U.S. Equities Tumble, Reversing Wednesday's Gains on Rising Recession Fears

House GOP member focusing on Vilsack’s tapping of CCC Charter Act

|

In Today’s Digital Newspaper |

Big new-crop sales of cotton to China. Sizable sales of new-crop upland cotton to China were reported in the most recent week along with sales of sorghum, soybeans, pork and beef. For the week ended June 9, activity to China for 2021-22 included net sales of 4,949 tonnes of corn, 67,139 tonnes of sorghum, 135,348 tonnes of soybeans (cancellations reduced what were gross sales of 1887,000 tonnes), and 7,332 running bales of upland cotton. For 2022-23, sales of 132,000 tonnes of soybeans and 363,736 running bales of upland cotton were reported. Net sales for 2022 of 4,610 tonnes of beef and 3,805 tonnes of pork were also reported.

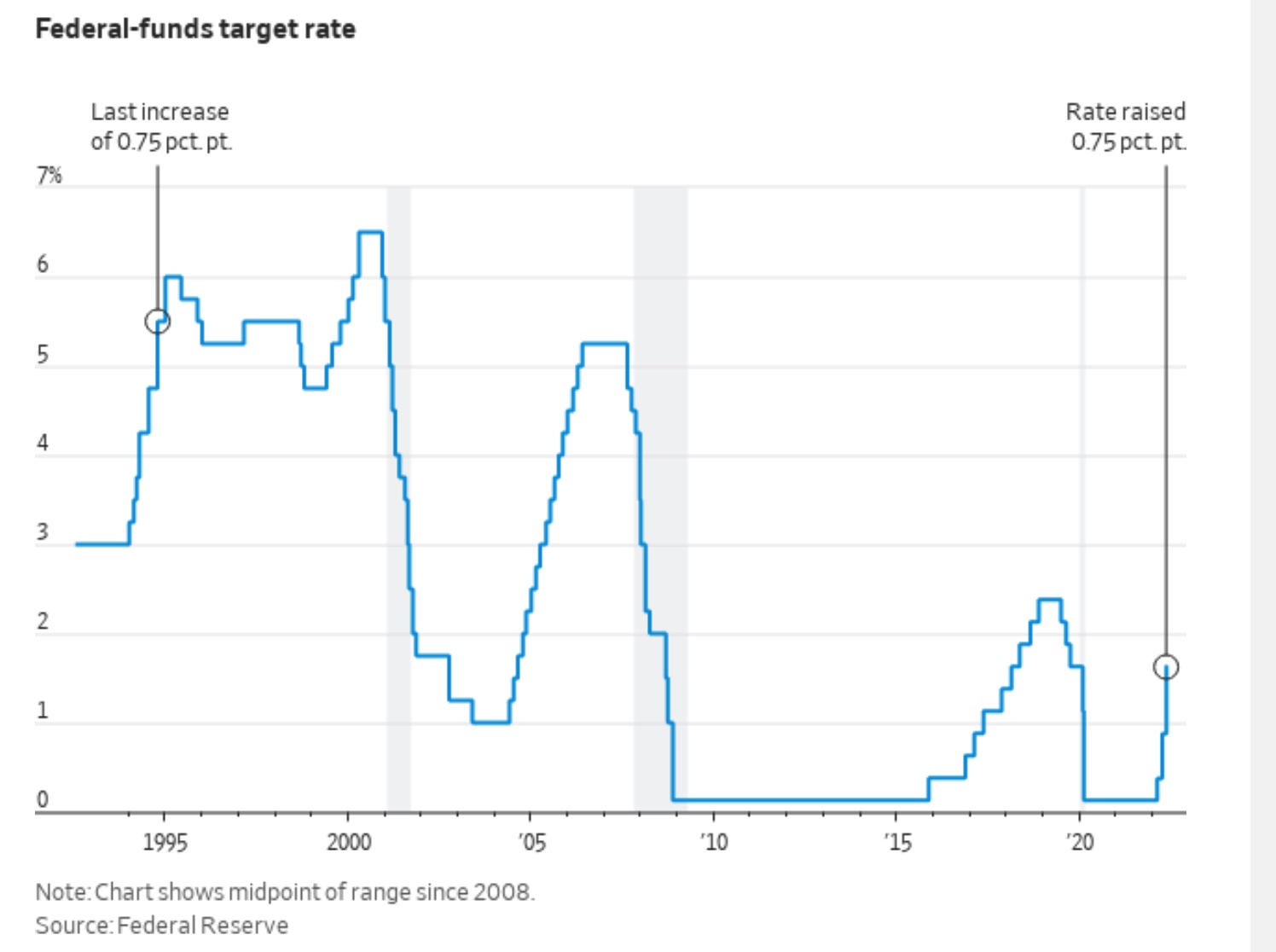

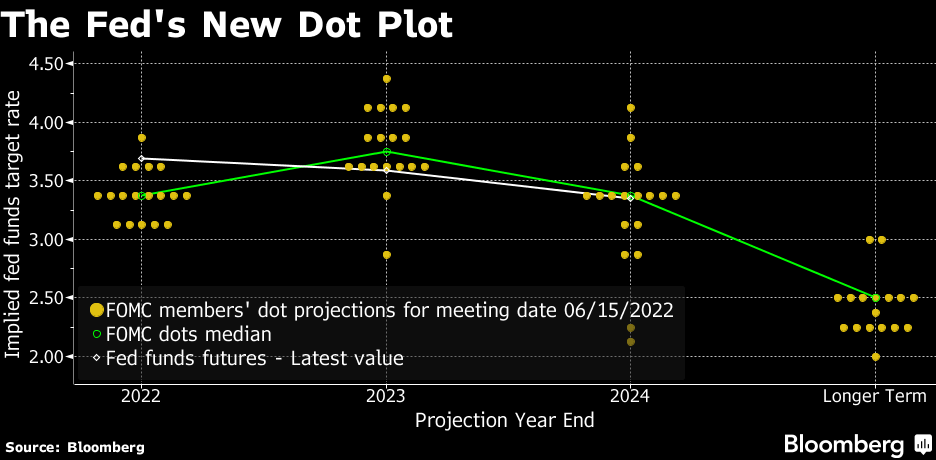

The Federal Reserve voted to raise interest rates by 0.75 percentage point Wednesday, the largest increase in 28 years, and said it would continue tightening monetary policy to fight inflation. Stocks were sharply lower early today after rallying late Wednesday immediately after the Fed announcement. Wednesday’s decision took the target range for the federal funds rate to 1.5% to 1.75%. Officials projected 3.4% by year-end and 3.8% by the end of 2023. The Fed also reiterated it will shrink its balance sheet by $47.5 billion a month — a move that took effect June 1 — stepping up to $95 billion in September.

“We’re not trying to induce a recession now. Let’s be clear about that,” said Fed Chairman Jerome Powell, who added that it was becoming more difficult to achieve what is known as a soft landing.

President Biden is scheduled to sign into law at 3:10 p.m. ET a bill aiming to address ocean shipping costs as part of an effort to ease supply-chain problems. We have details in Policy section.

French President Emmanuel Macron, German Chancellor Olaf Scholz and Italian Prime Minister Mario Draghi are visiting the Ukrainian capital of Kyiv for talks with President Volodymyr Zelenskyy as the war of attrition with Russia reaches a pivotal moment and Ukraine amplifies its calls for Western military support to counter Russia’s artillery barrages.

The U.S. is sending $1 billion in new military assistance to help Ukraine repulse Russia’s invasion. The package includes artillery, ammunition and coastal-defense systems, but some of the aid may not arrive for around two months.

The European Union signed an agreement Wednesday with Israel and Egypt to boost gas imports as European natural-gas prices jumped and as options for filling the continent’s natural-gas stores narrow.

Chinese President Xi Jinping reiterated support for Moscow’s security concerns in a call with Russian President Vladimir Putin.

Many rural Americans are still waiting for faster internet service despite billions of dollars spent on several rounds of federal programs to upgrade internet speeds in rural areas over the past decade.

GOP members challenged Dem spending wishes on nutrition and also said they are closely watching USDA Sec. Tom Vilsack’s aggressive use of the CCC Charter Act. Details in Policy section.

Environmental groups are suing the Biden administration over its decision to approve more than 3,500 oil and natural-gas drilling permits in New Mexico and Wyoming.

EPA sharply lowered safe-consumption levels for so-called forever chemicals in drinking water, signaling its conclusion that the widely found substances are more hazardous than previously thought.

Abbott Laboratories said it was halting production of its EleCare specialty baby formula at its Sturgis, Michigan plant after severe storms flooded areas of the plant. Abbott said the flooding would likely delay production and distribution for a few weeks, and its stock fell 2% in the premarket.

FDA advisers backed expanding access to the Pfizer-BioNTech and Moderna Covid-19 vaccines to children as young as 6 months old. Separately, Moderna plans to test its Covid-19 vaccine in babies 3 to 6 months old, the youngest group studied to date.

Dr. Anthony Fauci tested positive for Covid-19. He has mild symptoms, according to a statement from the NIH.

The House panel investigating the Jan. 6, 2021, attack on the Capitol will hold its third hearing today at 10 a.m. ET, looking at then-President Donald Trump's pressure campaign on his vice president, Mike Pence, to stop the transfer of power.

Elon Musk will answer questions directly from Twitter employees for the first time at an all-hands meeting today.

Election Day 2022 is 145 days away. Election Day 2024 is 873 days away.

|

MARKET FOCUS |

Equities today: U.S. equities rallied Wednesday before continuing the decline that this week pushed the S&P 500 into bear territory. U.S. Dow opened sharply lower and is currently down over 700 points. In Asia, Japan +0.4%. Hong Kong -2.2%. China -0.6%. India -2%. In Europe, at midday, London -2.1%. Paris -2%. Frankfurt -2.6%.

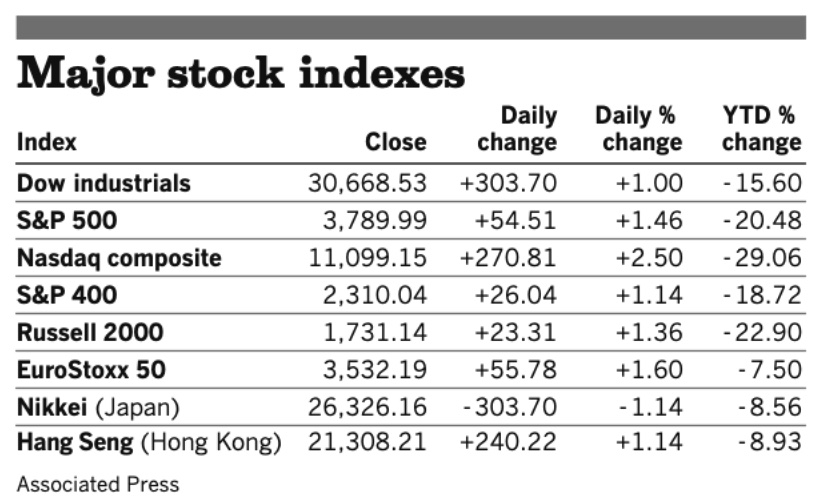

U.S. equities yesterday: The Dow rose 303.70 points, 1.0%, at 30,668.53. The Nasdaq gained 270.81 points, 2.5%, at 11,099.15. The S&P 500 rose 54.51 points, 1.46%, at 3,789.99.

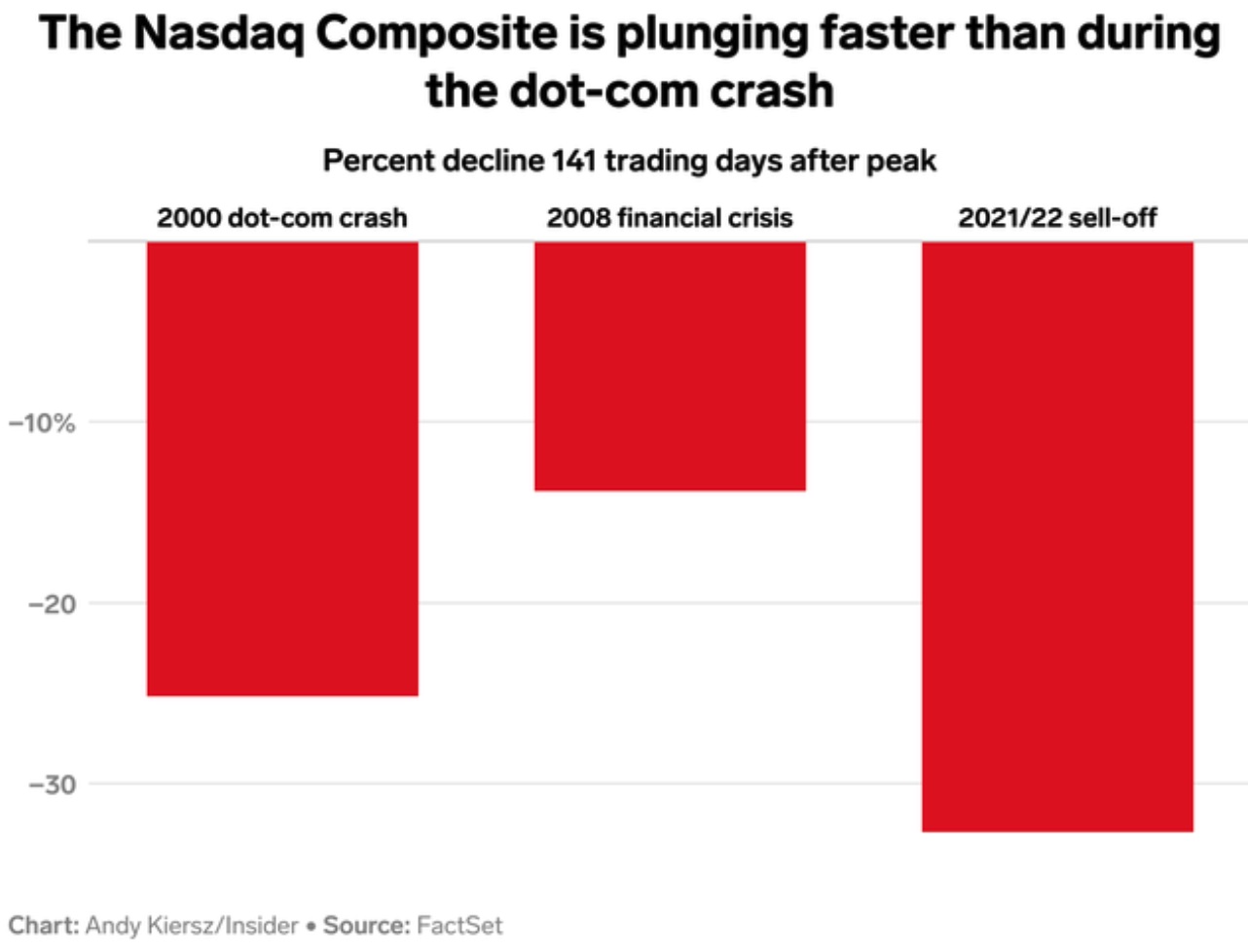

Recap: The S&P has fallen more than 20% from a high on Jan. 3 and the Nasdaq has plunged 30% from its November record. Bitcoin has erased two-thirds of its value and Treasuries have lost investors almost 12% in 2022.

The crash in the Nasdaq is looking a lot like the bursting of the 2000 dot-com bubble. But in 2000 it fell for two more years and didn't fully recover until 2015.

Agriculture markets yesterday:

- Corn: July corn futures rose 5 3/4 cents to $7.74, the contract’s highest closing price since May 27. December futures fell 1/4 cent to $7.21.

- Soy complex: July soybeans fell 4 3/4 cents to $16.93 3/4, the contract’s lowest closing price since June 1. November soybeans fell 1 3/4 cents to $15.23 1/2. July soymeal rose $6.50 to $417.50 per ton. July soyoil fell 61 points to 77.67 cents.

- Wheat: July SRW wheat fell 1/4 cent to $10.50. July HRW wheat fell 9 cents to $11.33 1/4. July spring wheat fell 7 1/4 cents to $12.01 1/4.

- Cotton: July cotton fell 30 points to 143.18 cents per pound, while December futures fell 273 points to 117.92 cents.

- Cattle: August live cattle soared $2.725 to $136.80. August feeders rose $1.975 to $173.275.

- Hogs: July lean hogs rose $1.65 to $108.275, the highest closing price since June 7. The CME lean hog index rose 73 cents to a 10-month high at $108.13 (as of June 13) and is expected to gain another 44 cents today.

Ag markets today: Corn futures mildly built on Wednesday’s gains overnight, while soybeans also firmed, and wheat traded mixed. As of 7:30 a.m. ET, corn futures were trading 3 to 6 cents higher, soybeans were 2 to 3 cents higher, SRW wheat futures were narrowly mixed, HRW wheat was 2 to 4 cents lower and spring wheat was 2 to 4 cents higher. Front-month U.S. crude oil futures were around $1.50 lower and the U.S. dollar index was more than 150 points lower this morning.

Technical viewpoints from Jim Wyckoff:

On tap today:

• U.S. jobless claims for the week ended June 11, due at 8:30 a.m. ET, are expected to edge down to 220,000, from 229,000 the prior week. UPDATE: Initial jobless claims dropped to 229,000 for the week ended June 11.

• U.S. housing starts for May, due at 8:30 a.m. ET, are expected to edge down from the prior month. UPDATE: May housing starts and building permits plunged 14.4% and 7%, respectively.

• USDA Weekly Export Sales report, 8:30 a.m. ET.

• Treasury Secretary Janet Yellen will meet with the CEO members of the Bank Policy Institute today to discuss global economic outlook, and Biden administration’s efforts to address inflation, according to Treasury’s daily guidance.

The Fed approved a 0.75-percentage-point interest rate increase, the largest since 1994. That will raise its benchmark federal-funds rate to a range between 1.5% and 1.75%. Fed Chairman Jerome Powell suggested that another 0.75-percentage-point rate rise could come at its next meeting, but hedged that it could also be the 0.5 it had earlier planned.

Bottom line: It is still possible to avoid a recession, but as Powell said, that now depends on factors outside of the Fed’s control. It may be the case that by hiking faster now, the terminal rate, or the peak of interest rates in this cycle, could be lower than it otherwise would be. The message from the Fed this week is that it will keep on hiking until inflation break. We have "a Volcker-esque Fed," Grant Thornton says, meaning it will risk a recession to avert a repeat of the 1970s.

Analysts lowered their estimates for second-quarter U.S. growth forecasts, in part in response to the retail-sales data released earlier this week. IHS Markit now sees the economy growing at a 0.9% pace, down from 1.8% on June 10. The Atlanta Fed now sees a flat growth reading in the second quarter, down from 0.9% on June 8. Analysts have been slowly lowering their forecasts for growth, prompting recession fears. The U.S. economy contracted at an annual rate of 1.5% in the first quarter.

Farm groups to urge ITC to not invoke duties on fertilizer imports. The U.S. International Trade Commission (ITC) is holding a hearing today for the final phase of its investigation into fertilizer imports from Russia and Trinidad and Tobago. The Commerce Dept. issued separate preliminary rulings that Russia and Trinidad and Tobago were unfairly subsidizing UAN exports as well as selling the UAN into the U.S. at below market prices.

The Bank of England raised interest rates by 0.25 percentage points (1.25% from 1%), signaling that it would “act forcefully” if needed to prevent high inflation becoming more persistent.

Market perspectives:

• Outside markets: The U.S. dollar index is a bit lower in early trading. The yield on the 10-year U.S. Treasury note is fetching 3.37%. West Texas Intermediate crude fell 1.3% to $113.76 a barrel. Gold futures rose 0.4% to $1,826 an ounce.

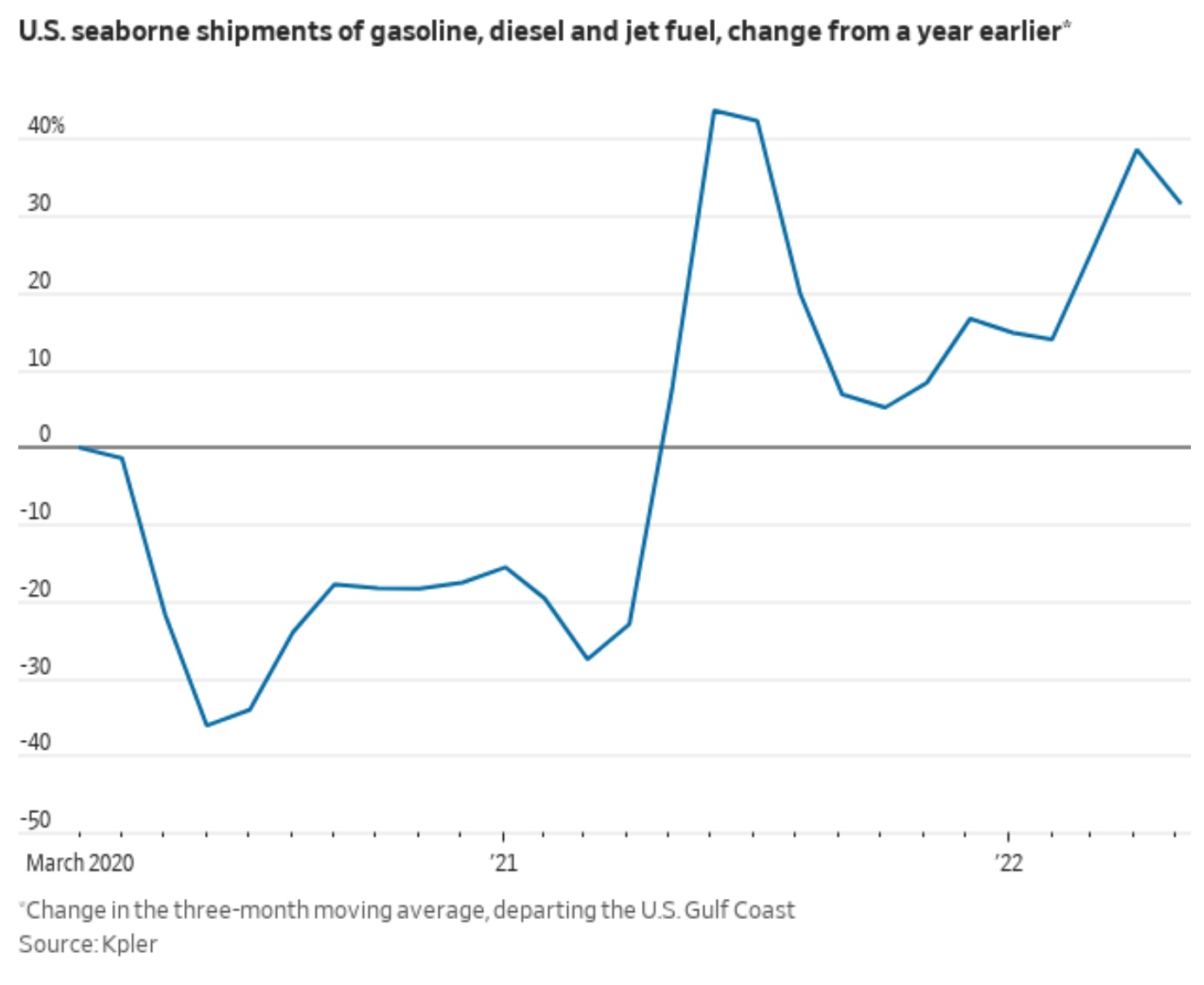

• American exports of gasoline, diesel and natural gas are draining already-low inventories and raising prices for U.S. consumers and companies.

• Georgia ports reach record in May. The Georgia Ports Authority hit an all-time volume record in May, moving 519,390 twenty-foot equivalent units and breaking a previous record of 504,350 TEUs set last October. May’s volumes were also 8.5% higher year-over-year. The diversion of vessels to the Port of Savannah from West Coast ports and other East Coast ports may have contributed to May’s volumes, with the Garden City Terminal handling more business in recent weeks, especially when compared to the volume spike last fall, according to GPA Executive Director Griff Lynch. Link for details.

• Ag trade: Japan purchased 186,441 MT of wheat in its weekly tender, including 99,293 MT U.S., 64,148 MT Canadian and 23,000 MT Canadian. Bangladesh withdrew its tender to buy 50,000 MT of optional origin milling wheat.

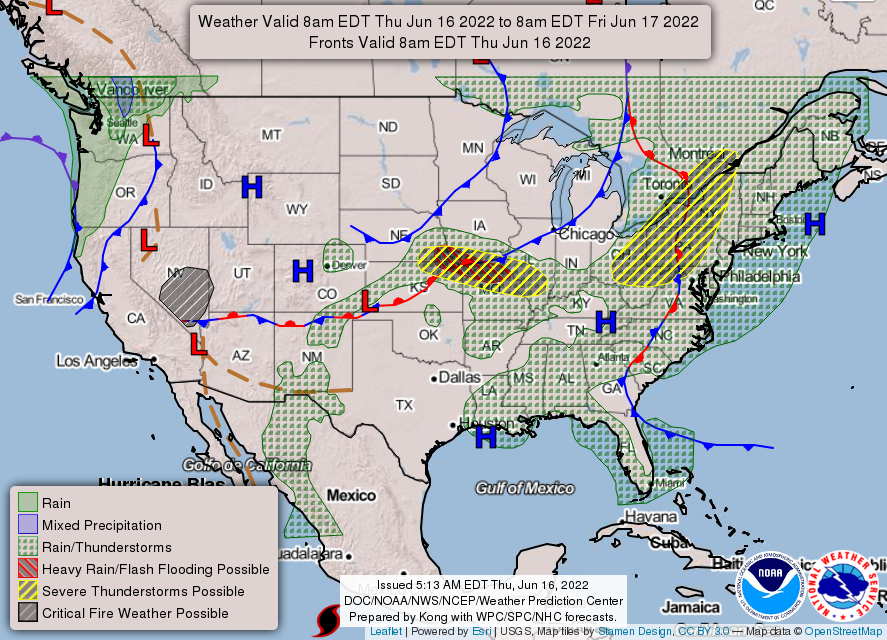

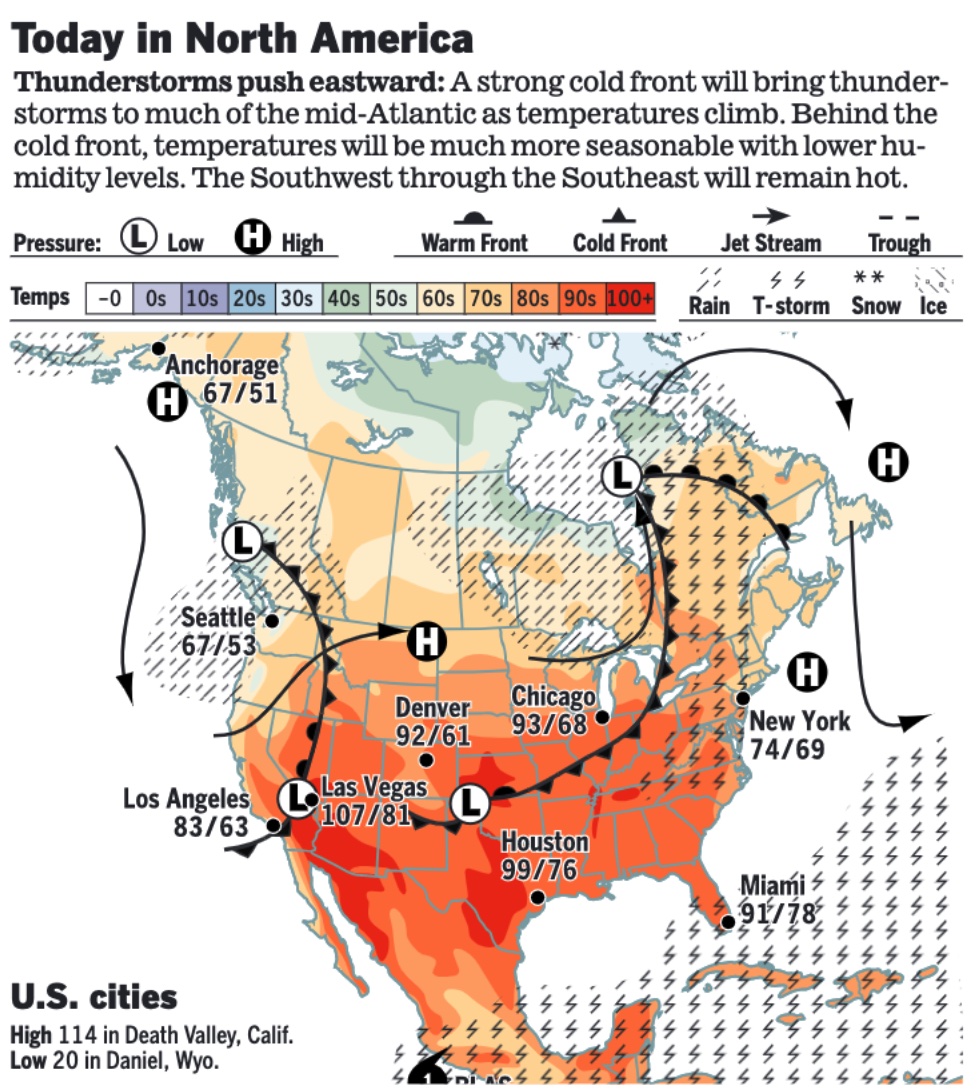

• NWS weather: Dangerous heat and humidity to persist across portions of the Midwest and Southeast today... ...Severe thunderstorms likely to develop this afternoon and evening across parts of the upper Ohio Valley and Upstate New York... ...Monsoon moisture to bring an increasing chance for showers and thunderstorms across the Southwest late in week

Items in Pro Farmer's First Thing Today include:

• Corn firmer, soybeans and wheat mixed overnight

• Romania to remain key grain exporter

• Cattle futures supported by strong cash trade

• Summer hogs narrow the gap with cash

|

RUSSIA/UKRAINE |

— Summary: The Russian military said Wednesday that it used long-range missiles to destroy a depot in western Ukraine’s Lviv region where ammunition for NATO-supplied weapons was being stored. Those strikes came as fighting raged for the city of Severodonetsk in the eastern Donbas area, the key focus of Russia’s offensive in recent weeks.

- European leaders arrived in Kyiv today. Emmanuel Macron, Olaf Scholz and Mario Draghi arrived in Ukraine for talks before an expected recommendation tomorrow that Ukraine be granted EU candidate status. Biden spoke to Volodymyr Zelenskyy too.

- NATO and its allies pledged new military aid to help Ukraine repulse Russia, including $1 billion from the U.S. This came in response to urgent pleas from Kyiv for better weapons amid growing views within Western capitals that the conflict may require a diplomatic resolution. The U.S. will also provide Ukraine for the first time with Harpoon antiship launchers, expected to arrive in around two months.

- "Russian Davos" just kicked off, but it's lacking any notable attendees from the West. Many business execs have shunned the event due to Russian sanctions and its invasion of Ukraine, giving attendees from China, India, and the UAE center stage.

— Market impacts:

- Gazprom cuts gas flow to Italy. Gazprom cut its gas flow to Italy by 15%, Italian state-owned supplier, Eni, said — a move that quickly followed the Russian state-owned gas giant also slashing capacity to Germany by 40%. Italy is the second-largest consumer of Russian gas, just behind Germany, and both countries agreed to comply with Moscow’s demands earlier this year to pay for their gas supplies in rubles. Eni said Gazprom has not yet provided a reason for its cutoff.

Meanwhile, Gazprom blamed its reduced capacity to Germany on technical issues at an entry point to the Nord Stream 1 pipeline — taking aim at Siemens, a German-owned engineering company, for failing to return gas-pumping units on time. “Right now, gas supplies into Nord Stream can be ensured at as much as 100 million cubic meters per day,” compared to the initial number of 167 mcm per day, Gazprom said in a statement. But that assessment was dismissed by German Economic Minister Robert Habeck, who told reporters: “We have established, in close consultation with the European Commission, that the maintenance problems are not related to the sanctions.”

Habeck suggested the cutoffs might be a political strategy: “This is not the beginning, but a continuation of a trend of a step-by-step operation as gas flows to different countries are cut,” he said.

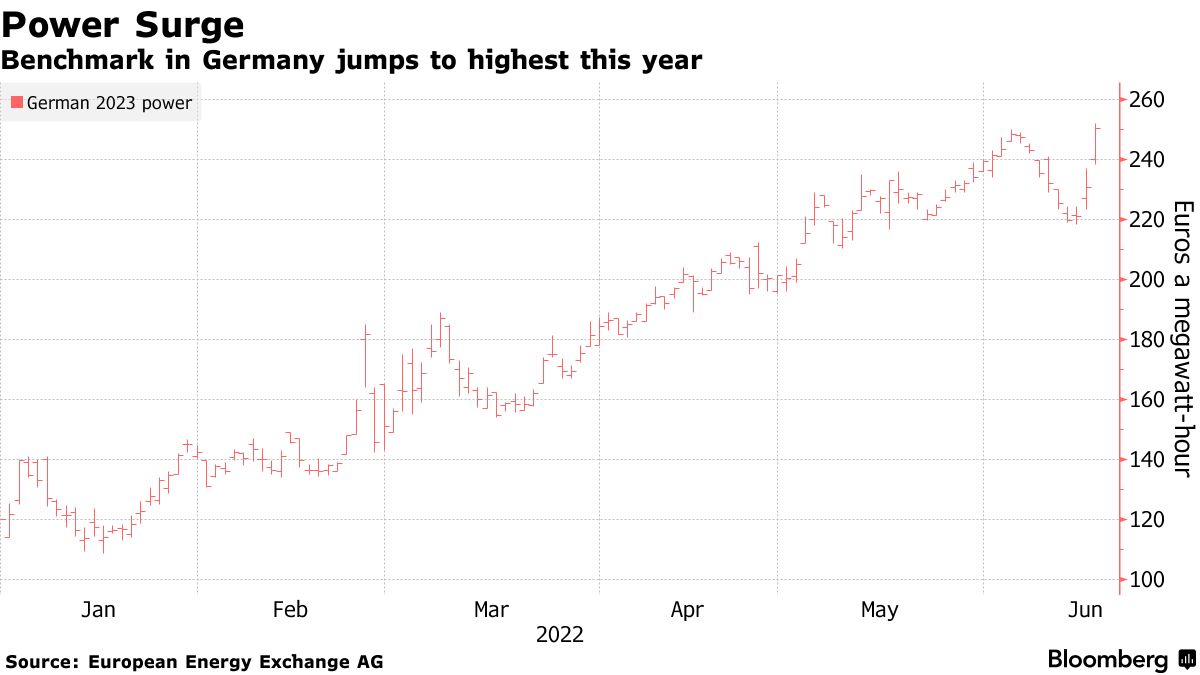

- European natural-gas prices jump as Russia cut supplies again. Europe’s options for filling its natural-gas stores to avoid a winter energy crisis are narrowing as flows from Russia decrease and U.S. shipments are poised to stall, sending gas prices higher.

|

POLICY UPDATE |

— Many rural Americans are still waiting for faster internet service despite billions of dollars spent on several rounds of federal programs to upgrade internet speeds in rural areas over the past decade. The Wall Street Journal reports (link) that despite those efforts, many residents are still stuck with service that isn’t fast enough to do video calls or stream movies — speeds that most take for granted. Many communities have been targeted for broadband upgrades at least twice already, but flaws in the programs’ design have left residents wanting.

Comments and perspective: Ever since the Obama administration, billions of dollars have been thrown at bringing high-speed broadband at rural America. But to date, the Agriculture panels in the House and Senate have held no significant hearings regarding accounting for the success and mostly failure of the prior spending. The solution is simple: Echo what the state of North Dakota has done to bring high-speed internet to rural America.

— Debate on nutrition funding and USDA’s tapping the CCC Charter Act surfaced during a subcommittee discussion Wednesday of funding for the USDA, FDA, and related agencies in fiscal 2023 (link for details). Texas Rep. Kay Granger, the senior Republican on the Appropriations Committee, and Maryland Rep. Andy Harris, the GOP leader on the subcommittee on agriculture, said Congress ought to cut federal spending to temper high inflation. They cited language that allows USDA to spend “for the last three months of the fiscal year, such sums as may be necessary” for food stamps. Subcommittee chairman Sanford Bishop of Georgia said the provision would ensure SNAP did not run out of money. “We should be finding ways to rein in spending, rather than writing a blank check,” said Granger. She said the FDA would get a 10% increase in funding despite bungling its oversight of infant formula makers. “This bill does nothing to help farmers and ranchers who are struggling with record-high costs for things like fuel and fertilizer. This will not help the American family struggling with high grocery prices.”

Harris also targeted the “WIC bump,” which triples the money allotted for the purchase of fruits and vegetables by the pregnant women, new mothers, and infants in the USDA program. “This bill simply continues a program that was meant to be temporary, without regard to the inflationary pressures and soaring food prices already squeezing taxpayers,” he said. “This targeted support has been a proven success,” with higher-quality diets among participants, said the National WIC Association. “This commonsense investment — extended repeatedly in fiscal year 2022 through bipartisan action — builds on WIC’s public health success to grow a healthier next generation.”

Increased use of CCC noticed. Harris said USDA Secretary Tom Vilsack is reportedly considering using the Commodity Credit Corporation to funnel money to schools, if Republicans continue to block the extension of pandemic-related school meal funding provisions. “My concern is that the USDA is using the CCC as a slush fund to circumvent congressional decisions and fund activities that have not been authorized. This is not the purpose of CCC authorities and funding,” Harris said, adding he would be watching what Vilsack does and that it may be “time to reconsider” the CCC authority. (Vilsack has notified Congress that he will tap the CCC for $1 billion for sending money for school meals.)

Next step: The appropriations measure is expected to be on the House floor in July.

— The bipartisan Ocean Shipping Reform Act will get President Joe Biden’s signature today. The law directs the Federal Maritime Commission (FMC) to prevent ocean carriers from unreasonably refusing to fill open cargo space with U.S. exports and investigate late fees charged by the container lines. Meanwhile, a slower U.S. economy is already cooling the ocean freight market. Spot rates for 20-foot containers to the U.S. from Asia have dropped about 33% since peaking last September, according to Drewry, a shipping consultancy and research firm in London. Those costs are still more than five times higher than their five-year average before the pandemic, and many shippers have locked in contract rates at double or triple the price they used to pay the carriers. According to Drewry estimates, the industry may make $300 billion this year, up from a record of $214 billion in 2021.

Ocean carriers would be prohibited from:

- “Unreasonably” refusing cargo space accommodations when available.

- Assessing fees that don’t comply with applicable regulations.

- Providing inaccurate invoices for demurrage or detention charges — late fees that carriers charge for holding cargo or assets beyond a contracted time period.

- Giving unreasonable preference to any commodity group or shipment, or disadvantaging any group or shipment.

Demurrage and detention fees: Invoices would have to include accurate information on a container’s availability date, port of discharge, free time, rates, and contact information, among other items. Shippers wouldn’t be obligated to pay fees if an invoice is inaccurate. The FMC could impose penalties or require refunds if it finds that a carrier’s invoice includes false or inaccurate information. It would have to investigate complaints regarding charges assessed by carriers and publish results of investigations on its website. Carriers would bear the burden of proving the reasonableness of any charges. Ocean carriers would be responsible for refunds or penalties in cases in which a nonvessel operating carrier provides a shipper with an invoice from the ocean carrier, and the commission finds that the nonvessel operating carrier isn’t responsible for the charge. The commission would have to disclose findings of false invoices by common carriers in addition to penalties that it has imposed or assessed against them for violations of ocean shipping regulations.

Retaliation: Carriers, marine terminal operators, and ocean transportation intermediaries would be barred from retaliating against shippers, their agents, ocean transportation intermediaries, or motor carriers by denying them available cargo space accommodations, or subjecting them to other discriminatory action if they choose to patronize another carrier or file a complaint. Carriers are already prohibited from using retaliatory measures under current law.

|

PERSONNEL |

— Nomination. President Joe Biden Wednesday announced his intent to nominate L. Felice Gorordo for U.S. alternate executive director of the International Bank for Reconstruction and Development.

|

CHINA UPDATE |

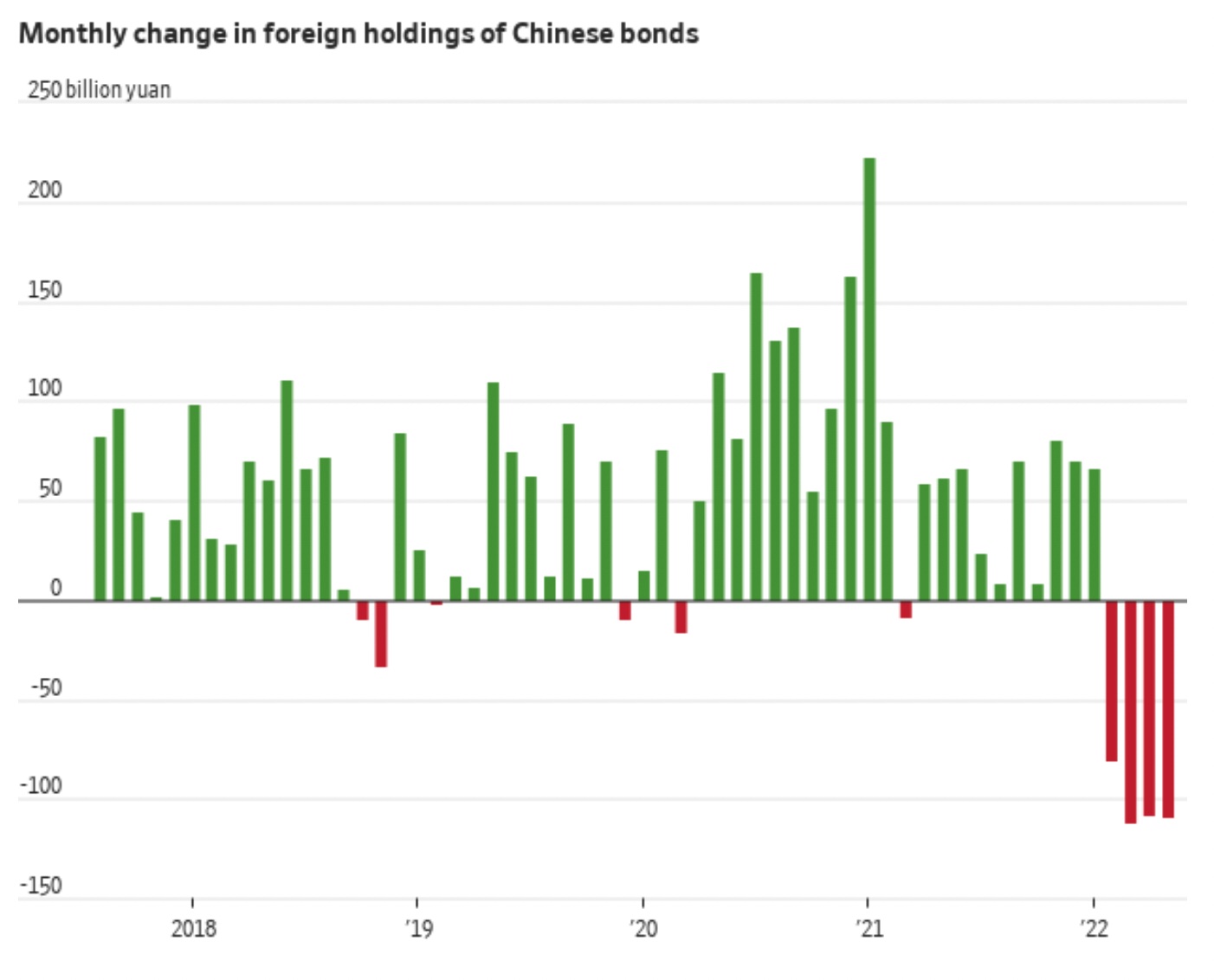

— Foreign investors cut their holdings of Chinese bonds by another $16 billion in May, a month that saw the yuan hit its lowest level in 20 months.

— China ramps up fixed-asset investments. China’s state planner said it had approved 10 fixed-asset investments worth 121 billion yuan ($18 billion) in May, a more than six-fold jump from April, as policymakers seek to get economic growth back on track after a Covid-induced slump. “We will ensure reasonable economic growth in the second quarter to provide a firm foundation and conditions for the economy in the second half of the year,” Meng Wei, spokeswoman at the National Development and Reform Commission (NDRC), said. Through the first five months of this year, NDRC approved a total of 48 fixed-asset investment projects worth 654.2 billion yuan ($97.4 billion), more than 80% of the 775.4 billion yuan ($115.5 billion) of projects in infrastructure, power, mining, water and manufacturing approved for all of 2021. NDRC also will give local governments more leeway in the use of funds they raise through special bonds, Meng said.

— China’s sow herd increases in May. China’s sow herd at the end of May was larger than in April, its first monthly increase in a year, an ag ministry official said. The sow herd rose 0.4% in May to 41.92 million head but was still 4.7% smaller than a year ago. Chinese hog producers have been liquidating sows over the past year amid poor production margins.

— On Wednesday, Xi Jinping marked his 69th birthday with a call to Russian President Vladimir Putin. During the call, Xi affirmed that the Sino-Russian relationship was as strong as ever. “China is willing to work with Russia to continue supporting each other on their respective core interests concerning sovereignty and security.” Xi also broached the Ukraine issue: “China has always independently assessed the situation on the basis of the historical context and the merits of the issue… All parties should push for a proper settlement of the Ukraine crisis in a responsible manner.” (Editor’s note: Xi did not call me even though we share a similar birthday date.)

|

TRADE POLICY |

— India again is major reason for WTO defeat. World Trade Organization (WTO) delegates and policy advocates say that Indian trade official Piyush Goyal’s forceful opposition to draft agreements on fishing subsidies, agricultural trade and other issues has stymied efforts to reach consensus. India in the past has led opposition to ag-related trade policy reforms.

|

ENERGY & CLIMATE CHANGE |

— Argentina to hike biodiesel levels to stretch diesel supplies. Argentina’s Economy Ministry will allow increased levels of biodiesel in fuel to address shortages of diesel fuel. The use of biodiesel would be increased to 12.5% from the current 5% for a period of 60 days and remain at 7.5% after the 60-day period. The agency said that 2.5 percentage points would be provided by small- and medium-sized companies with an additional 5 percentage points provided by all suppliers for a “transitory and exceptional period of at least 60 days.” Argentina last year lowered the level of biodiesel in diesel fuel to 5% from a mark of 10%. This is the same reasoning in the U.S. that E15 means less gasoline in a gallon versus E10.

— ExxonMobil responded to Biden’s call on U.S. oil refiners to boost capacity by saying it’s been doing precisely that. The biggest U.S. oil company said Wednesday it invested through the previous market downturn to raise refining capacity to process U.S. light crude by about 250,000 barrels a day. ExxonMobil outlined some solutions to the fuel crunch. "In the short term, the U.S. government could enact measures often used in emergencies following hurricanes or other supply disruptions — such as waivers of Jones Act provisions and some fuel specifications to increase supplies. Longer-term, the government can promote investment through clear and consistent policy that supports U.S. resource development, such as regular and predictable lease sales, as well as streamlined regulatory approval and support for infrastructure such as pipelines."

Perspective: The U.S. has lost about one million barrels a day of refining capacity in the pandemic. Some new refineries have opened in Asia, but the International Energy Agency recently reported that global capacity last year fell by 730,000 barrels a day. Some older refineries have closed because companies couldn’t justify spending on upgrades as government forces a shift from fossil fuels. The Wall Street Journal notes they also have to account for the Environmental Protection Agency’s tighter permitting requirements — the agency recently challenged a permit for an Indiana refinery — and steeper biofuel mandates. Also, S&P Global Platts estimates that renewable diesel in California fetched a $3.70 a gallon premium over regular diesel in the early weeks of 2022 owing to tax and regulatory credits. “This biofuel profit premium is driving the sort of capital misallocation that the World Bank noted last week in a report on economic growth and inflation,” the WSJ adds.

Chevron CEO Mike Wirth said recently that refineries are shutting down or being repurposed for renewable fuels because “the stated policy of the U.S. government is to reduce demand for the products that refiners produce.” When companies are told that demand for their product will become obsolete, it’s no surprise that they don’t invest in supply.

Meanwhile, the White House is willing to use the emergency wartime Defense Production Act to boost the nation’s supply of gasoline, White House Press Secretary Karine Jean-Pierre said Wednesday.

— Supreme Court is deciding a key environmental policy case. The court will soon issue a ruling in a case that challenges the Environmental Protection Agency’s power to regulate carbon emissions, which could have broad implications for agency powers and the Biden administration’s climate policy goals. If the court rules against the EPA, claims that the SEC is now overreaching may gain traction.

|

LIVESTOCK, FOOD & BEVERAGE INDUSTRY |

— Baby Formula: Abbott paused baby-formula production at its plant in Sturgis, Mich., after recent thunderstorms flooded part of the facility, causing another setback for the company’s efforts to help alleviate a nationwide formula shortage. Meanwhile, the Biden administration announced it is shipping 44,000 pounds of specialty formula from Switzerland to the U.S. today. The supply "will be available primarily through a distribution pipeline serving hospitals, home health companies, and WIC programs around the U.S.," the White House said.

Meanwhile, Mead Johnson Nutrition has been approved to ship 4.5 million pounds of base powder from Singapore to make infant formula for use in the WIC program. The powder will produce 5.7 million cans of formula. Link for details.

— A smooth way to becoming wealthy. Daily Harvest founder and CEO Rachel Drori quit her job in 2015 to start making smoothies in a kitchen in Queens. Now, at 39, she’s worth $350 million, and she’s built a billion-dollar brand around frozen fruits and vegetables. Link for details.

|

CORONAVIRUS UPDATE |

— Summary:

- Global Covid-19 cases at 537,355,075 with 6,314,405 deaths.

- U.S. case count is at 85,941,735 with 1,012,607 deaths.

- Johns Hopkins University Coronavirus Resource Center says there have been 591,982,644 doses administered, 221,883,332 have been fully vaccinated, or 67.34% of the U.S. population.

— Anthony Fauci, the chief medical adviser to Biden, tested positive for Covid-19 and asked to appear remotely this morning for his scheduled testimony to the Senate Committee on Health, Education, Labor and Pensions.

— Covid vaccines for infants and toddlers from Moderna and Pfizer won support from a panel of U.S. regulatory advisers. The committee advising the Food and Drug Administration voted unanimously in favor of clearance for Pfizer’s three-dose vaccine for youngsters ages six months through 4 years as well as Moderna’s two-dose for children six months through 5 years.

|

POLITICS & ELECTIONS |

— Texas Governor Greg Abbott’s lead over Democratic challenger Beto O’Rourke has narrowed in the three weeks since the Uvalde elementary-school massacre. Abbott, a Republican seeking a third term in November, has a lead of five percentage points over O’Rourke, according to a Quinnipiac University poll published Wednesday. In a December poll by the same institution, the incumbent had a 15-point lead.

|

CONGRESS |

— House bill to focus on lowering food, fuel prices. House lawmakers today will take up a measure that aims to lower food and fuel prices with new emergency funding, loan authority, and biofuel waivers. The bill — an expanded version of HR 7606 — would provide a total of $700 million in emergency funding to help reduce the costs of using crop nutrients or precision agriculture practices, and for grants to expand biofuel infrastructure. The bill would also establish a USDA office to investigate competition matters in meat and poultry markets.

Even if it clears the House, the measure will face hurdles in the Senate.

The legislative package would:

- Provide $500 million in emergency funding to cover the costs of adopting nutrient management or precision agriculture practices that support agricultural production.

- Provide $200 million in emergency funding for competitive grants to expand biofuel infrastructure.

- Modify a waiver to allow for higher percentage ethanol-based fuels to be sold year-round.

- Establish a USDA office to prosecute anticompetitive practices in the food and agriculture industry.

- Authorize a total of $300 million from fiscal 2023 through 2025 for loans or loan guarantees to increase the capacity of livestock and poultry processing facilities.

- Authorize a total of $60 million through fiscal 2025 for grants to diversify and increase livestock and poultry processing.

- Create a supply chain task force to help the government respond to agriculture and food supply chain disruptions.

— The House Agriculture-FDA appropriations bill includes 134 earmarks totaling $191 million. Rep. Henry Cuellar (D-Texas) garnered six earmarks totaling $10.7 million. His largest is nearly $3 million through USDA’s rural development funds for the Pleasanton Police Department and Municipal Court.

— Water bill markup. The House Natural Resources Subcommittee on Water, Oceans, and Wildlife will vote today on several water infrastructure-related measures in a markup. Link for details.

— USPS, others to get $100 million for EVs. The House Appropriations Subcommittee on Financial Services and General Government will consider its draft fiscal 2023 spending bill, which would give the Biden administration $100 million toward its efforts to transition the federal fleet to electric and zero-emission vehicles. The draft bill text doesn’t include language pushed by some House Democrats that would have required the U.S. Postal Service’s fleet to be at least 75% electric.

|

OTHER ITEMS OF NOTE |

— Elon Musk is expected to confirm his desire to own Twitter and touch on aspects of his strategy for the company when he speaks to its employees today at a virtual all-hands meeting.

— Supreme Court on Wednesday dismissed a case regarding the effort by Republican-led states to reinstate a Trump-era regulation penalizing lawful immigrants for using welfare benefits, deciding after the case was argued that it should never have agreed to hear it in the first place.

— Here’s a way to significantly drop the price of gas… and get fired. A California gas station manager is taking responsibility after he says he made a mistake that cost him his job: accidentally listing gas at 69 cents per gallon. CBS Sacramento reports former gas station manager John Szczecina says he unintentionally put the decimal in the wrong spot and listed gas at 69 cents instead of $6.99 at a Rancho Cordova gas station. “Well, it was a mistake that I did, you know,” Szczecina told the outlet. The mistake cost the gas station $16,000 after people shared the price on social media and lines started to form at gas pumps, according to the outlet.