Consensus Builder, Farmer, Former USDA Official Bill Northey Dies at 64

Odds sink for Senate border/Ukraine bill | China key for U.S. solar units | Fedspeak | ADM

|

Today’s Digital Newspaper |

MARKET FOCUS

- SEC to implement rule addressing structural issues within $26 trillion Treasury market

- BP reports the second-best annual results since 2012

- 30-year fixed mortgage rates surge to 7.04% amid positive economic reports

- German factory orders unexpectedly surge

- Natural gas futures experienced sharp 40% decline past three months

- AAR defends U.S. railroad safety amid disagreements

- Ag markets today

- Ag trade update

- NWS weather outlook

- Pro Farmer First Thing Today items

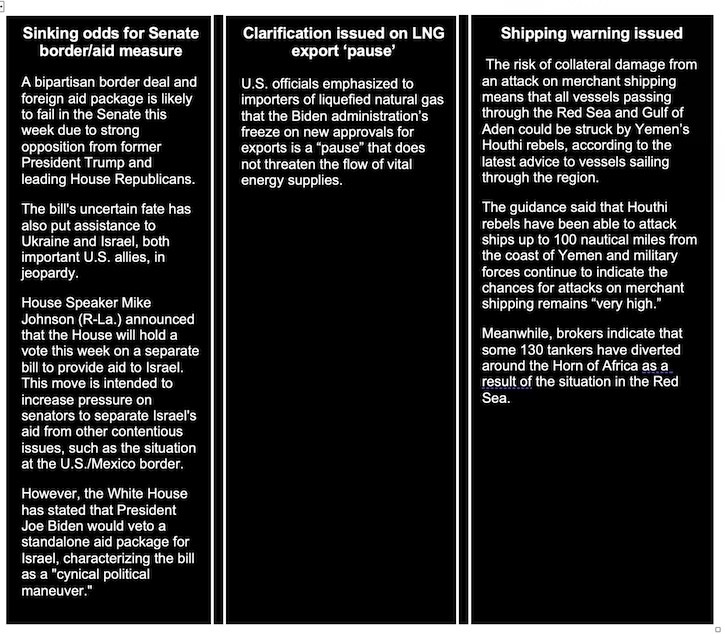

CONGRESS

- GOP House leaders face revolt re: rule suspension

- Funding bills may need supermajority to pass

- No chance for Senate border/Ukraine measure to clear Congress

ISRAEL/HAMAS CONFLICT

- Blinken met Muhammad Bin Salman, Saudi Arabia’s crown prince, in Riyadh

POLICY

- Dems object to IRA funding for 'industrial' agriculture practices

- European Commission withdraws plan to reduce pesticide use in EU by half

PERSONNEL - Bill Northey has died at the age of 64

CHINA

- China's 2024 rural policy: development for economic growth and rural job creation

- McDonald’s to open 1,000 burger joints in China this year, mostly in smaller cities

- U.S. Treasury team heads to China to talk subsidies, economic policies

TRADE POLICY

- Rep. Jason Smith seeks USITC global rice market review

ENERGY & CLIMATE CHANGE

- America wanted a homegrown solar industry. China is building a lot of It

LIVESTOCK, NUTRITION & FOOD INDUSTRY

- DOJ investigating accounting practices at Archer Daniels Midland's nutrition unit

POLITICS & ELECTIONS

- Rep. Victoria Spartz (R-Ind.) announces she will seek another term in Congress

- Nikki Haley requests Secret Service protection, citing threats

- Amid concerns a week out, Dems launch last-minute blitz in NY3 special election

|

MARKET FOCUS |

— Equities today: Asian and European stock markets were mixed to firmer in overnight trading. U.S. Dow opened slightly lower but then turned around 125 points higher. In Asia, Japan -0.5%. Hong Kong +4%. China +3.2%. India +0.6%. In Europe, at midday, London +0.5%. Paris +0.3%. Frankfurt -0.1%. Chinese shares rebounded after the country’s authorities intensified efforts to support ailing markets. The surge began after Central Huijin Investment, a state investment vehicle, said it would increase its holdings of exchange-traded funds. The CSI 300 index of Chinese shares — which fell to a five-year low on Feb. 2 — rose by 3.5% on Tuesday, its biggest one-day gain since November 2022.

U.S. equities yesterday: All three major indices ended in the red Monday with the Dow recovering from initial losses but still suffering a significant decline. The Dow was down 274.30 points, 0.71%, at 38,380.12. The Nasdaq fell 31.28 points, 0.20%, at 15,597.68. The S&P 500 ended down 15.80 points, 0.32%, at 4,942.81.

— BP (British Petroleum), a major energy company headquartered in the United Kingdom, reported the second-best annual results since 2012. Profits fell from record highs last year. Despite the strong results, the company's profits decreased compared to the previous year, which had seen record-high profits. After the CEO, Murray Auchincloss, announced plans to accelerate share buybacks, the company's stock prices increased. Share buybacks involve a company repurchasing its own shares, often viewed positively by investors. BP has been expanding its operations into the renewable energy sector, which has raised concerns among some investors. The strong financial results may alleviate these concerns. There were rumors circulating that BP might be a target for a takeover, which CEO Auchincloss had to address and rebuff.

— The SEC is set to implement a new rule aimed at addressing structural issues within the $26 trillion Treasury market. This rule will require proprietary traders and companies frequently involved in U.S. Treasuries trading to register as broker-dealers. This move is part of a broader effort to enhance regulatory oversight and represents the most significant overhaul of the Treasury market in decades. While the rule intends to improve market transparency and accountability, some concerns have been raised. These concerns include:

- Increasing Costs: Participants in the Treasury market may face rising costs as a result of the new registration requirement, potentially impacting their ability to engage in trading activities.

- Regulatory Burdens: Critics argue that the rule may impose unnecessary regulatory burdens, particularly on pensions and other market participants, which could affect their operations and competitiveness.

- Liquidity Risks: There are concerns about the possibility of a major liquidity drain in the market due to the regulatory changes, which could have consequences for market stability.

— Ag markets today: Corn, soybeans and wheat traded in narrow ranges in two-sided price action overnight but have adopted a mostly firmer tone this morning. As of 7:30 a.m. ET, corn futures were trading around a penny higher, soybeans were mostly 2 to 4 cents higher, SRW and HRS wheat futures were fractionally to a penny higher while HRW wheat was fractionally lower. Front-month crude oil futures were modestly firmer, and the U.S. dollar index was around 100 points higher.

Beef packer margins sharply negative. Cash cattle prices rose for a third straight week and have gained $4.33 during the span. Wholesale beef prices firmed 40 cents for Choice and 30 cents for Select on Monday. But over the past two weeks, wholesale beef prices have weakened, with Choice down $8.18. That has dropped packer cutting margins deep into the red, which may limit their pursuit of cash cattle as they try to manage supplies after a couple weeks of strong purchases.

Traders narrow hog premiums. The CME lean hog index is up another 44 cents to $73.56 as of Feb. 2. Since the beginning of the year, the cash index has risen $8.51. After Monday’s sharp losses, the premium in February hogs dropped to 84 cents, while it was down to $8.64 for April hogs.

— Agriculture markets yesterday:

- Corn: March corn was unchanged at $4.42 3/4, a near mid-range close.

- Soy complex: March soybean futures rallied 7 3/4 cents to $11.96 1/4 and settled nearer session highs. March soymeal rose $4.30 to $361.10, closing on session highs. March soyoil surged 60 points to 45.33 cents.

- Wheat: March SRW wheat closed down 9 1/2 cents at $5.90 1/4. March HRW wheat fell 11 cents at $6.14. Both markets closed nearer their session lows. March spring wheat futures dropped 8 3/4 cents to $6.91.

- Cotton: March cotton fell 7 cents to 87.04 cents, a near mid-range close.

- Cattle: April live cattle fell $1.40 to $182.35 and near the session low. Prices hit a three-month high early on but then reversed course to score a mildly bearish “outside day” down. March feeder cattle closed down $2.05 at $242.75 and nearer the session low.

- Hogs: April lean hog futures dropped $1.625 to $82.20, settling nearer session lows.

— Quotes of note:

- Fedspeak. Fed speakers are emphasizing the need for further data to confirm the trajectory of inflation before deciding on interest rate cuts. They are concerned about potential inflation risks and are closely monitoring economic trends. Additionally, Janet Yellen's testimony to Congress is an important event on the horizon. Details:

— Fed Gov. Michelle Bowman's perspective: Bowman believes that inflation will continue to decrease as long as interest rates remain at their current level. If data suggests inflation is approaching the 2% target, gradually reducing rates would be appropriate. However, she notes that the necessary conditions for rate cuts aren't in place yet, and inflation risks persist. These risks include potential shocks in food and energy markets due to geopolitical conflicts or a sudden surge in demand-driven inflation. High core services inflation and wage inflation are also concerns for her.

— Chicago Fed President Austan Goolsbee's view: Goolsbee would like to see more positive inflation data, but he doesn't rule out the possibility of a rate cut in March. He believes that additional data supporting the current trend would indicate a move towards normalization in the U.S. economy.

— Upcoming Fed speeches: Several Fed officials, including Bowman, Cleveland Fed President Loretta Mester, and Richmond Fed President Thomas Barkin, are scheduled to deliver speeches in the coming days.

— Janet Yellen's testimony: Treasury Secretary Janet Yellen is set to testify in the House and the Senate regarding the Financial Stability Oversight Council's annual report to Congress.

- “If barriers continue to prevent whistleblowers from reporting sanctions and anti-money-laundering violations, it will significantly hamper our nation’s ability to bring enforcement actions and strengthen our national security interests.” — From a letter sent Friday by Sens. Chuck Grassley (R-Iowa), Elizabeth Warren (D-Mass.) and Raphael Warnock (D-Ga.) to FinCEN director Andrea Gacki, asking about delays in the full implementation of a whistleblower award program at the agency.

— 30-year fixed mortgage rates surge to 7.04% amid positive economic reports and volatility. On Monday, the 30-year fixed mortgage rate reached 7.04%, surpassing 7% for the first time since December. This increase follows robust January job and manufacturing reports. Mortgage rates have exhibited volatility, briefly peaking at 8% in October, a 20-year high, before declining. Mortgage rates are not directly tied to the Federal Reserve but have a loose correlation with the 10-year Treasury yield, which can be impacted by Fed announcements. With spring being a pivotal period for the housing market, these rates are of significance, particularly in the face of elevated and continuously rising home prices.

— German factory orders unexpectedly surge. Factory orders in Germany unexpectedly soared 8.9% mom in December 2023, compared with market forecasts of a flat reading and after showing no growth in November. It was the strongest increase since June 2020, boosted by large orders in several industries, namely aircraft, metal products and electrical equipment.

Market perspectives:

— Outside markets: The U.S. dollar index was slightly higher, with the euro weaker against the greenback. The yield on the 10-year U.S. Treasury note was weaker, trading around 4.14%, with a mostly higher tone in global government bond yields. Crude oil futures were moving higher, with U.S. crude around $73.45 per barrel and Brent around $78.65 per barrel. Gold and silver futures were firmer, with gold around $2,045 per troy ounce and silver around $22.43 per troy ounce. ·

— Natural gas futures have experienced a sharp 40% decline in the past three months. This drop is attributed to several factors, not just weather-related ones.

- Unseasonably Warm Temperatures: Unusually warm weather across most of the U.S., with the exception of a brief cold snap in January, has contributed to the decline in natural gas prices. Warm weather reduces heating demand for natural gas.

- Oil Production Boosting Supply: The increase in oil production has led to a surplus of natural gas supply. Despite some natural gas producers scaling back their output, the overall supply remains high.

- Continued Warm Weather Forecast: Weather forecasters predict a warmer-than-usual February due to the El Niño weather pattern, which typically brings warmer temperatures inland. February is a significant month for natural gas demand.

- Growing Natural Gas Production: Natural gas production in the U.S. continues to grow, outpacing demand. This has resulted in natural gas storage levels being 5% above normal, putting downward pressure on prices.

- "Associated Gas" from Oil Wells: The production of "associated gas" from oil wells has increased alongside rising oil production. This is a significant reason why natural gas production continues to rise, despite a reduction in the number of production rigs. It is estimated that associated gas could make up around 20% of production through 2050.

- California Power Outages: Severe storms in California led to power outages affecting nearly 400,000 customers. The storms brought hurricane-force winds, heavy rain, and the risk of flooding, mudslides, and snowfall in higher elevations.

- LNG Export Capacity Growth: There is an expectation that liquefied natural gas (LNG) export capacity will increase by 85% over the next four years. This potential growth in LNG demand could benefit U.S. natural gas producers like EQT and Chesapeake Energy.

— AAR defends U.S. railroad safety amid disagreements. In response to recent comments made by Transportation Secretary Pete Buttigieg regarding rail safety, the Association of American Railroads (AAR) issued a strong letter defending the safety record of the U.S. railroad industry. The AAR asserts that rail transportation is the safest mode for cargo in the country, citing statistics that demonstrate improvements in employee casualty rates and a decrease in train accidents over the years.

The AAR expresses disappointment in what it sees as a misrepresentation of the industry's safety record and efforts to enhance safety, suggesting that such misunderstandings undermine public confidence in both rail safety and the Transportation Department.

The letter references the East Palestine, Ohio derailment from a year ago, where a Norfolk Southern Corp. freight train derailed, leading to significant costs and environmental concerns. President Biden plans to visit the town to address the aftermath of the incident.

The AAR also challenges the widely cited statistic of over 1,000 train derailments annually, arguing that the majority of these occur in rail yards or low-speed tracks, which are less severe and comparable to fender benders. However, the union representing rail workers disagrees with the AAR's claims. They argue that railroads have opposed new safety proposals, lobbied against rail-safety legislation in the Senate, and continue to operate longer trains, which they contend pose safety risks. Additionally, the union criticizes Norfolk Southern's limited participation in a Confidential Close Call Reporting System, which allows workers to report unsafe practices without fear of reprisals.

The AAR defends the industry's efforts to enhance safety, highlighting the voluntary placement of hot-bearing detectors and the lowering of temperature thresholds to identify anomalies along rail tracks. The AAR maintains that railroads are committed to advancing safety through their initiatives and collaborations with the Department of Transportation (DOT).

— Ag trade update: Japan is seeking 136,321 MT of milling wheat in its weekly tender. Tunisia tendered to buy 100,000 MT of durum wheat.

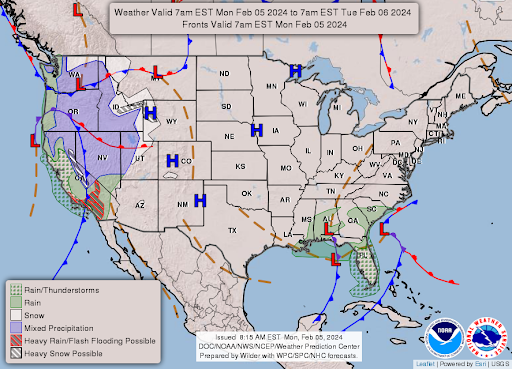

— NWS weather outlook: Heavy rain and flash flooding threat expands from Southern California into the Desert Southwest Tuesday... ...Heavy Snow for the Intermountain West mountains through mid-week... ...Temperatures will continue to run above average from the Plains to the Northeast with record breaking warmth for parts of the Upper Midwest.

Items in Pro Farmer's First Thing Today include:

• Grains mostly firmer this morning

• Cordonnier leaves Brazil, Argentina crop estimates unchanged

|

CONGRESS |

— Republican House leaders face revolt around rule suspension; funding bills may need supermajority to pass. Roll Call reports (link) Republican leaders in the House may be facing an “unprecedented” crisis in “modern congressional history: the need for a two-thirds supermajority to pass final spending bills for the current fiscal year.” Currently, far-right members of the House are “already outraged” that Speaker Mike Johnson (R-La.) has signed off on spending targets that are “roughly the same as the previous year’s,” leading some to argue that they will not allow a suspension of the technical requirement in House procedural rules that requires a two-thirds majority to pass funding bills for the current fiscal year. Experts discussed the complexity of House rules and how a small set of Republican members could prevent the House from suspending the rule.

|

ISRAEL/HAMAS CONFLICT |

— Secretary of State Antony Blinken met Muhammad Bin Salman, Saudi Arabia’s crown prince, in Riyadh. The pair discussed efforts to end the war in Gaza and provide lasting peace. U.S. officials are hoping that Saudi Arabia and Israel can agree to normalize diplomatic ties. Blinken will also visit Egypt, Israel, Qatar and the West Bank this week. He is expected to push for a ceasefire and the release of Israeli hostages.

|

POLICY UPDATE |

— Democrats object to IRA funding for 'industrial' agriculture practices. A group of Democratic members from both the House and Senate has expressed criticism regarding the inclusion of certain practices eligible for funding under the Inflation Reduction Act (IRA/Climate Bill) within the Environmental Quality Incentives Program (EQIP). They argue that these practices support what they refer to as "industrial animal agriculture practices."

Specifically, the lawmakers are concerned about practices such as funding for waste storage facilities, roofs and covers for biogas capture facilities, feed management for livestock, and waste separation facilities. They believe that these practices will primarily benefit large, industrial concentrated animal feeding operations (CAFOs) and do not effectively address the environmental impacts associated with such facilities.

In response to their concerns, the lawmakers, led by Sen. Cory Booker (D-N.J.) and Rep. Alma Adams (D-N.C.), have requested a briefing from the USDA's Natural Resources Conservation Service (NRCS) to discuss this issue further.

— The European Commission withdrew a proposed plan that aimed to reduce pesticide use in the European Union (EU) by half. This decision comes in response to protests by farmers within the EU. Commission President Ursula von der Leyen acknowledged the concerns of farmers about the future of agriculture and their livelihoods. However, she emphasized the need for agriculture to transition to a more sustainable production model to ensure long-term profitability.

Simultaneously, reports suggest that the European Commission is planning to proceed with a separate initiative aimed at reducing net greenhouse gas (GHG) emissions by 90% by the year 2040. This ambitious target would align the EU with its climate goals. However, these new environmental regulations have also contributed to farmer protests across Europe.

The initial proposal for agriculture called for a 30% reduction in non-carbon dioxide emissions by 2040 compared to 2015 levels. Still, officials have indicated that this target might be removed from the final document.

|

PERSONNEL |

— Bill Northey has died at the age of 64. Northey served as Iowa’s Secretary of Agriculture for eleven years before joining the Trump administration as Undersecretary for Farm Production and Conservation. The news of Northey’s passing was confirmed by his colleagues of the Agribusiness Association of Iowa. Northey was first elected Iowa Secretary of Agriculture in 2006. He won re-election in 2010 and 2014 but left office in 2017 to join USDA in Washington, DC.

Northey farmed with his family near Spirit Lake in northwest Iowa. Northey’s father, Wayne Northey, 90, died in December.

The Agribusiness Association of Iowa released the following statement on Monday: The state of Iowa, and all of agriculture, has lost a great leader who has left his mark on future generations and will be greatly missed. Bill was a tireless advocate for agriculture and a beloved leader for the entire AAI staff and organization. As we mourn the loss of our close colleague, we also extend our prayers for his family in this difficult time.”

Iowa Gov. Kim Reynolds ordered all flags to be at half-staff until Northey is buried. Funeral arrangements are pending. "Bill was a great leader whose work ethic and passion for Iowa agriculture was unmatched. Iowans and farmers around the country were fortunate to have such a rock-solid advocate and friend,” Reynolds said in a statement.

USDA Secretary Tom Vilsack said he knew Northey for decades. “I am extremely saddened to learn of the unexpected passing of Bill Northey,” Vilsack said, calling him “a lifelong champion, personally and professionally, for Iowa’s and all of America’s farmers.”

From ag consultant Randy Russell: "This is just a very sad day. Bill was one of the most thoughtful, kind and passionate advocates for production agriculture I have ever worked with. During the Trump administration his car was always one of the first parked at the Whitten Building and nearly always the last to leave. He was the ultimate public servant. Bill was a tremendous listener who approached his work at the Iowa Department of Agriculture and USDA with one goal in mind: how can each better serve farmers and ranchers across Iowa and the country."

From Jeff Harrison of Combest-Sell: “He was always empathetic to a producer cause, but you had to make a cogent argument. He understood things not only as a policymaker but as an on the ground producer, so it needed to make practical sense to him. You could see him processing. Yet, he was always charitable and kind. In a professional atmosphere where things can be unnecessarily divisive, Mr. Northey never operated that way. He had good will toward everyone. Above all, though we never talked about it, I know he was a devout man. In this way I suppose he led a life that Saint Francis of Assisi talked of: Preach the Gospel at all times. If necessary, use words. Requiem aeternam dona eis Domine: et lux perpetua luceat eis.”

The Iowa Farm Bureau said Northey was “a tireless champion, defender and promoter of farmers and agriculture at both the state and federal levels. His steadfast dedication and life’s work to ensuring agriculture thrives will continue to impact farm families here in Iowa and across the nation for years to come.”

Personal comments: I first gained a reporter’s experience with Northey while he was Iowa’s Secretary of Agriculture, but primarily when he became a disaster expert dealing with the state’s outbreak of bird flu. When he garnered a key USDA position in the Trump administration, Bill was always willing to talk to Pro Farmer about a farm policy issue, and talk to AgriTalk on complex issues. If Trump were to win the White House again, Bill would have been on the top tier list as potential candidates to head USDA.

|

CHINA UPDATE |

— China's 2024 rural policy prioritizes development for economic growth and rural job creation. The 2024 No. 1 Document, which outlines the annual rural policy guidance in China, has placed a strong emphasis on rural development to drive economic growth. Trivium China says this marks a shift from previous years, which primarily focused on food security. The document calls for implementing lessons from a village renovation effort launched by current Chinese leader Xi Jinping 20 years ago and dedicates three-quarters of its tasks to rural job creation, industrial development, infrastructure construction, and governance. It also specifies funding sources for rural development, including protecting rural-related fiscal funds in government budgets, supporting local government special-purpose bonds for rural projects, and providing support for banks and insurers involved in rural initiatives.

Bottom line: Beijing sees rural development as crucial for growing rural industry and improving the livelihoods of the nearly 480 million people still living in rural areas in China, and Trivium China says this will likely lead to increased investment in such initiatives throughout the year.

— McDonald’s plans to open 1,000 burger joints in China this year, mostly in smaller cities outside of Beijing or Shanghai. The firm is doubling down on its second-biggest market, even as many Western companies aim to “de-risk” from China. McDonald’s wants to have 10,000 outlets in the country by the end of 2028, up from around 5,500 now.

— U.S. Treasury team heads to China to talk subsidies, economic policies. The Biden administration has sent five senior U.S. Treasury officials to Beijing this week for economic talks that will include China’s “non-market” policies that are adding excess industrial capacity, a Treasury official said. The delegation, led by Treasury Undersecretary for International Affairs Jay Shambaugh, planned to hold frank conversations as part of the U.S/China Economic Working Group about Beijing subsidies the U.S. says encourage overproduction of goods, potentially flooding global markets. Affected industries include electric vehicles. The group will discuss the U.S. and Chinese economic outlooks, investment screening regimes for national security in both countries, and opportunities to cooperate on climate change and debt relief to poor countries, the official said.

Last week, the International Monetary Fund, in its latest economic outlook, projected that China’s economy would grow at a rate of 4.6% in 2024, a faster pace than previous projections. But it also urged China to make longer-term structural changes to its economy, such as overhauling its pension program and reforming its state-owned enterprises, to prevent its output from slowing more dramatically. “Without those reforms, there is risk that Chinese growth would fall below 4%,” Kristalina Georgieva, the IMF’s managing director, told reporters.

|

TRADE POLICY |

— Rep. Jason Smith seeks USITC global rice market review. Lawmakers need updated review and analysis of the global rice market so they can implement policies to best ensure U.S. producers can compete, House Ways and Means Committee Chairman Jason Smith (R-Mo.) says in a letter (link) to the U.S. International Trade Commission (USITC) Chairman David Johnson. The letter comes in advance of a Ways and Means Trade Subcommittee hearing to be held on Wednesday, Feb. 7, focused on “Advancing America’s Interests at the World Trade Organization’s 13th Ministerial Meeting.”

Smith’s letter details several areas the USITC should focus on in its analysis, including:

- Recent developments in the U.S. rice industry as well as those of other major global rice producers and exporters like Bangladesh, Brazil, China, India, Indonesia, Pakistan, Paraguay, Thailand, Uruguay, and Vietnam.

- Trade trends and developments in the global rice market that impact both U.S. and foreign imports and exports.

- Competitive strengths and weaknesses of U.S. and foreign rice producers, with a focus on how those factors affect costs, product differentiation, and supply chain reliability.

- A qualitative and quantitative assessment of what existing policies and programs are directly or indirectly affecting rice production and exports – including how such policies like export restrictions affect U.S rice production and prices as well as food security in developing countries.

- The impact on America’s rice industry from exports by other major rice producing countries to both the U.S. as well as traditional U.S. export markets.

|

ENERGY & CLIMATE CHANGE |

— America wanted a homegrown solar industry. China is building a lot of It. China’s biggest solar companies are expanding in the U.S., where they will reap generous government subsidies, the Wall Street Journal reports (link). This surge in activity is a response to the introduction of substantial production subsidies through the Inflation Reduction Act (Climate Bill) in 2022.

Analysis by the Wall Street Journal reveals that China-based companies are behind nearly a quarter of the approximately 80 gigawatts in new solar panel capacity announced since the legislation was passed. This positions them to benefit significantly from government subsidies, potentially collectively receiving up to $1.4 billion annually if the announced panel factories are constructed.

Several of these new facilities are substantial and expected to become operational this year, with the capacity to supply over half of the estimated 33 gigawatts of panels installed in the U.S. in the previous year.

Perspective: While this influx of Chinese interest benefits the U.S. economy and aligns with clean energy objectives, it also underscores the nation's reliance on China for solar production, with over 80% of global production taking place there. Critics argue that allowing Chinese manufacturers to benefit from U.S. subsidies could hinder efforts to develop a domestic supply chain and compromise energy security.

There are conflicting views within the U.S. government, with some lawmakers advocating for tougher tariffs on Chinese solar components, while others highlight the need for collaboration with Chinese manufacturers to harness their expertise, capital, and investment appetite.

In response, Chinese solar giants operating in the U.S. are working to demonstrate their commitment to the local market, emphasizing U.S. employment and plans to reinvest profits within the country. They also aim to bring suppliers to the U.S. and potentially build manufacturing facilities for solar cells, essential components of panels, within the country.

|

LIVESTOCK, NUTRITION & FOOD INDUSTRY |

— Department of Justice (DOJ) is currently investigating the accounting practices at Archer Daniels Midland's (ADM) nutrition unit. This development, initially reported by Reuters and based on information from two sources familiar with the matter, reveals that the U.S. Attorney's Office for the Southern District of New York has conducted interviews with former ADM employees regarding the nutrition unit's accounting practices. Specifically, the focus of the investigation is on pricing practices related to the sale of goods from ADM's commodities divisions to the nutrition division.

In January, the Securities and Exchange Commission (SEC) initiated its own inquiry, leading ADM to disclose the suspension of its Chief Financial Officer (CFO) as part of an internal investigation into the nutrition unit's accounting practices. Consequently, ADM has postponed the release of its 2023 financial results, and the company's shares have significantly declined, causing a nearly $8 billion reduction in its market value since the accounting issues were brought to light.

|

POLITICS & ELECTIONS |

— Rep. Victoria Spartz (R-Ind.), who tried to take an axe to checkoff programs, announces she will seek another term in Congress after all. “Deciding where your duty lies — family, work, or country, is never an easy task. Earlier last year, I decided to take some time off from running for public office to recharge and spend more time in Indiana with my family,” Spartz said in a statement. “However, looking where we are today, and urged by many of my constituents, I do not believe I would be able to deliver this Congress, with the current failed leadership in Washington, D.C., on the important issues for our nation that I have worked very hard on,” she continued. Spartz seemed to signal she would reconsider her decision in recent months, saying on NewsNation's The Hill in September, “I do need to regroup because I think my party is failing the people.” The solidly red district in Indiana's Fifth Congressional District went for former President Trump in 2020 by 16 points.

— Nikki Haley has requested Secret Service protection, citing threats she has received as the last major Republican challenger to Trump for the party’s presidential nomination, according to her campaign.

— Amid rising concerns a week out, Democrats launch last-minute blitz in NY3 special election. CNN reports (link) in the Feb. 13 special election to replace expelled NY3 Rep. George Santos (R), Democrats “made a safe choice” by selecting former Rep. Tom Suozzi (D) “to take on a little-known Republican, Mazi Melesa Pilip, who is new to the national scene. And, leaving little to chance, Democrats are pummeling the airwaves, outspending Republicans by nearly $4 million in the two-month race to fill Santos’ seat.” However, as the election approaches, “it’s Democrats who are sounding the alarm.” Politico reports (link) Democrats “are finally invoking George Santos as a bogeyman in the race to replace him — as part of a last-minute $1.25 million ad buy before next week’s bellwether special election. The late TV ad blitz in the final days suggests some concern from Democrats about next Tuesday’s election.”

Roll Call says (link) it is a “race that both sides are expecting to be close,” and if Republicans win, “it will give them momentum heading into a competitive election cycle in which they hope to grow their ranks. It will also underscore that messaging on immigration and the border, which has been a focal point in the campaign, is resonating with voters in the Long Island suburbs, where there are three districts, including this one that Republicans won in 2022 after voters backed Joe Biden over Donald Trump in 2020.” The Washington Post (link) runs a profile of the race.

|

KEY LINKS |

WASDE | Crop Production | USDA weekly reports | Crop Progress | Food prices | Farm income | Export Sales weekly | ERP dashboard | California phase-out of gas-powered vehicles | RFS | IRA: Biofuels | IRA: Ag | Student loan forgiveness | Russia/Ukraine war, lessons learned | Russia/Ukraine war timeline | Election predictions: Split-ticket | Congress to-do list | SCOTUS on WOTUS | SCOTUS on Prop 12 pork | New farm bill primer | China outlook | Omnibus spending package | Gov’t payments to farmers by program | Farmer working capital | USDA ag outlook forum | Debt-limit/budget package |