Supreme Court to Issue Ruling Today

China buys feedgrains, adjusts hog policy | Bayer | NS derailment | OPEC+ | Natgas rallies

|

Today’s Digital Newspaper |

MARKET FOCUS

- Apple hit with $1.953 billion fine for breaking EU law over music streaming

- Investor group raises takeover bid for Macy’s to $24 a share, a 14% increase

- JetBlue and Spirit Airlines terminate $3.8 billion merger agreement

- OPEC+ agrees to extend supply curbs to end of Q2

- Norfolk Southern derailment ignites proxy battle and safety concerns in rail industry

- Fed’s Daly: ‘We can’t underestimate the toll’

- Bayer's Roundup cancer trial ends in hung jury; mistrial declared

- U.S. natural gas futures: 6% surge, reaching three-week high

- Ag markets today

- U.S. daily export sales:

— 110,000 MT corn to Taiwan during 2023-2024 marketing year

— 126,000 MT soybean cake and meal to unknown destinations. Of the total, 30,000 metric tons for delivery during the 2023-2024 marketing year and 96,000 metric tons for delivery during the 2024-2025 marketing year

- China actively buys feedgrains

- Chevron idles two biodiesel plants

- India to buy more soyoil, less palm oil

- Biggest coffee-growing nations transforming into large buyers

- U.S. sugar supply crisis looms amid Mexican production decline

- Rising cocoa costs

- Ag trade update

- Powerful blizzard hits California, more bad weather ahead

- NWS weather outlook

- Pro Farmer First Thing Today items

CONGRESS

- Details and voting timeline for first FY 20224 funding package

ISRAEL/HAMAS CONFLICT

- VP Kamala Harris angers Netanyahu

RUSSIA & UKRAINE

- Poland wants EU sanctions on Russian, Belarussian ag products

POLICY

- Farmers mobilize worldwide against agricultural policies: exploring the root causes

CHINA

- Annual National People's Congress in Beijing begins Tuesday

- China's premier breaks tradition, scraps annual press briefing at NPC

- WSJ: Another China shock as country floods foreign markets with cheap goods again

- China barred from buying from SPR in U.S. funding bill

- China issues new regulations to control hog numbers

TRADE POLICY

- 13th Ministerial Conference for WTO in Abu Dhabi: No major agreements

ENERGY & CLIMATE CHANGE

- Ethanol producer Valero Energy Corp. joins $8 bil. carbon-capture and storage project

HEALTH UPDATE

- FDA approves ‘yogurt may lower diabetes risk’ claim

POLITICS & ELECTIONS

- Nikki Haley wins D.C.'s Republican primary, marking first victory of 2024 campaign

OTHER ITEMS OF NOTE

- U.S. migrant population to reach 8 million, 167% surge since 2019

|

MARKET FOCUS |

— Equities today: Asian and European stock markets were mixed in overnight trading. U.S. Dow opened around 150 points lower. Traders await key economic data due this week including the jobs report, JOLTS, and the ISM Services PMI. Also, Fed Chair Powell will deliver its semiannual testimony to Congress. Japan’s benchmark stock index closed above 40000 for the first time. Japan’s central bank is expected to begin lifting interest rates this year, for the first time in 17 years. In Asia, Japan +0.5%. Hong Kong flat. China +0.4%. India +0.1%. In Europe, at midday, London -0.5%. Paris +0.1%. Frankfurt -0.1%.

U.S. equities Friday: All three major indices finished Friday with gains which resulted in record finishes for the S&P 500 and the Nasdaq. On Friday, the Dow was up 90.99 points, 0.23%, at 39,087.38. The Nasdaq gained 183.02 points, 1.14%, at 16,274.94. The S&P 500 was up 40.81 points, 0.80%, at 5,137.08.

For the week, the Dow eased 0.1% while the S&P 500 was up 0.9% and the Nasdaq gained 1.7%

— Apple hit with €1.8 billion ($1.953 billion) fine for breaking EU law over music streaming. Brussels fined Apple for stifling competition from rival music streaming services, the first time the iPhone maker has been punished for breaching EU law. Margrethe Vestager, the bloc’s competition chief, said that for a decade the tech giant had broken EU antitrust rules by “restricting developers from informing consumers about alternative, cheaper music services available outside of the Apple ecosystem.” She said this amounted to abuse of the group’s dominant position for music streaming on its App Store. The penalty is the third-biggest antitrust fine the European Commission has imposed. Apple said it would appeal, signaling years of legal fights in EU courts. It said the commission had reached its decision despite failing to “uncover any credible evidence of consumer harm”, adding that Brussels’ reasoning “ignores the realities of a market that is thriving, competitive, and growing fast.”

— An investor group, comprising Arkhouse Management and Brigade Capital Management, has raised its takeover bid for Macy’s to $24 a share, marking a 14% increase and valuing the retailer at $6.6 billion. The move is aimed at potentially prompting Macy's to engage in negotiations, although it remains uncertain whether the increased offer will be sufficient. Macy's has recently unveiled its own turnaround strategy, adding complexity to the situation.

— JetBlue and Spirit Airlines terminate $3.8 billion merger agreement. A federal judge blocked the attempted merger in January after the Justice Department sued to bar the deal last year alleging the acquisition would stifle competition in the airline industry and eliminate Spirit as a discount alternative for price-conscious travelers. JetBlue and Spirit appealed the judge’s decision a couple of days later, but JetBlue noted the appeal was required under the terms of the merger agreement. Shares of JetBlue jumped 7% in premarket trading Monday.

— Ag markets today: Corn and soybeans traded higher amid corrective buying overnight, while the winter wheat markets favored the downside and spring wheat was mixed. As of 7:30 a.m. ET, corn futures were trading fractionally to a penny higher, soybeans were 4 to 8 cents higher, winter wheat markets were 1 to 3 cents lower and spring wheat was narrowly mixed. Front-month crude oil futures were about 65 cents lower, and the U.S. dollar index was trading just below unchanged.

Wholesale beef market strengthens. Wholesale beef prices continued their recent assent with gains of $1.08 for Choice and $1.56 for Select on Friday. While packer margins have improved amid the strengthening beef prices, they remain solidly in the red. As a result, packers will continue to manage tight market-ready cattle supplies by reducing kill hours, which should further support beef prices.

Pork cutout surges. The pork cutout jumped $4.23 on Friday, fueled by a $20.59 surge in primal belly prices. But all other cuts except loins also firmed. The pork cutout found support just above $90.00 last week, an area that up until a couple weeks ago acted as a solid price ceiling.

— Agriculture markets Friday:

- Corn: May corn futures dropped 4 3/4 cents to $4.24 3/4, but saw an 11 1/4 cent gain on the week.

- Soy complex: May soybeans rose 10 1/2 cents to $11.51 1/4 and gained 9 1/2 cents on the week to notch the first weekly gain since the week of Dec. 11. May soymeal rose $3.10 to $332.30, and picked up $4.30 week-over-week, while May soyoil fell 5 points to 45.16 cents, but rose 56 points on the week.

- Wheat: May SRW wheat fell 18 1/2 cents to $5.57 3/4, near the session low and closed at a contract low close. On the week, May SRW fell 11 1/4 cents. May HRW wheat lost 22 3/4 cents at $5.64 1/2, nearer the daily low and for the week gave up 12 cents. May spring wheat fell 15 1/4 cents to $6.43 3/4 and gave up 3 cents on the week.

- Cotton: May cotton closed down the limit of 400 points to 95.57 cents, but still managed to pick up 208 points on the week.

- Cattle: April live cattle rose $3.10 to $188.45, near the session high and for the week rose 55 cents. May feeder cattle futures gained $4.05 to $260.175, near the daily high, and for the week down $1.90.

- Hogs: Pork cutout leapt higher Friday and seemingly powered big gains in hog futures. The nearby April contract jumped $1.45 to close at $88.075. That represented a weekly rise of 87.5 cents.

— Quotes of note:

- Fed’s Daly: ‘We can’t underestimate the toll.’ The U.S. economy is doing well by just about every measure — GDP growth, jobs and moderating inflation. But the American people by and large don’t seem to be enjoying it. That’s why Bloomberg said they asked San Francisco Fed President Mary Daly why that might be. “She said we didn’t appreciate the ‘psychological toll’ of higher prices on people working ‘multiple jobs and not be able to afford things one month to the next.’” She believes that “as the economy continues to make gains and we bring inflation down, that scar will start to heal.” Daly says consumers’ resilience has “kept inflation a little bit higher for longer than we would have thought.” But as strong as the economy is, the Fed can't simply keep rates as restrictive as they are now, because "we want to avoid holding on all the way to 2%.” The challenge, she said, is to “calibrate so we're balancing the two objectives.” Link for more.

- Boeing… a step too far. “Did it go too far? Yeah, it probably did. But now it’s here and now. And now, I’ve got to deal with it.” — Boeing CEO Dave Calhoun, on the plane maker's outsourcing strategy.

— Bayer's Roundup cancer trial ends in hung jury; mistrial declared. The trial involving Bayer AG in Delaware regarding allegations that its Roundup weedkiller causes cancer concluded with a hung jury, unable to reach a verdict. Jurors deliberated for approximately three days before announcing their inability to agree on whether Anthony Cloud's non-Hodgkin's lymphoma resulted from exposure to Roundup manufactured by Bayer's Monsanto subsidiary. Consequently, Judge Vivian Medinilla declared a mistrial and dismissed the panel. (The case is identified as Cloud v. Monsanto, N21C-08-279, in the Delaware Superior Court in Wilmington.)

Background. Anthony Cloud, who passed away in 2021, had been employed as a groundskeeper at the South Carolina Baptist Convention's White Oak Conference Center for ten years. His family contended that his regular use of Roundup to eliminate weeds on the 800-acre property led to his illness, arguing that Monsanto failed to adequately warn Cloud about Roundup's potential health hazards.

This mistrial occurs amid ongoing litigation against Monsanto, with another Roundup trial underway in Philadelphia. In a previous Philadelphia trial, a separate jury ordered Bayer's unit to pay over $2.2 billion in damages to a former landscaper who attributed his cancer to the weedkiller.

Bayer, in response to the mistrial, emphasized the scientific consensus and regulatory assessments supporting the safety of Roundup, highlighting its victory in a separate Roundup trial in Arkansas. The company underscored its commitment to presenting cases based on robust scientific and regulatory evidence, indicating that the recent verdict reaffirms its approach.

Bayer, headquartered in Leverkusen, Germany, has allocated $16 billion to address the protracted litigation concerning Roundup. Additionally, the company intends to transition from glyphosate-containing Roundup to alternative weed-killing formulations in the U.S. market.

Market perspectives:

— Outside markets: The U.S. dollar index was firmer. The yield on the 10-year U.S. Treasury note was higher, with a mostly lower tone in global government bond yields. Crude oil futures were weaker ahead of U.S. market action, with U.S. crude around $79.78 per barrel and Brent around $83.45 per barrel. Gold and silver were under pressure ahead of US economic data, with gold around $2,090 per troy ounce and silver around $23.31 per troy ounce.

— U.S. natural gas futures saw a 6% surge, reaching a three-week high of $1.94/MMBtu on Monday, following an 8% gain in the previous week. This increase is attributed to producers scaling back operations, resulting in lower production levels compared to earlier in the month. EQT announced a reduction of nearly 1 billion cubic feet per day in production until March due to persistently low natural gas prices. Chesapeake Energy also slashed its 2024 fuel production by approximately 30% in response to recent price drops. Antero Resources and Comstock Resources are among other firms planning drilling cutbacks this year. Despite this, gas flow to LNG export terminals is expected to increase with the Freeport LNG facility returning to full power. However, recent EIA data indicates storage levels are 26.5% higher than average, presenting a challenge to the market.

— USDA daily export sales:

- 110,000 MT corn to Taiwan during 2023-2024 marketing year

- 126,000 MT soybean cake and meal to unknown destinations. Of the total, 30,000 metric tons for delivery during the 2023-2024 marketing year and 96,000 metric tons for delivery during the 2024-2025 marketing year.

— China actively buys feedgrains. China snapped up more than 20 cargoes of feedgrain amounting to more than 1.2 MMT on the international market in the past two weeks, Bloomberg News reported (link). China secured shipments of corn, sorghum and barley from suppliers including Ukraine and U.S., the report said, citing people familiar with the transactions.

— Chevron idles two biodiesel plants. Chevron indefinitely idled two Midwest biodiesel production facilities, the company confirmed on Friday, citing poor market conditions. Chevron idled plants in Ralston, Iowa, and Madison, Wisconsin, that combined can process 50 million gallon per year of biodiesel.

— India to buy more soyoil, less palm oil. India is expected to buy larger volumes of soyoil in 2024, while purchases of palm oil are likely to decline, as negative refining margins for palm oil versus positive margins for soyoil have prompted a switch in recent weeks. Sandeep Bajoria, chief executive of Sunvin Group, a vegetable oil brokerage and consultancy firm, said India’s soyoil imports will rise to 4.3 MMT 2023-24 from 3.5 MMT in 2022-23. He forecasts palm oil imports would fall to 9.2 MMT from 10 MMT in 2023-24. India’s sunflower oil imports are expected to remain around 3 MMT. India’s overall vegoil imports are expected to total around 16.5 MMT, the same as in 2022-23.

— Some of Asia’s biggest coffee-growing nations are finding it hard to satisfy caffeine cravings in their home markets. From Indonesia to Vietnam, high demand is transforming producers into large buyers. Link to details via Bloomberg.

— U.S. sugar supply crisis looms amid Mexican production decline. The U.S. faces a looming sugar supply crisis due to drought and mismanagement in Mexico, a major supplier. Without swift government intervention, U.S. sugar importers say they may resort to high-tariff imports to compensate for Mexico's lower production. Recent projections by USDA indicate a significant drop in Mexican sugar production for the upcoming fiscal year, exacerbating supply constraints. With limited options to raise the tariff-rate quota for low-duty sugar imports, U.S. sugar users may be forced to rely on high-tariff alternatives, driving domestic sugar prices higher.

Severe drought and crop mismanagement in Mexico have contributed to the decline in sugar production, leading to concerns among industry analysts. The shortage in Mexican sugar production will impact U.S. imports, with USDA anticipating a substantial decline for the upcoming year. Additionally, adverse weather conditions globally, such as the El Niño phenomenon, have further strained sugar producers, contributing to reduced imports under the U.S. tariff-rate quota program.

Analysts emphasize the urgency for government action to alleviate the supply crunch, suggesting an increase in sugar import quotas. However, USDA's ability to intervene is limited until April, leaving importers vulnerable to higher-tariff imports.

Background. The Office of the U.S. Trade Representative last year announced fiscal year 2024 TRQ allocations would be 1,117,195 metric tons raw value, the minimum required under World Trade Organization commitments. Under the farm bill, USDA can increase the TRQ level for sugar only after April 1 unless it declares an emergency shortage. USTR and USDA have accepted a GAO recommendation to revisit the TRQ allocation methods.

— Rising cocoa costs: The ongoing challenge for chocolate consumers and farmers. As the demand for chocolate surges and cocoa prices skyrocket, consumers are facing the prospect of higher chocolate prices. Factors such as adverse weather, crop diseases, and market speculation have driven cocoa prices to unprecedented levels, squeezing cocoa farmers in West Africa. Structural issues like climate change and underinvestment further exacerbate the situation, threatening the sustainability of cocoa production. Despite efforts by governments and industry players to protect farmers, challenges persist, including low farmgate prices and deforestation concerns. While consumers may see increased chocolate prices, farmers often fail to benefit from these hikes. The widening gap between cocoa demand and supply poses significant challenges for both small and large players in the chocolate industry, potentially leading to layoffs and reduced profitability. Amid these challenges, there is a call for the industry to commit to fairer pricing for farmers to ensure the future viability of cocoa production and prevent chocolate from becoming a luxury item. Link/paywall to more on this via the Financial Times.

— Ag trade update: Iran tendered to buy 180,000 MT of corn (sourced from Brazil, Europe, Russia, Ukraine or elsewhere in the Black Sea region), 120,000 MT of soymeal (sourced from Brazil or Argentina) and 120,000 MT of feed barley (sourced from the EU, Russia, Ukraine or elsewhere in the Black Sea region). Algeria tendered to buy at least 50,000 MT of optional origin soft milling wheat.

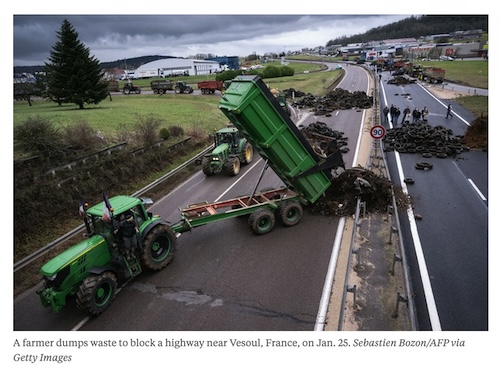

— A powerful blizzard has struck California, particularly impacting the Sierra Nevada region, Lake Tahoe, and Mammoth Mountain areas. The storm brought gusts of up to 190 mph and heavy snowfall, prompting the closure of key roads and causing travel disruptions. Avalanche warnings remain in place due to the extreme conditions. The blizzard, lasting longer than initially forecasted, led to the extension of rare blizzard warnings for the Lake Tahoe area through Monday morning. Roads to Mammoth Mountain and northern Tahoe from Sacramento and Reno were closed. Gusts exceeding 100 mph were expected on Sierra ridges, with significant snowfall predicted for various areas. Interstate 80 and Highway 88 were among the major routes closed due to heavy snow, spinouts, and whiteout conditions. Emergency responders faced challenges reaching motorists stranded on highways. The storm also caused power outages and impacted travel across the region. The storm's impact extended beyond the Sierra Nevada, affecting areas in Southern and Central California with rain, potential mudslides, and accidents. Link for details via the Los Angeles Times.

Of note: More snow is headed to northern California this week, on the heels of a blizzard that dumped more than 60 inches over parts of the Sierra Nevada mountains.

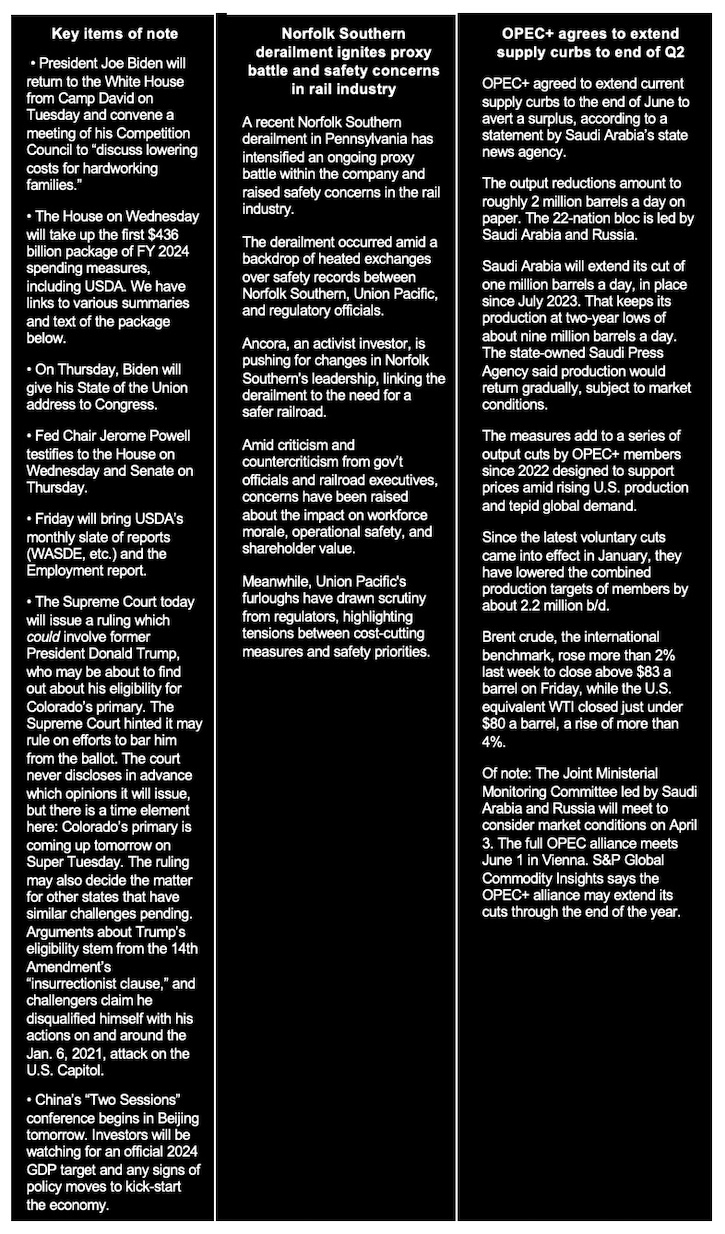

— NWS weather outlook: Increasing shower and thunderstorm chances ahead of a slow moving cold front through the Midwest, Mississippi Valley, and Southern Plains Monday, and the Ohio Valley and Southeast Tuesday... ...Another coastal storm is forecast to bring a new round of rain to the Mid-Atlantic Monday and New England Tuesday... ...Weather remains unsettled for northern portions of the West with additional very heavy snowfall expected for higher mountain elevations... ...Much above average, Spring-like temperatures for much of the central/eastern U.S.; wildfire threat remains elevated Monday for the southern High Plains.

Items in Pro Farmer's First Thing Today include:

• Corn and beans firmer, wheat mostly weaker overnight

• South American rains this week

• China holds annual parliamentary meeting this week

|

CONGRESS |

— This week a lot of important items are on tap in Washington this week. Link to our Sunday-released The Week Ahead.

— The $436 billion, six-bill spending package unveiled Sunday brings about various changes, including funding cuts for the FBI alongside boosts to nutrition programs, with notable provisions and adjustments:

- FBI funding cuts: The FBI would experience a reduction in its operating budget, with a 6% decrease amounting to $10.7 billion. Additionally, funding for FBI construction would see a significant decline, plummeting by 95% to $30 million from the current $652 million level. The Bureau of Alcohol, Tobacco, Firearms and Explosives would also face a 7% reduction.

- Justice Department cut: The Justice Department overall would undergo a $1 billion cut, resulting in $37.5 billion in appropriations.

- NASA funding decrease: NASA's budget would face a slight cut, receiving nearly $24.9 billion, down by $141.7 million compared to the current level.

- WIC program boost: The bill aims to enhance food aid under the WIC program, allocating $7.03 billion, an increase of $1.03 billion from the current level. With full funding, WIC recipients “will keep receiving the full fruit and vegetable benefit” created during the pandemic, said analyst Katie Bergh of the Center on Budget and Policy Priorities, a think tank, on social media. The SNAP pilot “would increase stigma and red tape,” she said. The funding bill had no reference to the SNAP pilot.

- New policy riders: A new policy rider would limit how the Veterans Affairs Department shares information with the federal gun registry, allowing sharing only in instances where a veteran poses a danger to themselves or others.

- Measures against adversarial governments: The package includes measures to prevent oil sales from the Strategic Petroleum Reserve to China and directs officials to monitor and flag foreign purchases of U.S. agricultural land, especially those by entities connected to China, North Korea, Russia, and Iran. The USDA secretary would be made a member of the Committee on Foreign Investment in the United States (CFIUS) when it comes to transactions on agricultural land, biotechnology, and industry. The USDA secretary would also be required to notify the CFIUS of any agricultural land transactions reported under the Agricultural Foreign Investment Disclosure Act (AFIDA) that may pose a risk to national security. The spending plan includes a $2.5-million boost for CFIUS reviews and a $1 million boost for the USDA Farm Production and Conservation Business Center to improve AFIDA reporting.

- Earmarks and Amtrak funding: Rep. Matt Gaetz's (R-Fla.) $50 million earmark for a helicopter hangar at Naval Air Station Whiting Field would remain intact. However, the bills entail a slight cut for Amtrak, receiving approximately $2.4 billion, including reduced funding for its northeast corridor grants.

The bills include the following base discretionary funding totals, according to summaries released by Senate Appropriations Committee Republicans.

- Agriculture-FDA: $26.228 billion

- Commerce-Justice-Science: $66.538 billion

- Energy and Water: $58.191 billion

- Interior-Environment: $38.55 billion

- Military Construction-VA: $153.92 billion

- Transportation-HUD: $89.484 billion

Of note: House Appropriations chairwoman Kay Granger (R-Texas) said the “minibus” funding bill would spend $100 billion less than President Biden requested. “The bills represent the first overall cut to non-defense, non-VA spending in almost a decade,” she said.

Timeline: The plan is for this bill to be voted on Wednesday in the House, with the Senate to follow. While this package is being taken up in the House under suspension, meaning it needs a two-thirds majority to pass, the votes are there as most Democrats will vote for the package. Unknown is how many Republicans will support it and if the majority of GOP House members do not vote for it, what that could mean for House Speaker Mike Johnson (R-La.)

Links: Bill text | Senate Appropriations summary and other links | House Approps GOP summary | House Approps Dem summary

|

ISRAEL/HAMAS CONFLICT |

— VP Kamala Harris angers Netanyahu. Benny Gantz, a minister in Israel’s war cabinet and leading political rival to Prime Minister Benjamin Netanyahu, plans to meet with Vice President Kamala Harris and national security adviser Jake Sullivan. Harris has called for an immediate, temporary cease-fire between Israel and Hamas to reunite hostages taken by Hamas with their families and provide more aid for Palestinians in Gaza. Harris called the situation in Gaza a "humanitarian catastrophe" while speaking at the annual commemoration of "Bloody Sunday" in Selma, Ala., a symbolic site in the U.S. fight for civil rights.

|

RUSSIA/UKRAINE |

— Poland wants EU sanctions on Russian, Belarussian ag products. Poland plans to ask the European Union to put sanctions on Russian and Belarusian agricultural products, Prime Minister Donald Tusk said. Poland has also demanded changes to regulations on Ukrainian grain moving across its borders amid farmer protests.

|

POLICY UPDATE |

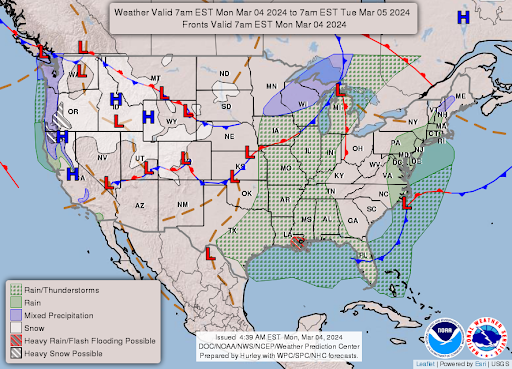

— Farmers mobilize worldwide against agricultural policies: exploring the root causes. In recent months, farmers across Europe and India have mobilized to protest agricultural policies, reflecting a growing trend of discontent among agricultural workers worldwide. The protests began in Europe, where farmers staged demonstrations including blockades, manure dumping, and egging of government buildings. These actions mirrored the mass protests witnessed in 2020-21. The discontent among farmers stems from various factors, differing from country to country. However, Christopher Barrett, an agricultural economist, suggests that farmers globally feel increasingly targeted by political measures. A recent edition of Flash Points (link) delves into the root causes of these protests, highlighting common grievances among farmers and exploring the influence of climate and trade policies on the transformation of global agriculture.

Comments: During last week’s Senate Ag Committee hearing, USDA Secretary Tom Vilsack was asked about farmer protests abroad. In essence, Vilsack said protests outside this country was a “completely different situation” than in the United States. But if the stick-and-then-carrot approach to force climate-smart practices continue, Vilsack and others may learn, again, that farmers are the same worldwide: they don’t like unfunded mandates and equity policy that redistributes the wealth. A growing number of farmers are beginning to question recent policy moves or proposed moves are “voluntary” because if they don’t oblige, carrots are pulled back.

|

CHINA UPDATE |

— Annual National People's Congress in Beijing, commencing on Tuesday, holds significant implications for asset trajectories in China not only for the current year but also for the foreseeable future. Premier Li Qiang is poised to unveil Beijing's yearly growth objectives, alongside other economic targets, and more importantly, the strategies to attain them. Anticipations suggest that Li will maintain a growth target of approximately 5% for 2024, mirroring last year's target, as part of efforts to align China with President Xi Jinping's ambition of nearly doubling the economy by 2035.

— China's premier breaks tradition, scraps annual press briefing at NPC. China's Premier Li Qiang has broken a long-standing convention by deciding not to hold a press briefing at the National People’s Congress, marking the first time in thirty years such an event won't take place. This move denies the second most powerful official in China an opportunity to establish a public profile, coming at a time of concerns regarding opaque policymaking and economic slowdown.

The decision was announced by official spokesperson Lou Qinjian, who stated that Li Qiang will not be taking questions at the conclusion of the National People’s Congress for the remainder of its five-year term, except under "special circumstances". This breaks tradition, as the annual press conference by the sitting premier has been a fixture since at least 1993. This decision is seen as another step towards increased opacity in the government, raising concerns both domestically and internationally.

The cancellation of the premier’s media briefing is viewed as a loss, as it removes a key platform for the government to communicate its plans informally and respond to criticisms. This move comes amid efforts by Beijing to boost confidence in an economy grappling with challenges such as a real estate crisis, geopolitical tensions with the US, and a significant decline in foreign direct investment.

The decision to scrap the briefing is likely to further diminish the influence of the premier, whose authority has already been overshadowed by President Xi Jinping's consolidation of power. Xi has been restructuring policymaking processes, reducing the premier's role, and blurring the lines between party and state.

Bottom line: While the cancellation of the briefing may limit opportunities for candid discussions and interpretations of internal dissent within the party, it also reflects a broader trend towards increased centralization of power under President Xi Jinping's leadership.

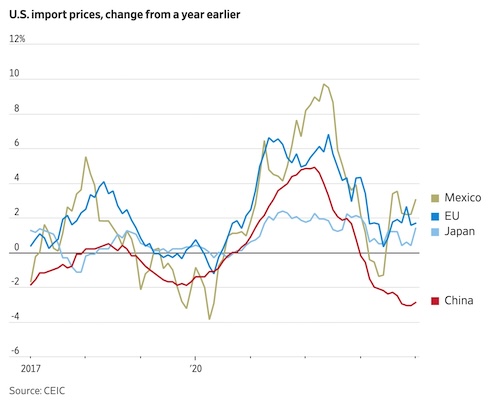

— The world is in for another China shock as the country floods foreign markets with cheap goods again, according to the Wall Street Journal (link).

— China barred from buying from SPR in U.S. funding bill. A provision in the must-pass government funding legislation unveiled Sunday would prohibit China from purchasing oil from the U.S. emergency stockpiles, known as the Strategic Petroleum Reserve (SPR). This move comes in response to criticism from Republican lawmakers following previous sales of reserve oil to Chinese-owned companies.

In 2022, nearly 1 million barrels of oil from the reserve were sold to Unipec America Inc., a subsidiary of China's Sinopec Corp. Despite objections, the White House has maintained that the Energy Department is legally obligated to sell reserve oil through competitive auctions, regardless of the buyer's nationality.

Background: The SPR, established in the 1970s after the Arab oil embargo, currently holds 360 million barrels, nearing a 40-year low. The Biden administration released 180 million barrels in 2022 to mitigate high oil prices after Russia's invasion of Ukraine and has since been working to replenish it, acquiring around 23 million barrels since last year.

The language in the government funding legislation mirrors a bill passed by the Republican-led House last year, which aimed to prevent the sale of reserve oil to China but was not taken up by the Senate.

Congress intends to approve the legislation before a partial shutdown deadline on midnight Friday.

— China issues new regulations to control hog numbers. China issued new regulations to control the nation’s hog production capacity after an aggressive expansion of farms over the past two years led to an oversupply, a move that could reduce the size of the world’s largest pig herd.

The retention of breeding sows will be dynamically adjusted according to changes in pork consumption and pig production efficiency, the ag ministry said. Regulatory measures will be triggered when the number of breeding sows rise or fall excessively to ensure a stable supply of pigs.

China last week lowered the national target for normal retention of breeding sows to 39 million from 41 million. Trivium China said, “If the number of breeding sows falls by two million in line with the lower national target, that would reduce China's pig herd size by at least 22 million, which will reshape the demand of feed grains like soybeans, corn and wheat.”

Background: China’s pig herds, which make up about half of the global total, were devastated by an outbreak of African swine fever from 2018 to 2021, leading to widespread culling, higher prices and a push for more production that in subsequent years resulted in volumes recovering to the point of overcapacity. China’s pig population was 434 million in 2023, up significantly from a low of 310 million in 2019.

Of note: Fitch, the rating agency, noted last week that “overcapacity in China’s hog breeding industry is likely to persist into the second quarter”, and that most breeders “are likely to continue facing losses.” It pointed to a “reluctance to downsize” across the market that “may partly stem from a desire to maintain their [breeders’] leading market positions and recoup previous investments.”

|

TRADE POLICY |

— 13th Ministerial Conference (MC13) for the WTO in Abu Dhabi concluded without major agreements on key global trade issues. Despite overtime sessions, no meaningful resolutions were reached on agricultural matters, fisheries, and other critical areas. The only significant accomplishment was the extension of a moratorium on tariffs for e-commerce data transmissions by two years. Challenges persisted, including unresolved issues such as agricultural subsidies and public stockholding, with India holding firm on its stance. Additionally, efforts to revise the dispute settlement process were unsuccessful, rendering the system essentially inoperable beyond initial dispute settlement. The Ministerial Declaration emphasized the need to strengthen the multilateral trade system and promote reforms at the WTO. While countries pledged to restore the dispute settlement mechanism to full operational status by 2024, doubts remain regarding actual resolution of disagreements.

Bottom line: While the MC13 conclusion ensures the WTO's continuity, it raises significant concerns about countries' ability to reach agreements on crucial issues in agriculture and other sectors.

|

ENERGY & CLIMATE CHANGE |

— Ethanol producer Valero Energy Corp. joined an $8 billion carbon-capture and storage project in the U.S. corn belt, supporting a proposed pipeline despite significant challenges ahead, Bloomberg reports (link). Valero, the second-largest corn ethanol maker by market share, agreed to transport greenhouse-gas pollution from eight of its facilities on Summit Carbon Solutions LLC's pipeline. With this addition, more than half of the U.S. corn ethanol industry, totaling 57 plants across the upper Midwest, will be part of the project.

Summit Agricultural Group's founder, Bruce Rastetter, highlighted the significance of Valero's involvement in tapping into new markets for renewable liquid fuels, including sustainable aviation fuel (SAF). This move is seen as crucial for the agriculture industry to reduce its carbon footprint amid the rise of electric cars threatening corn ethanol's future.

The project faces hurdles similar to those of its predecessor, including regulatory challenges and opposition from farmers. However, Summit aims to address these issues by improving communication with affected landowners along the proposed route spanning five states.

The pipeline is proposed to carry 18.5 million metric tons of carbon dioxide annually through Iowa, Minnesota, Nebraska, South Dakota, and North Dakota.

— Challenges faced by European companies in reporting carbon-intensive imports. A significant proportion of European companies have struggled to meet the early reporting deadline for their carbon-intensive imports, highlighting the hurdles faced by the EU's carbon border adjustment mechanism (CBAM), the Financial Times reports (link).

This mechanism aims to impose a tax on such imports to prevent them from undercutting the bloc's heavily regulated industries. However, fewer than 10% of the expected reports were submitted by German companies, with similar figures reported in other European countries.

The complex administrative process and lack of awareness among importers have contributed to this low compliance rate. Concerns have been raised about the potential impact on the competitiveness of EU industries, with fears of rising input costs particularly affecting sectors reliant on imports from countries like Russia, Turkey, India, and China.

Despite technical glitches and the novelty of the measure, the European Commission has received a substantial number of reports, mainly from imports originating in China. EU officials acknowledge the challenges and plan to simplify the reporting system based on early feedback from companies.

|

HEALTH UPDATE |

— FDA approves "yogurt may lower diabetes risk" claim. FDA said it would not object to a "qualified health claim" on packages of yogurt that say, “Eating yogurt regularly, at least 2 cups (3 servings) per week, may reduce the risk of type 2 diabetes according to limited scientific evidence.”

|

POLITICS & ELECTIONS |

— Nikki Haley wins D.C.'s Republican primary, marking first victory of her 2024 campaign. She trails far behind former President Donald Trump, who has won all other nominating contests so far by double digits. Her deficit could balloon if she can't win a majority of the 15 states tomorrow on Super Tuesday. More than a third of delegates are up for grabs on the largest primary day of the election season.

|

OTHER ITEMS OF NOTE |

— U.S. migrant population to reach 8 million, 167% surge since 2019. According to government data, the population of migrants living in the U.S. is set to surge to 8 million by the end of September, marking a significant 167% increase over the past five years. This surge is attributed to President Biden's border crisis. At the close of fiscal year 2023, over 6 million asylum seekers and other migrants were listed on the "non-detained docket," which includes cases involving noncitizens temporarily released from ICE custody. The Biden administration expects this number to reach 8 million by Oct. 1, as per Department of Homeland Security documents obtained by Axios. This increase contrasts sharply with the situation in 2019, during Donald Trump's presidency, when the number of migrants in the immigrant court backlog stood at 3 million.

|

KEY LINKS |

WASDE | Crop Production | USDA weekly reports | Crop Progress | Food prices | Farm income | Export Sales weekly | ERP dashboard | California phase-out of gas-powered vehicles | RFS | IRA: Biofuels | IRA: Ag | | Russia/Ukraine war, lessons learned | | SCOTUS on WOTUS | SCOTUS on Prop 12 pork | New farm bill primer | | Gov’t payments to farmers by program | Farmer working capital | USDA Ag Outlook Forum |