Consumer Price Index Surges 6.2% in October, Three-Decade High

Pelosi, progressives want vote on BBB week of Nov. 15

In Today’s Digital Newspaper

Market Focus:

• Consumer price index surges 6.2% in October, considerably more than expected

• Jobless claims fell to new pandemic low of 267,000

• Producer Price Index rises at record annual pace

• Federal Reserve officials closely watching inflation measures

• Childcare industry had trouble attracting workers before the pandemic.

• Biden to meet European Commission President Ursula von der Leyen

• Russia may be boosting natural-gas deliveries to relieve Europe’s energy crunch

• U.S. gov’t: global oil market to become oversupplied and prices will fall by early next year

• Demand for fuel is pushing ethanol prices close to an all-time high

• L.A.-area docks’ logjam begins to clear up

• Apple CEO Tim Cook owns some crypto

• Ag demand update

• Soybeans mildly pull back, corn and wheat mostly higher overnight

• China’s factory inflation surges to 26-year high

• China’s October new bank loans plunge, but not as much as feared

• Xi: China willing to work with U.S. to manage differences

• USDA raises cattle price forecast, lowers hog price

• Predictably slow start to cash cattle negotiations

• Pork cutout, cash hog index on the decline again

Policy Focus:

• CBO’s schedule for releasing cost estimate for Build Back Better Act

• Pelosi and progressives push for BBB vote week of Nov. 15

• Major IRS enforcement boost will likely be omitted from Dem BBB package

• White House announces infrastructure investment in ports and freight networks

China Update:

• Goldman warns on China growth

• Virtual summit likely next week between Biden and Xi

• China’s factory-gate prices surged at a record pace in October

Energy & Climate Change:

• Dems douse efforts to advance nearly $20-per-ton carbon tax initiative

Livestock, Food & Beverage Industry Update:

• Cattle market compromise reached by bipartisan group of senators; outlook murky

Coronavirus Update:

• U.S. gov’t agrees to buy 3.1 million courses of Merck’s Covid

• Pfizer asks FDA to authorize booster shot for all adults

• Federal judge declines to block vaccine mandate for federal employees & contractors

Politics & Elections:

• To GOP dismay, Sununu opts against Senate run in New Hampshire

Congress:

• 13 Republicans voting for infrastructure bill facing possible retaliation from own party

• Federal judge rejects Trump’s request to block disclosure of White House records

• House panel issues 10 new subpoenas to former Trump administration officials

• Top Dems demanding GOP leaders take action against Rep. Paul Gosar (R-Ariz.)

Other Items of Note:

• Thousands of migrants amass near Belarus’s border with Poland

• Bayer Crop Science announces new president

• Labor Dept. approved 317,619 seasonal guestworkers during fiscal year ending Sept. 30

MARKET FOCUS

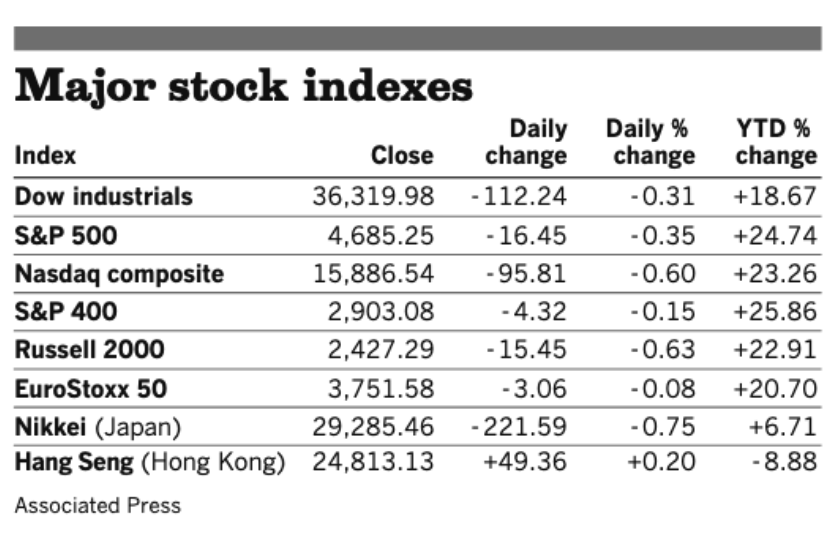

Equities today: Global stock markets were mixed in overnight trading. The U.S. stock indexes are pointed to weaker openings after this week’s second major inflation report showed consumer prices soaring last month. Asian equity markets were mostly lower following Chinese inflation data. Japan’s Nikkei was down 178.68 points, 0.61%, at 29,106.78. The Hang Seng Index gained 183.01 points, 0.74%, at 24,996.14. European equities are mixed. The Stoxx 600 was down 0.2% while other markets posted gains of 0.6% to losses of 0.3%.

U.S. equities yesterday: The Dow closed down 112.24 points, 0.3%, to 36,319.98, a day after the blue-chip index notched its 44th record of 2021. The Composite fell 95.81 points, 0.6%, to 15,886.54. The S&P 500 declined 16.45 points, 0.3%, to 4,685.25, its third-highest closing level in history.

On tap today:

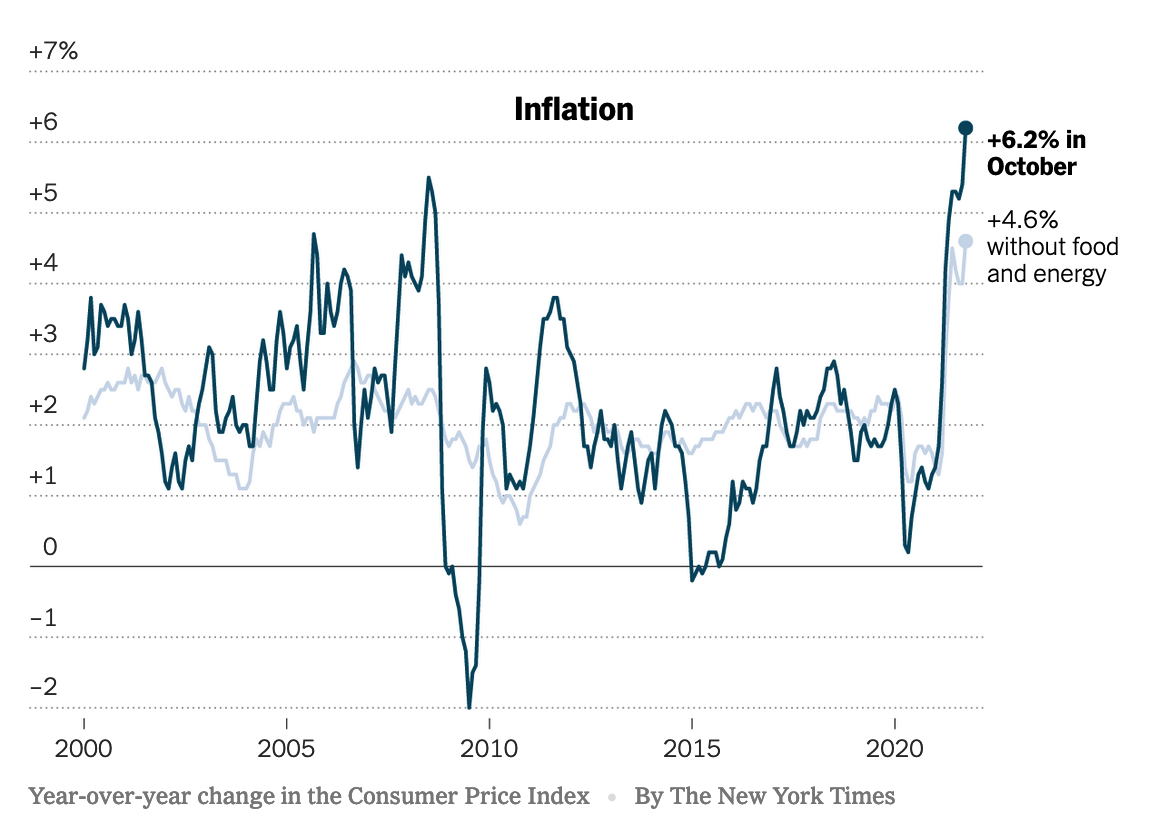

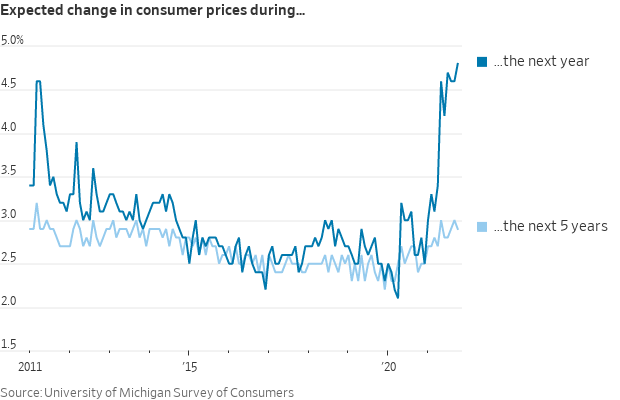

• U.S. consumer price index for October is expected to increase 0.6% from one month earlier and 5.9% from one year earlier. Excluding food and energy, the CPI is forecast to rise 0.4% and 4.3%. (8:30 a.m. ET) UPDATE: Inflation hit its highest point in more than 30 years, the Labor Department reported. The consumer price index, a basket of products ranging from gasoline and health care to groceries and rents, rose 6.2% from a year ago. That compared to the 5.9% estimate. On a monthly basis, the CPI increased 0.9% against the 0.6% estimate. Stripping out volatile food and energy prices, so-called core CPI was up 0.6% against the estimate of 0.4%. Annual core inflation ran at a 6.2% pace, compared to the 4% expectation and the highest since November 1990. The factors that pushed inflation higher in October were varied. Used and new car shortages have sent prices skyrocketing, supply chain issues have made furniture costlier, labor shortages are raising some service-industry price tags, and rents are rising after a weak 2020. The data will reinforce the view that inflationary pressures are proving far more persistent than initially expected — a growing risk the Federal Reserve acknowledged last week when it announced its plans to begin scaling back its $120 billion asset purchase program later this month. While the Fed sets its goal using a separate measure of inflation — the Personal Consumption Expenditures index — that too has picked up sharply this year.

• U.S. jobless claims are expected to fall to 265,000 in the week ended Nov. 6 from 269,000 one week earlier. (8:30 a.m. ET) UPDATE: Initial claims for jobless benefits, a proxy for layoffs, declined to 267,000 last week from a revised 271,000 the prior week, the Labor Department reported. The 4-week moving average of weekly claims was 278,000 for the week ending Nov. 6. Claims have declined since the average reached a recent peak of 424,000 in mid-July. The U.S. economy still has more than four million fewer jobs than it had in February 2020, even after employers added 531,000 in October, the Labor Department reported.

• U.S. wholesale inventories for September are expected to increase 1% from the prior month. (10 a.m. ET)

• U.S. federal budget deficit is expected to narrow to $179 billion in October from $284 billion one year earlier. (2 p.m. ET)

• President Biden meets European Commission President Ursula von der Leyen this morning and is scheduled to speak on supply-chain issues this afternoon. Biden will use the Port of Baltimore today for the backdrop of a speech on his plans for the bipartisan infrastructure measure to make progress against supply chain bottlenecks. Meanwhile, Biden spoke with the chief executive officers of Walmart, UPS, FedEx and Target to discuss easing supply chain bottlenecks. Biden and the executives talked about potential moves to speed up deliveries and lower prices. The executives told the president that store shelves will be well stocked for the holiday season.

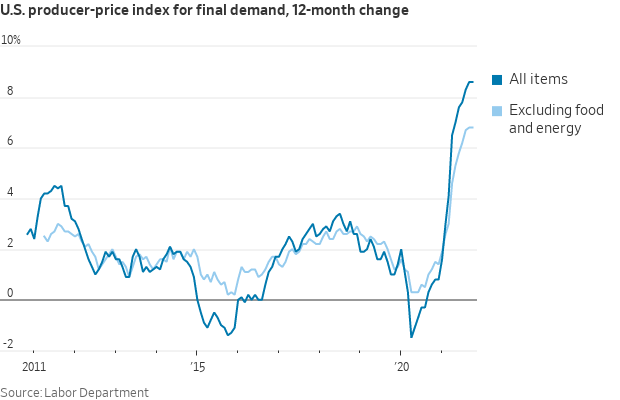

Producer Price Index rises at record annual pace. The Labor Department on Tuesday reported the Producer Price Index rose 0.6% in October for the month and 8.6% year-on-year, matching its biggest increase on record in October, underscoring rising cost pressures across the economy. Core PPI, which eliminates volatile food and energy prices, was up 0.4% for the month and 6.2% year-on-year, in line with forecasts.

Federal Reserve officials are closely watching inflation measures to gauge whether the recent jump in prices will prove temporary or lasting. One such factor is consumer expectations of future inflation, which can prove self-fulfilling as households are more likely to demand higher wages and accept higher prices when they anticipate higher future price growth.

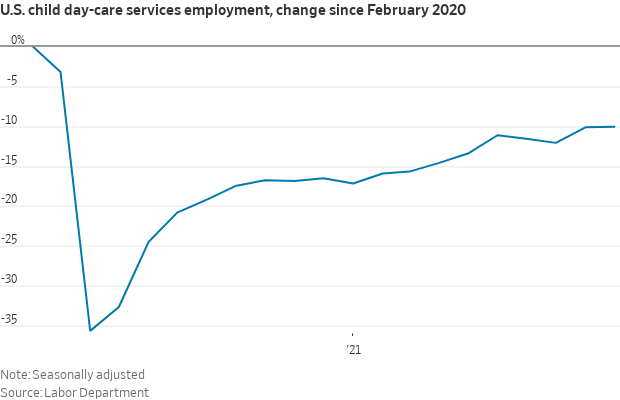

Worker watch: The childcare industry had trouble attracting workers before the pandemic. The problem has ballooned into a nationwide staffing crisis that economists say is adding a drag on the economic recovery because it is keeping some parents from re-entering the workforce while they search for childcare. Employment in the childcare industry has been among the economy’s slowest to rebound, and is still down more than 10% from pre-pandemic levels, the Wall Street Journal reports (link).

Market perspectives:

• Outside markets: The U.S. dollar index is higher amid weakness in the euro and British pound. The yield on the 10-year U.S. Treasury note rose, trading near 1.48%, with a mixed-to-positive tone noted in other global government bond yields. Gold and silver futures are down, with gold trading around $1,826 per troy ounce and silver around $24.22 per troy ounce.

• Crude oil prices are mixed ahead of U.S. trading with U.S. crude trading around $83.85 per barrel and Brent around $84.80 per barrel. Futures posted losses in Asian action, with U.S. crude down $0.36 at $83.85 per barrel while Brent was up $0.02 at $84.80 per barrel.

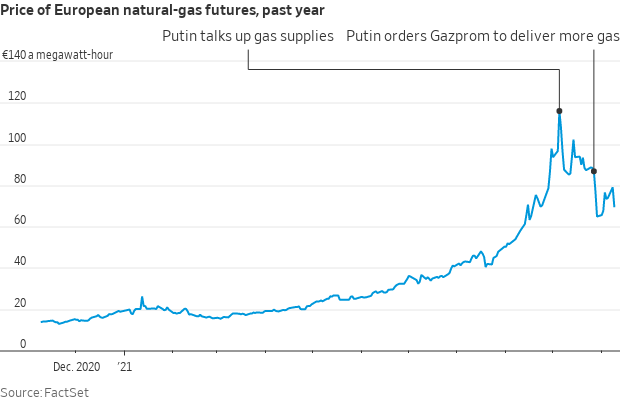

• Russia may be boosting natural-gas deliveries to relieve Europe’s energy crunch, as Moscow keeps a firm grip on the continent’s fuel supplies. President Vladimir Putin said last month that Russia, which supplies almost half of Europe’s gas imports, would boost deliveries in a bid to stabilize the market, with prices high and reserves low ahead of the European winter.

• U.S. gov’t projected that the global oil market will become oversupplied and prices will fall by early next year, cooling expectations that the White House may tap the nation’s emergency reserves. Separately, an industry report showed a decline in U.S. inventories last week.

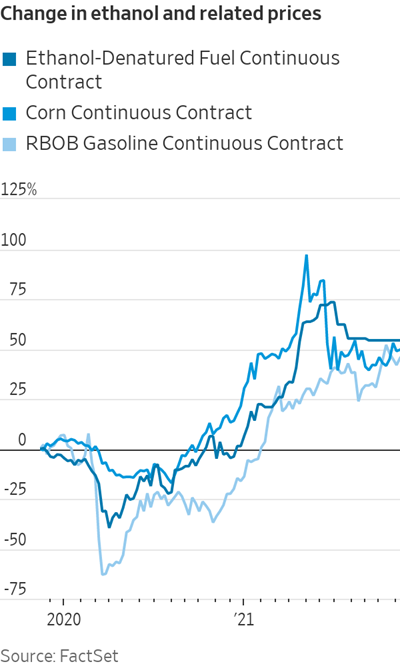

• Demand for fuel is pushing ethanol prices close to an all-time high. Prices for the corn-based fuel, a common additive to gasoline, have risen over 50% year to date, and earlier this year pushed through $2 a gallon for the first time since 2014. Commodity prices in general have been on the rise as fund traders have reached for a hedge on inflation. A snarled supply chain and increased input costs for crops have sent agricultural prices higher. Refineries, meanwhile, have been producing more fuel but haven't been able to keep up with the demand. Link to details via the WSJ.

• L.A.-area docks’ logjam begins to clear up. Starting Nov. 15, the ocean carrier companies that brought idling containers in will be charged $100 on the first day past deadline, $200 on the next, and so on — an escalating fine that could quickly for the thousands of containers on the docks. With less than a week to go until the fee kicks in, it seems to be making a difference. The number of containers subject to the fine is down 26% at Long Beach, and the number of containers with a dwell time of more than nine days is down 14% at L.A. — a difference of more than 10,000 boxes on the docks. “This fee is already meeting its objective,” Noel Hacegaba, deputy executive director of the Port of Long Beach, said in a statement. The ocean carriers have also responded with plans to send sweeper ships to remove the empty containers — approximately 30% of the total boxes piled up — that are clogging up the docks, Hacegaba said. Clearing out those empties would help address one of the major bottlenecks that truck drivers say are making it impossible to clear out cargo.

• Apple CEO Tim Cook owns some crypto. At the DealBook conference on Tuesday, Cook said he owns crypto. “I think it’s reasonable to own it as part of a diversified portfolio,” Cook told Andrew, quickly adding that he wasn’t giving investment advice. As for Apple, Cook said the company had “no immediate plans” to either put a portion of its cash in crypto, or to start accepting digital currencies in the App Store. But he added, cryptically, “There are other things that we are definitely looking at.”

• Ag demand: South Korea purchased 137,000 MT of corn — believed to be South American or South African origin. Japan tendered to buy 80,000 MT of feed wheat and 100,000 MT of feed barley.

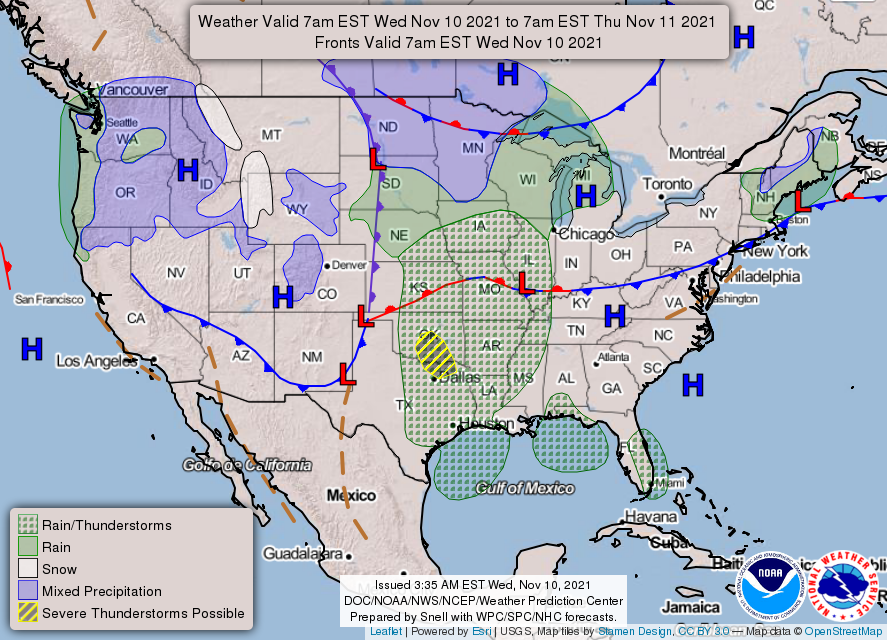

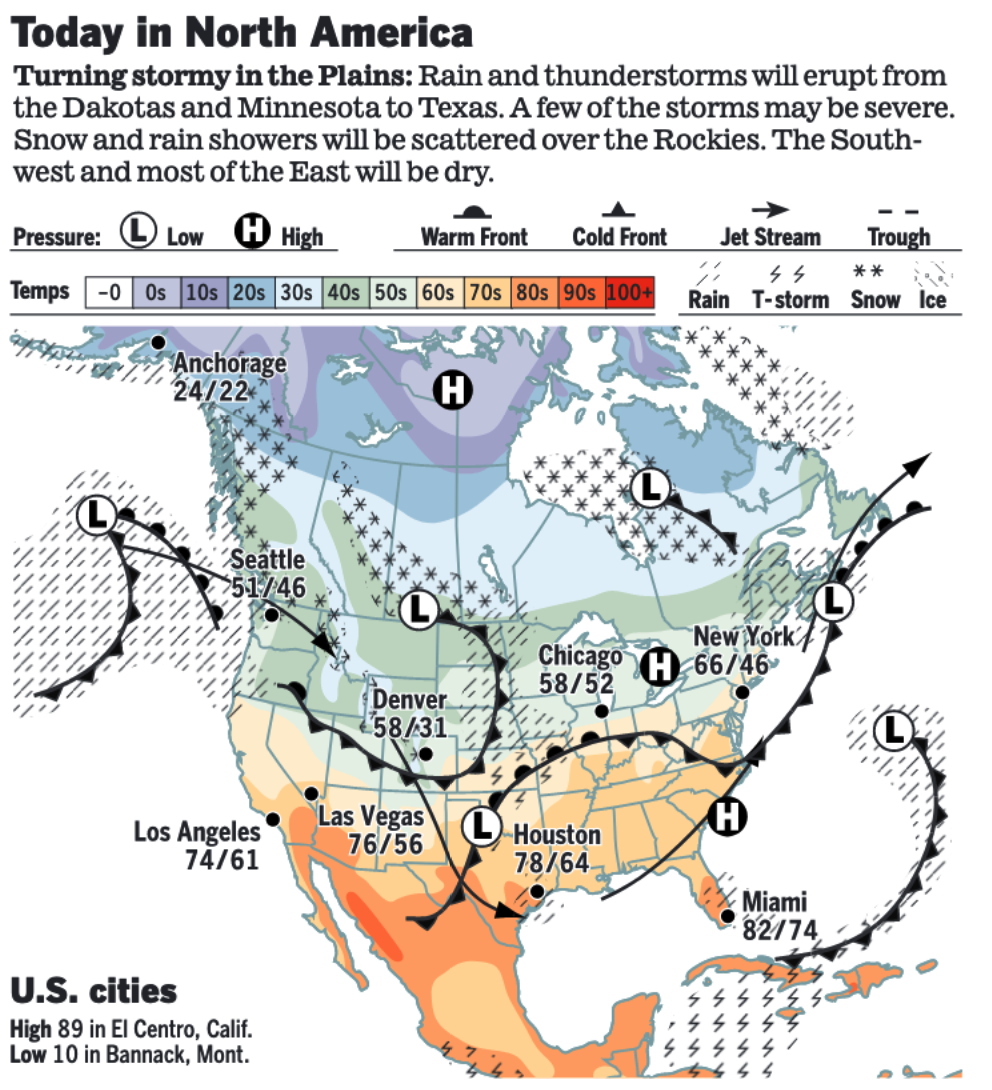

• NWS weather: There is a marginal risk of excessive rainfall over parts of the Pacific Northwest through Thursday morning... ...There is a slight risk of severe thunderstorms over parts of the Southern Plains through Thursday morning... ...Rain and higher elevation snow over parts of the Pacific Northwest, and Northern Rockies, Snow for the upper Midwest, starting in earnest on Thursday morning… ...There is a slight risk of excessive rainfall over parts of the Pacific Northwest from Thursday into Friday morning.

Items in Pro Farmer's First Thing Today include:

• Soybeans mildly pull back, corn and wheat mostly higher overnight

• China’s factory inflation surges to 26-year high

• China’s October new bank loans plunge, but not as much as feared

• Xi: China willing to work with U.S. to manage differences

• USDA raises cattle price forecast, lowers hog price

• Predictably slow start to cash cattle negotiations

• Pork cutout, cash hog index on the decline again

POLICY FOCUS

— CBO’s schedule for releasing a cost estimate for HR 5376, the Build Back Better Act. The Congressional Budget Office (CBO) is in the process of preparing a cost estimate for the current version of HR 5376, the Build Back Better Act (Rules Committee Print 117-18 incorporating a manager’s amendment by Congressman Yarmuth). Over the past several months, CBO said is has provided technical assistance to committees as they developed their proposals for various parts of the bill. “The analysis of the bill’s many provisions is complicated, and CBO will provide a cost estimate for the entire bill as soon as practicable,” it said. “We anticipate releasing estimates for individual titles of the bill as we complete them, some of which will be released this week. Other estimates will take longer, particularly for provisions in some titles that interact with those in other titles. When we determine a release date for the cost estimate for the entire bill, we will provide advance notice.”

— Pelosi and progressives push for BBB vote week of Nov. 15. House Speaker Nancy Pelosi (D-Calif.) told reporters in Glasgow on Tuesday at the U.N. climate change conference “That is our plan, to pass the bill the week of November 15th, as is indicated in our statements that were made at the time of passing the infrastructure bill.” Meanwhile, Rep. Pramila Jayapal (D-Wash.), chair of the Congressional Progressive Caucus, tweeted on the issue late Tuesday night: “To clarify for everyone: the agreement we made w/our colleagues was NOT for CBO score,” Jayapal said. “It was for some additional financial information from CBO. Agreement also says that in no event would the vote take place later than the week of Nov. 15. We trust our colleagues’ commitments.”

— A major IRS enforcement boost will likely be omitted from a forthcoming top-line revenue estimate of Democrats’ tax-and-spend package, complicating the question of whether the measure will be fully “paid for” as President Biden has pledged. The Biden administration estimates a better funded IRS could bring in $400 billion over a decade through more aggressive audits of corporations and the wealthy. The dilemma: Under budget rules set by Congress and the executive branch, the government’s nonpartisan analysts can’t officially count money that will be spent as also increasing revenue when estimating the cost.

— White House announces actions to boost infrastructure investment in ports and freight networks. The White House on Tuesday distributed an information sheet detailing the Biden administration’s actions to improve the infrastructure of the nation’s ports. The White House announced “a set of concrete steps to accelerate investment in our ports, waterways, and freight networks. These goals and timelines will mobilize federal agencies and lay the foundation for successful implementation of the historic Bipartisan Infrastructure Deal. This action plan will increase federal flexibilities for port grants; accelerate port infrastructure grant awards; announce new construction projects for coastal navigation, inland waterways, and land ports of entry; and launch the first round of expanded port infrastructure grants funded through the Bipartisan Infrastructure Deal.”

The White House said it will support “creative solutions” to current supply chain disruptions by allowing for flexibility in port grants. The U.S. Dept. of Transportation (DOT) will allow port authorities across the country to redirect project cost savings toward tackling supply chain challenges. It will also work to alleviate congestion at the Port of Savannah by funding the Georgia Port Authority pop-up container yards project. With this policy change, the Georgia Port Authority will be able to reallocate more than $8 million to convert existing inland facilities into five pop-up container yards in both Georgia and North Carolina. Under the plan, the Port of Savannah will transfer containers via rail and truck further inland so that they can be closer to their final destination, which will make available valuable real estate closer to the port. The effort will free up more dock space and speed goods flow in and out of the Port of Savannah, which leads the nation in containerized agricultural exports, the White House said.

CHINA UPDATE

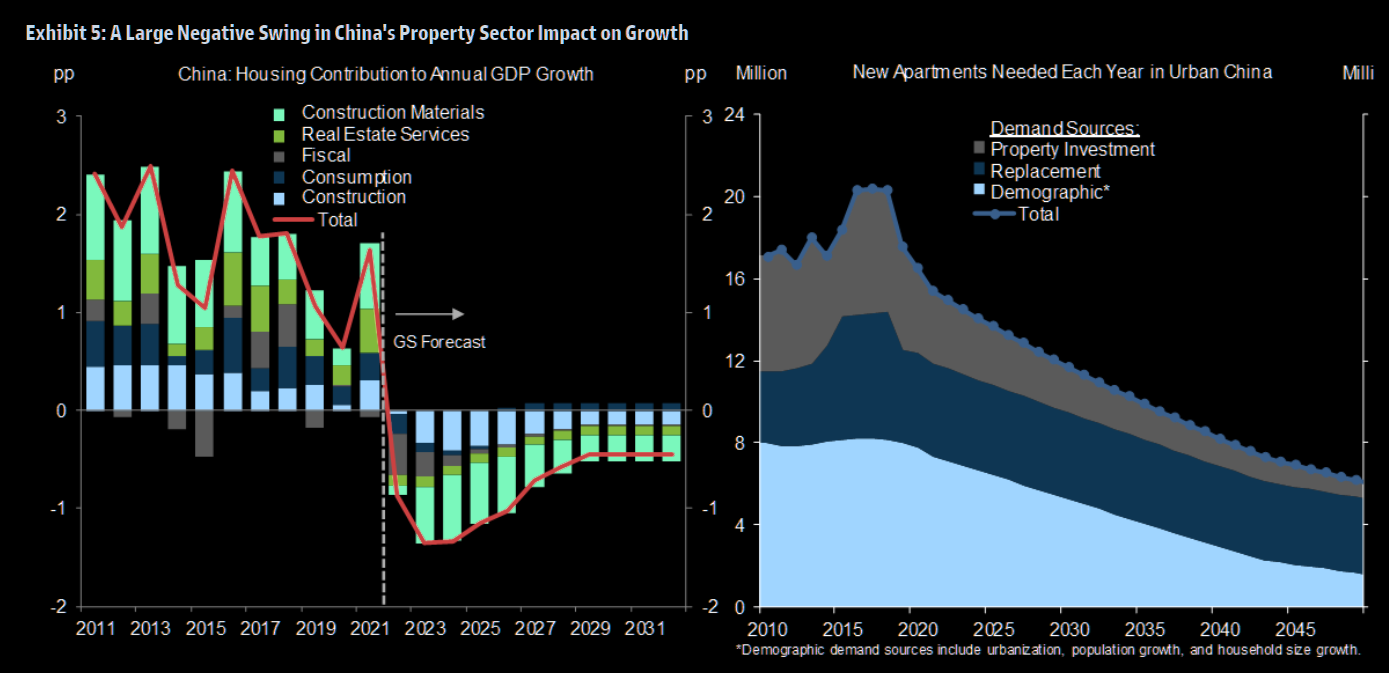

— Goldman warns on China growth: "Our forecast of 4.8% growth in China next year is below consensus. The key driver of this muted outlook is a negative swing in the property sector growth impulse from an average of +1½pp in the last five pre-pandemic years to just above -1pp in 2022 and beyond. This reflects the negative impact of deleveraging on construction, consumption, government spending, real estate services, and construction materials activity.” About one-quarter of the economy may be affected by a property slowdown. Also, China’s residential investment share of GDP is among the highest in international historical experience.

— Virtual summit likely next week between Biden and Xi. Chinese President Xi Jinping says Beijing is willing to "enhance exchanges and cooperation across the board" with the U.S. ahead of a virtual meeting with Biden tentatively planned for next week. Xi's statements signal a possible improving of relations between the two powers, which have often been at odds.

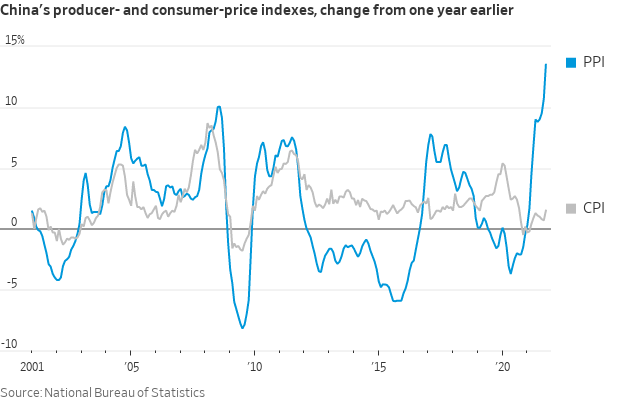

— China’s factory-gate prices surged at a record pace in October due to higher energy costs, adding to anxieties that global inflation will persist. China’s producer price index rose by a record 13.5% in October, the National Bureau of Statistics said, the fastest pace in 26 years (since November 1995), National Bureau of Statistics data showed and above economists’ median forecast for a 12.3% gain. Consumer inflation in the world’s second-largest economy rose by 1.5% last month from a year earlier, up from 0.7% in September, though it remained below the official target of around 3% for this year. Many economists said they expect China’s industrial inflation will edge lower in the coming months as Beijing’s interventions cut coal prices and consumer demand in the West for Chinese goods pulls back.

ENERGY & CLIMATE CHANGE

— Democrats douse efforts to advance a nearly $20-per-ton carbon tax being championed by Sen. Sheldon Whitehouse (D-R.I.). House Speaker Nancy Pelosi (D-Calif.) said she is “completely unaware of any deal on a carbon tax,” during a news conference at the COP26 climate summit in Scotland. “It is something that is talked about and may be an option for the future,” even though it’s not in the current House version of a broad climate-and-spending bill, Pelosi said.

LIVESTOCK, FOOD & BEVERAGE INDUSTRY

— Cattle market compromise reached by bipartisan group of senators. Sens. Deb Fischer (R-Neb.), Chuck Grassley (R-Iowa), Jon Tester (D-Mont.), and Ron Wyden (D-Ore.) reached a deal on a cattle market proposal. “This bill takes several steps to improve cattle price transparency and will improve market conditions for independent producers across the country,” Sen. Grassley says in statement. The legislation would establish regional mandatory minimum thresholds of negotiated cash and grid trades based on each region’s 18-month average trade in addition to requiring USDA to maintain a publicly available library of marketing contracts. Link to section-by-section summary of the bill; link to one-pager.

As to the fate of the legislative proposal: it’s unclear whether lawmakers will want to deal with the matter with their busy schedule ahead. It could be added to a must-pass spending bill, but some cattle industry lobbyists want to focus on extending mandatory price reporting.

CORONAVIRUS UPDATE

— Summary: Global cases of Covid-19 are at 251,008,208 with 5,067,409 deaths, according to data compiled by the Center for Systems Science and Engineering at Johns Hopkins University. The U.S. case count is at 46,694,852 with 757,409 deaths. The Johns Hopkins University Coronavirus Resource Center said that there have been 431,502,242 doses administered, 194,168,611 have been fully vaccinated, or 59.15% of the U.S. population.

— U.S. gov’t agrees to buy 3.1 million courses of Merck’s Covid pill. The U.S. government will buy another $1 billion worth of the Covid-19 pill made by Merck & Co Inc. and partner Ridgeback Biotherapeutics, the companies said on Tuesday. The U.S. gov’t in June agreed to buy 1.7 million courses of molnupiravir for $1.2 billion and is now exercising options to buy 1.4 million more. That brings the total secured courses to 3.1 million and worth $2.2 billion. Merck also said the gov’t has the right to buy 2 million more courses as part of the contract.

— Pfizer asks FDA to authorize booster shot for all adults. Pfizer and BioNTech said they had asked the Food and Drug Administration (FDA) to authorize their Covid-19 vaccine for all adults 18 and over, seeking to broaden who is eligible for a third shot of vaccine.

— Federal judge declines to block vaccine mandate for federal employees and contractors. A federal judge on the U.S. District Court for the District of Columbia on Monday opted not to block the Biden administration’s mandate that all federal employees and contractors be vaccinated against Covid-19, concluding that the 20 federal workers and military service members who brought the case have failed to meet any of the circumstances that allow for the issuance of an injunction.

POLITICS & ELECTIONS

— National Republicans surprised by Sununu snub. New Hampshire Gov. Chris Sununu (R) shocked national Republicans Tuesday by publicly rejecting entreaties to challenge Sen. Maggie Hassan (D) in next year’s midterm elections, delivering a setback to the GOP’s chances of putting another potentially competitive race on the board at a time when Republicans feel momentum at their back. In a press conference at the state capital in Concord, announced with just a few hours’ notice, Sununu said he would run for a fourth two-year term as governor. “My responsibility is not to the gridlock and politics of Washington, it’s for the citizens of New Hampshire,” Sununu told reporters. “I’d be honored to spend a few more years doing what I love doing with the people that I love.” Sununu’s comments took Republicans by surprise: He said he had not informed Senate Minority Leader Mitch McConnell (R-Ky.) or National Senatorial Campaign Committee chairman Rick Scott (R-Fla.) of his decision.

Hassan got some more good news on Tuesday. WMUR reported that former GOP Sen. Kelly Ayotte, who Hassan just edged out in 2016, won’t challenge her in 2022.

CONGRESS

— The 13 Republicans who voted for President Biden’s $1.2 infrastructure bill are facing retaliation from their own party. Some conservative House Republicans have discussed booting their colleagues from committee spots, though based on history, they are unlikely to succeed.

— U.S. Capitol riot: A federal judge rejected former President Donald Trump’s request to block the disclosure of White House records to a House panel investigating the Jan. 6 assault. Separately, the panel issued 10 new subpoenas to former Trump administration officials.

— Top Dems are demanding GOP leaders take action against Paul Gosar after the House conservative posted a video showing violence against AOC. Senior Democrats are demanding House Republicans take action against Rep. Paul Gosar after the far-right Arizonan posted a video apparently glorifying violence against Rep. Alexandria Ocasio-Cortez (D-N.Y.) and President Joe Biden. Speaker Nancy Pelosi (D-Calif.) called for an ethics and law enforcement investigation, while urging Minority Leader Kevin McCarthy (R-Calif.) to join her. Gosar’s office in a lengthy statement denied that he meant to “espouse violence” or cause any harm with the video. Instead he argued, using Ocasio-Cortez’s incomplete name, that it depicts “the battle for the soul of America.”

OTHER ITEMS OF NOTE

— Thousands of migrants have amassed near Belarus’s border with Poland, escalating tensions between Minsk and the European Union.

— Bayer Crop Science announces new president. Bayer Crop Science President Liam Cooper will leave the company at the end of the year and Chief Operating Officer Rodrigo Santos will take charge of the division and also take a place on Bayer AG’s board of management, the company announced on Tuesday. Santos, a Brazilian national, has been with Bayer for more than two decades in several roles, notably as the head of the company’s Latin America Crop Science division after Bayer acquired Monsanto in 2018 and as Crop Science COO since June.

— Labor Dept. approved 317,619 seasonal guestworkers during the fiscal year that ended on Sept. 30, up 15% from a year earlier, a farmworker advocacy group said. It was the highest number of jobs ever approved for H-2A guestworker visas, said Farmworker Justice, a critic of the program. “Almost all employers’ applications were approved.” Florida, Georgia and California were the leading states for visa approvals, together accounting for one-third of them. Link to a Farmworker Justice data that includes an interactive map showing H-2A job approvals by state.