In Massachusetts, Biden Will Tout Climate Efforts but Will Not Declare an Emergency ALL

NSAC report saying billions of dollars in savings from means testing crop insurance brings negative reaction

|

In Today’s Digital Newspaper |

President Biden is considering declaring a climate emergency, though he is not expected to do so this week, despite the Washington Post earlier this week saying that would be the case. Biden will make a climate announcement today, but will not declare a climate emergency this week, White House press secretary Karine Jean-Pierre said on Tuesday. Biden will announce executive action to confront climate change today in a speech at a shuttered coal-fired power plant in Massachusetts, vowing that he won’t allow a congressional impasse on climate legislation to prevent urgent work to slow rising global temperatures, according to people familiar with the matter. Biden is expected to direct federal funds toward communities facing extreme heat, while taking new executive action to boost domestic offshore wind production, according to a White House official.

White House officials are still weighing a separate declaration that climate change is a national emergency — a step that would unlock broad executive authority to propel clean-energy construction. It could also allow Biden to use the Cold War-era Defense Production Act and the federal procurement budget of $650 billion per year to manufacture clean transportation technologies.

Ukraine struck for the second day in a row the strategic bridge linking Russian-occupied Kherson with other Russian-held areas in southern Ukraine, part of preparations for a counteroffensive there. Ukraine's first lady, Olena Zelenska, is set to address the U.S. Congress at 11 a.m. ET.

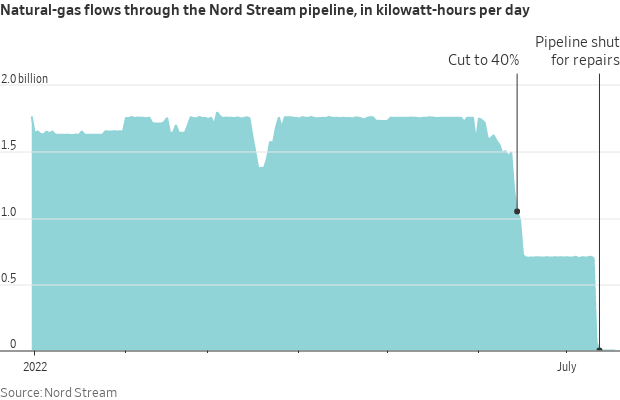

Russia likely will restart shipping gas through the Nord Stream 1 pipeline, but at less capacity, But Russian President Vladimir Putin warned sanctions against his country could hinder natural gas movement into Europe. Putin was quoted as saying that if sanctions prevent additional maintenance on pipeline components, gas flows through the pipeline could be reduced to 20% capacity.

The European Union called on countries to voluntarily curb their gas consumption, as part of a plan to prepare for a winter without ample supplies of Russian gas.

USDA daily export sale: 136,000 metric tons of soybeans for delivery to China during the 2022-2023 marketing year.

Demand for mortgages fell to the lowest point in 22 years last week, according to new data Wednesday from the Mortgage Bankers Association. Week over week, applications for a mortgage to purchase a home dropped 7%, and they were 19% lower than the same week in 2021.

U.K. inflation has exceeded economists’ forecasts, hitting 9.4% and many say it’s going higher.

U.S. begins trade fight with Mexico over energy policy. The Biden administration accuses Mexico President Andrés Manuel López Obrador’s government of favoring state-owned energy companies at the expense of American businesses, in a trade dispute that could lead to U.S. tariffs.

Just ahead of a House Ag subcommittee hearing today on crop insurance, a group released a report saying billions of dollars could be saved via means testing and moved to other ag sector policy topics. But a farm policy analyst slams the proposal. Details in Policy section.

The U.S. Senate is still working out the details to advance the long-awaited Chips for America Act, which includes $52 billion in incentives to expand the U.S. semiconductor industry, as well as a new, four-year 25% investment tax credit for chip-making. Senate Majority Leader Chuck Schumer (D-N.Y.) scheduled a vote to move forward on the bill on Tuesday, and it passed 64-34. Some analysts think its final passage could happen as early as next week. Details below.

Dan Cox's win in the race for the Maryland GOP gubernatorial nomination sets up what political analysts predict will be an uphill battle for Cox in the November general election, given that registered Democrats outnumber Republicans 2 to 1 in Maryland and that President Biden defeated Donald Trump 65% to 32% in 2020. On the Democratic side, the AP hadn’t declared a winner. Ahead of Tuesday’s primary, polls showed a close race between former U.S. Labor Secretary and Democratic National Committee Chairman Tom Perez, state Comptroller Peter Franchot and Wes Moore, an author who was chief executive of Robin Hood, an antipoverty foundation.

Italian bonds are rallying as Prime Minister Mario Draghi indicated he will stay in his role if he wins a confidence vote.

|

MARKET FOCUS |

Equities today: Global stock markets were mostly higher overnight. U.S. Dow opened flat and is currently down around 100 points. Earnings season rolls on with reports from Tesla Inc., Biogen Inc., Abbott Laboratories, Nasdaq Inc., Las Vegas Sands Corp. and CSX Corp. Tesla is expected to report its first sequential decline in quarterly profit in more than a year as it recovers from an extended shutdown at its Shanghai assembly plant. In Asia, Japan +2.7%. Hong Kong +1.1%. China +0.8%. India +1.2%. In Europe, at midday, London -0.2%. Paris -0.3%. Frankfurt -0.3%.

U.S. equities yesterday: The Dow gained 754.44 points, 2.43%, at 31,827.05. The Nasdaq advanced 353.10 points, 3.11%, at 11,713.15. The S&P 500 rose 105.84 points, 2.76%, at 3,936.69.

The S&P 500 is up 4% this month. The tech-heavy Nasdaq has climbed a perky 6.2%. All three major exchanges yesterday settled above 50-day moving average. Still, majority of analysts say this is a “bear market bounce.”

Agriculture markets yesterday:

- Corn: December corn futures fell 15 1/2 cents to $5.95 1/4.

- Soy complex: November soybeans fell 22 cents to $13.58 1/4 a bushel, around the middle of today’s range. August soymeal rose 50 cents to $435.00 and August soyoil fell 131 points to 61.89 cents.

- Wheat: September SRW wheat fell 1/2 cent to $8.12 1/4. September HRW futures fell 4 3/4 cents to $8.69 1/4. September spring wheat fell 8 3/4 cents to $9.30 1/4.

- Cotton: December cotton fell 62 points to 92.38 cents.

- Cattle: August live cattle rose 10 cents to $135.725. August feeder cattle rose $2.075 to $178.75.

- Hogs: August lean hog futures rose 70 cents to $112.825, the contract’s highest closing price since late April. Pork cutout values early Tuesday eached $125.72, the highest since August.

Ag markets today: Wheat futures posted strong gains overnight, while soybeans faced followthrough selling, though they are well off their lows this morning. Corn was caught in the middle and posted two-sided trade. As of 7:30 a.m. ET, corn futures were trading 1 to 2 cents lower, soybeans were 10 to 12 cents lower and wheat futures were 20 to 24 cents higher. Front-month U.S. crude oil futures were around $2 lower and the U.S. dollar index was about 200 points higher.

Technical viewpoints from Jim Wyckoff:

On tap today:

• Canada's consumer price index for June is expected to increase 8.4% from one year earlier. (8:30 a.m. ET)

• U.S. existing-home sales are expected to fall to an annual pace of 5.36 million in June from 5.41 million one month earlier. (10 a.m. ET)

The U.K.’s Office for National Statistics Wednesday said consumer prices were 9.4% higher in June than a year earlier, the highest rate of inflation since 1982 and a pickup from 9.1% in May. The figure marks the fastest rise in prices for a Group of Seven economy since the global surge began at the start of last year. Economists expect the annual rate of consumer price inflation to increase further. The Bank of England has said it should top out at around 11% in the final months of the year. The U.K. sets a ceiling on home energy prices twice yearly, and the next adjustment is due in October, when a further rise of 50% is expected.

Mortgage demand in the U.S. fell more than 6% last week compared with the previous week, hitting the lowest level since 2000, according to the Mortgage Bankers Association’s seasonally adjusted index. Applications for a mortgage to purchase a home dropped 7% for the week and were 19% lower than the same week in 2021. Buyers have been contending with high prices all year, but with rates almost double what they were in January, they’ve lost considerable purchasing power. Demand for refinances, which are highly rate sensitive, fell 4% for the week and were 80% lower than the same week last year. Those applications are also at a 22-year low.

Market perspectives:

• Outside markets: The U.S. dollar index is near steady in early U.S. trading. The yield on the 10-year U.S. Treasury note is fetching 2.971%. The 2-year and 10-year Treasury bond yields remain inverted at mid-week, which is one clue of an impending U.S. economic recession. U.S. crude was around $102.60 per barrel and Brent was around $105.65 per barrel. Gold and silver futures were lower ahead of U.S. economic data, with gold around $1,706 per troy ounce and silver around $18.71 per troy ounce.

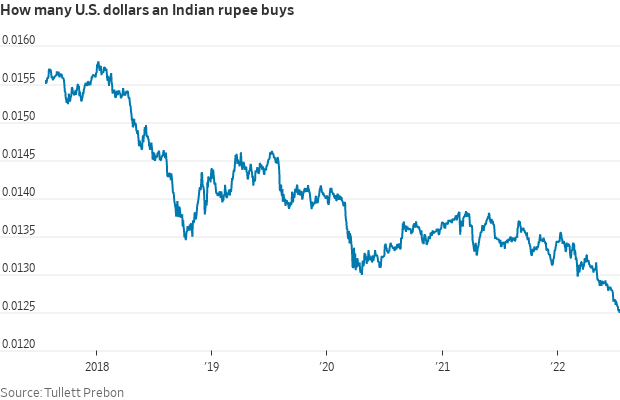

• India’s rupee hit a record low on Tuesday, against the backdrop of a stronger dollar and rising aversion by global investors to owning risky, emerging market assets. The currency crossed 80 rupees to the dollar during trading in India but closed at around 79.95, according to the Reserve Bank of India. A weaker rupee bodes trouble for the world’s fastest-growing major economy, which the World Bank expects to expand by 7.5% in the current financial year. India relies heavily on imports for both crude and edible oils, which have both become more expensive in rupee terms, pushing up inflation and eroding the country’s dollar reserves.

• The national average price for a gallon of gas fell again on Tuesday to $4.49, down from $4.98 just one month ago, according to AAA . Average prices are now below $4.50 in 24 states plus the District of Columbia, compared to just two states a month earlier. The 50-cent price decline translates to roughly $25 extra each month for the average consumer, or $190 million a day across the entire economy, according to White House estimates.

Biggest factors behind the gas price decline: Global demand for oil is falling amid high inflation, rising interest rates and a grim economic outlook. “Prices have come down because there’s stress in the rest of the world, and there’s a lot of financial stress,” said Diane Swonk, chief economist at KPMG, noting worries about the ability of China and emerging market economies to service their debt, not to mention ripple effects of the war in Ukraine. “The cloud attached to the silver lining is the reality that we’ve got a world economy that is still edging closer to recession, even as these prices come off, and these prices reflect that more than just good news,” she added.

• Port of Oakland closes night gates due to trucker protests. Protests over a California labor law have contributed to a rise in import container dwell times, according to project44 data.

• Ag trade: Jordan tendered to buy 120,000 MT of optional origin milling wheat. Egypt cancelled the tender to buy U.S. wheat yesterday but has tendered again for world wheat. Jordon and Pakistan are all in for wheat. The U.S. is not expected to do any of the business.

• The cattle market continues to have large beef movements and higher prices. The talk is China has bought more beef.

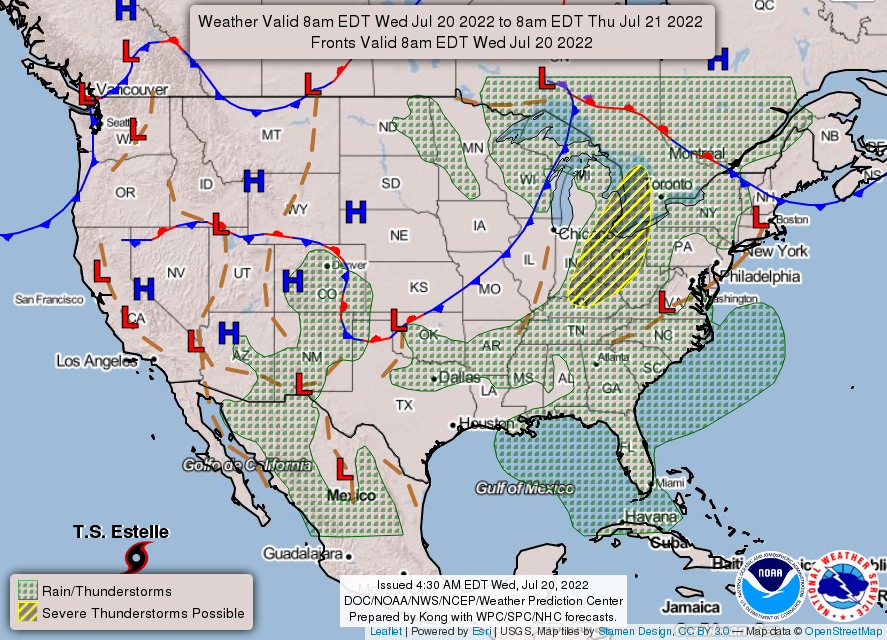

• NWS weather: Dangerous heat to continue through midweek across the south-central U.S., building into the Northeast today... ...Severe thunderstorms possible across portions of the Great Lakes and Ohio Valley today, and the Northeast and Southeast on Thursday... ...Monsoonal moisture to bring locally heavy rains and isolated flash flooding across portions of the Southwest into the southern Rockies.

Items in Pro Farmer's First Thing Today include:

• Wheat rallies, soybeans fall amid followthrough selling

• China’s sow herd increased again in June (details in China section)

• Big day for wholesale beef trade

• CME lean hog index picking up steam

|

RUSSIA/UKRAINE |

— Summary: Russian jets struck homes in Sloviansk for the first time as Russia renewed its offensive on Donetsk. Russia's military objectives in Ukraine have now expanded beyond the Donbas region in the eastern part of the country, Foreign Minister Sergei Lavrov told state media on Wednesday. “Now, [our] geography is different. It is not only the [Donetsk and Luhansk People’s Republics], it is also the Kherson region, the Zaporizhzhia region, and a number of other territories,” Lavrov said in an interview with the state-run RIA Novosti news agency, referencing the two breakaway regions by the names the pro-Russian separatists in the region promote. Lavrov also said that the impetus behind expanding their objectives was the West's continued military support for the Ukrainian resistance. Russia cannot accept that “in the parts of Ukraine that [President Volodymyr] Zelensky or the one who will replace him will control, there are weapons that will pose a direct threat to our territory and the territory of those [eastern Ukrainian] republics that have announced their independence,” the minister explained, threatening that their goals could continue to grow if the military aid starts including long-range weapons. “If Western countries supply long-range weapons to Ukraine, [these goals] will move even further,” Lavrov said.

- Ukraine grain talks advance but ‘not all issues resolved.’ Putin met Recep Tayyip Erdogan of Turkey, who has taken on a role of middleman in Ukraine diplomacy and has been working to overcome a Russian blockade of Ukrainian grain that has been aggravating a global food crisis. “Thanks to your mediation, we have moved forward,” Putin told Erdogan in televised remarks at the beginning of their meeting. “Not all issues have been resolved yet, but the fact that there is movement is already a good thing.” Last week, Russian and Ukrainian negotiators met in Istanbul for talks on the grain crisis, which the United Nations said yielded progress but no resolution. There is a framework agreement now with Russia to shift wheat from silos out through the Black Sea by the end of July.

Putin also called for what he said were remaining restrictions on Russian grain exports to be removed after the U.S. had largely removed preventions on Russian fertilizer exports. (U.S. says no sanctions on Russian grain or fertilizer.) Putin also indicated that the Kremlin believes that they do not see a desire from Ukraine to hold to a preliminary peace deal that was reached in March. - Vladimir Putin said Gazprom will r

estart gas supplies to Europe via the Nord Stream 1 pipeline on schedule, on Thursday — but at a drastically reduced capacity. Officially the pipeline is closed for maintenance. Some suspect Russia is manipulating gas flows as a political tool in retaliation for the EU’s support of Ukraine. Vladimir Putin said Gazprom will restart gas supplies to Europe via the Nord Stream 1 pipeline on schedule, on Thursday - but at a drastically reduced capacity. Officially the pipeline is closed for maintenance. Some suspect Russia is manipulating gas flows as a political tool in retaliation for the EU's support of Ukraine.

- Europe rolled out a plan to ration natural gas if Russia tightens taps. Guidelines from the European Union are expected to limit indoor heating to 66 degrees Fahrenheit and include criteria for energy-intensive industries to get priority gas access.

- U.S. Secretary of State Antony Blinken is expected to point to Russia’s invasion of Ukraine as an urgent reason for governments to cooperate more closely on the international supply chain, according to State Department officials. At a virtual meeting on Wednesday with representatives from more than a dozen countries, Blinken also will emphasize the need to reduce dependence on petroleum and natural gas from unreliable countries, instead focusing on trade in clean-energy products.

- China’s spending on Russian energy jumps to $6.4 billion in June. China spent 72% more on Russian energy purchases in June from a year earlier, as higher prices due to the war in Ukraine raised its import bill for oil, gas and coal.

|

POLICY UPDATE |

— Biden today will be in Somerset, Mass., to “deliver remarks on tackling the climate crisis and seizing the opportunity of a clean energy future to create jobs and lower costs for families,” the White House announced. Although no announcement is expected today, President Biden is considering declaring a climate emergency, which would unlock federal resources and administrative powers. The declaration could be used as a legal basis to block oil and gas drilling or other projects, although such actions would likely be challenged in court by energy companies or Republican-led states. A climate emergency would allow Biden to redirect spending to accelerate renewable energy, including wind and solar power, and speed transition from fossil fuels, the Associated Press reports (link).

Meanwhile, in an editorial (link), the Wall Street Journal says it criticized former President Donald Trump when he declared an emergency on the U.S. border and warned that a Democratic president might use it as precedent to declare a climate emergency. Now, the WSJ says, that warning appears to be coming true.

— Report: Crop insurance means test could save billions of dollars. Billions in taxpayer dollars could be saved over the next decade if the next farm bill puts a cap on federal subsidies paid to farmers who purchase crop insurance, according to a special report (link) published Tuesday by the National Sustainable Agriculture Coalition (NSAC). The report was likely timed to coincide with today’s House Agriculture General Farm Commodities and Risk Management Subcommittee hearing on crop insurance. NSAC is hosting a webinar next week to present the full findings of the special report.

The report says a cap would impact relatively few farmers, have little impact on total insurance use and make resources available for conservation programs and other initiatives that help farmers further reduce the risk of weather-related loss.

The strictest requires the complete elimination of insurance subsidies for any farm with an adjusted gross income over $250,000, which would amount to total savings of $20.2 billion and would impact 10.66% of all farms. All of the other caps would provide some savings on subsidy payments and reduce the extent to which subsidy payments are concentrated on a few farms, but to a lesser degree.

House Agriculture Subcommittee Chair Cheri Bustos (D-Ill.) at today’s hearing said: “Throughout the last two farm bill reauthorization processes, the message I heard loud and clear was to do no harm to crop insurance. The program has been and continues to be a central risk management tool for producers across the country, and it has continued to grow and evolve to address the challenges and risks our producers are facing.”

Comments: One agricultural policy analyst emails: “Among all the misguided things that NSAC pushes, this might be one of the worst. To spite others they bite off their own nose. In the name of helping small farmers, they hurt small farmers. Why? Take good risk out of the insurance risk pool — the thousands of midsized and larger full-time farm and ranch families — and you increase premiums on all the small farmers left in the insurance. Of course, it also seriously injured those booted out of crop insurance, but it also hurts those small farmers. Beyond this, crop insurance has collateralized agriculture without which we would return to asset-based lending which gave us the 1980s farm financial crisis. Such an incredibly bad idea.”

|

PERSONNEL |

— EPA nomination hearing postponed. The Senate Environment and Public Works Committee has delayed the confirmation hearing for Joseph Goffman to head up EPA’s air office due to Ukrainian First Lady Lena Zelenskyy delivering remarks to a joint session of Congress at the same time. Republicans were expected to focus on Biden administration climate-related regulations which EPA would play a key role in implementing. No date has been set for another hearing.

— Michael Barr was sworn in as the Federal Reserve’s new vice chair for supervision on Tuesday, the Fed said in a statement, giving the central bank a full seven-member board for the first time since 2013.

|

CHINA UPDATE |

— Kissinger warns Biden against endless confrontation with China. Former U.S. Secretary of State Henry Kissinger, 99, said geopolitics today requires “Nixonian flexibility” to help defuse conflicts between the U.S. and China as well as between Russia and the rest of Europe. While warning that China shouldn’t become a global hegemon, the man who helped re-establish U,S./China ties in the 1970s said that President Joe Biden should be wary of letting domestic politics interfere with “the importance of understanding the permanence of China… Biden and previous administrations have been too much influenced by the domestic aspects of the view of China,” Kissinger said in an interview Tuesday in New York with Bloomberg News Editor-in-Chief John Micklethwait. “It is, of course, important to prevent Chinese or any other country’s hegemony.” But “that is not something that can be achieved by endless confrontations,” he added in the interview. He’s previously said the increasingly adversarial relations between the U.S. and China risk a global “catastrophe comparable to World War I.”

— China’s sow herd increased again in June. China’s sow herd at the end of June rose for the second consecutive month, reaching 42.8 million head, according to the country’s ag ministry. While that was up 2% from May, it was still down 6.3% from last year. Current live hog production is at a “normal and reasonable” level, an ag ministry official said. “Live hog and pork production will increase steadily in July and August... the supply of large hogs is guaranteed in the second half of the year,” the official noted.

— Embattled property giant China Evergrande has yet to reach an agreement with bondholders, but still plans to release an update on restructuring talks in July.

— “Most CEOs, whether they admit it or not, are thinking seriously about how to either get out of China, if they are there, or at least about how to develop alternative sources of supply to insulate themselves from political risk,” said Bill Reinsch, trade expert at the Center for Strategic and International Studies.

— China Covid-19 cases hit two-month high. Infections jump in less-developed regions while authorities keep a lid on the virus in major export and commercial hubs.

— Chinese city Zhengzhou sets up bailout fund as mortgage boycott spreads. The homebuyer revolt over stalled projects is aggravating a property sector crisis. A Financial Times article (link) says refusing to pay mortgages is a powerful political weapon as unrest could mark a bad start to president Xi Jinping’s third term.

— China doubles down on infrastructure to spur growth. Renewable energy, technology and water management projects are set to be among the largest beneficiaries of China’s latest infrastructure investment boom, the likes of which has not been seen since the global financial crisis. Link for details.

— Reuters: China seeks to stop U.N. rights chief from releasing Xinjiang report. China is asking the United Nations human rights chief to bury a highly anticipated report on human rights violations in Xinjiang, according to a Chinese letter seen by Reuters and confirmed by diplomats from three countries who received it.

|

TRADE POLICY |

— U.S. begins trade fight with Mexico over energy policy. The Biden administration accuses Mexico President Andrés Manuel López Obrador’s government of favoring state-owned energy companies at the expense of American businesses, in a trade dispute that could lead to U.S. tariffs. The U.S. is seeking dispute settlement consultations under the U.S.-Mexico-Canada Agreement — the first step in what could lead to tariffs on a range of Mexican products.

Mexico comments. Mexico’s economy ministry, which is in charge of trade negotiations, said that Mexico’s government is willing to reach a “mutually satisfactory” solution during the consultation stage.

U.S. Trade Representative Katherine Tai said an array of Mexican policies undermine American companies and U.S.-produced energy in favor of Mexico’s state-owned power company Comision Federal de Electricidad, or CFE, and oil company Petróleos Mexicanos, or Pemex. “We have repeatedly expressed serious concerns about a series of changes in Mexico’s energy policies and their consistency with Mexico’s commitments under the USMCA,” Tai said. The policies discourage “investment by clean-energy suppliers and by companies that seek to purchase clean, reliable energy,” she said. U.S. officials said that Mexican officials haven’t been responsive to U.S. concerns raised repeatedly over the past 18 months.

What’s next? Under the USMCA, the U.S. and Mexico must start consultations within 30 days. If the consultations don’t lead to a resolution, the U.S. could request the establishment of a panel of experts. If an agreement isn’t reached there, the U.S. could impose import tariffs on Mexican products to offset the damage suffered by U.S. companies.

|

ENERGY & CLIMATE CHANGE |

— GOP warning on highway fund. Republicans warned Transportation Secretary Pete Buttigieg that the administration’s electric vehicle policies could worsen the diminishing solvency of the Highway Trust Fund. Buttigieg offered solutions and said Congress needs to make other decisions.

|

LIVESTOCK, FOOD & BEVERAGE INDUSTRY |

— Pork checkoff rate to drop by five cents, a 12.5% decline. USDA today has formally proposed reducing the pork checkoff rate from 40 cents to 35 cents per $100 value for live animals, in line with a vote by National Pork Producers Council delegates. Revenue from the checkoff is anticipated to fall $13.5 million. The amount raised for promotion and marketing in 2021 was $103.6 million, a 41% increase from the year before due to a 47% increase in live hog prices. Link Federal Register announcement.

Gross revenue from swine marketed in 2021 was approximately $27 billion. The proposed reduction is seen lowering the domestic assessment by $12.3 million and the importer assessment by $1.2 million. However, the notice said that even with the reduction, total program funds "will have increased significantly above 2020 levels owing to the ongoing increase in price levels, assuming general market conditions of 2021 persist."

— Every year, around $400 billion of food waste is junked by grocery stores, and because it cuts into corporate profits, companies can treat it as tax deductible. Link for details.

— FDA chief cites need for 'fundamental' change in its food program. Food and Drug Administration Commissioner Robert Califf said Tuesday that he has taken a closer look at the FDA food program and concluded that "fundamental questions about the structure, function, funding and leadership need to be addressed." The statement comes as criticism of the agency, spurred by the recent shortage of infant formula, has mounted. The FDA, through its Human Foods Program, regulates about 80 percent of the nation’s food supply, including areas as diverse as genetic engineering and food-borne pathogens. It shares regulatory oversight of the food system with USDA. “The agency’s inspectional activities related to the program also need to be evaluated, particularly in light of stresses related to the Covid-19 pandemic,” Califf said.

|

CORONAVIRUS UPDATE |

— Summary:

- Global Covid-19 cases at 565,270,350 with 6,374,568 deaths.

- U.S. case count is at 89,836,091 with 1,024,900 deaths.

- Johns Hopkins University Coronavirus Resource Center says there have been 599,289,113 doses administered, 222,682,315 have been fully vaccinated, or 67.58% of the U.S. population.

— A new vaccine on the U.S. market. Novavax shares in the premarket session slightly extended their big gains from Tuesday, when the Centers for Disease Control and Prevention approved the company’s Covid vaccine for adults. It joins shots from Pfizer, Moderna and Johnson & Johnson, which have been widely available since last year. The CDC is hoping that the Novavax vaccine, which uses more conventional technology that has been in utilized for three decades, will coax skeptics into getting the shot.

|

POLITICS & ELECTIONS |

—The three candidates to lead Britain’s Conservative Party will be whittled down to a final two today. Party members will then choose Boris Johnson’s successor as Tory leader and prime minister. But as inflation figures also released on Wednesday showed, Britain’s next leader will inherit extraordinary challenges. Prices rose by an annual rate of 9.4% in June, faster than expected and up from 9.1% in May.

— Sri Lankan lawmakers today elected former Prime Minister Ranil Wickremesinghe as president of the crisis-hit country. He received 134 votes from a possible 223. This move will likely anger protesters who have been demanding his removal from office for weeks.

— Italian Prime Minister Mario Draghi said he is ready to rebuild his governing coalition. The statement eased the political crisis which has gripped Italy for the last few weeks.

— Trump's candidate wins in Maryland. Dan Cox, a Maryland state delegate endorsed by former President Trump, easily won the Republican primary for governor. His 16-point victory over moderate Kelly Schulz, who was backed by Gov. Larry Hogan (R), is also a win for Democrats. Thinking he'd be the easier candidate in November, they boosted him with ads highlighting his hard-right stands. Cox’s victory over Schulz could be a blow to Republican chances to hold on to the seat in November. The DNC plowed more than $1 million behind an ad intended to boost Cox, seeing him as an easier opponent in November.

In a crowded Democratic primary for governor, best-selling author and political newcomer Wes Moore took an early lead over former U.S. labor secretary Tom Perez and Comptroller Peter Franchot.

Cook Political Report change today: Maryland Governor: Lean D to Solid D.

Glenn Ivey, the former top prosecutor in Prince George’s County, was projected to defeat former congresswoman Donna Edwards in the Democratic primary for the 4th Congressional District.

— Democrats across the 10 most competitive Senate races are outraising Republicans by more than $75 million among small-dollar donors giving less than $200, according to an Axios analysis of Federal Election Commission records. Link to more via Axios.

— Intelligence agencies say Russia remains a threat in elections. Top FBI. and National Security Agency officials warned yesterday that Russia could still seek to meddle or promote disinformation during the 2022 midterm races, even as it wages war in Ukraine. Iran and China also remained potent threats, the officials said.

|

CONGRESS |

— Senate eyes research tax break in Chips bill. The Senate voted by a 64-34 margin to begin debate on legislation to provide more than $52 billion in grants and incentives for the American semiconductor industry. Meanwhile, a bipartisan Senate group is making a last-minute push to revive a tax break for corporate R&D in the bill. Sen. Todd Young (R-Ind.) said lawmakers are eyeing a one-year extension to a tax break for R&D costs that expired at the end of 2021.

— The House Judiciary Committee is expected to advance legislation that would ban assault weapons for the first time in nearly two decades. While the move will make a statement, the bill stands little chance in the Senate.

— Jan. 6 riot. Prosecutors opened their criminal case against Steve Bannon, telling jurors he defiantly ignored a House subpoena, an accusation Bannon’s lawyers disputed. The National Archives and Records Administration asked the Secret Service to investigate whether text messages from Jan. 5 and 6, 2021, were improperly erased.

|

OTHER ITEMS OF NOTE |

— With the national student loan pause set to expire at the end of August after a more than two-year break, some borrowers remain in limbo about what exactly that means for them. The Biden administration has approved $26 billion in federal student loan forgiveness for 1.3 million borrowers and many remain hopeful additional student loan cancellation will occur in the coming weeks. Link for details via Forbes.

— The U.S. recently disrupted a North Korean state-sponsored hacking campaign that targeted medical facilities, recovering about a half-million dollars in ransom payments.

— NASCAR is coming to Chicago. The racing promotion reached a minimum three-year deal to hold a race in the city starting in 2023. Cars on the 2.2-mile downtown circuit will pass by famous Chicago landmarks like Soldier Field, Grant Park, and Buckingham Fountain.

— The Pittsburgh Steelers’ stadium will no longer be called Heinz Field, and many fans are in open revolt over the new name. Link for details.