Tentative West Coast Port Labor Deal Reached; Peak Season Chaos Averted

Walmart to construct $257 million beef packaging and distribution facility in Olathe, Kansas

|

In Today’s Digital Newspaper |

Sorghum, upland cotton sales to China mark latest weekly update. USDA’s weekly Export Sales report for the week ended June 8 showed activity for 2022-23 including net reductions of 617 metric tons of corn, net sales of 100,150 metric tons of sorghum, 19,607 metric tons of soybeans, and 70,542 running bales of upland cotton. For 2023-24, the only activity reported was 63,800 running bales of upland cotton. Net sales for 2023 of 4,722 metric tons of beef and 1,927 metric tons of pork were also reported.

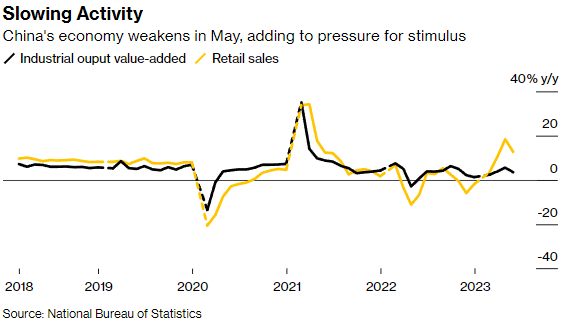

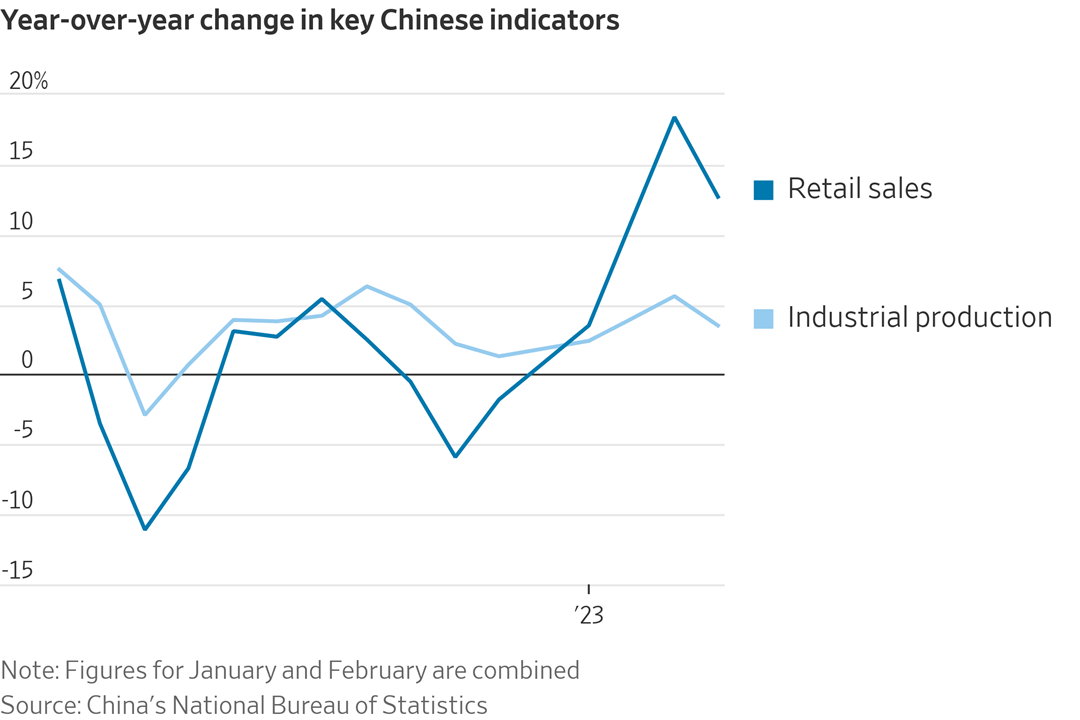

A weakening Chinese economy has prompted the central bank to cut rates. China’s youth jobless rate edged up to a fresh record in May to nearly 21%. Meanwhile, torrential rains have impacted China's wheat harvest, which is nearing completion at the end of June. More in China section.

The Fed provided a hawkish surprise in the FOMC statement, and it caused some temporary declines in stocks, but the declines didn’t hold and the reason why is clear: The market doesn’t believe the “dots” indicating at least two more rate hikes this year. More in Markets.

The European Central Bank raised interest rates to their highest level in 22 years, warning that inflation is far from vanquished. The ECB’s decision to raise its benchmark deposit rate by a quarter-point to 3.5% comes as it grapples with both an apparent wage-price spiral and a stagnant economy.

Gold experienced its fifth consecutive day of decline, which is its longest losing streak since February. More in Markets section.

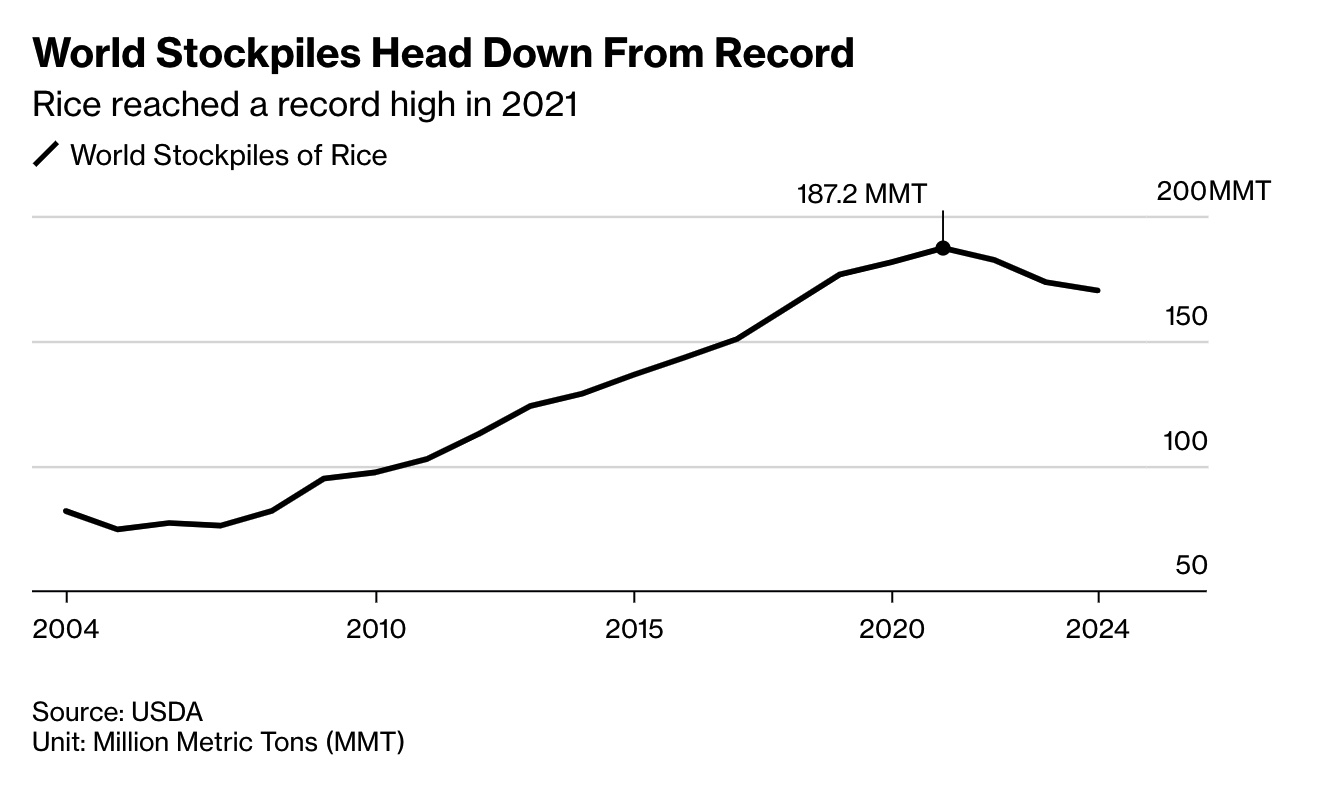

Global rice stockpiles are currently near record levels, but the arrival of El Niño could put those reserves to the test.

Russian President Vladimir Putin has acknowledged that his military is facing a shortage of high-precision ammunition and attack drones amidst the ongoing conflict with Ukraine. This unusual admission from Putin has led some analysts to believe that he might be seeking a way out in case the war takes an unfavorable turn for Russia. Meanwhile, Ukrainian forces are reporting some progress in their offensives in the southern and eastern regions of the country, with Kyiv's top general citing "certain gains" achieved this week. Meanwhile, Russia is facing its worst labor shortage in decades as a result of the war in Ukraine.

The Pacific Maritime Association and International Longshore and Warehouse Union announced Wednesday night they had reached a tentative agreement on a six-year contract covering workers at 29 West Coast ports. The tentative deal is subject to ratification by the two parties. The PMA and ILWU said they would not release any details of the agreement at this time.

Oil prices are sliding despite OPEC production cuts. Prices have fallen in four of the past five sessions and are now hovering near 2023 lows, with traders parsing better-than-expected production by sanctioned countries including Russia and Iran and fears of an international industrial slowdown that could slow growth in fuel demand. More in Markets section.

The Biden administration is advancing a new market for large companies to purchase clean-energy tax credits, a key component of last year's climate law. More below.

EPA's final ruling on the Renewable Fuel Standard is still under review at the Office of Management and Budget (OMB), even though all of their 35 scheduled meetings have concluded. More in Energy section.

The world is awash in rice, with global stockpiles at close to record levels. But the arrival of El Niño, which usually brings hotter and drier conditions to Asia, will put those reserves to the test. More in Markets section.

Two USDA agencies will begin a sampling project to see if there are antibiotic residues in beef marketed as “raised without antibiotics,” said USDA Secretary Tom Vilsack.

Walmart, the largest U.S. grocer, said it will build a $257 million facility in the Kansas City suburbs to package and distribute ready-to-sell beef to its stores. More in Food section.

In response to California’s Proposition 12, Sen. Roger Marshall (R-Kan.) is introducing the Ending Agricultural Trade Suppression (EATS) Act today. Meanwhile, based on various sources, we have an update on California’s implementation of Proposition 12.

U.S. continues duties on imports of biodiesel from Argentina, Indonesia.

USTR Katherine Tai will give what her office says is a “major speech” this afternoon. See Trade Policy section.

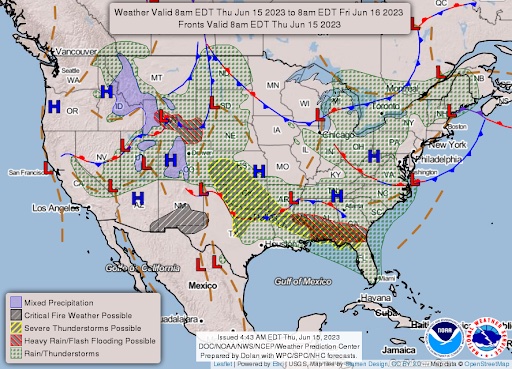

Around 45 million people in the U.S. face threats from severe storms spanning from the Central Plains to the Southeast. The Storm Prediction Center has assigned a level 4 of 5 risk for severe storms in Kansas, Oklahoma, and the Texas Panhandle. This follows a recent event that left more than 135,000 people in the South without power due to strong winds and tornadoes. Concurrently, the Midwest is contending with smoke from Canadian wildfires, which has raised concerns about hazardous air quality for millions of residents in Wisconsin and Minnesota. Conditions are expected to improve later this week, according to the National Weather Service.

|

MARKET FOCUS |

Equities today: Global stock markets were mixed overnight. U.S. Dow opened around 15 points lower then turned higher. In Asia, Japan -0.1%. Hong Kong +2.2%. China +0.7%. India -0.5%. In Europe, at midday, London flat. Paris -0.8%. Frankfurt -0.7%.

U.S. equities yesterday: The Fed's meeting conclusion hit all three major industries and only the Dow failed to work back into positive territory by the close. The Dow was down 232.79 points, 0.68%, at 33,979.33. The Nasdaq was up 53.16 points, 0.39%, at 13,626.48. The S&P 500 rose 3.58 points, 0.08%, at 4,372.59.

Agriculture markets yesterday:

- Corn: July corn fell 4 3/4 cents to $6.07 3/4, a mid-range close, while December futures fell 2 cents to $5.49 1/4.

- Soy complex: July soybeans led the complex lower, falling 11 cents to $13.88 1/4, while November soybeans rose 1/2 cent to $12.40 and nearer the session high and at a four-week high close. July soybean meal fell $7.80 to $389.70 and near the session low. Prices closed at a 10-month-low close. July bean oil gained 53 points to 55.96 cents.

- Wheat: July SRW futures fell 6 cents on the session before settling at $6.30 1/4, nearer the session low. July HRW futures also fell 6 cents on the day, closing at $7.85 3/4. July spring wheat fell 1/2 cent to $8.09 1/4.

- Cotton: December cotton fell 91 points to 80.11 cents and nearer the session low. Prices hit a two-week low.

- Cattle: Anticipation of cash market losses sent cattle futures lower Wednesday, with nearby June falling $1.975 to $177.45 and most-active August tumbling $2.95 to $170.925. August feeder cattle futures plunged $4.55 to $235.90.

- Hogs: August lean hog futures surged $2.25 before settling at $89.675. The June contract expired 7.5 cents higher at $87.20 at noon.

Ag markets today: Mounting weather concerns supported corn and soybean futures overnight, while wheat followed to the upside. As of 7:30 a.m. ET, corn futures were trading 6 to 10 cents higher, soybeans were 16 to 19 cents higher, SRW wheat was mostly 8 cents higher, while HRW and HRS wheat were 3 to 4 cents higher. Front-month crude oil futures were around 85 cents higher, and the U.S. dollar index was nearly 200 points higher.

Market quotes of note:

- Sevens Report on FOMC decision: “The key takeaways from the Fed are 1) Data remains the key to this market, 2) The risk of a recession and hard landing is not gone (nor is it very diminished) so we need to continue to watch for signs of that hard landing, because at these valuations a 10% decline on recession worries would just be the start.” The report adds: “As to the question of ‘why’ the dots show two additional rate hikes, the answer is because the Fed doesn’t want its pause to further stoke inflation by investors taking this as a cue that they’re ‘definitely’ done and easing financial conditions. It’s equivalent to a parent warning a child of the worst possible punishment so as to deter any possibly negative behavior.”

- Fed chairman Powell on inflation: “The process of getting inflation down is going to be a gradual one. It’s going to take some time,” Jay Powell, the Fed chair, said yesterday. He added that the Fed would be “stretching out” increases, signaling that it is hardly done tightening, but that it has entered a more gradual phase.

On tap today:

• European Central Bank is expected to raise its benchmark interest rate to 3.5% from 3.25%. (8:15 a.m. ET) UPDATE: See info in “black box” lead.

• U.S. retail sales for May are expected to fall 0.2% from the prior month. Follow our coverage here. (8:30 a.m. ET) UPDATE: U.S. retail sales in May surpassed expectations by increasing 0.3% month-over-month, building on the 0.4% increase seen in April. This growth signals that consumer spending remains strong despite rising inflation and interest rates. The most significant sales increases were in building materials and garden equipment (2.2%), and motor vehicles and parts (1.4%). Other sectors experiencing growth included food services and drinking places; general merchandise stores; furniture stores; food and beverages stores; sporting goods, hobby, musical instrument, & book stores; and electronics and appliances. Health, personal care, and clothing stores saw no change, while gasoline stations and miscellaneous store retailers experienced declines in sales. Core retail sales, which exclude certain sectors, increased 0.2% following a 0.6% gain in April.

• U.S. jobless claims are expected to fall to 245,000 in the week ended June 10 from 261,000 one week earlier. (8:30 a.m. ET) UPDATE: In the week ending June 10, the number of Americans filing for unemployment benefits reached 262,000, which is significantly higher than the market expectation of 245,000 and equal to the previous week's revised value. This is the highest number since October 2021, indicating some softening in the U.S. labor market after a long period of tightness. This shift may be attributed to the Federal Reserve's aggressive tightening campaign, affecting businesses in the United States. The four-week moving average, which accounts for volatility, increased by 9,250 to 246,750. On a seasonally unadjusted basis, claims rose by 28,763 to 249,212, with Texas and Minnesota experiencing notable increases.

• U.S. import prices for May are expected to decrease 0.5% from the prior month. (8:30 a.m. ET) UPDATE: US import prices in May fell by 0.6% month-over-month, a larger decrease than the 0.5% decline predicted by the market. This followed a 0.3% rise in April (a downward revision). The decrease in import prices was primarily driven by a 6.4% drop in fuel prices due to lower petroleum and natural gas costs, which experienced the most significant monthly fall since August 2022. In contrast, nonfuel import prices only declined by 0.1% after remaining unchanged in April. Year-over-year, import prices dropped by 5.9%, marking the largest decrease in three years.

• Federal Reserve Bank of New York's Empire State survey is expected to rise to minus 16.0 in June from minus 31.8 one month earlier. (8:30 a.m. ET) UPDATE: The N.Y. Empire State Manufacturing Index saw an unexpected increase of 38 points, reaching +6.6 after a four-month low of -31.8 in May. This surpassed market predictions of -16.0. Approximately 31% of respondents noted improvements in conditions, while 24% reported worsening conditions. Key index components showed positive changes as well. The new orders index rose to 3.1, and shipments jumped to 22.0. However, the unfilled orders and inventories indexes remained negative at -8.0 and -6.0, respectively, while the delivery times index remained almost unchanged at -1.0. The index for employee numbers stayed negative for the fifth consecutive month, with the average workweek index also below zero. Both input and selling price increases slowed substantially, and capital spending plans remained weak. Nevertheless, companies were more optimistic about the future, as indicated by a better outlook for the next six months.

• Philadelphia Fed's manufacturing survey is expected to fall to minus 14.8 in June from minus 10.4 one month earlier. (8:30 a.m. ET) UPDATE: In June 2023, the Philadelphia Fed Manufacturing Index in the U.S. dropped to -13.7, down from -10.4 in May. This decline was near market expectations, which predicted an index score of -14.8. While the survey showed that general activity and new orders indicators were negative, the shipments index saw an upturn and was positive. Employment remained stable, and the price indexes were noted to be below long-term averages. Although many future indicators showed improvement, the outlook for growth over the next six months remained cautious.

• U.S. industrial production for May is expected to be unchanged from the prior month. (9:15 a.m. ET)

• U.S. business inventories for April are expected to rise 0.2% from the prior month. (10 a.m. ET)

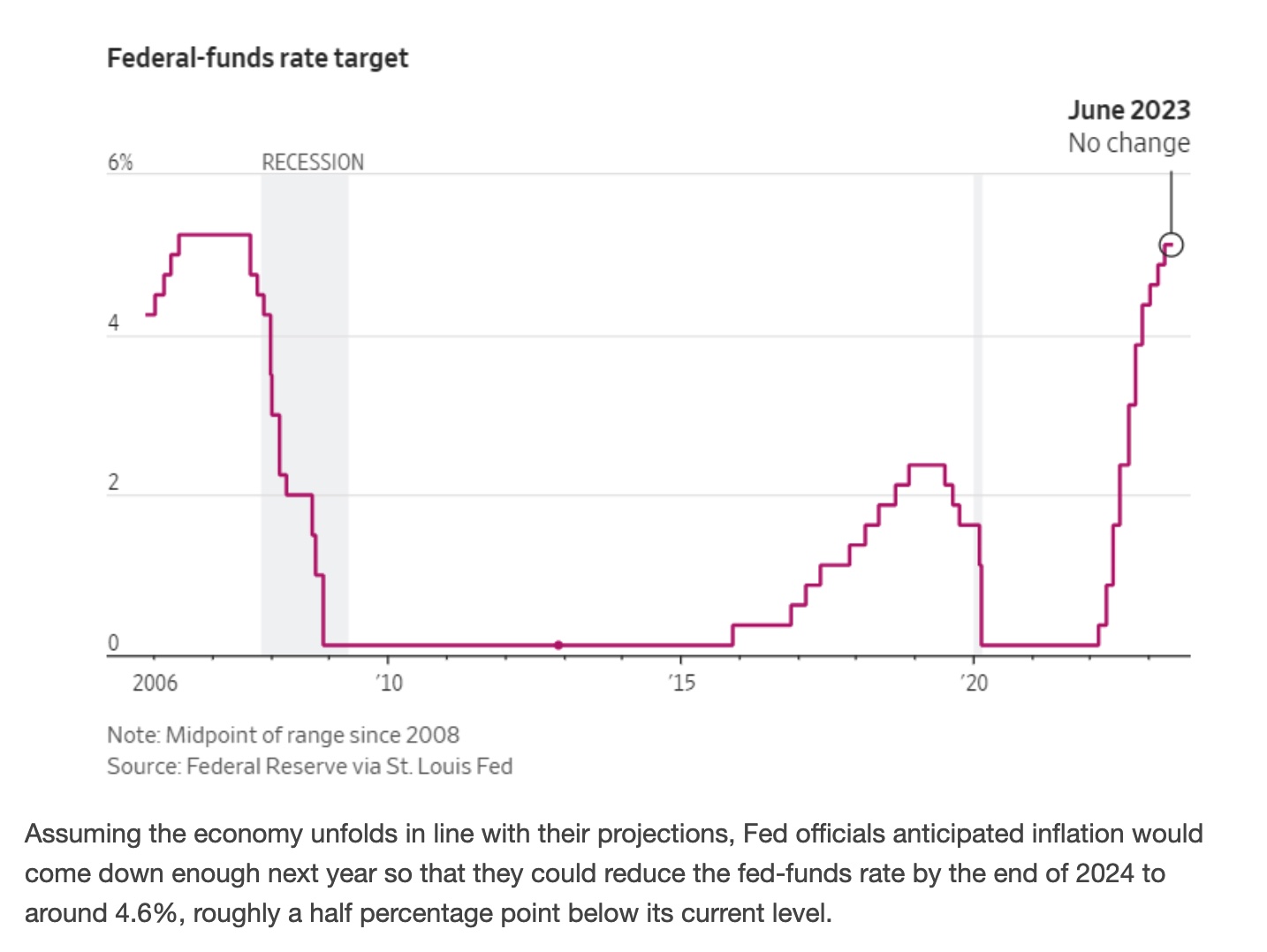

The Federal Open Market Committee (FOMC) decided to pause interest rate increases after implementing 10 consecutive hikes, with the target range for the Fed funds rate standing steady at 5% to 5.25%. The decision to pause rate increases allows the Fed to assess the impact of previous hikes and evaluate additional information for future monetary policy.

Although the Fed did not provide explicit guidance on its next moves, officials' updated forecasts spooked markets, with several rate hikes expected in 2023. The median outlook suggests two additional increases this year, with officials seeing higher rate expectations for 2024 and 2025. Their projections for GDP, unemployment, and inflation have also been updated.

Fed Chair Jerome Powell noted that the decision to pause rate increases solely applied to this meeting, and future decisions will be made on a meeting-by-meeting basis. He also ruled out any rate decreases or discussions regarding fiscal policy.

Of note: Rates are actually going to effectively continue to tighten as the Fed will continue its runoff of the balance sheet at the pace they have been using. And Powell did not indicate he thought Fed assets would get tight.

While markets were expecting only one more rate increase this year, the updated forecasts now indicate two or more increases might come, surprising the market. The Fed will continue tightening its balance sheet and remains focused on bringing down inflation to the 2% target.

Markets still do not believe the Fed will increase rates more than once. CME Fed funds futures show the highest probabilities for a 25-basis-point increase in July which would take the target range to 5.25% to 5.5%. for the remaining meetings of the year, the highest probabilities are for the target range to stay at that level.

Powell will testify before Congress next week, delivering the Fed’s semiannual monetary policy report to the House Financial Services Committee on June 21.

Market perspectives:

• Outside markets: The U.S. dollar index was slightly higher even as the euro and yen were both firmer against the U.S. currency. The yield on the 10-year U.S. Treasury note was firmer, trading around 3.82%, with a higher tone in global government bond yields. Crude oil futures moved higher, with U.S. crude around $69 per barrel and Brent around $74 per barrel. Gold and silver were sharply lower ahead of US trading, with gold around $1,939 per troy ounce and silver around $23.31 per troy ounce.

• Sterling reached its highest level against the dollar since April 2022, driven by strong economic data and expectations of further Bank of England interest rate hikes. The pound rose as much as 0.8% to $1.2698 and gained 0.16% against the euro to €1.1705. This increase happens as markets price in a peak U.K. interest rate of 5.71% by year-end, up from 5.35% earlier this month. The U.K. economy showed expansion in Q1 2023, defying previous recession predictions. Furthermore, private-sector wages (excluding bonuses) experienced their fastest growth rate on record outside the coronavirus period. Amid ongoing inflationary issues, expectations for tighter U.K. monetary policy have supported the pound.

• Gold experienced its fifth consecutive day of decline, which is its longest losing streak since February. This downturn occurred after the Federal Reserve paused interest-rate increases but signaled that monetary tightening isn't over. The prospect of additional rate hikes, which are generally negative for gold as it doesn't provide interest, caused the precious metal to fall below the $1,940 to $1,980 per ounce range seen this month. As a result, gold is now on track for its lowest closing price in three months.

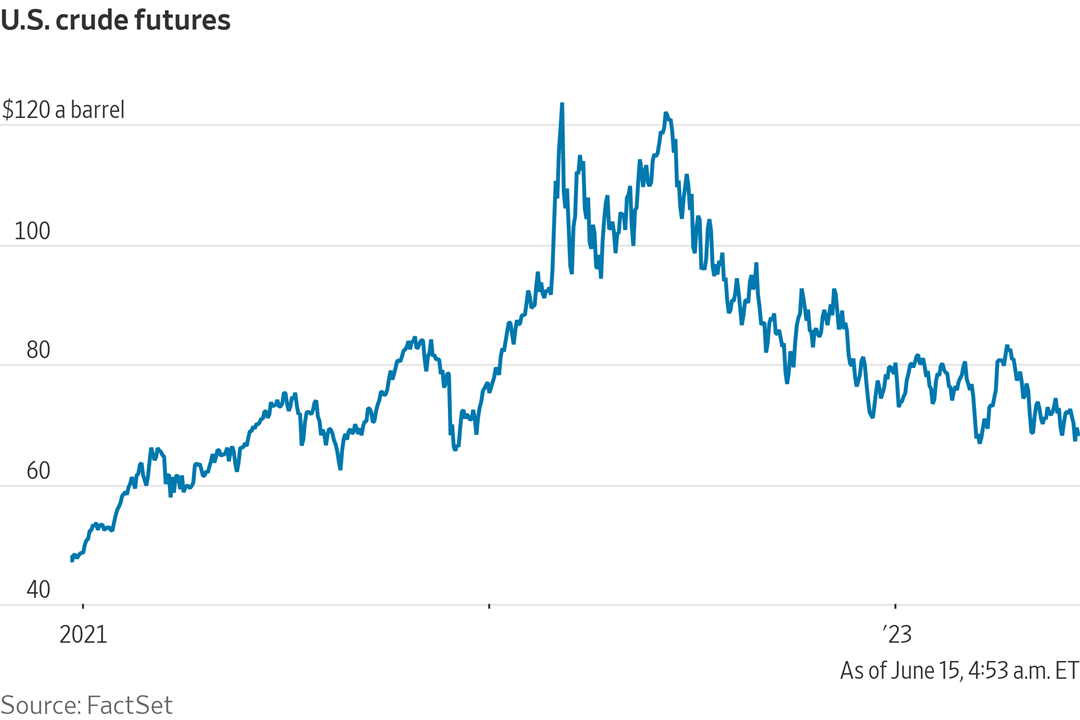

• Saudi Arabia's decision to reduce crude output in order to stabilize global oil markets has not had the desired effect thus far. In fact, prices have dropped in four out of the past five sessions and are now approaching the lowest levels of 2023. This can be attributed to higher-than-expected production in sanctioned countries like Russia and Iran, as well as concerns about a potential industrial slowdown that may affect fuel demand growth. Consequently, even the most optimistic analysts on Wall Street have slashed their oil forecasts. Data from the Commodity Futures Trading Commission indicates that short positions on U.S. crude significantly increased between April 18 and May 30. Additionally, exchange-traded funds that track oil prices have suffered outflows in recent weeks.

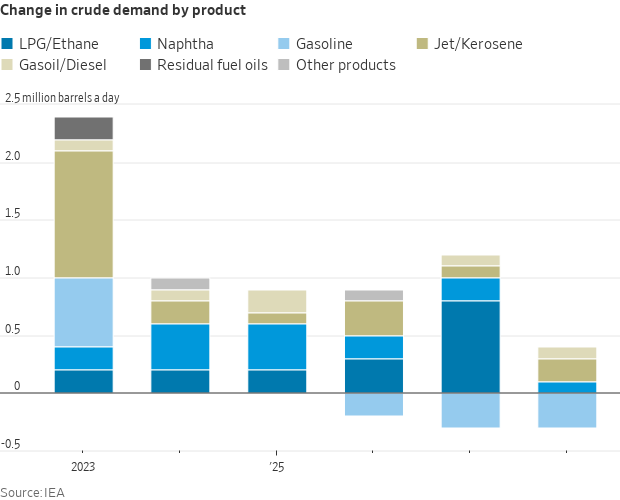

• The International Energy Agency (IEA) is projecting a volatile period in energy markets in the next few years, as electric-vehicle uptake surges and developed nations rapidly transition to cleaner sources of energy. The group expects demand to peak before the end of the decade, projecting a far more rapid shift away from fossil fuels than previously expected. Rapidly growing Asian economies will continue to prop up the global appetite for oil in the coming years. But the IEA also lifted its forecast for oil-demand growth this year by 200,000 barrels a day, with China accounting for 60% of that increase. That will feed more demand for crude tankers traveling along longer routes to Asia, extending the earnings surge in that shipping market.

• Global rice stockpiles are currently near record levels, but the arrival of El Niño could put those reserves to the test. El Niño typically brings hotter and drier conditions to Asia, which is responsible for producing and consuming 90% of the global rice supply. Thailand, the world's second-biggest exporter, has already asked farmers to reduce planting due to lower rainfall. Rice yields have historically been lower during El Niño years, and stronger cycles could further affect the rice supply.

Although a shortage isn't expected, Chookiat Ophaswongse of the Thai Rice Exporter's Association believes the market will become more favorable for sellers. As a result, global rice stockpiles are predicted to decrease by 5% this season. Importers are becoming more cautious, leading to increased purchases in recent months.

India's outlook heavily relies on the southwest monsoon, with normal rainfall predicted to support production. Despite the challenges El Niño may pose to rice harvests, the overall output is expected to remain steady at 512.5 million metric tons due to rising demand. Agricultural research firm The Rice Trader states that there is no shortage, but maintaining healthy strategic stocks is important. Link to more via Bloomberg.

• NWS weather outlook: Numerous severe thunderstorms expected today across parts of the central and southern Plains... ...Additional chances for flash flooding and severe weather throughout the central/eastern Gulf Coast and Southeast, as well as into the central High Plains through Friday... ...Mid-June heat wave underway across much of Texas and the Deep South... ...Poor air quality due to Canadian wildfire smoke forecast over the northern Plains and Midwest today.

Items in Pro Farmer's First Thing Today include:

• Grains strengthen overnight

• Exchange further cuts Argentine soybean crop

• Strategie Grains cuts EU crop forecasts

• NOPA May soy crush expected to be record large

• China to start auctioning state-owned soybean reserves

• Slow developing cash cattle negotiations

• Cash hog fundamentals strengthen

|

RUSSIA/UKRAINE |

— Ukraine claimed “partial success” in its counter-offensive against Russian forces in Zaporizhia, a south-eastern region. Ukraine’s top general said his troops had recaptured about 100 sq km (40 sq miles) of land and were “moving forward.” President Vladimir Putin insisted that Ukraine’s efforts were failing, adding that its casualty rate was ten times higher than Russia’s.

— Cargill exec: Black Sea grain shipments shrinking. Jan Dieleman, president of Cargill’s ocean transportation business, told Reuters, “The [Black Sea] corridor is definitely not performing as it was at the beginning. It’s more focused on the smaller (ship) sizes now.” Dieleman said if the Black Sea grain deal ended, the price impact would be less “simply because it is a smaller (export) program already. The grain market is not the same as it was a year ago.”

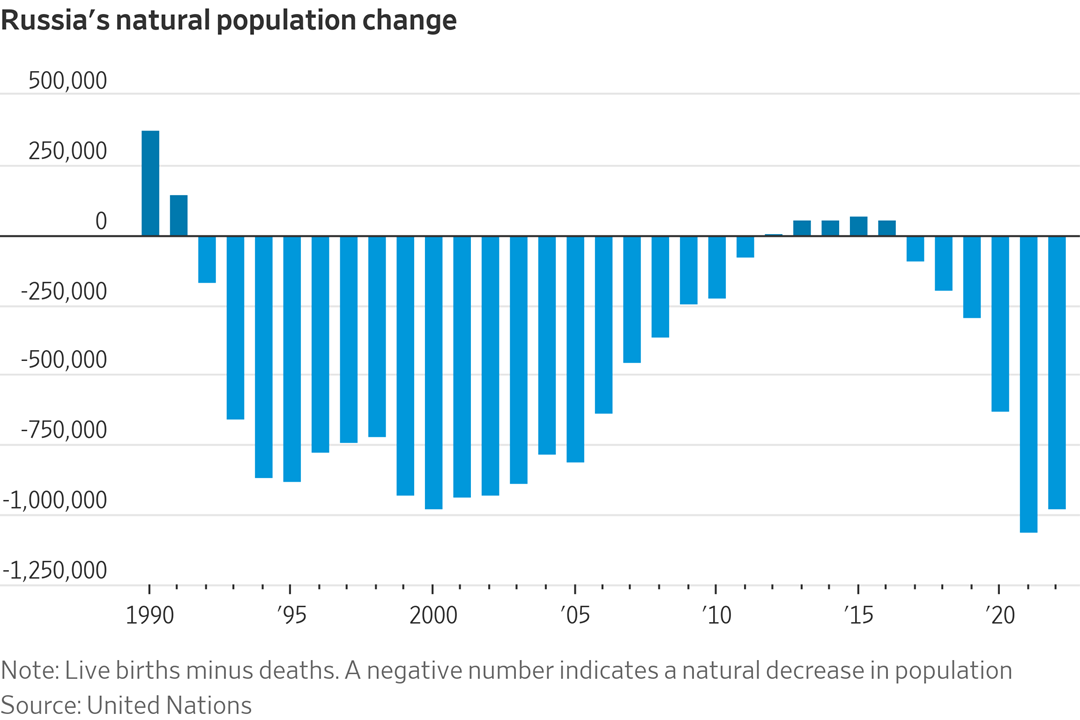

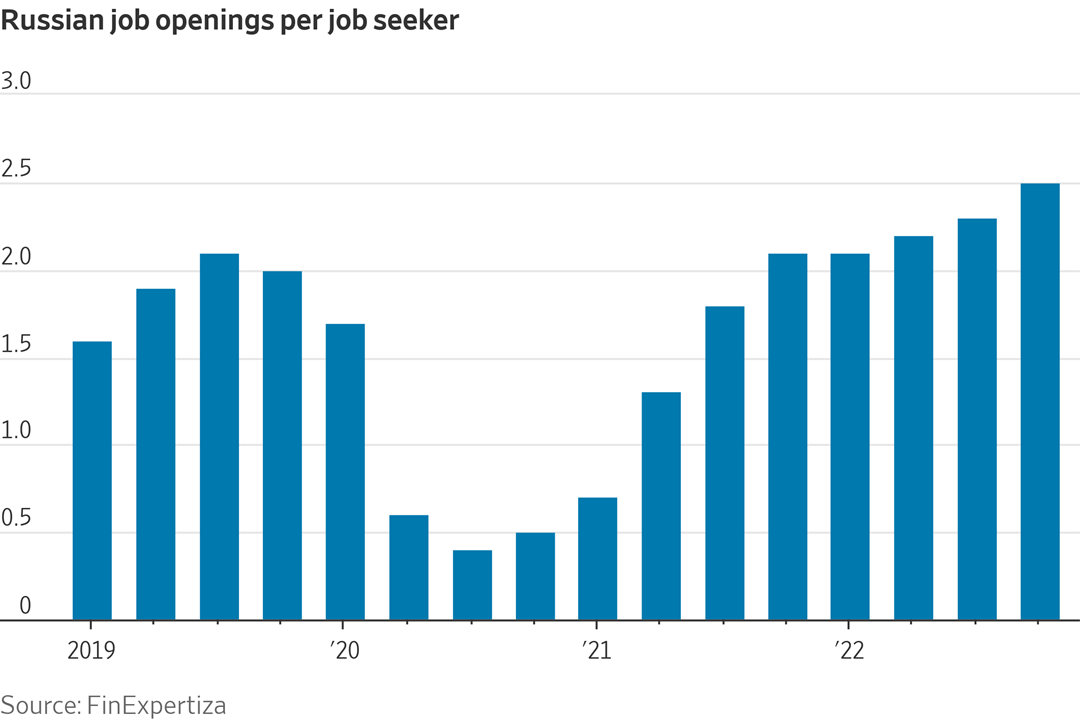

— Russia is facing its worst labor shortage in decades as a result of the war in Ukraine, which has led to significant emigration and deployment of workers to the front lines. The current crisis not only exacerbates an already limited labor market, but also weakens the economic foundation of a nation dealing with sanctions and international isolation. Russian businesses are short of everyone from programmers and engineers to welders and oil drillers, professions needed to boost the economy and support the war effort in Ukraine. To stem the tide, last month, President Vladimir Putin ordered officials to develop measures to reverse the population outflow.

|

POLICY UPDATE |

— Highlights of what House Ag Chair G.T. Thompson (R-Pa.) told reporters at a Wednesday “coffee session” (Link to our separate interview with Thompson):

Farm bill timeline. He announced plans to begin drafting the next Farm Bill later this month, aiming to mark up the bill in September, despite concerns from Sen. Chuck Grassley (R-Iowa) about needing more time to draft a new measure. Thompson remains optimistic about meeting deadlines and moving the bill forward in September. He doesn't expect significant resistance from ultra conservative lawmakers who have slowed chamber action in the past over debt limit disagreements. Thompson noted improving nutritional outcomes under the Supplemental Nutrition Assistance Program (SNAP) as a key area for discussion.

A bipartisan bill. Though instances of disagreement and potential speed bumps, like fights over nutrition policy or other areas like dairy, are expected, Thompson remains confident that the farm bill will be bipartisan, bicameral, on time, and highly effective. House Ag Forestry Subcommittee Chair Doug LaMalfa supports these efforts, noting the importance of agriculture and the Farm Bill this year.

SNAP/food stamps. Thompson hopes to examine potential changes to SNAP, with a focus on improving nutritional outcomes and addressing inefficiencies like benefit restrictions for certain food items.

Other aspects of the upcoming farm bill include potential improvements to the Market Access Program, expansion of crop insurance, and changes to account for crop quality.

— USDA is updating the Emergency Relief Program (ERP) Phase Two to provide a method for valuing losses and accessing program benefits to eligible producers of certain crops, including grapes grown and used by the same producer for wine production or forage that is grown, stored and fed to livestock, that do not generate revenue directly from the sale of the crop. These updates ensure that ERP benefits are more reflective of these producers’ actual crop losses resulting from 2020 and 2021 natural disaster events. USDA’s Farm Service Agency (FSA) will begin accepting ERP Phase 2 applications from eligible wine grape and forage producers once this technical correction to ERP is published in the Federal Register and becomes effective, which it anticipates will be on Friday, June 16, 2023. The deadline to submit applications for ERP Phase 2 is July 14.

|

PERSONNEL |

— The Senate Banking Committee plans a hearing on Philip Jefferson to be the Fed’s vice chair on June 21. Fed board nominees Lisa Cook and Adriana Kugler will also be discussed, according to a statement.

|

CHINA UPDATE |

— China’s central bank ramps up rate cuts as the economy weakens. China’s central bank lowered the rate on one-year loans by 10 basis points to 2.65%, the first reduction since August. Growth in industrial output slowed last month while retail sales growth missed estimates. Meanwhile, Chinese real estate investment slumped further in May, while youth unemployment hit another record, rising to 21%.

The People’s Bank of China also said it was offering $33 billion to banks to safeguard liquidity. Earlier this week, the bank cut a short-term lending rate.

— U.S. Secretary of State Antony Blinken is set to visit China June 18-19, following a series of meetings between US. and Chinese officials and recent statements by President Biden indicating an upcoming thaw in relations. Blinken's initial visit planned for February was canceled due to the controversy surrounding alleged Chinese spy balloons over the U.S.

While details about this trip are limited, Blinken will meet with Foreign Minister Qin Gang and possibly Chinese President Xi Jinping. In a recent phone call between Blinken and Qin, the Chinese official placed the responsibility for strained ties on Washington and urged the U.S. to respect China's core interests. Qin's comments highlight Beijing's skepticism of American intentions.

— Torrential rains have impacted China's wheat harvest, which is nearing completion at the end of June. Approximately 80% of the wheat area has been harvested so far, which is similar to the timeline of last year. The Chinese Ministry of Agriculture is expected to release yield and quality estimates once the harvest is completed.

Since China is the world's largest wheat grower and importer, this year's wheat harvest results will have significant implications for farmers, food prices, and global grain markets.

Upshot: Wheat is a crucial crop for China's food security, and its overreliance on imported agricultural commodities is a growing concern for the country's leadership. A major crop failure would exacerbate these worries.

— China unveils plans to modernize agricultural production. China aims to produce 40% of its vegetables and 60% of aquaculture in modern facilities by 2030 to better ensure safe and stable food supplies. The plan targets greater use of digital solutions and advanced equipment to boost food output, China’s ag ministry said.

— Canada froze ties with the Asian Infrastructure Investment Bank (AIIB), a multilateral lender founded by China, because of alleged interference by the Chinese Communist Party. The AIIB’s communications director, a Canadian, resigned after accusing the bank of being “dominated” by CCP officials. The AIIB dismissed the claim as “baseless.” Canada said it would “halt” activities at the bank until an investigation was complete.

— Taiwan fully opens market to Canadian beef. Taiwan’s government agreed to fully open its market to imports of Canadian beef, lifting a stumbling block as Taipei works to sign a bilateral trade deal with Ottawa. Taiwan had previously banned imports of Canadian beef slaughtered more than 30 months earlier due to concerns about bovine spongiform encephalopathy (BSE).

|

TRADE POLICY |

— G20 Agriculture Ministers’ Meeting kicks off in India today and ends June 17. The meeting brings together ranking ag officials from 29 countries and 10 multilateral organizations. On the likely agenda:

- Global solutions to rising food insecurity

- More support for farmers adapting to climate change

- Cooperation in agricultural technology

- Countries are expected to push Russia to extend the Black Sea Grain Corridor deal, which guarantees safe passage for agricultural exports from Ukraine. The current deal expires in mid-July.

— U.S. Trade Representative Katherine Tai will give what her office says is a major speech at an Open Markets Institute conference this afternoon called The Next World System: Can U.S. Trade Policy Make Us More Secure, Democratic, & Prosperous? In her speech, Ambassador Tai will focus on how the U.S. trade agenda is prioritizing resilience in the global economy. This builds on the recent speech by National Security Advisor Jake Sullivan regarding American economic leadership. Tai will highlight the issues that arose from pursuing efficiency and low costs in trade policy, which resulted in vulnerable and high-risk supply chains. The Biden administration says it is working to address these problems by raising standards, promoting sustainability, and prioritizing the needs of workers and producers.

Excerpts from Tai’s speech provided by the USTR office:

- “Our world is different now. A war in Europe, with drastic economic consequences. A worsening climate crisis. A digital transformation that continues to accelerate and transform our world, creating economic opportunities, powerful industry giants, as well as threats and harms to democracy and humanity all at the same time. And of course, fragile supply chains and an unsustainable version of globalization demanding reform and improvements. It is abundantly clear that these challenges have implications for competition policy, as well as trade policy. So, all of us working in these spaces must row in the same direction.”

- “Today, labor leaders, CEOs, foreign leaders, and the president’s national security advisor all agree: Our global supply chains, which have been created to maximize short-term efficiency and minimize costs, need to be redesigned for resilience. Because resilient supply chains are vital for greater national and economic security. By this, we mean production that can more easily and quickly adapt to and recover from crises and disruptions. It means having more options that run through different regions. But getting there requires a fundamental shift. A shift in the way we incentivize decisions about what, where, and how we produce goods and supply services.”

- “I recently had an important conversation with UAW President Shawn Fain and AFL-CIO Secretary-Treasurer Frederick Redmond in Detroit, during the APEC Ministers Responsible for Trade Labor Dialogue. Shawn shared how the closure of the General Motors plant in his hometown in Indiana was a vivid illustration of why we must do things differently. When the plant shut down, people lost their jobs. They lost their healthcare. The small businesses that sustain the community closed down, and people started moving away in search of other opportunities. Those who lost their jobs, if they were fortunate to find new ones, often had to settle for lower wages and worse benefits. Their children faced an uncertain future. This is what a race to the bottom looks like. You can see how the decision to allow artificially low costs and low prices to lead U.S. economic policymaking has made us less secure, less free, and less prosperous.

- “I hear all the time that because we are not doing traditional trade agreements, we are not doing trade at all. But if we look at what those agreements did, we see the ways in which they contributed to the very problems we are now trying to address. The industrial supply chain rules in our traditional free trade agreements were based on that same premise of efficiency and low cost. Because of it, they allow significant content to come from countries that are not even parties to the agreement — free riders, who have not signed up to any of the other obligations in the agreement, such as labor and environmental standards. That means these rules benefit the very countries that have used unfair competition to become production hubs. That is how the supply chain rules in these FTAs tend to reinforce existing supply chains that are fragile and make us vulnerable. This does not make sense at a moment in history when we are trying to diversify and make them more resilient.”

— U.S. continues duties on imports of biodiesel from Argentina, Indonesia. The U.S. International Trade Administration (ITA) has issued a notice (link) in the Federal Register that announces their decision to continue the antidumping duty (AD) and countervailing duty (CVD) orders on biodiesel imports from Argentina and Indonesia. This decision comes after the conclusion that revoking these orders would likely result in material injury to the U.S. biodiesel industry due to the continuation or recurrence of unfair trade practices and subsidies. On June 8, the U.S. International Trade Commission (USITC) released a determination that supported these concerns, finding that there was indeed material injury caused by the imports. The orders were made effective on the same day and are to remain in place for five years. The USITC began a five-year review of the duties, which were first implemented on January 4 and April 26, 2018.

|

ENERGY & CLIMATE CHANGE |

— The Biden administration is advancing a new market for large companies to purchase clean-energy tax credits, a key component of last year's climate law. This initiative aims to bring additional capital to clean-energy projects like wind, solar, hydrogen, and batteries. These projects are essential for meeting U.S. emissions reduction targets. The Treasury Department has proposed rules on how developers can sell these credits, and related rules have also been issued that allow state and local governments, nonprofits, universities, and tribes to claim tax credits.

The new rules, part of the Inflation Reduction Act, permit entities like utility-scale solar installations to sell their tax credits to companies that had no involvement in the project but want to lower their tax bill. This system replaces the previous, less efficient process of tax-equity financing. Although there are still some uncertainties related to the new market, proponents of the change believe this will quickly drive more investment into clean-energy projects. Critics argue that the credits excessively benefit corporations and function more like spending programs than tax cuts.

— EPA's final ruling on the Renewable Fuel Standard is still under review at the Office of Management and Budget (OMB), even though all of their 35 scheduled meetings have concluded. The EPA has a deadline of finalizing the rules by June 21, which was established after reaching an agreement with Growth Energy on an extension. The specific date for the release of these finalized rules is not yet known, but it is anticipated to be shortly after the OMB review is finished, as has been the pattern previously.

|

LIVESTOCK, FOOD & BEVERAGE INDUSTRY |

— Walmart earlier this week revealed plans to construct a $257 million beef packaging and distribution facility in Olathe, Kansas. This move is part of Walmart's goal to establish a full Angus beef supply chain. The facility, a first-of-its-kind "case-ready" beef facility for Walmart, is set to open in 2025, creating 667 new jobs and employing around 1,000 people during construction.

Once operational, the Olathe facility will distribute Angus cuts from Sustainable Beef LLC to Walmart stores across the Midwest. Walmart had acquired a minority stake in the rancher-owned, premium beef company last August, which has also enabled the opening of a $325 million processing facility at the Nebraska headquarters.

Walmart's aim in building an end-to-end supply chain for Angus beef, first announced in 2019, is to answer customer demand for a more transparent supply chain. The company sees the Olathe facility as "an important milestone" in strengthening its supply chain and expanding its supply of high-quality beef.

Upshot: It’s the first time the retail giant has owned and operated a case-ready beef facility.

— In response to California’s Proposition 12, Sen. Roger Marshall (R-Kan.) is introducing the Ending Agricultural Trade Suppression (EATS) Act today. This bill aims to prevent states from enacting laws that impact agricultural production in other states. The law has attracted co-sponsors including Republican Senators Chuck Grassley, Joni Ernst, John Cornyn, Tom Cotton, Deb Fischer, Kevin Cramer, Eric Schmitt, and Ted Budd. The EATS Act seeks to preserve states' rights by limiting their ability to impose agricultural regulations on other states.

California’s Proposition 12 requires pork sold in the state to be produced under specific conditions, which has caused concerns for pork-producing states, with potential nationwide implications on food costs and producers' ability to comply. Proponents of the EATS Act argue that such regulations unfairly burden other states and their agricultural industries, while opponents claim that the Act would undermine states' rights and give multinational conglomerates an unfair advantage.

Despite the support for the EATS Act, some believe that the bill is unlikely to pass Congress, as some food companies and retailers are already advocating for better living conditions for animals. The pork industry itself is divided, with several companies having adopted the California standards and reducing the use of gestation crates. The National Pork Producers Council and other agricultural organizations have supported the EATS Act, hoping to protect farmers and ranchers from burdensome regulations.

— USDA is considering implementing higher standards for meat products marketed as "humanely raised" or antibiotic-free. This effort aims to respond to criticism that these claims are often exaggerated to justify higher prices. USDA's Food Safety and Inspection Service (FSIS) is under pressure to tighten oversight of marketing claims on packaged food, as consumers often pay a premium for such products based on perceived benefits such as health, environmental impact, or animal welfare.

Recent studies from animal welfare groups and science journals reveal that the USDA's rules for allowing such claims may be too lax. A report from the Animal Welfare Institute found that the USDA could not substantiate animal-raising claims on many meat products that carried related labels. Similar investigations found issues with incomplete or inaccurate label applications and antibiotics in meat that was labeled antibiotic-free.

In response, USDA wants to reduce fraudulent claims and plans to revise guidelines for companies providing documentation about animal-raising claims. They are strongly encouraging the use of third-party certification to verify these claims. Additionally, the FSIS and USDA's Agricultural Research Service plan to assess antibiotic residues in cattle and revise labeling requirements based on the results.

— California Proposition 12 update (based on several sources):

- Proposition 12 has led to significant changes in the pig production industry. U.S. producers are currently losing around $40 per pig, while Ukrainian producers are making a profit of $100 per head, making their country possibly the most profitable for hog production globally.

- Strict enforcement of Prop 12 isn't occurring at the moment, and pork already in the pipeline won't face penalties. However, starting Jan 1, 2024, third-party inspection and certifications will be required, along with yearly renewals. Distributors must register with the CDFA by July 1, 2023.

- As a result of Prop 12, only 8% of U.S. sow housing can currently meet the new standard, which is inadequate to fulfill California's pork demand. Producers have identified a decrease in conception rates on compliant farms as a major issue, with one solution being to double the amount of food provided to sows during the first 30 days of gestation, but this comes with added expense.

- Major processors believe they will gradually meet California's pork demand, which is approximately 13% of total U.S. pork consumption. However, the types of pork products consumed in the state, such as bacon and ribs, might shift towards more hams and loins.

— Most of the 1.4 billion tons of food thrown away globally each year goes to landfills, polluting water and soil and releasing methane. South Korea is doing things differently, turning most food scraps into animal feed, fertilizer and fuel, the New York Times reports (link).

— USDA supports BSE negligible risk designation for France. USDA’s Animal and Plant Health Inspection Service (APHIS) published a notice endorsing the World Organization for Animal Health (WAOH)'s assessment that France is a negligible risk country in relation to BSE, based on their review of supporting information. Public comments on the U.S. position must be submitted by Aug. 14.

|

HEALTH UPDATE |

— Annual health care spending is expected to reach nearly $7.2 trillion in 2031, increasing faster than the country's economy. Health expenditures will rise from 18.3% in 2021 to 19.6% of the GDP in 2031, according to estimates from the Centers for Medicare and Medicaid Services. In 2021, the U.S. spent $4.3 trillion on healthcare, more than any other developed country relative to the size of its economy, and this trend will persist.

Medicare spending is projected to grow faster than in the private sector, at an average of 7.5% a year, partly due to baby boomer enrollment. The Inflation Reduction Act from last year allows Medicare to negotiate drug prices with manufacturers for the first time, but changes to save money for the program are not expected to take effect until 2031.

Health insurance coverage reached a record high in the U.S., but millions could lose Medicaid coverage as Covid-era rules boosting enrollment expire. Medicaid enrollment peaked at over 90 million in 2022 and is anticipated to drop to 81.1 million by 2025.

|

POLITICS & ELECTIONS |

— Donald Trump raised $6.6 million in campaign contributions since his indictment and remains the frontrunner in the GOP race. A Quinnipiac poll mostly conducted after the charges showed 53% of Republican and GOP-leaning voters supporting him. Ron DeSantis had 23%.

— The Republican Party and big business are increasingly distancing from each other. According to a WSJ analysis (link), Republicans now rely less on corporate and industry PACs than they have in the past 30 years, instead opting for smaller individual donations, often from individuals skeptical of big-business priorities like free trade. Conservatives claim the separation is due to CEOs being more politically active, taking progressive stances on divisive social issues. Company executives who thought this discord would dissipate after Trump's departure now face ongoing hostility from the GOP in Congress.

|

CONGRESS |

— House Ag appropriations measure. House appropriators battled over abortion, equity and rural priorities as they amended and advanced the fiscal year (FY) 2024 spending bill for USDA and related agencies Wednesday. The Appropriations Committee voted 34-27 along party lines to report out the bill that would provide $25.3 billion in discretionary funding. The base allocation for the draft bill is $17.8 billion, boosted by nearly $8 billion in rescissions to get to the full discretionary amount. Because of the rescissions, the topline is slightly higher than the $25.1 billion enacted in fiscal 2022. The fiscal 2023 appropriation is $25.5 billion. Republican appropriators said the caps agreed upon for discretionary nondefense funding set at fiscal 2023 levels for fiscal 2024 are only a ceiling, and that their goal was to write bills to 2022 levels.

The Food and Drug Administration (FDA) is set to receive $6.6 billion in total funding, while the Commodity Futures Trading Commission would receive $345 million. There were heated debates on funding cuts and policy decisions. Republicans sought to block the FDA's decision to remove a requirement for health care providers to dispense the abortion drug mifepristone in person. Democrats, on the other hand, argued this move as an attempt to restrict access to abortion.

The committee rejected an amendment that would preserve funding for rural electric cooperatives and for debt relief to farmers and ranchers with direct loans from the Agriculture Department or loans from private lenders guaranteed by the department.

Reactions were mixed, with Republicans defending the decisions and Democrats criticizing them for negatively affecting rural communities and minority producers. x

|

OTHER ITEMS OF NOTE |

— One of Saturn’s moons appears to have all the ingredients for life. Scientists found a key form of phosphorus in Enceladus’s ice-covered ocean, according to a new study. That means it has all six elements needed for life. This subsurface ocean might be the most habitable place in the solar system (other than Earth), though no actual life has been found.

— Supreme Court decision. A couple’s $14,729 tax-refund lawsuit could lead to a corporate windfall and challenges to other tax-code provisions. The Supreme Court is scheduled today to consider taking the case that asks whether people and companies must receive, or realize, income before it can be taxed under the 16th Amendment. The result could block Democrats’ proposals to tax wealthy Americans. Link for more via the WSJ.

|

KEY LINKS |

WASDE | Crop Production | USDA weekly reports | Crop Progress | Food prices | Farm income | Export Sales weekly | ERP dashboard | California phase-out of gas-powered vehicles | RFS | IRA: Biofuels | IRA: Ag | Student loan forgiveness | Russia/Ukraine war, lessons learned | Russia/Ukraine war timeline | Election predictions: Split-ticket | Congress to-do list | SCOTUS on WOTUS | SCOTUS on Prop 12 pork | New farm bill primer | China outlook | Omnibus spending package | Gov’t payments to farmers by program | Farmer working capital | USDA ag outlook forum | Debt-limit/budget package |