U.S. Gov’t Backs NPPC, Farm Bureau in Prop 12 Supreme Court Case to be Heard Oct. 11

WSJ survey accelerates odds of U.S. recession but Biden, Yellen say it is ‘not inevitable’

|

In Today’s Digital Newspaper |

Ukrainian troops are resisting a heavy Russian offensive in and around the city of Severodonetsk in the Luhansk region, despite the continued bombardment from several directions, according to the Ukrainian military. Meanwhile, Russian journalist Dmitry Muratov auctioned off his Nobel Peace Prize medal, raising $103.5 million to support Unicef’s humanitarian response to the war in Ukraine.

Russia’s blockage of Ukrainian grain exports continue with new crop supplies facing already filled storage facilities.

Ukrainian President Volodymyr Zelensky said on Monday that Ukraine is moving along the path to becoming part of the European Union. The EU is deciding this week whether the country should be formally considered for candidate status.

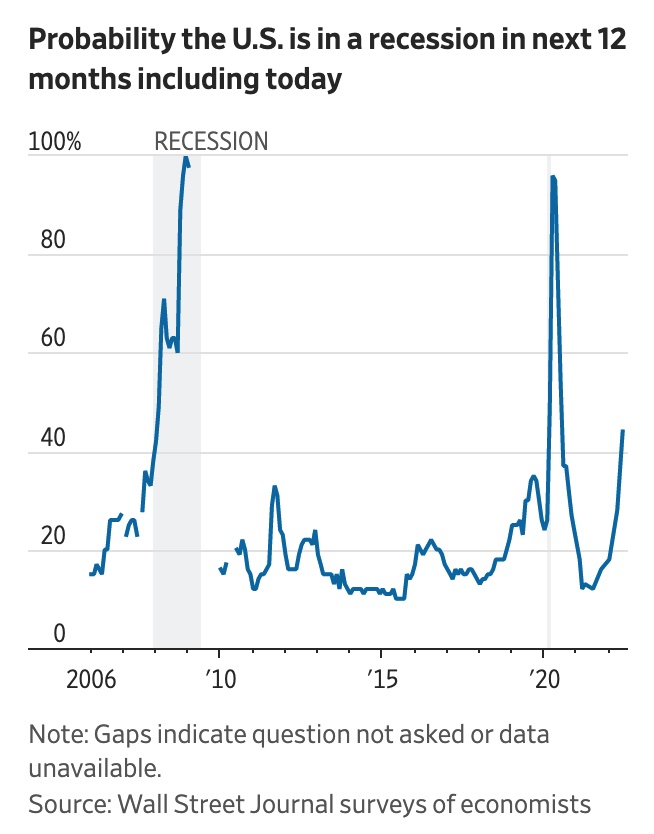

Elon Musk, Nouriel Roubini and Goldman Sachs Group Inc. are all warning of the growing risk of a recession in the U.S.. Meanwhile, President Joe Biden has weighed in on the debate, saying that a contraction isn't "inevitable" following a conversation with former Treasury Secretary Lawrence Summers. Treasury Secretary Janet Yellen also said recession isn’t inevitable, despite rising borrowing costs, high inflation, and energy price shocks hitting American consumers. The economy will slow, she said on Sunday, and transition to steady and stable growth. Meanwhile, a Wall Street Journal survey of economists in June found that 44% expect a recession in the next year. That is a dramatic increase from the 28% of economists who forecast a recession in the Journal’s April survey and 18% in January.

Economists have cut their forecast in half for inflation-adjusted gross domestic product in the fourth quarter of this year. A WSJ survey now says they see a 1.3% rise compared with the fourth quarter of 2021.

Bitcoin’s price rose back above $21,000 on Tuesday, after a long weekend of carnage as the cryptocurrency winter sets in, pressured by rising inflation and interest-rate increases by the Fed that have sent investors rushing to the sidelines.

The national average was $4.98 a gallon on Sunday — Yellen said it would be worth considering a temporary gas tax holiday. And President Biden said he should decide by the end of the week on suspending the federal gas tax. Such a pause in the 18.3-cent-per-gallon federal tax would require Congress to act, and there has been little traction among lawmakers on the idea so far. Several states have suspended their gas taxes, but a federal effort led by Democrats hasn’t caught on in Congress yet.

Despite high gas prices and the prospect of a recession looming, Americans are on track to set a road trip record for July 4, AAA predicts. Approximately 42 million Americans — more than ever — will take a road trip of 50 miles or more during the holiday weekend, the automotive group said.

Berlin on Sunday outlined new steps to reduce gas consumption and build up stockpiles for the winter. Germany’s economy ministry said it would increase its dependency on coal-fired power plants and store more gas. The Dutch government declared an “early warning” stage of a natural gas crisis because of Russia’s tightening of supplies.

Today, U.S. natural-gas exporter Venture Global struck a deal to supply natural gas to a German company.

Construction projects in the U.S. are running short on labor just as $1 trillion in federal infrastructure money starts to kick in. Details below.

Canadian National Railway said its shipments throughout Canada and the U.S. haven’t been interrupted by a walkout.

Employees at an Apple store outside Baltimore voted to unionize, a first for the company’s retail employees in the U.S.

The WSJ reports a national teacher shortage threatens to grow as many teachers leave a profession whose stresses have multiplied.

U.S. foods group Kellogg is to split into three public companies by spinning off its North American cereal and its plant-based food businesses, which together account for about a fifth of its sales.

Supreme Court update:

- U.S. gov’t backs NPPC, Farm Bureau in Proposition 12 Supreme Court case. The Prop 12 case will be heard Oct. 11.

- Supreme Court to hear wetlands case Oct. 3.

Thousands of U.S. flights were canceled or delayed. Over the holiday weekend, which included the busiest travel day of the year, staffing shortages caused widespread flight disruptions. And a pilot shortage has prompted American Airlines to stop flying to Toledo, Ohio, and Ithaca and Islip, N.Y., in September.

On the international political front:

- Macron fails to secure a majority. The centrist coalition led by President Emmanuel Macron of France is projected to come out ahead in crucial parliamentary elections, but a strong showing from an alliance of left-wing parties and a far-right surge prevented his forces from securing an absolute majority of seats, a setback the NYT says could complicate his second term.

- Gustavo Petro, once a member of a leftist guerrilla group that fought the Colombian state, was on Sunday elected president after pledging to battle inequality and poverty and insert the state squarely into the economy of a country that is Washington’s closest ally in Latin America. With Petro’s victory, all but one of Latin America’s major countries would be led by anti-establishment leftists, some of which have frosty relations with the Biden administration.

- Israel is gearing up for another general election after Prime Minister Naftali Bennett and his key coalition ally, Foreign Minister Yair Lapid, agreed to submit a bill to dissolve parliament.

The House select committee investigating the January 6, 2021, attack on the U.S. Capitol will focus today’s hearing on how former President Donald Trump and his allies pressured state-level officials to overturn the 2020 election results.

Election Day 2022 is 140 days away. Election Day 2024 is 868 days away.

|

MARKET FOCUS |

Equities today: Global stock markets were mixed to higher overnight. Dow futures surged 500 points as the market tries to recover from a brutal week. In Asia, Japan +1.8%. Hong Kong +1.9%. China -0.3%. India +1.9%. In Europe, at midday, London +1%. Paris +1.5%. Frankfurt +1.9%.

U.S. equities Friday: All three major indices registered losses for a third week, with the Dow and Nasdaq down 4.8% over the week and the S&P 500 was 5.8% lower. Friday saw the Dow end down 38.29 points, 0.13%, at 29,888.38 after a volatile trading session, and its 11th losing week out of 12. The Nasdaq rose 152.25 points, 1.43%, at 10,798.35. The S&P 500 was up 8.07 points, 0.22%, at 3,674.84.

Agriculture markets Friday:

- Corn: July corn dropped 3 3/4 cents to $7.84 1/2 after touching $8.00 overnight. December corn fell 4 cents to $7.31. For the week, July corn firmed 11 1/4 cents and the December contract rallied 10 1/2 cents.

- Soy complex: July soybeans fell 7 1/2 cents to $17.02, down 43 1/2 cents for the week, while November soybeans fell 5 3/4 cents to $15.37 1/2. July soymeal rose $8.40 to $438.10, while July soyoil fell 255 points to 73.79 cents.

- Wheat: July SRW wheat fell 44 cents to $10.34 1/4, down 36 1/2cents for the week and the lowest closing price since April 7. July HRW wheat fell 43 1/2 cents to $11.05 and July spring wheat tumbled 39 1/2 cents to $11.69 1/2.

- Cotton: July cotton fell 8 points to 143.45 cents per pound Friday, down 161 points for the week, while December cotton fell 94 points to 118.29 cents.

- Cattle: August live cattle gained 27.5 cents to $136.575, up 37.5 cents for the week. August feeders rose $1.65 to $172.95, down $1.525 for the week.

- Hogs: July lean hogs rose $1.425 to $110.30, up $5.525 for the week. August hogs rose $1.85 to $107.875. Hog futures surged to two-week highs as wholesale market strength conveyed firm retail demand. Pork cutout values rose $1.87 early Friday to $113.23.

Ag markets today: Grain and soy complex futures are under pressure coming out of the holiday weekend, led lower by sharp losses in soyoil. As of 7:30 a.m. CT, corn futures were trading 15 to 22 cents lower, soybeans were 19 to 24 cents lower and wheat futures were 9 to 13 cents lower. Front-month U.S. crude oil futures were around $1.50 higher and the U.S. dollar index was more than 400 points lower this morning.

Technical viewpoints from Jim Wyckoff:

On tap today:

• U.S. existing home sales are expected to fall to an annual pace of 5.41 million in May from 5.61 million one month earlier. (10 a.m. ET)

• USDA Grain Export Inspections, 11 a.m. ET.

• Federal Reserve speakers: Richmond's Thomas Barkin to the National Association for Business Economics at 11 a.m. ET, Cleveland's Loretta Mester on women in leadership at 12 p.m. ET, and Mr. Barkin to the Risk Management Association at 3:30 p.m. ET.

• USDA Crop Progress, 4 p.m. ET.

WSJ survey: Recession probability soars as inflation worsens; Economists see interest-rate increases raising likelihood of recession to 44% in coming 12 months. Economists surveyed by the Wall Street Journal have dramatically raised the probability of recession to a level usually seen only on the brink of or during actual recessions. Economists on average put the probability of the economy being in recession sometime in the next 12 months at 28% in the Journal’s last survey in April and at 18% in January. The WSJ notes: “Since the Journal began asking the question in mid-2005, a 44% recession probability is seldom seen outside of an actual recession. In December 2007, the month that the 2007-to-2009 recession began, economists assigned a 38% probability. In February 2020, when the last recession began, they assigned a 26% probability.”

The latest survey’s results showed a marked increase in economists’ forecast for inflation, which they see ending the year at 7%, up from 5.5% in the April survey. The poll of 53 economists was conducted June 16 to 17, after the Fed voted to sharply raise the benchmark federal-funds rate by 0.75 percentage point to a range between 1.5% and 1.75%.

Economists expect unemployment to rise as the Fed raises rates, although they see it staying at relatively low levels by historical comparison. On average, they forecast unemployment rising from 3.6% in May to an average of 3.7% at the end of 2022 and 4.2% at the end of 2023.

The WSJ says one bright spot is that economists still expect the economy to grow this year, although they slashed their growth projection in half in the most recent survey. On average, they see inflation-adjusted gross domestic product rising 1.3% in the fourth quarter of 2022 from a year earlier, down from 2.6% in the April survey. Last year the economy grew 5.5%, the fastest since 1984, following a 2.3% drop in 2020 when the pandemic began.

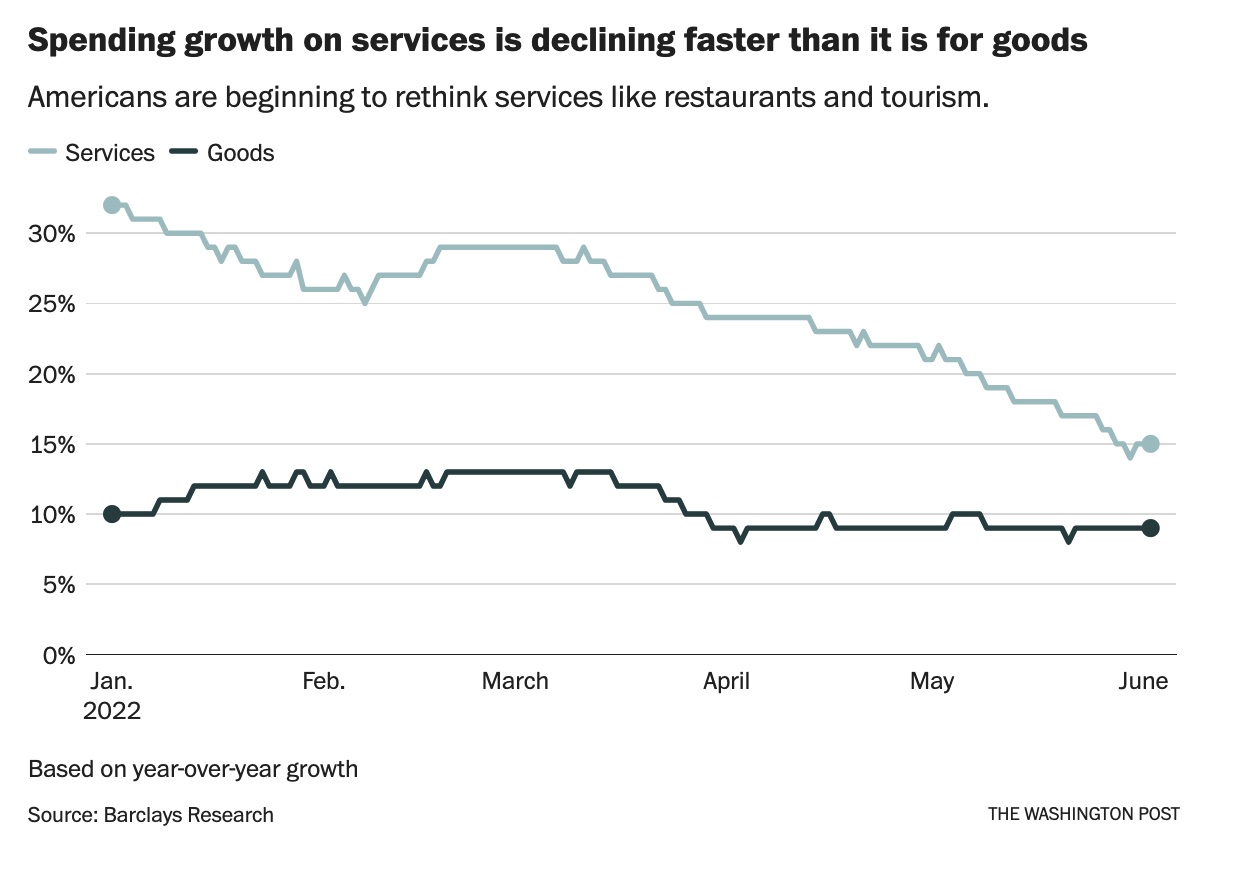

Washington Post: Americans are starting to pull back on travel and restaurants. In a worrisome sign for the economy, U.S. consumers are beginning to rethink their spending on services. A WaPo article (link) says More Americans are beginning to hold off on booking flights, getting haircuts, building backyard pools and replacing old, leaky roofs — in some of the new signs that the consumer engine of U.S. economic growth could be losing steam.

Federal Reserve Bank of Cleveland President Loretta Mester said the risk of a recession in the U.S. economy is increasing, and that it will take several years to return to the central bank’s 2% inflation goal. Treasury Secretary Janet Yellen said Sunday that “unacceptably high” prices are likely to stick with consumers through 2022 and that she expects the U.S. economy to slow down, “But I don’t think a recession is at all inevitable.”

Meanwhile, an economic model maintained by Federal Reserve Bank of New York economists suggests the chance of achieving a “soft landing” for the U.S. economy is just 10%. “According to the model, the probability of a soft landing — defined as four-quarter GDP growth staying positive over the next ten quarters — is only about 10%,” the economists wrote in a blog post published Friday on the bank’s website. “Conversely, the chances of a hard landing — defined to include at least one quarter in the next ten in which four-quarter GDP growth dips below -1%, as occurred during the 1990 recession — are about 80%.” In the blog post, the New York Fed economists noted that the “model forecast is not an official New York Fed forecast, but only an input to the Research staff’s overall forecasting process.”

Tesla CEO and billionaire Elon Musk said the U.S. economy will likely face a recession in the near term in an interview with Bloomberg on Tuesday, echoing concerns raised by several other top business leaders and financial institutions following the Federal Reserve’s recent, steeper-than-expected hike in key interest rates.

A revival in U.S. infrastructure investment is crashing against the country’s tight labor market. Construction projects across the U.S. are running short on workers just as $1 trillion in federal infrastructure money starts to kick in. The Wall Street Journal reports (link) that is leading companies to get creative in efforts to attract and retain workers, and raising concerns about the prospects for some ambitious projects. Associated General Contractors of America says publicly funded transportation projects are coming in at least 20% higher than anticipated because of added labor costs, as well as higher fuel and raw materials prices. Moody’s Analytics projects the bipartisan infrastructure law’s peak impact will be late in 2025, when there will be about 872,000 more jobs because of the projects across the country. The higher labor costs could sap some of the value from what has been President Biden’s signature legislative achievement.

Market perspectives:

• Outside markets: The U.S. dollar index is lower in early trading. The yield on the 10-year U.S. Treasury note is fetching 3.275%. For perspective, the German 10-year bund is yielding 1.725% and the U.K. 10-year Gilt yield is at 2.593%. Crude futures pushed higher with WTI recouping roughly a quarter of Friday's rout. Gold was steady near $1,836/oz, and bitcoin rose back above $21,000.

• Bitcoin and other cryptocurrencies have this week rebounded from their recent slides, with Bitcoin up about 20% from its for-the-move low reached last Saturday. Bitcoin fell below the $20,000 threshold for the first time since November 2020 amid monetary tightening by central banks. The decline in value of the largest cryptocurrency, which serves as a reference point for other digital assets, erased years of gains for its owners and sparked worries that it could force liquidations of leveraged bets, prompting further sell-offs.

• Two American and three Iranian naval vessels had a confrontation in the Strait of Hormuz, a chokepoint for global oil shipping. According to the U.S. Navy, an Iranian craft headed directly for an American patrol ship before changing course. Tensions between the two countries are high: Iran recently enriched enough uranium for a nuclear bomb, and negotiations to curb its ambitions are faltering.

• Ag trade: Saudi Arabia purchased 300,000 MT of wheat from unspecified origins. Algeria tendered to buy a nominal 50,000 MT of optional origin milling wheat. Japan is seeking 168,330 MT of wheat in its weekly tender. Bangladesh tendered to buy 50,000 MT of optional origin milling wheat. Tunisia tendered to buy 75,000 MT of soft wheat and 50,000 MT of feed barley — both optional origin, excluding the Black Sea region.

• Today is the summer solstice, aka the longest day and shortest night of the year in the Northern Hemisphere.

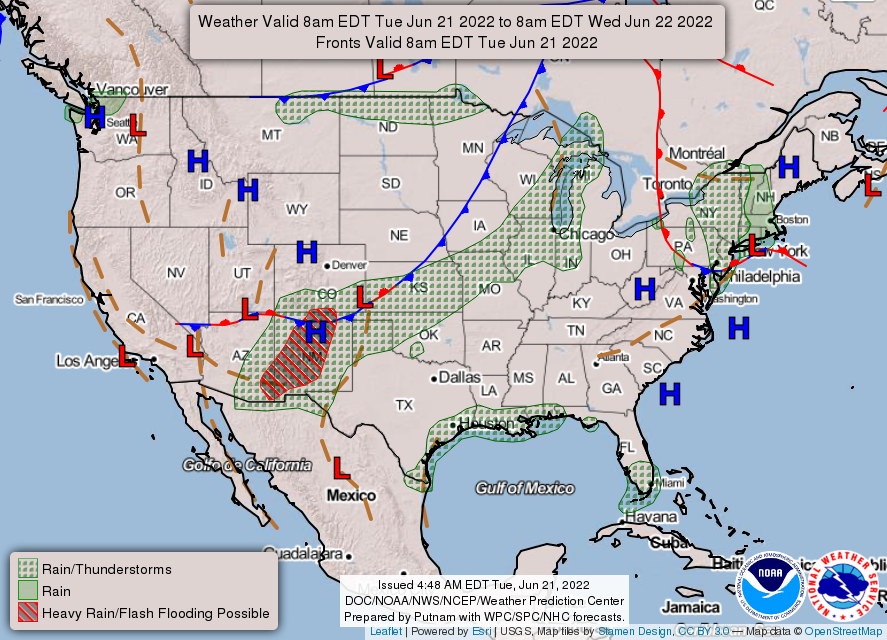

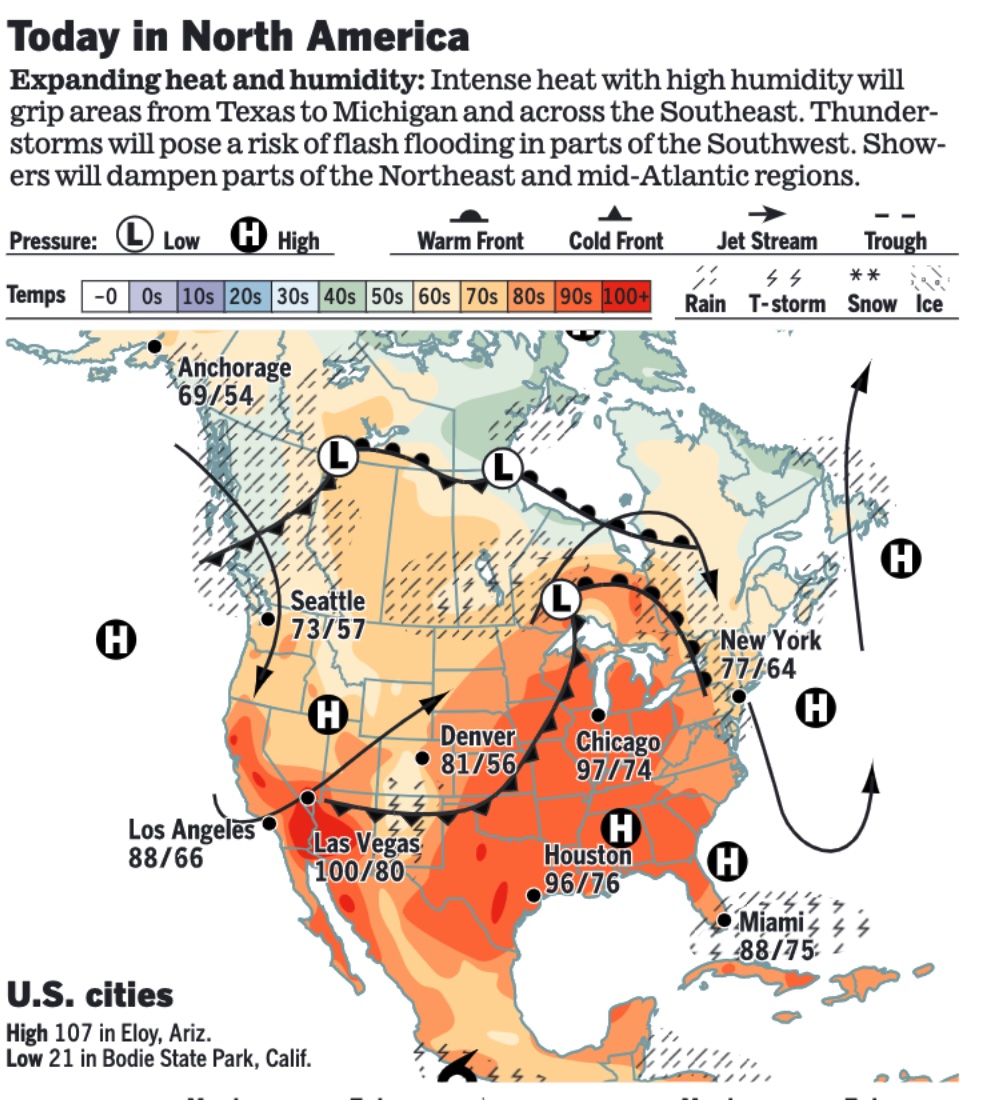

• NWS weather: Monsoonal moisture will support widespread showers and thunderstorms across parts of the Southwest and southern Rockies, posing a risk for flash flooding... ...Severe thunderstorms expected across the Midwest today, while the severe weather and flash flood threats head east for the northern Mid-Atlantic on Wednesday... ...Stifling heat and humidity across the Plains and Midwest to expand east and include the Southeast by mid-week.

Items in Pro Farmer's First Thing Today include:

• Heavy price pressure after extended weekend

• Indonesia issues more palm oil export permits

• Firmer cash cattle expectations

• July hogs back above cash index

|

RUSSIA/UKRAINE |

— Summary: Russian forces appear to have renewed their advance south of Izyum, a city in eastern Ukraine, seeking to penetrate deeper into the Donetsk region, according to Britain’s defense ministry. Meanwhile, the governor of Luhansk, the other half of Ukraine’s embattled Donbas region, said shelling continued in the city of Severodonetsk, with 568 civilians trapped in the Azot chemical plant. The New York Times notes that Russian forces mounted an assault on Sunday against Toshkivka, a key Ukrainian defensive position near Sievierodonetsk and Lysychansk, “highlighting Ukraine’s faltering defense of two of the last cities in the Luhansk province of the Donbas region that are not yet under Russian control.”

- Ukraine and Moldova move closer to EU candidacy. The European Commission last week formally recommended EU candidate status for Ukraine and its small neighbor Moldova. The final decision lies with the 27 members of the European Council, who will discuss membership at a summit this week. Georgia had also applied for EU membership but was deemed unready. However, some observers say it is highly unlikely that Ukraine will be able to meet the EU’s criteria to start negotiations until after the war ends. The average time for a country to join the EU is four years and 10 months. Meanwhile, Volodymyr Zelenskyy, Ukraine’s president, said he expected Russia to intensify attacks on his country ahead of an EU decision on whether Ukraine should receive candidate status to join the bloc.

- Putin speaks. In a speech at the St. Petersburg International Economic Forum, Russia’s president, Vladimir Putin, declared that “the era of the unipolar world” has ended. He said that America and its allies were living “under their own delusions” and blamed the West for rising food prices. He later said Russia had “nothing against” Ukraine joining the EU.

- U.K. training program. Boris Johnson, Britain's prime minister, said his country would oversee a big training program for Ukrainian armed forces fighting Russian troops in Ukraine. On his second visit to Kyiv since the war began four months ago, Johnson said the proposed scheme could involve training up to 10,000 soldiers every four months. It had the potential to “change the equation” of the war, he added.

- A brutal war: A NYT analysis of more than 1,000 photos found that Russia has used hundreds of weapons in Ukraine that are widely banned by international treaties and that kill, maim and destroy indiscriminately.

- Moscow threatened to retaliate against Lithuania after the Baltic state blocked the transport of some goods to and from Kaliningrad, a Russian exclave, across its own territory. Lithuania says it is enforcing EU sanctions which came into force on June 17. Russia called the move “openly hostile”. The EU ambassador to Russia arrived in Moscow to discuss the situation, having been summoned by Russia.

— Market impacts:

- 2022 really is a year where world hunger and the food crisis are front and center,” World Central Kitchen executive director Nate Mook told Forbes. Just back from Ukraine, where he has spent the past 120 days feeding hungry refugees and others impacted from Odessa to Kyiv, Mook talked about the missile that hit a train transporting 34 pallets of food that his aid organization was set to distribute. “The world needs to recognize that food is an issue that affects all of us, even if it happens in a place like Ukraine or a place like Yemen or the horn of Africa,” says Mook. “Hunger leads to unrest, which leads to destabilization, which leads to security issues, which leads to problems back at home.”

- Josep Borrell, the EU’s foreign policy chief, called Russia’s blockade of Ukrainian grain exports a “war crime.” He called on Russia to end its blockade, saying it is “inconceivable” that people are starving while wheat sits in Ukraine.

- Ukrainian farmers are running out of space to store this year’s harvest. With Black Sea ports cut off by the war with Russia, Ukraine has found it hard to export much of its massive grain and seed production. Because of the bottleneck, millions of metric tons of grain, soybean and oilseed are currently still in warehouses and silos that should be empty by now in anticipation of the new harvest, which has already begun and moves into high gear during the next month. Farmers say that without proper storage their grains and seeds will go to waste at the same time Russia’s invasion of Ukraine threatens exports from both countries, sending global prices higher, the Wall Street Journal reports (link).

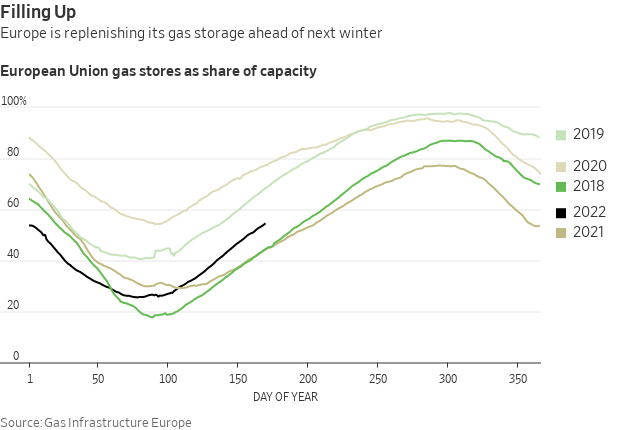

- Europe’s summer months are known as the “filling season.” Lower demand for natural gas allows the bloc to replenish its vast underground storage network for colder months, when consumption soars. This year’s effort to top up reservoirs has become a closely watched gauge of Europe’s energy security. The job has become a lot harder after Russia last week cut its supplies through its main pipeline to Europe by almost half, the WSJ notes (link).

- Germany announced that it would take emergency measures, including restarting coal-fired power plants, to cut its reliance on Russian gas supplies. Robert Habeck, the vice-chancellor, said coal would be burnt only for a “transitional period”. The use of gas in industry would also be reduced through a “gas auction” model. Habeck said the “top priority” was to ensure gas-storage facilities are full by winter.

|

POLICY UPDATE |

— Biden: Decision on gas tax holiday may come this week. The Biden administration is increasingly searching for ways to spare the public from higher prices at the pump, which began to climb last year and surged after Russia invaded Ukraine in February. Biden said Monday that he will decide by the end of the week whether he would support a federal gasoline tax holiday, possibly saving U.S. consumers as much as 18.4 cents a gallon. “Yes, I’m considering it,” Biden told reporters after taking a walk along the beach near his vacation home in Delaware. “I hope to have a decision based on the data — I’m looking for by the end of the week.” Gas prices nationwide are averaging just under $5 a gallon, according to AAA, the first time in nine weeks that the weekly average has decreased. Taxes on gasoline and diesel fuel help to pay for highways. But Treasury Secretary Janet Yellen on Monday noted “consumers are really hurting from higher gas prices” and remained open to a gas tax holiday.

The Penn Wharton Budget Model released estimates Wednesday showing that consumers saved at the pump because of gas tax holidays in Connecticut, Georgia, and Maryland. The majority of the savings went to consumers, instead of service stations and others in the energy sector.

Biden recently lashed out at oil companies, saying they are making excessive profits when people are feeling the crunch of skyrocketing costs at the pump and inflation. But Biden said he would not be meeting the oil executives himself. “I want an explanation for why they aren’t refining more oil,” Biden said. The American Petroleum Institute and American Fuel & Petrochemical Manufacturers sent a joint letter to Biden that said refineries are operating near their maximum capacity already and nearly half of the capacity taken off line was due to the facilities converting to renewable fuel production.

Meanwhile, California legislators will investigate high gas prices. The Los Angeles Times reports (link) California Assembly Speaker Anthony Rendon (D) “on Monday announced a legislative inquiry to determine if oil companies are ‘ripping off’ drivers.” Rendon “said the Assembly select committee will consider what measures the state can enact to reduce gas prices and ‘stand up to the profiteers who are abusing a historic situation to suck profits from California’s wallets.’” The LAT says California’s “highest-in-the nation gas prices remain a volatile political issue in the midst of an election year, and Republican lawmakers continue to attack the Legislature’s Democratic leadership for failing to take quick action to provide relief.”

— Democrats join conference on student debt cancellation. Senate Majority Leader Chuck Schumer (D-N.Y.), Warren and Rep. Ayanna Pressley (D-Mass.) plan to join the American Federation of Labor and Congress of Industrial Organizations and union leaders for a roundtable discussion Wednesday on canceling student debt for American workers. President Biden on Monday was asked by reporters if he was nearing a decision on whether to cancel some federal student debt by executive order and replied that he was. Asked if another extension of repayments — which have not been required since he took office — is possible, he replied: “it’s all on the table right now.”

|

PERSONNEL |

— Biden appoints Lynn Malerba to serve as U.S. Treasurer. President Joe Biden named Lynn Malerba as the new U.S. treasurer, a position that includes oversight of the U.S. Mint, Bureau of Engraving and Printing and Fort Knox. The move clears the way for Treasury Sec. Janet Yellen’s signature to finally appear on U.S. currency, as by custom the two signatures are added to notes together.

— How lucrative is a tour in Washington’s revolving door? A first-of-its-kind analysis shows 77 officials who served under Obama and Biden boosted their assets by an estimated 270% from 2017 to 2021 by hopping from the public to private sector. Link for details.

|

CHINA UPDATE |

— China’s May corn imports from Ukraine plunged. China imported only 126,727 MT of corn from Ukraine in May, down sharply from 695,585 MT in April and 1.26 MMT last year. China imported 1.9 MMT of corn from the U.S. in May, virtually the same amount as last year. In the first five months of this year, China imported 6.4 MMT of corn from the U.S., down from 6.7 MMT during the same period last year. China’s corn imports in May from all origins fell 34.1% from a year ago, while shipments in January-May were down 2.9%.

— China’s pork imports plunged in May. China imported 130,000 MT of pork during May, down 10,000 MT (7.1%) from April and 65.7% less than last year. Through the first five months of this year, China’s pork imports at 680,000 MT fell 65.2% compared with the same period last year.

— JD.com’s midyear shopping festival posted the slowest sales growth in at least five years, the latest gauge of the hit to consumer appetites from China’s stringent Covid-19 restrictions.

|

LIVESTOCK, FOOD & BEVERAGE INDUSTRY |

— U.S. gov’t backs NPPC, Farm Bureau in Proposition 12 Supreme Court case. U.S. government filed a brief to the Supreme Court supporting the NPPC and Farm Bureau challenge to California’s animal housing law, Proposition 12. In an amicus brief (link), Solicitor General Elizabeth Prelogar said California “’has no legitimate interest in protecting’ the welfare of animals located outside the state,” quoting a previous Supreme Court decision. “Voters in pork-producing States must determine what constitutes ‘cruel’ treatment of animals housed in those States — not voters in California,” the brief said, quoting a 1935 Supreme Court decision, Baldwin v. G.A.F. Seelig Inc. Of note, Senate Ag Committee Chair Debbie Stabenow (D-Mich.) previously called on USDA Secretary Tom Vilsack to support California's Proposition 12 before the Supreme Court.

Prelogar’s brief noted the U.S. “takes no position on whether petitioners will ultimately be able to prove that Proposition 12 unduly restricts interstate commerce” under the Supreme Court’s Pike v. Bruce Church Inc. decision. But at this stage, “petitioners have plausibly alleged that Proposition 12 will have substantial adverse impacts on the interstate pork market,” her brief said, urging the Supreme Court to reverse the 9th U.S. Circuit Court of Appeals’ decision to dismiss the ag groups’ challenge, and remand the case to the appeals court. “If petitioners prove those allegations, then those burdens are ‘clearly excessive in relation to’ what petitioners allege to be insubstantial or non-existent ‘local benefits,’” she said.

Background: Farm Bureau and NPPC are challenging the constitutionality of California’s Proposition 12. The state law seeks to ban the sale of pork from hogs that don’t meet the state’s arbitrary production standards, even if the pork was raised on farms outside of California. AFBF and NPPC argue Proposition 12 violates the constitution’s Commerce Clause, which restricts states from regulating commerce outside their borders. The brief states Proposition 12 “will require massive and costly changes across the entire $26-billion-a-year industry. And it inescapably projects California’s policy choices into every other State, a number of which expressly permit their farmers to house sows in ways inconsistent with Proposition 12.”

Timeline: The Prop 12 case will be heard Oct. 11.

— From sizzle to fizzle? Plant-based meats flew off the shelves during the pandemic and hype around Impossible Foods and Beyond Meat helped draw $2 billion of capital to the sector. Now, with more than 100 startups in the plant-based chicken nugget space alone and growth slowing, investors are worried meatless meat could fizzle out. Link to details.

— Kellogg is separating into three independent businesses. The company will spin off its North American cereal operation and plant-based division. The remaining business, which will house its snacks, international cereal, noodles and North American frozen breakfast brands, will continue to be led by Steve Cahillane as chairman and CEO. The spin-off of the North America cereal and plant-based businesses are slated to be completed by the end of 2023.

|

CORONAVIRUS UPDATE |

— Summary:

- Global Covid-19 cases at 539,783,312 with 6,320,517 deaths.

- U.S. case count is at 86,297,195 with 1,013,493 deaths.

- Johns Hopkins University Coronavirus Resource Center says there have been 592,269,252 doses administered, 221,924,152 have been fully vaccinated, or 37.35% of the U.S. population.

— Covid-19 vaccines for children younger than 5 are rolling out this week following a recent sign-off from the FDA and CDC. The safety data from Moderna and Pfizer found potential side effects were mostly mild and short-lived. Side effects most commonly included pain at the injection site and sometimes there was swelling or redness.

|

POLITICS & ELECTIONS |

— Bass’ lead in L.A. mayoral race gets bigger. With the latest tranche of ballots tabulated on Friday, Rep. Karen Bass opened a nearly seven-point lead over Rick Caruso, the billionaire developer. Bass now has 42.9% of the vote, compared with Caruso’s 36.3%. That spread is not too far from the findings of a poll co-sponsored by the Los Angeles Times last month. Link for details.

— France’s Macron projected to lose majority in parliament. President’s party and allies are projected to remain the largest coalition after Sunday’s vote but without the seats to form a majority, a rebuke of his pro-business agenda. The estimated turnout was 46%, according to Harris Interactive, low by historical standards but higher than the 42.6% in the second round of 2017.

— Musk gives his opinion on who is driving the Democratic Party. Tech billionaire Elon Musk revealed that he believes certain unions are primary drivers of the Democratic Party’s and Biden administration’s policies. “The general public is not aware of the degree to which unions control the Democratic Party. One does not need to speculate on this point,” Musk said in an interview published over the weekend (link). Two of Musk’s businesses, Tesla and SpaceX, are not unionized, which Musk says is because of the “negative employment” in Silicon Valley. He says that Tesla workers typically often have numerous job offers. “Last year, Biden held an EV summit where Tesla was explicitly not allowed to come, but [United Auto Workers] was. So, Tesla has made two-thirds of all the electric vehicles in the United States,” said Musk, who is estimated to be worth more than $250 billion.

— Left-wing candidate Gustavo Petro won the Colombian presidential race on Sunday, becoming the first leftist leader to do so. The former guerrilla with a checkered past won by a slim margin with over 50% of the votes, against 77-year-old entrepreneur Rodolfo Hernandez. In this historic win, his running mate Francia Marquez will now become the first Afro-Colombian to hold executive powers. Petro beat Hernández, a former construction tycoon, by a wider margin than polls had predicted, with 50.5% of the vote to Hernández's 47.3%. Petro, a former mayor of Bogotá, the capital, has been a congressman for decades. He has pledged to make university education free and ban new oil and gas projects but will need to work with a fragmented Congress.

— Israel’s prime minister, Naftali Bennett, and foreign minister, Yair Lapid, agreed to dissolve parliament, triggering new elections. If the deal is approved in a Knesset vote next week, Lapid would become caretaker prime minister until a poll can be organized. In a statement, the two men said the decision was made after “attempts to stabilize the coalition were exhausted”. The forthcoming general election will be Israel’s fifth in less than four years.

|

CONGRESS |

— Jan. 6 committee will hold its fourth hearing with state election officials, including Georgia Secretary of State Brad Raffensperger, expected to testify. The panel will also hear from Arizona House Speaker Rusty Bowers, who was reportedly pressured by Ginni Thomas (wife of Supreme Court Justice Clarence Thomas) to decertify President Joe Biden’s victory in the state.

— Senate Finance Committee releases retirement reform. The Senate Finance Committee on Friday released details of the retirement reform legislation it is scheduled to mark up Wednesday. The bill includes tweaks to 401(k) and individual retirement accounts meant to increase the ability of late-career workers to catch up on savings.

|

OTHER ITEMS OF NOTE |

— NEC Director Brian Deese on Biden’s trip to Saudi Arabia, on Fox News Sunday: “What’s behind this is a very simple proposition, which is when it is [in the] U.S. interest for the president to engage with a foreign leader, he will do so.”

Energy Secretary Jennifer Granholm on whether it’s “appropriate” for Biden to meet with Saudi Crown Prince Mohammed bin Salman (MBS), on CNN’s State of the Union: Granholm said it is “her understanding” that Biden and MBS would meet. Biden has previously condemned Saudi Arabia for its human rights record, including the murder of journalist Jamal Khashoggi. “The president is very concerned about that, and I'm sure will raise that issue. But he's also very concerned about what people are experiencing at the pump. And Saudi Arabia is head of OPEC. And we need to have increased production, so that everyday citizens in America will not be feeling this pain that they're feeling right now,” Granholm said.

— Appeals court orders EPA to reconsider glyphosate cancer ruling. The California-based 9th U.S. Circuit Court of Appeals ordered the Environmental Protection Agency to re-examine its 2020 finding that glyphosate did not pose a health risk for people exposed to it by any means — on farms, yards or roadsides or as residue left on food crops, the Associated Press reported (link). Amy van Saun, senior attorney at Center for Food Safety and lead counsel in the case, said in a news release, “Today is a monumental victory for farmworkers, wildlife, and the public… The court has held EPA's approval of Monsanto's glyphosate unlawful and rebuked EPA for ignoring real-world evidence of cancer risks from using glyphosate, and for failing to even consider impacts to endangered species.”

— Supreme Court to hear wetlands case Oct. 3. In a wetlands case before the court, William Reilly and Carol Browner, former administrators of the EPA, said two Idaho landowners whose wetlands enforcement case the court will hear, told the court that Michael and Chantell Sackett’s test for when wetlands should be regulated “ignores that Congress explicitly defined ‘navigable waters’ for purposes of the statute to mean all ‘waters of the United States,’ not only those with a continuous connection or that are traditionally navigable.” On October 3 the court will listen to arguments in the case Sackett v. EPA about the Waters of the United States rule.

— This week, the Supreme Court is expected to deliver its official ruling on an abortion case that could lead to the overturning of Roe v. Wade. The Court usually waits to release its most controversial rulings until right before it leaves for a recess, which will arrive on June 26 (Sunday).

— Border Patrol agents set an all-time monthly record in May with nearly 223,000 migrants. With four months left, border officials have processed migrants 1.5 million times this fiscal year — putting the government on track to surpass last year's record high.

— Assange extradition. The British government approved an order to extradite WikiLeaks founder Julian Assange to the U.S., where he will face espionage charges related to publishing classified U.S. intelligence documents. The Friday decision comes two months after a U.K. court granted Assange's extradition and brings the Australian national's decadelong battle with the U.S. closer to an end. WikiLeaks intends to file an appeal with Britain's high court. Assange faces 17 counts brought under the Espionage Act and one charge of computer misuse.