Hot Inflation Reports Up Odds Fed Will Boost Rates 100 Basis Points

Resuming Ukrainian grain exports faces several hurdles, including what Putin says

|

In Today’s Digital Newspaper |

Yesterday's worse-than-expected inflation data has heightened anxiety about how aggressive the Federal Reserve will be in raising interest rates. More analysts are now signaling the Fed may boost rates 100 basis points. Fed funds futures put the odds for a 100-basis-point rise at 83.3% this morning with only a 16.7% chance the Fed will only do 75 basis points. Concerns that consumers could begin to expect higher inflation to last longer spurred a more aggressive rate-rise path. A 100-basis point hike would follow a half-point hike by the Fed in May and a three-quarters-points increase in June. If the Fed goes with a 100 basis-point increase, it will take rates to between 2.5% and 2.75%. At the June press conference, Fed Chair Jerome Powell said the longer-run neutral rate at which it neither stimulates nor restricts the economy is in the “mid-2s.” Which means that by September, the Fed will be able to restrain the economy.

Last time the Fed boosted rates by 100 basis points? Financial Times says February 1982, firmly in the Volcker era. The fed funds rate rose to 14.78% from 13.22% in the span of a single month.

Bank of Canada on Wednesday went for a triple-digit rate hike. Tiff Macklem, the Bank of Canada governor, called the move “very unusual” but said it reflected “very unusual economic circumstances.”

Inflation watch: The average monthly rent in Manhattan topped $5,000 a month in June for the first time ever, according to a report from brokerage firm Douglas Elliman and Miller Samuel Real Estate Appraisers and Consultants. That's up nearly 30% from a year ago. Housing represents about a third of the value of the basket of goods and services that the U.S. Bureau of Labor Statistics uses to track consumer prices, making its trajectory especially important. That complicates "peak inflation" hopes, even as oil prices drop.

Producer price gains accelerated in June. Key reading of producer-level inflation showed an 11.3% annual rate.

JPMorgan Chase reported earnings this morning that were lower than forecasts, as it set aside bigger reserves to cover bad loans, a possible ominous sign for the rest of the banking sector. Its CEO, Jamie Dimon, said the bank was suspending share buybacks. Morgan Stanley’s earnings also fell short of expectations.

China a part of big export sales week for wheat. U.S. wheat export sales surged to over 1 million tonnes for the week ended July 7, with China a factor in the rise in business. Sales activity for China for 2022-23 the week ended July 7 included 265,300 tonnes of wheat, 90,500 tonnes of corn, 90,000 tonnes of soybeans, and 2,598 running bales of upland cotton. Sales activity for 2021-22 (current marketing year for most commodities except wheat) to China included net reductions of 2,839 tonnes of corn, net reductions of 130,759 tonnes of soybeans, net sales of 77,695 tonnes of sorghum and 1,200 running bales of upland cotton. Net sales of 471 tonnes of beef and 1,559 tonnes of pork for 2022 delivery were also reported. The sales of more than 1 million tonnes of wheat were the first weekly sales of 1 million tonnes or more since the week ended July 4, 2013.

Michael Barr was confirmed as the Fed’s top banking regulator.

If you closely read articles about a “possible” agreement to resume Ukrainian grain exports you will see a lot of caveats. We go through the most important hurdles ahead in the Russia/Ukraine section.

The war in Ukraine is clouding the world’s economic prospects for this year and next, the IMF warned.

Treasury Secretary Janet Yellen pitched China on a plan to cap the price of Russian oil. She also commented on the strength of the U.S. dollar. More below.

White House officials are monitoring labor talks in the logistics industry as unions representing 115,000 rail workers and 22,000 West Coast dockworkers negotiate fresh contracts but won’t get directly involved at this stage.

Worries about inflation and the economy add to doubts about Senate Democrats’ ability to pass President Biden’s slimmed-down economic package before the August recess. But Democratic leaders in Congress have a potential solution: Slim the package further, perhaps by existing energy language and big tax increases. More in Policy section.

A plan to pass $52 billion in funding for semiconductor manufacturers instead of a broad USICA/China bill package is being pushed by some key Democrats. Commerce Secretary Gina Raimondo said it appears that lawmakers are looking to split off $52 billion in subsidies for domestic chipmaking from a larger legislative package to boost the United States' competitiveness with China and pass a separate bill with those incentives.

Tesla supplier Panasonic plans to build a $4 billion factory in Kansas to make electric-vehicle batteries.

The FDA authorized Novavax’s Covid-19 vaccine, providing a new option that works differently than the two leading vaccines — but at a time of low demand for vaccines and boosters.

Netflix said it will join with Microsoft to launch a low-cost, advertising-supported streaming plan, a surprise move and a major boost for Microsoft’s ad business.

Election Day 2022 is 117 days away. Election Day 2024 is 845 days away.

|

MARKET FOCUS |

Equities today: Global stock markets were mostly down overnight. U.S. futures are signaling big losses of around 500 points for the Dow. JPMorgan Chase said Thursday that second-quarter profit slumped as the bank built reserves for bad loans by $428 million. Profit declined 28% from a year earlier to $8.65 billion, or $2.76 a share, driven largely by the reserve build, New York-based JPMorgan said in a statement. A year ago, the bank benefited from a reserve release of $3 billion. Later, Morgan Stanley reported that its revenue fell in the second quarter, which CEO James Gorman called “a more volatile market environment than we have seen for some time.” In Asia, Japan +0.6%. Hong Kong -0.2%. China -0.1%. India -0.2%. In Europe, at midday, London -0.7%. Paris -0.9%. Frankfurt -0.7%.

U.S. equities yesterday: The Dow ended down 208.54 points, 0.67%, at 30,772.79. The Nasdaq fell 17.15 points, 0.15%, at 11,247.58. The S&P 500 was down 17.02 points, 0.15%, at 3,801.78.

Agriculture markets yesterday:

- Corn: December corn futures ended the day up 8 3/4 cents at a midrange close of $5.95 1/4.

- Soy complex: November futures closed up 6 1/2 cents at $13.49 1/2, September Soy meal was up $11.30 at $412.20, September bean oil futures were down 1.18 at 57.69 cents per pound.

- Wheat: September SRW wheat futures slid 3 1/2 cents to $8.10 3/4 Wednesday, while the September HRW contract dipped 5 1/2 cents to $8.62 1/4. September HRS futures skidded 5.0 cents to close at $9.13 3/4.

- Cotton: Futures remained weak Wednesday, as demonstrated by the December contract’s loss of 313 points to a close at 87.71 cents per pound.

- Cattle: August live cattle closed up 20 cents at $136.875 and nearer the session high. Prices hit a three-week high today. August feeder cattle closed up $1.225 at $180.80, near the session high and hit a 13-week high.

- Hogs: July lean hogs rose 90 cents at $114.50. August hogs closed up $1.50 at $110.50, near mid-range and closing at a 2.5-month high close.

Ag markets today: Overnight price action was two-sided and relatively quiet, though corn, soybeans and winter wheat all lower and near session lows this morning. As of 7:30 a.m. ET, corn futures were trading 3 to 5 cents lower, soybeans were 14 to 18 cents lower, winter wheat was 4 to 6 cents lower and spring wheat was steady to 5 cents higher. Front-month U.S. crude oil futures were around $2.50 lower and the U.S. dollar index was nearly 800 points higher, hitting a fresh 20-year high.

Technical viewpoints from Jim Wyckoff:

On tap today:

• U.S. jobless claims, due at 8:30 a.m. ET, are expected to hold steady at 235,000 in the week ended July 9, unchanged from one week earlier.

• U.S. Producer Price Index for June, due at 8:30 a.m. ET, is expected to increase 0.8% from the prior month. UPDATE: The Labor Department said the PPI, which generally reflects supply conditions in the economy, increased to 11.3% on a 12-month basis in June. That marked its seventh consecutive double-digit gain, and compared with a revised 10.9% increase in May, and signaled upward price pressures continue to move through the economy. On a one-month basis, producer prices increased a seasonally adjusted 1.1% in June from the prior month, marking an acceleration from the revised 0.9% gain in May. June’s rate of increase was higher than the average monthly gain of 0.2% in the two years before the pandemic.

• USDA Weekly Export Sales report, 8:30 a.m. ET.

• Federal Reserve governor Christopher Waller speaks on the economic outlook at 11 a.m. ET.

• China's gross domestic product for the second quarter, due at 10 p.m. ET, is expected to grow 0.9% from the same period one year earlier.

The Fed may debate a 100 basis-point rate hike. Officials at the Federal Reserve may debate a 100-basis point rate hike later this month after headline inflation for June outstripped expectations. Federal Reserve Bank of Cleveland President Loretta Mester said officials should raise the rate by at least 75 basis points.

Bank of America said a mild U.S. recession will arrive this year. Americans are getting bogged down by a so-called "inflation tax," analysts wrote in a Wednesday note, and it's weighing on spending power as consumers spend less on goods and services. Before yesterday, the bank had predicted a growth recession, where the US would avoid an outright contraction of the economy. But BofA swiftly adjusted course the same day new government data was published.

Social Security recipients could see a 10.5% cost-of-living adjustment, which would add an extra $175 to the average monthly benefit of $1,669 starting in January 2023, the Senior Citizens League projects. The Social Security Administration will announce the 2023 cost of living adjustment in October.

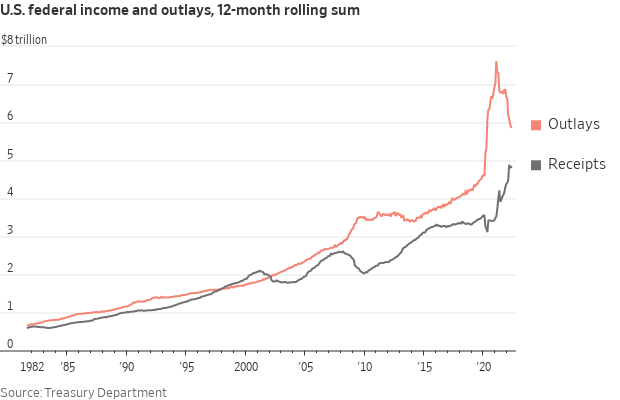

U.S. budget gap narrowed by record $1.7 trillion since October. Higher tax revenues and the phasing out of pandemic-relief spending sliced the U.S. federal government’s budget deficit by a record $1.7 trillion in the first nine months of the fiscal year. The federal government ran an $89 billion deficit during June, a 49% decline from a year earlier, as spending fell and revenue increased. The federal deficit narrowed 77% through June of this fiscal year, which began in October, compared with the same period the prior year, falling to $515 billion from $2.2 trillion. That was the largest-ever deficit decline in the first nine months of a fiscal year.

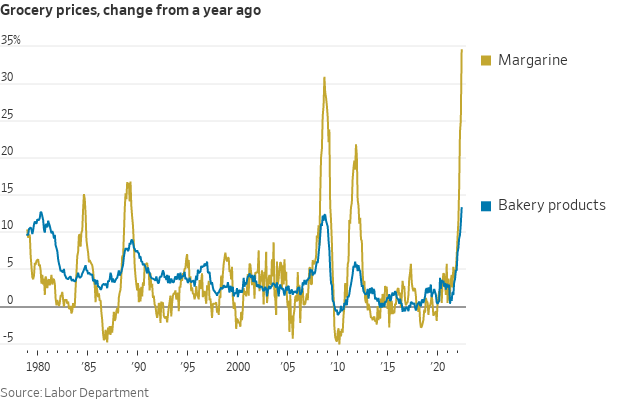

Prices that rose the most in June: Hot dogs, cookies and the electricity bill. The Wall Street Journal looked at what drove June’s inflation — and the (relatively few) areas in which price pressures eased. Link

The steady rise in housing costs in recent months picked up momentum in June, as tenants’ rents rose 5.8% from a year ago.

Prices at the pump and household bills shot up in June, sending energy costs 41.6% higher than a year earlier, the steepest climb since 1980.

EU cuts euro zone growth forecasts, revises up inflation outlook. The European Commission cut its forecasts for economic growth in the eurozone for this year and next and revised up its estimates for inflation. The commission now predicts growth of 2.6% this year for the 19-country currency bloc, slightly less than the 2.7% it had forecast in May. But next year, when the impact of the Ukraine war and of higher energy prices may be felt even more acutely, growth is now forecast to be 1.4%, instead of the 2.3% previously estimated. For the broader 27-country European Union, the growth forecast was unchanged at 2.7% this year, but revised down to 1.5% in 2023 from 2.3%. In a major change, the commission also raised its estimates for eurozone inflation, which this year is now expected to peak at 7.6% before falling to 4.0% in 2023. In May, it had forecast prices in the eurozone would rise 6.1% this year and 2.7% in 2023.

Market perspectives:

• Outside markets: The U.S. dollar index is higher and hit a 20-year high following the hot CPI report Wednesday. The yield on the 10-year U.S. Treasury note is fetching 2.982%. The 2-year/10-year Treasury note yield curve remains inverted and at its most inverted in 22 years. Such is a clue of impending U.S. economic recession. Gold and silver futures are under heavy pressure, with gold trading around $1,710 per troy ounce and silver around $18.49 per troy ounce.

• Treasury Secretary Janet Yellen comments on U.S. dollar. Yellen weighed in on the impact of a stronger dollar on other economies: “On the one hand, it can strengthen their ability to export, which is good for their growth. On the other hand, to the extent that countries have dollar-denominated debt, it can make those debt problems — which already are very severe — more difficult.”

• Crude oil futures rose to more than $120 a barrel after Russia invaded Ukraine but have declined sharply over the past month. Nymex futures overnight fell to a three-month low of $93.24 a barrel. January crude oil futures are now trading at $84 a barrel, suggesting the marketplace thinks crude prices will continue to decline in the coming months. Crude’s plunge has pulled other major commodity market prices down, too. The weakening raw commodity sector is one significant early clue that inflationary pressures have peaked.

• What’s dropping energy prices? Flagging economic growth and higher prices are weighing on demand for crude, while sanctions on Russia are having less impact on oil production than expected. U.S. and Canadian producers are leading an increase in global output, while Russian supplies prove resilient. That has helped drive crude prices after prices were nearing $130 a barrel earlier this year. Meanwhile, AAA measured the national average price for diesel this week at $5.611 a gallon, down about 16 cents a gallon from a month ago, and the price in Texas has slipped closer to $5 a gallon. Still, prices remain far higher than a year ago.

• Truckers servicing some of the U.S.’ busiest ports are staging protests as state-level labor rules that change their employment status begin to go into effect, creating another choke point in stressed U.S. supply chains. Freight operators across California are bracing for rough roads ahead over the state’s new trucking-employment law. Trucking companies and truck owner-operators say they are trying to figure out how to operate under the measure known as AB5. Transport workers are demonstrating at the California port gateways of Los Angeles, Long Beach and Oakland, the Harbor Trucking Association said in a statement. The protests have had no impact on operations at the Los Angeles complex, Executive Director Gene Seroka said.

• White House is monitoring labor talks in the logistics industry as unions representing 115,000 rail workers and 22,000 West Coast dockworkers negotiate fresh contracts but won’t get directly involved at this stage. Dock- and railroad-worker unions are currently negotiating contracts with employers, with the latter threatening to strike as soon as July 18.

• Ag trade: Japan purchased 130,900 MT of wheat from its weekly tender, including 53,260 MT U.S., 48,737 MT Canadian and 28,903 MT Australian. South Korea purchased 135,000 MT of corn from unspecified origins and 65,000 MT of Australian feed wheat. Jordan tendered to buy 120,000 MT of optional origin milling wheat.

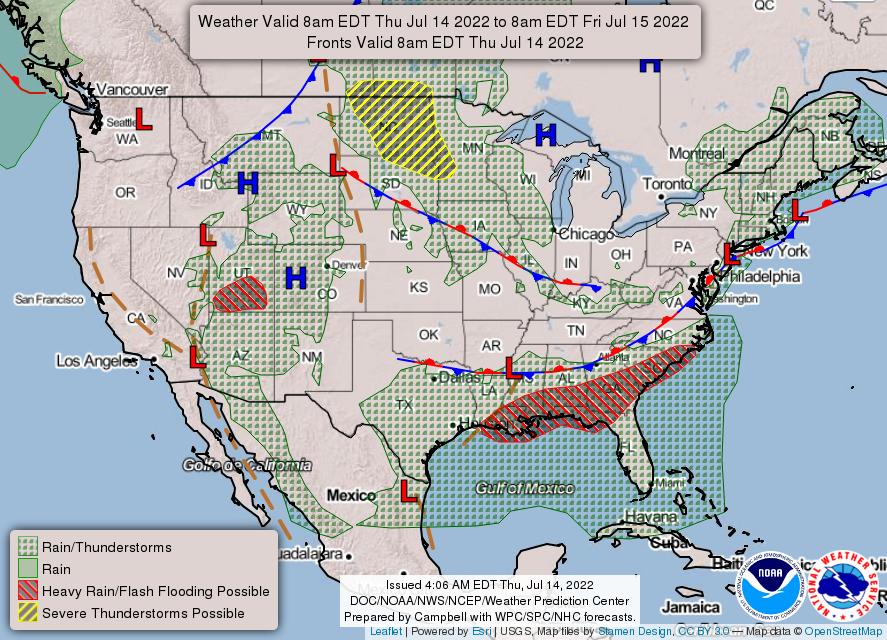

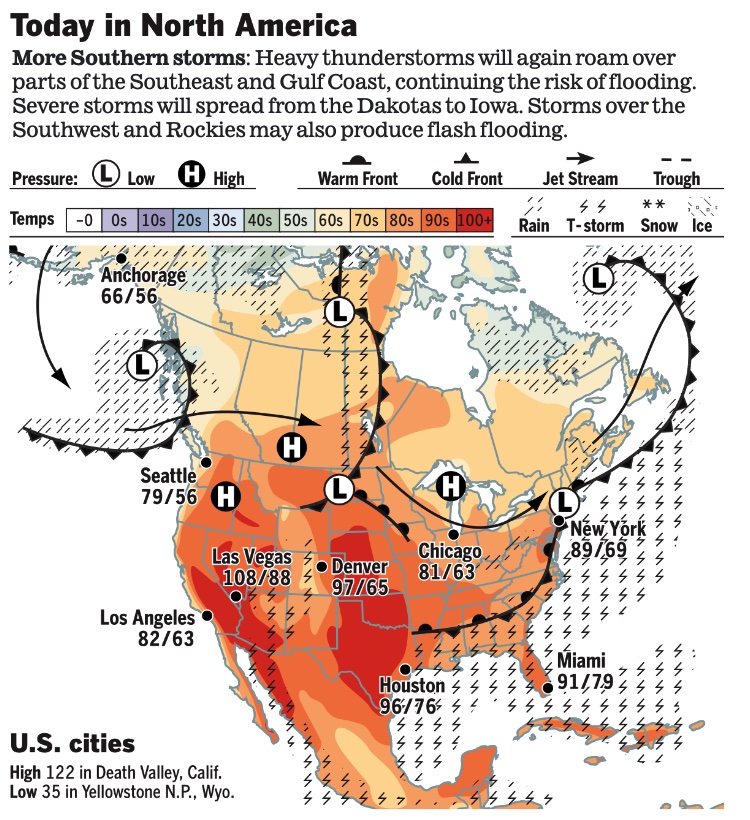

• NWS weather: There is a Slight Risk of excessive rainfall over parts of the Central Gulf Coast to the southern Mid-Atlantic Coast on Thursday and retreats to the Central Gulf Coast on Friday... ...There is a Slight Risk of excessive rainfall with monsoonal thunderstorms over parts of the Great Basin on Thursday expanding into the Central Rockies on Friday... ...There is a Slight Risk of severe thunderstorms over parts of the Northern Plains and adjacent parts of the Upper Mississippi Valley through Friday morning... ...Dangerous heat and humidity across parts of the South Plains will continue as well as parts of the Great Basin.

Items in Pro Farmer's First Thing Today include:

• Weaker bias this morning

• Firm raises Russian wheat crop forecast

• China’s wheat production increased 1% (details in China section)

• Exchange lowers Argentine wheat crop estimate amid dry weather

• Consultancy lowers EU wheat crop forecast

• Bigger German wheat crop despite heat, dryness

• Brazilian BRF plant cleared to export pork to Canada

• Cash cattle trade around steady

• Cash hog fundamentals continue to strengthen

|

RUSSIA/UKRAINE |

— Updates:

- The European Union is working with the U.S. on a joint approach to enforcing their economic sanctions against Russia, European Commission Director General for Trade Sabine Weyand said. Meanwhile, a U.S. Treasury official doesn’t anticipate Washington applying sanctions on countries or companies that fail to join a proposed price cap on Russian oil.

- Russian President Vladimir Putin will have to sign off on any deal on Ukraine grain exports. Anyone know or trust what Putin will do? Big media reports movement on the prospects for reopening Black Sea shipments of Ukrainian grain, with Turkey’s Defense Minister Hulusi Akar announcing that a deal between Russia, Ukraine, Turkey and the U.N. will be signed next week. However, U.N. Secretary General Antonio Guterres was more guarded after talks in Istanbul between the four parties. “Hopefully we'll be able to have a final agreement" next week, Guterres said. "I'm optimistic, but it's not yet fully done,” he said, adding that “more technical work will now be needed to materialize today's progress.

Awaited are statements from either Ukraine or Russia on the talks and/or apparent agreement. Before the talks, Ukrainian Foreign Minister Dmytro Kuleba said that grain exports from his country’s ports would not resume without security guarantees to ship and cargo owners, and to Ukraine’s status as an independent nation.

Timeline: Officials believe a final deal could come when Putin meets Turkish President Recep Tayyip Erdogan next week in Tehran.

Hurdles ahead even with any agreement. Experts have cautioned that an agreement will not have an immediate impact. It will take time to ensure there are no mines in the Black Sea shipping channel, and then to get cargo ships to Odesa, Ukraine’s largest Black Sea port. Inspections will have to be done and arrangements made for shipping out the 22 million tons of grain that Ukraine’s president says are now in silos.

Skepticism prevails. Moscow claims Ukraine’s heavily mined ports are causing the delay. Putin has pledged that Moscow would not use the corridors to launch an attack, if the sea mines were removed. But Ukrainian officials have blamed a Russian naval blockade for holding up the exports and causing the global food crisis. They are skeptical of Putin’s pledge to not take advantage of cleared Black Sea corridors to mount attacks on Ukrainian ports, noting that he insisted repeatedly this year that he had no plans to invade Ukraine.

Perspective: Seventy vessels from 16 countries have remained stuck in Ukrainian ports, a Russian official said.

— Market impacts:

- The war in Ukraine is clouding the world’s economic prospects for this year and next, the International Monetary Fund warned, as the conflict settles into a costly stalemate despite intense fighting on the ground. The IMF said it would downgrade its forecast for global economic growth in 2022 and 2023 later this month, in part because of the worsening fallout from the war, which has stoked inflation around the world and worsened existing supply-chain woes. The bank said a possible interruption in Russian natural gas supplies to Europe as the economic war between Moscow and the West intensifies could tip many economies into recession and trigger a global energy crisis.

|

POLICY UPDATE |

— Perhaps a slimmed down, slimmed down reconciliation measure sans energy language. That’s the latest possibility that signals a Democrat-only measure could be limited to negotiating Medicare prescription drug costs and extensions for expiring Affordable Care Act/ObamaCare provisions.

According to the Congressional Budget Office (CBO), implementing the Medicare prescription drug plan proposed by Senate Democrats would save the federal government nearly $288 billion over a decade while having little impact on the number of new drugs introduced. Some of those savings could be used to shore up Medicare, support ObamaCare premium subsidies or reduce the deficit.

In terms of a timeline, centrist Sen. Joe Manchin (D-W.Va.) this week said Democrats have until Sept. 30 to hold a vote. That’s the day that a budget resolution allowing them to pass legislation with just 50 votes expires.

As for Manchin, he dubbed a much-scaled back package as “a big deal.”

— Another scaled-back measure: USICA/China bill. A plan to pass $52 billion in funding for semiconductor manufacturers instead of a broad USICA package is being pushed by some key Democrats. This legislation could be drafted and passed in the coming weeks. The $52 billion for U.S. semiconductor chip makers could in turn spur tens of billions more in private investment. Senate Minority Leader Mitch McConnell (R-Ky.) said earlier this week that he was open to this chips-funding-only approach, as did Commerce Secretary Gina Raimondo during an appearance on Capitol Hill Wednesday. Raimondo today is leading a classified briefing for House members today on the issue.

|

PERSONNEL |

— Fed’s top banking regulator Michael Barr confirmed by Senate. Barr’s confirmation Wednesday as the Federal Reserve’s vice chairman for supervision provides the central bank with a full seven-member board for the first time in nearly a decade and adds to a group of Biden-appointed bank overseers who may revisit financial regulations that were eased during the Trump administration. Barr won bipartisan support for the regulatory role, which has a four-year term. The vote was 66-to-28, surpassing the 50 votes needed for confirmation. Earlier on Wednesday, senators confirmed Barr to a 10-year term on the Fed’s governing board.

|

CHINA UPDATE |

— SEC chairman Gary Gensler cast doubts on the prospects of an audit deal with China. The Securities and Exchange Commission head expressed doubt that negotiators in Washington and Beijing will reach a deal granting U.S. regulators access to audit papers of Chinese companies listed on American exchanges.

— China’s wheat production increased 1%. China’s wheat output will rise 1% this year, boosted by a 0.7% increase in yields and a slight gain in acreage. The National Statistics Bureau estimated China’s wheat production at 135.76 MMT. An ag ministry official said the quality of wheat was “the best in recent years” due to good weather and timely harvests. USDA projects China’s wheat crop at 135 MMT.

|

ENERGY & CLIMATE CHANGE |

— Panasonic picked Kansas for its battery mega-factory. The $4 billion manufacturing plant will employ 4,000 workers. The company and Gov. Laura Kelly announced the new project Wednesday, just hours after Kelly and eight top leaders of the Kansas Legislature signed off on a package of incentives worth $829 million over 10 years. The state had created a new program to offer incentives that could reach $1 billion or more only five months — because of Panasonic’s project. The company said it would invest about $4 billion in the plant in DeSoto, Kansas, a town with about 6,000 people and 30 miles southwest of Kansas City, Missouri. The town has been trying to redevelop a long-abandoned army ammunition plant. Sen. Jerry Moran (R-Kan.) said the project has national significance because it lessens U.S. dependence on China for manufactured products. “It improves our job capabilities and increases our national security,” Moran said during remarks to about 250 state officials and business leaders who gathered for Kelly’s announcement and a reception afterward.

|

LIVESTOCK, FOOD & BEVERAGE INDUSTRY |

— As much as 40% of all food in America ends up wasted. That’s more than 100 billion pounds, worth more than $400 billion, each year. Grocery stores have a powerful disincentive to solving the problem — tax breaks. Link to Forbes article for details.

|

CORONAVIRUS UPDATE |

— Summary:

- Global Covid-19 cases at 559,951,727 with 6,363,521 deaths.

- U.S. case count is at 89,222,046 with 1,023,620 deaths.

- Johns Hopkins University Coronavirus Resource Center says there have been 597,307,105 doses administered, 222,455,652 have been fully vaccinated, or 67% of the U.S. population.

— The most infectious and transmissible variant yet has arrived. The latest version of the shape-shifting BA.5 variant, an offshoot of Omicron, is fueling a global surge in cases —illustrating how the virus has evolved and can evade immunity provided by previous Covid-19 vaccines. In the U.S., BA.5 accounted for 65% of new infections last week, according to the CDC. The variant is also on the march in China, raising the fear that major cities there may soon reinstate strict lockdown measures that were recently lifted.

— FDA clears Novavax as another Covid-19 vaccine for adults. A fourth Covid-19 vaccine option for adults 18 and over will soon be available, after the Food and Drug Administration cleared Novavax’s two-dose course for emergency use. If the Centers for Disease Control and Prevention agrees with the FDA, Novavax’s vaccine doses could be available within weeks. The Novavax shot is protein-based, offering an alternative to the mRNA vaccines currently in use even as vaccine demand is falling. Novavax, a vaccine administered as two shots given three weeks apart, is made with more conventional technology than the mRNA vaccines from Pfizer and BioNTech, Moderna or the vaccine made by Johnson & Johnson. It also offers an alternative for those “who may have an allergic reaction to mRNA vaccines or who have a personal preference for receiving a vaccine other than a mRNA-based vaccine,” the Department of Health and Human Services said. Novavax’s vaccine can be stored at higher temperatures than mRNA vaccines and has already been authorized in more than 40 other countries, including the U.K. and Canada.

|

POLITICS & ELECTIONS |

— Electoral shift: For the first time, a New York Times poll found Democrats had a larger share of support among white college graduates than among non-white voters, evidence of a transformation in the party’s coalition. Link for details.

|

OTHER ITEMS OF NOTE |

— Pentagon asks to move billions for border, drones. The Pentagon is asking lawmakers to allow almost $3 billion to be reprogrammed and used for priorities including deploying the military to the southwest border, new air defense artillery, and for technology to counter unmanned drones. The Defense Department sent an omnibus reprogramming request of $2.86 billion to Congress.

— Netflix hires Microsoft for ad service partnership. Netflix announced it will team up with Microsoft to help it build a cheaper subscription tier with ads, a step it had refused to take for years. According to Netflix COO Greg Peters, Microsoft will bring strong privacy protections and “innovate” the service’s tech and sales departments. Netflix is hoping that a low-cost option will help it win back fans — it lost 600,000 subscribers in the first three months of 2022 and is expected to have lost 2 million during Q2.