Biden Unveils FY 2024 Budget Proposals This Afternoon in Philadelphia

Consensus: Argentine soybean crop 27 MMT and heading lower

|

In Today’s Digital Newspaper |

USDA daily export sale: 184,000 tonnes of soybeans to unknown destinations during the 2022-23 marketing year.

No corn sales to China reported in week ending March 2. USDA weekly Export Sales data for the week ending March 2 did not report any sales of U.S. corn even though such purchases had been rumored in the market. Activity for 2022-23 included net sales of 136,952 tonnes of wheat, 155,294 tonnes of sorghum, 178,527 tonnes of soybeans and 15,306 running bales of upland cotton. Sales for 2023/24 of 63,000 tonnes of soybeans were also reported. Net sales for 2023 of 500 tonnes of pork and 832 tonnes of beef were also reported.

Exchange slashes Argentine soybean, corn crop forecasts. Details in Market Perspectives section.

President Joe Biden will travel to the swing-state of Pennsylvania this afternoon to unveil a federal budget plan with spending proposals and higher taxes on the wealthy that will form a blueprint for his expected 2024 re-election bid. They include a 25% minimum tax on billionaires and nearly doubling the capital gains rate. The new budget will cut the deficit by nearly $3 trillion over the next 10 years, the White House announced on Wednesday. The deficit reduction will be a central part of Biden's budget proposal and a symbolic marker as the president approaches the showdown with House Republicans over the looming debt ceiling crisis. The budget is unlikely to gain momentum on Capitol Hill as Republicans, who control the House, are expected to oppose most of Biden’s proposals. It will offer a starting position for Democrats as lawmakers begin hashing out their visions for government spending before the fiscal year ends on Sept. 30. We have details in Policy section.

Fed Chairman Jerome Powell said officials were keeping their options open over how much to raise interest rates this month. Powell, speaking a day after investors interpreted his remarks to a congressional panel to suggest a half-point rate rise was likely, said February data on hiring and inflation would shape the outcome of the Fed's March 21-22 meeting. More below.

The Argonne National Laboratory in the U.S. has essentially cracked the battery technology for electric vehicles, discovering a way to raise the future driving range of standard EVs to a thousand miles or more. It promises to do so cheaply without exhausting the global supply of critical minerals in the process. Link for more in Energy and Climate Change section.

Norfolk Southern CEO Alan Shaw will testify on the East Palestine, Ohio, train derailment at a Senate Environment and Public Works Committee hearing, where he’ll say he’s sorry for the train wreck that spilled toxic chemicals in Ohio last month and the company is “determined to make it right.” In prepared testimony reviewed by Bloomberg, he’ll say that the railroad has committed to $20 million in reimbursements and other payments in East Palestine and is urgently working to remove waste from the area. More in Congress section, including a link to a Washington Post commentary item penned by Shaw.

House members receive CBO briefing on debt. House Republicans and Democrats showed no sign of surrendering their positions after a briefing on the nation’s over $31 trillion debt on Wednesday. The closed-door meeting for House of Representatives members was meant to establish a common set of facts for the debate from the director of the nonpartisan Congressional Budget Office, Phillip Swagel, who has warned that the federal debt will surpass the size of the U.S. economy within the next decade if no steps are taken.

U.S. jobless claims rise to 2-1/2-month high. The number of Americans filing for unemployment benefits jumped to 211,000 last week, the most since December 24, and above market expectations of 195,000. The latest report came on the heels of stronger-than-expected private payroll and job opening data, which pointed to a still-tight labor market. Investors now await Friday's payroll numbers.

Canada joined the U.S. in consultations on Mexico’s GMO corn import ban decree. More in Trade Policy section. Meanwhile, Canada also made clear it will firmly oppose “any proposition from the U.S. to renew a mandatory country-of-origin labeling system for pork and beef,” said the nation’s trade and agriculture ministers in response to a proposed USDA overhaul of the voluntary Product of USA label.

U.S. officials are probing whether a pro-Ukrainian group had a role in the attack on the Nord Stream natural-gas pipeline. A senior official said the assessment isn’t definitive, but it adds to the growing sense among investigators in the U.S. and Europe that neither Russian government nor pro-Russian operatives were behind last year’s attack on the pipeline in the Baltic Sea. Link to more via the Wall Street Journal.

The personal data of House members and staff was compromised due to a recently uncovered security breach of healthcare group DC Health Link, House leadership said. More in Congress section.

|

MARKET FOCUS |

Equities today: Global stock markets were mixed to weaker overnight. U.S. Dow opened around 140 points higher. In Asia, Japan +0.6%. Hong Kong -0.6%. China -0.2%. India -0.9%. In Europe, at midday, London -0.8%. Paris -0.6%. Frankfurt -0.5%.

U.S. equities yesterday: The Dow ended down 58.06 points, 0.18%, at 32,798.40. The Nasdaq rose 45.67 points, 0.40%, at 11,576.00. The S&P 500 was up 5.64 points, 0.14%, at 3,992.01.

Agriculture markets yesterday:

- Corn: May corn dropped 8 3/4 cents to $6.25 1/2, marking the lowest close since March 1.

- Soy complex: May soybeans rose 2 1/4 cents to $15.17 3/4. May soybean meal saw losses of $2.10 and closed near the low at $485.70. March soyoil saw corrective buying today, finishing 42 points higher at 59.08 cents.

- Wheat: May SRW wheat fell 10 1/2 cents to $6.87 1/2 and nearer the session low. May HRW wheat rose 1 cent to $8.00 1/4 and near mid-range. Both markets hit new contract lows in the May futures. May spring wheat fell 14 1/4 cents to $8.38 1/2.

- Cotton: May cotton fell 15 points to 82.62 cents, ending the session below the 100-day moving average.

- Cattle: April live cattle fell 52 1/2 cents to $165.45 and near mid-range. May feeder cattle gained $1.95 at $206.15, near the session high and hit another contract high.

- Hogs: Nearby April hog rallied 95 cents to $85.75 but stalled at overhead resistance. The cash and wholesale pork markets continued climbing, with pork cutout surging $1.49 to $88.51.

Ag markets today: Corn and soybeans traded higher overnight, while the wheat market turned mixed this morning after corrective gains earlier in the session. As of 7:30 a.m. ET, corn futures were trading 1 to 3 cents higher, soybeans were 4 to 8 cents higher, SRW wheat was narrowly mixed, HRW wheat was steady to a penny lower and HRS wheat was mostly 6 to 7 cents higher. Front-month crude oil futures were trading just above unchanged, and the U.S. dollar index is around 250 points lower.

Technical viewpoints from Jim Wyckoff:

On tap today:

• U.S. jobless claims are expected to have risen to 195,000 in the week ended March 4. (8:30 a.m. ET) UPDATE: We previously updated the report’s information.

• USDA Weekly Export Sales report, 8:30 a.m. ET.

• Federal Reserve Vice Chair for Supervision Michael Barr speaks at the Peterson Institute for International Economics. (10 a.m. ET)

Fed Chair Jerome Powell said no decision has been made on the size of this month’s rate increase, telling a House panel Wednesday that it’ll hinge on incoming job and inflation numbers. He reiterated the Fed will probably hike more and potentially faster if data warrant and again urged lawmakers to raise the debt ceiling.

A question from Rep. Ayanna Pressley (D-Mass.) to Powell was about interest rates. She asked: “To prevent a recession, will you pause future interest rate hikes?” Powell responded: “We’re not seeking to have a recession, and we don’t think we need to have a recession.”

Traders are now pricing in a 76% probability of a 50-basis-points hike in March, up from 31% a week ago, according to CME’s FedWatch tool. Some analysts now see the federal-funds rate peaking at 6%.

Friday’s Employment and next Tuesday’s CPI report are key. Analysts say the Fed will need a surprisingly soft jobs number, and/or a significant fall in inflation next week to change the current narrative. Numbers to keep in mind are: 207,500 (the amount of jobs economists expect were added in February); and 5.9% (the level to which they see the annual rate of inflation falling).

Citadel chief Ken Griffin says a downturn is looming. Griffin last year pocketed $4.1 billion in earnings after his hedge fund's record year. Household savings are shriveling and surging interest rates are choking growth, he told Bloomberg on Wednesday. Consumers had saved up a large chunk of cash during the pandemic, but the subsequent excess spending has spurred higher inflation and put pressure on the Fed to tighten policy. "We have the setup for a recession unfolding," the billionaire investor said.

He called for the Fed to be clearer and more consistent with its messaging, and to stifle any hopes of easing policy. "Every time they take the foot off the brake — or the market perceives they're taking their foot off the brake — and the job's not done, they make their work even harder," Griffin said.

Beige Book update. A Federal Reserve survey of business anecdotes from around the country found that economic activity remained reasonably strong at the start of the year. The Fed’s Beige Book reported that half the 12 regional banks saw expanding activity while the other half saw little change. Retail sales picked up in some places during what is typically a slow time of year. Travel and tourism remained strong, and manufacturing appeared to stabilize after a period of contraction. But inflation and high interest rates continued to drag on growth, the report said.

U.S. ag imports surged by $1.31 billion in January, to $17.11 billion, causing a slight trade deficit. U.S ag exports eased slightly to $17.02 billion in January compared with $17.,03 billion in December. That left a trade deficit of $85 million for the month. Ag imports were $15.80 billion in December.

For the first four months of fiscal year (FY) 2023, ag imports total $69.06 billion versus imports of $66.05 billion, for a surplus of $3.01 billion.

USDA’s forecast for FY 2023 trade is for exports of $184.5 billion and imports of $199 billion for a trade deficit of $14.5 billion. USDA’s forecasts signal exports are not poised to match the results from FY 2022.

Market perspectives:

• Outside markets: The U.S. dollar index was lower. The yield on the 10-year U.S. Treasury note was higher, trading around 4%, with a mixed tone in global government bond yields. U.S. crude was trading around $76.60 per barrel and Brent around $82.70 per barrel. Gold and silver futures were narrowly mixed, with gold firmer around $1,820 per troy ounce and silver weaker around $20.14 per troy ounce.

• Exchange slashes Argentine soybean, corn crop forecasts. The Rosario Grain Exchange slashed its estimate of Argentina’s soybean crop by 7.5 MMT to 27 MMT. That would be the smallest crop since the country produced 21.2 MMT of soybeans in 1999 — and warned there could be additional crop losses if temps don’t moderate and there aren’t timely late-season rains. The exchange also slashed its corn crop forecast by 7.5 MMT to 35 MMT. “Argentina is suffering from a climate scenario without precedent in modern agriculture,” the exchange said. “There are no weather conditions on the horizon which allow us to offer an estimated minimum for the harvest.”

• Ag trade: Japan purchased 80,570 MT of milling wheat in its weekly tender, including 50,970 MT of U.S. and 29,600 MT Canadian. Algeria purchased 200,000 MT of durum wheat, with more purchases possible. Saudi Arabia tendered to buy 480,000 MT of wheat.

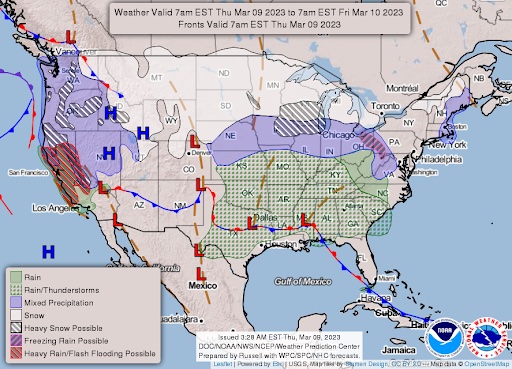

• NWS weather outlook: Threat of heavy rain, flooding, and heavy high-elevation snow for the West as an Atmospheric River impacts the region... ...Moderate to locally heavy snowfall accumulations will spread from the Northern/Central Plains into the Great Lakes and Appalachians Thursday-Friday... ...Shower and thunderstorm chances with locally heavy rainfall continue for the Southern Plains and Lower Mississippi Valley Thursday; precipitation chances increase for the East Coast Friday

Items in Pro Farmer's First Thing Today include:

• Soybeans and corn firmer, wheat mixed

• Brazil trims soybean crop estimate, raises corn production forecast

• Ukraine’s grain production could fall 37% this year (details in Russia/Ukraine section)

• Choice beef price drop attracts buying

• Methodical climb in cash hog index continues

|

RUSSIA/UKRAINE |

— Summary: Russia unleashed “a massive rocket attack” that hit critical infrastructure and residential buildings in 10 regions of Ukraine, with officials reporting at least six deaths. President Volodymyr Zelenskyy described the barrage as an attempt by Moscow “to intimidate Ukrainians again.” EU defense ministers said they would propose spending at least $1.1 billion on ammunitions for Ukraine, giving Kyiv more ammunition from EU members’ stocks and using bloc funding to help replenish those supplies, when national leaders meet at a summit later this month. Separately, South Korea said it had approved the export of its weapons components to Ukraine last year, as the country faces pressure to provide military aid directly to Kyiv.

- Zelenskyy invites McCarthy. Ukrainian President Volodymyr Zelenskyy asked U.S. House Speaker Kevin McCarthy (R-Calif.) to come to Ukraine to see “how we work, what’s happening here, what war caused us, which people are fighting now, who are fighting now,” CNN reported. “And then after that, make your assumptions,” Zelenskyy added. As the Republican Party debates the future of U.S. aid to Ukraine, McCarthy — while expressing his support for Kyiv — has said that they won’t write a “free blank check” for it. In response to Zelenskyy’s invitation, McCarthy doubled down on his statements, telling CNN: “I don’t have to go to Ukraine to understand where there’s a blank check or not.”

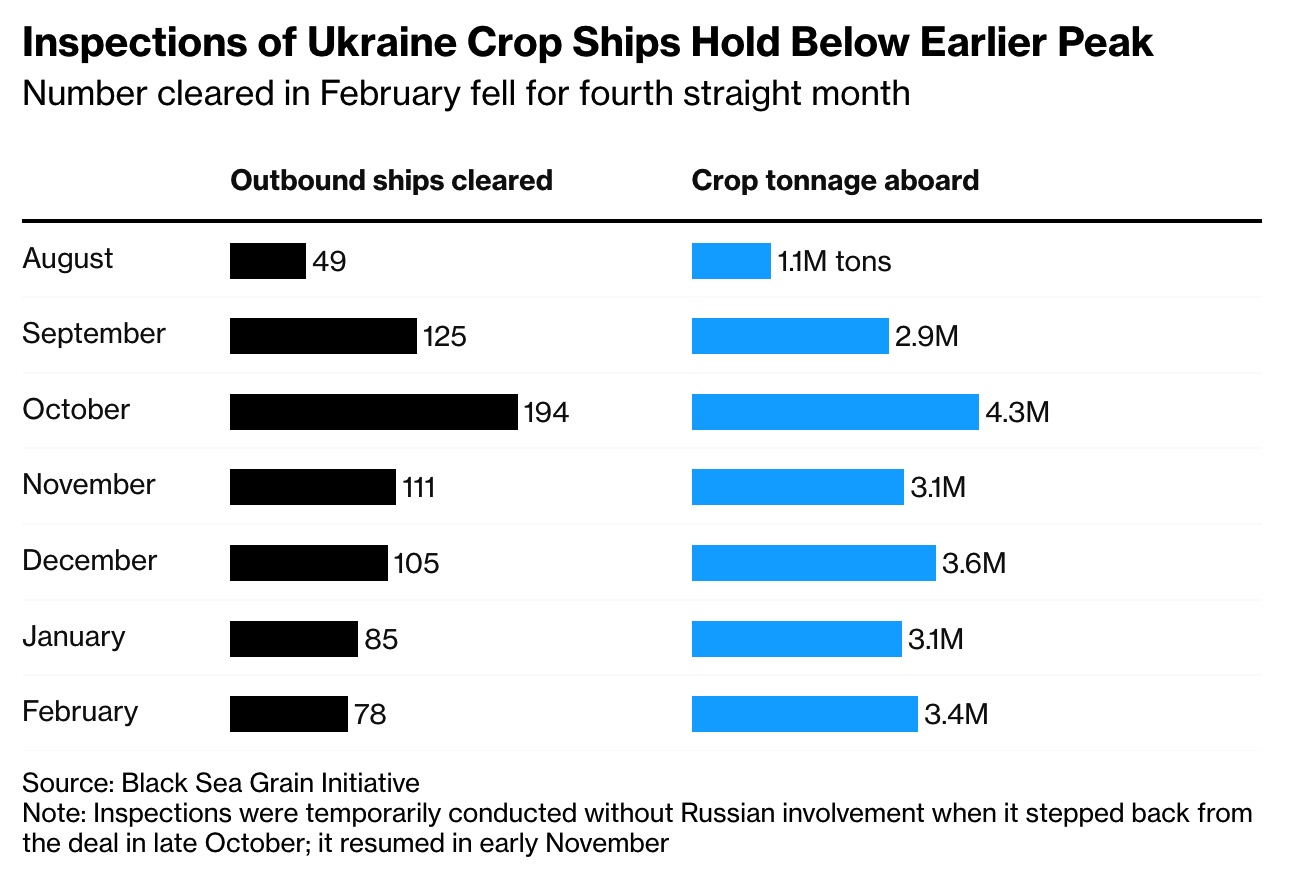

- Most expect extension of Ukraine grain export deal. The current agreement runs through March 18 and can be continued for another 120 days if no side seeks to modify or terminate the pact. The United Nations on Wednesday stressed how critical the deal is, and Kyiv and Moscow have voiced demands with talks underway.

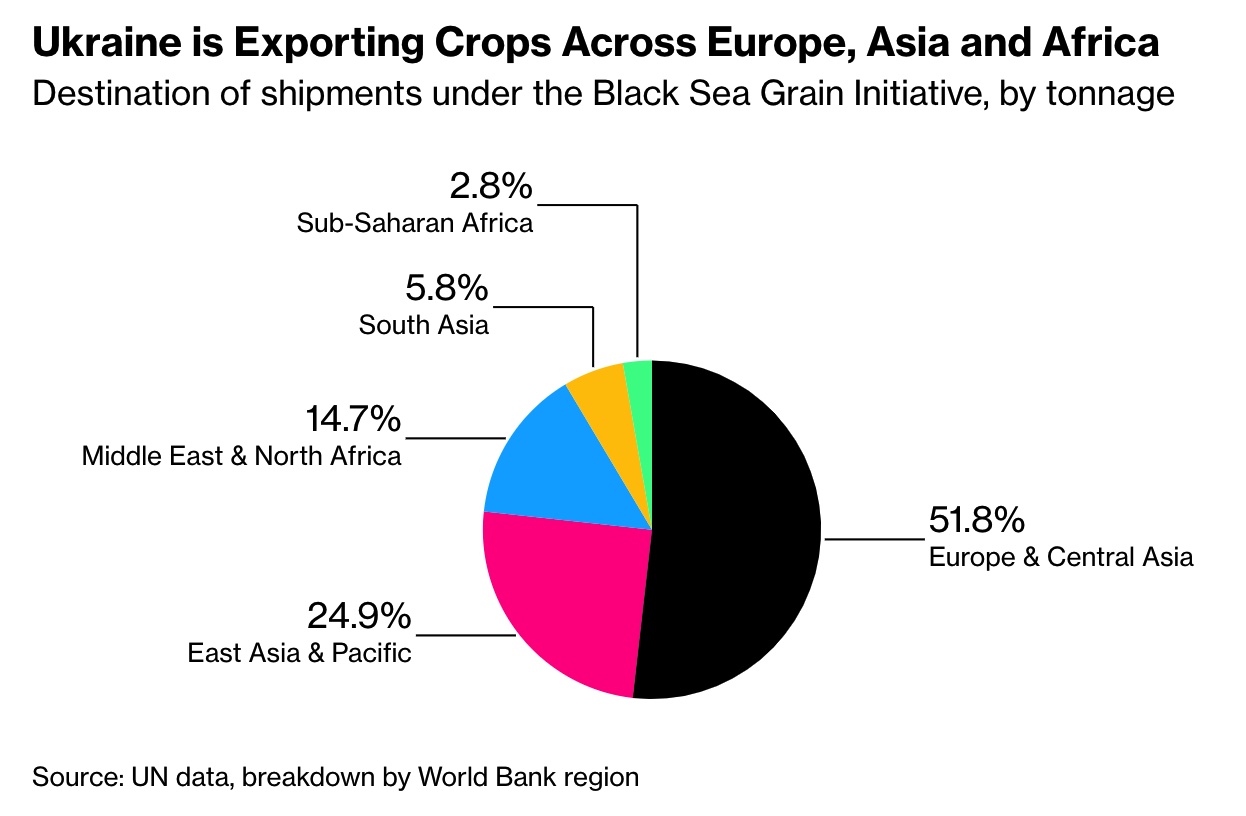

Russia said there is still a ‘a lot of questions’ with Black Sea grain deal. The Kremlin said on Thursday there were still “a lot of questions” remaining over the Black Sea grain deal, and that there were currently no plans for talks between President Vladimir Putin and U.N. Secretary-General Antonio Guterres. “There are still a lot of questions about the final recipients, questions about where most of the grain is going. And of course, questions about the second part of the agreements are well known to all,” Kremlin spokesman Dmitry Peskov said. The “second part” of the deal refers to a memorandum of understanding with the U.N., which facilitates Russian food and fertilizer exports.

Ukraine has shipped 23 million tons since the deal was first struck in July, though volumes are still down about a quarter from last year, according to Bloomberg analysis. The major holdup has been inspections for vessels heading in and out of the three ports covered by the agreement. Only about three outbound ships are cleared each day, limiting the initiative from reaching its 5-million-ton monthly target. Ukraine says Russia is purposefully slowing the pace, something Moscow denies.

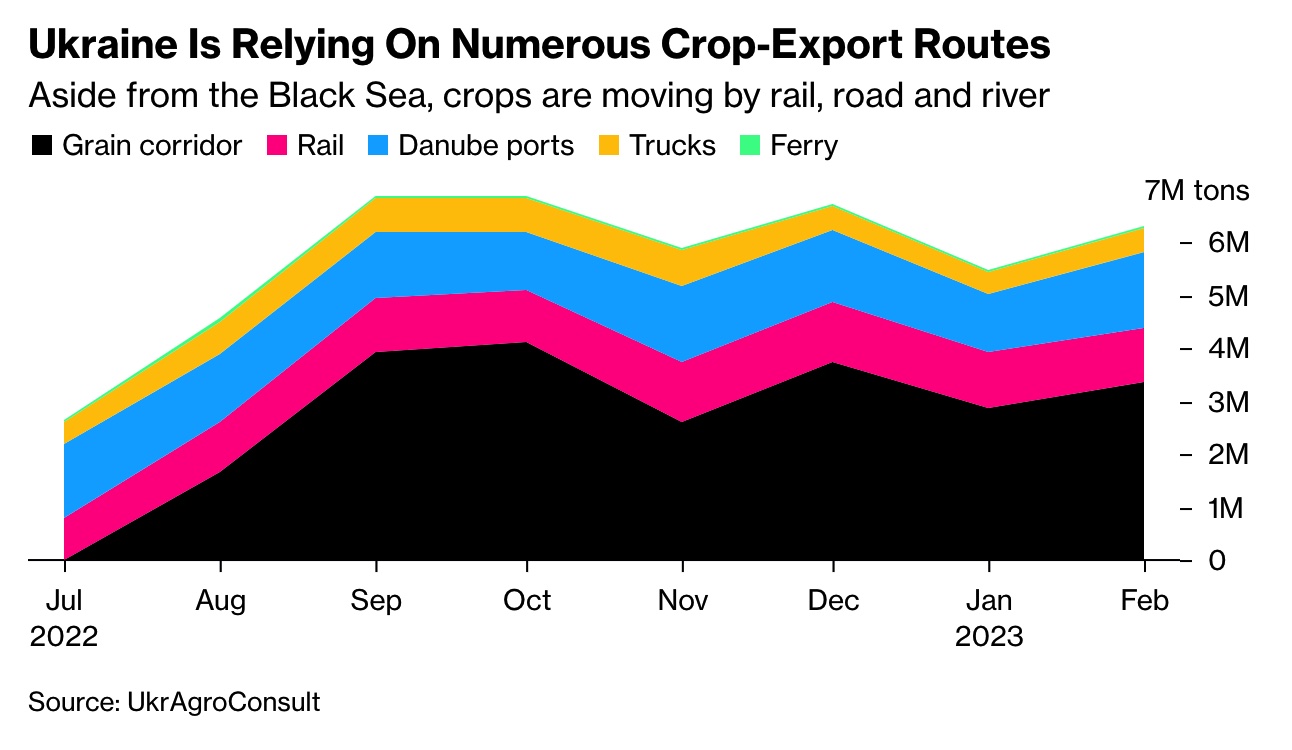

Ukraine is still moving grain by rail, road and river — routes turned to when its Black Sea terminals were blocked at the start of the war. It will keep using those avenues if Black Sea trade gets disrupted, but they can’t handle all flows and are a costly alternative.

— Ukraine’s grain production could fall 37% this year. Ukrainian grain harvest may fall 37% to 34 MMT in 2023 because of a smaller grain sowing area and lower yield, Ukraine's national academy of agricultural science said. The academy also said a possibly larger area under oilseeds could result in a 13% rise in Ukraine’s oilseed harvest, which it said could reach 19.3 MMT. The scientists said in a report that based on preliminary estimates, Ukraine would face a 45% reduction in the area seeded to grains, while yields could decline 15% to 30% from last year.

|

POLICY UPDATE |

— President Biden’s FY 2024 budget proposals released today will be a political document designed to reveal what GOP conservatives seek to take away and the potential U.S. default they are threatening if the House keeps insisting on big reductions in spending. The president’s blueprint will not become law. It’s an opening bid at the start of lengthy negotiations heading into the summer and fall if not longer.

Biden says nearly $3 trillion in proposed measures would reduce deficits over 10 years. As expected, proposed tax increases, opposed by conservatives, play a big role in the president’s revenue math.

- Biden wants a 5.2% pay raise for federal workers. It would fall short of the 8.7% raise called for in legislation introduced in the House and Senate and backed by several Democrats and federal employee unions.

- Biden will push a 25% billionaire tax on the richest 0.01% of Americans, levies on rich investors and companies.

- The budget would close a loophole that allows some wealthy investors with "passthrough businesses" to avoid paying tax on their investments.

- It would increase the top tax rate for Americans making $400,000 a year to 39.6% from 37%, reversing a Trump-era tax bill.

- The budget sets the corporate tax rate at 28% — still well below the 35% rate that prevailed prior to the 2017 tax law, a White House official said.

- The president’s budget plan includes hundreds of billions of dollars in proposed savings through lower drug prices, some higher business taxes, anti-fraud vigilance and less “wasteful” spending, according to White House aides.

- The president will propose a defense budget of $835 billion, higher than last year's due to the ongoing war in Ukraine and rising tensions with China.

Upshot: Democrats in the House and Senate aren’t sure they’ll produce their own budget documents, saying they’ll review Biden’s proposal and only draft their own resolutions if they need to take a different approach from the president.

Under House Budget Committee Chairman Jodey Arrington (R-Texas), GOP leaders will present a competing budget in the coming weeks that is expected to cut as much as $150 billion in the upcoming fiscal year from domestic programs, sparing defense, Social Security and Medicare. They’ve promised steep cuts beginning next fiscal year in a blueprint that could erase the deficit within a decade. To do that, they need to identify roughly $16 trillion in savings. Some conservatives are pushing for greater savings in fiscal 2024, perhaps as much as $200 billion.

|

PERSONNEL |

— Northwestern professor Janice Eberly is the favorite to succeed Lael Brainard as Fed vice chair though no final decision has been made, Bloomberg reports. She served as chief economist at the Treasury under Barack Obama. Bloomberg Economics said she’d be a dovish voice. Eberly is a Northwestern University professor who was a senior economist in the Obama administration.

— The Senate today will vote on confirmation of Danny Werfel to be commissioner of the Internal Revenue Service and James Edward Simmons Jr. to be a judge for the Southern District of California. The Senate also will vote on confirmation of Maria Araujo Kahn to be a judge for the Second Circuit Court of Appeals.

— New chief counsel for Schumer. Senate Majority Leader Chuck Schumer (D-N.Y.) is hiring Evan Turnage, former senior counsel for Sen. Elizabeth Warren (D-Mass.), to serve as his new chief counsel. Turnage, who will join Schumer's office later this week, specializes in antitrust and competition and may signal a new push from the Senate to pursue antitrust reforms aimed at Big Tech companies.

|

CHINA UPDATE |

— China ‘open’ to visit by U.S. Commerce Secretary Gina Raimondo, trade ties ‘very important’ despite tensions. The Ministry of Commerce in Beijing said on Wednesday that it was “open” to a visit by Raimondo after she said last week that she was considering visiting China. Raimondo said last week that she was considering visiting China, stressing communication remains a priority to de-escalate tensions with Beijing. Relations between mainland China and the U.S. are in a stalemate over various issues, including security, Taiwan and advanced technology, but trade between the world’s two largest economies remains strong. In 2022, U.S. exports to China increased by $2.4 billion to $153.8 billion and imports from China increased by $31.8 billion to $536.8 billion, according to the U.S. Bureau of Economic Analysis.

Yellen visit? China’s Ministry of Commerce also said last month that it would welcome a visit by U.S. Treasury Secretary Janet Yellen. She had also expressed an interest to visit China to discuss economic issues with her Chinese counterparts despite the cancellation of Blinken’s planned trip to Beijing.

Meanwhile, the 2023 trade policy agenda and 2022 annual report released by the Office of the U.S. Trade Representative (USTR) last week described the trade relationship with China as “complex and competitive,” pointing out that the Bipartisan Infrastructure Law, the Chips and Science Act and the Inflation Reduction Act all allow the U.S. to compete with China from “a position of strength.”

— China inflation lowest in a year. China's annual inflation rate fell to 1.0% in February 2023 from 2.1% in January, missing market forecasts of 1.9%. This was the lowest print since February 2022, with prices of food and non-food slowing sharply, as consumers remained cautious despite the removal of zero-Covid policy. Meantime, producer deflation extended into a fifth month.

— The Netherlands agrees to restrict chip making exports to China. The move, made on national security grounds, will bolster U.S. efforts to deny Beijing access to advanced semiconductor technology. Relatedly, Chinese AI companies are using subsidiaries and cloud computing partners to skirt export controls, according to the Financial Times.

— FBI Director Chris Wray told the Senate Intelligence Committee that the Chinese government has the ability to control software on millions of devices and could control the data of millions of users because of its relationship with TikTok parent company ByteDance Ltd. Wray also warned that the Chinese government could drive narratives on TikTok by controlling what content is shared with users with little to no "outward signs of it happening."

|

TRADE POLICY |

— Canada joins U.S. in requesting USMCA talks with Mexico on GMO ban. Canada asked for formal consultations with Mexico over the Latin American nation’s restrictions on genetically modified agricultural imports under their USMCA trade accord, following a separate request by the U.S. focused on corn earlier this week.

Canada is not a major corn exporter and has not shipped any corn to Mexico since August, according to data from the Canadian Grain Commission, whereas the U.S. counts the Latin American country as its second-largest market for corn.

But Canada is concerned overall about Mexico putting arbitrary prohibitions on agriculture produced using biotechnology. Canada is the world’s top producer and exporter of canola, a genetically modified crop that is used in everything from deep-frying to salad dressing, with Mexico one of the top buyers.

— Canada will firmly oppose “any proposition from the U.S. to renew a mandatory country-of-origin labeling system for pork and beef,” said the nation’s trade and agriculture ministers in response to a proposed USDA overhaul of the voluntary Product of USA label. Link for details.

|

ENERGY & CLIMATE CHANGE |

— “The vast majority of the heavy lifting for electrification will be iron-based cells.” — At Tesla's recent investor day, Elon Musk predicted that the kind of lithium-ion batteries that are currently ubiquitous in electric vehicles will be displaced by cheaper alternatives.

— Carbon capture has bipartisan backing, shaky track record. The U.S. set aside $62 billion over five years for carbon capture and storage projects as part of a 2021 infrastructure package, despite a previous investment of $1.1 billion in 2009 producing limited results. Trapping carbon emissions from industrial processes, such as cement and steel production, for reuse may play a critical role in meeting climate targets, however, and the technology continues to have bipartisan support in Washington while implementation at scale remains elusive. Link to details from Roll Call.

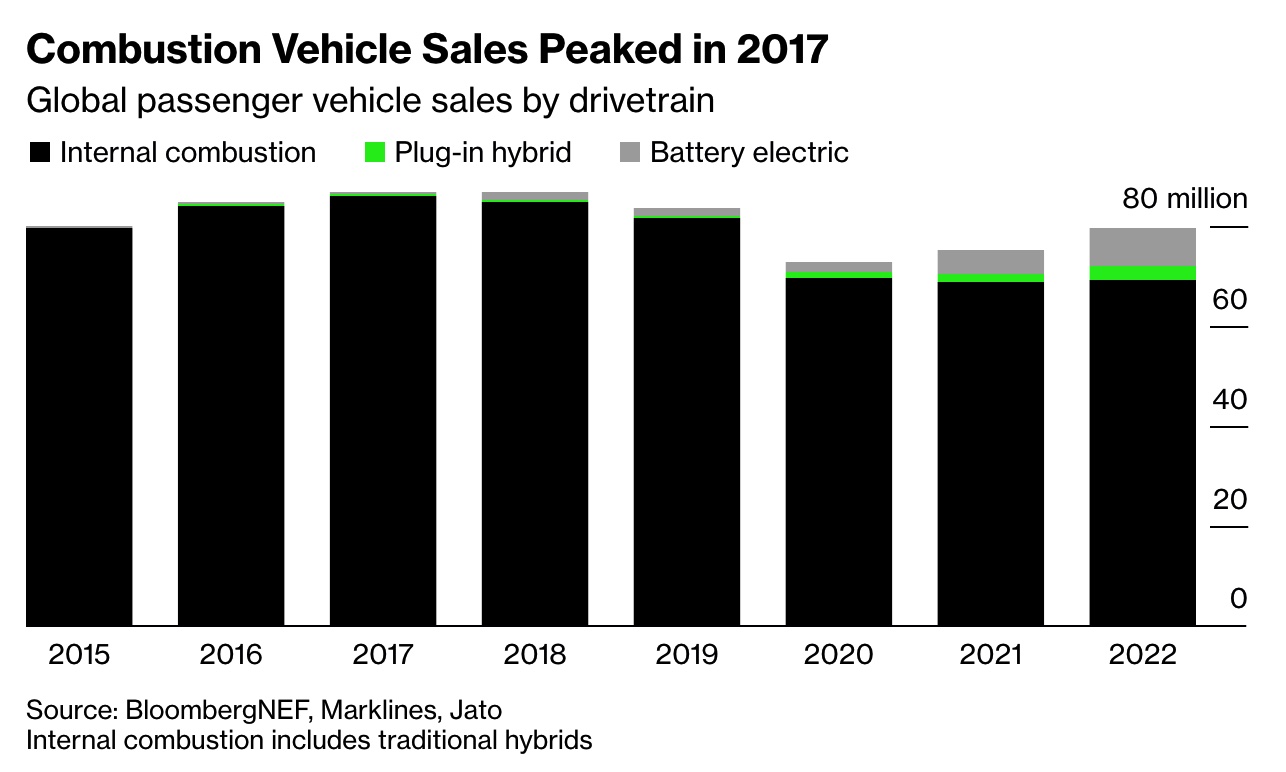

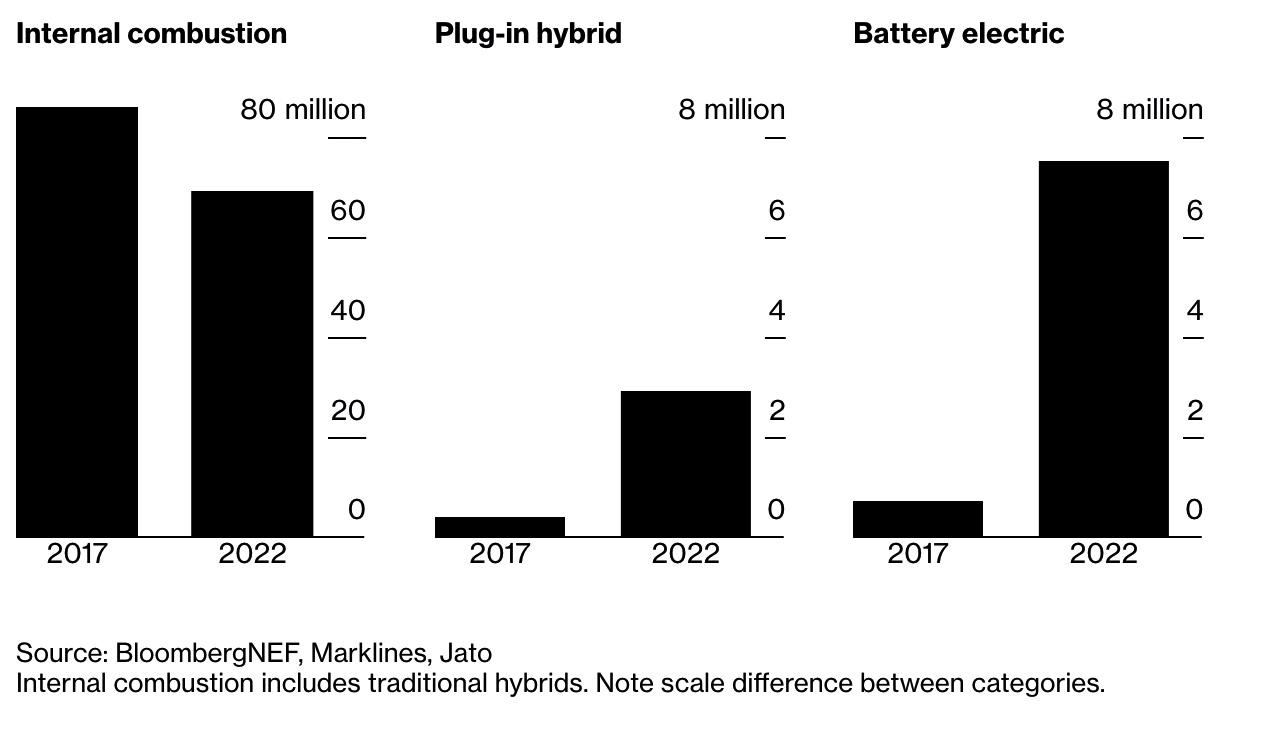

— The global market for internal combustion engines has peaked with big implications for the future of oil demand and emissions, says BNEF analyst Colin McKerracher. It’s becoming clearer that vehicles burning gas and diesel are unlikely to ever get back to the level reached in 2017. Link to details via Bloomberg.

— The U.S. and Europe pursuing a compromise on climate subsidies. The two sides are in talks over a potential trade deal that would allow European companies to qualify for some benefits under the Inflation Reduction Act, the NYT reports (link). The EU has repeatedly said that climate-related subsidies from the law could hurt European companies.

Meanwhile, the U.K. is also in talks with the U.S. to limit damage from a wave of green subsidies, Bloomberg reports (link).

— The coming EV batteries will sweep away fossil fuel transport, with or without net zero. Link to exclusive extract from the Telegraph’s Economic Intelligence newsletter. Highlights:

“The Argonne National Laboratory in the U.S. has essentially cracked the battery technology for electric vehicles, discovering a way to raise the future driving range of standard EVs to a thousand miles or more. It promises to do so cheaply without exhausting the global supply of critical minerals in the process.

“The joint project with the Illinois Institute of Technology (IIT) has achieved a radical jump in the energy density of battery cells. The typical lithium-ion battery used in the car industry today stores about 200 watt-hours per kilo (Wh/kg). Their lab experiment has already reached 675 Wh/kg with a lithium-air variant.

“This is a high enough density to power trucks, trains, and arguably mid-haul aircraft, long thought to be beyond the reach of electrification. The team believes it can reach 1,200 Wh/kg. If so, almost all global transport can be decarbonized more easily than we thought, and probably at a negative net cost compared to continuation of the hydrocarbon status quo.”

— The Energy Department unveiled a $6 billion program that aims to decarbonize industrial emissions from the production of concrete, steel, chemicals and other materials, providing up to half of the cost for as many as 55 first-of-a-kind or early-stage emissions reduction projects by 2025. The program, called the Industrial Demonstrations Program, is backed by 12 states that have pledged to use the lower-emission materials in state-funded infrastructure projects.

|

LIVESTOCK, FOOD & BEVERAGE INDUSTRY |

— Bullish outlook for the meat marketplace. Link to Winsight Grocery Business’ conversation with the North American Meat Institute’s Julie Anna Potts and 210 Analytics’ Anne-Marie Roerink at this week's Annual Meat Conference about the industry's tailwinds, headwinds and future.

— Biden administration considering mass vaccination of U.S. poultry in response to lingering outbreak of avian flu that has killed off millions of birds and has helped spike egg and poultry costs. There are some existing vaccines for farm birds, but USDA spokesman Mike Stepien told the New York Times recently that no vaccination effort has been authorized and the department is unsure if the existing vaccines will be effective against the current strain of H5N1 bird flu. Erica Spackman, a researcher for the USDA’s Agricultural Research Service, told the newspaper that scientists are researching new vaccine candidates to help curb the ongoing bird flu outbreak.

— The cost of food ingredients is down, but grocery bills are still up. This in part is because food producers, which started raising prices a few years ago, have other expenses that remain pricey — like labor and transportation. But critics and industry experts say the cost increases during the pandemic gave food makers cover to hike prices above what those increases called for, boosting profits and correcting what they saw as too-low prices in previous years. Between January 2022 and January 2023, groceries got 11.3% more expensive.

Many food companies are forecasting that they might slow down or pause price increases — but not lower them. "Companies view these as occasional opportunities, and they don't want to miss out," said Jean-Pierre Dubé, a marketing professor at the University of Chicago.

|

HEALTH UPDATE |

— Summary:

- Global Covid-19 cases at 676,420,430 with 6,880,217 deaths.

- U.S. case count is at 103,755,433 with 1,123,299 deaths.

- Johns Hopkins University Coronavirus Resource Center says there have been. The Johns Hopkins University Coronavirus Resource Center said that there have been 672,076,105 doses administered, 269,554,116 have received at least one vaccine, or 81.81% of the U.S. population.

|

POLITICS & ELECTIONS |

— 51,465 is how many votes Libertarian Party nominee Jo Jorgensen won in Arizona in the 2020 presidential race, roughly five times greater than Biden’s margin of victory in the battleground state, NBC News notes. It’s a number that’s worth remembering now that the group No Labels, which promotes bipartisanship, has gained access to the ballot in Arizona to potentially run a third-party presidential candidate under the “No Labels Party.” The group has also gained access to the ballot in Colorado, and is working to do so in other states.

|

CONGRESS |

— Senate voted 81-14 Wednesday in favor of a GOP-led resolution to nullify a Washington, D.C., crime reform law that would have eased punishments for some violent crimes including carjacking. Thirty-three Democrats, including Majority Leader Chuck Schumer (D-N.Y.), joined every Republican senator to back the measure. President Biden has said he will not veto the measure, upsetting some Democrats. Democrats' fear of Republican "soft on crime" criticism in 2024 trumped their push for the local autonomy of D.C. and the 700,000 residents who live there.

— Sen. Fetterman is working from the hospital. Sen. John Fetterman’s (D-Pa.) chief of staff Adam Jentleson tweeted, “Productive morning with Senator Fetterman at Walter Reed discussing the rail safety legislation, farm bill and other Senate business. John is well on his way to recovery and wanted me to say how grateful he is for all the well wishes. He’s laser focused on PA & will be back soon.”

— Norfolk Southern CEO Alan Shaw is set to testify today to the Senate Environment and Public Works Committee. Shaw plans to tell lawmakers he’s sorry for the train wreck that spilled toxic chemicals in Ohio last month and the company is “determined to make it right.” Shaw said in prepared testimony that the railroad has committed to $20 million in reimbursements and other payments in East Palestine and is urgently working to remove waste from the area. While Shaw and officials have said it’s safe to return to East Palestine, the town most affected by the disaster, residents and cleanup workers have reported rashes, sore throats and other illnesses. No fatalities have been reported.

Link to a commentary item Shaw wrote that’s in the Washington Post.

— The House Ways and Means Committee is set to mark up a bill to require officials to prioritize payments if the federal government hits the debt limit. The measure (HR 187), introduced by Rep. Tom McClintock (R-Calif.), would let the government keep borrowing to make payments on previous debt and keep making Social Security payments. GOP consideration of the measure illustrates Republicans’ preparation for a tense standoff with Biden on the debt limit, but it does not appear to have much support among Democrats.

“That stuff is too cute by half, will have virtually zero support among Democrats — and with the majority leader here in the Senate — and does nothing to change the accountability of Republicans for the damage that ensues if the grenade that they’re playing with goes off,” Senate Budget Chair Sheldon Whitehouse (D-R.I.) told reporters Tuesday.

— House members’ personal data exposed in health data breach. House Chief Administrative Officer Catherine Szpindor, who yesterday said that personal identifiable information of hundreds of members of Congress and staff were stolen in a significant data breach, is set to appear before the House Administration Subcommittee on Modernization. Information exposed in the breach included "full names, date of enrollment, relationship (self, spouse, child), and email address, but no other Personally Identifiable Information (PII)," and it is believed that lawmakers were not specifically targeted in the attack.

|

OTHER ITEMS OF NOTE |

— South Korean President Yoon Suk Yeol and his wife will visit Japan next week at Tokyo's invitation, the first such visit in 12 years after Seoul announced a plan to end a protracted dispute over wartime forced labor.

— Woke defined. Some 56% of Americans surveyed say the term “woke” means "to be informed, educated on, and aware of social injustices," while 39% say instead that the word means "to be overly politically correct and police others' words."

|

KEY LINKS |

WASDE | Crop Production | USDA weekly reports | Crop Progress | Food prices | Farm income | Export Sales weekly | ERP dashboard | California phase-out of gas-powered vehicles | RFS | IRA: Biofuels | IRA: Ag | Student loan forgiveness | Russia/Ukraine war, lessons learned | Russia/Ukraine war timeline | Election predictions: Split-ticket | Congress to-do list | SCOTUS on WOTUS | SCOTUS on Prop 12 | New farm bill primer | China outlook | Omnibus spending package | Gov’t payments to farmers by program | Farmer working capital | USDA ag outlook forum |