India Mulls Restricting Wheat Exports as Several Heat Waves Damage Crops

FOMC | Biden policy re: China | CRP enrollment | E15 report | Record diesel prices

|

In Today’s Digital Newspaper |

European officials today proposed banning Russian oil and petroleum product imports, the bloc's strongest move yet to wean itself off Kremlin-backed energy. The plan calls for a six-month phase-in for ditching Russian crude and a year-end target for refined products (it gives Hungary and Slovakia an additional year). European Commission President Ursula von der Leyen said it will be an "orderly" process that "allows us and our partners to secure alternative supply routes and minimizes the impact on global markets." Meanwhile, the latest U.S. military aid headed to Ukraine includes drones that hover over a battlefield before diving toward a target.

Global companies have a critical role to play in isolating Russia and helping Ukraine restore its economy, Ukrainian President Volodymyr Zelensky said at WSJ’s CEO Council Summit in London, and he pledged attractive investment conditions for global companies after the war ends.

It’s Federal Reserve Day today with the FOMC widely expected to announce a 50-basis-point hike in interest rates and more details about the start of the balance sheet runoff to pare down the Fed’s nearly $9 trillion portfolio. It would be the first time since 2000 that the central bank has raised interest rates by that much in one meeting. Key will be further details and direction ahead from a presser from Fed Chairman Jerome Jay Powell.

Diesel prices are at record levels and U.S. natural gas prices yesterday rose to fresh 13-year highs.

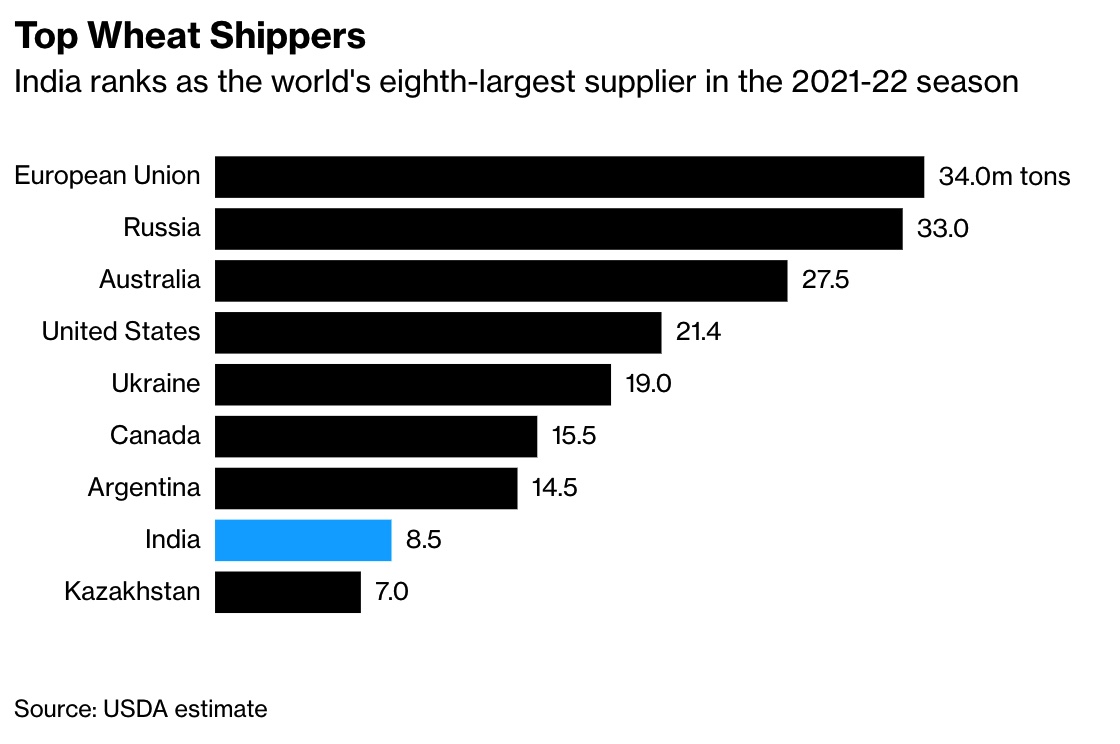

India is considering restricting wheat exports as severe heat waves have damaged crops, exacerbating tight global supplies after the war in Ukraine sent food inflation soaring, Bloomberg reports. Curbing exports would be a hit to India’s ambition to cash in on the rally in global wheat prices after Russia’s war in Ukraine upended trade flows out of the critical Black Sea breadbasket region. Importing nations have looked to India for supplies, with top buyer Egypt recently approving the South Asian nation as an origin for wheat imports.

The U.S. trade deficit in March hit $109.8 billion, up 22% and above $100 billion for the first time. That came as imports hit a record of $351.5 billion, up 10.3%, as oil prices and inflation added to the costs of imported goods. Exports also hit a new record, rising 5.6% to $241.7 billion.

Chinese leader Xi Jinping is pushing to make his nation more self-reliant, a mission Russia’s war in Ukraine has made more imperative, the WSJ reports. China has pumped billions of dollars into semiconductor production, stockpiled grains and oil, and established international links to its financial system.

Secretary of State Antony Blinken will outline the Biden administration’s policy toward China at 11 a.m. ET Thursday in D.C. at George Washington University.

USDA announced the latest details on CRP enrollments. We have the info plus analysis in the Policy section.

President Biden is considering limiting student-loan forgiveness to borrowers who make less than $125,000 a year.

Ohio Primary: Author and venture capitalist J.D. Vance won Ohio’s Republican primary for U.S. Senate, demonstrating former President Donald Trump’s influence over GOP voters.

CIA Director William Burns made an unannounced trip to Saudi Arabia last month to meet with Crown Prince Mohammed bin Salman.

|

MARKET FOCUS |

Equities today: Global stock markets were mostly lower overnight. U.S. Dow opened up around 40 points higher and then went slightly lower and then flipped over 100 points higher as trading is cautious ahead of the FOMC announcement and presser by Chairman Jerome Powell. Asian equities post losses ahead of U.S. Fed meeting conclusion amid continued market holidays as markets in China, Japan and other countries were closed for a holiday. The Hang Seng Index declined 232.37 points, 1.10%, at 20,869.52. The Australia S&P/ASX fell 11.5 points, 0.16%, at 7,304.7. European equity markets are lower in early trading after most markets opened in positive territory. The Stoxx 600 was down 0.5%, with regional markets nearly unchanged to down 0.4%.

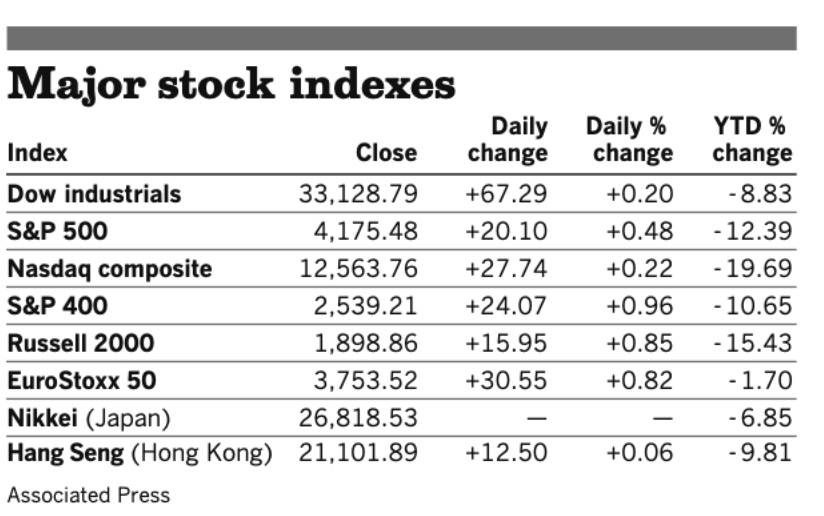

U.S. equities yesterday: The Dow moved up 67.29 points, 0.20%, at 33,128.79. The Nasdaq rose 27.74 points, 0.22%, at 212,563.76. The S&P 500 was up 20.10 points, 0.48%, at 4,175.48.

Agriculture markets yesterday:

- Corn: July corn futures fell 10 1/2 cents to $7.93, the contract’s lowest settlement since April 22. December corn lost 7 cents to $7.35 1/4.

- Soy complex: July soybeans fell 14 3/4 cents to $16.30 1/2, the contract’s lowest closing price since April 7. July soymeal fell $7 to $423.90, the lowest close in over three months. July soyoil rose 19 points to 80.28 cents.

- Wheat: July SRW wheat fell 10 cents to $10.45 1/2, the contract’s lowest closing price since April 7. July HRW wheat fell 5 1/4 cents to $10.92 3/4, also the lowest close since April 7. July spring wheat fell 12 1/4 cents to $11.55 1/2.

- Cotton: July cotton fell 73 points to 150.08 cents per pound after earlier posting a contract high at 152.90 cents.

- Cattle: June live cattle rose 12.5 cents to $135.325 and May feeder futures rose 97.5 cents to $162.40.

- Hogs: June lean hogs fell $2.775 at $102.20, the lowest closing price since $101.875 on Jan. 19. Cash benchmarks continued to erode, with the CME lean hog index down 18 cents to $101.59, the fourth straight daily decline. The index is expected to drop another 44 cents today.

Ag markets today: Trade was relatively light in the grain and soy markets for much of the overnight session, but buyer interest has picked up early this morning. As of 7:30 a.m. ET, corn futures were trading 3 to 6 cents higher, soybeans were 6 to 9 cents higher, winter wheat futures were 20 to 24 cents higher and spring wheat was 15 to 17 cents higher. Front-month U.S. crude oil futures were more than $4 higher, and the U.S. dollar index was around 100 points lower this morning.

Technical viewpoints from Jim Wyckoff:

On tap today:

• ADP employment report is expected to show that the U.S. private sector added 390,000 jobs in April. (8:15 a.m. ET)

• U.S. trade deficit is expected to widen to a record $106.7 billion in March from $89.19 billion one month earlier. (8:30 a.m. ET) UPDATE: See details below for results and analysis.

• S&P Global's U.S. services index for April is expected to tick up to 55.0 from a preliminary reading of 54.7. (9:45 a.m. ET)

• Institute for Supply Management's services index is expected to hold at 58.3 in April, unchanged from the prior month. (10 a.m. ET)

• Federal Reserve releases a policy statement at 2 p.m. ET and Chairman Jerome Powell holds a press conference at 2:30 p.m. ET. (See related item below)

• WSJ CEO Council today features Treasury Secretary Janet Yellen, Microsoft founder Bill Gates and James Gorman of Morgan Stanley.

FOMC meeting conclusion looms. The two-day meeting of the Federal Open Market Committee (FOMC) concludes today at 2 pm ET and the post-meeting statement will give the first signals of the Fed’s monetary policy changes which are expected to include a 50-basis-point increase in the target range for the Fed funds rate and potentially an agreement on the start of the balance sheet runoff to pare down the Fed’s nearly $9 trillion portfolio. That will set the stage for the 2:30 pm ET presser with Fed Chair Pro Tempore Jerome Powell. This could be the biggest post-meeting press conference with Powell as his remarks will be dissected word by word for clues on their future monetary policy actions. Focus will be on whether he still signals an aggressive set of actions on monetary policy lie ahead as the U.S. central bank seeks to temper inflation. How he characterizes the Fed’s views on the initial reading on first quarter GDP which say a contraction of 1.4% in the U.S. economy is another key and attention will be on whether has prompted any shift by Fed officials on the monetary policy path ahead. Recall the Fed has used the phrasing that data will drive their decisions so that data point becomes very important. The trade data released this morning will give the Fed another piece of the puzzle as stronger imports are a negative for the U.S. economy even though they signal demand for goods not produced here. And the Russian invasion of Ukraine figures into the policy mix which again makes this one of the most potentially important Fed meeting conclusions in some time.

Records set in trade data. The U.S. trade deficit in March hit $109.8 billion, up 22% and above $100 billion for the first time. That came as imports hit a record of $351.5 billion, up 10.3%, as oil prices and inflation added to the costs of imported goods. Exports also hit a new record, rising 5.6% to $241.7 billion. This marked five straight months with U.S. imports topping $300 billion as U.S. consumers continue to demand goods that are not produced at home. The higher oil prices that inflated import data also bolstered the value of U.S. exports.

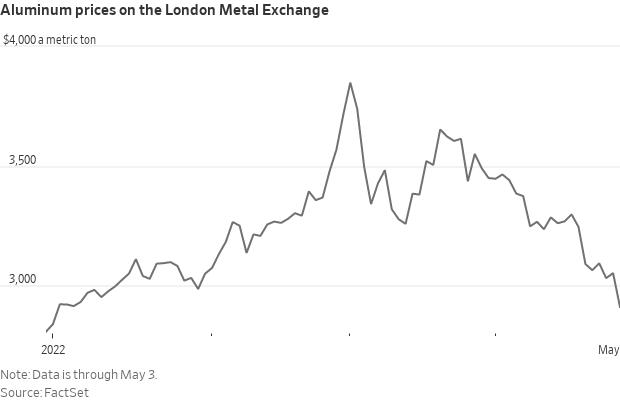

The pandemic’s resurgence in China has helped pull metals prices down from highs hit following Russia’s invasion of Ukraine, the WSJ notes (link). Worries that new economic lockdowns will erode demand from the world’s largest commodity consumer have dragged aluminum and tin down more than 17% from their recent all-time highs. Copper, vital to everything from construction to electronics, has lost 12% since its March record. While prices for many metals remain above prepandemic levels, their retreat from records eases some immediate concerns about supply shocks adding to an inflationary spiral.

Market perspectives:

• Outside markets: The U.S. dollar index is slightly weaker with several currencies firmer against the greenback. The yield on the 10-year U.S. Treasury note was lower, around 2.96%, while global government bond yields were generally higher. Gold and silver futures were weaker ahead of U.S. trading with a focus on the coming Fed meeting conclusion. Gold was trading around $1,868 per troy ounce and silver around $22.62 per troy ounce.

• Crude oil futures are moving higher in the wake of the European Union plan to halt imports of Russian oil. U.S. crude is trading around $106.75 per barrel and Brent around $109.25 per barrel. Futures were firmer in Asian trading, with U.S. crude around $103.40 per barrel and Brent around $105.90 per barrel.

• Diesel prices are at record levels and U.S. natural gas prices yesterday rose to fresh 13-year highs. The average nationwide price of diesel rose to $5.51-per-gallon this week, per Energy Department data, an all-time high (if you don't adjust for inflation). Natural gas yesterday climbed well above $8 per million British thermal units before easing.

• India is considering restricting wheat exports as severe heat waves have damaged crops, exacerbating tight global supplies after the war in Ukraine sent food inflation soaring, Bloomberg reports (link). It says top officials are discussing the move and will recommend it to Prime Minister Narendra Modi, who will then make the decision Link to Reuters report on India’s current wheat crop situation.

• Ag trade: South Korea purchased 50,000 MT of U.S. milling wheat. Taiwan purchased 55,000 MT of corn – expected to be sourced from South Africa. Tunisia tendered to buy 100,000 MT of soft wheat and 75,000 MT of feed barley – both optional origin.

• La Niña could bring a dry 2022. “The dice are loaded for a lot of big fires across the West,” said Park Williams, a climate scientist at UCLA. “And the reason for that is simple: The vast majority of the western U.S. is in pretty serious drought.” If NOAA is correct, high temperatures and the lingering La Niña will have major impacts on urban and agricultural water use across the American West, including California’s increasingly extreme fire season. The federal gov’t has already announced that it will delay water releases from Lake Powell, the nation’s second-largest reservoir, because of worsening drought conditions along the Colorado River. To boost the shrinking reservoir, the U.S. Bureau of Reclamation said Tuesday that it plans to hold back water to reduce risks of the lake falling below a point at which Glen Canyon Dam would no longer generate electricity. La Niña typically brings dry winters to Southern California and the Southwest. Now, with California’s rainy season largely past and a hot dry summer rapidly approaching, forecasters say La Niña has a 59% chance of continuing through the summer, and up to a 55% chance of persisting through the fall. Experts say this summer could be a repeat of last year, when fires burned more than 2.5 million acres across California — more than any other year except 2020. In the northern United States, La Niñas are typically associated with colder, stormier-than-average conditions and increased precipitation. In the southern U.S., they’re known for warmer, drier and less stormy conditions.

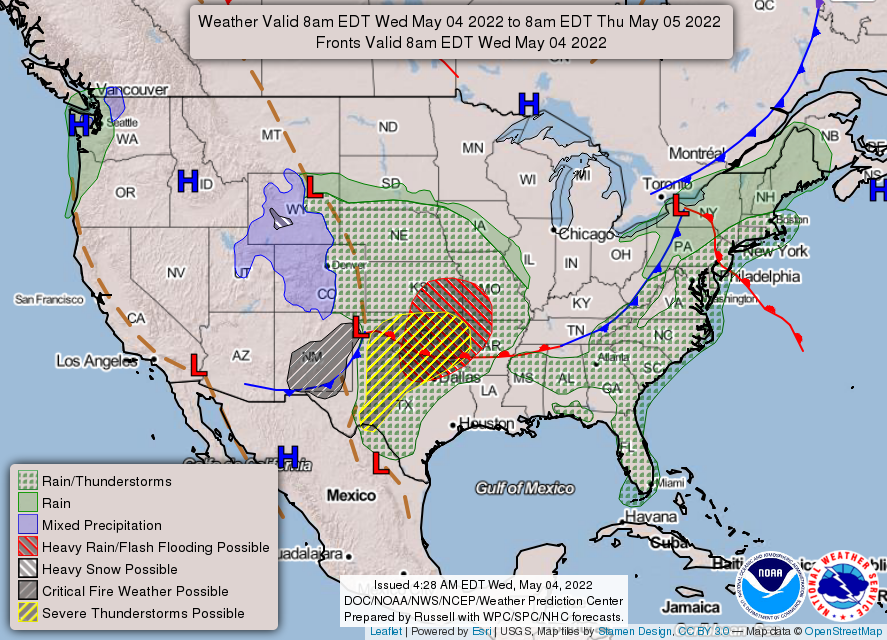

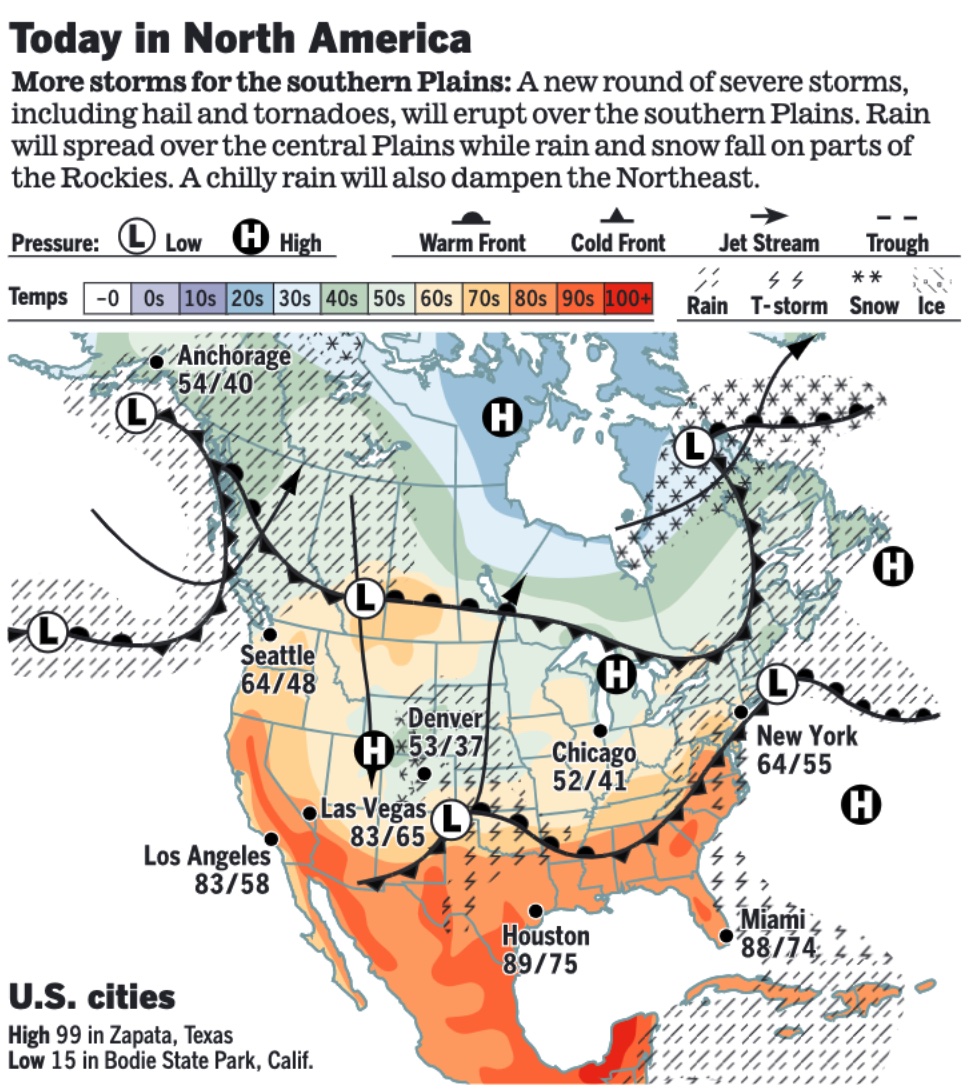

• NWS weather: On Wednesday and Thursday, heavy rain and severe thunderstorms will develop over portions of the Central/Southern Plains and Middle/Lower Mississippi Valley... ...There is a Critical Risk of fire weather over parts of the Southern Rockies.

Items in Pro Farmer's First Thing Today include:

• Firmer price action overnight

• Ukraine’s April grain exports a third of year-ago (Details in Russia/Ukraine section)

• India plans less wheat, more rice in food program

• Wholesale beef prices dive, movement improves

• Hog market still trying to find a bottom

|

RUSSIA/UKRAINE |

— Summary: The U.S. and Britain have been sending a stream of increasingly powerful arms, and Russia’s Nordic neighbors — Finland and Sweden — are inching closer to joining NATO. Russia is focusing on cementing both military and political control over the territory it has taken so far in Ukraine after making only marginal gains in the east. Western officials are debating the Kremlin’s calculations in not trying harder to halt weapons shipments in Ukraine. Meanwhile in Ukraine, fresh evacuations from Mariupol began today as a convoy of buses departed from the besieged Ukrainian port city, according to a local official. And in Lviv, electricity has been restored after a series of missile strikes hit power stations last night, causing major disruptions and damage.

• EU to propose ban on all Russian oil imports. Brussels will propose a phased-in ban on imports of all Russian oil as member states prepare to discuss a sixth package of penalties against Moscow for its invasion in Ukraine. The measure would ban the import of crude oil in the next six months and refined oil product imports by the end of 2022. The European Commission president, Ursula von der Leyen, made the announcement. Impact: An EU oil ban is a tightening noose on Russia’s economy as Moscow has limited scope to redirect crude sales to alternative markets, says the Financial Times. The Financial Times reports that "China’s independent refiners have been discreetly buying Russian oil at steep discounts" amid moves by western nations to cut reliance on Russia. S&P Global Commodity Insights reports a sharp uptick in India's imports of Russian Urals crude.

- Once Russia’s richest person speaks out about Putin. Speaking to a packed ballroom at the Milken Institute’s conference, Mikhail Khodorkovsky — once Russia’s richest person, before a rift with Vladimir Putin led to his arrest and ultimately exile — was blunt: “The world will not be a safe place as long as Putin remains in power.”

— Market impacts:

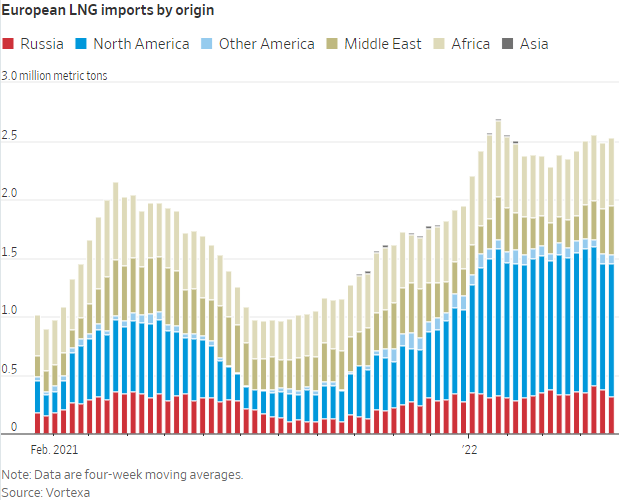

- Europe is racing to stock up on oil and natural gas before it imposes tighter sanctions on Russian energy. Terminals to import liquefied natural gas took in a record amount of the fuel for the time of year in April, according to commodity-tracking firm Vortexa. Oil imports from non-Russian suppliers, meanwhile, hit their highest level since the start of the pandemic. Governments and companies are preparing for Russian imports to slow by seeking alternative sources in the U.S., Africa, the Middle East and Asia — as well as squeezing more supply out of Europe itself.

- Ukraine’s April grain exports a third of year-ago. Ukraine exported 923,000 MT of grain in April, according to APK-Inform. That was down from 2.8 MMT for the month last year. The total included 768,486 MT of corn and 127,130 MT of wheat. Ukraine also exported 151,529 MT of sunflower oil and 169,681 MT of oilseeds, mostly sunseeds.

- Global group sees rising food insecurity risks with Russian invasion of Ukraine having potential to make things worse. The Global Network Against Food Crises was established by the U.N. and the European released its annual report on food insecurity and while it contains forecasts for the level of global food insecurity, the report cautions the outlooks did not reflect Russia’s invasion of Ukraine. The group noted that global wheat output was poised to rise a fourth straight year before the invasion, but that has now created “major uncertainties regarding the production and export capacities of agricultural products from Ukraine due to widespread infrastructure damage and destruction, and from the Russian Federation due to the economic impact of the war.” The report detailed that in 2020, “38 countries/territories affected by food crises received 34% of the total Ukrainian exports of wheat and maize (corn) products. Food-crisis countries also accounted for 73% of Russian exports of wheat.” Some 27 of those received 13.4 million tonnes of wheat and corn from Russia and Ukraine, with the report noting the largest of those importers were Yemen, the Sudan, Nigeria and Ethiopia, “which are consistently among the world's ten largest food-crisis countries.”

|

POLICY UPDATE |

— USDA accepts 2 million acres for CRP from latest general signup, but new offers lag. USDA announced that over 2 million acres have been accepted into the Conservation Reserve Program (CRP) via the general signup that ended in March. FSA advised that over 2.0 million acres were offered and that “approximately 2.0 million acres are acceptable.” Those acres can be enrolled in CRP with a contract start date of October 1.

The average rental rate was $51.51 per acre, which is below the current average for CRP ground enrolled via general signups of $55.71 per acre.

USDA said that producers submitted offers on just over half of expiring CRP contracts for re-enrollment via the general signup, but there were less 400,000 acres offered as new acres to be enrolled in CRP. Last year, USDA noted there were over 700,000 new acres offered for enrollment via the general signup conducted then.

Offers for CRP were ranked using the Environmental Benefits Index (EBI), with a maximum score of 545. Those with an EBI of 184 or greater were “deemed basically acceptable,” FSA said. However, there is a separate list of states where an EBI score of 174 or greater were determined “basically acceptable.”

Producers have 15 calendar days to notify their FSA county office of whether they want to continue with the offer to participate after receiving notice from FSA via form CRP-23 that their offer was accepted.

USDA also said that 260,000 acres have been offered for enrollment under continuous CRP and Conservation Reserve Enhancement Program (CREP) signup efforts.

USDA noted that there are about 3.4 million acres of CRP contracts expiring as of Sept. 30, but that figure reflects only acres enrolled via general signups as USDA data shows contracts on another 560,000 acres enrolled via continuous signup efforts also expire Sept. 30.

The announcement from USDA does not quite mesh with comments from USDA Secretary Tom Vilsack on April 5 when he told reporters that 52% to 56% of acres under contracts that mature at the end of September were not offered for re-enrollment, yet USDA’s release said that over half of the maturing CRP acres were put in for re-enrollment. Vilsack also said that around 800,000 acres of land not currently under a CRP contract were to be enrolled in the program. The actual signup figures also raise questions of why Vilsack’s comments from early April did not match up very well. It points to the potential peril of discussing data that has not yet been finalized.

But there is more information ahead that will provide even greater clarity on the situation, including detailed data on the general CRP signup that closed March 11.

Key information yet to be released include where the acres are located that were submitted for re-enrollment in CRP. But more importantly, that data will provide some perspective on where CRP acres could be brought back into production. There are limits on how much of those acres will be able to come back into production for, as CRP rules do not allow preparation of the ground to begin before July 1 at the earliest relative to removing cover on those acres. And the CRP contract holder would lose rent from the start of that process through Sept. 30 when the contract expires.

The lure of current commodity prices was acknowledged by Vilsack in the release announcing the signup results. “Our conservation programs are voluntary, and at the end of the day, producers are making market-based decisions as the program was designed to allow and encourages,” he noted. That suggests USDA will not likely come close to the legislated maximum of 27 million acres to be in CRP for fiscal year (FY) 2023. With 22.1 million acres in the program currently, contracts on 4 million acres expiring Sept. 30, and only 2 million acres enrolled via this general signup, the program will remain millions of acres shy of the legislative cap which this USDA views as a goal, not a limit as is stated in law.

— IRS Commissioner Chuck Rettig asked Congress to help curb syndicated conservation easements, tax-advantaged transactions which the agency has considered for years to be abusive. The transactions involve a group of investors who buy interests in land, donate the development rights, then receive charitable deductions intended to incentivize land conservation. The agency has said the promoted transactions often rely on appraisals that significantly inflate the value of the property — resulting in deductions worth several times more than the amount investors put into the deal.

|

CHINA UPDATE |

— President Joe Biden on Tuesday accused the Chinese government of trying to interfere in negotiations over a broad China competition bill (HR 4521) that would bolster domestic semiconductor manufacturing. “Fundamentally, this is a national security issue. This is one of the reasons why the Chinese Communist Party is lobbying folks to oppose this bill,” the president said Tuesday in Troy, Alabama. “And it’s an issue that unites Democrats and Republicans. So, let’s get it done.” The Chinese Embassy in Washington has been seeking meetings with administration officials, congressional offices, think tanks and companies to gather information about the status of the bill and what provisions are likely to make it to the president’s desk, people familiar with the meeting requests said. Administration officials have all declined the requests, as have many of the congressional offices.

— Secretary of State Antony Blinken will outline the Biden administration’s policy toward China at 11 a.m. ET Thursday in D.C. at George Washington University, according to a statement.

— Chinese leader Xi Jinping is pushing to make his nation more self-reliant, a mission Russia’s war in Ukraine has made more imperative, the WSJ reports (link). China has pumped billions of dollars into semiconductor production, stockpiled grains and oil, and established international links to its financial system. At the root of the push is the fear of getting blocked out of Western economies by heavy penalties of the sort the U.S. and European Union have thrust at Russia. China’s much larger economy is more difficult to cut off than Russia’s, but that doesn’t make it bulletproof, the WSJ article concludes. “One lesson that China is probably taking from the fallout is it remains vulnerable to financial, economic and technological sanctions,” said Eswar Prasad, the International Monetary Fund’s former China division chief and a professor of trade policy

|

TRADE POLICY |

— USTR starts required review of Section 301 tariffs on China. The Office of the U.S. Trade Representative (USTR) has readied a notice to appear in the Federal Register that they are launching the four-year review of the Section 301 tariffs put in place July 6, 2018, and August 23, 2018. Under the Trade Act of 1974, the first step in the four-year review process is notifying representatives of domestic industries which benefit from the trade actions of the possible termination of the tariffs and provide them the opportunity to request that the tariffs be continued. They have a 60-day window to make those requests. For tariffs imposed via the July 6, 2018, action, those seeking to have the tariffs continued must submit their requests between May 7 and July 5. For the Aug. 23, 2018, action, comments are due between June 24 and Aug. 22. Link to the pre-publication document that has not yet been put on review at the Federal Register. The review is taking place amid a backdrop of discord within the administration as U.S. Trade Representative Katherine Tai has pushed to keep the tariffs in place to preserve leverage with China relative to them living up to terms of the Phase 1 agreement, while others including Treasury Secretary Janet Yellen have suggested removing tariffs would be a potential way to temper inflation.

|

ENERGY & CLIMATE CHANGE |

— Unintended consequences re: climate change provisions. Industry lawyers are warning that the climate change provisions of the Biden administration’s new environmental permitting rules will throw more proposed projects into the courts—potentially jeopardizing the very projects the White House wants to promote. Wind farms, solar arrays, and renewable energy transmission lines — all parts of the White House’s bid to cut domestic greenhouse gas emissions in half by 2030 — could be affected, according to attorneys.

— Battery startup in rural Washington. A battery materials startup called Sila, cofounded by a one-time Tesla engineer and backed by Mercedes-Benz, is building a massive factory in rural Washington to make battery anodes that use silicon instead of graphite. Its aim: to power millions of electric vehicles.

— Apple Inc. has recruited a longtime Ford Motor Co. executive who helped lead safety efforts and vehicle engineering, a sign the iPhone maker is again ramping up development of an electric car," Bloomberg reports (link).

— Hurdles to higher ethanol blends. Biofuel and farm groups see E15 and other higher blends of corn ethanol into gasoline as the strategy to higher sales, but the current structure of the Renewable Fuel Standard "does not serve to incentivize ethanol blends higher than E10." Link to report from USDA’s Office of the Chief Economist.

— DOE announces $45 million in funding to boost EV battery tech. The Department of Energy (DOE) announced up to $45 million in funding to support domestic development of advanced batteries for electric vehicles (EVs). Through DOE’s Advanced Research Projects Agency-Energy (ARPA-E) the department is launching the new Electric Vehicles for American Low-Carbon Living (EVs4ALL) program. The EVs4ALL funding opportunity aims to address three key market concerns: faster charging, increasing efficiency across temperature extremes and improving the lifespan and capacity of the batteries.

|

LIVESTOCK, FOOD & BEVERAGE INDUSTRY |

— White House to hold conference on hunger, nutrition and health. The White House has announced it will hold the first White House Conference on Food, Nutrition, and Health since 1969, with the event to take place in September. No specific date has been set. The goal of the conference is to rally “public and private sectors around a coordinated strategy to accelerate progress and drive transformative change in the U.S. to end hunger, improve nutrition and physical activity, and close the disparities surrounding them.” There will be public listening sessions leading up to the conference the White House said will allow input from all regions of the U.S. Link to White House announcement.

— Starbucks plans $1 billion in wage increases and investments in its stores. However, the wage increase won’t apply to stores where employees have unionized, the company said, explaining that it will need to negotiate deals with the unions involved in those stores. The initiative was announced as labor organizers have won initial votes at more than 50 stores, including several this week. Some labor lawyers argued the move amounted to a pressure tactic that might be illegal.

|

CORONAVIRUS UPDATE |

— Summary: Global cases of Covid-19 are at 514,943,711 with 6,241,119 deaths, according to data compiled by the Center for Systems Science and Engineering at Johns Hopkins University. The U.S. case count is at 81,506,838 with 994,748 deaths. The Johns Hopkins University Coronavirus Resource Center said that there have been 574,232,736 doses administered, 219,483,386 have been fully vaccinated, or 66.61% of the U.S. population.

— CDC issues new statement, says travelers should still wear masks on planes. The Centers for Disease Control and Prevention (CDC) on Tuesday said that it still recommends that people wear masks on planes, trains, airports, and other modes of public transportation, despite a court last month ruling against the agency’s rule. The Transportation Security Administration (TSA) said last month, following the court ruling, that it will no longer enforce the CDC’s masking order for airports and planes, meaning that Tuesday’s recommendation from the CDC has no teeth.

— Severe Covid-19 may be linked to cognitive impairment equivalent to aging 20 years and losing 10 IQ points, a new U.K. study finds.

|

POLITICS & ELECTIONS |

— Ohio's Republican Senate primary was the first major midterm test of Trump's enduring influence over the Republican Party -- and Trump's candidate won. J.D. Vance, the venture capitalist and "Hillbilly Elegy" author, emerged from a well-funded field of Republicans vying to replace retiring Sen. Rob Portman. Vance, 37, now faces Rep. Tim Ryan (D-Ohio), who easily won the Democratic Senate primary on Tuesday and is running a campaign focused on economic issues affecting working-class voters who left the party under Trump. Trump’s endorsements will be tested in coming weeks with GOP primaries in states including Pennsylvania, North Carolina and Georgia. He has sought to use the election cycle as a way to bolster his status as Republican kingmaker while teasing a possible 2024 White House run.

In Indiana, Sen. Todd Young is seeking a second term in office. He ran unopposed on the Republican ballot.

— The Trump family business paid $750,000 to settle suit with Washington. The District of Columbia claimed that the Trump International Hotel had accepted excessive payments from the former president’s inauguration committee, a nonprofit, in part to host a private event for his children.

|

OTHER ITEMS OF NOTE |

— North Korea launched what appeared to be a medium-range ballistic missile, as Kim Jong Un ramps up his nuclear program ahead of Biden’s first visit to Seoul. The regime fired off a ballistic missile just after noon local time on Wednesday from an area near Pyongyang Sunan International Airport, according to South Korea’s Joint Chiefs of Staff.

— Supreme court issues rare statement on leak of Roe v. Wade ruling, orders marshal to investigate. The Supreme Court on Tuesday responded to the leak of a draft ruling and confirmed its authenticity, issuing a statement from Chief Justice John Roberts, who called the leak “a betrayal of the confidences” of the institution. On Monday evening, Politico published a purported draft copy of the court’s ruling, which suggested that the landmark abortion law Roe v. Wade would be overturned. The Supreme Court confirmed the document’s authenticity but said the draft does not represent a final decision by the court “or the final position of any member” in the case. “To the extent this betrayal of the confidences of the Court was intended to undermine the integrity of our operations,” Roberts wrote, “it will not succeed,” adding that the “work of the Court will not be affected in any way.” Roberts also said he directed the Marshal of the Supreme Court to carry out an investigation into the leak and the individual who leaked it to the press. Should the leaker be identified, it’s not clear what punitive actions will be taken against them, although Roberts said the leak could be considered a significant breach of trust. “We at the court are blessed to have a workforce — permanent employees and law clerks who are intensely loyal to the institution and dedicated to the rule of law,” the George W. Bush-appointed chief justice added. “Court employees have an exemplary and important tradition of respecting the confidentiality of the judicial process and upholding the trust of the Court.”

— Elon Musk plans to take Twitter public just a few years after his proposed buyout. Musk said he plans to stage an initial public offering of Twitter within as little as three years of buying it. His $44 billion deal to take Twitter private is expected to close later this year, subject to conditions including the approval of Twitter shareholders and regulators.

— U.S.-Saudi Meeting: CIA Director William Burns made an unannounced trip to Saudi Arabia last month to meet with Crown Prince Mohammed bin Salman, as the Biden administration pushes to repair ties with the kingdom.