UK, Brazil Focus on New Trade Agreements While U.S. Trade Policy in Holding Pattern

U.S. producer prices above expectations | Farm bill issue festers | Red Sea shipping diversions to linger

|

Today’s Digital Newspaper |

MARKET FOCUS

- U.S. producer prices rise more than expected

- U.S. retail sales rise less than expected

- Yellen said it’s “unlikely” that market interest rates will return to pre-Covid levels

- ADM shares dip amid DOJ probe, rebound on buyback program

- Biden says United States Steel Corp. should retain American ownership

- Sierra Club and Sierra Club Foundation file lawsuit against SEC

- Oil prices headed higher, says Sevens Report

- Oil prices rose to 4-month highs on draw in crude inventories & gasoline stocks

- IEA predicts global oil markets will experience supply deficit throughout 2024

- Peso hit strongest closing position against U.S. dollar since 2015

- FT: U.S. engaged in secret talks with Iran on Houthis to halt Red Sea attacks

- Ag markets today

- USDA daily export sale: 100,000 MT corn to Mexico during 2023-2024 marketing year

- ‘Beef rice’ the next challenge for beef

- Ag trade update

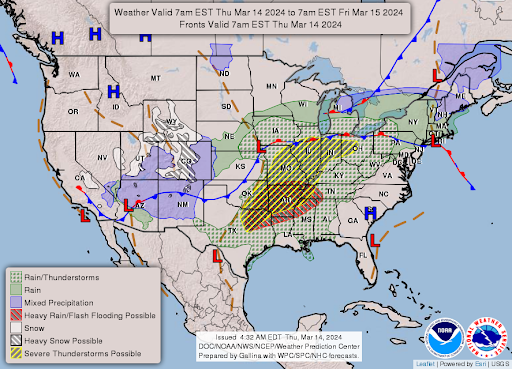

- NWS weather outlook

- Pro Farmer First Thing Today items

CONGRESS

- House passes bill to ban TikTok in the U.S. unless Chinese owner sells

- Steve Mnuchin putting together an investor group to purchase TikTok

- CBO: Nondefense programs spared from automatic cuts

RUSSIA & UKRAINE

- IKAR expects bigger Russian grain crop this year

POLICY

- Senate Ag GOP staff unveils report on conservation in new farm bill

CHINA

- China unveils plan to boost economic growth through equipment renewal

- U.S. wheat cancelations by China noted in weekly data

- China cancels, postpones Aussie wheat buys, too

TRADE POLICY

- UK recently signed trade agreement with state of Texas

- Brazilian president aims to boost ag exports to India and Africa

- Canada reboots trade forum amid Trump uncertainty

ENERGY & CLIMATE CHANGE

- Lithium America secures DOE loan for Nevada lithium project .

- DOE awards $750 million for clean hydrogen projects

LIVESTOCK, NUTRITION & FOOD INDUSTRY

- McDonald’s CFO: Cash-strapped customers choosing to eat more often at home

- Recovery continues for egg layer flocks affected by HPAI

OTHER ITEMS OF NOTE

- National Park Service to remove around 140 iconic cherry trees in Washington, D.C.

|

MARKET FOCUS |

— Equities today: Asian and European stock markets were mixed in overnight trading. U.S. Dow opened slightly higher but is now slightly lower. In Asia, Japan +0.3%. Hong Kong -0.7%. China -0.2%. India +0.5%. In Europe, at midday, London flat. Paris +0.9%. Frankfurt +0.2%.

U.S. equities yesterday: The Dow ended with a gain of 37.83 points, 0.10%, at 39,043.32. The Nasdaq fell 87.87 points, 0.54%, at 16,177.77. The S&P 500 lost 9.96 points, 0.19%, at 6,165.31.

Of note: The S&P 500 is in its longest stretch since 2018 without a drop of at least 2%.

— ADM shares dip amid DOJ probe, rebound on buyback program. Archer Daniels Midland (ADM) shares experienced a dip before rebounding in late trading Wednesday due to reports of a U.S. Department of Justice investigation into the company's accounting practices. The investigation focuses on ADM's ethanol trading business, particularly regarding the proper accounting for hedges. This probe comes in the wake of earlier reports of a broader investigation into ADM's accounting practices, including its Nutrition unit. Current and former employees have received grand jury subpoenas related to these inquiries. Despite these challenges, ADM announced an accelerated stock buyback program to repurchase $1 billion of common shares, which contributed to a 2.1% increase in its stock price on Wednesday. Earlier in the week, ADM's stock had surged after the company posted better-than-expected Q4 results.

— President Joe Biden said United States Steel Corp. should retain American ownership, coming out against a takeover by Japan’s Nippon Steel Corp. despite the risk of upsetting a key ally ahead of a state visit next month by the Japanese prime minister, Fumio Kishida.

— Sierra Club and Sierra Club Foundation have filed a lawsuit against the Securities and Exchange Commission (SEC) in the U.S. Court of Appeals for the District of Columbia Circuit. This lawsuit is in response to a recently released SEC rule regarding climate disclosure requirements for publicly traded companies. According to the Sierra Club, the new rule fails to provide investors with sufficient information regarding companies' potential exposures to climate risks. One major concern highlighted in the suit is that the rule does not mandate reporting of Scope 3 emissions, which encompass a company's entire supply chain.

The SEC finalized the rule despite criticisms and did not include provisions for reporting Scope 3 emissions. This decision has triggered legal challenges from various quarters, including Republican-led states, energy companies, and other entities. Critics argue that the rules are overly intrusive and extend beyond reasonable regulatory measures.

— Ag markets today: Soybeans extended their recent corrective gains during the overnight session, while wheat traded lower and corn favored the downside in two-sided trade. As of 7:30 a.m. ET, corn futures were trading 1 to 2 cents lower, soybeans were mostly 2 to 4 cents higher, winter wheat markets were 7 to 8 cents lower and spring wheat was 1 to 3 cents lower. Front-month crude oil futures were around 60 cents higher, and the U.S. dollar index was trading just above unchanged.

Packers continue to slow cattle slaughter. Estimated week-to-date cattle slaughter totaled 351,000 head through Wednesday, 11,000 head below week-ago and 23,151 head behind last year’s pace. Slaughter will be down notably from last week’s light 583,000 head tally. Given their struggles with tight market-ready supplies and negative margins, packers continue to drag their feet on cash negotiations, while feedlots are positioned to wait on steady/firmer bids.

Cash hog index continues seasonal climb. The CME lean hog index is up another 41 cents to $82.02 as of March 12, extending the seasonal price climb. April lean hog futures finished Wednesday at a $2.855 premium to today’s cash quote. That’s slightly less than the five-year average advance of $3.75 from now until April 16, when the contract is cash settled against the index.

— Agriculture markets yesterday:

- Corn: May corn fell 1/2 cent to $4.41 1/4, a near mid-range close.

- Soy complex: May soybeans closed up 3/4 cent at $11.96 3/4, near the session high and hitting a four-week high. May soybean meal fell $2.80 at $336.40 and near mid-range. May bean oil closed up 75 points at 48.57 cents, nearer the session high and closed at a two-month-high close.

- Wheat: May SRW wheat closed 3 1/4 cents lower to $5.44 1/4, a mid-range close. May HRW fell 9 3/4 cents to $5.87 1/, while May HRS ended 8 1/2 cents lower at $6.63 1/2, each closing low-range.

- Cotton: May cotton closed down 33 points at 94.90 cents and nearer the session low.

- Cattle: Cash strength continues supporting the cattle complex. Nearby April live cattle rose $1.675 to $189.925, while the June contract surged $2.10 to $186.05. Expiring March feeder futures advanced $1.30 to $250.275, while April feeders climbed $1.725 to $255.85.

- Hogs: April lean hog futures dropped 47.5 cents to $84.875, though it settled nearer session highs.

— Quotes of note:

- Treasury Secretary Janet Yellen said it’s “unlikely” that market interest rates will return to pre-Covid levels. And she told Fox Business that a moderation in the rise of U.S. housing costs will help deliver lower inflation in 2024. Asked why White House projections released Monday showed markedly higher expectations for interest rates in coming years compared with projections a year ago, Yellen said the new numbers were in line with private sector forecasts.

- Oil prices headed higher, says Sevens Report: “Yesterday’s EIA report was a bullish release and supported the case for higher WTI and Brent futures in the near term from both a supply perspective (headline inventory draw and output decline), and demand outlook (firming gasoline supply). That paired with a general sense of optimism among investors for a soft economic landing and a still-resilient equity market, not to mention still-elevated geopolitical risks, all helped push WTI futures towards the psychological $80/barrel level that has been acting as stubborn resistance. The 2024 uptrend remains intact, and a break beyond $80/barrel seems increasingly likely in the sessions ahead.”

- “Family Dollar is a victim of the macro environment out there.” — Dollar Tree CEO Rick Dreiling, on the decision to close nearly 1,000 stores, most of them the Family Dollar brand.

— U.S. producer prices rise more than expected. In February 2024, the Producer Price Index (PPI) for final demand in the U.S. increased by 0.6% compared to the previous month, which is the largest rise since August of the previous year, surpassing market expectations of a 0.3% increase.

This increase was driven primarily by a surge in goods prices by 1.2%, marking the highest increase in six months. This surge in goods prices was mainly influenced by a significant 4.4% rise in energy costs and a 1.0% increase in food prices. Additionally, the cost of services also saw an uptick, rising by 0.3% in February, following a 0.5% increase in the previous month. Within services, prices for transportation and warehousing services climbed by 0.9%, while prices for trade declined by 0.3%.

Meanwhile, the core rate, which excludes more volatile items like food and energy, increased by 0.3% in February. This represents a slowdown from the 0.5% increase observed in January but slightly exceeded the consensus forecast of 0.2%.

Looking at the yearly basis, producer price inflation accelerated to 1.6% in February from January's 0.9%, easily surpassing forecasts of 1.1%. This suggests a notable increase in the overall prices of goods and services over the past year.

The PPI data is the last piece of the inflation puzzle available before the Federal Reserve’s rate-setting committee meets next week. The figures feed into the Fed's preferred inflation measure — the PCE — which will only get released after the Fed decides on interest rates and releases its dot plot on March 20.

— U.S. retail sales rise less than expected. In February 2024, retail sales in the United States experienced a 0.6% increase compared to the previous month. This followed a revised 1.1% decline in January, which was initially reported as a 1.4% drop. The February figure fell short of market expectations, which had anticipated a 0.8% gain. The modest rise, coupled with the notable decrease in January, suggests a potential slowdown in consumer spending.

Key sectors experiencing growth in February included building materials and garden equipment sales, which increased by 2.2%. Motor vehicles and part dealers also saw a notable rise of 1.6%, while electronics appliance stores experienced a 1.5% increase. Additionally, sales at gasoline stations rose by 0.9%, with other minor increases observed at miscellaneous store retailers (0.6%), food services and drinking places (0.4%), general merchandise stores (0.4%), and food and beverages stores (0.1%).

Conversely, several sectors witnessed declines in sales during February. These include furniture stores (-1.1%), clothing (-0.5%), health (-0.3%), and nonstore retailers (-0.1%). When excluding food services, auto dealers, building materials stores, and gasoline stations, which are considered in the calculation of core retail sales used for GDP calculation, the core retail sales remained flat in February.

Market perspectives:

— Outside markets: The U.S. dollar index was firmer amid weakness in the euro and yen. The yield on the 10-year U.S. Treasury note was higher, trading around 4.20%, with a mixed tone in global government bond yields. Crude oil futures moved higher, with U.S. crude around $80.40 per barrel and Brent around $84.55 per barrel. Gold futures were lower ahead of US inflation data, trading around $2,171 per troy ounce, while silver was firmer around $25.19 per troy ounce.

— Peso hit its strongest closing position against the U.S. dollar since 2015. The Mexican peso appreciated on Wednesday morning to reach 16.66 to the U.S. dollar, its strongest position since July 2023. By 1 p.m. Mexico City time, the peso had weakened slightly to trade at 16.68 to the greenback, according to Bloomberg but recovered to 16.67 by the close of the trading day. While the peso reached a high of 16.62 last year, the USD:MXN exchange rate at the end of a trading day hasn’t been below the 16.66 level seen Wednesday morning since December 2015.

— Oil prices rose Wednesday to four-month highs on a surprise draw in crude inventories and gasoline stocks. Crude stocks fell by 1.5MM/bbls last week, larger than the 1.3MM/bbls forecasted. Gasoline inventories fell by 5.7MM/bbls sending futures prices to their highest price since September 2023. In Russia, Ukraine struck oil refineries in a second day of heavy drone attacks, causing a fire at Rosneft's biggest refinery in what Russian President Vladimir Putin said was an attempt to disrupt his country's presidential election this week. WTI traded up $2.16 or 2.8% to close at $79.72. Brent traded up $2.11 or 2.6% to close at $84.03.

— International Energy Agency (IEA) predicts that global oil markets will experience a supply deficit throughout 2024, contrary to the surplus previously anticipated. This shift is attributed to the likelihood of OPEC+ continuing their output cuts in the latter half of the year. Saudi Arabia and its allies have agreed to extend production curbs of approximately 2 million barrels per day until mid-year, with the IEA assuming these measures will persist until the end of 2024. This move aims to balance oil markets, according to the IEA.

The IEA's updated projections suggest a slight deficit in oil supply rather than the significant surplus forecasted earlier. Additionally, the agency has increased its forecasts for global oil demand in 2024. Despite OPEC+ not fully implementing the recent curbs, these measures have helped support crude prices amid slowing consumption growth and ample supplies from the Americas. Brent futures closed at over $84 a barrel, marking a four-month high.

The IEA has revised its forecasts for world oil demand growth in 2024, attributing the adjustment to a stronger outlook for the U.S. and an increased need for ship fuel due to vessels taking longer routes to avoid Houthi attacks in the Red Sea. Consequently, the amount of oil stored aboard ships has surged to nearly 1.9 billion barrels, the second-highest level since the peak of the COVID-19 pandemic.

Global oil demand is projected to reach a record average of 103.2 million barrels per day in 2024. However, the growth forecast remains lower than expectations from major traders such as Vitol Group and OPEC. The agency anticipates a sharp deceleration in consumption growth compared to last year, attributing it to the post-pandemic rebound reaching its peak and the ongoing shift away from fossil fuels. China's economic expansion is expected to slow significantly, affecting oil consumption.

Despite rising oil consumption, supplies from the Americas, particularly the US, Brazil, Canada, and Guyana, are expected to increase, potentially leading to a surplus in global markets if not for the OPEC+ production cuts.

The IEA's decision to assume an extension of OPEC+ curbs before official confirmation is considered unusual, as the agency typically waits for policies to be announced before factoring them into its forecasts. However, this decision is based on previous extensions by the alliance. OPEC+ will convene in Vienna on June 1 to decide on extending the production cuts into the second half of the year.

— U.S. engaged in secret talks with Iran to persuade Tehran to use its influence over Yemen's Houthi movement to halt attacks on ships in the Red Sea, the Financial Times reports (link). The discussions, held in Oman in January, marked the first direct negotiations between the two nations in 10 months. Led by White House Middle East adviser Brett McGurk and Iran's deputy foreign minister Ali Bagheri Kani, the talks also addressed concerns regarding Iran's nuclear program. The Biden administration aims to employ diplomatic channels alongside military deterrence to de-escalate tensions in the region, particularly amid a surge in hostilities involving Iranian-backed groups following the Israel-Hamas conflict. Despite the efforts, attacks by the Houthis persist, prompting US officials to recognize that military action alone may not suffice in deterring them, emphasizing the need for Tehran to exert pressure on the group.

— ‘Beef rice’ the next challenge for beef. South Korean researchers have grown beef cells in rice grains in what they say is a major step towards achieving a sustainable, affordable and environmentally friendly source of protein that could replace farmed cattle for meat. “Beef rice” uses grain particles as the base for cultivating animal muscle and fat cells. In the research, rice grains were treated with enzymes to create an optimal environment for cell growth, then infused with bovine cells that are cultivated to achieve the final hybrid product, which resembles a pinkish grain of rice.

— USDA daily export sale: 100,000 MT corn to Mexico during 2023-2024 marketing year.

— Ag trade update: Japan purchased 114,305 MT of milling wheat, including 60,895 MT U.S., 25,400 MT Canadian and 28,010 MT Australian. South Korea tendered to buy 100,800 MT of rice, with 77,700 MT to be sourced from the U.S., 22,000 MT from China and 1.1 MT from Vietnam.

— NWS weather outlook: Heavy snow through today from the central Rockies, the foothills, and nearby High Plains before gradually tapering off on Friday... ...A long-duration event of mountain snow and lower-elevation rain expected to develop over the Four Corners region beginning on Friday... ...Severe thunderstorms and excessive rainfall expected to push southward from the east-central Plains this morning to the Arklatex region on Friday, and into southeastern Texas by Saturday morning... ...Very mild/warm weather expands eastward from the central to the eastern U.S. going into the weekend.

Items in Pro Farmer's First Thing Today include:

• Soybeans firmer, corn and wheat weaker overnight

• Exchange inches up Argentina’s soybean crop estimate

• Strategie Grains cuts EU wheat, barley crop forecasts

|

CONGRESS |

— House passes bill to ban TikTok in the U.S. unless its Chinese owner sells the video-sharing app, mounting the most serious challenge yet to a popular service that critics call a national-security threat. The measure now faces a less-certain future in the Senate. President Joe Biden has said he would sign the legislation if it passes, even though his re-election campaign recently joined TikTok and despite the risk he would alienate younger voters eight months before facing Donald Trump in an election rematch.

Of note: Beijing does not allow any U.S. social media companies to operate in China. “I find it supremely ironic because government officials here are using the X platform to criticize the United States,” Ambassador Nicholas Burns said in an interview with Bloomberg Television on Thursday. “They don’t give their own citizens the right to use X, to use Instagram, to use Facebook, to have access to Google.” Burns said the video-sharing app and advanced chips are central to the competition between the world’s two largest economies, further signaling the Biden administration’s toughened position toward China’s technological ambitions. “Technology is in many ways now at the heart of the competition between the United States and China, whether it’s commercial technology, TikTok for instance, or whether it’s technology that can be transformed into military technology used to compete against us,” Burns said.

Former Treasury Secretary Steve Mnuchin is putting together an investor group to purchase TikTok, the former Trump cabinet secretary announced in an interview on CNBC’s Squawk Box on Thursday morning. “This should be owned by U.S. businesses,” Mnuchin told CNBC’s Andrew Ross Sorkin, adding that “there's no way that the Chinese would ever let a U.S. company own something like this in China.” Mnuchin gave no details on which other investors were joining the group, but noted “there would be no one investor that controlled this.” Mnuchin didn’t say whether ByteDance has been receptive to the idea of a sale.

— CBO: Nondefense programs spared from automatic cuts despite funding deadline uncertainty. The Congressional Budget Office (CBO) stated that nondefense programs won't face automatic spending cuts even if Congress doesn't pass its remaining six spending bills by the April 30 deadline. This forecast has significance in the funding dispute between Republicans and Democrats, potentially averting a partial gov’t shutdown. According to the CBO, defense programs could still face a 1% cut, amounting to a reduction of up to $11 billion. Initially, concerns arose that nondefense programs, including Democratic priorities, might face a larger cut, possibly up to 5 percent or $41 billion, based on earlier estimates.

However, a recent forecast from the CBO, based on the six government funding bills passed by Congress last week, suggests that nondefense programs could be shielded from cuts. This development could provide Democrats with more leverage in the funding negotiations. President Biden signed a package containing six of the 12 annual government funding bills over the weekend, providing full-year funding for several departments and offices.

These six bills were drafted based on a spending top-line agreement aligned with the bipartisan debt limit deal from the previous year. Currently, lawmakers are still negotiating the remaining six bills, which include funding for key departments such as Defense, Labor, Health and Human Services, Education, and Homeland Security. In the interim, these offices are funded through a stopgap measure, maintaining spending at fiscal 2023 levels.

CBO reasoning. Taking into account the stopgap measure and the funding bills passed last week, the CBO stated that nondefense funding is $3 billion below the $736 billion cap, indicating that no sequestration of nondefense budgetary resources would be necessary. However, the final decision regarding whether sequestration is required and the calculation of any percentage reductions, rests with the Office of Management and Budget (OMB).

|

RUSSIA/UKRAINE |

— IKAR expects bigger Russian grain crop this year. Russian ag consultancy IKAR expects Russia’s 2024 grain crop to total 147 MMT, including 93 MMT of wheat, Russian news agency Interfax reported. In 2023-24, Russia produced 144 MMT of grain, including 91.6 MMT of wheat. Despite the expected increase in production, IKAR reportedly forecasts Russian grain exports will fall to 50 MMT in 2024-25 from 67 MMT estimated for the current marketing year.

|

POLICY UPDATE |

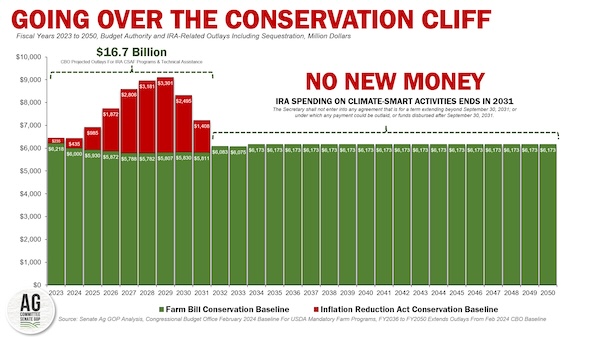

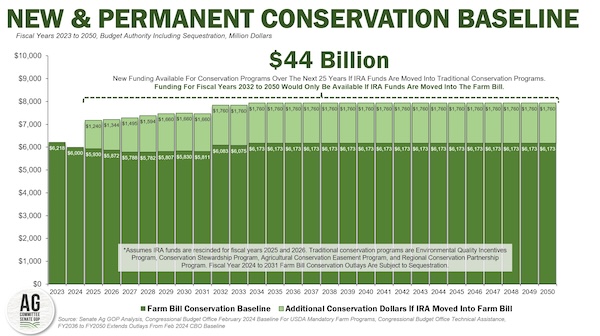

— Senate Ag GOP staff unveils report on conservation in new farm bill. The Republican staff of the Senate Agriculture Committee published a report (link) on conservation in the farm bill. Senate Ag Committee Chairwoman Debbie Stabenow (D-Mich.) has said she is unwilling to reprogram conservation money in the Inflation Reduction Act (IRA/Climate Bill), but the GOP report says, “Any discussion about ‘protecting IRA resources’ that does not begin with prioritizing additional baseline for the conservation title risks missing out on this investment.”

The report discusses a potential bipartisan solution to address a looming "conservation cliff" resulting from the IRA of 2022. This act allocated significant funds for climate-smart agriculture and forestry activities (CSAF), but these funds are set to expire by 2031, creating uncertainty for conservation efforts. The proposal suggests moving the IRA funds into the farm bill to create permanent funding streams for conservation activities.

Key takeaways from the GOP staff report include:

- Opportunity for increased funding: Congress has an opportunity to increase funding for conservation, natural resource preservation, and wildlife habitat needs by moving IRA funds into a bipartisan farm bill.

- Potential impact: By reallocating IRA funds, there could be a substantial increase in conservation spending over the next 25 years, totaling more than $44 billion, which is three times larger than the expiring IRA resources.

- Bipartisan solution: Moving IRA funds into the farm bill could represent a historic bipartisan investment, benefiting farmers, ranchers, foresters, conservationists, and other stakeholders.

- Mechanism for funding: By utilizing Section 257 of the Balanced Budget and Emergency Deficit Control Act of 1985, the new increased funding levels for conservation programs would continue into perpetuity, subject only to Congressional reauthorizations.

- Potential agreement: The report suggests rescinding funding for IRA agriculture conservation programs in fiscal years 2025 and 2026, redirecting these funds to provide nearly $1.8 billion per year for local communities, farmers, and ranchers for conservation efforts.

- Need for action: The report emphasizes the urgent need for Congress to act to address the conservation cliff, highlighting the demand for conservation program spending that exceeds available funds.

- Stakeholder involvement: The proposal involves various stakeholders, including farmers, ranchers, foresters, and conservationists, who rely on voluntary conservation programs to meet their local conservation needs.

- Environmental benefits: Redirecting IRA funds into the farm bill could help improve soil health, water quality and quantity, reduce greenhouse gas emissions, and sequester carbon, contributing to the economic and environmental sustainability of farming for generations to come.

— Senate Ag GOP report is a "pre-buttal" to event today on Capitol Hill where Stabenow and USDA Undersecretary for Farm Production and Conservation Robert Bonnie will speak at a climate-smart agriculture expo at the Russell Senate office building hosted by the National Sustainable Agriculture Coalition and the League of Conservation Voters.

|

CHINA UPDATE |

— China unveils plan to boost economic growth through equipment renewal. China unveiled a plan to stimulate economic growth by encouraging consumers and businesses to replace old equipment and goods, a key component of its goal for a 5% economic growth rate this year. The State Council announced that projects focused on equipment renewal would receive support from the central government budget, besides tax incentives and targeted lending from banks. This action plan aims to boost spending on equipment across various sectors, including industry, agriculture, transport, education, and healthcare, by at least 25% by 2027 compared to last year. However, China's 2024 growth target faces challenges due to weak domestic demand caused by a housing slump and low confidence among businesses and consumers. These factors are also contributing to deflationary pressures, which are raising concerns about China's export competitiveness.

— U.S. wheat cancelations by China noted in weekly data. Some of the recent cancelations by China of purchases of U.S. SRW wheat were noted in the weekly Export Sales update from USDA covering the period ending March 7. Activity for 2023-24 relative to China was reported as net sales reductions of 120,709 metric tons of wheat, net sales of 132,997 metric tons of corn, 5,727 metric tons of sorghum, 256,144 metric tons of soybeans, and 28,228 running bales of upland cotton. For 2024, there were net sales of 1,682 metric tons of beef and 3,892 metric tons of beef. Given that there were cancelations totaling 504,000 metric tons announced for China, next week’s update will reflect some additional sales cancels for China.

— China cancels, postpones Aussie wheat buys, too. Chinese importers have cancelled or postponed about 1 MMT of Australian wheat cargoes, trade sources with direct knowledge of the deals told Reuters. Some of that total was washed out, while other cargoes were delayed from first quarter shipment to delivery later this year. USDA reported daily sales cancellations of U.S. SRW wheat by China totaling 504,000 MT between late last week and Monday. French traders cautioned there were no clear signs of French wheat being cancelled, though they said it was possible Chinese buyers might wash out some cargoes given lower prices than when they were purchased.

|

TRADE POLICY |

— UK recently signed a trade agreement with the state of Texas, as negotiations for a post-Brexit deal with the wider United States have stalled. The agreement was signed by UK Trade Secretary Kemi Badenoch and Texas Governor Greg Abbott in London. This move comes amid the UK government's struggle to fulfill its promise of securing significant trade deals following Brexit.

The agreement with Texas is described as a memorandum of understanding aimed at enhancing cooperation between UK businesses and counterparts in the U.S. state. Badenoch highlighted that this signing marks the UK's eighth state-level pact with the U.S., providing UK firms access to states with a combined GDP of £5.3 trillion ($6.8 trillion).

The UK government has been actively seeking new trade agreements globally to demonstrate the benefits of leaving the EU. Despite some trade deals being signed with countries like Australia, New Zealand, and Singapore, negotiations for broader agreements, including with the U.S. and Canada, have faced challenges.

Besides the agreement with Texas, recent UK trade engagements include pacts with other U.S. states like Florida and Indiana. Moreover, the UK has joined the Comprehensive and Progressive Agreement for Trans-Pacific Partnership (CPTPP), aligning itself with 11 Asia-Pacific countries.

— Brazilian President Luiz Inácio Lula da Silva aims to boost agricultural exports to India and Africa amid stalled trade negotiations with the European Union (EU). Agriculture Minister Carlos Favaro revealed plans for a trade mission to India comprising over 300 entrepreneurs to tap into India's growing demand for products like fruits, juices, coffee, and black beans. Additionally, there are opportunities to increase sales of meat and grains to Africa following Lula's recent visits to Egypt and Ethiopia, where he engaged with leaders of the African Union.

The shift in focus comes as talks between the Mercosur bloc (comprising Brazil, Argentina, Uruguay, and Paraguay) and the EU face obstacles. European farmers are concerned about potential cheap imports from countries with lower environmental standards, leading to criticism from French President Emmanuel Macron.

Despite challenges with the EU, Brazil has leveraged Lula's global popularity to open 96 new markets since the beginning of his third term in January 2023. The country has also seen a significant increase in the number of meatpackers authorized to export to China. Brazil recently secured approval to export beef, pork, and poultry to the Philippines through a streamlined accreditation process, bypassing traditional importer inspections.

While there remains a possibility of progress in Mercosur-EU negotiations, Brazil perceives the talks as deadlocked, particularly due to France's protectionist stance. Favaro emphasized Brazil's readiness to explore alternative markets in Asia, Africa, and the Middle East if EU trade relations with agribusiness do not advance.

Of note: As we reported Wednesday, Sens. John Thune (R-S.D.); John Boozman (R-Ark.), ranking member of the Senate Ag Committee ; and Mike Crapo (R-Idaho), ranking member of the Senate Finance Committee, led 19 of their colleagues in urging U.S. Trade Representative Katherine Tai and USDA Secretary Tom Vilsack to increase U.S. agricultural exports and improve the competitiveness of U.S. products abroad. “We expect trade to fluctuate in response to macroeconomic factors and market conditions,” wrote the senators. “However, the current sharp decline in U.S. agricultural exports is directly attributable to and exacerbated by an unambitious U.S. trade strategy that is failing to meaningfully expand market access or reduce tariff and non-tariff barriers to trade. While the Biden administration continually refuses to pursue traditional free trade agreements, China, Canada, the European Union, the United Kingdom, and others continue to ink trade pacts that diminish American export opportunities and global economic influence.”

— Canada reboots trade forum amid Trump uncertainty. Canada is reviving an official forum to strengthen its $2.5 billion daily trading relationship with the U.S., especially in light of Prime Minister Justin Trudeau's concerns over potential unpredictability with a possible return of Donald Trump to the presidency. Canadian Treasury Board President Anita Anand has initiated meetings to gather input from Canadian businesses for the Canada/United States Regulatory Cooperation Council, reigniting a cross-border dialogue that last convened in September 2019.

Anand plans to host additional meetings across Canada to address barriers hindering trade between the two nations, emphasizing the importance of preventing issues from escalating into trade disputes. Canada is the US's largest purchaser of export goods, while the U.S. represents a significant portion of Canada's global trade.

Despite the uncertainty surrounding the U.S. presidential election in November, Anand asserts that the Regulatory Cooperation Council's focus remains on fostering a robust trading relationship regardless of the occupant of the White House. Anand, who assumed her position in July, met with various businesses in British Columbia, including truckers and retailers, to discuss issues such as digitizing border trade documentation and ensuring fair competition between e-commerce imports and domestically manufactured goods.

|

ENERGY & CLIMATE CHANGE |

— Lithium America secures DOE loan for Nevada lithium project. Lithium America has received a conditional commitment loan of $2.26 billion from the U.S. Department of Energy (DOE) for its Thacker Pass project in Nevada. This project, anticipated to become North America's largest source of lithium for electric vehicle batteries, aligns with President Joe Biden's initiatives to decrease reliance on Chinese lithium supplies. Construction at the site began in March 2023, with the DOE loan earmarked for constructing processing facilities as part of the phase 1 plan. This phase aims to produce 40,000 tonnes of battery-quality lithium carbonate annually, sufficient for approximately 800,000 electric vehicles per year. The majority of the capital for Phase 1 will come from the DOE loan and General Motors' $650 million investment. However, the project's cost has increased to nearly $2.93 billion from the initial estimate of $2.27 billion. Thacker Pass is projected to reach full capacity in 2028, targeting an annual production of 80,000 tonnes. It will extract lithium from a significant clay deposit, a pioneering endeavor at a commercial scale.

— DOE awards $750 million for clean hydrogen projects. The Department of Energy (DOE) has allocated $750 million for 52 projects aimed at lowering the cost of producing clean hydrogen. This funding initiative intends to enhance the viability of clean hydrogen in transportation and industrial applications by reducing technology costs. Of the total funding, $316 million will support eight projects focused on manufacturing low-cost electrolyzers. The remaining projects will concentrate on supply chain development, identifying optimal materials for electrolyzer production, and fuel cell manufacturing, among other endeavors. The overarching goal is to enable the production of up to 10 gigawatts of electrolyzers annually.

|

LIVESTOCK, NUTRITION & FOOD INDUSTRY |

— McDonald’s CFO Ian Borden said cash-strapped customers are increasingly buying food from supermarkets, choosing to eat more often at home instead of at restaurants. McDonald’s wants to woo them back with bundle deals for $4 or less, and is test-marketing bigger burgers. It is also looking to boost its chicken offerings, which have faster sales growth than its burgers.

— Recovery continues for egg layer flocks affected by HPAI. The recovery from highly pathogenic avian influenza (HPAI) in egg layer flocks is progressing as two major commercial egg sector mega-flock farms were released from quarantine this week. These farms, located in Hardin County, Ohio (2.6 million head), and Merced County, California (1.4 million head), were among the last remaining under quarantine. Currently, only one small commercial egg layer operation in Dallas County, Missouri (20,000 head), remains under quarantine. In total, the HPAI outbreak that began in the fall of 2023 affected flocks totaling 12.9 million birds, along with an additional 2.8 million egg layer pullets.

Of note: With the release of these quarantines, the U.S. egg-layer flock is now poised for a full recovery in the coming months.

|

OTHER ITEMS OF NOTE |

— National Park Service plans to remove around 140 iconic cherry trees in Washington, D.C., to build taller sea walls to protect the Jefferson Memorial. Link for details.

|

KEY LINKS |

WASDE | Crop Production | USDA weekly reports | Crop Progress | Food prices | Farm income | Export Sales weekly | ERP dashboard | California phase-out of gas-powered vehicles | RFS | IRA: Biofuels | IRA: Ag | | Russia/Ukraine war, lessons learned | | SCOTUS on WOTUS | SCOTUS on Prop 12 pork | New farm bill primer | | Gov’t payments to farmers by program | Farmer working capital | USDA Ag Outlook Forum |