April Jobs Report Shows Hiring Picked Up, Unemployment Rates Drops to 3.4%

Investors Fret About Bank Failure Contagion | China buys corn from Africa

|

In Today’s Digital Newspaper |

The U.S. economy added 253,000 jobs in April, above market expectations of 180,000 and compared to the 165,000 gain in March. Employment continued to trend up in professional and business services, health care, leisure and hospitality, and social assistance. Meanwhile, the jobless rate decreased to 3.4%, matching the 50-year low hit in February. Details and market impact in Markets section, including some key revisions that have traders’ attention.

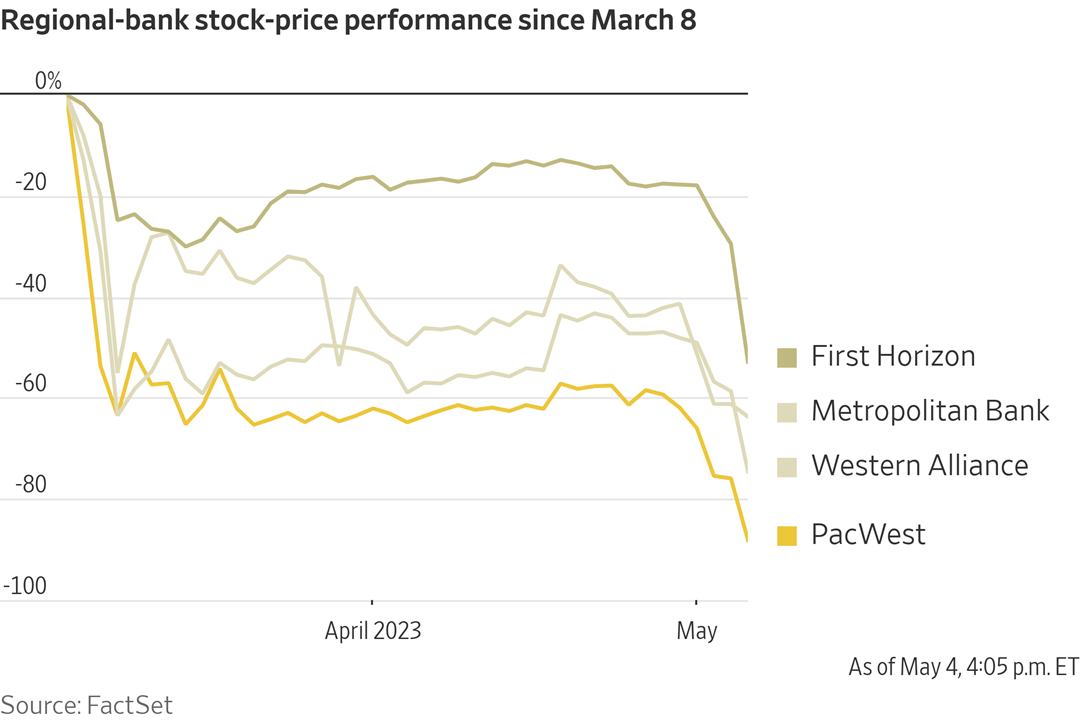

Regional-bank stocks tumbled Thursday despite assurances from the Federal Reserve that the banking system is on solid footing. A discussion of this and how consumers are getting concerned in Markets section.

China is buying corn from Africa and mulling pork purchases in China to boost prices. More in China section.

Ukrainian grain shipments slowing amid uncertainty of deal extension. Details in Russia/Ukraine section.

Ag bankers stress crop insurance, farm lending link. A Senate Ag subcommittee heard from agricultural bankers Thursday. Consensus: Crop insurance programs often make the difference in farmers being able to stay in business. More in Policy section.

Have you noticed the White House and USDA Secretary Tom Vilsack hasn’t said much lately about all the profits being made by meatpackers. There’s a reason. See Livestock section.

The U.S. and allied nations are racing to buttress Ukraine’s air defenses. With Kyiv’s stockpile of antiaircraft missiles running low, countries are looking to provide Ukraine with air-defense systems and air-to-air missiles as it prepares for a counteroffensive, the success of which depends on keeping Russia’s warplanes from pummeling Ukraine’s troops and infrastructure. Some of the air defenses have been “MacGyvered” with parts from a variety of systems, the Pentagon’s acquisitions chief told the Council on Foreign Relations this week, referring to the process of improvisation.

June 14 is EPA deadline for final RFS levels for 2023-2025. Will EPA announce higher mandates for biodiesel and renewable diesel? More in Energy & Climate Change section.

Global food prices end year-long decline. The U.N. Food and Agriculture Organization global food price index inched up 0.8% in April, ending a 12-month string of declines, but was 19.7% below year-ago. More in Food section.

WHO declares end to Covid global public health emergency.

|

MARKET FOCUS |

Equities today: Global stock markets were mixed to firmer overnight. U.S. Dow opened 280 points higher then further rallied over 400 points higher following a Jobs report that lowered the odds of a U.S recession.

U.S. regional banking stocks are rallying in a positive sign for the recovery of the sector. PacWest’s shares gained as much as 26% in US premarket trading Friday, while peers Western Alliance Bancorp and First Horizon rose 15% and 5.4% respectively.

U.S. equities yesterday: All three major indices finished lower with only the Nasdaq able to edge into positive territory briefly during the trading session. The Dow ended down 286.50 points, 0.86%, at 33,127.74. The Nasdaq declined 58.93 points, 0.49%, at 11,966.40. The S&P 500 was down 29.53 points, 0.72%, at 4,061.22.

Agriculture markets yesterday:

- Corn: July corn futures closed 1/2 cent higher at $5.89, near the intraday high. December corn futures fell 2 cents to $5.28 1/2. that helped push the US regional-banking system into turmoil.

- Soy complex: July soybeans rose 1/2 cent to $14.17 3/4, near the session high, while July meal fell 30 cents to $424.60. July soyoil fell 16 points to 52.48 cents.

- Wheat: July SRW wheat rose 5 1/4 cents to $6.45 and nearer the session high. July HRW wheat gained 13 1/4 cents to $7.98 1/4 and nearer the session high. HRS wheat futures rose 8 1/2 cents to $8.12.

- Cotton: July cotton futures closed up the 300-point daily trading limit at 81.76 cents.

- Cattle: June live cattle futures slipped 7.5 cents to $161.575 Thursday, while May feeder futures rose 22.5 cents to $203.655.

- Hogs: June lean hogs fell 85 cents to $87.15 and near the session low.

Ag markets today: Corn, soybeans and wheat firmed amid corrective buying during overnight trade. As of 7:30 a.m. ET, corn futures were trading 2 to 4 cents higher, soybeans were 3 to 10 cents higher, SRW wheat futures were 3 to 4 cents higher, HRW wheat was 6 to 8 cents higher and HRS wheat was 7 to 9 cents higher. Front-month crude oil futures were nearly $2.00 higher, and the U.S. dollar index was modestly lower.

Market quotes of note:

- Investor Bill Ackman said that banks across the U.S. will be under threat unless regulators move to insure all deposits. In his view, the entire regional banking sector will remain at risk until the FDIC steps up its insurance regime. "We are running out of time to fix this problem," Ackman said, just a few days after First Republic was taken over by JPMorgan.

- Debt-limit timeline. Moody’s Analytics chief economist Mark Zandi told the Senate Budget Committee he estimates the timeline on the so-called X date could be as soon as June 8. “The idea that we aren’t going to default is slowly breaking down,” Zandi told Budget Chair Sheldon Whitehouse (D-R.I.) at a hearing Democrats called to highlight the impact of the GOP’s cuts to domestic programs. Zandi testified that across-the-board cuts the GOP wants amid recession worries are “especially inopportune” and could “meaningfully increase the likelihood of such a downturn.” He said he favors a short-term debt fix covering government borrowing to Oct. 1, the start of the fiscal year. According to Moody’s, the cuts would reduce employment growth by 784,000 jobs through 2024. A default that lasted at least six weeks, Moody’s said, could cost the economy more than 7 million jobs.

- Ag sector ‘hot spots’ according to grain trader and analyst Richard Crow:

1) Ukraine/Russia corridor

2) Canada's dry weather in the Prairies

3) Watch the weather in the NE part of Brazil's corn turning dry (they don't grow much safrinha corn in NE Brazil)

4) Planting of crops in the U.S. Northern States

On tap today:

• U.S. nonfarm payrolls are expected to increase by 180,000 in April and the unemployment rate is forecast to tick up to 3.6% from 3.5% one month earlier. (8:30 a.m. ET) UPDATE: See item below.

• Baker Hughes rig count is out at 1 p.m. ET.

• Federal Reserve releases March consumer credit data at 3 p.m. ET.

• CFTC Commitments of Traders report, 3:30 p.m. ET.

• Fed speakers: St. Louis's James Bullard to the Economic Club of Minnesota at 1 p.m. ET, and governor Lisa Cook to Michigan State University's graduating class at 1 p.m. ET.

Jobs report better than expected. Labor market adds 253,000, Unemployment ticks down to 3.4%. Despite major employers continuing to cut jobs, the Labor Department's jobs report showed an unexpected rebound in employment — coming in well above economist projections as the Federal Reserve gauges whether the economy is cooling enough to officially end its aggressive rate-hiking campaign. Highlights:

- Total employment increased by 253,000 in April — far exceeding economist expectations of 180,000 after growth in March marked the lowest monthly gain since December 2020, according to data released Friday by the Labor Department.

- Services continue to be an area where additional workers have been hired, reflecting shifting consumer patterns toward services and making fewer purchases of goods.

- Unemployment rate ticked down to 3.4% from 3.5% in March — matching a 54-year low hit in January and defying projections it would tick up to 3.6%.

- Wage growth came in stronger than forecast, coming in at 4.4% year over year, versus projections of 4.2%, as hourly earnings rose 16 cents to $33.36.

- Labor Department revised data for the two prior months to show there were 149,000 fewer jobs added than previously believed in February and March.

- The April number largely exceeds the 70,000 to 100,000 monthly job gain needed to keep up with growth in the working-age population and compares with the average monthly gain of 290,000 over the prior six months.

Impact: The report does not alter the expectation for a steady rate decision in June, but now CME Fed funds futures are listing probabilities of just over 2% for another 25-basis-point increase. But equities initially rallied due to declining odds of a U.S. recession, at least based on current data.

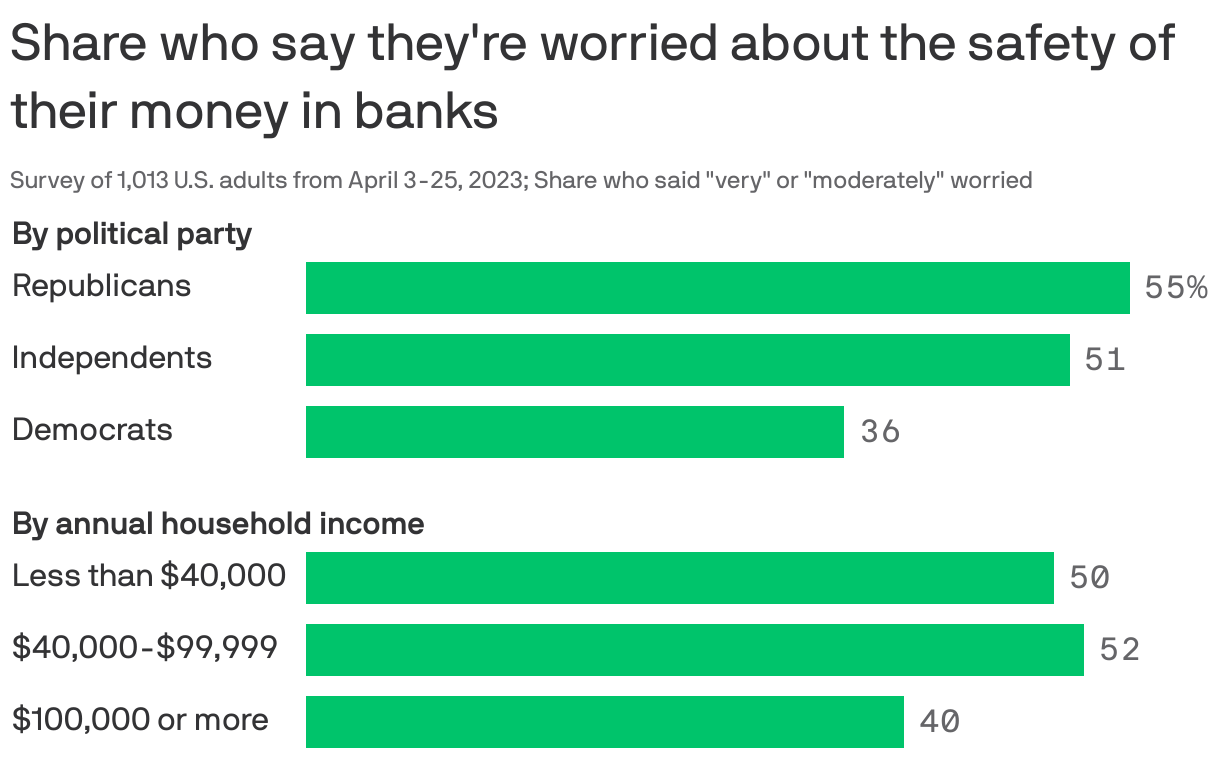

Half of Americans worry about deposits, a level of anxiety last seen during the financial crisis in 2008. Though most people's deposits are in FDIC-protected accounts — where they're safe — the results are a sign of diminishing confidence in the finance system, notes Axios.

Regional-bank stocks tumbled Thursday despite assurances from the Federal Reserve that the banking system is on solid footing. PacWest Bancorp, which has been hit hard since the collapses of several banks, dropped by about 50%. Investors have been wondering how much further the problems in regional banking could spread, and whether they will spill over to the broader economy. According to the Wall Street Journal (link), “the continued pressure shows how hard it might be to stop the downward spiral in regional bank stocks, regardless of how the companies are faring. Many banks enjoyed solid profits in the first quarter.”

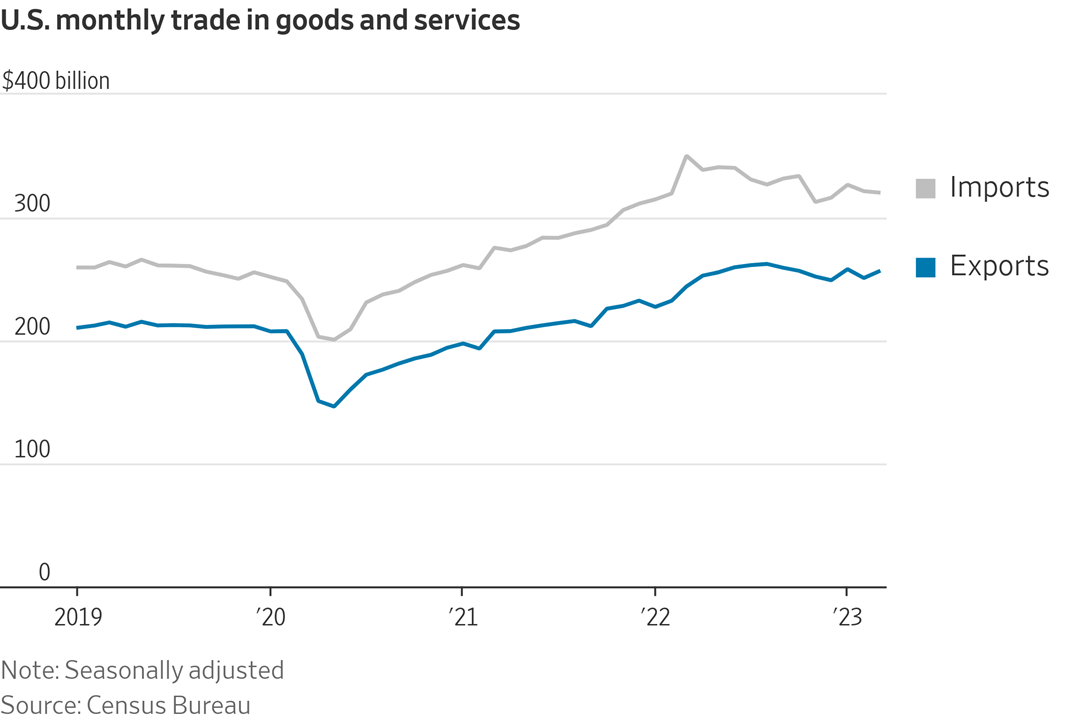

U.S. trade with world rose in March. U.S. trade with the rest of the world increased in March as companies shipped more oil, natural gas and vehicles overseas and exported more products to China after it lifted Covid restrictions. Exports rose 2.1% in March from the prior month to a seasonally adjusted $256.2 billion while imports declined 0.3% to $320.4 billion, the Commerce Department said. The trade deficit in goods with China in March was the lowest since March 2020.

Agriculture not a reason for narrower trade gap in March. While the overall U.S. trade deficit narrowed to $64.2 billion in March from $70.6 billion in February on rising exports against imports that declined, the U.S. ag sector exports saw a wider deficit. While ag exports improved to $15.87 billion in March, up nearly 4% from February, imports surged to $17.68 billion, a 16% increase from the prior month. That produced a deficit of $1.83 billion versus a surplus of $49.1 million in February. That pushed fiscal year (FY) 2023 agricultural exports to $100.19 billion vs imports of $98.94 billion for a cumulative surplus of just $1.25 billion.

Market perspectives:

• Outside markets: The U.S. dollar index was little changed, with several foreign rival currencies higher versus the greenback. The yield on the 10-year U.S. Treasury note was higher, trading around 3.40%, with a higher tone in global government bond yields. Crude oil gained, with U.S. crude around $70.35 per barrel and Brent around $74.35 per barrel. Gold and silver futures were under pressure, with gold around $2,044 per troy ounce and silver around $26.12 per troy ounce.

• Oil prices under pressure. This week’s oil-price tumble has its origins in concerns that higher interest rates from the Federal Reserve are slowing the economy and curbing energy demand. But the Wall Street Journal notes (link) there’s another factor behind the slide: Traders say Russia keeps pumping and exporting huge volumes of oil to maximize income for its beleaguered economy — crude that has added to a global surplus.

Today so far, oil is staging a bit of a rebound, though is still set for the worst week since mid-March, continuing its third weekly decline.

• Sugar prices are expected to continue rising amid a tightening in global supply. Packaged-food makers that use sugar as a main ingredient might need to implement price hikes to offset high-input costs and alleviate margin pressure, Bloomberg Intelligence says.

• Federal Railroad Administration issues advisory on long trains. The Federal Railroad Administration (FRA) issued a safety advisory (link) recommending railroads take precautions with longer trains. “Freight-train length, particularly for Class I railroads, has increased in recent years,” the advisory said. “The operation of longer trains presents different, more complex, operational challenges, which can be exacerbated by the weight and makeup of the trains.”

Three significant incidents have occurred since 2022 involving trains with more than 200 cars, where train handling and train makeup is believed to have contributed to the incidents, the FRA noted. These incidents in Springfield, Ohio; Ravenna, Ohio; and Rockwell, Iowa, involved trains that were 12,250 feet or longer and weighed over 17,000 trailing tons.

Next steps: The FRA and the National Academies of Sciences are conducting separate research studies on trains comprised of up to 200 cars and trains longer than 7,500 feet. In the meantime, the safety advisory is meant to “ensure railroads and railroad employees are aware of the potential complexities involved in the operation of longer trains,” the agency stated. FRA recommended railroads work to prevent communications losses between end-of-train devices, lessen the impacts long trains may have on blocked crossings, and review operating rules and locomotive engineer certification programs.

• Ag trade: Taiwan purchased 52,225 MT of U.S. milling wheat.

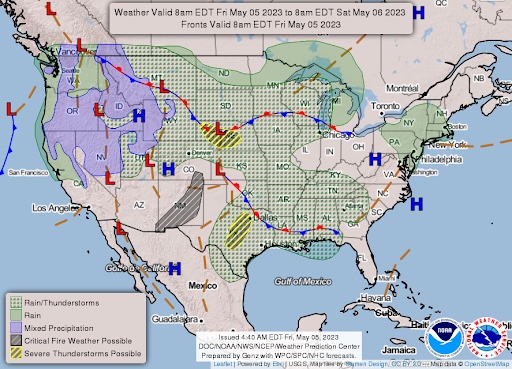

• NWS weather outlook: Active weather pattern from the Pacific Northwest to the Midwest; severe storms expected from the southern and central High Plains to the Mississippi Valley... ...Summer-like heat to engulf the Southern and Central Plains this weekend with some record-breaking high temperatures possible... ...Cooler than normal temperatures to stick around in the West; temperatures to reach more seasonal levels in the East this weekend.

Items in Pro Farmer's First Thing Today include:

• Firmer grain price tone overnight

• Wholesale beef holding up

• Cash hogs climbing, pork cutout struggling

|

RUSSIA/UKRAINE |

— Ukrainian grain shipments slowing amid uncertainty of deal extension. The pace of shipments from Ukraine via the Black Sea grain deal has slowed amid concerns ships could be stalled if a deal is not renewed, Reuters reported, citing two sources and shipping data. The number of ships coming in to pick up cargoes has dropped this week to two vessels per day from three to four ships on average daily in the past three weeks, data from the joint coordination center showed. Danish shipping group NORDEN, which is active in transporting grains, is among companies not sending ships into the region. “We are not participating in that trade at the moment... It is a risky area — it is very hard to predict what will happen,” NORDEN’s Chief Executive Jan Rindbo told Reuters. There are currently 107 forward grain orders for ships in the market, with 94 for May and only a few orders for the forward months, Shipfix data showed. Insurance for ships going into the grain corridor has remained stable for now.

|

POLICY UPDATE |

— Ag bankers stress crop insurance, farm lending link. A Senate Ag subcommittee heard from agricultural bankers Thursday. Consensus: Crop insurance programs often make the difference in farmers being able to stay in business.

One of the bankers noted that crop insurance was critical since the safety net programs under the farm bill have become outdated with provisions linked to costs from 2012. The liabilities covered by crop insurance are “the element of crop insurance that allows farmers and ranchers to obtain credit, invest in their operations, to better market their crops,” a crop insurance agent from Mississippi told the panel. William Cole, a crop insurance agent testifying on behalf of the Crop Insurance Professionals Association (CIPA), agreed, saying crop insurance was not only an important tool for farmers but provides stability to the wider rural business landscape. “It's so important to our small rural communities, not just the farmers relying on it, these lenders here rely on it heavily, and the tractor dealerships, the seed and chemical dealerships, so it's the underpinning of all of our rural communities to a certain extent,” he told lawmakers.

An industry plea: Cole and other insurance industry representatives called on USDA to increase administrative reimbursements, which have not been increased for inflation since 2015. A cost-saving Standard Reinsurance Agreement (SRA) that USDA negotiated with the industry set minimum and maximum subsidy levels of subsidy in 2011 and adjusted them for inflation through 2015.

Regarding banking failures seen this year, Compeer Financial’s Jase Wagner said the impact in agriculture “is not real acute right now, it is around the edges.” Other lenders noted \impacts have not been seen in their regions, but they are monitoring conditions very carefully.

Many of those lending to agriculture can be small community banks and they have not made riskier investments like “megabanks,” according to Gus Barker, president of First Community Bank in Newell, Iowa. “We have not seen withdrawals of major deposits or anything like that,” he added.

A topic where lenders disagreed was a proposal from the Farm Credit System to allow its lenders to go beyond farmers and related businesses to financing things like community infrastructure. Those in the community banking side called for lawmakers to reject the proposal, arguing that goes beyond the scope of business the system was established for.

The lenders seemed to agree on a need to boost the lending limits on USDA guaranteed loans as lawmakers ready for the next farm bill. Phillip Morgan, CEO of Southern AgCredit, who testified on behalf of the Farm Credit Council, and Barker both said the limits should be bumped to $3.5 million for guaranteed real estate loans and $3 million for guaranteed operating loans — from current levels of roughly $2 million. “The price of land and inputs have just skyrocketed for us,” noted Barker, who said the bump would help accommodate some of those higher costs. Besides increasing the rate, he said ICBA supports indexing loan limits to inflation going forward. Morgan said increasing the limits is especially important given the high levels of capital investment required for farmers to earn median income levels and would especially help young and beginning farmers.

Upshot: All the bankers agreed that the increased interest rates are going to have an impact on farm borrowers ahead. “The rapid rise in interest rates over the last 12 months will impact every operator that we have,” said Morgan. “In some cases, we will have a number of producers who will face both higher operating line costs plus real estate interest rate costs.” Still, Morgan said the Farm Credit System (FCS) is “very well positioned to be able to weather that adversity.”

Of note: Our talks with ag bankers this week brought a clear consensus: Farms are going to get bigger at an accelerated pace over the next decade. And this means an even bigger need for financing, risk management and an effective farmer safety net.

— Washington Post editorial: Cut off wealthy farmers. A Washington Post article (link) says “evidence shows a disproportionate share of subsidies flows to relatively high-income farmers. For reasons of both fairness and spending control, there should be income-based limits on the ag safety net.”

|

PERSONNEL |

— President Biden is expected to nominate the chief of staff of the Air Force — Gen. Charles "CQ" Brown Jr., a seasoned officer and fighter pilot — as chairman of the Joint Chiefs of Staff, the Washington Post reports (link). Brown would succeed Gen. Mark Milley, whose term expires at the end of September. he top two Pentagon leadership positions would be held by African American men — Brown and Defense Secretary Lloyd Austin — for the first time. Brown would be the second Black man to become chairman, after Colin Powell.

|

CHINA UPDATE |

— Canada is considering expelling Chinese diplomats following reports that the Chinese government targeted a Canadian lawmaker. China is said to have sought information about Michael Chong’s relatives as part of efforts to deter “anti-China positions.” Chong has accused China of human-rights violations. Canada’s foreign minister, Melanie Joly, summoned the Chinese ambassador to discuss the issue. China dismissed the allegations as “political farce.”

— Senate Appropriations Committee is planning a two-step process to examine U.S. competitiveness with China beginning next week. On Wednesday Chair Patty Murray (D-Wash.) is planning a closed-door, full committee session for lawmakers to hear privately from officials from the Defense, State, and Commerce departments as the committee prepares to work with other panels on follow-on legislation to last year’s CHIPS and Sciences Act. On May 16, lawmakers will hear from Defense Secretary Lloyd Austin, Secretary of State Antony Blinken, and Commerce Secretary Gina Raimondo in an open session on the U.S./China relationship.

— China imports first corn from South Africa. China received its first cargo of corn from South Africa this week, Xinhua News reported. A 53,000-MT cargo was purchased by state-owned grain trader COFCO and will be sold to domestic feed makers. Between March 25 and April 14, 108,104 MT of corn shipments left South African ports destined for China.

— China considering pork purchases to support prices. China’s state planner will hold discussions with other departments about a new round of pork purchases for state reserves to support hog prices, it said on Friday. Prices were below 15 yuan ($2.17) per kilogram last month, data from Shanghai JC Intelligence Co. shows, pressured by excess supply. In Cangzhou, Hebei, one of the main hog-trading locations in northern China, hog prices have slumped 44% since last October.

|

TRADE POLICY |

— IPEF ministerial set for May 27 in Detroit. The next ministerial-level meeting under the Indo-Pacific Economic Framework (IPEF) will take place May 27 in Detroit, marking one year since the initial discussions took place in Japan. The last session was in September. A third negotiating round under the IPEF will be held May 8-15 in Singapore. Meanwhile, a session of APEC trade officials will take place May 25-26, hosted by U.S. Trade Representative Katherine Tai, with that session including countries outside the IPEF such as China, Russia, Canada and Mexico.

|

ENERGY & CLIMATE CHANGE |

— Manchin applauds speedier FERC permits to boost grid reliability. The Federal Energy Regulatory Commission (FERC) will continue to move faster to rule on natural gas projects and revamp electric grid planning, acting chair Willie Phillips told lawmakers at a Senate hearing, drawing praise from sometimes centrist Sen. Joe Manchin (D-W.Va.).

Meanwhile, Senate Republicans are proposing two energy permitting bills and hoping to get their Democratic colleagues on board. The legislation from Sens. Shelley Moore Capito (R-W.Va.) and John Barrasso (R-Wyo.), announced Thursday, would truncate deadlines for environmental reviews, accelerate permitting for infrastructure and transportation projects, and authorize a long-delayed natural gas pipeline in West Virginia.

— June 14 is EPA deadline for final RFS levels for 2023-2025. EPA committed to finalizing their Renewable Fuel Standard (RFS) levels for 2023 by June 14 as part of a consent decree in the suit brought against EPA by Growth Energy. EPA announced proposed RFS levels for 2023, 2024 and 2025 on Dec. 1, 2022. EPA’s final RFS plan will need to go to the Office of Management and Budget (OMB) soon for the reviews to be completed prior to the June 14 deadline.

Biodiesel and renewable diesel interests are hoping EPA upwardly adjusts the mandated levels from the initial announcement, thinking they were understated. EPA Administrator Michael Regan recently stated the industry provided EPA more information and he seemed to signal an upward adjustment was ahead.

— Westinghouse Electric Corp. announced a new nuclear reactor called the AP300 - a smaller version of its flagship AP1000 nuclear reactor - which will generate around 300 megawatts of energy at a cost of $1 billion per unit. The smaller reactors are less costly to build, more versatile and are being looked at as ways for industrial producers to use carbon-free sources of heat. Link for details.

|

LIVESTOCK, FOOD & BEVERAGE INDUSTRY |

— Global food prices end year-long decline. The U.N. Food and Agriculture Organization global food price index inched up 0.8% in April, ending a 12-month string of declines, but was 19.7% below year-ago. The slight monthly increase was led by a strong increase in sugar prices, along with smaller gains in meats, while cereal grains, dairy and vegoils continued to drop. Compared to year-ago, prices were down 6.1% for meat, 15.1% for dairy, 19.8% for cereal grains and 45.3% for sugar, while vegoils dropped 23.0%.

— Have you noticed the White House and USDA Sec. Vilsack have been silent lately about their usual haranguing of meatpackers? Reason: The U.S beef herd has shrunk to its smallest size since 1962. As a result, meatpackers are paying considerably more for the cows they turn into meat, which cuts into their profits. Analysts told Reuters that “the amount of money meatpackers earn buying cattle and converting them into meat fell below $40 per head of cattle in April, after topping $700 per head in May 2020 … On Wednesday, the margins were about $117 per head.”

“Packers are scrambling,” Derrell Peel, an Oklahoma State University agricultural economist, told Reuters. “They will likely try to pass on costs to customers, charging more for ground beef and steaks at a time of high inflation, analysts said, but it is still a question whether higher beef prices will ruin consumers’ appetites.”

Bad timing. Meanwhile, the Biden administration continues to pump money into boosting the ability of smaller ranchers to compete with the packing giants by building local and regional processing infrastructure.

— Michelle Obama's healthy food company. Former First Lady Michelle Obama launched a food company for kids whose first product is a drink called PLEZi that has less sugar and more nutrients than leading fruit juices. Link for details.

|

HEALTH UPDATE |

— Death rates in the U.S. dropped an estimated 5% in 2022 from the previous year, as the overall number of COVID deaths fell, according to reports based on provisional data released by the CDC yesterday. Covid slipped from the top three causes of death. But cancer deaths and deaths from heart disease both rose last year. Covid was the underlying cause or contributing cause in about 7.5% of U.S. deaths in 2022.

— WHO declares end to Covid global public health emergency. The spread of Covid-19 is no longer a global public health emergency, the World Health Organization (WHO) declared on Friday. “For more than a year, the pandemic has been on a downward trend with population immunity increasing from vaccination and infection, mortality decreasing, and the pressure on health systems easing,” WHO Director-General Tedros Adhanom Ghebreyesus said at a press conference in Geneva. “This trend has allowed most countries to return to life as we knew it before Covid-19,” Tedros said. “It’s therefore with great hope that I declared Covid-19 over as a global health emergency,” he said.

|

CONGRESS |

— Bank failures get lawmakers’ attention:

- Sen. Elizabeth Warren (D-Mass.) is pressing former First Republic CEO Michael Roffler for information on executives’ compensation and their lobbying for more lenient banking regulations.

- Sens. Richard Blumenthal (D-Conn.) and Ron Johnson (R-Wis.) are looking into KPMG’s relationship with three recently failed banks, asking the firm for a wide range of documents for their initial inquiry. “

Meanwhile, Goldman Sachs’s role in SVB’s attempt to raise funds in March is under review by governmental agencies, which are looking into the failed transaction that helped push the U.S. regional-banking system into turmoil.

|

OTHER ITEMS OF NOTE |

— President Biden told tech executives that they have a “moral duty” to ensure artificial intelligence does not harm society. Biden spoke at a meeting organized by the White House and attended by the bosses of Anthropic, Google, Microsoft and OpenAI, companies that run AI chatbots. Sam Altman, the chief executive of OpenAI, said afterwards that “we’re surprisingly on the same page on what needs to happen.”

— King Charles will be crowned at Westminster Abbey tomorrow after he became monarch of the United Kingdom and 14 other realms on the death of his mother Queen Elizabeth in September.

|

KEY LINKS |

WASDE | Crop Production | USDA weekly reports | Crop Progress | Food prices | Farm income | Export Sales weekly | ERP dashboard | California phase-out of gas-powered vehicles | RFS | IRA: Biofuels | IRA: Ag | Student loan forgiveness | Russia/Ukraine war, lessons learned | Russia/Ukraine war timeline | Election predictions: Split-ticket | Congress to-do list | SCOTUS on WOTUS | SCOTUS on Prop 12 | New farm bill primer | China outlook | Omnibus spending package | Gov’t payments to farmers by program | Farmer working capital | USDA ag outlook forum |