Did USDA Put Politics in Government Contingency Plans? (Updated)

Did USDA Put Politics in Government Contingency Plans? (updated)

Student loan payments | Nov. 17 next CR deadline | World Bank lowers China’s GDP for 2024

|

Today’s Digital Newspaper |

Note: This report under Policy Update includes revised USDA contingency plans relative to the Farm Service Agency.

MARKET FOCUS

- USDA daily export sales:

— 210,000 MT corn to Mexico during 2023-2024 marketing year

— 132,000 MT soybeans to China during 2023-2024 marketing year - Ag markets today

- Ag trade update

- In last quarter, oil emerged as standout performer in financial markets

- Office prices in U.S. will only rebound after a severe collapse: survey

- Americans buck economic trends, continue to spend amid rising rates and inflation

- Americans started new businesses at rapid clip coming out of Covid-19 pandemic

- Crude-oil pipeline from Iraq’s Kurdistan region to Med coast of Turkey will resume

- Comex gold futures prices hit 10-month low overnight

- Malaysia announces measures to tame rice prices

- NWS weather outlook

- Pro Farmer First Thing Today items

RUSSIA & UKRAINE

- Biden urges McCarthy to follow up quickly with funding for Ukraine

- Ukraine: five ships are heading to its Black Sea ports for loading

- Ukraine reports significant drop in freight rates for grain exports through corridor

- Ukraine grain exports fall sharply

POLICY

- USDA's updated contingency plans, released late Friday afternoon, included a shift

CHINA

- China's economy shows encouraging signs of recovery as holiday season begins

ENERGY & CLIMATE CHANGE - European Union introduced its carbon border adjustment mechanism

- Interior Dept. proposes record-low Gulf lease sales as part of new five-year plan

LIVESTOCK & FOOD INDUSTRY

- U.S. restricts French poultry over HPAI vaccine

CONGRESS

- Reality: Congress merely deferred key decisions

- California Gov. appoints Laphonza Butler to fill remainder of Feinstein’s term

- House reconvenes today at 2 p.m. ET with packed agenda

OTHER ITEMS OF NOTE

- Supreme Court returns to the bench

- Trump arrives at New York court for $250 million fraud trial

- Today’s calendar of events

|

MARKET FOCUS |

— Equities today: Asian and European stocks were mixed overnight, with Asian shares mostly down and European shares mostly up. U.S. Dow opened around 70 points lower. In Asia, Japan -0.3%. Hong Kong closed. China closed on an extended holiday. India closed. In Europe, at midday, London -0.4%. Paris -0.3%. Frankfurt -0.2%.

U.S. equities Friday: U.S. equities finished mostly lower Friday amid no solution to a potential government shutdown when the closing bell sounded. The Dow was down 158.84 points, 0.47%, at 33,507.50. The Nasdaq rose 18.05 points, 0.14%, at 13,219.32. The S&P 500 was down 11.65 points, 0.27%, at 4,288.05.

The S&P 500 ended September in negative territory for a fourth consecutive year. The S&P 500 declined 3.7% from July 1 through Friday’s close, the Dow dipped 2.7% and the tech-heavy Nasdaq fell 4.1%.

— In the last quarter, oil emerged as a standout performer in the financial markets. The Brent crude benchmark saw a significant increase of 27.2%, while West Texas Intermediate (WTI) also surged by 28.5% compared to the previous quarter. This surge in oil prices had a positive impact on Russian stocks, with the Moscow Exchange experiencing a notable gain of 12.7% when measured in the local currency. When converted to dollars, the increase was approximately 3%. As a result, Russian stocks have shown remarkable growth this year, surpassing a 50% gain based on Russian measurements. This indicates the close relationship between oil prices and the performance of the Russian stock market, given the country's significant reliance on oil exports for its economy.

— Agriculture markets Friday:

- Corn: December corn fell 11 3/4 cents to $4.76 3/4, marking a 1/2 cent loss on the week.

- Soy complex: November soybeans fell 25 1/2 cents to $12.75, marking the lowest close since June 28 and a weekly loss of 21 1/4 cents. December meal gave up $10.30, closing at $381.20, a $4.60 loss on the week. December soyoil fell 108 points to 55.83 cents and lost 379 points week-over-week.

- Wheat: December SRW wheat futures dropped 37 1/4 cents to $5.41 1/2, near the daily low and set a contract low. For the week, December SRW fell 38 cents. December HRW wheat lost 21 1/4 cents to $6.63 3/4, near the session low and hit a contract low. On the week, December HRW lost 47 1/2 cents. December spring wheat futures fell 38 3/4 cents to $7.08 1/4 and lost 62 1/4 cents on the week.

- Cotton: December cotton fell 152 points to 87.19 cents but gained 128 points on the week.

- Cattle: December live cattle futures lost $2.50 at $187.925 and near the daily low. For the week, December live cattle fell $3.425. November feeder cattle futures dropped $2.775 at $254.90 and near the session low. On the week, November feeders lost $8.625.

- Hogs: Nearby October dove $3.75 to $80.20 Friday, while most-active December matched that drop to $71.775. That closing price marked a weekly drop of 40 cents.

— Ag markets today: Corn and wheat futures traded higher on corrective buying overnight, while soybeans faced followthrough selling. As of 7:30 a.m. ET, corn futures were trading 3 cents higher, soybeans were 5 to 6 cents lower and wheat futures were 4 to 8 cents higher. Front-month crude oil futures were around 80 cents higher, and the U.S. dollar index was nearly 300 points higher.

Weaker cash cattle expectations. Cash cattle traded steady (Southern Plains) to lower (northern market) last week, though traders will have to wait until later this morning to get the official average price. With the flip of the calendar, packers will have fresh contract supplies available, which is expected to lead to lower prices in the negotiated market again this week.

Cash hog prices weakening seasonally. The CME lean hog index is down 56 cents to $85.58 (as of Sept. 28). With the cash index signaling the start of an extended seasonal decline after a brief move up in September, traders have extended discounts futures hold to cash. October lean hog futures finished Friday $5.38 below today’s cash quote, while the December contract held a $13.805 discount.

— Quotes of note:

- “If someone wants to make a motion against me, bring it,” a defiant House Speaker Kevin McCarthy (R-Calif.) said after the spending bill passed 335 to 91, with far more Democratic support than Republican. “There has to be an adult in the room.” Rep. Matt Gaetz (R-Fla.), a member of the far-right House Freedom Caucus and a rebel critic of McCarthy since the Speaker’s election in January, made good on his threat Sunday, announcing, “Kevin McCarthy’s gonna get his wish,” on ABC’s This Week. McCarthy brushed off Gaetz’s threat Sunday, calling the situation “personal” with the Florida lawmaker. “That’s nothing new, he’s tried to do that from the moment I ran for office,” McCarthy said on CBS News’ Face the Nation. House Democrats could save him, if they want to. McCarthy will likely need Democratic votes to succeed. Democrats are no fan of the speaker, especially after he allowed an impeachment hearing against President Biden to begin. But with another shutdown deadline looming, would they want to help oust McCarthy or keep in power a speaker who’s shown some willingness to work with them?

- Lack of confidence. “The fact that inflation has come down doesn’t mean prices have come down,” said Tim Quinlan, senior economist at Wells Fargo. “For consumers, as long as prices remain elevated, which is what they are from their perspective, it still kind of weighs on confidence.”

- “There are real benefits to self-reporting, remediating and cooperating.” — The SEC's Gurbir S. Grewal, on charges made against 10 firms on Friday for failing to maintain and preserve electronic communications. The SEC imposed the smallest fine — $2.5 million — on Perella Weinberg, crediting the company for reporting the violations to the agency.

— Office prices in the U.S. will only rebound after a severe collapse. Approximately two-thirds of the 919 respondents in a Bloomberg survey believe that office prices in the U.S. will only recover significantly after experiencing a severe decline. An even larger majority of respondents anticipate that U.S. commercial real estate prices will not reach their lowest point until the second half of 2024 or later. The decline in commercial property values is primarily attributed to the Federal Reserve's aggressive rate hikes. The adverse effects of these higher interest rates are expected to have a prolonged impact on owners of U.S. commercial real estate, which Morgan Stanley estimates to be worth a total of $11 trillion. Analyst Lea Overby from Barclays noted that changes in interest rates typically lead to a gradual adjustment in the U.S. real estate market.

— Americans buck economic trends, continue to spend amid rising rates and inflation. Despite the economic challenges posed by rising interest rates, persistently high inflation, reduced pandemic savings, and a cooling labor market, American household spending remains surprisingly robust. In August, consumers increased their spending by 5.8% compared to the previous year, significantly surpassing the less-than-4% inflation rate. Notably, the "experience economy," which includes activities like travel and concerts, witnessed a summer boom, the Wall Street Journal reports (link) This counterintuitive spending behavior can be attributed to a challenging housing market prompting consumers to reallocate funds they would typically save, coupled with the pandemic's revelation of the unpredictability of long-term plans related to health, work, or daily life. Consequently, Americans are choosing to invest in once-in-a-lifetime experiences while fearing they may not have the opportunity to do so in the future.

Bucking

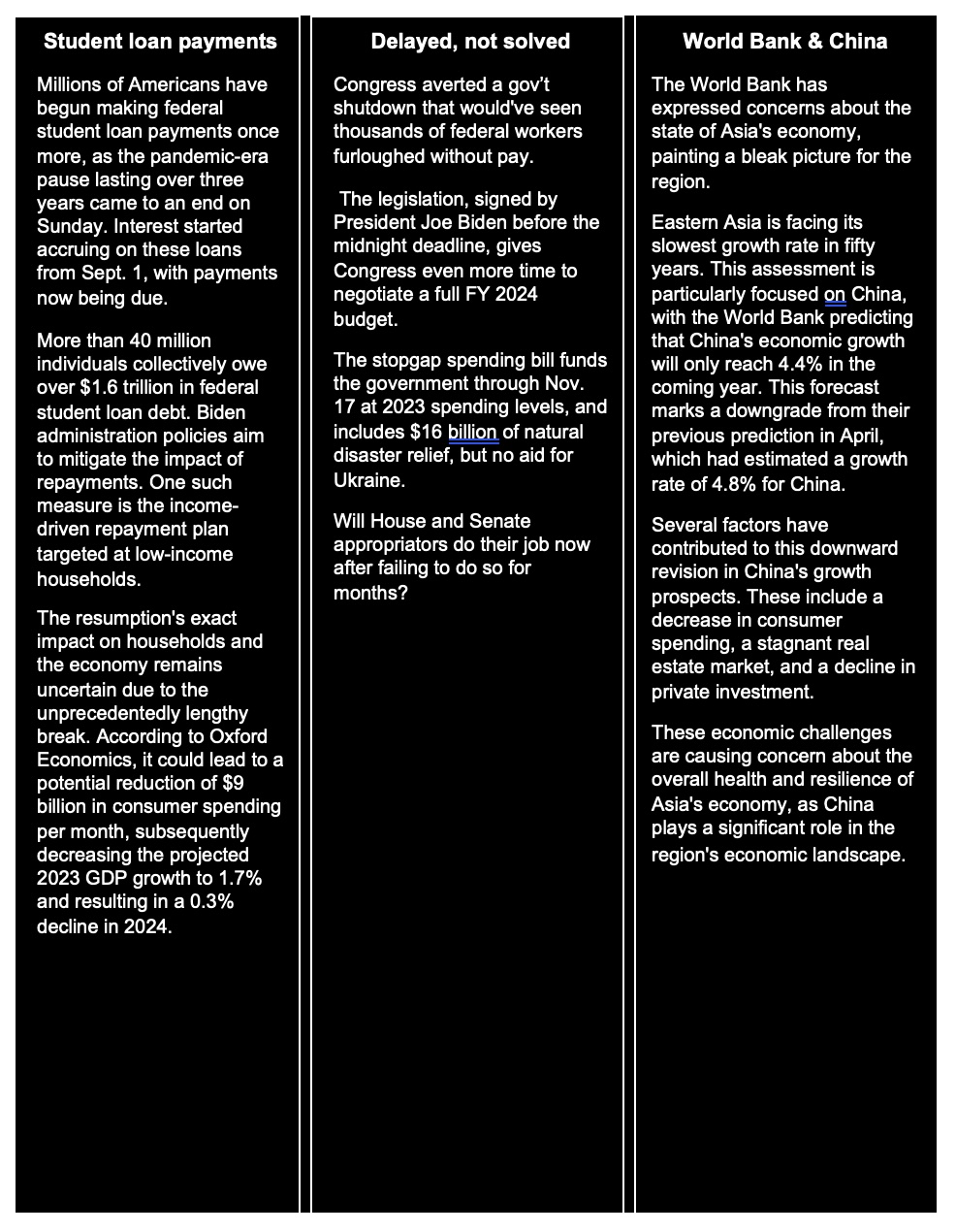

— Post-Pandemic surge: Americans embrace entrepreneurship, fueling job creation and economic growth. Following the Covid-19 pandemic, Americans have embarked on a remarkable entrepreneurial journey, breathing life into new businesses. This surge in entrepreneurial activity holds the potential to stimulate economic growth and technological advancement. The Federal Reserve's Ryan Decker and the University of Maryland's John Haltiwanger, in a Brookings Paper (link/pdf) on Economic Activity, affirm that the increase in business applications and registrations during the pandemic was indicative of genuine entrepreneurship. It led to substantial job creation and the reshuffling of jobs and workers, demonstrating resilience even amid challenging economic conditions — a sharp contrast to the decline in entrepreneurship witnessed during the Great Recession.

Market perspectives:

— Outside markets: The U.S. dollar index was firmer, with the euro, British pound and Swiss franc all weaker against the greenback. The yield on the 10-year U.S. Treasury note was higher, trading around 4.64%, with a steady-to-higher tone in global government bond yields. Crude oil futures eased back from highs seen during overnight trading, with U.S. crude around $91.25 per barrel and Brent around $92.80 per barrel. Gold and silver were under pressure, with gold around $1,852 per troy ounce and silver around $21.87 per troy ounce.

— Crude oil recently wrapped up its most substantial quarterly gain since the early months of the conflict in Ukraine. The front-month WTI crude marked its strongest performance in Q3 since Q1 2022. Simultaneously, energy stocks enjoyed a robust quarter. However, analysts on Wall Street anticipate that this bullish trend in oil prices will gradually lose momentum. Unless a significant supply crisis emerges, there is limited optimism among experts that oil prices will sustain levels above $100 per barrel soon. Instead, the prevailing sentiment is that prices are likely to remain around the $90 per barrel mark for the remainder of the year. J.P. Morgan has noted that the impact of higher oil prices is already starting to dampen demand, suggesting potential challenges ahead for the oil market.

— Crude-oil pipeline running from Iraq’s Kurdistan region to the Mediterranean coast of Turkey will resume operations this week, Turkish Energy Minister Alparslan Bayraktar said.

— Comex gold futures prices hit a 10-month low overnight amid rising U.S. Treasury yields and the strong U.S. dollar.

— Malaysia announces measures to tame rice prices. Malaysia announced a subsidy and other measures to try to cool rice prices amid concern over rising costs and supply shortages. The country’s ag ministry said it would provide a subsidy of 950 ringgit ($201.78) per ton for imported white rice in the states of Sabah and Sarawak from Oct. 5. The ministry also asked the Federal Agricultural Marketing Authority to increase distribution of local white rice to rural areas. All government contracts for rice procurement would now involve purchasing imported white rice instead of local white rice.

— Ag trade update: Mauritius tendered to buy 6,000 MT of optional origin long grain white rice.

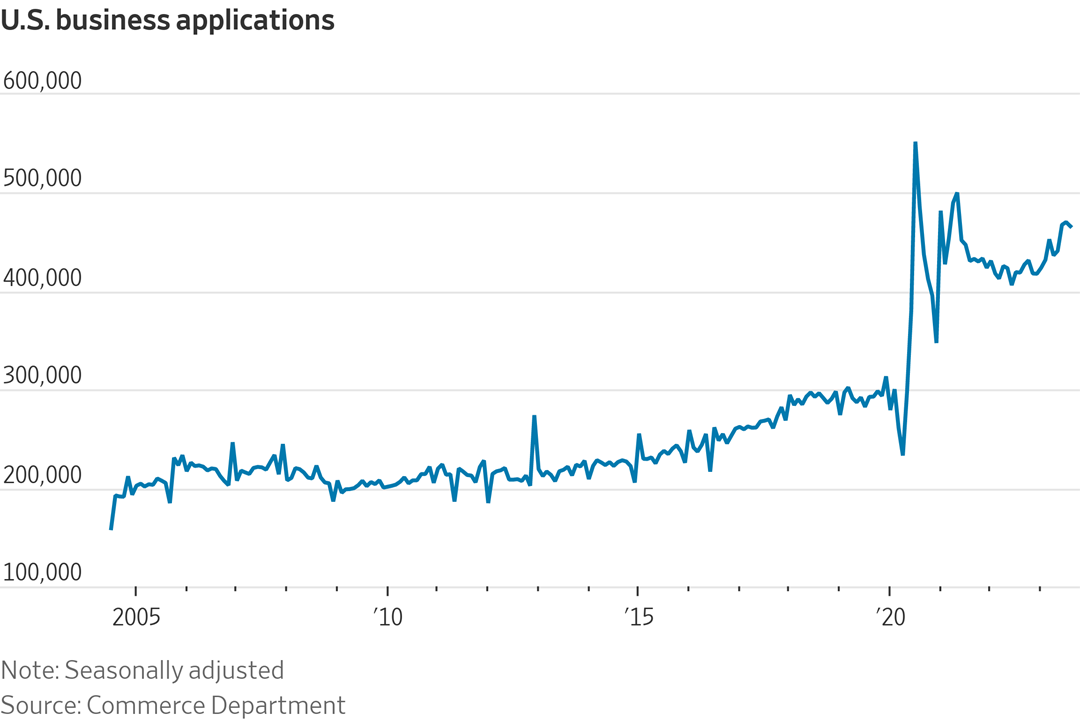

— NWS weather outlook: There is a Slight Risk of excessive rainfall over parts of the Southern High Plains on Monday... ...There is a Slight Risk of severe thunderstorms over parts of the Southern High Plains on Monday and over parts of the Central/Southern Plains on Tuesday... ...Moderate to heavy snow over parts of the higher elevations of Northern Rockies.

Items in Pro Farmer's First Thing Today include:

• Corn and wheat firmer, beans weaker to start the week

• August soy crush expected to be down sharply

• More ships headed to Ukrainian Black Sea ports, freight rates fall

• World Bank keeps China’s 2023 GDP growth forecast unchanged, cuts outlook for 2024

|

RUSSIA/UKRAINE |

— President Biden urged House Speaker Kevin McCarthy (R-Calif.) to follow up quickly with funding for Ukraine hours after Congress passed a spending bill to avoid a U.S. gov’t shutdown, but did not include $6 billion in aid. Less than two weeks ago, Ukrainian President Volodymyr Zelenskyy visited Washington to plead for new weapons systems and urged allies to keep up their financial and military support for Kyiv. “There’s an overwhelming number of Republicans and Democrats in both the House and the Senate who support Ukraine. Let’s vote on it,” Biden said Sunday at the White House.

— Ukraine said five ships are heading to its Black Sea ports for loading, while three others recently left with cargoes, as Kyiv seeks to overcome a Russian blockade of its commodity exports. The five vessels — Olga, Ida, Danny Boy, Forza Doria and New Legacy — will be loaded with 120,000 tons of grain for Africa and Europe at the ports of big Odesa, which include Chornomosk and Pivdennyi, Infrastructure Minister Oleksandr Kubrakov said on Facebook. The ships are in the temporary corridor set up by the Ukrainian Navy, heading toward the ports, according to ship tracking data.

— Ukraine reported a significant drop in freight rates for grain exports through their newly established corridor. According to Ukrainian Agriculture Minister Mykola Solsky, freight costs have recently become "30% to 40% cheaper" over the past 2-3 weeks. While these rates remain relatively high, this reduction is seen as a substantial cost-saving development. However, specific figures to substantiate these claims were not provided by the minister.

— Ukraine grain exports fall sharply. Through the first three months of 2023-24, Ukraine exported 6.68 MMT of grain, down 2.31 MMT (25.7%) from the same period last year. The discontinuation of the Black Sea grain deal in mid-July forced Ukraine to keep alternative routes, which slowed down shipments. Exports included 3.3 MMT of wheat, 2.7 MMT of corn and 622,000 MT of barley.

|

POLICY UPDATE |

— USDA's updated contingency plans, released late Friday afternoon, included a shift under the Agricultural Marketing Service (AMS) that shifted the Market News function from being an excepted operation in the August 2020 plan due to its importance to the agriculture industry, to now being activity that would not take place in the event of a shutdown. Link to updated USDA plans.

Both the August 2020 and updated contingency plan have a section under AMS on the impacts of a shutdown. AMS noted that no Market News means that buyers and sellers would be “unable to determine market value of an agricultural commodity being traded, creating uncertainty in the market about market trends and reluctance to move products, particularly livestock, to market.”

The document also contained a potentially politically motivated statement that echoes an often-used comment from the Biden administration: the ”brunt of the impact will be most keenly felt by producers, growers, and other small farmers; most affected will be the small farmers who market their commodities through formula arrangements, where the determination of price is based on published data.”

There was a HUGE change for the Farm Service Agency (FSA).

The Farm Service Agency (FSA) August 2020 contingency plan lists several operations that will continue, with some of them including Market Assistance Loans; provision of new Direct and Guaranteed Farm Operating Loans and servicing those loans; emergency loans; Farm Storage Facility Loans; servicing existing Conservation Reserve Program contracts but no new signups can be made; Dairy Margin Coverage; sugar Price Support Loans, continued implementation of the 2018 Farm Bill, including Agricultural Risk Coverage and Price Loss Coverage efforts; Livestock Forage Disaster and presumably other emergency aid programs.

Action on the National Organic Certification Cost-Share Program would halt.

However, under the UPDATED contingency plan that finally became available this morning after an issue kept the document from being available over the weekend, “FSA employees will cease all program delivery activities.” If a shutdown continues past 10 days, the plan said that one farm loan employee per service center will be on call in order to complete certain loan processing items in order to protect the security interest of the government. “This will not include any new loan processing,” the plan stated.

However, the package noted that those paid with Inflation Reduction Act (IRA) funding who oversee policy development and program activities under IRA Section 22006 “will continue their work to the extent feasible, up to application approval during the first two weeks of a lapse in appropriation.” The plan also indicated that during the first two weeks of a shutdown would include “review and processing of distressed borrower payments up to application approval.” A shutdown longer than two weeks would prompted officials to reevaluate the contingency plan “to consider whether it is appropriate to fund additional staff or to add excepted staff necessary to support the funded activity, to potentially include payment processing.”

|

CHINA UPDATE |

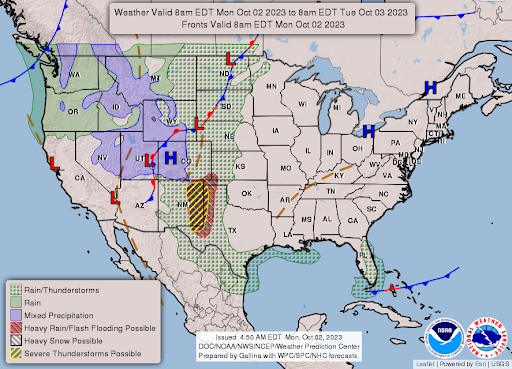

— China's economy shows encouraging signs of recovery as holiday season begins. After several months of sluggish growth, China's economy is displaying promising signs of improvement, offering a glimmer of optimism for the global economy, which is grappling with the impact of higher interest rates affecting consumers and businesses in the U.S. and Europe. In September, factories reported their first expansion in activity since the spring, and indicators such as railway and flight bookings suggest a robust week for tourism as China embarks on its weeklong National Day holiday celebrations. However, economists caution that the economy is not yet fully restored, and it is too early to determine if a substantial turnaround is on the horizon.

Details: China’s official manufacturing purchasing manufacturers index (PMI), which tracks larger and state-owned factories, rose to 50.2 in September. That was the first time the reading was above the 50.0 level, which separates expansion from contraction since March. The Caixin manufacturing PMI, which gauges smaller and privately-owned factories, declined to 50.6 in September from a 51.0 reading in August, but still marked the second straight month of sector growth.

|

ENERGY & CLIMATE CHANGE |

— European Union introduced its carbon border adjustment mechanism, accelerating a push to become the first climate-neutral continent and taking a first step toward moving other parts of the world to follow suit. The measure will eventually place a levy on carbon-intensive imports so that European companies forced to comply with the continent’s strict climate laws won’t face unfair competition from producers outside the bloc. From Sunday, the start of the first phase of the so-called Carbon Border Adjustment Mechanism, importers from six carbon-intensive industries will be required to start reporting on their emissions.

The mechanism has already faced pushback from the EU’s major trading partners including Russia and China, who argue that it undermines the principles of free trade. It’s also added to trade tensions between the EU and U.S, with the Biden administration asking earlier this year for its steel and aluminum exports to be exempt.

— Interior Dept. proposes record-low Gulf lease sales as part of new five-year plan. The Department of Interior (DOI) unveiled its proposed five-year plan for oil and gas lease sales in the Gulf of Mexico, and it includes a historically low number of sales. Under this plan, up to three lease sales are suggested, which would mark the lowest level ever recorded. The proposed sales are scheduled for 2025, 2027, and 2029. This reduction follows provisions from a government package passed last year, which linked oil lease sales to the DOI's capacity to issue offshore wind power lease sales.

Notably, the new plan does not include any lease sales for the Atlantic Ocean, Pacific Ocean, or Alaskan waters. This is a significant departure from a previous plan that had proposed 47 lease sales across all U.S. coastal waters. The decision to scale back is attributed to concerns about "risks to local coastal economies." The prior five-year plan expired in June 2022, and this new proposal reflects a shift in the DOI's approach to offshore leasing.

|

LIVESTOCK, FOOD & BEVERAGE INDUSTRY |

— U.S. restricts French poultry over HPAI vaccine. France started vaccinating ducks against highly pathogenic avian influenza on Monday, prompting the U.S. to impose trade restrictions on French poultry imports. Vaccinated birds may not show signs of infection, meaning it is impossible to determine whether the virus is in a flock, USDA said. Japan was also still reluctant to accept French poultry after vaccination.

|

CONGRESS |

— Reality: Congress merely deferred key decisions and now lawmakers have just weeks to resolve fights over aid to Ukraine, heading off a surge in border crossings and the overall size of the federal government.

— California Gov. Gavin Newsom (D) will appoint Emily’s List President Laphonza Butler to fill the remainder of late Sen. Dianne Feinstein’s term, making her the only Black woman in the Senate and just the third in its history. Appointing Butler will allow Newsom to fulfill his pledge to select a Black woman to represent California after Kamala Harris became vice president in 2021, vacating her seat as junior senator. Butler has a history as a longtime labor leader in California, including serving as president of SEIU Local 2015, the biggest union in the state. As a partner at political consulting firm SCRB Strategie, she advised and represented Uber in its dealings with organized labor. She was an advisor to Kamala Harris during her presidential run.

It’s unclear whether Butler will seek election to serve out a full term; three prominent California lawmakers have already announced they plan to run for Feinstein’s seat.

She is expected to be sworn in to fill Feinstein's Senate seat as early as this week.

— House reconvenes today at 2 p.m. ET with a packed agenda, including plans to vote on two critical spending bills this week. Five measures, including one aimed at simplifying educational requirements for federal cybersecurity positions, will be considered today under suspension of the rules, requiring a two-thirds majority for passage. Voting on these measures is slated for 6:30 p.m. ET today. Leadership has scheduled action on the Energy and Water Development spending bill (HR 4394) for tomorrow and Wednesday, while the Legislative Branch bill (HR 4364) will be taken up on Thursday. The Rules Committee will convene today at 4 p.m. ET to discuss these measures.

In the Senate, the session resumes tomorrow with a focus on considering more of President Biden's nominees. Majority Leader Chuck Schumer (D-N.Y.) has scheduled a vote on invoking cloture, or limiting debate, for James O'Brien's nomination as an assistant secretary of state, set for 5:30 p.m. ET tomorrow. Cloture has also been filed for two district court nominees: Brendan Hurson for the District of Maryland and Susan DeClercq for the Eastern District of Michigan.

|

OTHER ITEMS OF NOTE |

— Supreme Court returns to the bench for a term that conservative activists hope will bring new constraints on federal power, including how it regulates financial institutions and environmental protection.

The Supreme Court will hear two cases in its upcoming term on law in Florida and Texas that bar social media companies from “censoring” users for their beliefs. Conservatives have railed against social media companies for allegedly showing bias against them while social media giants argue the laws infringe on their First Amendment rights.

— Trump arrives at New York court for $250 million fraud trial. Former President Donald Trump plans to attend the opening day of a civil-fraud trial that pits him against New York Attorney General Letitia James and could shed light on his finances and business practices.

— Calendar of events today include:

Monday, Oct. 2

• President Biden delivers remarks at 2 p.m. ET on the Americans with Disabilities Act, and meets with his Cabinet.

• Federal Reserve. Fed Chairman Jerome Powell participates in discussion on growing the local economy in York, Pennsylvania; Fed Vice Chair for Supervision Michael Barr speaks on Monetary Policy and Financial Stability at the Forecasters Club Luncheon, Cornell Club, New York.

• International trade. The Washington International Trade Association (WITA) holds its virtual 2023 Intensive Trade Seminar; runs through Tuesday.

• Semiconductor export controls. The Center for Strategic and International Studies (CSIS) holds a virtual discussion on "Allied Perspectives on Semiconductor Export Controls."

• AI and employment. The Brookings Institution holds a discussion on "Artificial Intelligence (AI) in Employment and Hiring."

• Climate costs. The Center for Global Development (CGD) holds a virtual discussion on "The Cost of Climate: How Can Countries Pay for Climate Action?"

• Bank regulatory reform. The Federalist Society for Law and Public Policy Studies holds a virtual discussion on "How Risky Are the Banks Now? What Regulatory Reforms Make Sense?"

• Broadband access. The American Enterprise Institute for Public Policy Research (AEI) holds a discussion on "Will Broadband be Affordable? Assessing Regulations for Broadband Subsidies."

• U.S./-India relations. The Federalist Society for Law and Public Policy Studies holds a virtual discussion on "US-India Relations: An Important but Ambiguous Partnership."• Economic reports. PMI Manufacturing | Construction Spending | ISM Manufacturing Index

• Energy reports. ADIPEC Abu Dhabi; runs through Thursday | Spain and IEA host pre-COP28 Climate and Energy Summit | Holiday: China, Australia, Hong Kong, India, South Korea, Nigeria, Canada.

• USDA reports. AMS. Export Inspections NASS: Cotton System | Fats & Oils | Grain Crushings | Crop Progress

|

KEY LINKS |

WASDE | Crop Production | USDA weekly reports | Crop Progress | Food prices | Farm income | Export Sales weekly | ERP dashboard | California phase-out of gas-powered vehicles | RFS | IRA: Biofuels | IRA: Ag | Student loan forgiveness | Russia/Ukraine war, lessons learned | Russia/Ukraine war timeline | Election predictions: Split-ticket | Congress to-do list | SCOTUS on WOTUS | SCOTUS on Prop 12 pork | New farm bill primer | China outlook | Omnibus spending package | Gov’t payments to farmers by program | Farmer working capital | USDA ag outlook forum | Debt-limit/budget package |