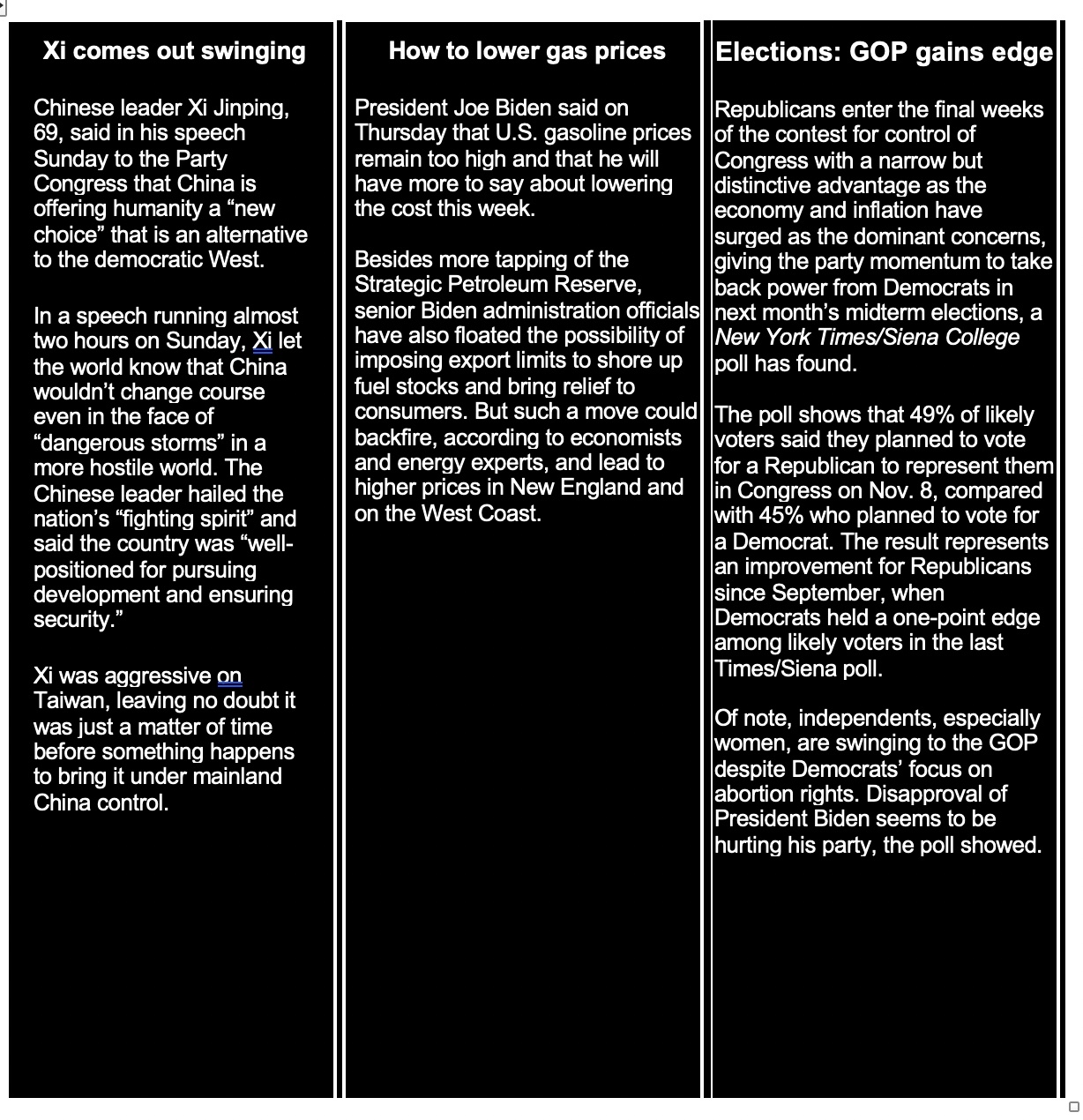

Xi Jinping Speech to Party Congress Aggressive, Leaving no Doubts About Taiwan

NYT poll shows swing to GOP candidates | Biden to unveil efforts to lower gas prices

Washington Focus

China’s Communist Party plenum began Sunday, President Biden promises an action plan this week on high gas prices, and election campaigns get closer to the final votes on Nov. 8.

The new leadership line-up of China’s ruling Communist Party will be unveiled next Sunday, Oct. 23, a day after its twice-a-decade national congress wraps up on Oct. 22 after a week of meetings. While Xi Jinping is set to receive a third term as the paramount party leader, there will be major changes in other senior positions.

The reshuffle will be completed next March at the annual parliamentary sessions after changes in key government posts are confirmed — such as who will take over from Li Keqiang as the new premier.

Xi warned against foreign interference in Taiwan, and said China will “never promise to renounce” force. During a speech Sunday, Xi said China reserves the option of “taking all measures necessary” against “interference by outside forces” on the issue of Taiwan. He spoke firmly about China’s resolve for reunification with the self-governed island, which Beijing considers part of its territory. He was speaking at the opening ceremony of the ruling Communist Party of China’s 20th National Congress, held once every five years.

“We will continue to strive for peaceful reunification with the greatest sincerity and the utmost effort,” Xi said in Chinese, according to an official translation. “But, we will never promise to renounce the use of force. And we reserve the option of taking all measures necessary.”

“This is directed solely at interference by outside forces and a few separatists seeking Taiwan independence,” he said, emphasizing that resolving the Taiwan question is a matter for the Chinese to resolve. Xi gave the issue of Taiwan greater prominence in his speech than he had five years ago at the party’s 19th National Congress.

President Biden recently signaled new action to lower gasoline prices. Biden suggested last week that his administration could announce new actions to help tackle rising gas prices in the U.S., which have reversed their downward trend in recent weeks and are expected to rise higher following news of the OPEC+ production cuts. "The price of gas is still too high, and we need to keep working to bring it down," Biden said yesterday in Los Angeles. He declined to offer any additional details, but added: "I'll have more to say about that next week."

It is murky what Biden might do to help temper prices in the U.S., though the White House has not ruled out the possibility that he could order the release of additional oil from the nation’s Strategic Petroleum Reserve (SPR) beyond the drawdown of 180 million barrels announced in March. The administration has also explored the possibility of limiting exports of petroleum products to reduce prices at home, but no announcements have been made.

The final stretch for Nov. 8 elections is at hand, with prognosticators continuing to predict close races in the House and Senate. Most predict a GOP pickup of 8 to 20 seats in the House, which would be enough for Republicans to control the chamber. As for the Senate, election watchers are noting several close races make the final verdict too close to call at this juncture, with some predicting a continued 50/50 split, while others are plus one for either Democrats or Republicans. But the latest NYT/Siena College poll previously mentioned (see black box) signals a late move toward GOP candidates.

We may not know the final verdict on who controls the Senate until a possible Dec. 6 runoff in Georgia between the two top polling candidates if anyone does not garner 50.1% of the vote following Nov. 8.

Some events on tap this week include:

Monday, Oct. 17

· Biden trade agenda. The Center for Strategic and International Studies (CSIS) holds a discussion with former U.S.Trade Representatives on "what a positive trade agenda should look like for the Biden administration."

· Fertilizer duties vote. International Trade Commission holds a meeting including a vote on Inv. No. 731-TA-1586 (Final)(Sodium Nitrite from Russia).

· Global financial institutions and the global economy. The Atlantic Council's Geoeconomics Center holds a virtual event to launch the Bretton Woods 2.0 project, which will examine "the deep challenges facing the Bretton Woods Institutions" (the World Bank and the International Monetary Fund) and work to "reimagine the governance of international finance for the modern global economy."

· Bread and wheat in Egypt. The Carnegie Endowment for International Peace (CEIP) holds a discussion on "Staple Security: Bread and Wheat in Egypt."

· Taiwan trade. The Hudson Institute holds a virtual discussion on "Strengthening Taiwan's Trade and Economic Stability."

Tuesday, Oct. 18

· Iran situation. The Center for Strategic and International Studies (CSIS) holds a discussion on "Is Iran on the Brink?" - focusing on recent anti-government activists in Iran.

· Clean Water Act at 50. The International Code Council (ICC) holds a conference on "ICC Waters: Standards for a Resilient Future," marking the 50th anniversary of the Clean Water Act.

Wednesday, Oct. 19

· China and the Arctic. The Hudson Institute holds a virtual discussion on "Dragon in the North: Assessing the Growing Chinese Threat to the Arctic Region."

· Trade in Africa. The Peterson Institute for International Economics (PIIE) holds a virtual discussion on "The Future of Trade in Africa."

Thursday, Oct. 20

· U.S. winter outlook. The National Oceanic and Atmospheric Administration's Climate Prediction Center holds a conference call briefing on "The US Winter Outlook."

· China’s rise since Mao. The Hudson Institute holds a virtual book discussion on "China after Mao: The Rise of a Superpower."

· COP27. The Environmental and Energy Study Institute (EESI) holds a virtual discussion on "Climate Change Loss and Damage," as part of the "What Congress Needs to Know About COP27" series.

· Iran protests. The Atlantic Council holds a virtual discussion on "How the latest women-led protests in Iran might shape the country's trajectory."

Friday, Oct. 21

· Canada trade perspectives. The Washington International Trade Association (WITA) holds a discussion with Canadian Minister of Innovation, Science and Industry Francois-Philippe Champagne.

· War in Ukraine. The Center for Strategic and International Studies (CSIS) holds a discussion with French Minister for Europe and Foreign Affairs Catherine Colonna on "Transatlantic Relations," focusing on the war in Ukraine and foreign policy priorities.

Economic Reports and Events for the Week

Earnings reports and Federal Reserve speakers are the focus this week.

Monday, Oct. 17

- Federal Reserve Bank of New York releases its Empire State Manufacturing Survey for October. Expectations are for a minus 2.5 reading, compared with minus 1.5 in September. Readings above zero represent economic expansion in the survey.

Tuesday, Oct. 18

- Federal Reserve releases industrial production data for September. Economists are looking for no change, after a 0.2% drop in August. Capacity utilization is expected at 79.9%, roughly in line with August’s 80.0%.

- National Association of Home Builders releases its NAHB/Wells Fargo Housing Market Index for October. Consensus estimate is for a 43.5 reading, compared with 46 in September. The index has dropped every month in 2022 from its 84 reading in December.

- Fed speakers: Bostic discusses current state of the labor market; Kashkari on the economy

- Earnings: China 3Q GDP

Wednesday, Oct. 19

- MBA Mortgage Applications

- Census Bureau reports new residential construction data for September. Economists forecast a seasonally adjusted annual rate of 1.480 million new housing starts, compared with 1.575 million in August.

- Federal Reserve Bank releases its Beige Book on current economic conditions among its 12 districts.

- Fed speakers: Kashkari participates in Q&A; Bullard delivers opening remarks; Evans on the economic outlook

Thursday, Oct. 20

- Jobless Claims

- Conference Board releases its Leading Economic Index for September. Consensus estimate is for a seasonally adjusted 0.3% month-over-month decline, after a 0.3% drop in August.

- National Association of Realtors reports existing home sales for September. Expectations are for a seasonally adjusted annual rate of 4.70 million homes sold, compared with 4.80 million in August.

- Philadelphia Fed Manufacturing Index is released. Estimates call for a minus 5.0 reading in October, compared with minus 9.9 in September.

- Fed Balance Sheet

- Money Supply

- Fed speakers: Jefferson delivers opening remarks; Cook on diversity and careers in economics; Bowman delivers opening remarks

Friday, Oct. 21

- Fed speaker: Williams delivers opening remarks

Key USDA & international Ag & Energy Reports and Events

Traders will watch Thursday’s update on supply and demand from the International Grains Council.

On the energy front, several oil industry conferences take place with a host of industry speakers.

Monday, Oct. 17

Ag reports and events:

- Export Inspections

- Crop Progress

- Feed Grains: Yearbook Tables

- Argus Fertilizer Europe conference, Madrid, day 1

Energy reports and events:

- FT Energy Transition Summit, London (through Oct. 19); Speakers include CEOs of RWE, EDF Energy, TAQA, Scottish Power, Octopus Energy, National Grid, EDP, Cepsa

- Energy Information Administration publishes monthly Drilling Productivity Report

- WTI crude November options expire on Nymex

- Holidays: Israel, Colombia

Tuesday, Oct. 18

Ag reports and events:

- Fruit and Tree Nuts Data

- Vegetables and Pulses Data

- Livestock, Dairy, and Poultry Outlook

- Sugar and Sweeteners Outlook

- China’s second batch of September trade data, including corn, pork and wheat imports

- China’s 3Q pork output, hog inventory

- Oils & Fats International Congress, Kuala Lumpur, day 1

- Argus Fertilizer Europe conference, Madrid, day 2

- EU weekly grain, oilseed import and export data

Energy reports and events:

- API weekly U.S. oil inventory report

- China industrial output for September, including coal, gas & power generation; and crude oil & refining

- China’s 2nd batch of September trade data, including LNG & pipeline gas imports; oil products trade breakdown

- European Commission due to deliver latest proposals on energy markets reforms, ahead of leaders’ summit later in the week

- American Fuel & Petrochemical Manufacturers Summit, San Antonio, Texas (3 days)

Wednesday, Oct. 19

Ag reports and events:

- Broiler Hatchery

- Food Expenditure Series

- Oils & Fats International Congress, Kuala Lumpur, day 2

- Argus Fertilizer Europe conference, Madrid, day 3

Energy reports and events:

- EIA weekly U.S. oil inventory report

- U.S. weekly ethanol inventories

- Genscape weekly crude inventory report for Europe’s ARA region

- Petroleum Association of Japan briefing

- Earnings: Baker Hughes

Thursday, Oct. 20

Ag reports and events:

- Weekly Export Sales

- U.S. Bioenergy Statistics

- Livestock Slaughter

- Milk Production

- China’s third batch of September trade data, including soybean, corn and pork imports by country

- International Grains Council report

- Malaysia’s Oct. 1-20 palm oil export data

Energy reports and events:

- EIA natural gas storage change

- WTI crude November futures expire on Nymex

- Insights Global weekly oil product inventories in Europe’s ARA region

- China September output data for base metals and oil products

- China’s 3rd batch of September trade data, including country breakdowns for energy and commodities

- EU leaders assemble for a summit in Brussels where they will discuss the latest proposals on energy put forward by the Commission on Oct. 18, as well as other political issues (2 days)

Friday, Oct. 21

Ag reports and events:

- CFTC Commitments of Traders report

- Peanut Prices

- Cotton Ginnings

- Rice Stocks

- Cattle on Feed

- Chickens and Eggs

- FranceAgriMer weekly update on crop conditions

Energy reports and events:

- Baker Hughes weekly U.S. oil/gas rig counts

- Earnings: Schlumberger

|

KEY LINKS |

WASDE | Crop Production | USDA weekly reports | Crop Progress | Food prices | Farm income | Export Sales weekly | ERP dashboard | California phase-out of gas-powered vehicles | RFS | IRA: Biofuels | IRA: Ag | Student loan forgiveness | Russia/Ukraine war, lessons learned | Election predictions: Split-ticket | Congress to-do list | SCOTUS on WOTUS | SCOTUS on Prop 12 |