CBO Forecasts Huge and Growing Annual Cost of Servicing Bulging U.S. Debt

Debt-related budget cuts ahead for farm programs, other entitlements, but timeline unclear

|

In Today’s Digital Newspaper |

China had warned of retaliation over the downing of a balloon earlier this month, but the latest salvo in tension-filled U.S.-Sino relations is coming over arms sales to Taiwan. Beijing has imposed sanctions on Lockheed Martin and a subsidiary of Raytheon Technologies by adding them to a so-called "unreliable entity list" that aims to punish firms that jeopardize its national security.

Valery Zaluzhny, head of Ukraine’s armed forces, said that Russia fired 36 missiles at his country on Wednesday night. Russia said it had broken through two of Ukraine’s defense lines in the east and pushed its troops back. Ukraine denied the claim and said it is inflicting heavy losses on enemy troops. On Wednesday, NATO allies pledged more military support ahead of its spring counter-offensive.

David Malpass will step down as president of the World Bank by June, nearly a year before his five-year term ends. Appointed by the Trump administration, Malpass was criticized last autumn for initially refusing to state that human activity had contributed to global warming. U.S. Treasury Secretary Janet Yellen recently demanded that the World Bank take “bolder and more imaginative” steps to tackle climate change.

Austan Goolsbee is in the running for the Fed’s vice chair post. President Biden is reportedly considering the Chicago Fed president to replace Lael Brainard, who is the president’s new top economic adviser. Brainard was an influential monetary policy dove; Goolsbee’s position on interest rates is more centrist.

Several new farm bill items are in play. See Policy section for details.

U.S. and Europe are hoping to use critical minerals to patch up a rift over EV subsidies while reducing reliance on China. See Energy section for more.

More than a week after a 150-car Norfolk Southern train left the track and sent chemicals into the air, ground and creeks, many people in and around East Palestine, Ohio, are concerned about contamination, distrustful of railroad and government officials, and frustrated by what one resident called a lack of clarity about the risks. Air and water monitoring continues, and many residents said they worry about being back in their homes after the evacuation. Now, Norfolk Southern is under scrutiny from regulators, public officials and residents.

The U.S. antitrust complaint against Apple is ramping up. Justice Department officials began their investigation into Apple’s marketplace power, including its rules for developers in its app store, in 2019. According to the Wall Street Journal, they have been building up the team and requesting more documents in recent months, suggesting the department will decide on whether to file a lawsuit by the spring.

Walmart grocery shoppers in certain markets now have the option to have their orders delivered by drone.

|

MARKET FOCUS |

Equities today: Global stock markets were mostly higher. U.S. stock indexes are pointed toward slightly lower openings when the New York day session begins. In Asia, Japan +0.7%. Hong Kong +0.8%. China -1%. India +0.1%. In Europe, at midday, London +0.2%. Paris +1%. Frankfurt +0.5%.

U.S. equities yesterday: The Dow managed to gain 38.78 points, 0.11%, at 34,128.05. The Nasdaq rose 110.45 points, 0.92%, at 12,070.59. The S&P 500 was up 11.47 points, 0.28%, at 4,147.60.

Agriculture markets yesterday:

- Corn: March corn futures fell 6 cents to $6.76 1/4, near the session low.

- Soy complex: March soybeans fell 11 3/4 cents to $15.25 3/4, ending the session below the 10-day moving average, while Mach meal futures dropped $9.90 to $491.10 and March soyoil rose 84 points to 61.24 cents.

- Wheat: March SRW futures fell 16 3/4 to $7.69 1/4 near session lows. March HRW futures fell 11 1/2 cents to $8.94 1/2, while spring wheat fell 7 1/4 cents to $9.24 3/4.

- Cotton: March cotton futures lost 285 points to 82.55 cents. May cotton fell 283 points to close at 82.87 cents.

- Cattle: April live cattle fell 7 1/2 cents to $164.60 and nearer the session high. March feeder cattle gained 67 1/2 cents at $187.325 and near mid-range.

- Hogs: Hog futures gave back a sizeable portion of early-week gains, with nearby April falling 75 cents to $86.50.

Ag markets today: Corn, soybeans and SRW wheat faced light followthrough selling during overnight trade, while HRW and HRS wheat mildly rebounded. As of 7:30 a.m. ET, corn futures were trading around a penny lower, soybeans were 1 to 3 cents lower, SRW wheat was 2 to 4 cents lower, HRW wheat was mostly 1 to 3 cents higher and HRS wheat was 4 to 5 cents higher. Front-month crude oil futures were modestly firmer, while the U.S. dollar index is around 175 points lower.

Technical viewpoints from Jim Wyckoff:

On tap today:

• U.S. jobless claims are expected to rise to 200,000 in the week ended Feb. 11 from 196,000 one week earlier. (8:30 a.m. ET)

• U.S. Producer Price Index for January is expected to increase 0.4% from the prior month. (8:30 a.m. ET)

• U.S. housing starts are expected to fall to an annual rate of 1.35 million in January from 1.382 million one month earlier. (8:30 a.m. ET)

• Philadelphia Fed's manufacturing survey is expected to rise to minus 7.8 in February from minus 8.9 one month earlier. (8:30 a.m. ET)

• USDA Weekly Export Sales report, 8:30 a.m. ET.

• Federal Reserve speakers: Cleveland's Loretta Mester on monetary policy at 8:45 a.m. ET, St. Louis's James Bullard on the economic outlook at 1:30 p.m. ET, governor Lisa Cook to the Sadie Collective at 4 p.m. ET, and Mester on the economic outlook at 6:15 p.m. ET.

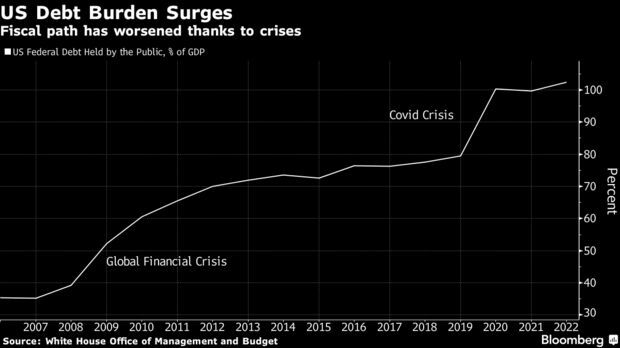

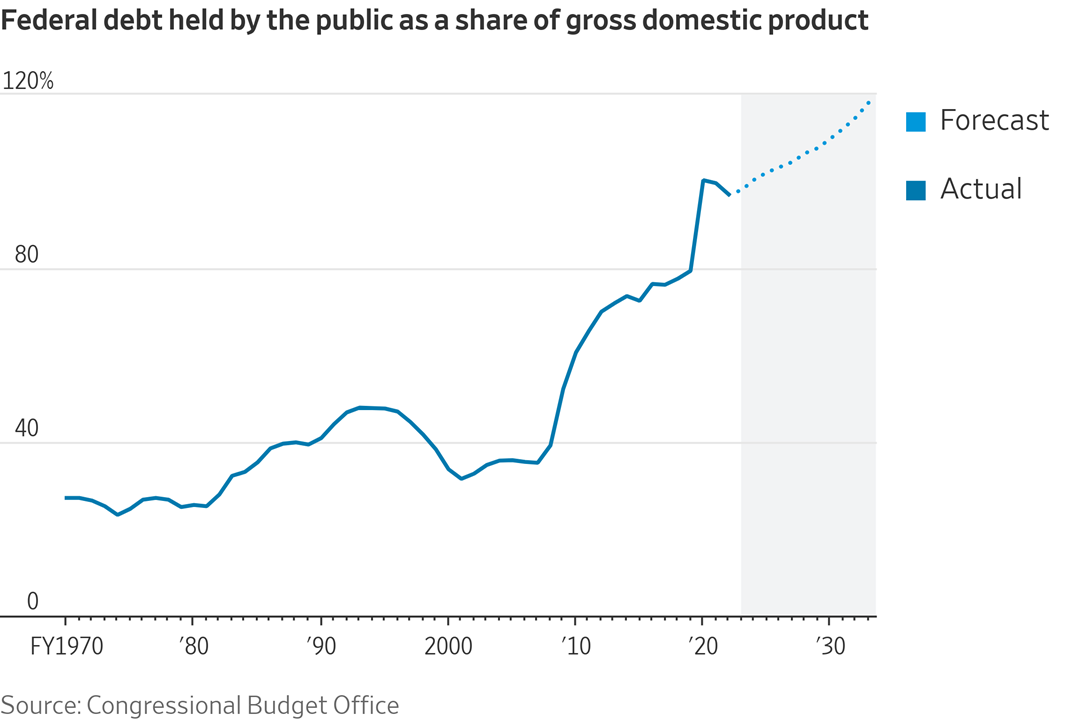

U.S. debt will increasingly become a major issue in Washington. The Congressional Budget Office (CBO) warned of a sharp deterioration in the federal budget and estimates the federal gov’t will exhaust its ability to borrow more money and will be in danger of defaulting on the national debt at some point between July and September, a tighter timeline than has been signaled by the Treasury Department. CBO said, “The projected exhaustion date is uncertain because the timing and amount of revenue collections and outlays over the intervening months could differ from CBO’s projections. In particular, income tax receipts in April could be more or less than CBO estimates. If those receipts fell short of estimated amounts — for example, if capital gains realizations in 2022 were smaller or if U.S. income growth slowed by more in early calendar year 2023 than CBO projected — the extraordinary measures could be exhausted sooner, and the Treasury could run out of funds before July.” Link to CBO report.

Upshot: CBO expects to revisit its projection in May after the current tax filing season closes and it has a clearer picture of how much federal tax revenue will come in this year. The office said that if receipts fall short of its estimates, the Treasury could run out of funds before July.

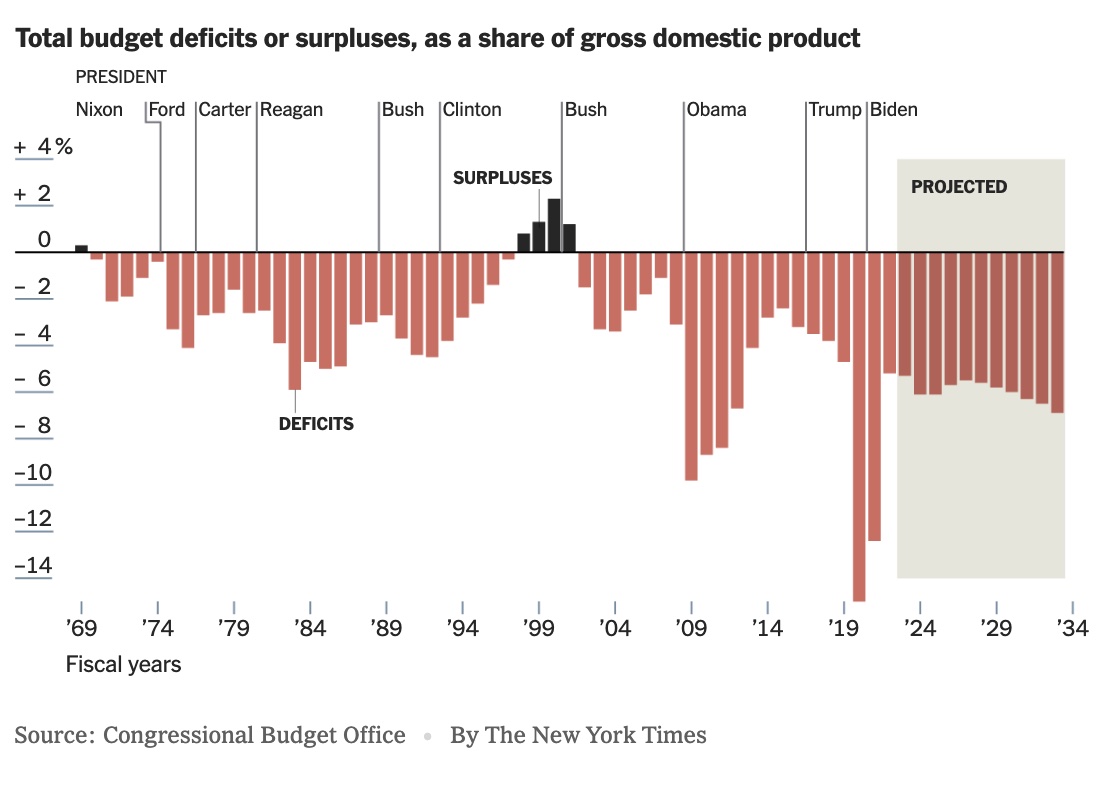

“Over the long term, our projections suggest that changes in fiscal policy must be made to address the rising costs of interest and mitigate other adverse consequences of high and rising debt,” CBO Director Phillip Swagel said in a statement. Among the stark figures released by the CBO Wednesday: The budget deficit for 2023 is now seen $426 billion worse than projected last May, at $1.41 trillion. Debt held by the public is seen climbing to $46 trillion by 2033, amounting to 118% of GDP — the highest in U.S. history. The budget office now predicts that federal interest costs will total $10.4 trillion over the next decade, up from $8 trillion. Those costs will be partially offset by about $1 trillion in increased tax revenues that stem from high inflation driving up nominal incomes for workers.

Linkage. In a tweet on Wednesday, House Speaker Kevin McCarthy (R-Calif.) again called for pairing discussions about spending cuts to raising the borrowing cap. Republican lawmakers are refusing to raise the limit — which caps the total amount of money that the federal government is authorized to borrow to fulfill its financial obligations — unless President Biden agrees to steep but unspecified spending cuts. Biden has repeatedly said that he will not negotiate over raising the borrowing cap, which simply allows the government to pay for expenses that Congress has already authorized. Biden hit back at Republicans on the debt on Wednesday, highlighting the new House majority’s plans to extend expiring tax cuts signed into law under Trump and repeal tax increases on high earners and corporations that Biden signed into law last year, which he said would add $3 trillion to deficits.

Bottom line: The budget office director noted that it would be difficult for lawmakers to balance the budget in 10 years without making changes to Social Security and Medicare. “It’s mathematically possible,” Swagel said, adding that “it’s very, very challenging.”

Market perspectives:

• Outside markets: The U.S. dollar index was weaker on a corrective pullback from recent good gains that saw the index hit a five-week high Wednesday. Nymex crude oil futures prices are slightly up and trading around $78.75 a barrel. The yield on the benchmark U.S. 10-year Treasury note is presently fetching 3.788%.

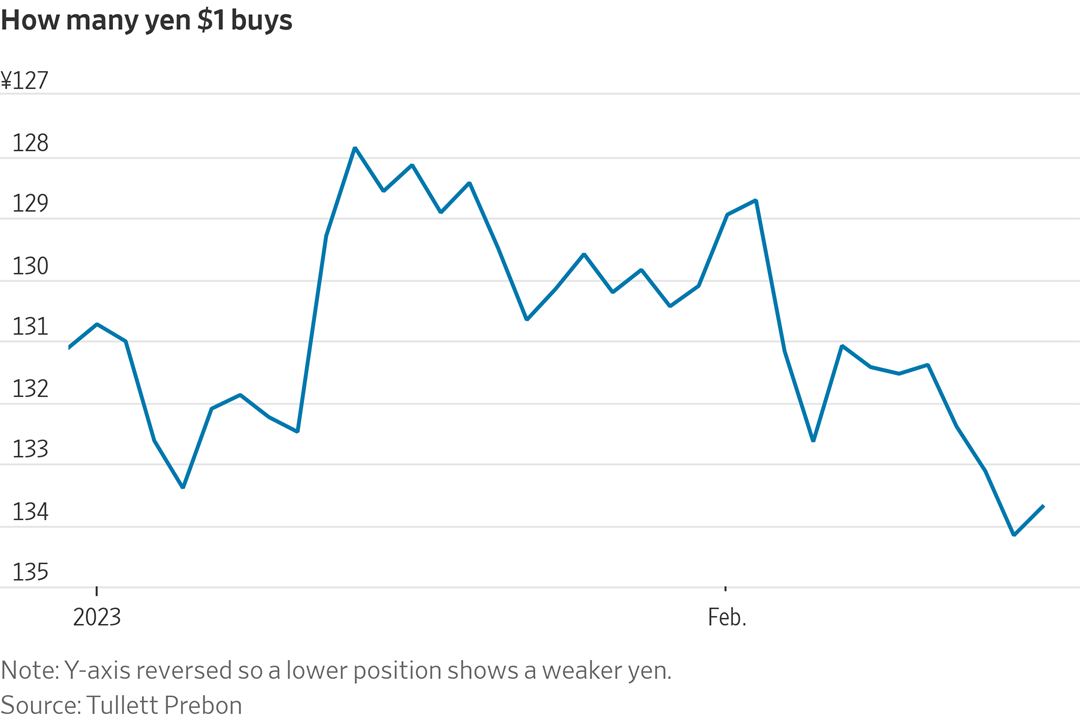

• Japanese yen touched a six-week low late Wednesday. The chance of significant further tightening by the Federal Reserve has been revived — and with it, a downward trend in the Japanese yen.

• Securities and Exchange Commission proposed a rule that could make it more difficult for many asset managers to invest customers’ money in cryptocurrencies, as policy makers push to rein in the sector following trading platform FTX’s collapse.

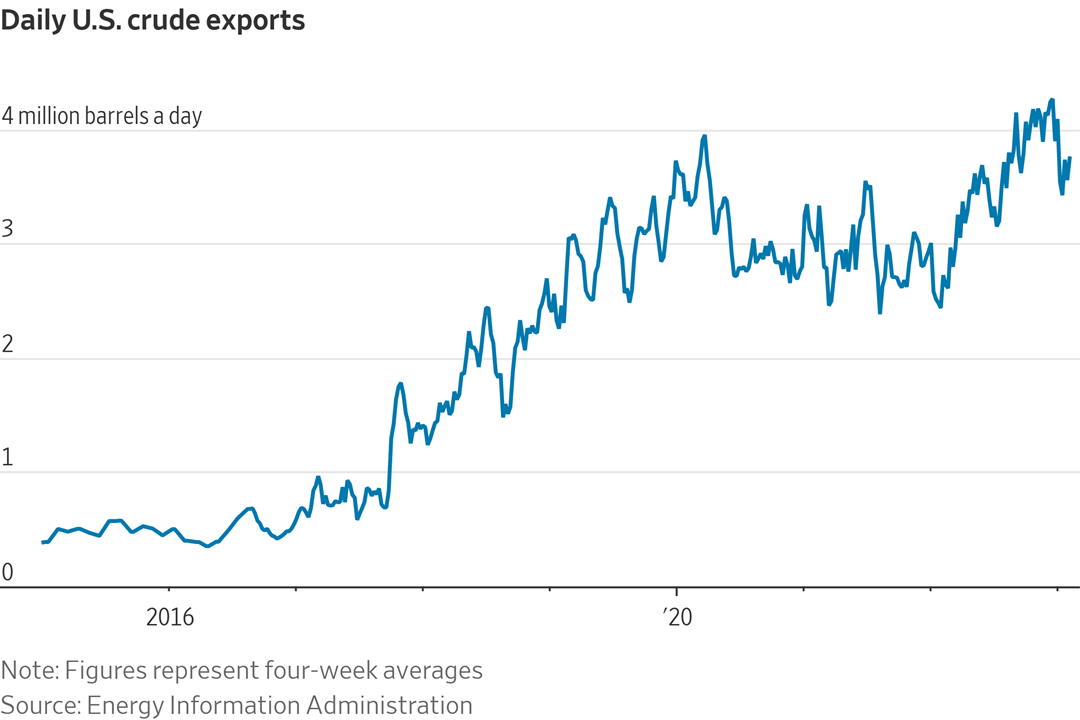

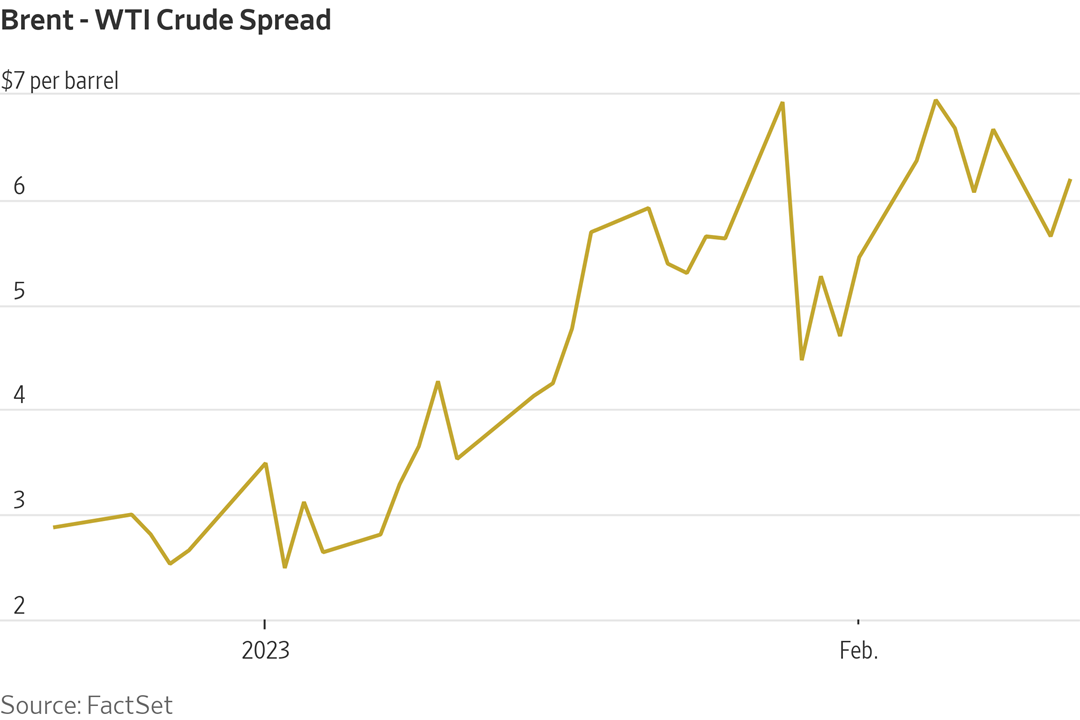

• Booming oil exports boost U.S. role as global price maker. U.S. crude exports increasingly shape global oil prices, as well as the financial instruments bought and sold by producers, refiners and traders to avoid or capitalize on price swings. In June, a Texas-produced crude will be formally added to the Brent complex, the global benchmark. A spurt in U.S. crude production over the past decade accelerated the shift, pushing exports to new heights. Following the Kremlin’s invasion of Ukraine, Western sanctions on Russian energy cemented the trend by making Europe more reliant on U.S. shipments. “We have gone from a very domestically focused market into an international powerhouse,” said Peter Keavey, CME Group’s global head of energy and environmental products, speaking about U.S. Gulf Coast oil. Link for more via the Wall Street Journal.

• The premium of Europe's Brent crude oil to U.S. standard WTI has more than doubled to over $6 per barrel since the start of the year. Six dollars is sometimes cited by analysts as a critical level beyond which U.S. barrels begin flowing overseas.

• Savannah port exports up 21% in January; total cargo dips 11.5 percent on slow-down in imports, empty containers. The Port of Savannah’s loaded container exports grew 21% in January. The nation’s busiest port for U.S. goods handled 110,305 twenty-foot equivalent container units of exports, an increase of 19,419 TEUs. Compared to pre-pandemic numbers, the Port of Savannah’s January trade of 421,714 TEUs in total cargo showed 11.7% improvement over January 2020, in which Georgia Ports Authority (GPA) handled 377,671 TEUs. U.S. exports were a bright spot for GPA last month, in which total cargo dipped 55,000 TEUs or 11.5% compared to January 2022. The decrease was fueled in part by reduced orders in retail and manufacturing, resulting in import loads softening by 39,850 TEUs, or 16%. Similarly, the export of empty containers via Savannah declined 34,650 TEUs on reduced demand for Asian goods served by the empty boxes. Weather also played a role, delaying six vessels slated to call Savannah in late January to the next month. Georgia’s deepwater ports and inland barge terminals support more than 561,000 jobs throughout the state annually, and contribute $33 billion in income, $140 billion in revenue and $3.8 billion in state and local taxes to Georgia’s economy.

• Ag trade: Japan purchased 76,203 MT of wheat in its weekly tender, including 22,178 MT U.S., 31,000 MT Canadian and 23,025 MT Australian. Thailand purchased 60,000 MT of feed wheat expected to be sourced from the Black Sea region. Tunisia tendered to buy 100,000 MT of soft milling wheat and 75,000 MT of feed barley – both optional origin.

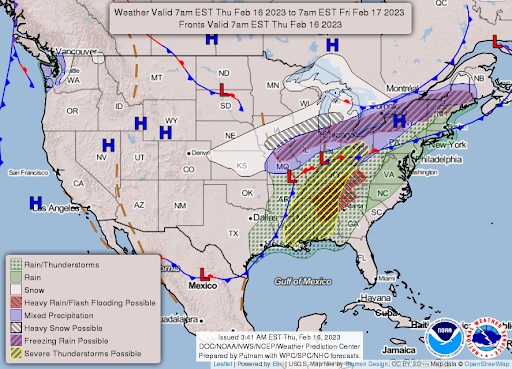

• NWS weather outlook: A swath of snow is forecast to stretch from the central Plains to the lower Great Lakes and northern New England through much of Friday as a low-pressure system tracks rapidly from the central U.S. through New England... ...Strong to severe thunderstorms and threat of flash flooding will impact portions of the interior Deep South and the Tennessee Valley through tonight.

Items in Pro Farmer's First Thing Today include:

• Corn and soybeans weaker, wheat mixed overnight

• AgRural cuts Brazilian soybean crop estimate

• China to buy domestic soybeans for state reserves

• ECB official: Slow the pace of rate increases

• Waiting on cash cattle trade

• Cash hog prices firm again, pork cutout drops

|

RUSSIA/UKRAINE |

— Ukraine war to take sharp economic toll in Eastern Europe. Russia’s war in Ukraine will cause a sharp slowdown in economic growth across Eastern Europe this year, deterring foreign investment and lifting energy prices and borrowing costs, the European Bank for Reconstruction and Development (EBRD) has warned. Most of the European countries that are closest to the front line showed surprising resilience during the first year of the war. But many economies in the region are more reliant on energy-intensive factories than their counterparts in Western Europe and they could see their market share erode as their costs increase. “We are expecting this year to be tough,” said Beata Javorcik, the EBRD’s chief economist.

|

POLICY UPDATE |

— New farm bill updates:

- Link to how CBO’s latest forecast signal lots of spending for the upcoming farm bill. Meanwhile, Sen. John Boozman (Ark.), top Republican on the Senate Ag Committee, voiced concern Wednesday about the Congressional Budget Office’s increased cost estimate for the Supplemental Nutrition Assistance Program in the farm bill. “We are looking at the most expensive farm bill ever,” Boozman said in a statement, adding that the projection from the nonpartisan budget office "will make this farm bill a much heavier lift for Congress.”

- Democrats: 2023 Farm Bill should be a climate bill. House Democrats are working to include provisions aimed at helping farmers store more carbon in the soil, plant more trees and become more resilient in the face of extreme weather, Rep. Kim Schrier (D-Wash.) told the Washington Post. “We’ve already started planning for the farm bill and how to push the policies that are great for farmers, great for soil health and also great for the planet,” said Schrier, who is co-chairing the House Sustainable Energy and Environment Coalition’s Climate and Agriculture Task Force. “I think this farm bill could really turn out to be a huge climate win,” Ben Thomas, senior policy director for agriculture at the Environmental Defense Fund and a former deputy undersecretary at USDA, told the WaPo.

|

PERSONNEL |

— Federal Reserve’s next vice chair. The Wall Street Journal reported (link) that the White House was considering Austan Goolsbee, president of the Chicago Fed, to be the Federal Reserve’s next vice chair. Goolsbee would replace Lael Brainard, who will take over as director of the National Economic Council later this month. Before heading to the Chicago Fed last month, Goolsbee, 53, served as a top economic adviser to former President Barack Obama and before his appointment this year was a professor of economics at the University of Chicago’s Booth School of Business. Punchbowl News writes, “Several potential new Fed nominees were floated, and the business pubs suggested several more. Most of these potential picks are eminently qualified, but they’re also white, which is the issue.”

— World Bank President David Malpass to step down early. Malpass will step down on June 30, the bank said Wednesday. Malpass had been appointed to a five-year term that was set to expire in 2024. He said in a statement that the current strength of the bank’s financial and operational position provides for an opportunity for a leadership transition, without providing other reasons for his departure. The bank didn’t discuss plans for a successor.

His announcement comes after a recent controversy over climate change comments, and positions President Joe Biden to name a replacement.

In the know. Minutes after Malpass informed the bank’s board on yesterday that he was leaving, Treasury Secretary Janet Yellen was out with a statement — a sign top officials were aware he was quitting.

|

CHINA UPDATE |

— U.S. Ambassador to Japan Rahm Emanuel said the Chinese balloon’s intrusion into the U.S. was part of a pattern of aggressive behavior by Beijing. Emanuel noted China’s recent beaming of military-grade laser on a Philippine coast guard patrol vessel, the harassment of US planes by Chinese jets and China’s opening of illegal police stations in the U.S., Ireland and other countries. “The balloon to me is not an isolated incident,” Emanuel said. If China wants to be a respected member of the international community, the envoy added, “then you act appropriately to certain basic premises. that is you don’t open police stations in other countries ignorant of their laws, as if your laws don’t have any boundaries.”

China has warned it will retaliate against the U.S. for allegedly undermining its sovereignty after the Air Force downed a spy balloon earlier this month.

— China puts Lockheed, Raytheon on trade blacklist over Taiwan arms sales. China imposed fresh sanctions on Lockheed and a Raytheon unit over arms sales to Taiwan, as tensions with the U.S. continued to escalate. Putting the companies on its “unreliable entities list” prohibits them from export and import activities related to China. Under China’s latest sanctions, Lockheed Martin and Raytheon Missiles and Defense won’t be able to conduct trade relating to China or make any new investments in the country. China also banned senior company executives from entering China or obtaining a work permit. The Chinese ministry also said it was imposing fines on the two companies that are worth twice the value of the arms that each company has sold to Taiwan since September 2020.

The sanctions are expected to have a limited impact since American defense companies are broadly barred from making military sales to China.

— WaPo: China balloon confrontation may have started as a mistake. One of Beijing’s earliest statements (link) about what the U.S. gov’t calls a Chinese spy balloon that sailed into American airspace said the vehicle had “deviated far from its planned course” due to “unexpected” weather. The Washington Post is now asking, “What if that was maybe at least partially true?”

The WaPo Tuesday night reported (link) that not only did the U.S. track the balloon from the day it lifted from its base on Hainan Island but that U.S. officials are trying to assess whether it was, in fact, blown off course. “U.S. monitors watched as the balloon settled into a flight path that would appear to have taken it over the U.S. territory of Guam. But somewhere along that easterly route, the craft took an unexpected northern turn, according to several U.S. officials, who said that analysts are now examining the possibility that China didn’t intend to penetrate the American heartland with their airborne surveillance device,” the WaPo reported. “The balloon floated over Alaska’s Aleutian Islands thousands of miles away from Guam, then drifted over Canada, where it encountered strong winds that appear to have pushed the balloon south into the continental United States, the officials said, speaking on the condition of anonymity to describe sensitive intelligence.”

WaPo upshot: “This new account suggests that the ensuing international crisis that has ratcheted up tensions between Washington and Beijing may have been at least partly the result of a mistake.”

— Thousands of Chinese pensioners took to the streets of Wuhan and Dalian, two big cities, to protest against cuts to their health benefits. Last week provincial officials said they would reduce the amount of medical expenses retirees could claim from their health-savings plans. China is tightening spending following its costly zero-Covid policy. Such demonstrations are rare in China; this was the second in a week.

— China starts small with GMO corn production. China will likely plant less than 1% of its corn fields with genetically modified varieties this year, two people familiar with the plans told Reuters. The ag ministry has designated around 4 million mu (267,000 hectares or 660,000 acres) to be planted with GMO corn this year, said a senior manager at a Chinese seed developer briefed on the plans. Several varieties will be planted in certain counties of Inner Mongolia, Jilin, Hebei and Yunnan provinces, he said. “It’s a large-scale trial, not a fully fledged commercial release,” said a second industry source who has also been briefed on the plans. The plans could still change, said both sources, although planting typically starts in about two months and farmers are already buying seed.

|

ENERGY & CLIMATE CHANGE |

— U.S. and Europe are hoping to use critical minerals to patch up a rift over EV subsidies while reducing reliance on China. The two sides are looking to form a group that would cooperate on procuring minerals used in clean-energy technologies such as electric-vehicle batteries, the Wall Street Journal reports (link). Washington and Brussels have been at odds over last year’s Inflation Reduction Act (IRA), which required that a significant share of minerals in a vehicle’s battery must come from the U.S. or a country with a free-trade agreement with the U.S. to be eligible for subsidies. The EU doesn’t have such a deal.

Under the plan for the critical-minerals club, the U.S. would negotiate trade agreements with allies including Japan and the EU, the WSJ said, citing people familiar with the plan. The allies could then pursue additional deals with countries such as Ukraine and Zambia to secure supplies of clean-energy raw materials, the people said. A European official said such outreach could help Western countries compete with China and Russia for influence in Africa, while drawing Ukraine closer to the EU.

|

LIVESTOCK, FOOD & BEVERAGE INDUSTRY |

— Walmart grocery shoppers in certain markets now have the option to have their orders delivered by drone. Thirty-six Walmart stores in seven states recently launched drone delivery hubs. The retail chain says the flying devices can deliver groceries in 30 minutes or less. So far, the program is available in North Carolina, Utah, Virginia, Arkansas, Arizona, Florida and Texas, but more stores are expected to offer drone delivery. Walmart's website says 4,700 of its stores are located within 90% of the U.S. population, making it "uniquely positioned to offer drone delivery at scale."

|

HEALTH UPDATE |

— Summary:

- Global Covid-19 cases at 673,518,173 with 6,857,917 deaths.

- U.S. case count is at 103,005,929 with 1,115,638 deaths.

- Johns Hopkins University Coronavirus Resource Center says there have been 670,306,507 doses administered, 269,208,743 have received at least one vaccine, or 81.71% of the U.S. population.

|

OTHER ITEMS OF NOTE |

— Immigration. Florida Republican Gov. Ron DeSantis on Wednesday signed a bill expanding a controversial state program to transport migrants. The measure allows the DeSantis administration to pick up where the governor left off last year when he sent two planes of migrants from San Antonio, Texas, to Martha's Vineyard, Massachusetts. The action sparked multiple lawsuits.

|

KEY LINKS |

WASDE | Crop Production | USDA weekly reports | Crop Progress | Food prices | Farm income | Export Sales weekly | ERP dashboard | California phase-out of gas-powered vehicles | RFS | IRA: Biofuels | IRA: Ag | Student loan forgiveness | Russia/Ukraine war, lessons learned | Election predictions: Split-ticket | Congress to-do list | SCOTUS on WOTUS | SCOTUS on Prop 12 | New farm bill primer | China outlook | Omnibus spending package |