Fed Inflation Gauge Not as Bad as Feared

Why corn producers will be pleased with coming House GOP farm bill proposals

|

Today’s Digital Newspaper |

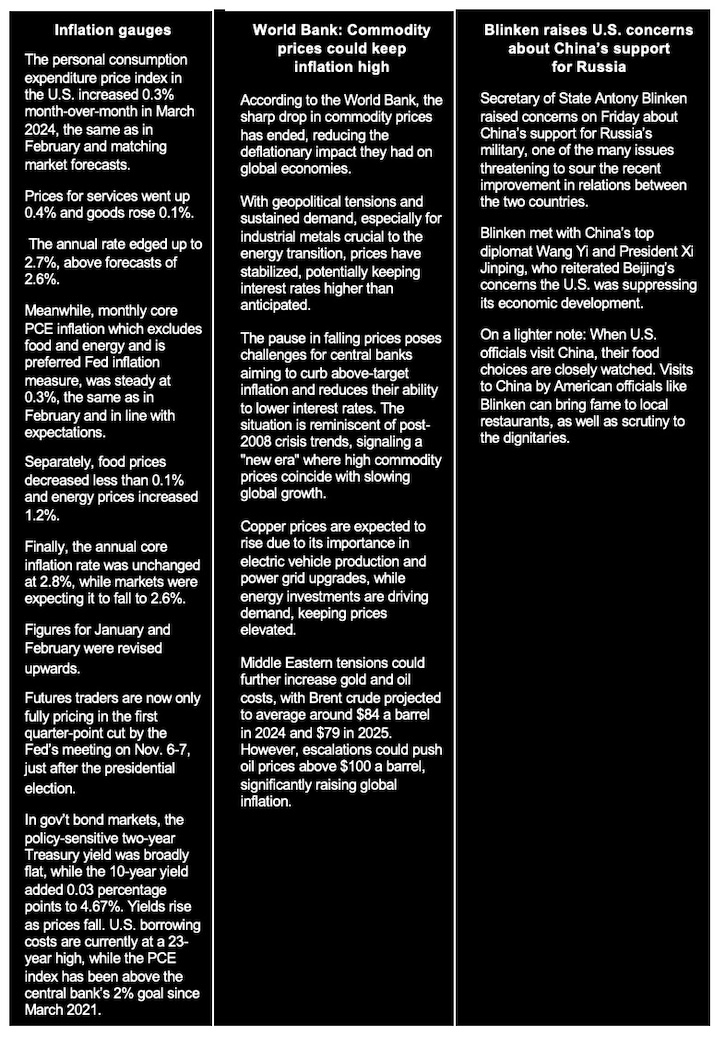

MARKET FOCUS

- Japan keeps rates unchanged, yen weakens

- Fed inflation gauge not as bad as feared, but…

- Copper hits $10,000 a ton for first time in two years

- Anglo American Plc rejects $39 billion takeover proposal from BHP Group

- China’s gold demand surges amid safe-haven demand

- Ag markets today

- India’s rice price falls to three-month low on slowing demand

- Grain trader and analyst Richard Crow on ag markets

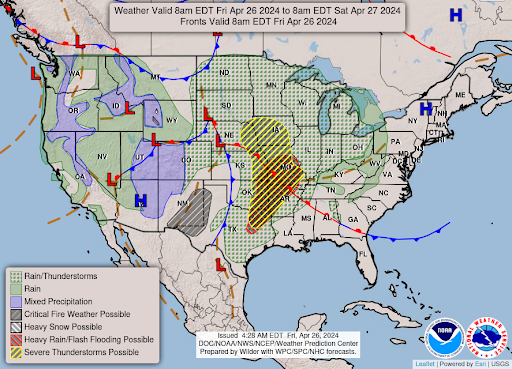

- NWS weather outlook

- Pro Farmer First Thing Today items

BALTIMORE BRIDGE COLLAPSE

- First cargo ship navigates through new deep-water channel in Baltimore

RUSSIA & UKRAINE

- Ukraine chose not to use U.S. Abrams M1A1 battle tanks for now

- Ukraine’s ag minister, Mykola Solskyi, was taken into custody in a corruption probe

POLICY

- Sugar loan rate to rise via House GOP farm bill

- Pay cap to rise and be indexed to inflation via House GOP farm bill

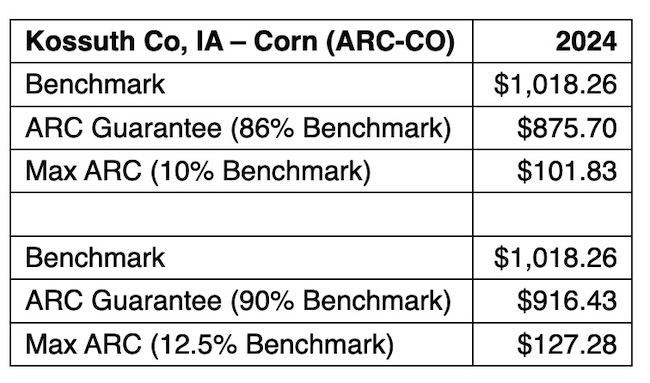

- Corn producers will be happy re: ARC-CO proposal in coming farm bill

CHINA

- China passes retaliatory tariff law

- China to pay consumers up to nearly $1,400 to replace old cars .

- China’s beefed-up statistics & accounting laws under review, robust fines to increase

ENERGY & CLIMATE CHANGE

- Biden administration to release SAF tax credit model April 30

- South Korea warns China's graphite control may jeopardize U.S. EV subsidies

- Iowa board votes against more evidence in pipeline permit decision

- U.S. coal industry encountering fresh challenges due to policy shifts

- NYT looks at five major climate policies that Trump would probably reverse

LIVESTOCK, NUTRITION & FOOD INDUSTRY

- USDA updates food price outlook, projecting a more modest rise for 2024

- USDA to unveil final rule on salmonella in some uncooked chicken products

- FDA: H5N1 found in one-fifth of milk samples, but still safe for consumers

POLITICS & ELECTIONS

- WSJ: Trump allies drafting plans to erode Fed independence post-election

- Charlie Cook on a Biden/Trump rematch

- Trump's economic team exploring strategies to discourage de-dollarization efforts

OTHER ITEMS OF NOTE

- Minneapolis approves $15 minimum for cigarette packs, highest in U.S.

- Cotton AWP eases again

|

MARKET FOCUS |

— Equities today: Asian and European stock indexes were mixed to firmer overnight. U.S. Dow opened slightly lower but tis currently up around 150 points. In Asia, Japan +0.8%. Hong Kong +2.1%. China +1.2%. India -0.8%. In Europe, at midday, London +0.5%. Paris +0.3%. Frankfurt +0.7%.

U.S. equities yesterday: All three major indices finished with losses. The Dow fell 375.12 points, 0.98%, 38,085.80. The Nasdaq was down 100.99 points, 0.64%, 15,611.76. The S&P 500 lost 23.21 points, 5,048.42.

— Ag markets today: Corn, soybeans and wheat traded in narrow ranges during a quiet overnight session. As of 7:30 a.m. ET, corn futures were trading fractionally to a penny lower, soybeans were 2 to 4 cents lower, SRW wheat was a penny lower, HRW wheat was fractionally to a penny higher and HRS wheat was narrowly mixed. Front-month crude oil futures and the U.S. dollar index were both modestly higher this morning.

Cash cattle strengthen. After trade on Wednesday at roughly steady prices in the Southern Plains, cash cattle firmed yesterday, with packers paying up to $2.00 higher prices in the northern market. The stronger cash trade fueled a big turnaround in cattle futures, resulting in bullish reversals. That may lead to followthrough buying in futures and strong gains for the week.

Cash hog index pulls back. The CME lean hog index is down 22 cents to $91.43 as of April 24. The index has declined three of the last five days, suggesting a pause in the seasonal price rally. That may trigger followthrough selling in hog futures after sharp losses on Thursday. Unless there’s persistent heavy pressure on the cash market, however, sustained downside pressure on futures should be limited.

— Agriculture markets yesterday:

- Corn: May corn rose 3 1/4 cents to $4.41, nearer the session high.

- Soy complex: May soybean futures slipped 3 1/4 cents to $11.62 3/4, though deferred contracts posted gains. May meal futures fell $2.10 to $343.90, settling near mid-range. May bean oil futures firmed 16 points to 44.82 cents and near session highs.

- Wheat: July SRW wheat rose 7 1/2 cents to $6.20 1/2, near the session high and hit another 10-week high. July HRW wheat gained 10 1/2 cents to $6.40 1/2, near the session high and hit another three-month high. July spring wheat futures rallied 12 3/4 cents to $6.98 1/4, closing near session highs.

- Cotton: July cotton futures firmed 7 points to 81.08 cents and settled near mid-range.

- Cattle: June live cattle rose $2.55 to $177.80. May feeder cattle futures gained $2.15 at $246.25. Prices closed near their session highs.

- Hogs: Hog futures slumped in the wake of Wednesday’s USDA Cold Storage report. June hog futures dove $2.45 to $105.00. Wednesday’s USDA Cold Storage Report proved surprisingly bearish for the hog outlook, due primarily to the rise in stockpiles, whereas a reduction often occurs during March.

— Japanese yen declined beyond 156 per dollar for the first time since 1990 as the Bank of Japan (BOJ) maintained its interest rates, ignoring the yen's steep fall. The BOJ altered its approach to bond purchases, raised inflation projections, and predicted steady economic growth. Tokyo’s core inflation rate dipped to 1.6%, a two-year low, partly due to new education subsidies. The yen's value has dropped approximately 10% against the dollar this year. This drop is attributed to the BOJ's decision to keep interest rates low while other major economies have raised theirs. The situation has encouraged traders to invest in higher-yielding currencies instead of the yen. Speculation is ongoing about potential intervention by Japanese authorities to stabilize the yen.

Market perspectives:

— Outside markets: The U.S. dollar index was higher, with the euro weaker against the greenback. The yield on the 10-year U.S. Treasury note was weaker, trading around 4.68%, with a mixed tone in global government bond yields. Crude oil futures were higher, with U.S. crude around $84.15 per barrel and Brent around $88.50 per barrel. Gold and silver were putting up gains ahead of inflation data, with gold around $2,356 per troy ounce and silver around $27.58 per troy ounce.

— Copper hit $10,000 a ton for the first time in two years amid speculation that the world’s mines will struggle to meet a coming wave of demand from green industries.

Meanwhile, Anglo American Plc rejected a $39 billion takeover proposal from BHP Group, saying it significantly undervalues the company. The offer from its mining rival “significantly undervalues” the company, Anglo American said, setting up a potential fight. BHP must now weigh improving its bid — and figure out how to win over the South African government, whose public pension fund is Anglo American’s biggest shareholder.

— China’s gold demand surges amid safe-haven demand. China’s gold consumption in the first quarter of 2024 jumped 5.94% from a year earlier on soaring safe-haven demand, the country’s Gold Association said. Bullion consumption totaled 308.905 MT in the first three months of the year. Purchases of gold bars and coins jumped 26.77% in the January-March period to 106.323 MT, or 34% of the total consumption. Additionally, buying from China’s central bank continued for a 17th straight month in March, bringing the total gold reserve to 2,262.67 MT at the end of March.

Of note: China’s young people are rushing to buy gold. Many buyers were middle-aged women looking to add to their nest-eggs or buy chunky bracelets. But these days Chinese gold shops regularly serve customers in their 20s.

— India’s rice price falls to three-month low on slowing demand. India’s rice export prices fell to their lowest level in more than three months this week on weak demand and ample supplies. India’s 5% broken parboiled variety was quoted at $528 to $536 per metric ton this week, down $10 from last week and below the record high of $560 reached last month. Thailand’s 5% broken rice prices were quoted between $580 to $585 per metric ton, similar to last week’s $585 price.

— Grain trader and analyst Richard Crow on ag markets: “The wheat market is getting attention. Despite the forecast for rain in the Western wheat area, the market still gains in price. Russia’s area has some rain forecasted for over the weekend. The weather in Europe had frost Wednesday night and again last night: the wheat is like Northern Ohio wheat in development. It will be harvested in late July. The U.S. wheat area is waiting for rain, but the forecast still has hope a week away. As the price of wheat increases, the corn price delivered to Europe gets attention. The price spread of new crop wheat to corn suggests that some feed wheat would be displaced. U.S. corn is the cheapest corn for Europe if they buy U.S. corn. U.S. corn could trade with Spain, but it is questionable to Northern Europe due to GMO issues. The change in wheat values is causing some thinking about corn.”

— NWS weather outlook: An active weather pattern for much of the Plains into the Mid to Upper Mississippi Valley regions... ...Thunderstorms to bring heavy rain, localized Flash Flooding and Severe Weather to portions of the Plains... ...An elevated to Critical Fire Weather threat across the Southern High Plains... ..Cooler than average temperatures expected from the Rockies to the West Coast and from the Mid-Atlantic to the Northeast, while much above average temperatures spread from the Southern Plains to the Great Lakes.

Items in Pro Farmer's First Thing Today include:

• Quiet grain trade overnight

• French wheat crop ratings decline

|

BALTIMORE BRIDGE COLLAPSE |

— First cargo ship has navigated through a new deep-water channel in Baltimore after the Francis Scott Key Bridge collapse halted maritime traffic. The bulk carrier Balsa 94, bearing the Panama flag, is headed for Saint John, Canada, with two more vessels, including a vehicle carrier bound for Panama, following its lead. This marks a key development in the restoration efforts as crews have been working to clear the debris from the harbor's entrance. The reopening of this channel is vital for the local economy, as many jobs were affected by the bridge's collapse. Assistance programs for affected workers have been initiated by local authorities. The Balsa 94's journey, flanked by tugboats and passing the site of the collapse, signals the beginning of traffic resumption through this critical port, known for processing a high volume of cars and farm equipment. The temporary channel will close shortly for further salvage operations before a scheduled reopening next month to restore the usual flow of maritime traffic. Meanwhile, investigations into the cause of the Dali's collision with the bridge are ongoing.

Of note: Four of seven ships trapped in Baltimore’s harbor since the Francis Scott Key Bridge collapsed last month have cleared the wreckage and are en route to their destinations.

|

RUSSIA/UKRAINE |

— Ukraine chose not to use U.S. Abrams M1A1 battle tanks for now in its battle with Russia in part as Russian drones have made it too difficult to operate the tanks without detection or coming under attack, miliary officials told the Associated Press. The decision to sideline the tanks due to their high detectability and susceptibility to drone strikes reflects the evolving dynamics of battlefield technology. The loss of five out of the 31 tanks underscores the risks associated with deploying such equipment in environments dominated by advanced reconnaissance and strike capabilities. Moreover, the U.S. commitment to provide an additional $6 billion in long-term military aid, including munitions for Patriot air defense systems and long-range ballistic missiles known as ATACMs, signifies a deepening involvement in the conflict. The provision of ATACMs, which allow for strikes deep into enemy-held territory, represents a significant escalation in the level of offensive capabilities being made available to Ukraine.

— Ukraine’s agriculture minister, Mykola Solskyi, was taken into custody in a corruption probe. He is accused of being involved in illegally seizing land worth more than $7 million in 2017-18, before he was a minister. Solskyi, who denies the allegations, resigned on Thursday. He is the country’s highest official to be accused of corruption by a court since Russia’s invasion of Ukraine in 2022.

|

POLICY UPDATE |

— More possible items in coming House GOP farm bill. Our special report on the topic (link) released Thursday detailed some of the likely important topics to be included in the Chairman’s mark, with the unveiling coming either the week of May 13 or May 20, and a markup about five days following release of text. Besides the topics included in the special report, here are some other possible farm policy items:

- Sugar: An increase in the sugar loan rate.

- Farm program pay cap: The payment limit could increase and be inflation indexed but depends on interaction of ARC/PLC enhancements.

- ARC-CO change. In current law, ARC-CO triggers at 86% of benchmark revenue and has a maximum payment rate of 10% of the benchmark. In the coming House GOP farm bill proposal, the trigger increases to 90% and the maximum payment increases to 12.5%.

What does that amount to? Let’s look at corn in Kossuth Co, IA, for 2024 as an example (see table below). The first set of numbers looks at current law and the second set looks at this in the context of the proposal. By increasing from 86% to 90%, the trigger point would increase from $875.70/ac to $916.43/ac (i.e. it triggers a payment if county revenue falls below $916.43/ac). In other words, it increases the likelihood/probability of payments from ARC-CO. Further, the maximum payment increases from $101.83/ac to $127.28/ac…a 25% increase! In other words, in a case where county revenue falls to 77.5% (i.e. 90% minus 12.5%), a maximum payment would be reached…and it would be 25% higher than under the 2018 Farm Bill. It may look like a tweak…but it’s effectively a 25% increase in support when the world falls apart.

Bottom line: Although far more goes into a farm bill than just the nuggets we have detailed, at this juncture it appears that most if not every commodity will look at the Chairman's mark and say this is a definite improvement over current law. While corn is on the lower end in terms of its statutory price increase, because of the effective reference price (corn is coming off high price years), changing the statutory price will still be a winner for corn. And improvements in crop insurance buyup provisions, pay cap changes and hefty trade promotion funding should be seen as across-the-board positives for farmers. Improvements in dairy and livestock assistance programs are also farmer friendly. Unless the final details change significantly from initial observations, this measure is indeed putting the farm back into the farm bill. Farm-state Democrats will be challenged to answer to their farmer constituents if they do not support the underlying bill. If not, the only conclusion is that they want an issue and not a bill. If that is the case, the opposition will resurrect their sky-is-falling mantra regarding SNAP funding and no give on the Thrifty Food Program. If so, both political parties will see even higher hurdles in 2025 when a new Congress and the White House (new or old) has to deal with the debt limit.

|

CHINA UPDATE |

— China passes retaliatory tariff law. The Tariff Law, which was approved by China’s top legislature after three rounds of deliberations going back to 2022, is the latest addition to Beijing’s arsenal of trade defense instruments as it maintains an uneasy truce with the U.S. following a trade war that kicked off during the Trump administration. The law, which will take effect Dec. 1, outlines a range of legal provisions related to tariffs on Chinese imports and exports, from what constitutes tax incentives to China’s right to retaliate against countries that renege on trade agreements. “It’s like a nuclear weapon: the point of having it is not to use it, but to deter others from using the same against you,” Henry Gao, professor at Singapore Management University, told Reuters. Link for details.

— China to pay consumers up to nearly $1,400 to replace old cars. China plans to give car owners up to nearly $1,400 to replace their old cars with new ones, a move to boost slowing demand in the world’s largest electric-vehicle market. Link to details via the WSJ. Some observers say the offer is too low.

— China’s beefed-up statistics and accounting laws under review, robust fines to increase cost of fraud. China is reviewing amendments to laws governing statistics and accounting, with Beijing eager to clamp down on inflated or manipulated economic statistics and uphold rules in the world’s second-largest financial market. Link to details via the South China Morning Post.

|

ENERGY & CLIMATE CHANGE |

— Biden administration to release SAF tax credit model April 30. The Biden administration is expected to release a climate model for its sustainable aviation fuel (SAF) subsidy program on April 30, two sources familiar with the matter told Reuters. That will determine what feedstocks are eligible for the SAF tax credits. Earlier this month, Reuters reported the model was expected to be more restrictive than what the corn-based ethanol industry had expected.

— South Korea warns China's graphite control may jeopardize U.S. EV subsidies; seeks exemptions, invests heavily in U.S. tech amid policy concerns. South Korea has expressed concerns that China's dominance over battery-grade graphite, a key component for electric vehicles (EVs), could undermine the subsidy program at the core of President Joe Biden’s green technology initiative. China controls over 99% of the market for this material, essential for EV batteries. South Korea's trade minister warned that without exemptions from rules barring Chinese companies, no EV makers might qualify for the new U.S. subsidies. This issue has been brought up with the U.S. Commerce Department.

Meanwhile, South Korean tech giants have heavily invested in the U.S., attracted by subsidies for semiconductor and battery production. Samsung Electronics is investing heavily in Texas, and SK Hynix in Indiana, while Korean battery companies are poised to represent a significant part of North America's battery capacity by 2030.

However, there are concerns that U.S. policy changes could disrupt South Korean investments, a risk underscored by threats from Republican presidential candidate Donald Trump to prioritize fossil fuels. In response, South Korea is considering incentives to retain domestic chip production and sees its global trade diversification as a strength amid U.S./China tensions, positioning itself as a strategic partner for countries looking to reduce reliance on China and Taiwan.

— Iowa board votes against more evidence in pipeline permit decision despite expansion concerns. In a split vote, the Iowa Utilities Board (IUB) declined to solicit more evidence before it decides whether to issue a pipeline permit to Summit Carbon Solutions, according to a Thursday board order. The IUB is currently facing a critical decision regarding Summit Carbon Solutions' pipeline permit, amid controversies and expansions in the project plan. Summit has significantly expanded its pipeline network proposal, adding 340 miles to the originally planned 690 miles and increasing the number of connected ethanol producers. This expansion has prompted new permit requests while the initial application is still under consideration.

As the IUB nears a decision on the first permit, the Sierra Club of Iowa and other opponents have called for a delay, arguing that the expansion warrants a reopening of the evidentiary record and consolidation of permit applications to fully assess the implications. Conversely, the Iowa Farm Bureau Federation, while not advocating for consolidation, supports revisiting the record to understand the impact of the expansion on the original proposal.

Summit’s project aims to transport captured CO2 from ethanol plants to North Dakota for underground storage, representing a significant initiative in carbon capture and storage efforts. However, the project has faced regulatory hurdles, particularly in the Dakotas where initial proposals were rejected by state regulators.

— The U.S. coal industry is encountering fresh challenges due to policy shifts, even as international coal trade dynamics evolve, the Wall Street Journal reports (link). The Biden administration has implemented stringent regulations aimed at reducing emissions from both existing coal power plants and new natural gas facilities. These new regulations are expected to spark significant investment in technologies for carbon capture and storage. However, the regulations are likely to face legal battles. The changes could also have substantial impacts on infrastructure, particularly for power plants that are major clients of U.S. railroads. Railroads are already experiencing a rapid decline in coal shipments. Meanwhile, domestic coal suppliers like Consol Energy are increasingly turning to foreign markets, with exports now accounting for a significant portion of their sales, as a response to the closure of coal power plants in the U.S.

— The New York Times looks at the five major climate policies that former President Donald Trump would probably reverse if he were re-elected (link). They are:

- Coal and gas power plants: The Biden administration's stringent emissions controls for power plants may be overturned. While Trump's claims about the reliability of renewable energy are false, he has indicated a willingness to roll back regulations on coal power, potentially reopening the door to increased fossil fuel plant construction.

- Automobile emissions standards: Trump has criticized Biden's efforts to transition to electric and hybrid vehicles, citing potential economic harm. He aims to reverse policies that push for electric vehicle adoption, considering them detrimental to the auto industry and job market.

- The Inflation Reduction Act (IRA): Trump is expected to attempt to dismantle the IRA, which is a significant investment in climate change mitigation, including the removal of incentives for electric vehicles, solar and wind power, and energy-efficient home improvements.

- Oil and gas drilling: Trump plans to boost fossil fuel production by lifting the Biden administration’s restrictions on coal, oil, and gas projects, and by approving new drilling ventures, including in the Arctic National Wildlife Refuge.

- Global climate negotiations: Trump’s previous withdrawal from the Paris Agreement slowed international climate progress. His return to power could see the U.S. retreating once more from global climate commitments, undermining efforts to limit global warming.

Bottom line: These changes could significantly impact both domestic and global efforts to address climate change.

|

LIVESTOCK, NUTRITION & FOOD INDUSTRY |

— USDA updated its food price outlook, projecting a more modest rise in U.S. food prices for 2024 compared to previous years. The forecast for all food is now at an increase of 2.2%, with grocery store prices expected to go up by 1.2%. This marks a slight decrease from the March outlook. Restaurant prices are anticipated to increase by 4.2%, a minor uptick from the March prediction of 4.1%. While there have been month-to-month fluctuations, USDA notes that most food categories are predicted to see price changes below their 20-year historical average in 2024. The only exceptions are fish and seafood, and dairy products, which are expected to decrease by 1.6%. Pork prices are projected to remain stable, revising the previous forecast of a decline. Egg prices have been notably volatile, affected by the avian influenza outbreak, yet are expected to be 4.8% higher, consistent with the March outlook but above the historical average.

Overall, the trend reflects ongoing consumer price pressures, though the rate of increase has slowed. Restaurant prices continue to rise faster than the average, influenced by factors such as rent, utilities, and labor costs, including the impact of minimum wage hikes. There's also evidence of a consumer divide, with high-income individuals buying more premium products and lower-income shoppers focusing on budget-friendly options, potentially leading to a market shift that could squeeze middle-tier consumers.

— USDA to unveil final rule on salmonella in some uncooked chicken products. USDA today will announce a final rule the agency has developed which would declare salmonella an adulterant in some raw chicken products, the first time the Food Safety and Inspection Service (FSIS) has taken such a step. The action would allow the agency to request the recall of products that test positive for even a low level of salmonella. The Office of Management and Budget (OMB) finished its review of the USDA plan earlier this week. The new rule will apply only to raw breaded stuffed chicken products which make up less than 0.15% of the U.S. chicken supply.

The poultry industry is not welcoming the rules, arguing that USDA lacks the authority to declare salmonella an adulterant. The rule is set to take effect one year from when it is published in the Federal Register and officials have expressed confidence the new rule will withstand any legal challenges.

— FDA: H5N1 found in one-fifth of milk samples, but still safe for consumers. Initial results show about one in five retail samples of milk showed traces of the H5N1 virus that has impacted the U.S. dairy herd. FDA noted quantitative polymerase chain reaction (qPCR)-positive do not necessarily represent actual virus that may be a risk to consumers. Additional testing is required to determine whether intact pathogen is still present and if it remains infectious, which would help inform a determination of whether there is any risk of illness associated with consuming the product. FDA is further assessing any positive findings through egg inoculation tests, a gold-standard for determining if infectious virus is present. “To date, the retail milk studies have shown no results that would change our assessment that the commercial milk supply is safe,” FDA said.

Earlier this week, Colombia banned certain U.S. beef imports due to bird flu concerns, signaling potential global market risks. Colombia's import halt is a small portion of the U.S.' $10 billion beef exports; no other nation has followed suit. The U.S. Meat Export Federation anticipates shipment delays to the Dominican Republic.

|

POLITICS & ELECTIONS |

— WSJ: Trump allies drafting plans to erode Fed independence post-election. The Wall Street Journal reports (link) that Donald Trump's allies are developing strategies that might undermine the Federal Reserve's independence if he is re-elected. These discussions involve proposals ranging from minor policy adjustments to drastic changes, such as involving the president directly in setting interest rates. A secretive group has drafted a document proposing that the Fed's regulations be subject to White House review and suggesting more aggressive use of the Treasury Department to check the Federal Reserve's power.

Additionally, the draft asserts that Trump would have the authority to replace Jerome Powell as Fed Chair before his term ends in 2026, although it is unclear if Trump is aware of or supports these plans. This initiative has caused concern among Trump advisers who favor traditional views of the Fed's independence, fearing it could lead to higher inflation and interest rates. There are also significant legal and institutional obstacles to these proposals, such as the lack of vacancies on the Fed's board and the president's limited authority to fire Fed governors.

The New York Times’ Andrew Ross Sorkin has questions about such a move, which could have huge consequences including raising the U.S. government’s borrowing costs because of investor worries about the Fed’s loss of independence.

- “Does Trump really support these nascent proposals? Representatives for the former president told The Journal that “no aspect of future presidential staffing or policy announcements should be deemed official” unless it came from him or an authorized official — but they didn’t dismiss the report entirely and he has long favored more powers to chip away at the authority of the Fed and other agencies.

- “Could Trump recruit a credible candidate for Fed chair under these circumstances?

- “Would Trump’s financial backers, including the hedge fund billionaire John Paulson, support these plans?”

For context, remember that presidents have tried to influence the Fed before. See Andrew’s 2018 interview with Paul Volcker who led the central bank from 1979 to 1987: Volcker recounts being summoned to meet with President Ronald Reagan and his chief of staff, James Baker, in the president’s library next to the Oval Office in 1984. Reagan “didn’t say a word,” Volcker wrote. “Instead, Baker delivered a message: ‘The president is ordering you not to raise interest rates before the election.’” Volcker wasn’t planning to raise rates at the time. “I was stunned,” he wrote. “I later surmised that the library location had been chosen because, unlike the Oval Office, it probably lacked a taping system.”

— Charlie Cook on a Biden/Trump rematch. The veteran election analyst says: “It’s pretty clear that President Biden’s chances of getting re-elected are better than they were in the latter half of January. An argument can now be made that Biden is an even-money bet to win the national popular vote… As Al Gore and Hillary Clinton can attest, the national popular vote and the national polls that attempt to estimate it aren’t what counts; it’s getting 270 votes in the Electoral College that really matters… Biden and Trump are now effectively even in Pennsylvania and Wisconsin, but Trump still has a lead of a little over 3 points in Michigan and Nevada, and a wider 4-point margin in Arizona and Georgia, all states that Biden won in 2020. Trump also leads by a comparable margin in North Carolina, which he did win four years ago. To win re-election, Biden has to win all three of the Frost Belt states, Michigan, Pennsylvania and Wisconsin, as well as either the 2nd District of Maine or the 2nd District of Nebraska. If Biden loses any of that northern trio, he would have to replace those with a similar haul of electoral votes from elsewhere, a taller order. Thus his path is both more uphill and narrower than in 2020.”

Cook’s bottom line: “Biden’s chances are better than they were three months ago, while still short of what he and his backers would want them to be. Too many political observers want everything binary, either 0% or 100%. But politics is rarely a sure thing.”

— Former President Donald Trump's economic team is exploring strategies to discourage international de-dollarization efforts, spurred by emerging markets looking to minimize reliance on the U.S. dollar, according to Bloomberg (link). These discussions, held in private due to the sensitive nature of the subject, involve potential punitive measures for countries that shift towards conducting bilateral trade in currencies other than the dollar. Possible sanctions could include export controls, accusations of currency manipulation, and the imposition of tariffs.

This pushback comes in the wake of a vocal critique against the dollar's global financial dominance, which gained momentum after the U.S. led sanctioning efforts against Russia, limiting its access to the dollar. In a recent development, President Joe Biden signed a law enabling the seizure of Russian dollar assets to help rebuild Ukraine, a move that has caused some Republican lawmakers to express concerns over its possible detrimental effects on the dollar's global standing.

The BRICS nations (Brazil, Russia, India, China, and South Africa), known for discussing de-dollarization, have increased their international influence by inviting significant oil producers like Saudi Arabia and the UAE to join them, both of which currently peg their currencies to the dollar.

Trump advisors are specifically eyeing the BRICS bloc's moves to de-dollarize as a target for counteraction in the event of Trump's return to office. Trump himself has publicly advocated for maintaining the dollar's status as the global reserve currency and has criticized countries moving away from the dollar. Although he previously considered devaluing the dollar to boost domestic manufacturing, he recently has been against such interventions.

Amid a strengthening dollar, due in part to the Federal Reserve's interest rate policies, some countries are contemplating intervention to support their own currencies, with Japanese and South Korean authorities signaling their readiness to take action against excessive volatility in their exchange rates. Meanwhile, Chinese officials have already made efforts to curb the weakening of the yuan.

|

OTHER ITEMS OF NOTE |

— Minneapolis approves $15 minimum for cigarette packs, highest in U.S. The Minneapolis City Council unanimously passed an ordinance Thursday that requires retailers to sell a pack of cigarettes for at least $15, which is likely the highest required price in the country. The ordinance’s backers and city staff say it will encourage smokers to quit and will save money that would otherwise be spent treating smoking-related illnesses. Some members of the public have expressed concerns that the additional costs would be borne by working people addicted to tobacco and force community gathering spaces to close. Link for details.

— Cotton AWP eases again. The Adjusted World Price (AWP) for cotton moved down to 61.33 cents per pound, effective today (April 26), a decline from 62.18 cents per pound the prior week and the lowest AWP since it was 60.90 cents per pound the week of Dec. 18, 2020. USDA also announced that Special Import Quota #2 will be established May 2 for the import of 31,702 bales of upland cotton, applying to supplies purchased no later than July 30 and entered into the U.S. no later than Oct. 28.

|

KEY LINKS |

WASDE | Crop Production | USDA weekly reports | Crop Progress | Food prices | Farm income | Export Sales weekly | ERP dashboard | California phase-out of gas-powered vehicles | RFS | IRA: Biofuels | IRA: Ag | | Russia/Ukraine war, lessons learned | | SCOTUS on WOTUS | SCOTUS on Prop 12 pork | New farm bill primer | | Gov’t payments to farmers by program | Farmer working capital | USDA Ag Outlook Forum |