What’s Taking EPA So Long to Act on Year-Round E15 Requests?

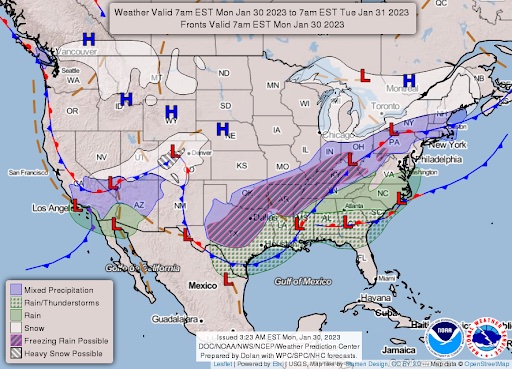

More than 25 million people in U.S. under winter weather alerts this morning

|

In Today’s Digital Newspaper |

U.S. gasoline prices have surged 12% over the past month to average $3.51 per gallon, threatening the Fed's inflation fight and potentially extending last year's big rally in refinery equities. Gasoline exports have also doubled from a year ago as China's reopening means there are more people using fuel, while diesel is rising again toward 2022's highs as Europe bans Russian oil products starting Feb. 5.

States press EPA over lack of action on E15 requests. Attorneys general from seven states that requested a Reid Vapor Pressure (RVP) waiver from EPA to allow sales of E15 fuel during the summer months are asking EPA why they have not yet acted on their request. EPA’s proposal on the states’ request has been under review at the Office of Management and Budget (OMB) since Dec. 5 with seven meetings held on the plan. Currently, EPA has targeted releasing their decision in March, well beyond the statutory deadline. A total of nine states have sought waivers, but the plan under review at OMB appears to only cover eight states.

Court grants request from two small refiners to halt their RFS compliance. Details below.

Remember last week when reports noted General Motors announced it intends to spend just under one billion dollars to develop its next-generation V8 engine. In the Energy section below, we provide perspective on what wasn’t said in the report relative to GM’s far more funding for electric vehicles.

Toyota is not only defending its title as the world's top-selling automaker for a third year in a row, but it is doing so by a wide margin. The company has been studying rivals including Tesla, and considering bigger upfront investment in its EV technology and manufacturing capabilities. But longtime CEO Akio Toyoda called himself a spokesman for “a silent majority” of people in the auto industry who questioned a single-minded focus on EVs. That stance isn’t likely to change, say observers, but Toyota analysts say Toyoda’s move to the chairman’s role makes it easier for a new CEO to steer in new directions on EVs.

Treasury Secretary Janet Yellen warned South African officials about the consequences of violating U.S. sanctions, as the Biden administration tries to balance its response to Russia’s invasion of Ukraine with a broader effort to deepen ties with African governments.

Russia is advancing on beleaguered Bakhmut as Ukraine awaits Western tanks. On Sunday, Russia claimed the capture of another village in the Bakhmut area in Ukraine’s east and launched a heavy artillery barrage against the southern city of Kherson. The WSJ says Western officials fear the Kremlin could gain the upper hand in any lengthy war of attrition. Those worries have fueled a sharp increase in Western military aid to Ukraine, aiming to help it change the war’s dynamic and overwhelm Russia’s ability to fight.

China’s top nuclear-weapons research institute, meanwhile, has bought sophisticated U.S. computer chips at least a dozen times in the past two and a half years, circumventing decades-old American export restrictions meant to curb such sales.

Unilever taps a board member as its new CEO. The British consumer giant hired Hein Schumacher, who is also the head of a Dutch dairy cooperative, as its chief executive. The hiring of Schumacher, who began his career at Unilever, had the support of Nelson Peltz’s Trian, which had sought to shake up the conglomerate. Link for more via the Financial Times (paywall).

More than 25 million people in the U.S. are under winter weather alerts this morning stretching from Texas to Illinois, bringing the risk of heavy precipitation and significant icing to the region. The winter storm is also bringing dangerously cold air to some cities in the Central U.S., with possible wind chills as low as 45 degrees below zero Showers are also forecast for parts of the Lower Mississippi, Tennessee and Ohio valleys, as well as parts of the Northeast, the Mid-Atlantic and Southeast today.

Israel carried out a drone strike targeting a defense compound in Iran, as the U.S. and Israel look for new ways to contain Tehran’s nuclear and military ambitions, according to U.S. officials and people familiar with the operation.

|

MARKET FOCUS |

Equities today: Global stock markets were mixed overnight. U.S. stock indexes are pointed toward lower openings. This coming week brings earnings reports from many of tech’s most important players, including Meta Platforms (Wed.), Apple (Thur.), Alphabet (Thur.), and Amazon.com (Thur.). In Asia, Japan +0.2%. Hong Kong -2.7%. China +0.2%. India +0.3%. In Europe, at midday, London +0.1%. Paris -0.7%. Frankfurt -0.8%.

U.S. equities Friday: All three major indices finished higher Friday, led by the Nasdaq while the Dow and S&P 500 managed modest gains. The Dow gained 28.67 points, 0.08%, at 33,978.08. The Nasdaq was up 1009.30 points, 0.5%, at 11,621.71. The S&P 500 rose 10.13 points, 0.25%, at 4,070.56.

For the week, all three notched advances with the Dow up 1.8%, the Nasdaq up 4.3% (a fourth straight week of gains) and the S&P 500 up 2.5%. Of note: Tesla shares jumped 11% to cap a huge 33% surge on the week after reporting record quarterly revenue.

The Nasdaq is closing in on its best January in more than 20 years. With two trading days to go, the index is up 11% on the month, its best January since a 12.2% gain in January 2001.

Short sellers betting against U.S. stocks are down $81 billion so far, thanks to this month’s market rally.

Agriculture markets Friday:

- Corn: March corn futures ended 1/2 cent higher at $6.83, which was up 6 3/4 cents for the week.

- Soy complex: March soybeans fell 14 cents to $15.09 1/2, ending the session below the 10-day moving average, but up 3 cents on the week. March meal dropped $3.60 to $473.50 and March soyoil fell 17 points to 60.62 cents.

- Wheat: March SRW wheat futures dropped 2 1/2 cents to $7.50, though that was a gain of 8 1/2 cents on the week. March HRW wheat firmed 4 1/2 cents to $8.69 1/4, which was up 21 1/4 cents for the week. March HRS futures rose 3 1/2 cents to $9.21 1/2 and finished 8 3/4 cents higher for the week.

- Cotton: March cotton fell 61 points to 86.89 cents after trading as low as 86.11 cents. The contract finished 19 points higher on the week.

- Cattle: Nearby February live cattle ended Friday unchanged at $156.725; that marked a weekly rise of 10 cents. With the January future expiring at $179.575 Thursday, nearby March feeder futures advanced 62.5 cents to $183.475, which represented a $2.50 weekly advance.

- Hogs: Nearby February hog futures fell $1.15 to end the week at $75.875. That represents a weekly decline of $1.95.

Ag markets today: Grain and soy futures opened the week with solid gains, led by sharp advances in soybeans. As of 7:30 a.m. ET, corn futures were trading around 3 cents higher, soybeans were 12 to 18 cents higher, winter wheat futures were 7 to 10 cents higher and spring wheat was 2 to 3 cents higher. Front-month crude oil futures were trading near unchanged, while the U.S. dollar index was around 100 points lower this morning.

Technical viewpoints from Jim Wyckoff:

On tap today:

• Dallas Fed's manufacturing survey for January is out at 10:30 a.m. ET.

• USDA Grain Export Inspections report, 11 a.m. ET.

• China's official purchasing managers indexes for January are out at 8:30 p.m. ET.

• The IMF publishes its biannual world economic outlook at 8:30 p.m. ET.

The main event on this week's economic calendar is the conclusion of the two-day meeting of the Federal Open Market Committee on Wednesday. The central bank is widely expected to raise the federal-funds rate by a quarter of a percentage point, to a target range of 4.50% to 4.75%. As always, the post-meeting press conference from Chairman Jerome Powell will be closely watched for hints about the Fed's next moves.

Former Treasury Secretary Lawrence Summers urged the Federal Reserve to refrain from signaling its next move after an expected interest-rate hike because of the economy’s highly uncertain outlook.

Treasury Secretary Janet Yellen said she’s encouraged by recent U.S. data on inflation and jobs but conceded the economy is at risk of recession amid high interest rates. Condon covers her analysis.

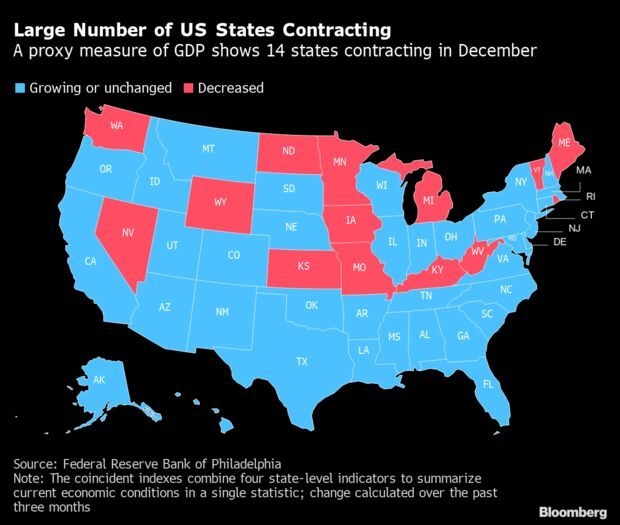

The economies of 14 U.S. states were contracting in December, according to a monthly measure published by the Federal Reserve Bank of Philadelphia.

Toyota sold 10.5 million vehicles in 2022, retaining its title as the world’s top-selling carmaker for the third consecutive year. The Japanese firm was able to overcome supply-chain constraints to increase production. Last week it announced a new chief executive, Koji Sato, to lead Toyota in capturing more of the electric-vehicle market. Volkswagen, a German carmaker, came in second, selling 8.3 million vehicles, its lowest sales in more than a decade.

Germany economy falls into winter recession. On Monday, when Germany’s statistics office unveiled its final figure for GDP growth in the fourth quarter of 2022, the number was slightly worse than expected. The country’s economy shrank by 0.2% compared with the third quarter. That followed a 0.5% rise in GDP between second and third quarters. Another contraction, as is predicted for the first quarter of 2023, would mean a recession, which it had previously seemed as though Germany might narrowly avoid.

Market perspectives:

• Outside markets: The U.S. dollar index is a bit weaker. Nymex crude oil futures prices are slightly down and trading around $79.50 a barrel. Oil traders are awaiting an OPEC-plus cartel meeting this Wednesday. Meantime, the yield on the benchmark U.S. 10-year Treasury note is presently fetching 3.551%.

• New Russia oil ban will push diesel higher, says a Barron’s article (link). U.S. distillate inventories, which include diesel, stand 20% below the five-year average.

The roller-coaster ride for diesel markets is unlikely to end anytime soon. Prices for the fuel have settled somewhat after reaching record highs last summer. Denton Cinquegrana, chief oil analyst of the Oil Price Information Service, a sister company of the Wall Street Journal, writes (link) that the decline in the pump prices in recent months won't likely be duplicated in 2023, however, because many of the same elements that drove the surge in prices remain in place. Diesel supplies remain tight by historical standards, and there are still strong constraints in replenishing stocks. One factor is that refineries that have deferred maintenance since the pandemic began will have to resume the critical work, likely putting a cap on output. Europe’s looming restrictions on Russian refined products also looms over world markets and diesel supplies.

• BP cut its projections for oil and gas sales over the next decade. The war in Ukraine will drive countries to pursue renewable energy, and the energy shock will damage economic growth and hit demand, the company said in its annual report. It projects a global demand in 2035 of 93 million barrels of oil a day, 5% down from last year’s forecast, while its natural gas forecast was down 6%. It means global carbon emissions will peak this decade, several years earlier than previously anticipated. Even under the new forecast, though, the world is falling short of a 2050 net-zero target.

• Bitcoin is headed for its best start to the year since 2013. Risk appetite is growing among investors ahead of a smaller expected Fed hike this week. Over recent weeks, the cryptocurrency market has regained its $1 trillion market cap.

• Ag trade: Egypt tendered to buy an unspecified amount of optional origin corn. Algeria tendered to buy a nominal 50,000 MT of optional origin durum wheat.

• NWS weather: Prolonged and potentially significant icing event to impact a large area from the southern Plains to the Tennessee Valley... ...Frigid temperatures over the central and western United States to begin moderating early this week... ...Heavy rain and scattered flash floods possible across eastern Texas and the lower Mississippi Valley on Wednesday.

Items in Pro Farmer's First Thing Today include:

• Soybeans lead overnight price gains

• One more round of rains before Argentina turns drier again

• Brazil rains to keep soybean harvest slow

• Brazil soybean harvest reaches 5% done

• Limited winterkill concerns for U.S. winter wheat

• China sells all wheat put up for auction

• Bullish cash cattle hopes

• Cash hog index rises for third straight day

|

RUSSIA/UKRAINE |

— Summary: Russia escalated strikes near the contested city of Bakhmut on Saturday as it sought to cut off Ukraine’s supply routes and encircle the city, while Ukrainian officials warned of a major new Russian offensive in coming weeks.

- Yellen confident of reaching deal on new Russia fuel-price caps. Treasury Secretary Janet Yellen said she’s confident that discussions aimed at extending restrictions on the sale of Russian petroleum products will be concluded and a deal can be reached by the Feb. 5 deadline.

- Ukraine’s calls for Western jets — just after NATO allies agreed to provide tanks — was dismissed as “frivolous” by German Chancellor Olaf Scholz. Ukraine’s prime minister told Politico that Kyiv’s supporters should send fighter planes “as soon as possible” because training Ukrainian pilots would take months. Scholz told Tagesspiegel that “firing up” a debate on aircraft when “we’ve only just made a decision” on tanks “undermines people’s trust in government.” Scholz also said that it was important to keep talking to Moscow: He called Russian President Vladimir Putin in December.

|

CHINA UPDATE |

— In a memo, Air Mobility Command head Gen. Mike Minihan warned troops that he predicts the U.S. will be at war with China by 2025, NBC reported. The four-star Air Force general predicts that Beijing could move on Taiwan next year, when both Washington and Taipei are consumed by elections.

Details: In an internal memo leaked to NBC News, Minihan told his troops: “I hope I am wrong. My gut tells me we will fight in 2025.” The general runs the Air Mobility Command, the Air Force’s tank-refueling operation, and he says in his memo that he wants his force to be “ready to fight and win in the first island chain” off the eastern coast of continental Asia. He called for taking more calculated risks in training.

The Wall Street Journal notes that U.S. Navy Adm. Phil Davidson told Congress in 2021 that he worried China was “accelerating their ambitions to supplant the United States,” and could strike Taiwan before 2027. Gen. Minihan came to his post after a tour as deputy of Indo-Pacific Command. “He like many others suggested that 2025 may be a ripe moment for Chinese President Xi Jinping to move. Taiwan and the U.S. both have presidential elections in 2024 that China may see as moments of weakness,” the WSJ notes in a commentary item (link) on the topic.

— China’s top nuclear-weapons lab used American computer chips after they were banned. The state-run China Academy of Engineering Physics (CAEP) has managed to obtain the semiconductors made by U.S. companies such as Intel and Nvidia since 2020 despite its placement on a U.S. export blacklist in 1997, a Wall Street Journal review of procurement documents found (link). Such purchases defy longstanding restrictions imposed by the U.S. that aim to prevent the use of any U.S. products for atomic-weapons research by foreign powers. CAEP didn’t respond to requests for comment.

— Chinese consumers appear to be spending again. Official data showed that spending on travel and entertainment, including bookings for theater tickets and hotels, was up compared with previous years, according to Bloomberg. Outbound air travel more than quadrupled year-on-year as well, suggesting that high-spending Chinese tourists will flock abroad once more. All that has Western companies optimistic about an economic rebound.

— China claims Covid-19 cases have fallen. China’s Center for Disease Control has said that its Covid-19 wave has peaked, and that the number of critically-ill individuals in hospitals is down more than 70% since the first week in January. However, some are concerned that the wave, which was concentrated at first in urban areas, has spread to more rural areas as people traveled for lunar new year festivities, and many remain skeptical of official Chinese data.

|

ENERGY & CLIMATE CHANGE |

— Colombian President Gustavo Petro plans to roll back the petroleum industry in his country, which is Latin America’s third-largest oil producer. Petro said the move is necessary to combat the climate crisis, while economists say oil is critical for growth.

— EPA dragging out decision on year-round E15 requests from several states. Nine states have sought authorization from EPA for year-round E15 use. Attorneys general representing seven Midwest states are against asking EPA to issue a waiver that would allow E15 to be sold in the region, starting this summer. In a letter (link) to EPA Administrator Michael Regan, the AGs note that a group of governors formally petitioned for the waiver more than 270 days ago. “Without prompt action, there is a risk that E15 gasoline will not be available during the 2023 summer driving season and vehicle emissions will be higher than if EPA followed its obligations under the Clean Air Act,” the AGs wrote.

— Court grants request from two small refiners to halt their RFS compliance. The Fifth Circuit Court of Appeals Friday granted a request from two small refiners that they be allowed to halt their compliance under the Renewable Fuel Standard (RFS) after they were denied small refiner exemptions (SREs) by EPA. EPA rejected the requests of the two refiners and scores of other small refiners dating back to 2016, citing their interpretation of provisions in the Clean Air Act allowing for SREs.

Details: San Antonio Refinery and Calumet Shreveport Refining challenged the EPA decision and the court ruled that the “retroactive application of EPA’s ‘new interpretation’ — which quite possibly will read the exemption framework promulgated by Congress out of the statute entirely, such that no small refinery will ever qualify for one — is thus likely contrary to law.” The court determined the two refiners were able to show a “likelihood of success” on their SREs prior to EPA’s new interpretation

Impact: The court decision prevents EPA from applying the new standard on prior requests and grants a stay in the matter until the court can determine whether EPA’s new standard can legally be applied.

EPA said it was reviewing the decision. Some predict other firms will follow this suit relative to previously requested SREs.

— Perspective on GM funding for electric autos. General Motors last week announced it intends to spend just under one billion dollars to develop its next-generation V8 engine. The company will invest $918 million across four of its U.S. sites, of which $854 million will be spent developing the sixth-generation small block V8, and $64 million on supporting EV production.

To be fair, GM is investing over $35 billion through 2025 in electric vehicles and is moving quicker than most automakers. However, they may not be moving as quickly as they claim. Also, recall the U.S. gov’t last summer granted a loan of $2.5 billion to General Motors to further its EV battery development. The Energy Department granted the loan to GM and its joint venture with South Korean tech giant LG. It was the first new grant from the government’s Advanced Technology Vehicles Manufacturing loan program since 2010 and will help the two companies construct more EV battery production facilities to further their efforts in developing and manufacturing Ultium Cells.

|

LIVESTOCK, FOOD & BEVERAGE INDUSTRY |

— “A Nationwide Fight Over Food Insecurity Is Just Beginning,” by The New Republic’s Grace Segers: “From a draconian new proposal in Iowa to farm bill deliberations in Washington, the ideological battles over food aid will soon kick off — and no one knows who will end up paying the price.” Link.

|

HEALTH UPDATE |

— Summary:

- Global Covid-19 cases at 670,399,962 with 6,824,215 deaths.

- U.S. case count is at 102,283,586 with 1,107,646 deaths.

- Johns Hopkins University Coronavirus Resource Center says 668,814,259 does have been administered, 268,927,705 have received at least one vaccine, or 81.0% of the U.S. population.

|

CONGRESS |

— President Joe Biden and House Speaker Kevin McCarthy (R-Calif.) will meet on Wednesday on the debt limit. “I know the president said he didn’t want to have any discussions, but I think it’s very important that our whole government is designed to find compromise,” McCarthy said during an appearance on CBS’ “Face the Nation” Sunday. McCarthy said that he doesn’t want a default, yet House Republicans are demanding billions of dollars in spending cuts that Democrats will reject. McCarthy says he won’t touch Medicare or Social Security; Medicaid and other entitlement programs weren’t mentioned.

— U.S./Mexico border hearing. The House Oversight Committee has a hearing scheduled for the week of Feb. 6 on the situation at the U.S./Mexico border.

— Republicans are largely backing away from House Speaker Kevin McCarthy’s support for considering replacing federal income and payroll taxes with a national sales tax. Link to details via Politico.

— For more on the week ahead… link to our weekly report.

|

OTHER ITEMS OF NOTE |

— A drone attack on an Iranian military facility was reportedly carried out by Israeli intelligence. A large explosion hit the city of Isfahan, a center of Iran’s missile and nuclear programs, on Saturday. The United States denied involvement, and intelligence officials told the New York Times that Israel’s Mossad was behind the attack. Iran supplies weapons to Russia, and Moscow is trying to obtain Iranian Shahab missiles, although U.S. officials say this strike was likely prompted by Israel’s own security concerns. Iran said it had shot down the drones and little damage was caused, though The Guardian cited eyewitnesses and footage which showed huge explosions and smoke.

|

KEY LINKS |

WASDE | Crop Production | USDA weekly reports | Crop Progress | Food prices | Farm income | Export Sales weekly | ERP dashboard | California phase-out of gas-powered vehicles | RFS | IRA: Biofuels | IRA: Ag | Student loan forgiveness | Russia/Ukraine war, lessons learned | Election predictions: Split-ticket | Congress to-do list | SCOTUS on WOTUS | SCOTUS on Prop 12 | New farm bill primer | China outlook | Omnibus spending package |