IMF: Growth Slows as Economies Grapple with Supply Disruptions, Inflation, Record Debt

SCOTUS to review WOTUS | Rural infrastructure funding | Dakota Access Pipeline impacts

|

In Today’s Digital Newspaper |

Market Focus:

• IMF: Growth slows as economies grapple with supply disruptions, inflation, record debt

• Rising prices are hitting food supply chains; fertilizer costs weighing on farmers

• South Korea’s economy grew by 4% in 2021, fastest pace of expansion in 11 years

• Prices of lithium carbonate have quintupled in China from a year earlier

• Ag demand update

• Wheat extends Monday’s gains

• Heightened attention on Russia/Ukraine situation

• HRW wheat deteriorates more

• Consultant maintains Brazil & Argentine crop estimates, lowers Paraguay soybean

• Neutral Cold Storage data

• Beef prices rise, but movement slows

• Cash hog index rises again

Policy Focus:

• CFAP 2 payouts marginally changed

• Supreme Court to review WOTUS issue

• Justice Department’s new antitrust chief favors filing lawsuits

• Rural infrastructure funding to be announced Wednesday

China Update:

• China Evergrande asked international creditors to give it more time

• China’s feed wheat use to fall sharply

• China to allow gene-edited crops in push for food security

Trade Policy:

• Biden admin. reviewing nationalist energy policies of Mexico

Energy & Climate Change:

• Lawmakers who support rival petroleum and ethanol industries joined forces

• Axios takes a look at Dakota Access Pipeline impacts

Livestock, Food & Beverage Industry Update:

• Biden competition council meets, meat industry again flagged as a problem

• New dairy export group formed

Coronavirus Update:

• Biden administration will not be enforcing federal employee vaccine mandate

• New York judge blocks state’s mask mandate

Politics & Elections:

• Supreme Court OKs proxy votes in House

• President Biden cursed at a reporter

Other Items of Note:

• U.S. orders 8,500 troops on heightened alert amid Russia concerns

|

MARKET FOCUS |

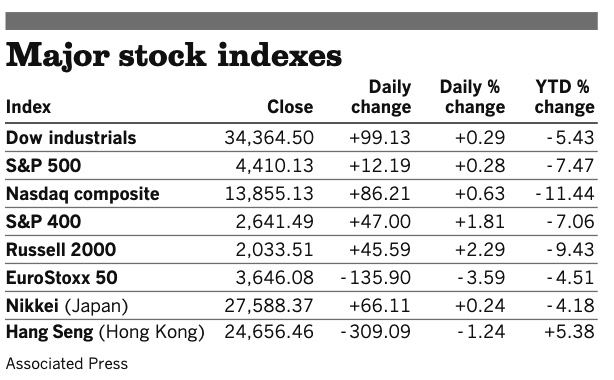

Equities today : Japan’s benchmark Topix index entered correction territory, closing 10% below its high in September. Markets in Hong Kong and South Korea also finished lower. Global stock markets were mixed overnight, with Asian shares mostly down and European shares mostly up. U.S. Dow opened around 300 points lower. Asian equities finished with losses despite the late U.S. rise on Monday that brought U.S. markets back into positive territory. The Nikkei fell 457.03 points, 1.66%, at 27,131.34. The Hang Seng Index was down 412.85 points, 1.67%, at 24,243.61. European equities are registering gains in rather volatile early trade activity. The Stoxx 600 was recently up 0.8% with regional markets up 0.4% to 1.1%.

U.S. equities yesterday: All three major indices reversed course after midday, slowly pulling off their session lows to eventually end in positive territory after having registered sizable declines during the session. The Dow rose 99.13 points, 0.29%, at 34,364.50. The Nasdaq was up 86.21 points, 0.63%, at 13,855.13. The S&P 500 finished up 12.19 points, 0.28%, at 4,410.13.

On tap today:

• S&P/Case-Shiller 20-city home-price index for November is expected to rise 18% from one year earlier. (9 a.m. ET)

• International Monetary Fund releases its World Economic Outlook update at 9 a.m. ET. See item below for details.

• Conference Board's consumer confidence index is expected to fall to 111.7 in January from 115.8 one month earlier. (10 a.m. ET)

• Richmond Fed's manufacturing survey is expected to tick down to 15 in January from 16 one month earlier. (10 a.m. ET)

• FOMC: Federal Reserve begins its two-day policy meeting.

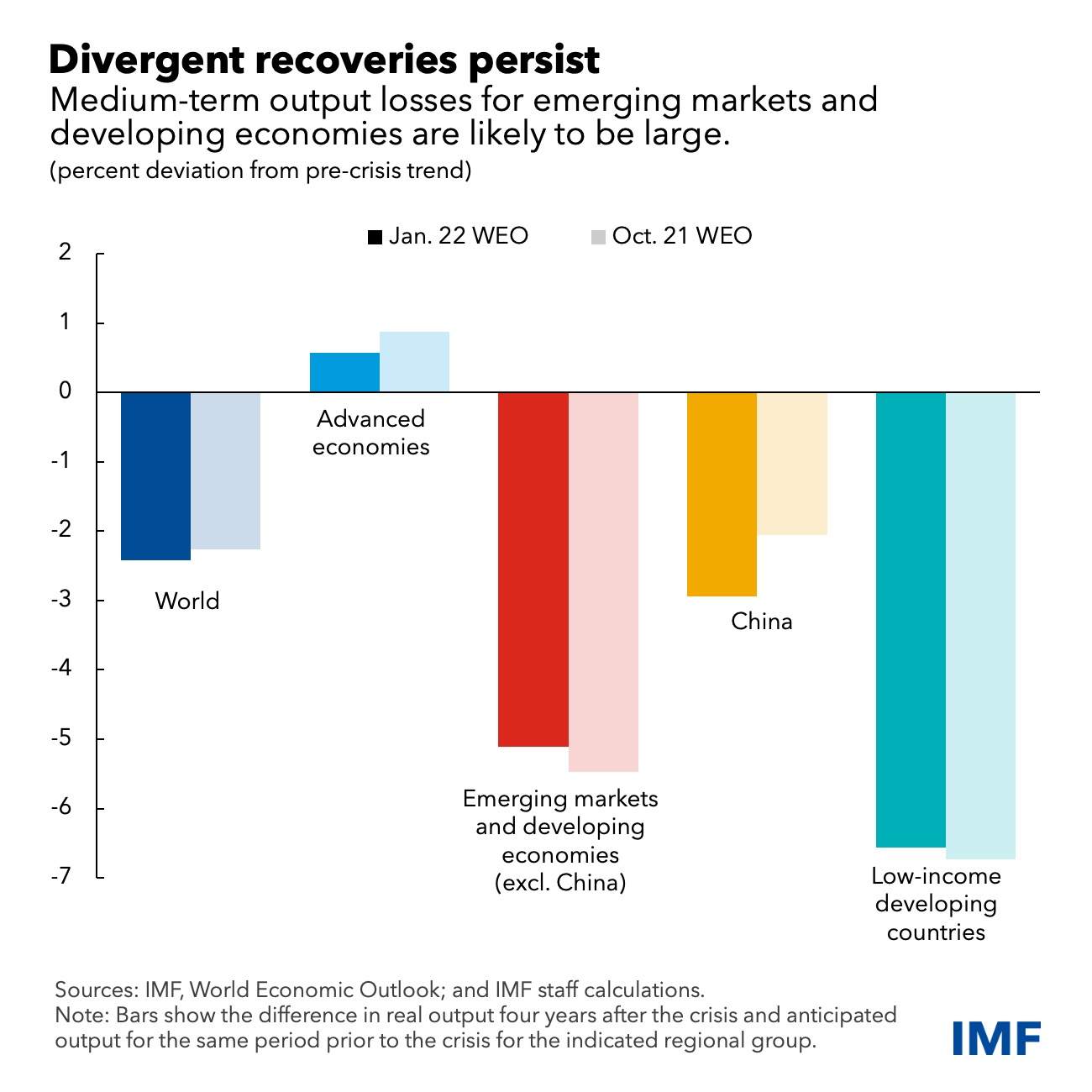

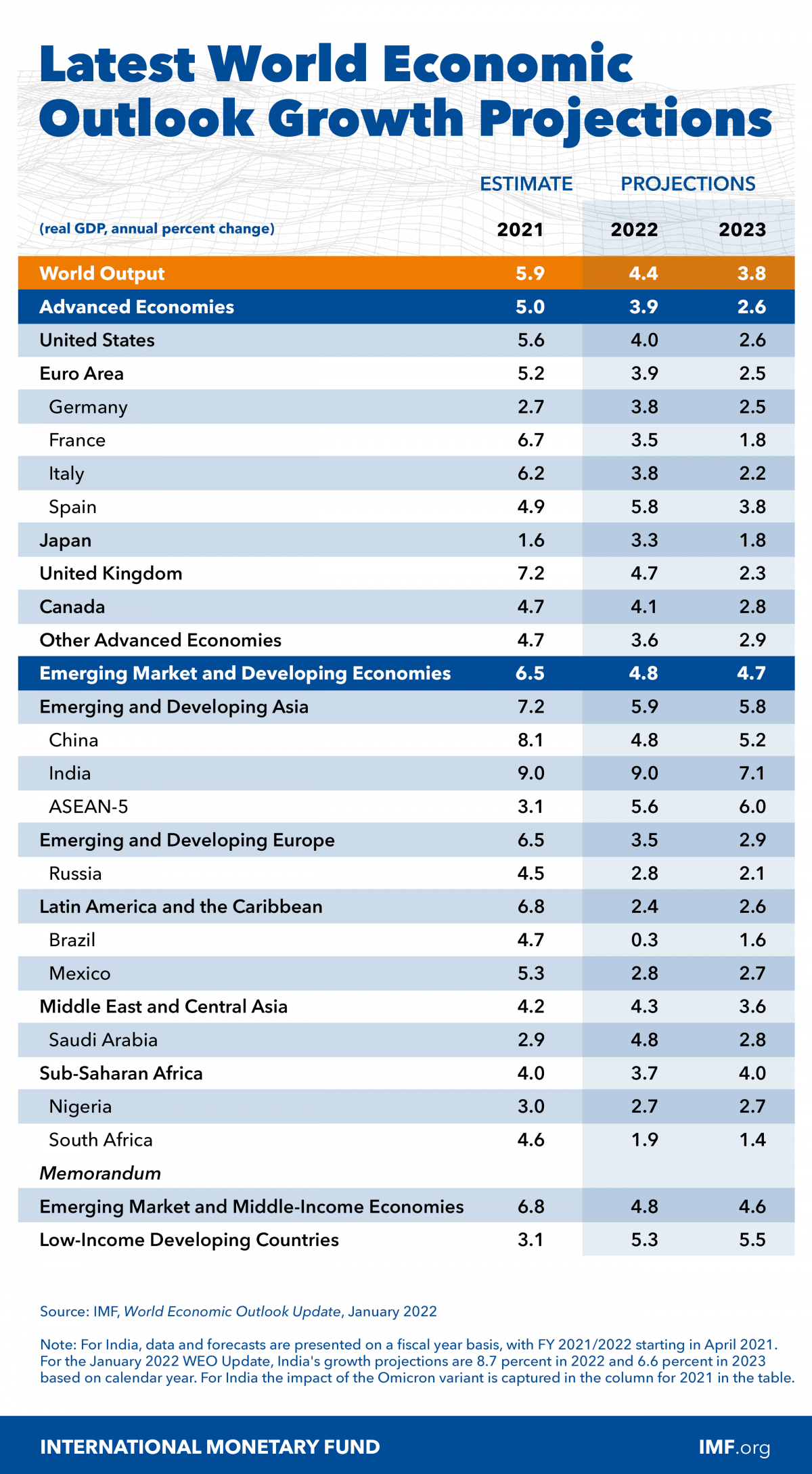

IMF: Growth slows as economies grapple with supply disruptions, inflation, record debt. The continuing global recovery faces multiple challenges as the pandemic enters its third year, the International Monetary Fund (IMF) said in a report today. The rapid spread of the Omicron variant has led to renewed mobility restrictions in many countries and increased labor shortages, it noted. Meanwhile, supply disruptions still weigh on activity and are contributing to higher inflation, adding to pressures from strong demand and elevated food and energy prices. Moreover, record debt and rising inflation constrain the ability of many countries to address renewed disruptions.

Some challenges, however, could be shorter lived than others. The new variant appears to be associated with less severe illness than the Delta variant, and the record surge in infections is expected to decline relatively quickly. The IMF’s latest World Economic Outlook anticipates that while Omicron will weigh on activity in the first quarter of 2022, this effect will fade starting in the second quarter.

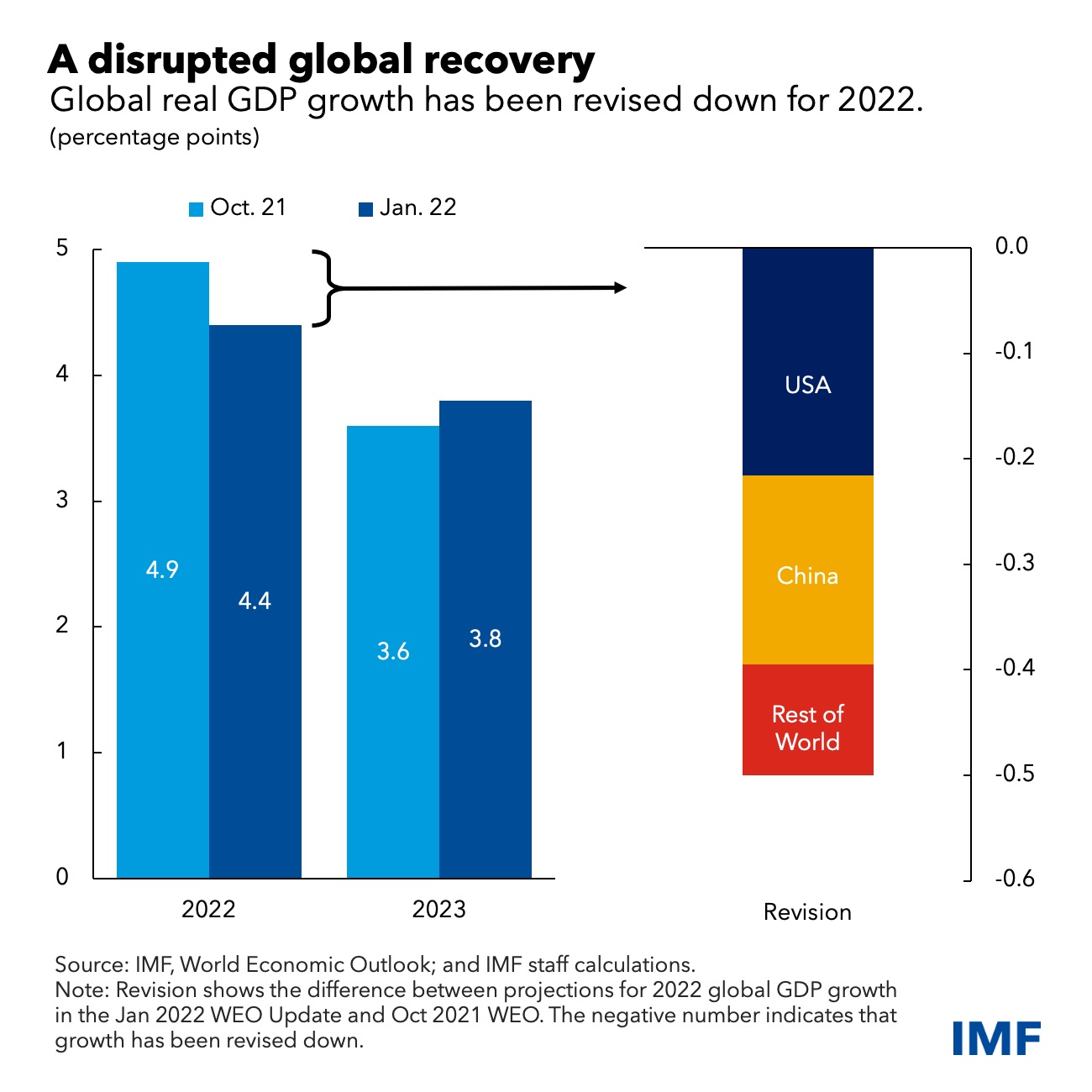

Other challenges, and policy pivots, are expected to have a greater impact on the outlook. IMF projects global growth this year at 4.4%, 0.5 percentage point lower than previously forecast, mainly because of downgrades for the United States and China. “In the case of the United States, this reflects lower prospects of legislating the Build Back Better fiscal package, an earlier withdrawal of extraordinary monetary accommodation, and continued supply disruptions. China’s downgrade reflects continued retrenchment of the real estate sector and a weaker-than-expected recovery in private consumption. ”Supply disruptions have led to markdowns for other countries too, such as Germany. IMF expects global growth to slow to 3.8% in 2023. This is 0.2 percentage point higher than in the October 2021 WEO and largely reflects a pickup after current drags on growth dissipate.

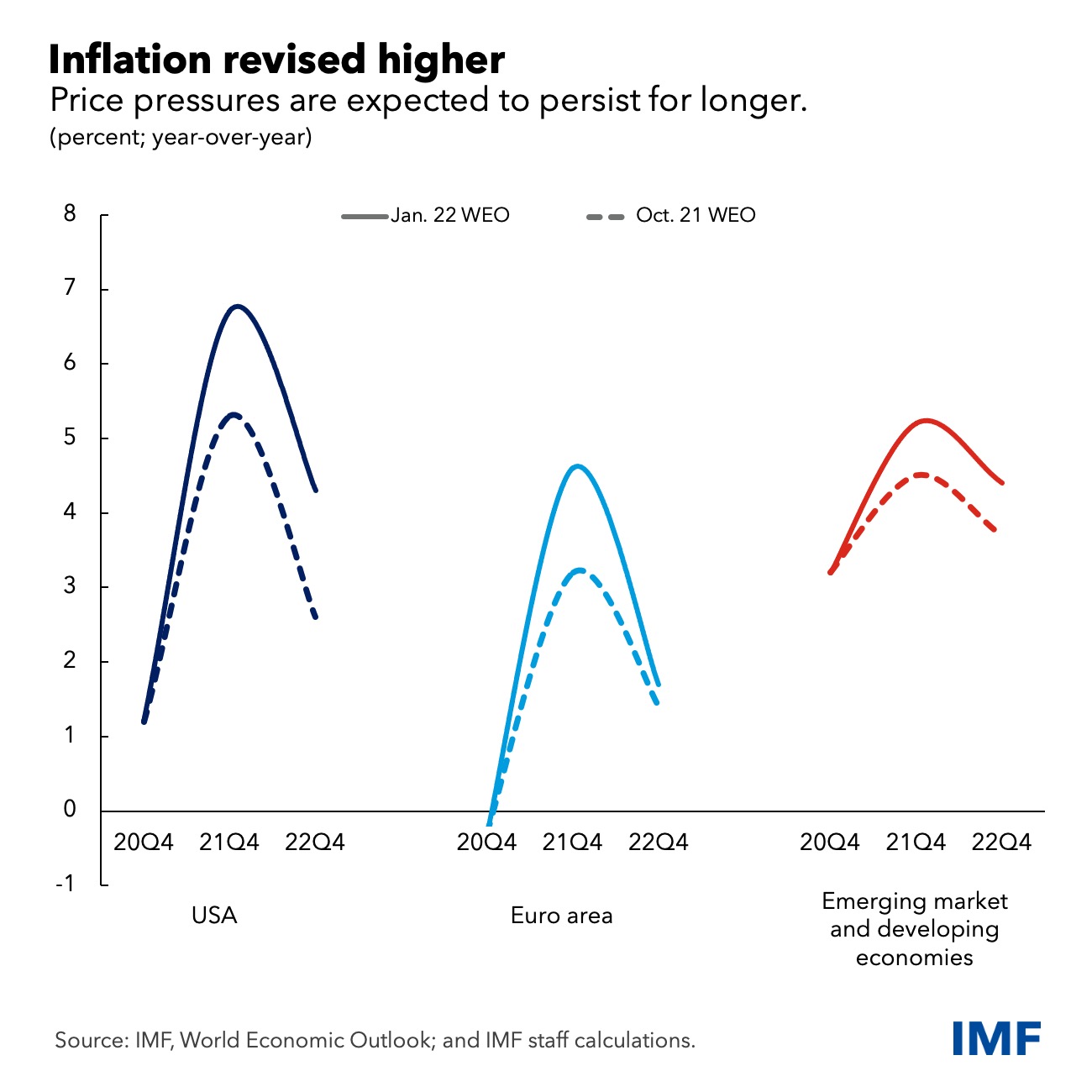

IMF revised up its 2022 inflation forecasts for both advanced and emerging market and developing economies, with elevated price pressures expected to persist for longer. Supply-demand imbalances are assumed to decline over 2022 based on industry expectations of improved supply, as demand gradually rebalances from goods to services, and extraordinary policy support is withdrawn. Moreover, energy and food prices are expected to grow at more moderate rates in 2022 according to futures markets. Assuming inflation expectations remain anchored, inflation is therefore expected to subside in 2023.

Rising prices are hitting food supply chains and high fertilizer costs are weighing on farmers across the developing world, the Wall Street Journal reports (link), making it much more expensive to cultivate crops from avocado and corn to coffee. That is forcing many farmers to cut back on production, signaling global food-price bills could go higher this year after hitting decade highs in 2021. The sector is being hit in part by global energy costs, which can flow through into fertilizer prices. Major fertilizer producers including China, Turkey, Egypt and Russia have also curbed exports, further dimming supplies. Farmers in the U.S. are feeling the pinch, but the impact is likely worse in developing countries, where small farmers have limited access to bank loans. Rising prices and diminished food shipments would exacerbate hunger, which is already acute in some parts of the world.

South Korea’s economy grew by 4% in 2021, the fastest pace of expansion in 11 years. Growth was driven by greater exports and construction activity which more than made up for the slow recovery in the covid-hit services sectors. The South Korean central bank expects exports to continue to power growth in 2022.

Market perspectives:

• Outside markets: The U.S. dollar index is moving higher as the two-day U.S. Fed meeting starts with the euro and British pound both weaker against the U.S. currency. The yield on the 10-year U.S. Treasury note is slightly weaker, trading around 1.76%, with a positive tone in global government bond yields. Gold and silver futures are under pressure ahead of U.S. market action, with gold around $1,839 per troy ounce and silver around $23.73 per troy ounce.

• Crude oil futures are seeing choppy trade, with U.S. crude around $83.30 per barrel and Brent around $86.50 per barrel. Futures had been higher in Asian action, with U.S. crude rising 38 cents at $83.69 per barrel and Brent up 52 cents at $86.79 per barrel.

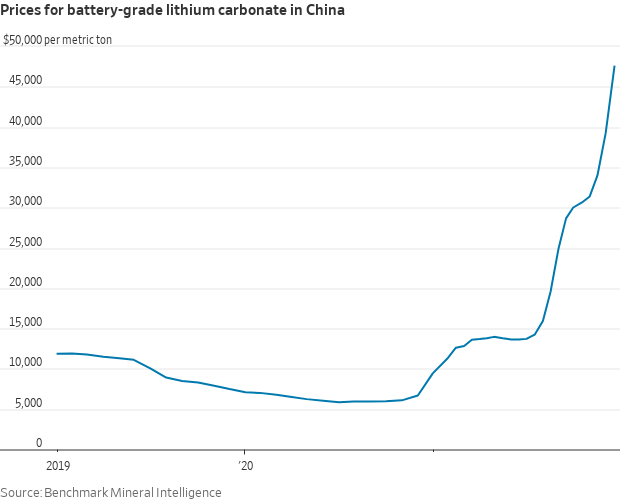

• Prices of lithium carbonate have quintupled in China from a year earlier, and other battery materials from nickel to cobalt have also been rising and could remain elevated as new supply will take time to come online. Shortages also are flaring in some lesser known battery components, adding to the risks of concentration in electric-vehicle supply chains already dominated by China. That has made securing material supplies more important as car makers seek to ensure they can keep production lines moving.

• Ag demand: Iran tendered to buy up to 60,000 MT each of corn, soymeal and feed barley from unspecified origins. Japan is seeking 47,841 MT of Australian wheat in its weekly tender.

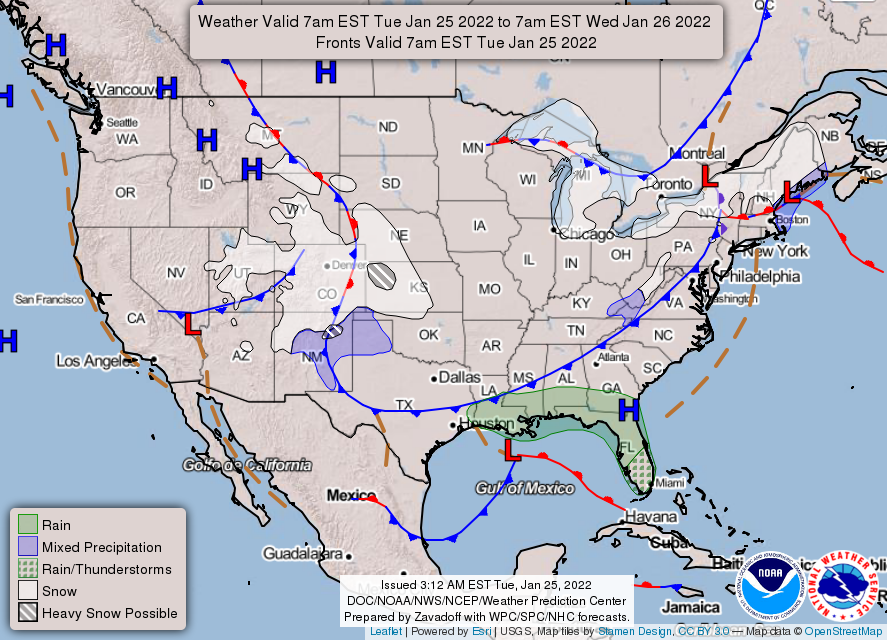

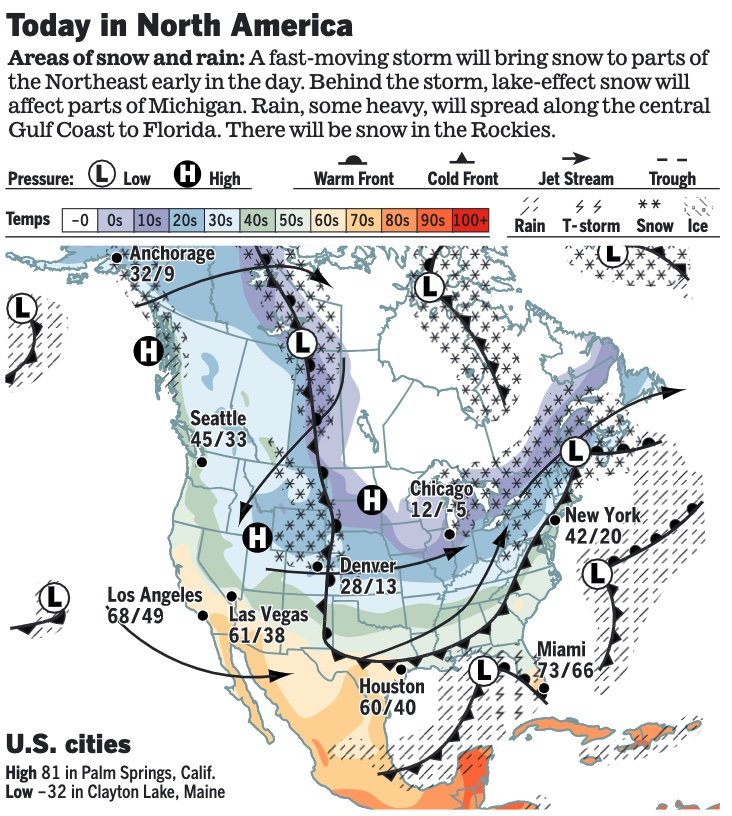

• NWS weather: Light to moderate snow will move through New England today before a clipper system exit the region tonight... ...Showers across the Gulf Coast states will spread into Florida later today... ...Arctic air will plunge into the eastern two-thirds of the country with a round of snow today across the central/southern Rockies and High Plains.

Items in Pro Farmer's First Thing Today include:

• Wheat extends Monday’s gains

• Heightened attention on Russia/Ukraine situation

• HRW wheat deteriorates more

• Consultant maintains Brazil & Argentine crop estimates, lowers Paraguay soybean

• Neutral Cold Storage data

• Beef prices rise, but movement slows

• Cash hog index rises again

|

POLICY FOCUS |

— CFAP 2 payouts marginally changed. Payouts under the Coronavirus Food Assistance Program 2 (CFAP 2) remained at $19.07 billion as of Jan. 23, with original CFAP 2 payouts at $14.24 billion and the top-up payments edged up to $4.83 billion ($4.82 billion prior). CFAP 1 payments were unchanged at $11.76 billion as of January 23, including $10.57 billion in original CFAP 1 payments and $1.19 billion in top-up payments.

— Supreme Court to review WOTUS issue. The justices said Monday that they will consider, probably in the term beginning in October, a long-running dispute involving an Idaho couple who already won once at the Supreme Court in an effort to build a home near Priest Lake. The Environmental Protection Agency says there are wetlands on the couple’s roughly half-acre lot, which brings it under the jurisdiction of the Clean Water Act, and thus requires a permit. Justices will hear the case even though the Biden administration is writing a new definition of the upstream reach of the clean water law.

The Supreme Court could issue a new decision outlining the scope of Clean Water Act jurisdiction as the court announced it will review a decision from the 9th U.S. Court of Appeals that accepted former Supreme Court Justice Anthony Kennedy’s test in the Rapanos case in 2006. That was a split decision that wetlands and other waters fall under federal jurisdiction if they possess a “significant nexus” to navigable waters. In accepting the case, the Supreme Court said it would consider whether the Ninth Circuit U.S. Court of Appeals used “the proper test for determining whether wetlands are ‘waters of the United States.'”

The petition was filed by an Idaho couple, Chantell and Michael Sackett, who dispute EPA’s determination that an area of their property is wetlands. The case involves a roughly 15-year-long dispute between EPA and Chantell and Mike Sackett. The couple owns a residential lot which EPA determined to be wetlands falling under CWA jurisdiction and ordered them to revert work to fill and level the land in preparation to build a new home.

The Sacketts are being represented by the Pacific Legal Foundation (PLF) and are being supported by a coalition of 21 states and a slew of business and conservative interest groups. Damien Schiff, a Pacific Legal Foundation lawyer, said the Sackett case “is emblematic of all that has gone wrong with the implementation of the Clean Water Act. The Sacketts’ lot lacks a surface water connection to any stream, creek, lake, or other water body, and it shouldn’t be subject to federal regulation and permitting.”

American Farm Bureau Federation (AFBF) President Zippy Duvall said his group was “pleased that the Supreme Court has agreed to take up the important issue of what constitutes ‘Waters of the US’ under the Clean Water Act,” and hopes the case “will bring more clarity” to the regulations. Given the high court’s decision to hear the case, the group urged EPA “to push pause on its plan to write a new WOTUS rule until it has more guidance on which waters fall under federal jurisdiction.”

The Biden administration moved to scrap the Trump-era Navigable Waters Protection Rule (NWPR), which abandoned the “significant nexus test,” and instead largely adopted the approach detailed by Justice Scalia in Rapanos. The administration has proposed rolling back WOTUS to an updated version of its pre-2015 definition — to include waters with a significant nexus to traditionally navigable waters — while the agency works on a broader rewrite in a second rulemaking. The outcome of the Sackett’s case could have major implications for the ongoing WOTUS rulemakings.

— Justice Department’s new antitrust chief favors filing lawsuits to block problematic mergers rather than accept settlements that allow companies to proceed with their deals. Jonathan Kanter said last night at a New York Bar Association event that the settlements that are frequently negotiated with government antitrust officials often suffer from “significant deficiencies” and fail to protect competition in markets.

— Rural infrastructure funding. USDA Deputy Secretary Jewel Bronaugh is to announce more than $1 billion for rural infrastructure projects during a visit to an Alabama hospital on Wednesday.

|

CHINA UPDATE |

— China Evergrande asked international creditors to give it more time to get a grip on its complicated financial situation, warning that legal action could be destabilizing.

— China’s feed wheat use to fall sharply. China’s use of wheat in feed rations is expected to be far below year-ago levels, due to increased corn supplies, reduced corn prices and higher wheat prices. New government restrictions prohibiting wheat sold from state stockpiles to be used by feed producers will also slash demand for wheat as a feedstock. Feed wheat use could fall to between 10 MMT and 24 MMT in 2021-22, down from more than 40 MMT the previous year, according to Reuters.

— China to allow gene-edited crops in push for food security. China has published trial rules for the approval of gene-edited plants as it seeks to bolster its food security. The new guidelines published by China’s ag ministry come amid a raft of measures aimed at overhauling its seed industry, seen as a weak link in efforts to ensure the country can feed the world’s biggest population. The draft rules stipulate that once gene-edited plants have completed pilot trials, a production certificate can be applied for, skipping the lengthy field trials required for the approval of genetically modified crops. Beijing has also recently passed new regulations that set out a clear path for approval for GMO crops.

|

TRADE POLICY |

— Biden admin. reviewing nationalist energy policies of Mexico to see how they relate to the country’s commitments to their 2020 North American deal (USMCA). The Office of the U.S. Trade Representative and the departments of Commerce and Energy “remain committed to ensuring fair treatment for U.S. exporters and investors,” the agency’s leaders said in a letter to Rep. Buddy Carter (R-Ga.).

Meanwhile, Energy Secretary Jennifer Granholm said Mexico signaled “openness” to resolving U.S. concerns over legislation favored by Mexican President Andres Manuel Lopez Obrador that would hand more control over its power sector to national power utility the Comision Federal de Electricidad (CFE). Granholm met with Lopez Obrador Friday (Jan. 21) during a visit to Mexico, and afterwards he said the Mexican gov’t would handle energy disputes with companies affected by the reform legislation on a “case by case” basis.

"There was receptivity to what we were saying, in the same way that I was receptive to hearing the explanation for why this law was put forward," Granholm told Reuters regarding U.S. concerns about the bill, which critics fear will slow investment in renewable energy and dent cross-border cooperation. “I think there is an openness for resolution, and I hope that that happens." Granholm said she conveyed U.S. concerns that “the current and the proposed energy policies are really inconsistent with the shared vision for North American cooperation and global competitiveness.”

|

ENERGY & CLIMATE CHANGE |

— Lawmakers who support rival petroleum and ethanol industries joined forces to oppose the administration’s push to electrify the federal vehicle fleet, marking a rare moment of unity between oft-warring interests. Fifty Republicans — including 17 from oil-rich Texas and 21 from the U.S. Corn Belt — warned Biden that his executive order requiring the federal government to purchase only zero-emission vehicles risks forfeiting climate progress and will make the U.S. dangerously dependent on China.

— Axios takes a look at Dakota Access Pipeline impacts. The news outlet says Iowa's soil in the right-of-way of the Dakota Access Pipeline is still recovering roughly six years after the project was installed. The nearly 1,200-mile Dakota underground pipeline cuts diagonally across Iowa to an oil terminal near Patoka, Illinois. It went into service in 2017.

Highlights of Axios’ report:

- Three companies are proposing new pipeline projects that would cross Iowa to capture carbon dioxide from ethanol and fertilizer plants. Environmental impacts and the future of agriculture in the area are under debate.

- During the two crop seasons after the Dakota Access Pipeline's installation in 2016, crop yields in the right-of-way of the project fell as much as 25%, according to an Iowa State University study published late last year. Recovery is ongoing, researchers found.

- The project caused severe subsoil compaction and impaired soil structure that can discourage root growth and reduce water infiltration, ISU researchers concluded.

- The three proposed carbon pipelines may not be as big or deeply trenched. If that's the case, it could help minimize yield losses, Mehari Tekeste, an assistant agriculture professor who led the study at ISU, told Axios.

- Navigator CO2 Ventures — whose proposal includes areas in northern Polk County — is confident that crop losses would be short term due to a restoration process, spokesperson Andrew Bates told Axios.

- Farmers will get a 240% reimbursement for yield losses throughout the life of the Navigator project, Bates said. But Keokuk County farmer Steve Roquet told Axios that Dakota Pipeline officials made him a similar 240% reimbursement promise in 2016. But it's calculated in such a way that it fails to fully cover losses, he said.

|

LIVESTOCK, FOOD & BEVERAGE INDUSTRY |

— Loose labeling practice on beef has grabbed President Biden’s attention as he and anti-trust regulators set their sights on giant meatpacking conglomerates. Hamburger or a steak marked “Product of the USA” may contain beef from cattle raised as far away as Australia. The long-simmering fight over the label, which consumer advocates and ranchers consider misleading, generates grievances among cattle producers over the lopsided market power of the four companies that control 85% of U.S. beef-processing. Producers have been growing increasingly frustrated at the diminished share they receive of soaring grocery-store prices even as they grapple with drought and higher feed costs. Biden yesterday said his administration’s efforts to discourage greater corporate consolidation would help tame inflation.

At a meeting with economic advisers the White House has dubbed his Competition Council, Biden said his administration plans to combat non-compete clauses one in five workers are asked to sign, even when they’re not given access to particularly sensitive information about their employers. The council was formed to help enact an executive order on competition Biden signed in July. His administration has also worked with ports, truckers and labor unions to ease supply-chain bottlenecks that have contributed to rising prices, though the president’s top economic advisers concede the government can’t do much to influence the basic forces of supply and demand.

— New dairy export group formed. The International Dairy Foods Association (IDFA), the Port of Los Angeles, and CMA CGM announced the formation of a Dairy Exports Working Group, focused on identifying and addressing supply chain issues hampering U.S. dairy product exports. Their focus will be on West Coast ports were the majority of U.S. dairy product exports originate. They will also look at efforts to streamline the movement of products from the interior of the United States to the West Coast.

The group seeks to find ways to aggregate and streamline U.S. dairy exports from multiple suppliers, increase rail availability in interior locations to get product to West Coast ports, see if a “fast lane” concept for vessels agreeing to depart full or with fewer empty cargo containers is a viable option, set terms for exporters using empty containers and set guarantees to fix and surpass “ghost bookings.”

|

CORONAVIRUS UPDATE |

— Summary: Global cases of Covid-19 are at 355,250,899 with 5,606,299 deaths, according to data compiled by the Center for Systems Science and Engineering at Johns Hopkins University. The U.S. case count is at 71,709,180 with 868,512 deaths. The Johns Hopkins University Coronavirus Resource Center said that there have been 535,307,175 doses administered, 210,459,963 have been fully vaccinated, or 64.11% of the U.S. population.

— Biden administration says it will not be enforcing the federal employee vaccine mandate amid ongoing litigation, after a Texas federal judge on Friday blocked the enforcement of the vaccine mandate for government employees. The move comes after the judge called the mandate an overstep of presidential authority, while striking down a separate mandate that had applied to private sector workers.

USDA will not enforce the White House order for federal employees to be vaccinated against Covid-19 while a court appeal is pending, said a spokesman on Monday. USDA “will not take any action to implement or enforce the vaccination requirement” until there is a resolution of the court case challenging the order, said the USDA spokesman. “This includes pausing all activities related to processing exemption requests and any disciplinary actions.” As of Jan. 19, 88.6% of USDA employees are vaccinated and 9.7% have requested a medical or religious exemption, said the spokesman. The overall compliance rate of 98.3% indicated that 1.7%, or 1,300 of USDA’s 75,962 permanent employees, had not received at least one inoculation against the coronavirus or requested a waiver. USDA Secretary Tom Vilsack told the House Agriculture Committee last week that “we’re…encouraging them to either get vaccinated or to request accommodation and they still have time to do that.”

— A New York judge blocks the state’s mask mandate. The rule requiring masks at all indoor public places was enacted unlawfully because it hadn’t been approved by state lawmakers, the judge ruled.

|

POLITICS & ELECTIONS |

— Supreme Court OKs proxy votes in House. The Supreme Court on Monday said it turned down an appeal from House Minority leader Kevin McCarthy (R-Calif.) seeking to strike down a rule set by House Democrats that allows members to cast proxy votes during the pandemic. Without comment or dissent, the court dismissed the case of McCarthy vs. Pelosi and let stand a special rule set by the House when some members feared traveling to Washington. Lawyers for the House had urged the high court to turn down the case. They said the rule on proxy votes was adopted when it became apparent early in the pandemic that it was unsafe to travel. They also quoted the Constitution: “Each House may determine the rules of its proceedings.”

— President Biden cursed at a reporter who asked him about the potential political consequences of inflation at a White House event on Monday. Biden’s comments came after Peter Doocy, a White House correspondent for Fox News, asked the president if inflation would be a political liability ahead of the midterm elections. “No — that’s a great asset,” Biden deadpanned. Doocy, appearing later on Sean Hannity’s Fox program, said Biden had called to apologize. “He cleared the air, and I appreciate it,” Doocy added. “We had a nice call.”

|

OTHER ITEMS OF NOTE |

— U.S. orders 8,500 troops on heightened alert amid Russia concerns. The Pentagon ordered 8,500 troops on higher alert Monday to potentially deploy to Europe as part of a NATO “response force” amid growing concern that Russia could soon make a military move on Ukraine. President Biden consulted with key European leaders, underscoring U.S. solidarity with allies there, despite reluctance from Germany.

Biden administration officials said a final decision had not been made about whether to dispatch troops, but 8,500 U.S.-based soldiers and other personnel specializing in reconnaissance, intelligence, aviation and transportation were being placed on heightened readiness to be dispatched to Europe if needed. Biden has thus far ruled out putting American troops in Ukraine but has signaled a willingness to use U.S. military personnel to bolster NATO forces if requested.

French and German leaders are scheduled to meet later today in Berlin to discuss the situation.

Biden and Secretary of State Antony Blinken pledged to “impose massive consequences and severe economic costs” on Russia for any “additional aggression” against Ukraine. One possible measure would be booting Russia from international banking transactions. While such an action would be devastating to Moscow, it would also hurt its European trade partners.

Separately, the U.S. is keeping a close eye on potential Russian cyberattacks, which the Department of Homeland Security warned could occur if Moscow perceives that a U.S. or NATO response to a potential Russian invasion of Ukraine would threaten Russia's long-term national security.

Russia still expects to receive written U.S. responses to its security demands this week, after which it will decide on prospects for future diplomacy. Among other things, Russia is demanding that NATO pull back military infrastructure from its periphery, something the alliance has so far refused to do.

The Biden administration plans to hold two classified briefings today for congressional leadership aides and committee staff on Ukraine, Punchbowl news reported. The administration is also working on briefings for all members of the House and Senate when Congress returns next week, according to Punchbowl. Both House Speaker Nancy Pelosi (D-Calif.) and Senate Majority Leader Chuck Schumer (D-N.Y.) yesterday requested briefings from the White House for all members.

Market impacts: With fears of a conflict between Russia and Ukraine rising, this is threatening the energy supply in Europe, which is already coping with soaring natural gas prices, rattling companies that do business there. As for potential ag market impacts, any invasion is seen as initially being bullish for corn and wheat futures because Ukraine sells both crops to China; others, however, say they would see any market uptick as an opportunity to sell those commodities.