House Reformed WHIP+ Proposal Includes $8.5 Bil. in 2020 and 2021 Ag Disaster Aid

China wolf warrior attitude towards U.S. continues | Day 1 of FOMC confab

In Today’s Digital Newspaper

Market Focus:

• Very negative impact on Chinese tech stocks

• Day one of two re: FOMC confab

• Biden administration moving to tilt pay and power toward workers

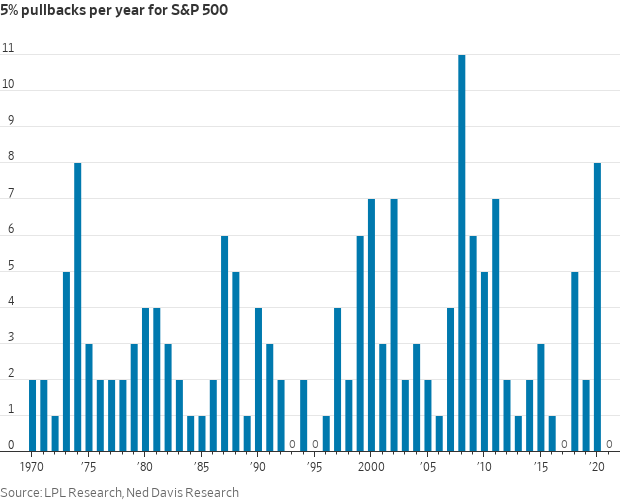

• S&P 500 hasn’t suffered 5% pullback since Oct., has advanced 35% since

• CBO to publish estimates for some of Biden’s budget proposals on July 30

• Which baseline will be used to assess legislative proposals?

• Bitcoin back in focus, slipping back below $38,000

• Ag demand update

• Markets bounce as crop condition ratings slide

• Sultry weather grips Northern Plains and western Corn Belt

• No change in Cordonnier’s U.S. crop estimates

• Cordonnier slices Brazilian corn crop projection as farmer brace for another cold snap

• U.S. spring wheat tour kicks off; final yield peg to come Thursday

• Brazil an aggressive exporter of soymeal, while Argentine shipments of meal slump

• Feeder cattle futures soar

• Will lean hog rebound hold?

Policy Focus:

• WHIP+/ag disaster bill authorizes up to $8.5 billion for eligible 2020 and 2021 disasters

• Biden's infrastructure bill hits snags, but talks continues

• Little change in CFAP payouts

Biden Administration Personnel:

• Senate Agriculture panel approves Moffitt for USDA post

• Hipp nomination on hold

China Update:

• Hong Kong man found guilty in first verdict under national-security law

• China's new ambassador to the U.S., Qin Gang, heading to Washington today

• U.S./China discussions end with no major breakthroughs

• China to hold another auction of imported corn July 30

Trade Policy:

• Hearing today on status of USMCA

Energy & Climate Change:

• China says proposed EU carbon border tax violates WTO rules

• Pressure coming today on Interior’s Haaland over gas, oil lease sales

Coronavirus Update:

• Record Covid infection pace in Tokyo

• White House announces Covid-19 travel restrictions will remain

• First federal agency mandates Covid-19 vaccine

• Biden announces “long Covid” sufferers may qualify as disabled

Congress:

• House to take up FY 2022 Ag appropriations measure today

• Former Sen. Mike Enzi (R-Wy.) dies after sustaining serious injuries from bicycle accident

Other Items of Note:

• Need for more shepherds on U.S. farms

MARKET FOCUS

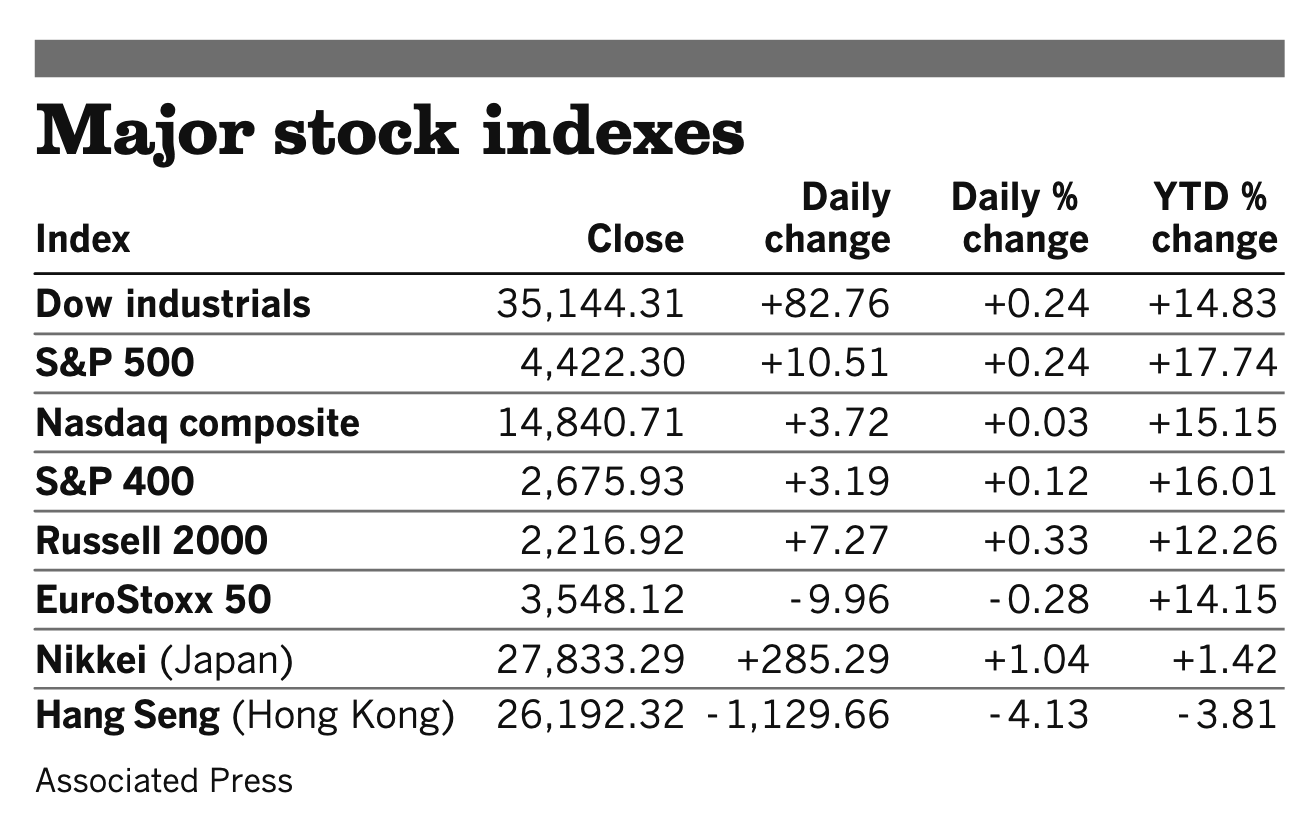

Equities today: Sweeping crackdowns across China are continuing to send shockwaves across financial markets. U.S.-listed shares of Alibaba slid 7.2%; KE Holdings, 28%; and JD.com, 8.6%. Shares in Meituan, a leader in the food-delivery sector, dropped for a second day after regulators ordered the industry to ensure workers earned a local minimum wage. Amid Beijing’s efforts to rein in a wide range of companies, an SEC commissioner said that U.S.-listed Chinese firms should disclose the risks of government interference. In global trading today, Chinese tech stocks’ decline accelerated. Asia markets ended mixed, Europe was lower at midday and U.S. stock futures were down. Hong Kong’s Hang Seng fell 1,105.89 points, 4.22%, at 25,086.43. Japan’s Nikkei was up 136.93 points, 0.49%, at 27,970.22.

U.S. equities yesterday: All three major indices managed to post record finishes to open the week. The Dow was up 82.76 points, 0.24%, at 35,144.31. The Nasdaq rose 3.72 points, 0.03%, at 14,8740.71. The S&P 500 added 10.51 points, 0.24%, at 4,422.30. The benchmark S&P 500 hasn’t suffered a 5% pullback since October and has advanced 35% since the end of that month. The last time the index enjoyed a respite of such length was from June 2016 to early February 2018 when stocks charged steadily higher before the 2016 presidential election and after Donald Trump’s surprise victory.

On tap today:

• U.S. durable goods orders for June are expected to increase 2% from a month earlier. (8:30 a.m. ET)

• S&P/Case-Shiller 20-city home price index for May is expected to increase 16.4% from one year earlier. (9 a.m. ET)

• Conference Board's consumer confidence index is expected to fall to 124.0 in July from 127.3 the prior month. (10 a.m. ET)

• Richmond Fed's manufacturing survey is expected to slip to 21.5 in July from 22 in June. (10 a.m. ET)

• Federal Reserve begins a two-day policy meeting.

• USMCA: The Senate Finance Committee meets for a hearing on the U.S.-Mexico-Canada Agreement one year after its implementation.

Biden administration is moving to tilt pay and power toward workers, the Wall Street Journal reports (link). The series of regulatory changes—which, in some cases, would reverse Trump administration efforts—are aimed at raising workers’ pay and give them other benefits. Business groups are pushing back against the Labor Department’s efforts to reshape rules governing employers. Opponents say the moves could burden businesses amid an uneven economic recovery. Regulatory action allows the administration to implement part of its agenda without the need for Congress to pass legislation.

CBO to publish estimates for some of the president’s budget proposals on July 30. The Congressional Budget Office (CBO) will publish estimates of the budgetary effects of some of the proposals in President Bidens budget (which was released on May 28, 2021) on Friday, July 30, at 11:00 a.m. ET. CBO works with the staff of the Joint Committee on Taxation (JCT) each year to estimate the budgetary effects of the changes to spending programs and the tax code proposed by the president. This year, however, because of the extensive work required for legislation currently being considered by the Congress, CBO and JCT have not been able to complete a comprehensive analysis of the president’s proposals. The estimates released this week will cover only some of those proposals and will not include CBO’s assessment of how all of the President’s proposals — taken together — would affect deficits and debt in the coming years in relation to the agency’s most recent baseline projections, which were released earlier this month. CBO may produce estimates of the budgetary effects of other proposals in the president’s budget at a later date.

Which baseline will be used to assess legislative proposals? Typically, lawmakers use the March scoring baseline…which generally follows CBO’s analysis of the president’s budget. But CBO has not done that this time. As of now, the only detailed baseline is February 2021. With appropriators and others already making a lot of progress on various bills, sources see an argument for using the February 2021 baseline.

Market perspectives:

• Outside markets: The U.S. dollar index is higher as the euro, yen and British pound are all weaker versus the U.S. currency. The yield on the 10-year U.S. Treasury note is weaker, trading just above 1.26%, with a mixed tone in global government bond yields. Gold and silver futures moved to being nearly unchanged ahead of U.S. economic updates, with gold around $1,798 per troy ounce and silver around $25.24 per troy ounce.

• Crude prices are little changed ahead of U.S. trading, having given up earlier modest gains. U.S. crude is trading around $71.95 per barrel and Brent around $73.80 per barrel. Futures moved higher in Asian action, with U.S. crude up 23 cents at $72.14 per barrel and Brent was up 31 cents at $74.01 per barrel.

• Bitcoin is back in focus, slipping back below $38,000. Amazon has quashed chatter about it potentially adding crypto to its payment options.

• Ag demand: Egypt tendered to buy an unspecified amount of wheat from global suppliers. Pakistan tendered to buy 110,000 MT of wheat. Turkey’s state grain board issued an international tender to buy around 395,000 MT of milling wheat and 515,000 MT of animal feed barley.

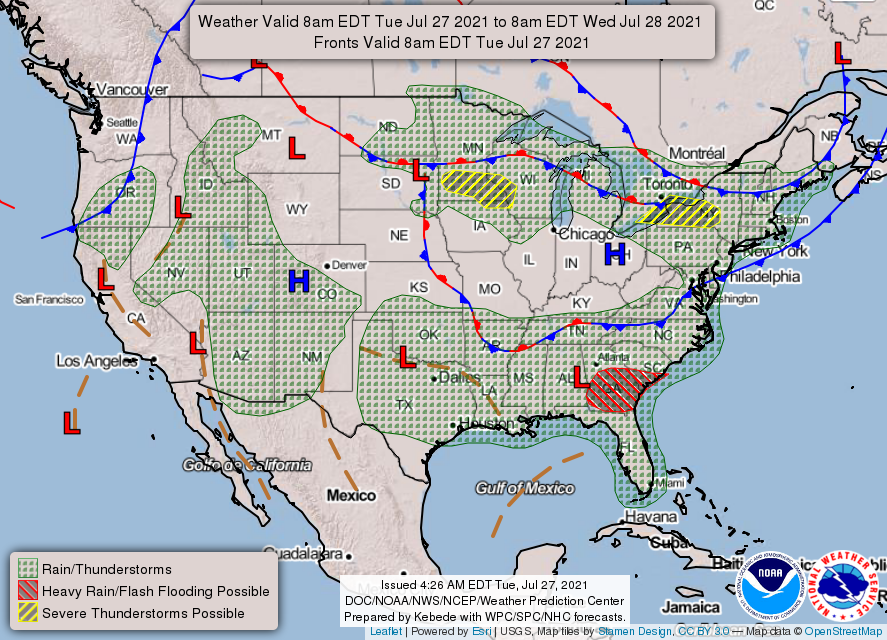

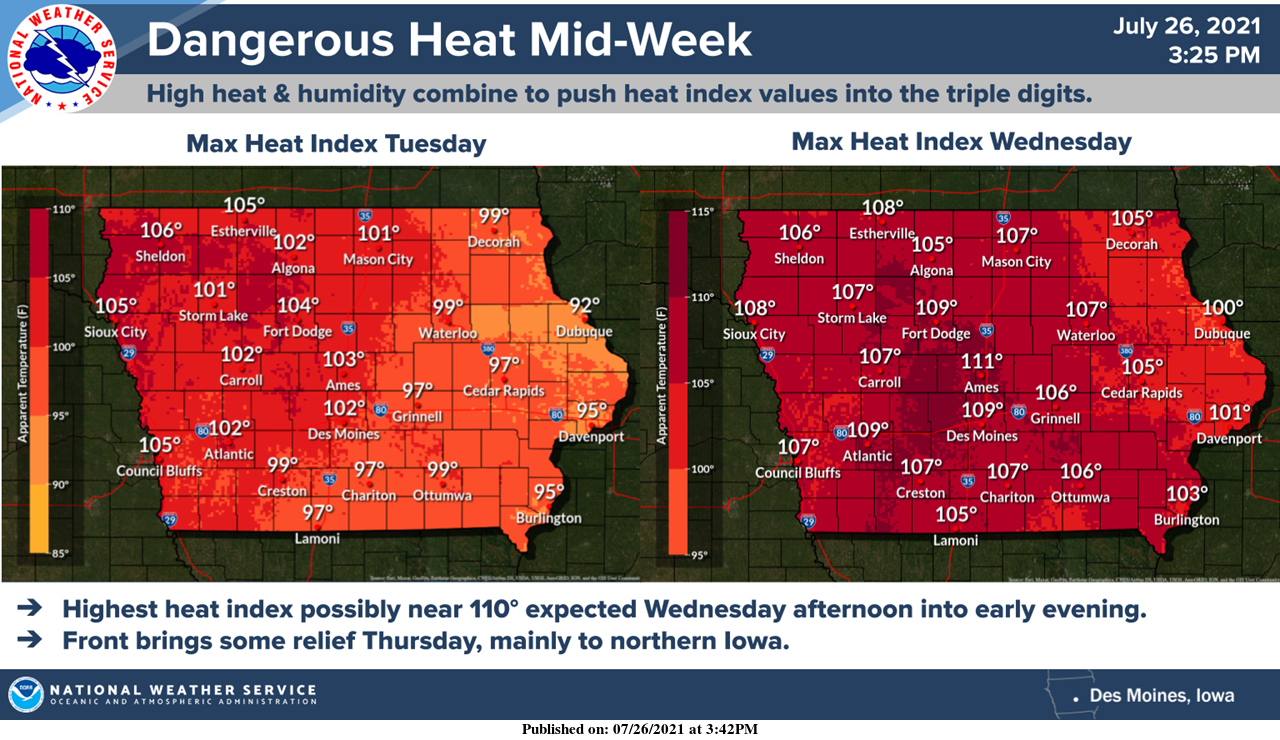

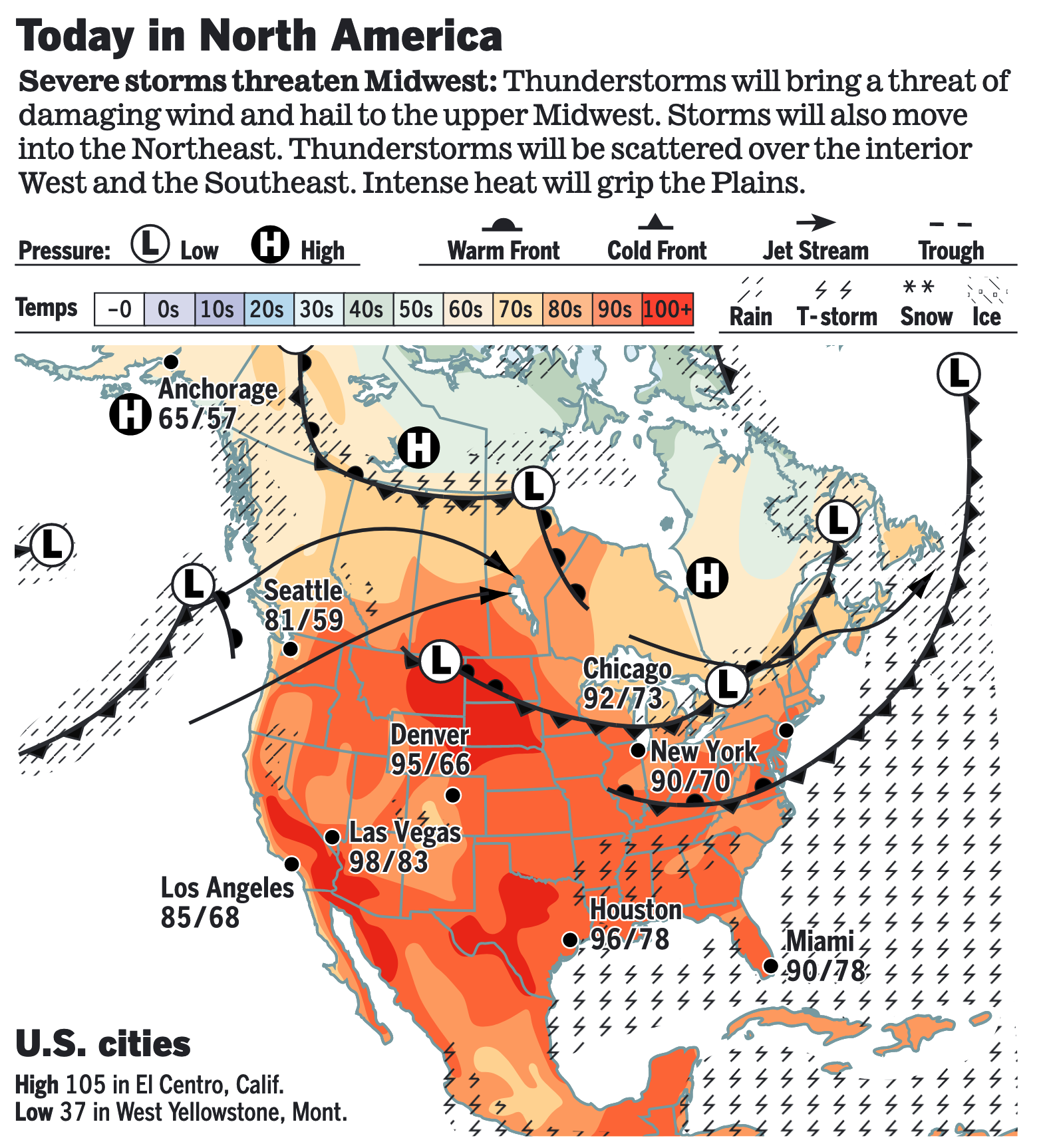

• NWS weather: There is a Slight Risk of excessive rainfall over parts of the Southeast through Wednesday morning... ...There is a Slight Risk of excessive rainfall over parts of the Upper Midwest/Upper Great Lakes Wednesday through early Thursday... ...There is a Slight Risk of severe thunderstorms over parts of the Upper Midwest and the Lower Great Lakes through Wednesday morning... ...Excessive Heat Warning over parts of the Northern High Plains; Heat Advisory over parts of the Lower Mississippi Valley/Southern Plains, Northern/Central Plains, and the Northern High Plains.

Items in Pro Farmer's First Thing Today include:

• Markets bounce as crop condition ratings slide

• Sultry weather grips Northern Plains and western Corn Belt

• No change in Cordonnier’s U.S. crop estimates

• Cordonnier slices Brazilian corn crop projection as farmer brace for another cold snap

• U.S. spring wheat tour kicks off; final yield peg to come Thursday

• Brazil an aggressive exporter of soymeal, while Argentine shipments of meal slump

• Feeder cattle futures soar

• Will lean hog rebound hold?

POLICY FOCUS

— Latest WHIP+/ag disaster bill authorizes up to $8.5 billion for eligible 2020 and 2021 disasters. The measure is expected to be linked to a must-pass bill later this year. It would cover losses via drought, high winds, excessive heat, and polar vortexes, and would also cover power outage, losses to wine grapes impacted by smoke and allow direct payments to sugar and dairy cooperatives for losses, including milk dumping, that affect an entire co-op. Link to text of bill.

WHIP+ reforms include making it easier for farmers to qualify for drought losses, with those eligible facing a county with a USDA disaster designation due to D2 drought versus a previous requirement of D3 (extreme) or D4 (exceptional).

Payment caps would generally be limited to $250,000 per person, but payments for high-value specialty crops would be capped at $900,000.

— Biden's infrastructure bill hits snags. Lawmakers had previously set Monday as a target for closing out their talks on a roughly $1 trillion agreement. Aides disagreed over funding for water infrastructure and how to apply a requirement that federal contractors pay their employees a locally prevailing wage, among other issues. Republicans rejected a counteroffer advanced by the Biden administration and Democrats, saying it attempted to reopen settled issues. Democrats accused Republicans of stalling.

A key dispute is over water funding. The group agreed to $55 billion in new water funding but are divided over whether they agreed to tack on $15 billion in regular water funding Congress was expected to appropriate anyway for the next five years.

Delay in recess threatened. Senate Majority Leader Chuck Schumer (D-N.Y.) related that lawmakers may stay in session through the weekend to finish a bill on infrastructure. The New York Times reports (link) the agreement “appeared in peril on Monday as negotiators privately traded blame over their inability to resolve major issues.” The “finger-pointing... done on condition of anonymity to avoid the appearance of torpedoing the talks, suggested that the bipartisan agreement triumphantly announced a month ago by President Biden and 10 senators in both parties has hit major snags on its way to being finalized.”

And then there is the House. Speaker Nancy Pelosi (D-Calif.) has said that she will not bring it up for a vote in the House until the$3.5 trillion budget blueprint, which Democrats plan to muscle through unilaterally over Republican opposition, had also been approved. “The bill is not as green as I would like it to be,” Pelosi said of the bipartisan infrastructure package, urging that more programs be included to address climate change. “Nonetheless, I hope that it will pass. I won’t put it on the floor until we have the rest of the initiative.”

— Little change in CFAP payouts. Payments authorized under the Coronavirus Food Assistance Program 2 (CFAP 2) were little changed as of July 25 at $11.76 billion. The total includes $6.28 billion in acreage-based payments, $3.46 billion for livestock, $2.75 billion for sales commodities, $1.22 billion for dairy and $63.8 million for eggs/broilers. CFAP 1 payments edged up to $10.6 billion.

BIDEN ADMINISTRATION PERSONNEL

— Senate Agriculture panel approves Moffitt for USDA post. The Senate Agriculture Committee as expected voted late Monday to advance the nomination of Jennifer Moffitt to be undersecretary for marketing and regulatory programs. Timing for a vote in the full Senate is not yet known.

Hipp nomination on hold. A full Senate vote on another nominee — Janie Hipp to be general counsel — is also uncertain as Senate Agriculture Committee Chair Debbie Stabenow (D-Mich.) said she believes a Republican has a hold on the nominee.

CHINA UPDATE

— Hong Kong man found guilty in first verdict under national-security law. A 24-year-old who collided with three police officers while riding a motorcycle last year was convicted of inciting secession and terrorism, in a verdict that reaffirms new limits on speech in the city and could set a precedent for future trials under the law.

— China's new ambassador to the U.S., Qin Gang, is heading to Washington today, ending speculation over who will be handed the difficult task of trying to ease fractious relations between the powers. The 55-year-old Qin has been a vice foreign minister and has had several western countries and regions in his portfolio. However, he has no direct US-related experience. The South China Morning Post said he has spent the last several days meeting with U.S. businesses in Chin before departing for Washington. He replaces Cui Tiankai, 68, who was the longest serving ambassador to the U.S. and had passed the retirement age for senior Chinese ambassadors, according to Reuters. Qin has also been a spokesman for the country’s foreign ministry, and many believe he will potentially take a tougher line than his predecessor. His focus is expected to in part be on the list of requests that were given to Deputy Secretary of State Wendy Sherman in her discussions this week in China. Another contentious meeting between Washington and Beijing proved unsuccessful on Monday (see next item for details), with Vice Foreign Minister Xie Feng saying the relationship was at a "dead end" and risks "serious consequences." As noted yesterday, Sherman was presented with two lists of "red lines" that were necessary to stabilize ties, including "U.S. wrongdoings that must stop" and "key individual cases that China has concerns with."

— U.S./China discussions end with no major breakthroughs. Meetings between Deputy Secretary of State Wendy Sherman and top Chinese officials yielded little in terms of shifting the dynamic between the two countries, with no major breakthroughs announced and the two sides released sharply worded statements after the sessions ended. However, a senior U.S. administration official said the goal of the meeting did not include reaching any agreements or specific outcomes.

The prospects of a meeting between President Joe Biden and Chinese President Xi Jinping were also not discussed, according to senior U.S. administration officials. White House Press Secretary Jen Psaki also confirmed a Biden-Xi meeting was not discussed but did not dismiss potential for that to take place. "The president continues to believe in face-to-face diplomacy. That is something he has long been an advocate for. And we expect there will be some opportunity to engage at some point, but it did not come up in the context of these meetings, and that was not the purpose of these meetings," she said.

This marks a second high-level meeting between the U.S. and China that has been marked with contention rather than cooperation as the two sides appear to be seeking to lay out their respective positions more than engage in any dialogue that would aim toward tempering rising tensions between the two.

— The British government is exploring ways to remove China’s state-owned nuclear energy company from future power projects in the U.K. — prompting warnings the group could respond by abandoning current projects.

— China to hold another auction of imported corn July 30. China announced it will auction more than 202,000 MT of the grain imported from the U.S. and nearly 50,000 MT of imported corn from Ukraine on July 30. These auctions are meant to ease food inflation, but recent sales have been met with light demand.

Perspective on the amounts of corn: 202,000 = 7.95 million bushels; around 50,000 is 1.97 million bushels.

TRADE POLICY

— Hearing today on status of USMCA. The Senate Finance Committee today will examine the US-Mexico-Canada Agreement (USMCA) after one year in existence. There will be no officials from the Biden administration testifying, but the panel will hear from labor representatives and others. Agriculture figures high on the list as the Northwest Dairy Association Chairman Allan Huttema and Biotechnology Innovation Organization (BIO) CEO Michelle Mc-Murray Health will testify. Huttema is likely to focus on Canada’s implementation of the dairy provisions where the US has lodged a complaint under dispute settlement provisions in the agreement. GMO and glyphosate ban actions by Mexico are to be a focus for BIO, in particular a call for the U.S. to start an enforcement case against Mexico on those issues.

ENERGY & CLIMATE CHANGE

— China says proposed EU carbon border tax violates WTO rules. China’s environment ministry slammed the European Union’s proposed carbon border tax, saying yesterday that the policy unnecessarily creates climate-related trade friction. The statements are the first official comments from China on the adoption of a Carbon Border Adjustment Mechanism proposal by the European Commission on July 14. Making the policy meet World Trade Organization rules is a key design issue.

— Pressure coming today on Interior’s Haaland over gas, oil lease sales. The Senate Energy and Natural Resources Committee today holds a hearing on the fiscal year (FY) 2022 spending plan for the Department of Interior, with Secretary Deb Haaland testifying. Beyond the budget, panel Republicans are expected to raise the halt in new oil and gas lease sales on federal lands, with Politico reporting that Ranking Member John Barrasso will tell Haaland “it is past time for the administration to comply with the law and hold new lease sales. The department needs to change course and get back to an American energy dominance agenda.”

Some lawmakers will likely raise the controversial nomination of Tracy Stone-Manning to head the Bureau of Land Management, with all of the panel’s Republican members recently calling on President Joe Biden to withdraw the nomination. However, the administration has given no indication they will pull the nomination back.

CORONAVIRUS UPDATE

— Summary: Global cases of Covid-19 are at 194,778,390 with 4,168,697 deaths, according to data compiled by the Center for Systems Science and Engineering at Johns Hopkins University. The U.S. case count is at 34,533,187 with 610,952 deaths. The Johns Hopkins University Coronavirus Resource Center said that there have been 342,212,051 doses administered, 163,173,366 have been fully vaccinated, or 49.7% of the U.S. population.

— Record Covid infection pace in Tokyo. Tokyo set a daily record for cases, reporting 2,848 on Tuesday, the fifth day of the Olympics, breaking the mark of 2,520 set in January.

— White House announces Covid-19 travel restrictions will remain. The White House confirmed Monday that because of the surge in cases from the Delta variant, the existing travel restrictions for international travel will remain in place. “We will maintain existing travel restrictions at this point for a few reasons. The more transmissible Delta variant is spreading both here and around the world, driven by the Delta variant cases that are rising here at home, particularly among those who are unvaccinated and appear likely to continue in the weeks ahead,” said Psaki. Psaki said the decision was due to a rise in infections among the unvaccinated with the Delta variant’s high rate of transmissibility and a recent advisory against travel to the United Kingdom.

— First federal agency mandates Covid-19 vaccine. The Department of Veterans Affairs will require its health care employees to receive the Covid-19 vaccine, becoming the first major federal agency to implement such a mandate.

— President Biden announces “long Covid” sufferers may qualify as disabled. President Biden announced on Monday that “long-term symptoms of Covid-19 could be considered a disability under federal civil rights laws, an announcement timed to coincide with the 31st anniversary of the landmark Americans with Disabilities Act. Biden listed some of the lingering effects that have been seen in coronavirus survivors, including breathing problems, brain fog, chronic pain or fatigue, and noted that the effects sometimes rise to the level of a disability. Biden added, “We are bringing agencies together to make sure Americans with long Covid, who have a disability, have access to the rights and resources that are due under the disability law.”

CONGRESS

— House to take up FY 2022 Ag appropriations measure today. The House will take up the fiscal year (FY) 2022 Agriculture appropriations bill today as part of a larger package, following House Rules Committee action on the bill. The rule makes in order 229 amendments on all the bills and allows for amendments to be offered en bloc. Of the 229 approved amendments, 26 are on the Agriculture bill. The spending package includes Agriculture-FDA, Energy and Water, Financial Services, Interior-Environment, Labor-HHS-Education, Military Construction-VA, and Transportation-HUD bills. Link to rules.

Some amendments to be considered:

- Amendment by Rep. Bob Good (R-Va.) would cut $3 billion in Supplemental Nutrition Assistance Program funds.

- Provision by Rep. Kat Cammack (R-Fla.) would eliminate language that would fund any unforeseen costs to fund SNAP in the last three months of the fiscal year.

- Bipartisan group of lawmakers led by Rep. Rodney Davis (R-Ill.) offered an amendment that would expand eligibility for USDA’s ReConnect broadband access grant program.

— Former Sen. Mike Enzi (R-Wy.) died after sustaining serious injuries from a bicycle accident on Friday, his family said late Monday. Enzi, 77, was known as one of the more conservative lawmakers during his time on Capitol Hill, where he served for four terms in the Senate before retiring late last year. The senator served 24 years in the Senate, including as chair of the Senate Budget Committee and Senate Health, Education, Labor and Pensions Committee.

OTHER ITEMS OF NOTE

— Restrictions on immigration have driven U.S. farmers to train more Americans in how to become shepherds. Link to NYT article.