USDA Crop Report/WASDE Key Focus Today

Oncoming freight train as ag sector braces for possible major railroad strike Friday

|

In Today’s Digital Newspaper |

Oncoming freight train… Tens of thousands of U.S. railroad workers could be on strike by the end of this week, a potential new shock to supply chains that would pose a pre-midterm political quandary for Biden and the Democrats. While ten of the twelve railroad worker union have struck deals, the holdouts - Brotherhood of Locomotive Engineers and Trainmen and the International Association of Sheet Metal Air, Rail and Transportation Workers — account for more than 90,000 rail employees. Railroads warned Friday that they may impose limits on certain shipments starting today — U.S. railroads are suspending transport of hazardous materials and other sensitive shipments starting today as a Friday deadline for a potential strike nears. On Sunday, Norfolk Southern said in an online notice that it “has begun enacting its contingency plans for a controlled shutdown of our network at 00:01 on Friday, Sept. 16.” Union Pacific and CSX also announced contingency planning for a possible strike. BNSF urged its customers to call members of Congress to prevent any interruptions. Pressure is building from industry groups and Republicans alike for Congress to intervene in the dispute, which the unions have been urging legislators not to do. Over the weekend, negotiations continued between the country's largest freight railroad companies — including Berkshire Hathaway's BNSF, Union Pacific and CSX. A national stoppage may cost up to $2 billion a day, a trade group warned. According to Bloomberg Intelligence analyst Lee Klaskow, BNSF and Union Pacific combine for 45% of Class I intermodal traffic. CSX and Norfolk Southern have 31%. Trains accounted for about 28% of total U.S. freight movements, according to government data for 2020, making it the busiest mode after trucks. Half of that traffic moves bulk commodities — particularly food, energy, chemicals, metals and wood products — as well as automobiles and industrial parts. The other 50% consists mostly of shipping containers carrying smaller consumer goods. The most immediate concern in the event of a rail strike would be for perishable goods. The American Bakers Association said “even a temporary interruption would create a devastating ripple effect” that would create a shortage of materials and ingredients.” Link to our special report on the topic.

Ukraine’s armed forces reportedly recaptured more than 20 towns and villages from Russian control on Sunday. In total they have retaken more than 3,000 square kilometers (1,158.3 square miles) of territory in 11 days, mostly in their country’s north-east, and have advanced to within 31 miles of the border with Russia, according to General Valery Zaluzhny, their commander-in-chief. These gains have, in effect, ended Russia’s grand plans to seize control of the entire Donbas, Ukraine’s eastern region. Emboldened, the Ukrainians are calling for more weapons from their allies.

Russia was "taken by surprise" regarding Ukraine advances in the east. Russia’s Ministry of Defense confirmed that it had pulled its forces out of Izium, six months after its forces laid siege to and then seized the city. Separately, the U.N.’s nuclear watchdog warned that the power station serving the reactors at Zaporizhia was destroyed by shelling.

Russia hit power plants deep behind Ukrainian lines, causing blackouts across the northeast of the country as Kyiv's forces pressed a lightning offensive, reversing months of Russian advances. More than 30 settlements suffered missile and air strikes over the past day, Ukraine said.

France and Romania reach accord to boost Ukrainian grain exports, according to French Transport Minister Clement Beaune. Details in Russia/Ukraine section.

Ukrainian farmers are likely to cut the winter grain planted area by at least 30% because of a jump in prices for seeds and fuel combined with a low selling prices of their grain, the Ukrainian Agrarian Council (UAC) said today.

Treasury Secretary Janet Yellen said Sunday that there is a "risk" that U.S. gas prices could rise again later this year. "Well, it's a risk. And it's a risk that we're working on the price cap to try to address," Yellen told CNN when asked if Americans should be worried about gas prices rising again later this year. Meanwhile, Yellen remarked that the U.S. economy can avoid recession, though that will require "some good luck." She told CNN that while the economy's growth rate was slowing, the labor market remained "exceptionally strong" with almost two vacancies for every worker looking for a job.

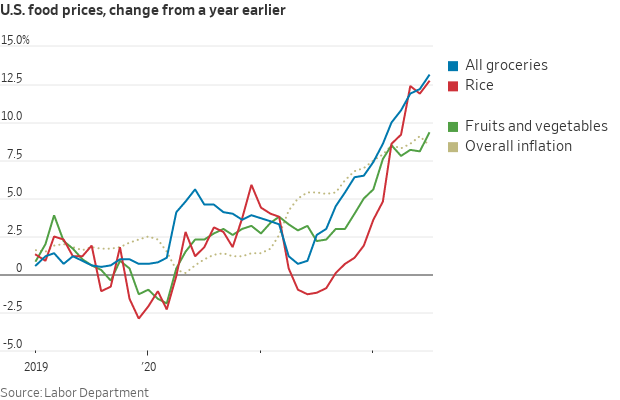

Rice is in the news… from major impacts on U.S. rice production in California to growing ramifications from India’s actions on its rice exports. We have updates on both in the Market and Food Industry sections.

The IMF is discussing a proposal for emergency lending to countries facing severe food-price shocks.

The European Union is checking whether protectionist elements of a $437 billion health, climate and tax law recently passed by the U.S. are in violation of World Trade Organization rules.

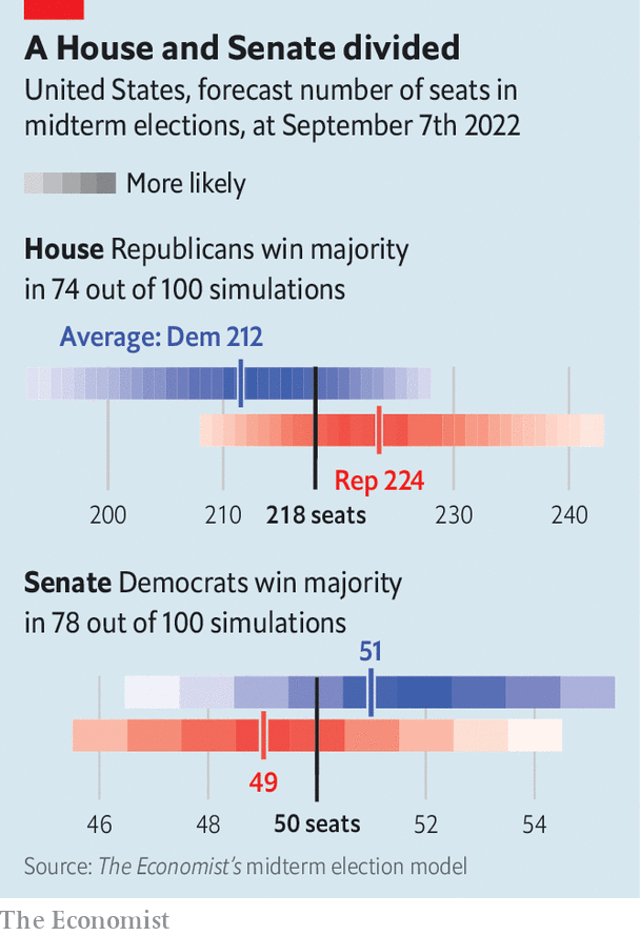

The Democrats are likely to lose the House but keep the Senate according to the Economist magazine’s latest predictions. But after a dismal outcome in recent election guesses, the magazine refined its model. To predict the outcome, each day the Economist’s election model runs 10,000 simulated elections based on polling, demographics, fundraising and historical results. It currently gives the Democrats a 76% chance of holding the Senate, and the Republicans a 74% chance of taking the House. A few months ago the Democrats seemed poised to lose both. Link for details in Politics & Elections.

Election polls do not have a good track record the past several elections, but the Politics & Elections section has a few updates on the matter.

Election Day 2022 is 57 days away. Election Day 2024 is 785 days away.

|

MARKET FOCUS |

Equities today: Global stock markets were mostly firmer overnight. U.S. stock indexes are pointing to higher openings. Investors will be closely watching the consumer price index report for August, scheduled to be released Tuesday, Sept. 13. Consensus estimates expect that inflation has ticked down slightly in the last month. Of note, from now until the Fed's September 20-21 meeting, central bank leaders are in a blackout period, meaning that they're not allowed to comment on policy until the day after the gathering (good news for some if not many investors). That means that stocks will be without the Fed speak that whiplashed them last week. In Asia, Japan +1.2%. Hong Kong closed. China closed. India +0.5%. In Europe, at midday, London +1.3%. Paris +1.2%. Frankfurt +1.5%.

In case you forgot the Fed speak last week: James Bullard and Christopher Waller all signaled their support for another 75-basis point rate hike at the next FOMC meeting. Their Kansas City colleague Esther George said the U.S. inflation rate remains far too high and policy makers have a “clear-cut” case for continuing to remove monetary support.

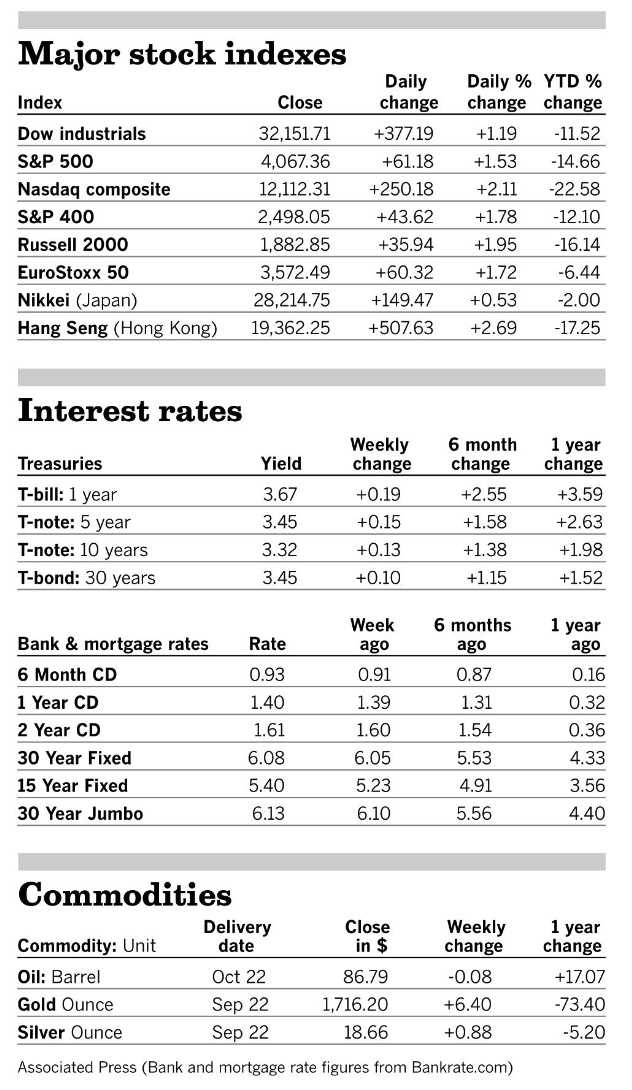

U.S. equities Friday: The Dow added 377.19 points, 1.2%, to 32,151.71. The S&P 500 gained 61.18 points, 1.5%, to 4,067.36 and the Nasdaq rose 250.18 points, 2.1%, to 121,12.31.

For the week, the Dow rose 2.7%, while the S&P 500 climbed 3.6% and the Nasdaq gained 4.1%. The 10-year U.S. Treasury tacked on 12 basis points during the week to end with a yield of 3.32%.

Agriculture markets Friday:

- Corn: December corn futures rose 16 1/2 cents to $6.85, up 19 1/4 cents for the week and the contract’s highest closing price since June 22.

- Soy complex: November soybeans rose 26 1/4 cents to $14.12 1/4, down 8 1/4 cents for the week. October soymeal rose $5.70 to $414.80. October soyoil rose 164 points to 66.68 cents.

- Wheat: December SRW wheat rose 40 1/2 cents to $8.69 1/2, up 58 1/2 cents for the week and the contract’s highest closing price since July 11. December HRW wheat gained 36 1/4 cents to $9.29 1/4. December spring wheat surged 29 1/4 cents to $9.27 1/2.

- Cotton: December cotton rose 100 points to 104.84 cents, up 163 points from a week ago.

- Cattle: October live cattle rose $1.30 to $145.675, up $1.125 for the week and the contract’s highest close since Aug. 17. October feeder cattle gained $1.175 to $185.575, up 62.5 cents for the week.

- Hogs: October lean hogs rose $1.05 to $93.175, up $3.15 for the week and the highest closing price since Aug. 30

Ag markets today: Quiet, two-sided trade was seen overnight as traders awaited USDA’s reports at noon ET. As of 7:30 a.m. ET, corn futures were trading 1 to 2 cents lower, soybeans were 1 to 2 cents higher and wheat futures were narrowly mixed. Front-month crude oil futures were around 50 cents higher and the U.S. dollar index is about 750 points lower.

Technical viewpoints from Jim Wyckoff:

On tap today:

• USDA releases its monthly forecast of production and use of agricultural commodities. (12 p.m. ET)

Treasury Secretary Janet Yellen said she remains hopeful the U.S. economy can avoid recession, but added that Americans understand the need for the Federal Reserve to conquer inflation.

Yellen: Gas prices could spike this winter. Treasury Secretary Yellen on CNN’s State of The Union “said Americans could experience a spike in gas prices in the winter when the European Union significantly cuts back on buying Russian oil, adding that a proposed Western price cap on Russia’s oil exports is being designed to keep prices in check.” Yellen said, “It’s a risk, and it’s a risk that we’re working on the price cap to try to address.” In an online report, CNN quotes Yellen as saying, “This winter, the European Union will cease, for the most part, buying Russian oil. And, in addition, they will ban the provision of services that enable Russia to ship oil by tanker. And it is possible that that could cause a spike in oil prices.” CNN says Yellen’s comments “could help fuel fears that gas prices will spike again after they began sinking last month, providing relief to inflation-weary consumers and an economy mired in a slowdown.”

Britain’s economy grew more slowly than expected in July, preserving the risk of recession. GDP grew by 0.2% in July, a smaller increase than the median forecast of 0.4%. Growth was stagnant over the three months to July compared to the earlier three-month period. Consumer and business activity has been dampened by soaring inflation.

Market perspectives:

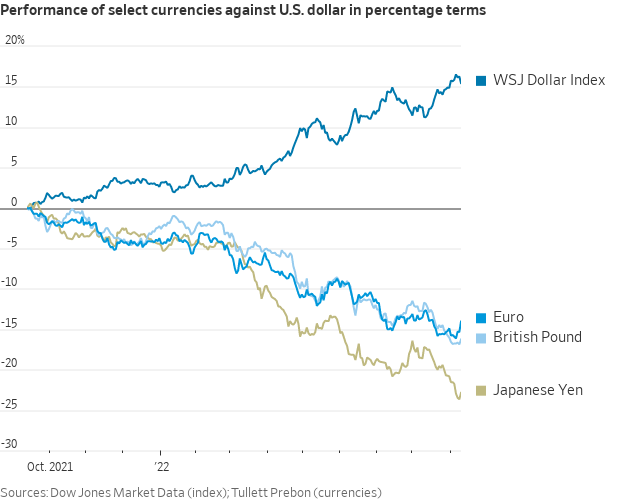

• Outside markets: The U.S. dollar index is solidly lower and hit a two-week low overnight. The yield on the 10-year U.S. Treasury note is fetching 3.298%. As for the dollar, it still has room to run, according to Larry Summers. The former Treasury Secretary called the U.S. a "mecca for capital," partly because the U.S. isn’t dependent on “egregiously expensive foreign energy.” Crude is moving higher, with U.S. crude around $87.50 per barrel and Brent around $93.80 per barrel. Gold and silver futures are seeing solid gains, with gold around $1,739 per troy ounce and silver around $19.38 per troy ounce.

The strong dollar has made imports cheaper for U.S. consumers but it also poses risks to the global economy, the Wall Street Journal reports (link). First, a strong dollar makes emerging market currencies less valuable, pushing up inflation in those countries. Higher inflation forces central banks to raise interest rates faster than they otherwise would, risking recessions around the world. The strong dollar also cuts into profits of U.S. corporations that have significant business abroad. And it could lead governments to intervene directly in currency markets or encourage investors to hoard dollars, which could disrupt financial markets.

• Question to anyone complaining about sky-high fertilizer prices. Did you buy fertilizer company stock? CF Industries shares are up 139% since the end of 2019. They trade at less than six times this year’s projected earnings. Investors are cautious because earnings are broadly expected to peak this year, and no one knows how quickly they will come down. The low estimate has CF earning about $7 a share next year. The high estimate is over $22. Link to Barron’s article on “A Natural-Gas Crisis in Europe Creates a Fertilizer Boom in North America.”

• U.S. rice group responds to India’s moves to curb rice exports. Peter Bachmann of the USA Rice Federation commented about recent moves by India regarding its rice. India announced that all non-basmati and non-parboiled rice exports out of India would incur a 20% export tariff besides the recent ban put in place for exports of broken rice.” In essence, these restrictions will make India, the world’s largest rice exporter, less competitive in the global market and will result in greater inflation of food costs throughout Africa, Asia, and parts of Europe,” Bachmann wrote. “This move by India is not surprising at all,” said Bobby Hanks, rice miller and chair of the USA Rice International Trade Policy Committee. “When you over-subsidize your farmers to the degree India has and you try to take risk out of the production process, you lose the natural resiliency that market-based economies have and it’s difficult for your supply and demand to balance out when there’s weather and market disruptions. If India were a market-based economy, their prices would have never stayed so artificially low for so long and they wouldn’t panic over a small reduction in acreage following a record year for production.” Earlier this summer, the U.S. along with Australia, Canada, Japan, Paraguay, Thailand, and Uruguay initiated consultations with India at the World Trade Organization under the Bali Peace Clause to further investigate India’s trade distorting policies for rice. “We are hopeful that the USTR will continue to take actions toward correcting India’s rice policies, including a full dispute settlement case,” said Hanks. “Every protectionist act like we saw this week is just further manipulating and distorting the global rice market and they control more than 40 percent of it.”

Concludes USA Rice: “Because of India’s artificially low prices, world market prices for rice have remained stagnant throughout the last three years as pandemic and war-related actions caused other commodity prices to skyrocket. As input costs for all crops increased over the last year, U.S. rice farmers never saw a commensurate rise in market prices because of India’s price distortion, which will likely result in tight or negative margins for this crop year.”

India is the world’s top rice exporter and countries had been relying on Indian rice to shore up food supplies after Russia’s invasion of Ukraine reduced wheat exports.

• In California drought, the latest victims are rice farms. Water cuts of more than 80% for many rice farmers have triggered an acreage decline steeper than for any other major crop in the state, hurting businesses that depend on the grain. The dry, hot weather has lingered so long that it is hitting rice farmers in the Sacramento Valley, the WSJ reports (link), ort, leaving companies that serve the business in increasingly precarious financial positions. The struggles among California farmers that typically produce about one-fifth of the U.S. rice crop are part of the deepening impact of a persistent drought in the American West. Farmers in businesses from tomatoes to alfalfa have cut output and changed the way they do business. Rice yields are withering, and U.S. rice exports were down 16% in the first six months of this year. Local farmers and officials say they are worried about the businesses that sell them tractors and seed and store their crops before they are shipped domestically or are exported.

Key quote: “Farmers will farm again when it rains. The question is, will we have the businesses we rely on?” — Tim Johnson, CEO of the California Rice Commission.

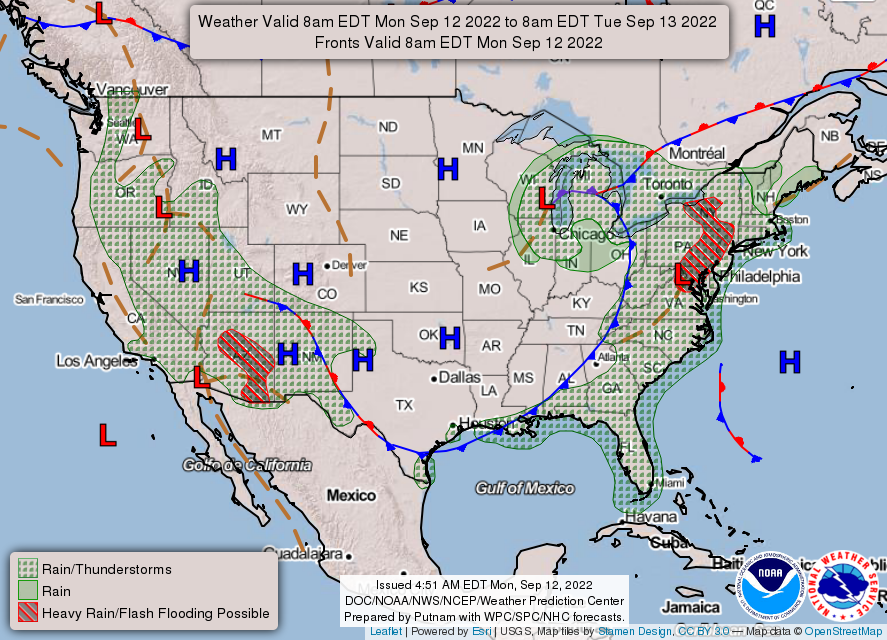

• NWS weather: There are Slight Risks of excessive rainfall over parts of the Upper Midwest/Great Lakes and Mid-Atlantic/Northeast today... ...There is a Slight Risk of excessive rainfall over parts of the Great Basin and Intermountain West on Tuesday... ...Midwest, Southwest and Southeast cool down while Great Plains warms up.

Items in Pro Farmer's First Thing Today include:

• Quiet trade ahead of USDA reports at noon ET

• Drier bias for most areas this week

• France, Romania agree to deal to boost Ukrainian grain exports (details below)

• Ukrainian farmers may cut winter grain acreage by at least 30% (see Russia/Ukraine)

• Followthrough buying expected in cattle futures

• Cash hog index under $100

|

RUSSIA/UKRAINE |

— Summary: Russia admits retreat from key towns in eastern Ukraine after stunning Ukrainian advance. Russia’s Ministry of Defense said it had pulled forces out of Balakliia and Izyum in the Kharkiv region, after a decision to “regroup” and transfer those forces to Donetsk in the south. Ukrainian forces have entered Izium after forcing Russian troops to retreat, an officer involved in the operation to liberate the strategic eastern city told CNN Saturday. Izium, which sits near the border between the Kharkiv and Donetsk regions, had been under Russian occupation for more than five months and had become an important hub for the invading military.

- Russian forces retaliated by attacking civilian infrastructure including power stations and water facilities to deprive people of light and heat, according to Ukrainian officials. Russia denied these motivations. On Monday the mayor of Kharkiv said that power had been restored in Ukraine’s second city after millions of people were said to be disconnected in the Kharkiv and Donetsk regions on Sunday.

- World Bank put the cost of rebuilding Ukraine at $349 billion —more than one and a half times the country’s GDP last year. In the short term, the bank said, $105 billion would be required to prepare for the coming winter and planting season and to repair transport systems, among other necessities. The number of Ukrainians in poverty, or those living on less than $5.50 a day, is projected to rise tenfold, to about a fifth of the population.

- France, Romania agree to deal to boost Ukrainian grain exports. France’s transport minister said on Sunday he would sign an agreement with Romania to help increase Ukrainian grain exports to developing countries including to the Mediterranean. “Tomorrow (Monday), I will sign an accord with Romania that will allow Ukraine to get even more grains out... towards Europe and developing countries, notably in the Mediterranean (countries) which need it for food,” Clement Beaune told France Inter radio, adding the deal covered exports by land, sea and river. According to a draft agreement of the French-Romanian deal, seen by Reuters, Paris would cooperate in developing a project aimed at increasing efficiency at the port of Galati, equipping border points in northern Romania, maximizing the use of grain containers stationed in the port of Constanța as well as increasing the capacity there and in the Sulina canal. It would also help to build a medium-term strategy on the axes of the corridor between Romania and Ukraine and provide pilings to optimize ship traffic. France will also provide funding for the initial technical expertise and work with Bucharest to identify financing.

- Ukrainian farmers may cut winter grain acreage by at least 30%. Ukrainian farmers are likely to cut the winter grain planted area by at least 30% because of a jump in prices for seeds and fuel combined with a low selling prices of their grain, the Ukrainian Agrarian Council (UAC) said on Monday. “The main reasons that encourage agricultural producers to reduce sown areas are the high cost of fertilizers, problems with the sale of grain, as well as too low purchase prices for agricultural products,” UAC said.

|

TRADE POLICY |

— The EU is checking whether protectionist elements of a $437 billion health, climate and tax law recently signed into law are in violation of World Trade Organization rules, according to Trade Commissioner Valdis Dombrovskis.

|

ENERGY & CLIMATE CHANGE |

— A simple way to reduce carbon emissions on family farms. Researchers have found that family farms can reduce their carbon emissions in a very simple way: just give their cows more pasture time. Link for details.

— Agencies will have to find ways of tracking and reporting their downstream carbon emissions, down to the level of their employees’ travel, under a new set of White House instructions. The rules from the Council on Environmental Quality will be especially tricky for large agencies, specialists say.

|

LIVESTOCK, FOOD & BEVERAGE INDUSTRY |

— The IMF is discussing a proposal for emergency lending to countries facing severe food-price shocks, according to Reuters. It would allow the IMF to provide rapid assistance to Ukraine as well as to places affected indirectly by its invasion. Some African countries have been worried about food shortages, though recently the prices of internationally traded staples have actually fallen.

— A heat wave in the Western U.S. is coursing through farming supply chains and into supermarkets. The high temperatures hitting California are damaging crops and shrinking shipments, the Wall Street Journal reports (link), leaving distributors searching for leafy greens and fruits from sources ranging from Canada to Florida. Supermarkets say they are giving less shelf space to products with weather-induced discolorations, bruises or burns. Stores are cutting prices on poor-quality items to avoid getting stuck with them. Produce is highly vulnerable to weather, and this year’s hot temperatures are creating more quality and supply problems. Early heat in Washington reduced the cherry supply this summer, grapes in some regions are growing mold and watermelon season ended earlier on the East Coast. Power conservation efforts in California are reaching shipping operations, with the state suspending a requirement that vessels use cleaner on-shore power while at port berths.

Meanwhile, Kroger says more shoppers are buying groceries at supermarkets as they look to save money and cook more meals at home.

|

CORONAVIRUS UPDATE |

— Summary:

- Global Covid-19 cases at 608,658,933 with 6,514,570 deaths.

- U.S. case count is at 95,250,753 with 1,050,323 deaths.

- Johns Hopkins University Coronavirus Resource Center says there have been 610,686,563 doses administered, 224,367,691 have been fully vaccinated, or 68.10% of the U.S. population.

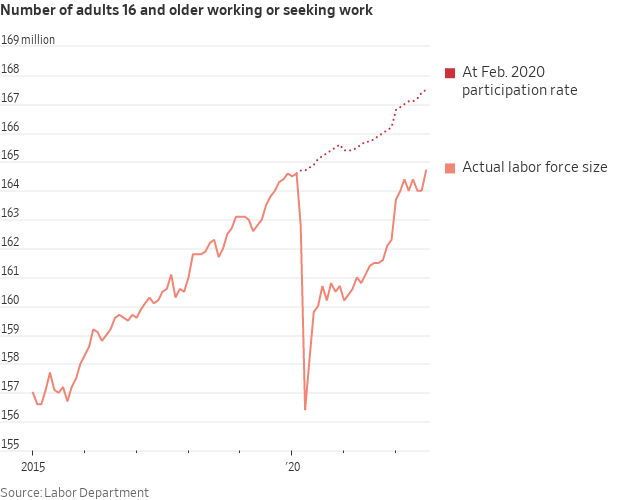

— Covid-19 has kept about 500,000 people out of the U.S. workforce, according to a new study (link). The authors expect that impact to remain as long as the disease continues to sicken people at current rates. Roughly 164.7 million people were in the labor force in August, exceeding the February 2020 level for the first time.

— New Zealand announced that it would be lifting the last of its Covid-19 restrictions. Jacinda Ardern, the prime minister, said that, from Tuesday onwards, vaccine mandates and mask-wearing requirements will be dropped. Meanwhile, in Japan a senior official suggested the government may soon relax restrictions on foreign travelers, as a way to boost the weakening yen.

|

POLITICS & ELECTIONS |

— The Economist recently unveiled its new forecasting model for U.S. midterm elections for Congress. As of September 9, it says, “algorithms think the Republicans are favored to secure a majority in the House of Representatives, but in most iterations see Democrats holding the Senate.” In the House, the model estimates Republicans will win an average of 223 seats in November — one more than the Democrats won in 2020. In the upper body, the average expectation is for Democrats to win 51 seats. “But uncertainty is still high: we give Democrats a one-in-four chance of holding their House majority and see a possibility for Democrats to win as few as 47 (or as many as 55) seats in the Senate. They have a three-in-four chance of keeping the chamber.” Link for details. Link to model.

Perspective: The Economist notes: “Followers of our models will note that polls were not a good predictor of the last election we forecast. Polls conducted in the month before the 2020 House and Senate elections overestimated Democratic candidates’ vote margins by seven percentage points on average. Still, polls remain the best tool we have to predict election outcomes; no other indicator comes close to providing such accurate projections in local races.” With that in mind, the Economist says they have designed a new suite of polling models “to better capture the signal in the noise of survey data.”

— Tight House, Senate Races intensify after busy August. J. Miles Coleman, associate editor of Sabato’s Crystal Ball at the University of Virginia, joined Bloomberg Government’s Emily Wilkins and Greg Giroux on the latest episode of the “Downballot Counts” podcast to discuss the aftermath of the bulk of primaries and the outlook for the general election. Link for details. The 50-50 Senate could go either way while the House is more likely than not to shift to Republican control. Coleman discussed the Crystal Ball’s latest race-rating changes, a string of special House elections in which Democrats performed better than expectations, and the political ramifications of the Supreme Court overruling Roe v. Wade.

— Five issues that will decide the midterm elections, according to The Hill (link for reasons why):

- Inflation

- Abortion

- Former President Trump, Mar-a-Lago and “ultra-MAGA Republicans”

- Immigration

- Biden’s performance

— Canada's opposition Conservatives chose 43-year-old Pierre Poilievre to lead their fight against Justin Trudeau. He inherits a favorable situation as the Liberals battle soaring inflation and an economic slowdown as interest rates surge. Most polls put the parties in a statistical tie.

|

OTHER ITEMS OF NOTE |

— Charles III proclaimed king. The Accession Council, a group of senior officials and politicians that convenes following the death of a monarch, formally proclaimed Charles III king on Saturday morning. King Charles delivered his first address as monarch on Friday evening. He honored the life and service of Queen Elizabeth II and pledged to follow his mother’s example throughout his reign. He said he would step back from some of his charitable duties and announced the elevation of his son, William, as Prince of Wales.

— Chief Justice John Roberts said he’s concerned that criticism of the Supreme Court over controversial decisions has veered into attacks on its legitimacy as an institution. Speaking publicly for the first time since the court eliminated the constitutional right to abortion, Roberts said criticism of rulings is “entirely appropriate,” but that the court’s role doesn’t change when people disagree with its decisions.

Meanwhile, the Supreme Court will reopen its proceedings to the public for the first time since the start of the Covid-19 pandemic when its new term starts in October, Roberts also signaled.

— President Biden and Japanese Prime Minister Fumio Kishida are considering holding a meeting in New York later this month to discuss issues including China, Taiwan and Russia’s invasion of Ukraine, the Sankei reported.

— The U.S. announced $40 million in funding for Sri Lanka to provide fertilizer and cash for farmers in a nation dealing with an acute shortage of essential items.

|

KEY LINKS |

WASDE | Crop Production | USDA weekly reports | Crop Progress | Food prices | Farm income | Export Sales weekly | ERP dashboard | California phase-out of gas-powered vehicles | RFS | IRA: Biofuels | IRA: Ag | Student loan forgiveness | Russia/Ukraine war, lessons learned | Election predictions: Split-ticket | Congress to-do list |