions and on Sustainable Aviation Fuel (SAF) in general. One source said there are enough carbon intensity reductions available for ethanol plants that have invested in technology that increases their output or lowers their inputs enough to get them under the 50kg/mmBTU of CO23 and “in the money.” But such ethanol plants want corn producers included. As one source put it: “We need farmers to pull on the plow just as hard as we are with investments and innovation of their own. Without each other, both groups lose. The bar will continue to go up. We all need to focus on getting our work done more safety, more efficiently, and more sustainably. That will not change.” With that in mind, note the following graphic that appeared last week on AgWeb (link):

— The North Dakota Public Service Commission (PSC) has scheduled public hearings regarding the Summit Carbon Solutions pipeline. The hearings, set to take place April 22, May 24, and June 4, will allow individuals to provide testimony, which will become part of the official record on the case. The PSC may consider input received outside of the hearings and may pose questions to the company based on this input, according to the North Dakota Monitor.

Summit Carbon Solutions describes its Midwest Carbon Express pipeline project as the world's largest carbon capture and storage project, aiming to gather carbon emissions from ethanol plants for underground storage. The pipeline route spans several states, including North Dakota, where it intersects with Tharaldson Ethanol at Casselton.

Although the PSC denied Summit's permit application last year, the company has adjusted its route, addressing concerns about landslides and proximity to populated areas. Summit sees the pipeline as beneficial to the ethanol industry and corn farmers supplying ethanol plants.

The project has drawn both support and opposition. N.D. Governor Doug Burgum has voiced support for carbon capture initiatives, while opponents have raised concerns about safety, farmland damage, and property values. Summit is offering compensation to landowners who sign voluntary agreements but may resort to eminent domain for those who do not comply, ensuring compensation for affected landowners regardless.

— Grassley raises concerns over EPA's proposed vehicle emissions regulation. Sen. Chuck Grassley (R-Iowa) expressed concern about a proposed regulation by the EPA regarding vehicle greenhouse gas emissions. The regulation, set to phase in over five years starting with model year 2027, has raised worries about its impact on the national debt, particularly due to electric vehicle (EV) tax credits.

Grassley highlighted a cost estimate (link) by the Congressional Budget Office (CBO), which projected a $224 billion increase in the cumulative deficit due to higher electric vehicle tax credit claims and reduced gas tax revenues. He emphasized that the EPA's proposed EV Rule, identified by the CBO as a significant contributor to these revisions, could burden American taxpayers. Grassley conveyed his concerns to the EPA in a letter (link), stating that the proposed regulation is neither supported by nor affordable for American taxpayers.

— In Minnesota, legislators are proposing to introduce a sales tax on commercial fertilizer to pay for closing drinking wells contaminated with nitrates and supplying thousands of southeast Minnesota residents with clean sources of water. The U.S. Environmental Protection Agency (EPA) ordered Minnesota to halt nitrate contamination in groundwater last November.

Under the measure, ag retailers and vendors for nitrogen fertilizer would pay a 99-cent-per-ton tax. The tax, expected to draw $3 million, would go to community health boards in eight southeastern counties to be used on safe drinking water, with priorities for mothers and infants.

According to a petition to the EPA filed last year by Minnesota Center for Environmental Advocacy, the Minnesota Well Owners Association and others, roughly 80 residents use private wells for drinking water in the impacted region.

Lee Helgen, executive director for Minnesota Crop Production Retailers, an association comprising members who’d directly pay the tax, says “There’s not a compelling nexus in policy between a statewide fertilizer tax and allocating funds for a very specific, narrow geographic” concern, labeling the policy approach “defective.”

— Farm labor: An issue not only for the United States, but now for Mexico. Mexico has is experiencing a diminishing farmworker population and its negative impact on agricultural industries, the Washington Post reports (link). Historically, Mexican workers crossed the border to work on American farms, but now Mexico faces a shortage of laborers due to various factors, including an aging workforce and increased opportunities elsewhere, including seasonal work visas in the United States.

As a result, Mexican farmers are advocating for a guest-worker program to address labor shortages. The government plans to open job opportunities to non-Mexicans, potentially attracting migrants in search of better opportunities.

Despite lower wages compared to the U.S., Mexican farms are improving working conditions and offering incentives to attract workers. However, recruiting foreigners to work in Mexican agriculture poses challenges, as seen in a pilot project where Central American workers struggled with farming and eventually left for the United States.

In the long term, Mexico's guest-worker programs may not immediately reduce migration to the U.S., but they could become more attractive if border crossing becomes more difficult, potentially shifting migration patterns.

Of note: Farm labor issues in the U.S. were a major topic addressed to USDA Secretary Tom Vilsack last week during the House Ag Appropriations Subcommittee hearing (link). Growers and agribusiness officials talk about labor as much as anything else. One person emailed me: “One of the biggest areas of concern I hear from almost every grower I speak with is labor — worker availability, cost, regulations —you name it. What are the chances for any help from the federal level?” Answer: With the current uncivil political climate, the odds are low.

Other Events of Note This Week

Monday, March 25

- Federal Reserve. Chicago Fed President Austan Goolsbee appears on Yahoo Finance. Fed Governor Lisa Cook speaks on the Fed’s dual mandate and the balance of risks at a lecture for students at Harvard University. Atlanta Fed President Raphael Bostic is part of a moderated conversation about equitable economic development at the University of Cincinnati Real Estate Center.

- Argentina outlook. Johns Hopkins University Paul H. Nitze School of Advanced International Studies virtual discussion on "Argentina and Milei: Is This Time Different?"

- Supporting Ukraine. National Press Club discussion on "the role of Baltic and U.S. leadership in supporting Ukraine, containing Russia and strengthening NATO defense and deterrence," part of its "Headliners" series.

- European elections. George Washington University Elliott School of International Affairs discussion on "The 2024 European Elections: How Far Right?"

- Former President Donald Trump’s deadline to post $454 million bond after losing New York state’s civil fraud suit. Trump has said he may have to offload prized assets to gather the necessary cash, or perhaps the listing of his Truth Social network will provide funding.

Tuesday, March 26

- Belt and Road Initiative. Wilson Center's Kissinger Institute on China and the United States discussion on "BRI (Belt and Road Initiative), Ports, and Debt: Getting the China Facts Straight."

- Climate change issues. Center for Global Development virtual book discussion on "Risk and Resilience in the Era of Climate Change."

- International trade. U.S. Customs and Border Protection 2024 Trade Facilitation and Cargo Security Summit for discussions on CBP's role in international trade initiatives and programs; runs through Thursday.

- Budgetary reform. American Enterprise Institute for Public Policy Research (discussion on "Improving Federal Agency Performance Through Budgetary Reforms."

- Russian elections. Carnegie Endowment for International Peace virtual discussion on "Russia has Re-Elected Putin. What Next?"

- U.S. Supreme Court hears case regarding FDA approval of mifepristone, the pill used in more than half of US abortions.

Wednesday, March 27

- Federal Reserve. Fed Governor Christopher Waller to speak on the economic outlook in New York.

- U.S./Africa trade policy. Carnegie Endowment for International Peace discussion on "What Is the Future of US-Africa Trade Policy?"

- Israel/Hamas war. Henry L. Stimson Center discussion on "The Israel-Hamas War: Impacts and Prospects, Six Months On."

- U.S. banking sector. Peterson Institute for International Economics virtual discussion on "The Future Structure of the U.S. Banking Sector."

- What’s next for Israel. Middle East Policy Council discussion on "The Middle East at War: What's Next for Israel and the Region?"

Thursday, March 28

- Carbon capture. United States Energy Association virtual discussion on "The Evolution of the Carbon Capture, Utilization, and Storage (CCUS) Industry."

- Economic outlook. American Bankers Association's Economic Advisory Committee virtual news conference "to present the latest consensus economic forecast."

- U.S.-Japan-Korea relations. Center for a New American Security virtual discussion on a report titled "Forging a New Era of U.S.-ROK-Japan Trilateral Cooperation."

- Financial stability in housing. Treasury Department meeting of the Financial Research Advisory Committee to discuss financial stability concerns in commercial real estate, assessing risks and hedge fund activities as well as private debt.

- Taiwan situation. Heritage Foundation discussion on "The American Case for Taiwan."

- NATO summit. United States Institute of Peace virtual discussion on "The Road to Washington's NATO Summit."

- Economic issues. Brookings Institution virtual Spring 2024 Brookings Papers on Economic Activity Conference; runs through Friday.

- U.S. policy in Israel. SETA Foundation at Washington DC discussion on "The U.S. Policy on Israel in an Election Year."

- Major League Baseball’s opening day in U.S., with all 30 teams scheduled to play following the season opening series in Seoul.

- French President Emmanuel Macron travels to Brazil to reset business and political ties.

- Sentencing of former chief executive of cryptocurrency exchange FTX Sam Bankman-Fried, convicted by a federal jury of conspiracy to commit wire fraud, conspiracy to commit commodities fraud, conspiracy to commit securities fraud and conspiracy to commit money laundering

Friday, March 29

- Good Friday. U.S. gov’t offices are open but U.S. stock, financial and commodity markets are closed.

- Federal Reserve. Fed Chairman Jerome Powell to participate in a Moderated Discussion with Kai Ryssdal at the Federal Reserve Bank of San Francisco Macroeconomics and Monetary Policy Conference. San Francisco Fed President Mary Daly delivers opening remarks at her bank’s Macroeconomics and Monetary Policy Conference.

- Economic activity conference. Brookings Institution virtual Spring 2024 Brookings Papers on Economic Activity Conference.

- National debt. The National Economists Club discussion on "From Riches to Rags: How We Turned Surpluses to Deficits and Exploded the National Debt."

- 2024 elections. Center for Strategic and International Studies discussion on "Defending Democracy: Ensuring Election Integrity in 2024."

- Anniversary of Wall Street Journal reporter Evan Gershkovich being arrested in the Urals city of Yekaterinburg and accused of trying to obtain defense secrets. He and his newspaper strongly reject the charges and the U.S. gov’t has designated him as wrongfully detained. Hopes for his release have waned in the wake of the death of Alexei Navalny.

Economic Reports and Events for the Week

In the upcoming week, the focus will be on a series of speeches by Federal Reserve officials, following the end of a blackout period after the latest Federal Open Market Committee (FOMC) meeting. The Fed has indicated its confidence in implementing three anticipated interest rate cuts throughout the year, and investors will closely monitor these speeches for insights that reinforce this stance. Various Fed board governors will be delivering talks throughout the week, culminating with Fed Chair Jerome Powell's participation in a moderated discussion at a San Francisco Fed conference towards the end of the week.

The economic calendar for the week includes key indicators such as the personal consumption expenditures price index, which is the Fed's preferred measure of inflation. The release of the PCE deflator for February in the report on personal income and spending at 8:30 ET will be Friday’s highlight. Some analysts say it would not be a surprise if the index came in above the 2.4% year-over-year reported for January, or the core index about 2.8% in the prior report. While the PCE deflator is the Fed’s preferred measure of inflation, the readings of the past couple of months are not enough to inspire the “greater confidence” policymakers want before easing monetary policy by lowering rates. Data on consumer confidence and durable goods orders will also be released, providing further insights into the state of the economy.

Monday, March 25

- Chicago Fed National Activity Index

- New Home Sales: Commerce Department's Census Bureau is expected to report that new home sales likely increased to a seasonally adjusted annual rate of 675,000 units in February, after 661,000 in the month prior.

- Dallas Fed Mfg. Survey

- Federal Reserve. Chicago Fed President Austan Goolsbee appears on Yahoo Finance. Fed Governor Lisa Cook speaks on the Fed’s dual mandate and the balance of risks at a lecture for students at Harvard University. Atlanta Fed President Raphael Bostic is part of a moderated conversation about equitable economic development at the University of Cincinnati Real Estate Center

Tuesday, March 26

- Durable Goods Orders: The Commerce Department's Census Bureau is expected to report that orders for durable goods likely increased 1.3% in February, after tumbling 6.2% in January.

- S&P CoreLogic Case-Shiller HPI

- FHFA House Price Index

- Consumer Confidence: The Conference Board is expected to say its consumer confidence index remained unchanged at 106.7 in March.

- Richmond Fed Manufacturing

- Milken Global Investors Symposium is held in Hong Kong.

- Australian Financial Review’s 10th annual banking summit will include a fireside chat by RBA’s head of payments policy, Ellis Connolly.

Wednesday, March 27

- MBA Mortgage Applications

- Federal Reserve. Fed Governor Christopher Waller to speak on the economic outlook in New York.

- Canada GDP: Statistics Canada is expected to report the monthly GDP figures. The economy likely expanded 0.4% in January, after a flat reading in the previous month.

- Many of China’s biggest banks report earnings through Friday and could reveal more margin pressure. Bank of Communications, Agricultural Bank of China, China Merchants Bank kick it off

Thursday, March 28

- Jobless Claims: The number of Americans filing new claims for unemployment benefits likely rose by 5,000 to 215,000 in the week ended March 23.

- GDP: The Commerce Department's Bureau of Economic Analysis will report the final estimate of the nation's Gross Domestic Product for the fourth quarter. The economy likely grew by 3.2% in the reported quarter.

- Pending Home Sales Index

- KC Fed Manufacturing

- Leading Indicators

- Consumer Sentiment: The University of Michigan's preliminary reading on the overall index of consumer sentiment is estimated to come at 76.5 in March, similar to the previously reported reading.

- Fed Balance Sheet

- Money Supply

Friday, March 29

- International Trade in Goods

- Wholesale Inventories

- Personal Income & Outlays: The release of the PCE deflator for February in the report on personal income and spending at 8:30 ET will be Friday’s highlight. Some analysts say it would not be a surprise if the index came in above the 2.4% year-over-year reported for January, or the core index about 2.8% in the prior report.

- Federal Reserve. Fed Chairman Jerome Powell to participate in a Moderated Discussion with Kai Ryssdal at the Federal Reserve Bank of San Francisco Macroeconomics and Monetary Policy Conference. San Francisco Fed President Mary Daly delivers opening remarks at her bank's Macroeconomics and Monetary Policy Conference.

Key USDA & international Ag & Energy Reports and Events

USDA reports on Thursday include Prospective Plantings, Grain Stocks and a Hogs & Pigs survey.

Monday, March 25

Ag reports and events:

- Export Inspections

- Food Price Outlook

- Oil Crops Yearbook

- Cold Storage

- Poultry Slaughter

- JRC MARS bulletin on crop conditions in Europe

- Malaysian palm oil export data for March 1-25

- Sugar production and cane crush data from Brazil’s Unica (tentative)

Energy reports and events:

- Brent May options expire

- Earnings: PetroChina; Kunlun Energy

- Holiday: India; Israel; Greece; Azerbaijan; Kazakhstan; Colombia.

Tuesday, March 26

Ag reports and events:

- Weekly Weather: State Stories

- EU weekly grain, oilseed import and export data

Energy reports and events:

- API weekly U.S. oil inventory report

- Angola final loading programs (May)

- Earnings: China Oilfield Services; Wood Group

- Holiday: Azerbaijan, Bangladesh

Wednesday, March 27

Ag reports and events:

Energy reports and events:

- EIA weekly U.S. oil inventory report

- Genscape weekly crude inventory report for Europe’s ARA region

- EIA Petroleum Status Report

- Weekly Ethanol Production

- North Sea loading programs (May)

- Holiday: Myanmar

Thursday, March 28

Ag reports and events:

- Export Sales

- Grain Stocks

- Prospective Plantings

- Hogs and Pigs

- Rice Stocks

- Egg Products

- Agricultural Prices

- Rice Yearbook

- Fruit and Tree Nuts Outlook

- Livestock Slaughter

- Port of Rouen data on French grain exports

Energy reports and events:

- Singapore onshore oil product stockpile weekly data

- EIA Natural Gas Report

- Brent May contract expires

- Baker-Hughes Rig Count

- Earnings: China Resources Gas; Capricorn Energy; EnQuest

- Holiday: Argentina, Malaysia, Mexico, Venezuela, Norway, Colombia, Panama, Philippines, Uruguay

Friday, March 29

Ag reports and events:

- U.S. gov’t offices are open but U.S. stock, financial and commodity markets are closed

- CFTC Commitments of Traders report

- Peanut Prices

Energy reports and events:

- Baker Hughes weekly U.S. oil/gas rig counts

- ICE weekly Commitments of Traders report for Brent, gasoil

|

KEY LINKS |

WASDE | Crop Production | USDA weekly reports | Crop Progress | Food prices | Farm income | Export Sales weekly | ERP dashboard | California phase-out of gas-powered vehicles | RFS | IRA: Biofuels | IRA: Ag | | Russia/Ukraine war, lessons learned | | SCOTUS on WOTUS | SCOTUS on Prop 12 pork | New farm bill primer | | Gov’t payments to farmers by program | Farmer working capital | USDA Ag Outlook Forum |