Senate Ag Panel Discord Over Reference Prices Now Public

Union workers strike America's Big Three automakers | Gas, diesel prices continue surge

|

Today’s Digital Newspaper |

MARKET FOCUS

- Historic triple strike: UAW walkout hits GM, Ford, and Stellantis over contract dispute

- European central bank hints at pausing rate increases after 10th consecutive hike

- Rising gas prices drive increase in U.S. retail sales, reflecting inflationary pressures

- Global diesel shortage drives prices to decades-high levels on S/D challenges

- China's strong economic data propels bullish oil market amid global refinery challenges

- Stronger dollar impacts earnings for U.S. companies operating abroad

- Ag markets today

- India reduces wheat stock limits, vows to stabilize prices amid festive season

- Japan to cut wheat import price for first time in three years

- Pro Farmer First Thing Today items

- NWS weather outlook

RUSSIA & UKRAINE

- Ukrainian President Volodymyr Zelenskyy will be visiting Washington next week

- Ukraine regains control of village near Bakhmut in ongoing conflict with Russia

- Russia's central bank raises key interest rate to 13% in effort to tackle rapid inflation

POLICY

- Senate farm bill writers at odds over reference price adjustments

- Expanding IRA resources in the 2023 Farm Bill for inclusive conservation

CHINA

- 2024 China agricultural import quotas announcement expected in early October

- Data on Friday showed improvement in consumer spending and factory output

- China takes more steps to boost liquidity

- China's defense minister removed amid leadership changes & economic challenges

TRADE POLICY

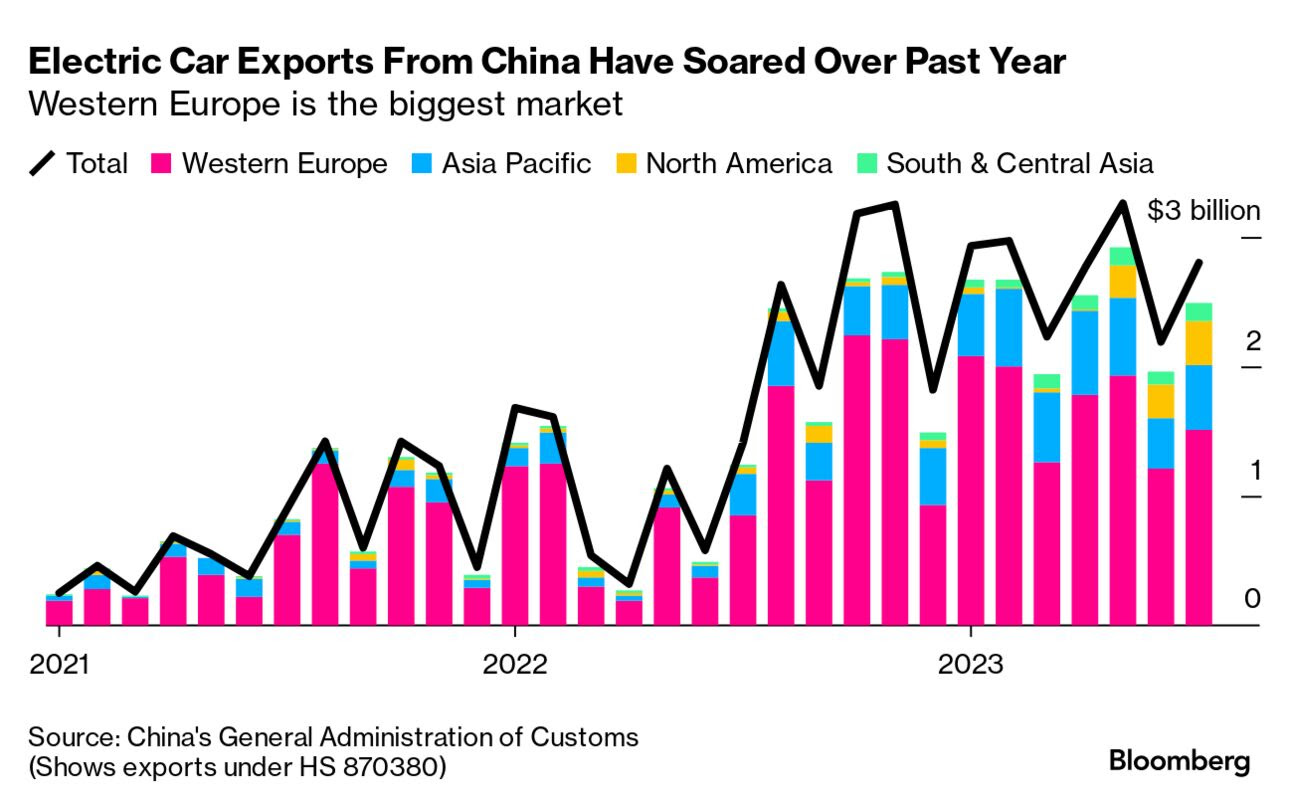

- EU investigates surge in Chinese-made electric car exports

ENERGY & CLIMATE CHANGE

- EU launches cross-border carbon tax

LIVESTOCK & FOOD INDUSTRY

- Kraft Heinz unveils 'Lunchables Grilled Cheesies' with 360 Crisp technology

HEALTH UPDATE

- Drug price negotiations

CONGRESS

- Conservatives block amendment debate on Senate FY 2024 spending bills

- Sen. Mike Lee (R-Utah) introduces anti-checkoff amendment to FY 2024 Agriculture bill

- House budget resolution to balance budget, slash deficits by $16 trillion

- House clears bill to bar EPA from letting California phase out gas cars

OTHER ITEMS OF NOTE

- Cotton AWP falls in latest week

- NASA's role in UFO Research: Collecting data, investigating unidentified phenomena

- Today’s calendar of events

|

MARKET FOCUS |

Equities today: Asian and European stocks were mostly higher overnight. U.S. Dow opened around 60 points lower. In Asia, Japan +1.1%. Hong Kong +0.8%. China -0.3%. India +0.5%. In Europe, at midday, London +0.8%. Paris +1.6%. Frankfurt +1%.

U.S. equities yesterday: All three major indices ended with gains. The Dow rose 331.58 points, 0.96%, at 34,907.11. The Nasdaq gained 112.47 points, 0.81%, at 13,926.05. The S&P 500 rose 37.66 points, 0.84%, at 4,505.10.

Agriculture markets yesterday:

- Corn: December corn futures closed 1 3/4 cents lower on the session to $4.80 1/2.

- Soy complex: November soybeans rose 10 3/4 cents to $13.60 1/2, closing near the session high and above the 40-day moving average. December soymeal rose $4.60 to $399.40, while December remained unchanged at 61.72 cents.

- Wheat: December SRW wheat fell 3 1/2 cents to $5.93 3/4, ending nearer the session high. December HRW wheat was down 8 1/4 cents at $7.36 1/2, a mid-range close. December spring wheat futures fell 4 cents to $7.83 1/2.

- Cotton: December cotton rose 93 points to 87.82 cents, ending near the session high and above the 10-day moving average.

- Cattle: October live cattle rose $2.325 to $185.475, near the session high and posted a contract high close. October feeder cattle closed up $2.825 at $261.875. The October cattle contract’s high and close represented all-time highs for nearby live cattle futures.

- Hogs: Although October lean hog futures dipped 62.5 cents on the day to $83.35, the midsession rebound and mid-range close implied underlying strength.

Ag markets today: Corn, soybeans and wheat held in relatively tight trading ranges during a quiet overnight session. As of 7:30 a.m. ET, corn futures were trading mostly a penny lower, soybeans were 3 to 4 cents lower, SRW wheat was fractionally higher, HRW wheat was 2 to 3 cents lower and HRS wheat was steady to a penny lower. Front-month crude oil futures were 50 cents higher, and the U.S. dollar index was about 100 points lower.

New high in cattle. October live cattle futures reached $185.775 on Thursday, marking an all-time high for a front-month contract on the continuation chart. Cash cattle traded higher in the northern market, while activity in the Southern Plains remained limited. While it appears a fall rally in the cash cattle market could be underway, premiums futures hold to cash prices may limit followthrough buying ahead of the weekend.

Stronger signs of short-term low for cash hogs. The CME lean hog index is up 46 cents, marking the fourth gain in the last six days, signaling a short-term low is in place. Seasonally, the cash market tends to firm into early October before facing heavier seasonal pressure as market-ready supplies build. As of Thursday’s close, October lean hog futures held a $3.59 discount to today’s cash quote.

Quotes of note:

- There’s “no way” the Fed will signal it’s done hiking at next week’s meeting, JPMorgan’s Bruce Kasman says. He expects their dot plot to show one more bump this year.

- Elon Musk at tech conference describes Taiwan as China’s Hawaii. Taiwanese Foreign Ministry spokesman Jeff Liu hit back: “We can’t tell whether or not Musk’s free will is for sale. But Taiwan is not for sale, that’s for sure.”

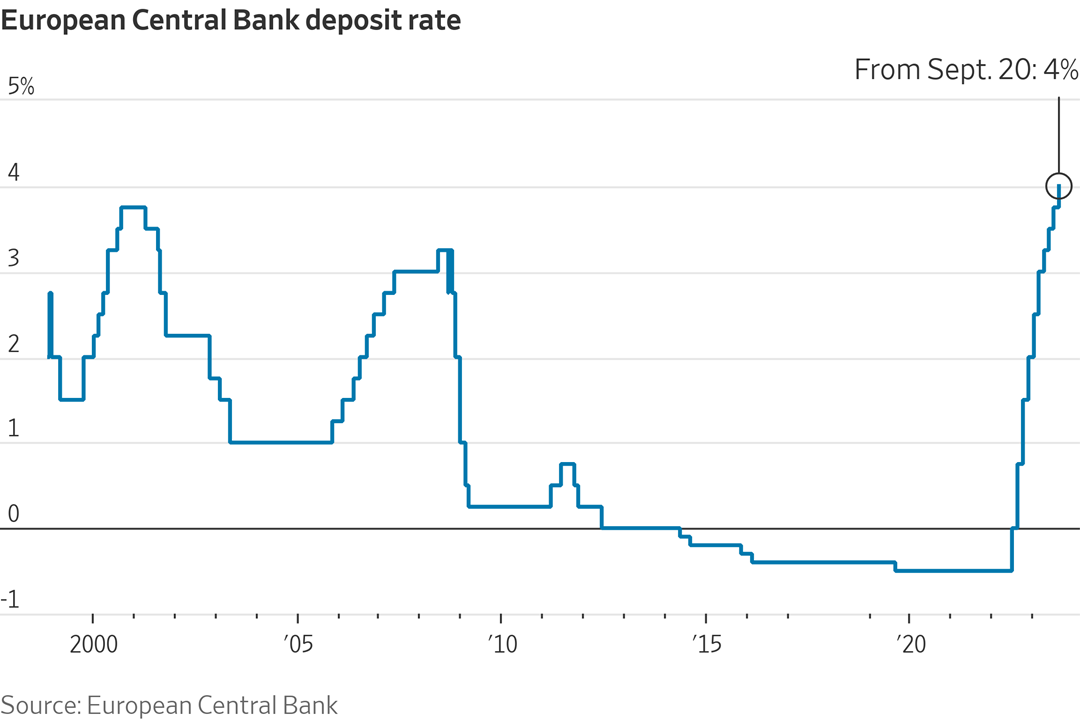

- European central bank hints at pausing rate increases after 10th consecutive hike. The European Central Bank (ECB) recently raised its borrowing costs for the tenth consecutive time, implementing a quarter-percentage-point increase. Following this move, the ECB signaled that it might halt further rate hikes, believing that current rates were sufficiently high to eventually curb inflation. This development is significant, and investors are closely observing whether the U.S. Federal Reserve will adopt a similar approach when its rate-setting committee convenes next week. The ECB's decision and its implications for future monetary policy decisions are drawing attention in the context of global central bank actions aimed at managing inflation and stabilizing financial markets.

- €10 billion: The budget surplus Ireland’s government is predicting for this year. The windfall could soar to €16 billion ($17 billion) in 2024 as government coffers overflow with corporate tax revenue, mainly from U.S. tech and pharmaceutical companies that have set up subsidiaries in the low-tax country in recent years.

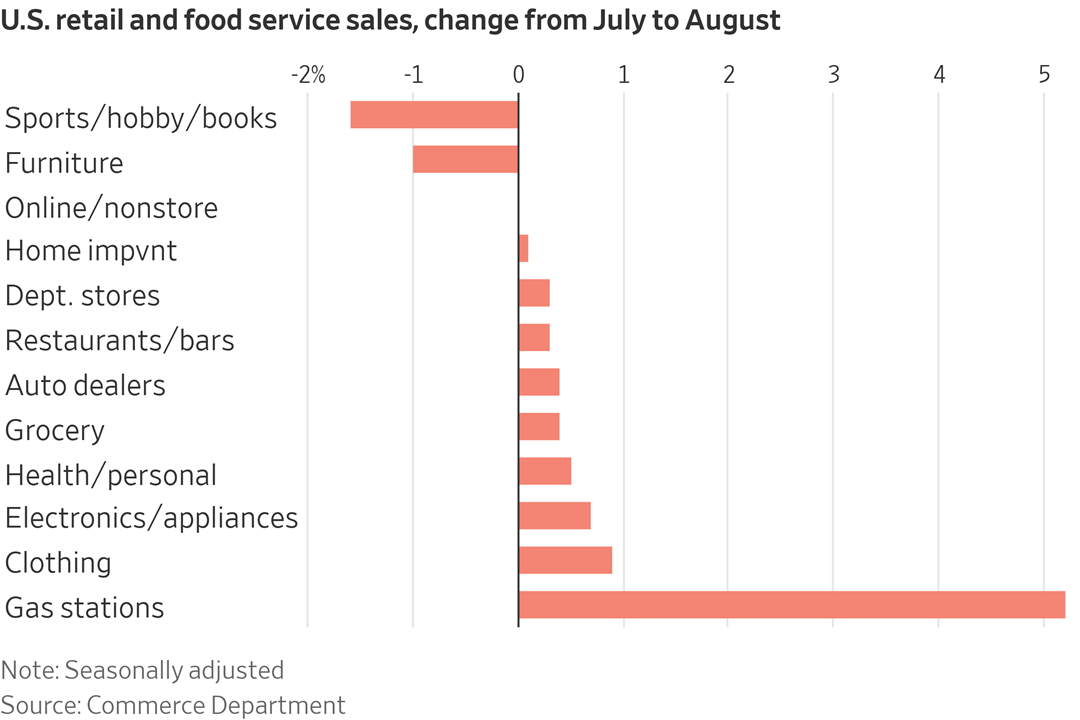

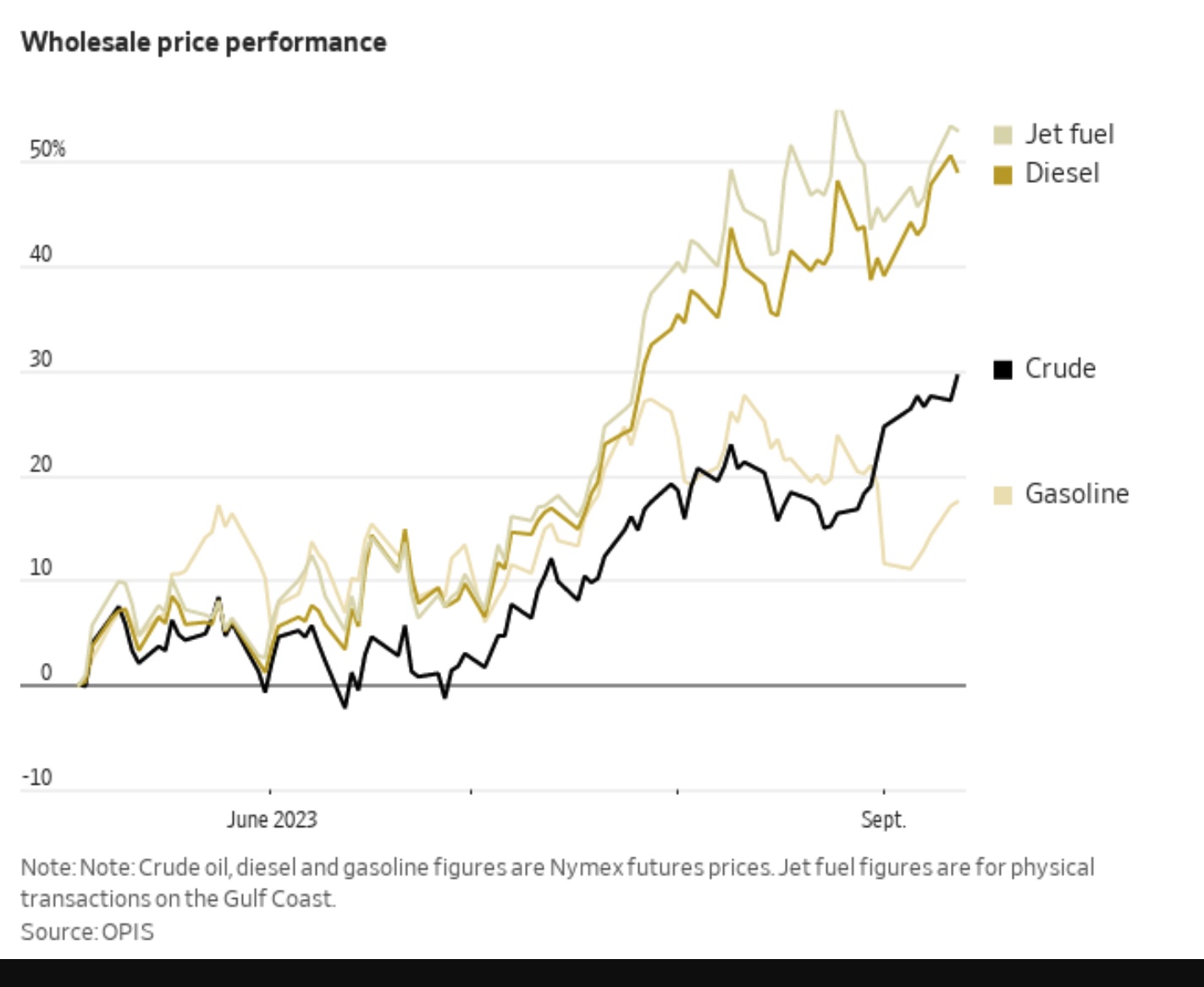

Rising gas prices drive 0.6% increase in U.S. retail sales, reflecting inflationary pressures. In August, Americans experienced an uptick in spending on gasoline, and companies contended with escalating costs for jet fuel and diesel fuel, highlighting the persistent inflationary pressures affecting the economy. The Commerce Department reported that higher gasoline prices played a significant role in driving a 0.6% increase in total U.S. retail sales from the previous month.

Energy prices charged by suppliers surged 10.5% in August, the Labor Department reported Thursday. That included jumps in prices for gasoline (up 20%), jet fuel (23.6%) and diesel fuel (41.1%). Rising fuel prices pose a risk for broader consumer inflation, affecting airline fares and costs for truckers, factories, meal deliveries and other goods and services.

Beyond the impact of gasoline prices, consumers also moderately increased their spending on other goods, contributing to the overall retail sales growth. Excluding gasoline, sales at stores, online retailers, and restaurants rose by 0.2%.

Market perspectives:

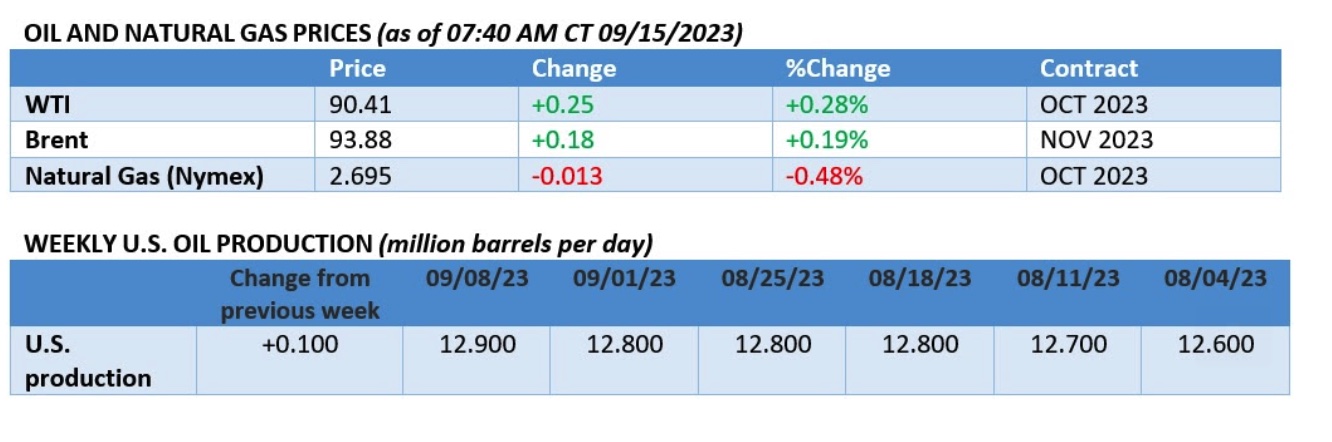

— Outside markets: The U.S. dollar index was weaker after hitting a six-month high on Thursday. Nymex crude oil prices are slightly higher and trading around $90.50 a barrel. Prices hit a 10-month high overnight. The benchmark U.S. Treasury 10-year note yield is presently garnering 4.33%. Crude oil futures remained higher, with U.S. crude around $90.40 per barrel and Brent around $93.85 per barrel. Gold and silver futures were higher, with gold around $1,942 per troy ounce and silver around $23.47 per troy ounce.

— Stronger dollar impacts earnings for U.S. companies operating abroad. A resurgent U.S. dollar, which has reached an eight-month high, is having a negative impact on the earnings of U.S. companies engaged in international operations, the Wall Street Journal reports (link). Notable companies such as Apple, Getty Images, and United Parcel Service (UPS) have reported that the strengthening dollar is causing challenges in terms of sales and profit margins. This is primarily because goods become more expensive for customers overseas because of the currency's appreciation. The Federal Reserve's efforts to combat inflation through interest rate increases have contributed to the dollar's recent strength. Additionally, growing investor confidence in the likelihood of a smooth economic transition in the United States has further boosted the dollar's value. The implications of the stronger dollar highlight the intricate relationship between currency fluctuations and corporate earnings, affecting companies with global operations.

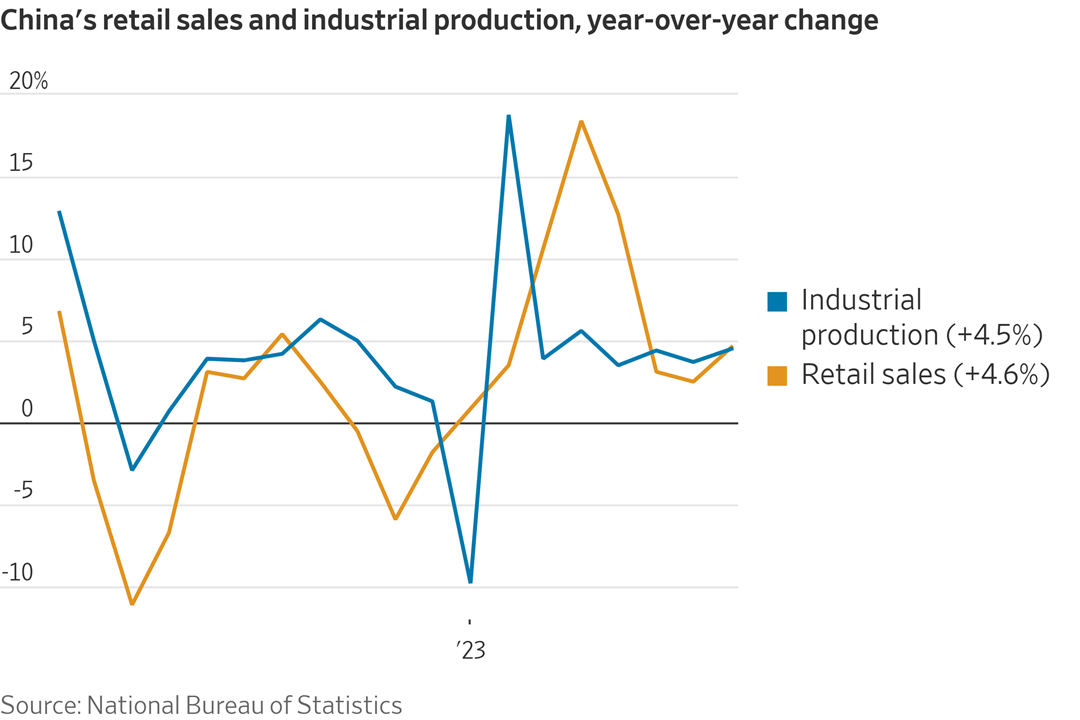

— China's strong economic data propels bullish oil market amid global refinery challenges. The oil market's bull run received a significant boost this week, primarily driven by positive macroeconomic data from China. Chinese manufacturing output and retail sales posted year-on-year growth rates of 4.5-4.6%, exceeding analysts' expectations. This robust economic performance, coupled with Chinese refinery runs hitting an all-time high of 15.23 million barrels per day (b/d) in August, has transformed China from a bearish factor to a leading bullish driver of oil prices. China's surging refinery activity has contributed to growing demand optimism in the oil market, even as Europe and the U.S. grapple with refinery maintenance issues. The strong economic data from China has become a pivotal factor in bolstering oil prices and underlining the nation's crucial role in influencing global oil demand and market dynamics.

— Historic triple strike: UAW walkout hits GM, Ford, and Stellantis over contract dispute. In an unprecedented move, the United Auto Workers (UAW) union initiated a strike against automotive giants GM, Ford, and Stellantis, commencing at midnight when negotiators failed to secure a last-minute agreement on a new contract. This historic labor action represents the first-ever simultaneous strike against the Big 3 automakers in Detroit, signifying a significant development in the automotive industry.

The collective workforce of these three companies comprises approximately 150,000 UAW-represented employees stationed at numerous factories across the United States, responsible for producing iconic vehicles such as the Ford F-150, Chevrolet Silverado, and Jeep Wrangler.

UAW President Shawn Fain hinted at the potential for an expanded strike, possibly encompassing additional plants or even a company-wide walkout, if the automakers do not yield to the union's demands. Fain asserted, "If we need to go all out, we will. Everything is on the table."

Ford responded to the strike, claiming they had offered a "historically generous" proposal, which included wage increases, cost-of-living adjustments, increased paid time off, and higher retirement contributions. GM expressed disappointment in the UAW's decision, despite their own substantial economic offer, featuring significant wage hikes and manufacturing commitments.

The primary conflict centers on the automakers' desire to secure a competitive edge against non-union rivals like Tesla, who maintain a cost advantage. In contrast, the UAW is pressing for a 36% pay increase and a return to traditional pensions.

Impact: If the strike were to encompass all U.S. plants of these automakers, it could potentially cost over $5 billion over a span of ten days, as projected by the Anderson Economic Group. Automakers have been bracing for a strike for weeks. So they won't run out of vehicles immediately. A 10-day strike could send Michigan into recession, according to a recent economic analysis (link). If the work stoppage were to last six weeks — the 2019 strike at G.M. lasted 40 — it could push the U.S. economy “close to the edge of a recession,” Mark Zandi, an economist for Moody’s, told the New York Times (link).

The union’s demands include:

- A 40% pay raise over four years, which would bring wages for many full-time workers to roughly $32 per hour.

- Reinstate cost-of-living adjustments, which have become a central plank in contract negotiations amid high inflation.

- A four-day workweek, a demand that’s grown in popularity since the pandemic scrambled workplace culture.

Membership

— Global diesel shortage drives prices to decades-high levels amid supply and demand challenges. Oil refiners worldwide are grappling with challenges that have led to a shortage of diesel fuel, a crucial energy source for various sectors of the global economy. Key regions like northwest Europe, New York, and Asia have witnessed soaring diesel prices, with benchmarks reaching multi-year or even decades-high levels.

Several factors have contributed to this situation:

- A hot summer in the Northern Hemisphere resulted in reduced oil processing.

- Delays in the startup of new refineries have compounded the problem.

- Plant closures have further tightened the supply, with 3.9 million barrels per day of production capacity shuttered in recent years.

- OPEC+ member countries like Saudi Arabia and Russia have implemented crude oil production cuts, leading to less availability of certain types of crude for processing.

- The focus on producing jet fuel to meet summer demand has diverted resources away from diesel production.

Wood Mackenzie Ltd. predicts a 1.5% drop in diesel yields for the next quarter compared to the previous year, amounting to a significant loss of 1.2 million barrels per day. However, the net supply reduction is expected to be 400,000 barrels per day because refiners will process more crude to compensate.

Despite these challenges, some relief is expected as plants in the Middle East and the massive Dangote facility in Nigeria gradually increase production. The end of the refinery maintenance season will also contribute to an acceleration in operations at many sites.

On the demand side, the outlook for diesel is relatively lackluster, with consumption expected to grow by only around 0.4% this year, according to the International Energy Agency (IEA). However, unexpected changes in demand patterns could further drive up diesel prices.

— India reduces wheat stock limits, vows to stabilize prices amid festive season. India has decided to lower the limits on the quantity of wheat that traders and millers are required to maintain, reducing it from 3,000 metric tons to 2,000 metric tons. This adjustment aims to provide flexibility and potentially bolster the availability of wheat stocks in the open market, especially during the upcoming festive season. Officials from the Ministry of Consumer Affairs, Food, and Public Distribution have emphasized that there is currently an adequate supply of wheat, rice, and sugar within the country. However, concerns have arisen regarding rumors regarding potential supply shortages, which could be exploited by certain unscrupulous actors. To ensure price stability and combat any unwarranted price hikes, India plans to release additional wheat stocks into the open market if the need arises. Despite these measures, India has not indicated any intentions to eliminate the import duty on wheat currently.

— Japan to cut wheat import price for first time in three years. Japan will slash the price at which it sells imported wheat to domestic flour mills from October by an average 11.1% to reflect lower import prices. It marks the first drop in three years and reflects softer international wheat prices. Japan buys five types of milling wheat from the U.S., Canada and Australia through import tenders and sells to domestic millers at prices set twice a year. For the six months starting Oct. 1, the ministry’s wheat selling price to local millers will average 68,240 yen ($465) per metric ton, down from 76,750 yen the previous six months.

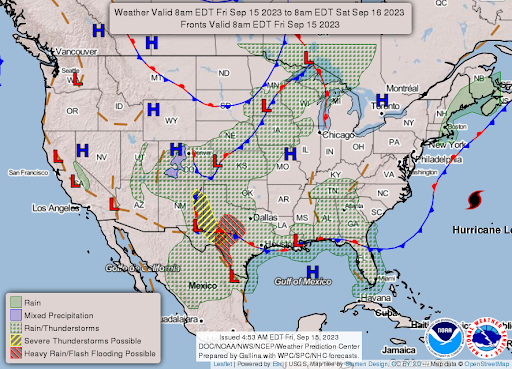

— NWS weather outlook: Lee continues tracking north, tropical storm and hurricane conditions possible for coastal New England Friday and Saturday... ...Heavy rain and strong storms likely over the Southern Plains Friday... ...Dry conditions in the West with some much above average highs expected for the Pacific Northwest/Northern Rockies this weekend.

Items in Pro Farmer's First Thing Today include:

• Another quiet overnight session for grains

• NOPA August soy crush expected to slow seasonally

• China continues directives to support yuan

|

RUSSIA/UKRAINE |

— Ukrainian President Volodymyr Zelenskyy will be visiting Washington next week and meeting with key members of Congress as part of his visit to the U.S. for the U.N. general assembly. While his participation in the U.N. General Assembly had been previously announced, the official announcement of his subsequent trip to Washington, where he is expected to meet with President Biden at the White House and engage with members of Congress on Capitol Hill, is yet to be made. This visit comes as the Biden administration seeks to reinforce support for Ukraine amidst an ongoing Ukrainian counteroffensive that has yielded less favorable results than anticipated. Despite these challenges, Zelenskyy remains steadfast in his belief that Ukraine can achieve significant progress.

Zelensky's last visit to Washington took place in December, during which he addressed the U.S. Congress and emphasized the importance of continued American weapon support for Ukraine in its ongoing conflict with Russia, which has persisted for nearly 19 months. Since that time, concerns have arisen among Ukraine's supporters due to a decline in public support for ongoing aid to the country from the United States.

— Ukraine regains control of Andrivka Village, near Bakhmut, in ongoing conflict with Russia. Ukraine's armed forces have reported the recapture of Andrivka village, situated to the south of Bakhmut, a town that Russia seized in May following an extensive and arduous campaign. Notably, several of Ukraine's most seasoned brigades have been engaged in the conflict around Bakhmut, an area that holds more symbolic than strategic significance. Ukraine's counter-offensive, initiated in June, had initially made only modest headway in this region. However, recent weeks have witnessed an acceleration in progress, reflecting the ongoing dynamics of the conflict between Ukraine and Russia.

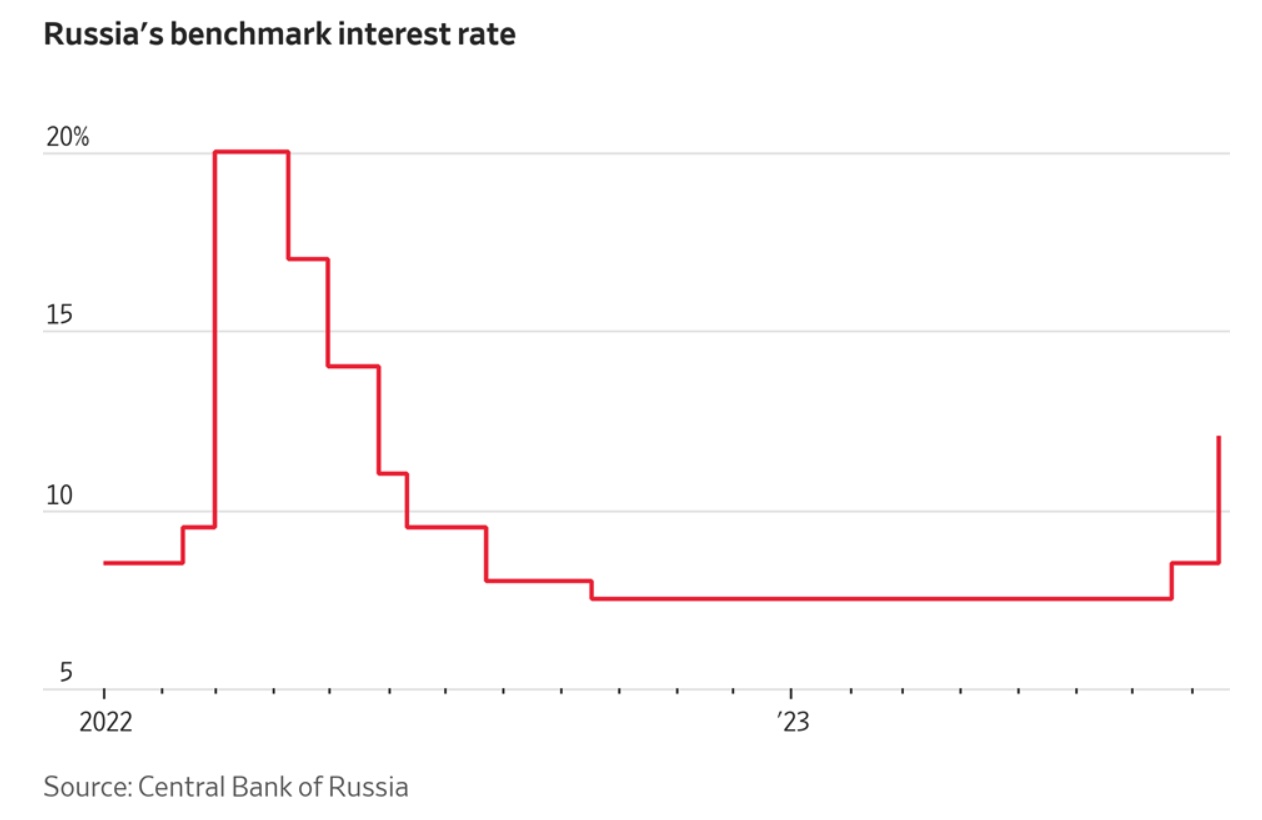

— Russia's central bank raises key interest rate to 13% in effort to tackle rapid inflation. In its ongoing efforts to combat rapidly rising prices, Russia's central bank has announced an increase in its key interest rate to 13%, building on last month's significant rate hike. The move comes in response to several contributing factors, including the devaluation of the ruble, increased military expenditure, and an ongoing labor shortage. These factors have collectively driven up the prices of essential goods such as food and clothing, as well as impacting the cost of international travel. The central bank's decision reflects Moscow's struggle to manage its economy effectively, striking a balance between sustaining economic activity and preventing imbalances and inflation from spiraling out of control.

|

POLICY UPDATE |

— Senate farm bill writers at odds over reference price adjustments. In the ongoing process of drafting a new farm bill, Senate Agriculture Chairwoman Debbie Stabenow (D-Mich.) is considering changes to the federal crop insurance program that would benefit a wide spectrum of farmers. However, other committee members are advocating for a focus on producers of major commodity crops, sparking a contentious debate over subsidies within this legislation.

The primary point of contention centers around subsidies in the face of budget constraints for farm and conservation programs. While the deadline some provisions for the current farm policy law is Sept. 30, Stabenow has suggested a new goal of Dec. 31 for passing the legislation.

Some commodity groups argue that reference prices for major crops in the Price Loss Coverage program need updating, as they are based on 2012 commodity prices and are considered too low. Raising these reference prices would make it easier for subsidy payments to be triggered, helping farmers cope with rising operating expenses, including costs for fertilizer and other inputs.

Stabenow emphasizes the importance of a farm bill that supports all of agriculture, including producers of commodities like corn and soybeans. However, she also recognizes that higher reference prices might not assist farmers who raise vegetables, fruits, and other crops not covered by such prices. Many farmers, she notes, are grappling with inflation and narrower profit margins.

Stabenow, during remarks at the International Fresh Produce Association’s annual conference in D.C. Thursday, said, “It's not just the commodity title, which affects 20 crops. It's the first title because it was there first. It's not the only title,” Stabenow added. “There’s tugs of war behind the scenes, but they’re usually behind the scenes, then we come together and write a bill,” she noted.

Stabenow believes that modifying the federally subsidized crop insurance program could have a broader impact, as it affects producers of 130 different crops. While acknowledging that the crop insurance program is not perfect, she underscores its wide-reaching nature.

The Congressional Budget Office projects baseline spending over a decade at $1.5 trillion, with approximately $1.2 trillion allocated for the Supplemental Nutrition Assistance Program (SNAP). Stabenow is actively seeking additional funding within these limits. Within the current funding limits, Senate Agriculture ranking member John Boozman (R-Ark.) said increasing reference prices is a priority. "Crop insurance is the underpinning of the farm safety net, but we need to modernize all the risk management tools available to producers," Boozman said. "A strong crop insurance program coupled with updated reference prices better positions farmers to be able to weather the storm of historic inflation, record large trade deficits and USDA's own projections for lower commodity prices in the near future."

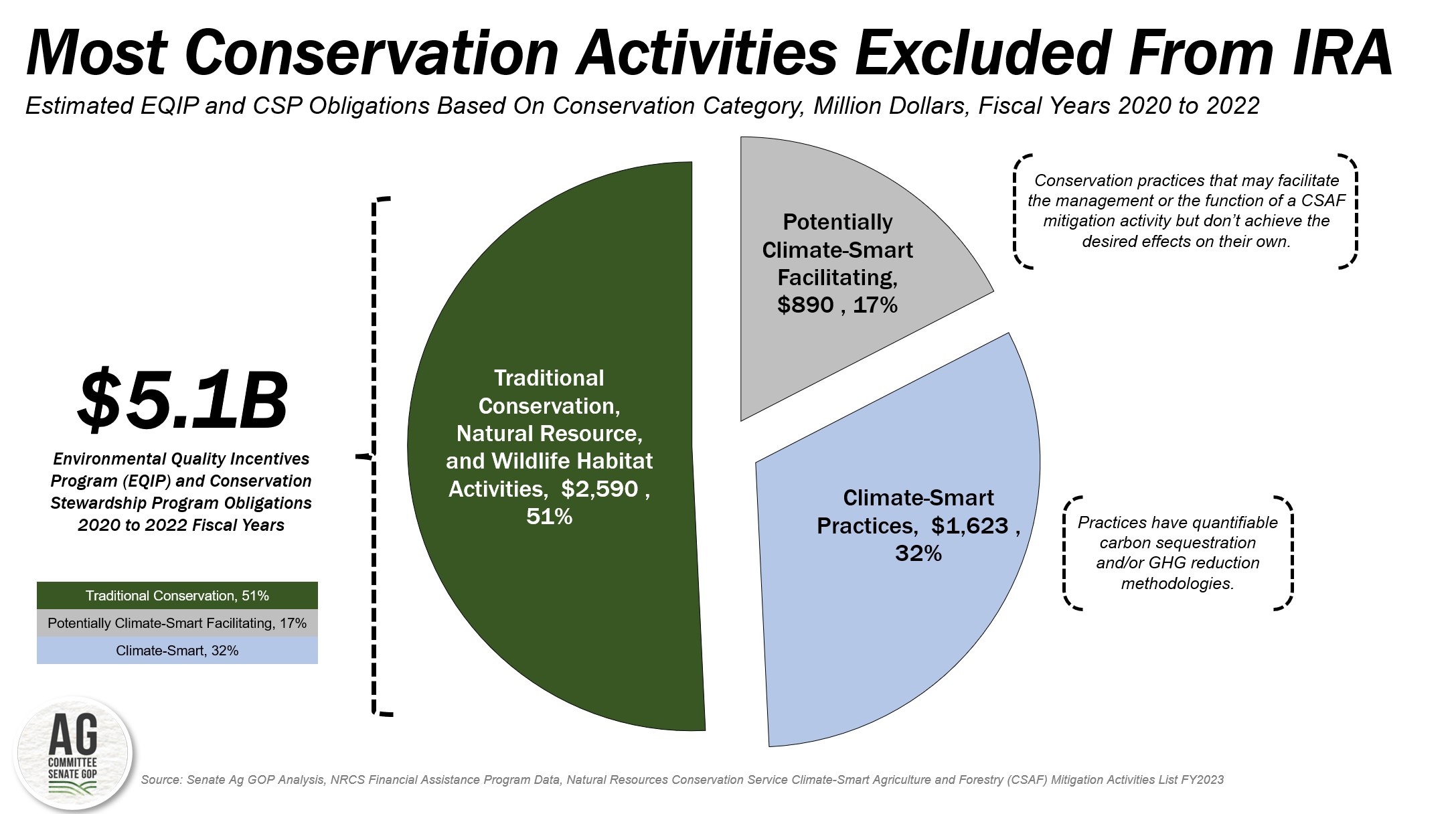

Senate Agriculture Committee Republicans are pushing to transfer around $18 billion in climate funding for agriculture conservation programs, provided in a 2022 law, to the farm bill baseline for conservation programs. In a blog posted Thursday (link and see next item), GOP committee members say USDA rules for what is climate friendly are too restrictive and reduce the number of farmers likely to qualify for cost-share payments. The members say the money should be reprogrammed to include more traditional conservation practices, making it easier to add to the farm bill baseline. However, Democrats, including Stabenow, have resisted this idea, fearing it could hinder efforts to enhance agriculture's role in reducing greenhouse gas emissions. “It is surprising to see that these popular resources are being targeted for other priorities, but I am committed to defending them for their intended purposes,” said Stabenow. In a statement, Stabenow said, “The climate crisis is the most urgent threat facing our farmers today, and all farmers benefit when we take this threat seriously.”

Bottom line: The debate over reference prices remains unsettled, with different committee members offering varying perspectives on how to address this issue in the farm bill. Some argue that raising reference prices is essential to support farmers, while others contend that it could lead to regional conflicts and benefit certain crop producers over others. That means progress on a new farm bill is stalled, with questions again surfacing if Stabenow will eventually file a Democrat measure due to the differences with GOP members.

Of note: Reports note that Stabenow has privately raised with some senators the possibility of getting $5 billion in additional funding from the Senate Finance Committee for the farm bill.

As for the House, Ag Committee Chair G.T. Thompson (R-Pa.) reiterated he’ll only release farm bill text once GOP leaders schedule a week of floor time for the legislation.

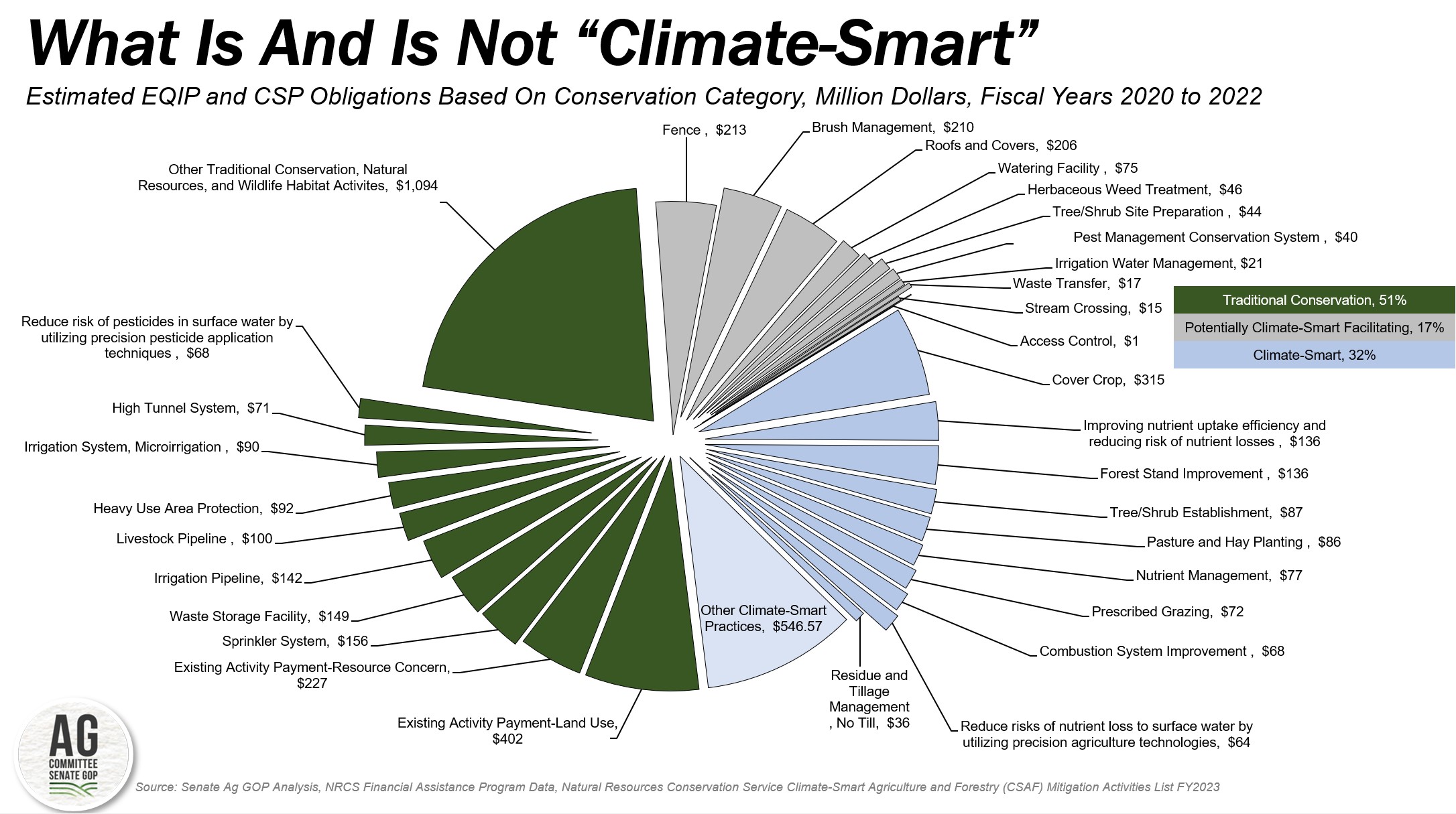

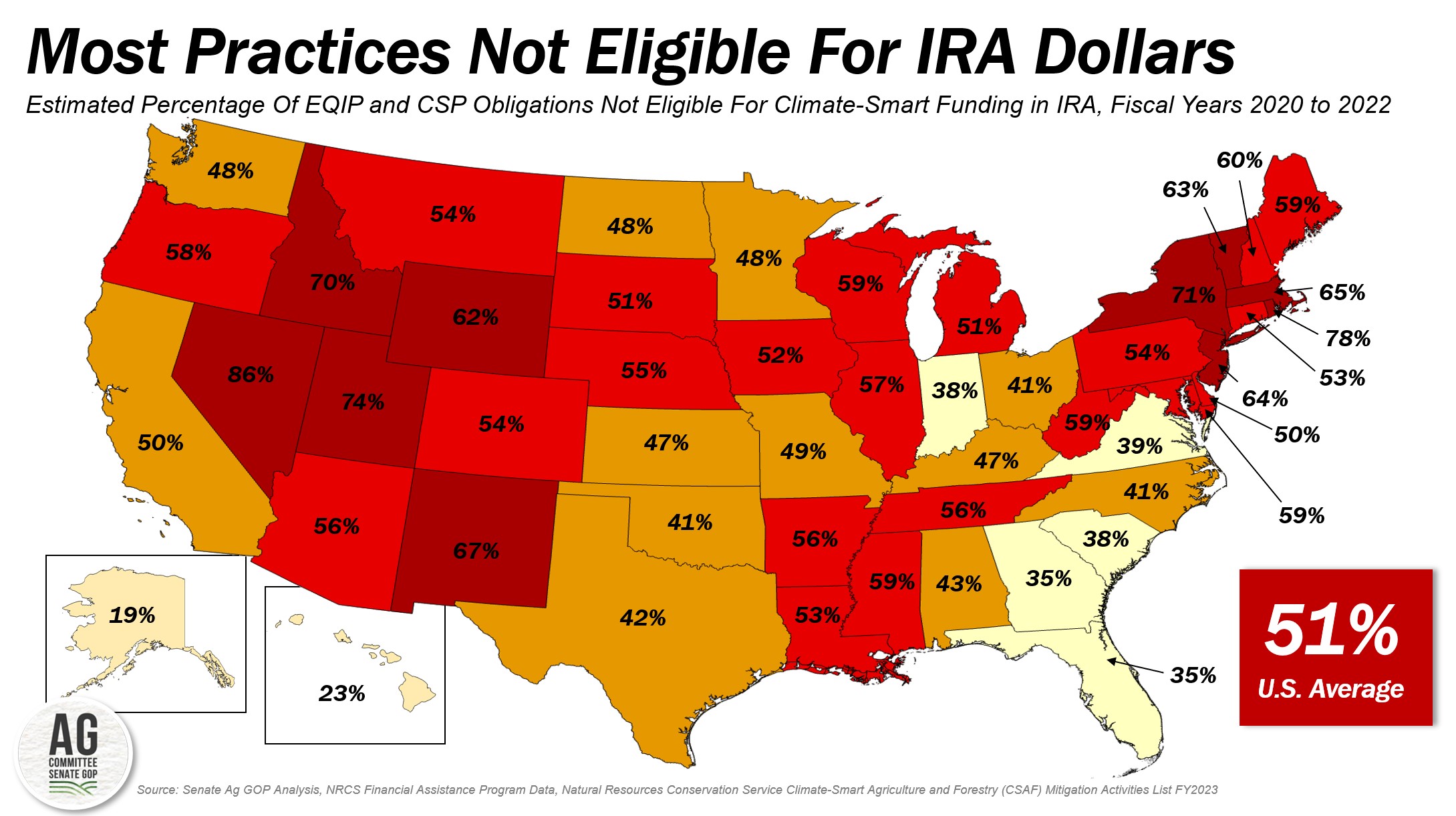

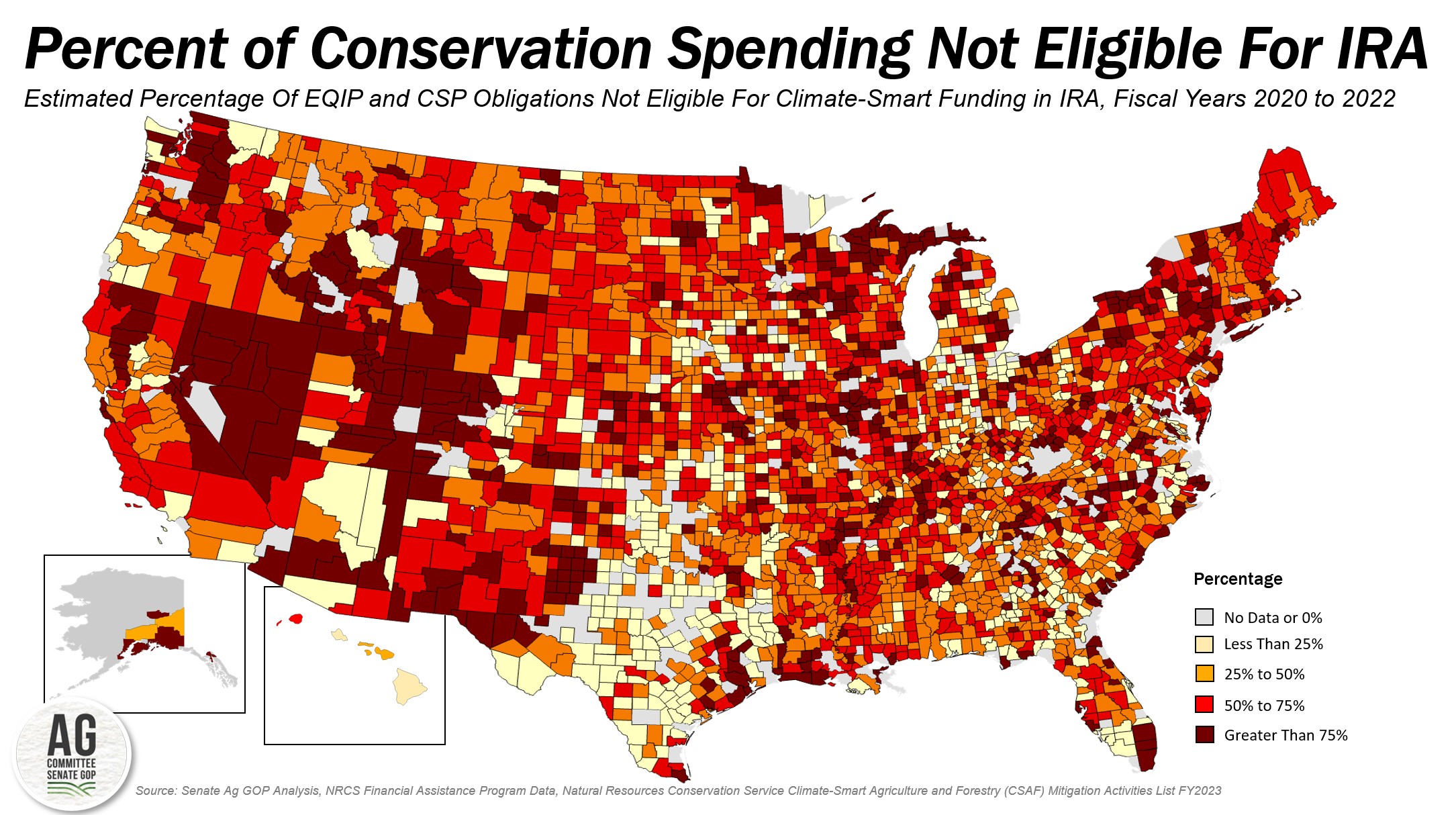

— Expanding IRA resources in the 2023 Farm Bill for inclusive conservation. Recent discussions about incorporating IRA (Inflation Reduction Act) dollars into the farm bill have overlooked a crucial aspect: the current allocation of farm-related conservation resources in the IRA may not effectively benefit all farmers. A newly released report (link) by Senate Ag Republicans delves into this issue, emphasizing that transferring IRA resources into the 2023 Farm Bill, while expanding eligibility criteria to encompass various resource needs aligned with local demand, can establish a permanent baseline and allocate additional resources to address the conservation requirements of all farmers and ranchers.

Key Points:

- Selective Impact of IRA Resources: A recent assessment of the Environmental Quality Incentives Program and the Conservation Stewardship Program financial obligations has revealed a significant limitation. It appears that fewer than half of the projects currently funded under these programs would meet the climate-smart criteria necessary for IRA eligibility.

- Narrow Focus of IRA: The IRA predominantly prioritizes specific activities geared toward reducing greenhouse gas emissions and sequestering carbon. Unfortunately, this singular focus disregards the desires of farmers and ranchers who seek increased investments in locally led conservation initiatives, natural resource preservation, and wildlife habitat programs. These are vital components that must be considered in the forthcoming Farm Bill.

- Broadening Eligibility for Inclusive Conservation: To address the conservation needs of all farmers and ranchers comprehensively, including but not limited to climate-smart agriculture and forestry activities, the report suggests a strategic move. Congress should transfer IRA resources into the 2023 Farm Bill while expanding eligibility criteria. This expansion should encompass a range of resource needs that reflect local demands, ensuring a more inclusive approach to conservation.

|

CHINA UPDATE |

— 2024 China agricultural import quotas announcement expected in early October. Every year, typically in late September or early October, Beijing unveils its import quotas for the following year, covering essential agricultural products such as wheat, rice, corn, cotton, and sugar. In 2024, Trivium China says these quotas are anticipated to be disclosed after the conclusion of the National Day holiday, likely during the week of October 9.

Key points noted by the China watcher:

- Tariff-Rate Quota System: China employs a tariff-rate quota system for specific agricultural imports, distinguishing between imports within the quota regime and those outside of it. Quota-regime imports enjoy significantly lower tariff rates, while those outside of it face substantially higher tariffs, with grains subject to a 65% rate.

- Steady Quota Expectations: Typically, Beijing maintains relatively stable grain quotas. Expected figures for 2024 are approximately 9.636 million metric tons of wheat, 7.2 million metric tons of corn, and 5.32 million metric tons of rice.

- Possible Changes: Several factors may disrupt the status quo this year. China's farmers have endured severe weather conditions that could impact yields. Additionally, the recent collapse of the Black Sea grain deal has injected uncertainty into the markets. Beijing's commitment to maintaining fully stocked food reserves as a food security measure adds further complexity.

- Market Impact: Even if the quotas remain unchanged, the mere announcement can exert influence on global agricultural markets. China's substantial impact on global agricultural demand and prices means that these announcements are closely watched by the international agricultural community.

— Data from China’s National Bureau of Statistics showed improvement in consumer spending and factory output in August as well as a further decline in unemployment.

Retail sales in China rose by 4.6% in August, surpassing expectations and the previous month’s 3.7%. Industrial production grew by 4.5% from a year earlier, outperforming the 3.9% prediction and the 3.7% rise in July. The country’s property crisis shows no signs of abating, however. Investment in that sector fell for the 18th month in a row.

— China takes more steps to boost liquidity. The People’s Bank of China (PBOC) said it was keeping the rate on 591-billion-yuan ($81.2 billion) worth of one-year medium-term lending facility (MLF) loans to some financial institutions unchanged at 2.50%. The decision was intended to keep “banking system liquidity reasonably ample” and quarter-end cash conditions stable, PBOC said. With 400 billion yuan worth of MLF loans set to expire this month, the operation resulted in a net 191 billion yuan of fresh fund injections into the banking system. This followed the move by PBOC on Thursday to cut the amount of cash banks must hold in reserve.

Meanwhile, China’s central bank told some brokerage companies this week to scale back their proprietary foreign exchange trading, two sources with direct knowledge of the matter told Reuters. The directive follows a series of recent steps by authorities to stem rapid declines in the Chinese yuan.

— China's defense minister, Li Shangfu, removed amid leadership changes and economic challenges. China reportedly removed its Defense Minister, Li Shangfu, who was taken away for questioning and relieved of his duties, according to information from American intelligence sources. The Biden administration officials did not provide specific reasons for Li Shangfu's removal, leaving the circumstances surrounding this decision unclear. This development comes amid a series of power shifts and leadership changes in Beijing. China is facing economic challenges, including a sluggish economy, declining apartment prices, and a slowdown in construction activity. These issues have raised concerns and could be contributing to broader changes within the country's leadership.

Of note: The removal of a high-ranking military official like Li Shangfu adds to the complexity of the ongoing developments in China, which are being closely monitored by international observers. One U.S. official said the trouble surrounding Li pointed to deep-seated issues that continue years into leader Xi Jinping’s campaign to shake up the military with anticorruption purges and structural reforms.

|

TRADE POLICY |

— EU investigates surge in Chinese-made electric car exports, potentially leading to tariffs on automakers. As we previously reported, the European Union (EU) has initiated an investigation into the significant increase in Chinese-made electric cars being exported to Europe. Concerns have arisen regarding whether these vehicles are receiving unfair subsidies, prompting the EU to scrutinize the situation. This inquiry follows previous investigations into various products, including paper, steel, and solar panels, which have led to the possibility of imposing tariffs on certain exports. In this case, the probe could potentially impact automakers such as BYD Co., Nio Inc., and even Tesla Inc., which ships cars from its gigafactory in Shanghai.

Bloomberg recently detailed how China subsidizes its electric car sector. Its review (link) noted that China's support for its electric car sector involves a combination of subsidies and benefits at various administrative levels, including local, provincial, and national. These measures aim to promote the growth of the electric vehicle (EV) industry and have led to significant support for both manufacturers and consumers. Here's an overview of how Bloomberg said China subsidizes its electric car sector:

1. Tax Breaks: One of the most substantial forms of financial aid is tax breaks for EV buyers. Almost all EVs sold in China are exempt from vehicle purchase taxes, making them more affordable for consumers. These tax exemptions have been in place since 2009 and were extended until 2027 to support the industry and the economy.

2. Production Subsidies: The Ministry of Industry and Information Technology (MIIT) provides subsidies to car companies based on the number of EVs they produce. These subsidies have amounted to billions of yuan and have helped maintain the growth of domestic EV sales.

3. Cheap Land, Loans, and Grants: To boost local economies, Chinese governments have offered incentives such as cheap loans, land, and grants to companies involved in the EV industry. Additionally, government entities have invested in EV manufacturers, contributing to their growth.

4. Charging Infrastructure: Beijing has supported the expansion of charging infrastructure across China, pledging subsidies for public chargers to meet the growing demand from EVs.

5. Research and Development (R&D) Support: R&D subsidies are mainly provided at the provincial or local level and include grants for key technologies, development of new EVs, and core parts. These subsidies encourage innovation and new model development.

6. Government Procurement: Chinese cities have purchased fleets of domestically produced electric buses and cars, providing steady revenue for local manufacturers. This government procurement has contributed to the growth of EVs in public or state-controlled fleets.

|

ENERGY & CLIMATE CHANGE |

— EU launches cross-border carbon tax. Starting from Oct. 1, the European Union is set to kickstart the world’s first carbon border tax as Brussels requires importers to report the CO2 emissions of energy-intensive products such as steel or cement if they’re sold into Europe, fully in force from 2026. Link for details.

|

LIVESTOCK, FOOD & BEVERAGE INDUSTRY |

— Kraft Heinz unveils innovative 'Lunchables Grilled Cheesies' with 360 Crisp technology. Kraft Heinz introduced a new product, "Lunchables Grilled Cheesies," which offers a convenient and delicious solution for quick meals. These microwavable sandwiches can be taken straight from the freezer and heated for just 60 seconds, providing a speedy and tasty option for consumers.

This launch marks the debut of Kraft Heinz's innovative "360 Crisp" technology platform, designed to create microwavable foods that deliver the same savory taste and texture as if they were prepared on a stovetop.

The Lunchables Grilled Cheesies are available in two varieties: plain and pepperoni. They come packaged in a unique microwave pouch that aims to preserve the bread's crispiness while ensuring the cheese remains gooey and satisfyingly melted.

These microwavable sandwiches are primarily targeted towards children, making them an appealing option for parents looking for quick and convenient meal solutions. Additionally, they are suitable for college dorms and convenience stores, catering to a wide range of consumers seeking a delicious and hassle-free snack or meal option.

|

HEALTH UPDATE |

— Drug price negotiations. Lawyers for the U.S. Chamber of Commerce and other business groups are expected to argue in the Ohio federal court for a preliminary injunction blocking the Biden administration’s prescription drug price negotiation program. The plaintiffs’ case is among the various cases that major drug companies are using to challenge the program.

|

CONGRESS |

— Senate faces gridlock as conservatives block amendment debate on FY 2024 spending bills. In a surprising turn of events, the Senate, after voting 91-7 in favor of advancing a bipartisan package of fiscal year (FY) 2024 spending bills, has hit an impasse. This sudden halt is due to objections raised by hardline conservatives who oppose any amendments to the legislation. Senate Appropriations Committee Chair Patty Murray (D-Wash.) and Vice Chair Susan Collins (R-Maine) attempted to gain unanimous consent to initiate the voting process for ten amendments — equally divided between Republicans and Democrats — pertaining to the MilConVa-Agriculture-Transportation/HUD minibus. However, Senator Ron Johnson (R-Wis.) objected to this proposal, effectively blocking the Senate from proceeding with the crucial amendment debate. This move by Johnson poses a significant challenge to the Republican Party's push for a robust amendment process.

Collins warned that dilatory tactics in the Senate will only lead to a reliance on a last-minute 12-bill package, rather than the three-bill measure senators are debating. “How can a member stand up and object, and at the same time say, ‘Oh, I don’t want an omnibus bill’? Well, that’s what we’re heading for,” Collins said on the floor yesterday.

— Sen. Mike Lee (R-Utah) introduces anti-checkoff amendment to FY 2024 Agriculture bill. In a significant development within the Senate appropriations process, Senator Mike Lee, a prominent co-sponsor of the Opportunity for Fairness in Farming (OFF) Act, introduced an amendment aimed at anti-checkoff legislation. This amendment has been proposed as a part of the FY 2024 Agriculture, Rural Development, and Food & Drug Administration appropriations bill. This amendment differs from the anti-checkoff proposal put forth by Representative Victoria Spartz (R-Neb.) in July.

The OFF Act could get a floor vote as part of this appropriations process. While the precise timing for the consideration of the Senate appropriations package remains murky, procedural steps in the legislative process underway.

Agricultural groups express concerns. ASA (American Soybean Association) and various other agricultural organizations have jointly penned a letter addressed to Senate leadership. They note their apprehensions regarding Sen. Lee's amendment and strongly advocate against Congressional interference with these successful programs. These programs play a pivotal role in supporting agricultural producers by facilitating research, education, and promotion efforts.

— House Budget Committee plans fiscal 2024 budget resolution to balance budget, slash deficits by $16 trillion. The House Budget Committee is gearing up to mark up a fiscal year (FY) 2024 budget resolution on Wednesday, Sept. 20, according to a statement from a Republican Budget Committee aide. Budget Chair Jodey Arrington (R-Texas) provided additional details, explaining that the resolution aims to achieve a balanced budget and reduce deficits by an ambitious $16 trillion over the span of a decade.

One notable aspect of the resolution is its call for the establishment of a bipartisan commission. This commission's primary role would be to craft legislation addressing the solvency concerns surrounding Social Security and Medicare. Instead of advocating for specific policy changes, the resolution seeks a collaborative approach through the commission, fostering bipartisan cooperation in addressing these critical social safety net programs.

— House clears bill to bar EPA from letting California phase out gas cars. The House on Thursday passed a bill that would prevent the EPA from signing off on California’s effort to phase out vehicles with internal combustion engines. The bill (HR 1435) passed, 222-190, with eight Democrats joining Republicans in support. The Biden administration said it “strongly opposes” the bill, but stopped short of promising a veto, and the legislation is unlikely to get the necessary support in the Senate. Introduced by Rep. John Joyce (R-Pa.), the measure would prohibit the EPA administrator from giving a waiver allowing a state to finalize emission standards that would directly or indirectly limit the sale of new vehicles with internal combustion engines.

Background. Under the Clean Air Act, the EPA has the authority to establish emissions standards for new motor vehicles, and it typically preempts state regulations in this regard. However, EPA can allow states to adopt their own standards through waivers, and California is the sole state currently eligible for such waivers due to its preexisting emissions standards.

HR 1435 aims to restrict EPA from issuing new waivers that limit internal combustion engine vehicles' sales and revoke existing waivers granted between January 1, 2022, and the date of the bill's enactment. Furthermore, the bill would prevent the EPA from considering any post-enactment state standard amendments as within the scope of an existing waiver.

The motivation for this legislation is partly linked to California's decision in August 2022 to phase out the sale of new internal combustion vehicles by 2035. This move has triggered concerns, with proponents of HR 1435 arguing that one state should not wield disproportionate influence over national automotive policy.

|

OTHER ITEMS OF NOTE |

— Cotton AWP falls in latest week. The Adjusted World Price (AWP) for cotton fell to 71.95 cents per pound, effective today (Sept/ 15), down from 73.55 cents per pound the prior week. Meanwhile, USDA said that Special Import Quota #22 will be established Sept. 21 for the import of 55,640 bales of upland cotton, applying to supplies purchased not later than Dec. 18 and entered into the U.S. not later than March 18.

— NASA's potential role in UFO Research: Collecting data and investigating unidentified phenomena. NASA has released information about an independent report suggesting that the space agency could play a significant role in collecting data on UFOs (Unidentified Flying Objects) and contributing to efforts to understand these mysterious phenomena. The report, created by a group of experts and scientists in 2022, was designed to outline a roadmap for NASA's involvement in UFO research, officially referred to as unidentified anomalous phenomena.

While the independent team did not discover concrete evidence indicating the presence of intelligent alien life, their findings emphasize the importance of NASA's contribution to the field. The report suggests that NASA should utilize satellites and advanced technology to explore the cosmos, particularly in the search for planets located in habitable zones that could potentially support life similar to Earth.

In response to these recommendations, NASA has announced the appointment of its first director of UAP (Unidentified Aerial Phenomena) research, signaling the agency's commitment to further investigation and collaboration in the study of these enigmatic occurrences.

— Calendar of events today include:

Friday, Sept. 15

• Seafood traceability. The Center for Strategic and International Studies (CSIS) holds a Seafood Alliance for Legality and Traceability Forum with the theme "Taking Stock and Next Steps."

• Russia’s invasion of Ukraine. The Brookings Institution holds a discussion on "Ukraine, the West, and the World: Breaking Point or Transformational Moment?"

• Argentina and the US dollar. The Cato Institute holds a virtual forum on "Why and How Argentina Should Dollarize."

• Economic reports. Empire State Manufacturing Survey | Industrial Production | Import & Export Prices | Consumer Sentiment

• Energy reports. WTI October options expire | ICE weekly Commitments of Traders report for Brent, gasoil | Baker-Hughes Rig Count | CFTC Commitments of Traders.

• USDA reports. ERS: Feed Grains: Yearbook Tables NASS: Livestock Historical Track Records | Peanut Prices

|

KEY LINKS |

WASDE | Crop Production | USDA weekly reports | Crop Progress | Food prices | Farm income | Export Sales weekly | ERP dashboard | California phase-out of gas-powered vehicles | RFS | IRA: Biofuels | IRA: Ag | Student loan forgiveness | Russia/Ukraine war, lessons learned | Russia/Ukraine war timeline | Election predictions: Split-ticket | Congress to-do list | SCOTUS on WOTUS | SCOTUS on Prop 12 pork | New farm bill primer | China outlook | Omnibus spending package | Gov’t payments to farmers by program | Farmer working capital | USDA ag outlook forum | Debt-limit/budget package |