Senior Official: Biden This Morning to Ban Importation of Russian Oil into U.S.

Some analysts upping odds of $5-plus regular gasoline average ahead

|

In Today’s Digital Newspaper |

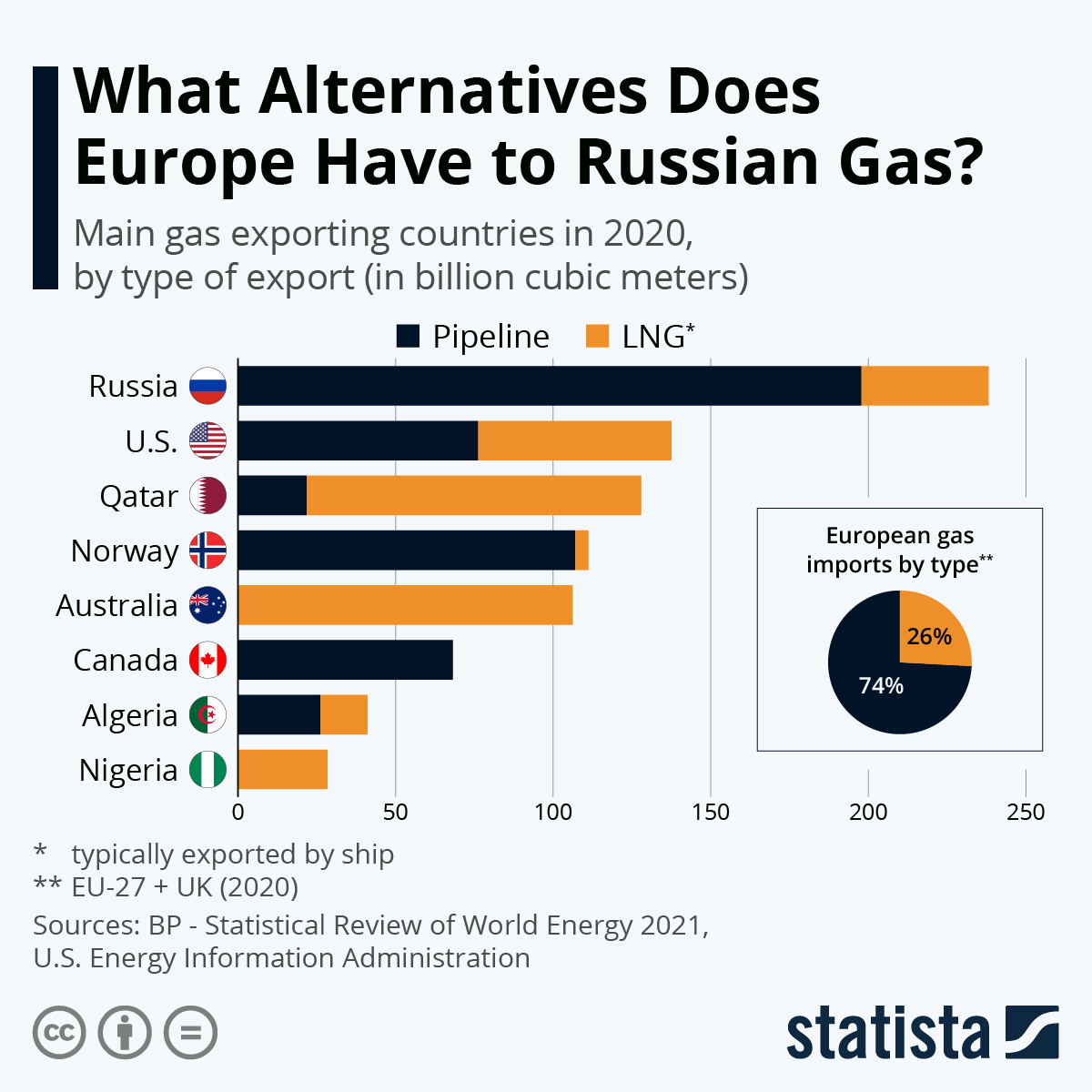

Congress is putting pressure on the Biden administration to ban Russian oil imports, as the U.S. and allies weigh tougher punishments for Moscow. This morning, a senior U.S. official said that would indeed occur, with President Biden scheduled to make the announcement at 10:45 a.m. from the White House. But Chancellor Olaf Scholz of Germany said he was reluctant to impose a ban, given his country’s dependence on Russian fuel (some alternative suppliers are detailed below). And despite joining in financial sanctions against Russia, Switzerland remains a hub for the trading of Russia’s raw materials and resources. Shell said it will end purchases of Russian crude and will shut more of its operations in Russia, as Western oil giants move to cut decades-long ties to Russia.

Ukraine managed to evacuate a convoy of civilians from the besieged northeastern city of Sumy but renewed Russian shelling at the city’s exit forced the effort to be halted.

USDA daily export sales:

• 193,000 MT hard red spring wheat to the Philippines during 2022-2023 marketing year

• 132,000 MT soybeans to China during 202-/2023 marketing year

• 126,000 MT soybeans to unknown destinations during 2021-2022 marketing year

Oil price analysts are frequently raising their estimates of potential price peaks ahead while nickel is taking on wheat futures for being the commodity many are watching (related item below).

|

MARKET FOCUS |

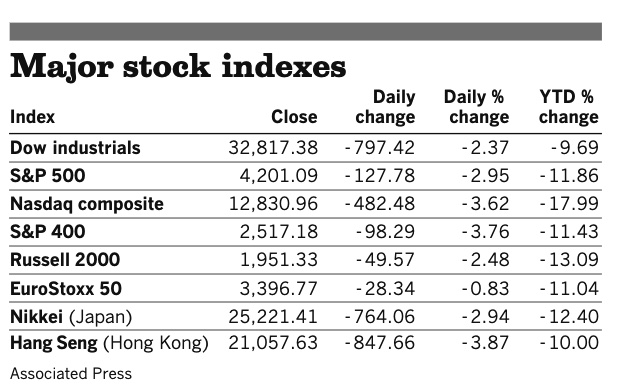

Equities today: Global stock markets were overnight and U.S. stock indexes are pointed toward higher openings. Asian equities saw another round of losses in most markets Monday after U.S. equity declines that pushed the Dow into correction territory and the Nasdaq into a bear market. The Nikkei fell 430.46 points, 1.71%, at 24,790.95. The Hang Seng Index lost 291.76 points, 1.39%, at 20,765.87. European equities have seen choppy action in early trading with most indices opening lower only to turn higher as the session unfolded. The Stoxx 600 was up 0.8% while regional markets were up 1.5% to more than 3%; the FTSE was only managing a 0.6% increase.

U.S. equities yesterday: The Dow fell 797.42 points, 2.37%, at 32,817.38. The Nasdaq dropped 482.48 points, 3.62%, at 12,830.96. The S&P 500 declined 127.78 points, 2.95%, at 4,201.09. The Dow entered a correction for the first time in two years. The Nasdaq Composite entered bear-market territory, dropping 20% from its Nov. 19 peak, the first bear market since the crash at the outset of the Covid-19 pandemic in March 2020. The average bear market lasts 110 trading days, according to Dow Jones Markets Data, though it is usually a positive signal for future returns: The average one-year move for the Nasdaq Composite after entering a bear market is a gain of 13%. Some analysts note this current backdrop feels more like the 1970s, and if so, that isn’t a great one for equities. According to data from Strategas Research Partners, the S&P 500’s total return was a decline of 33% after the start of the Arab oil embargo of 1973.

On tap today:

• U.S. trade deficit is expected to widen to $87.2 billion in January from $80.7 billion one month earlier. (8:30 a.m. ET)

• U.S. wholesale inventories for January are expected to rise 0.8% from the prior month. (10 a.m. ET)

• China's producer price index is forecast to increase 8.8% from a year earlier in February, and the consumer price index is expected to be unchanged. (8:30 p.m. ET)

Global stock markets are wilting, and the dollar is surging against other currencies as investors rush for the safety of U.S. assets. Economists are increasingly warning of a possible bout of stagflation, particularly in Europe, a situation of high inflation and low growth that afflicted major economies during the 1970s. Back then, central banks responded to a surge in oil prices with easy-money policies that caused a wage-price spiral. Now, some central banks might give up on their plans to increase interest rates after keeping them down during the pandemic. Link for more perspective via the WSJ.

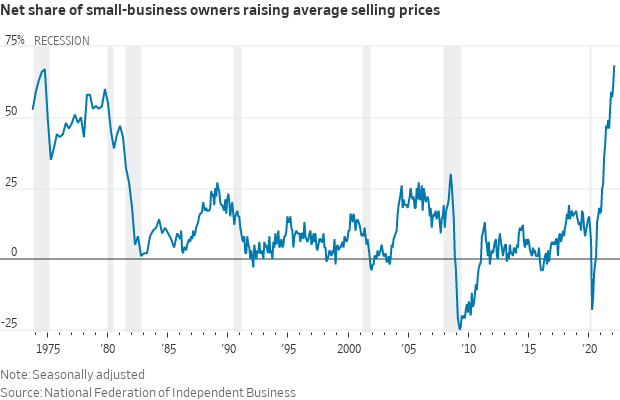

U.S. small-business optimism fell to its lowest level in more than a year and a record share of owners raised prices in February as businesses coped with supply chain disruptions, labor shortages and accelerating inflation. The National Federation of Independent Business (NFIB) optimism index dropped to 95.7 from 97.1 in January. That was the lowest since January 2021. The share of owners raising average selling prices increased to a net 68%, the highest reading on record in a series that goes back 48 years, the NFIB said.

Inflation expectations hit a high. The so-called 10-year break-even rate, which reflects bond investors’ prediction for inflation over the next decade, nearly reached 2.8% yesterday, a level unseen in almost three decades.

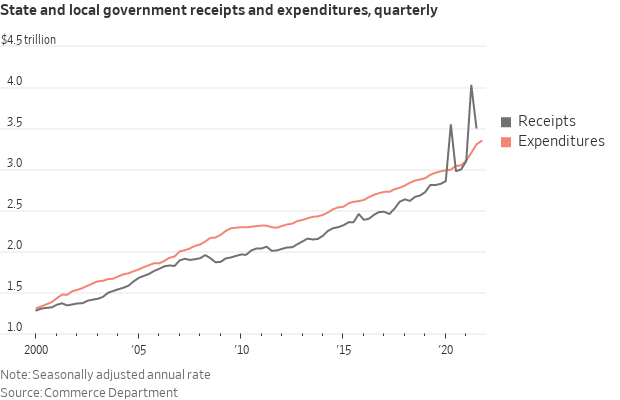

States flush with cash are aiming to slash taxes as the nation’s economic recovery and infusions of federal pandemic-relief funds have stoked budget surpluses. At least 13 states are considering income tax cuts this year, according to the Tax Foundation, a Washington group that generally favors simpler taxes with lower rates. Last year, some 16 states enacted or implemented income tax cuts — the largest wave in decades.

Consumers tap the brakes on credit card use. Consumer credit rose 1.9% in January, led by a rise in nonrevolving credit of 2.5%. But revolving credit — where credit and store cards are categorized — declined 0.3%, a sign that consumers opted to put the plastic away after the holidays. The $6.8 billion increase in credit marked the smallest rise in a year and was well below expectations consumers would expand credit use by $24 billion. There are several potential factors at play, including Covid, rising prices and high inflation and still constrained supplies of cars and other household goods. The decline in revolving credit was the first since April as consumers had been steadily increasing credit card use during 2021 as they emerged from the depths of the pandemic with pent-up spending. However, consumers are still sitting on a hefty level of savings that allow them the ability to service the increasing debt levels that they took on in 2021. Key will be whether this becomes a sustained pattern or was more of a “one-off” situation and consumers will resume credit card use.

Market perspectives:

• Outside markets: The U.S. dollar index is weaker in early dealings as several foreign rival currencies are higher against the greenback. The yield on the 10-year U.S. Treasury note was firmer, trading above 1.85% with a solidly higher tone in global government bond yields. Gold and silver futures are seeing solid buying interest, with gold above $2,019 per troy ounce and silver above $26.50 per troy ounce

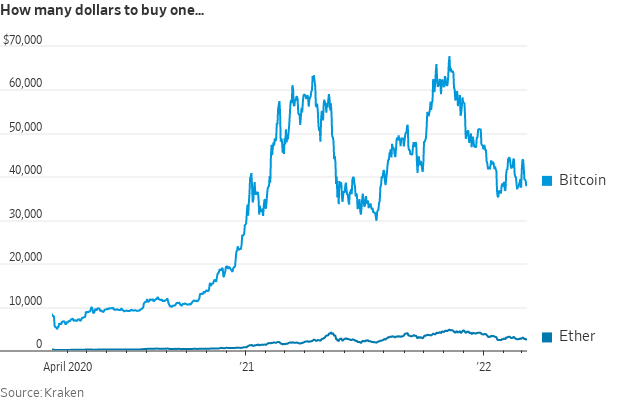

• Administration EO coming on cryptocurrencies. President Joe Biden will sign an executive order (EO) this week that will outline the U.S. government’s strategy for cryptocurrencies. The order will direct federal agencies to examine potential regulatory changes, as well as the national security and economic impact of digital assets. The directive is also expected to address the possibility of a U.S.-issued central bank digital currency.

• Crude oil futures remain higher ahead of U.S. trading, with U.S. crude over $121.75 per barrel and Brent crude atop $126 per barrel. The levels mark a rise from Asian action where U.S. crude was around $121 per barrel and Brent was around $125.75 per barrel.

• $200 oil? While oil came back down after surging to nearly $140 a barrel early Monday, investors are betting it's going to spike again soon. Option calls for oil futures piled in on Monday, with over 1,200 contracts calling for May Brent futures to hit $200 a barrel, per data from ICE Futures.

• Chief executives of some of the world’s largest oil companies and U.S. government officials warned Monday that there were no quick-fix solutions to the higher energy prices and market volatility that have followed Russia’s invasion of Ukraine. The chief executives of Exxon Mobil, Hess and France’s TotalEnergies, and presidential climate adviser John Kerry said there was no immediate relief in sight, and even higher energy prices and global economic disruption were likely.

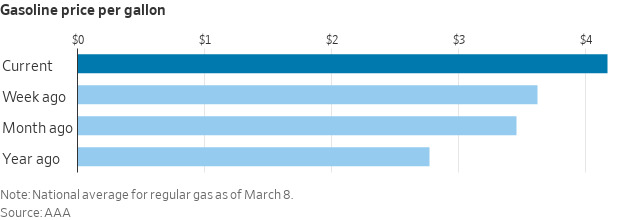

• Price for a gallon of regular gasoline soared to a new record high of $4.14, breaking the previous record of $4.11 set in 2008. Experts say the rapid spike in prices is squeezing many household budgets, at a time when many employers are starting to make employees return to offices.

The comparison with 2008 isn’t adjusted for inflation. The earlier record would equate to a price now of about $5.20 a gallon, according to one estimate. (Some analysts are over 60% odds that the average price will reach $5 or higher eventually.)

• Financial Times: IEA ready to release more oil to ease soaring energy prices, says chief. The head of the International Energy Agency (IEA) said the group’s members were ready to release more oil from emergency stockpiles to ease soaring energy prices, as he criticized Saudi Arabia and the United Arab Emirates for refusing to pump more crude.

• Volatile wheat market: $1.615 trading range in May SRW futures overnight.

• The IMEA of Mato Grosso (state estimator) reportedly lowered the crop estimate there, with some saying Brazil's crop could be under 120 million tons, even though most are in the 122-126 million ton range. Traders will be looking at USDA tomorrow (WASDE) to see what they estimate. Conab does not come until Thursday.

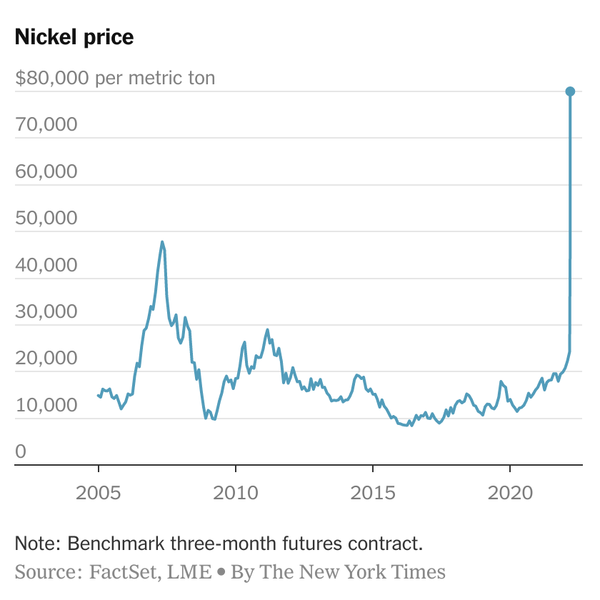

• Nickel more than doubled to $100,000 a ton before paring gains and eventually seeing trading suspended on the London Metal Exchange (250% increase in the metal’s price this week). The exchange said it’s calculating margin calls at the Monday closing price of $48,000 and is considering whether to adjust or cancel the trades made between then and the suspension. Russia is a large producer of nickel, which is used to make stainless steel and car batteries.

• Ag demand: Iran tendered to buy 60,000 MT each of corn, soymeal and feed barley from unspecified origins. South Korea passed on a tender to buy up to 130,000 MT of feed wheat as prices were deemed too high. Tunisia rejected all offers in a tender to buy 125,000 MT of milling wheat and 100,000 MT of feed barley because prices were too high.

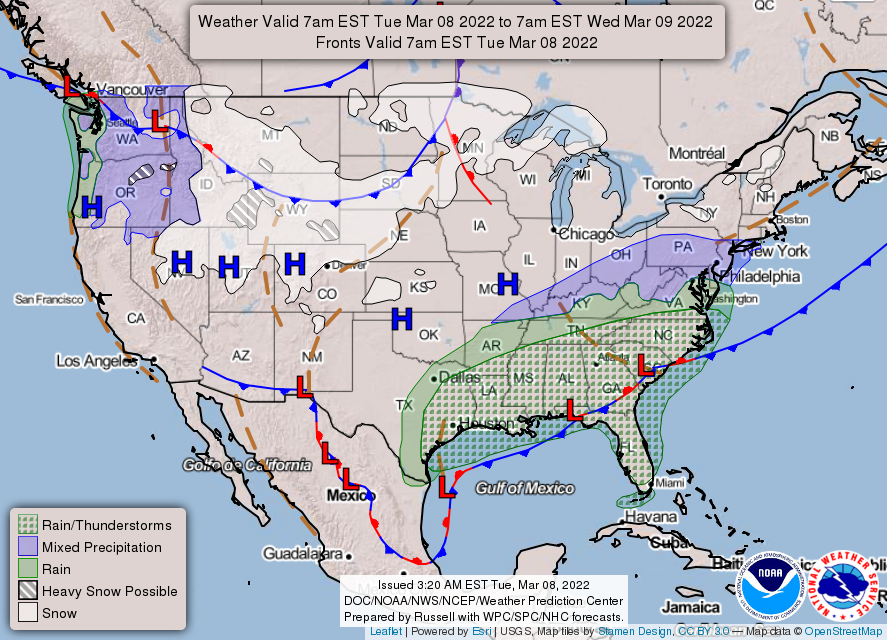

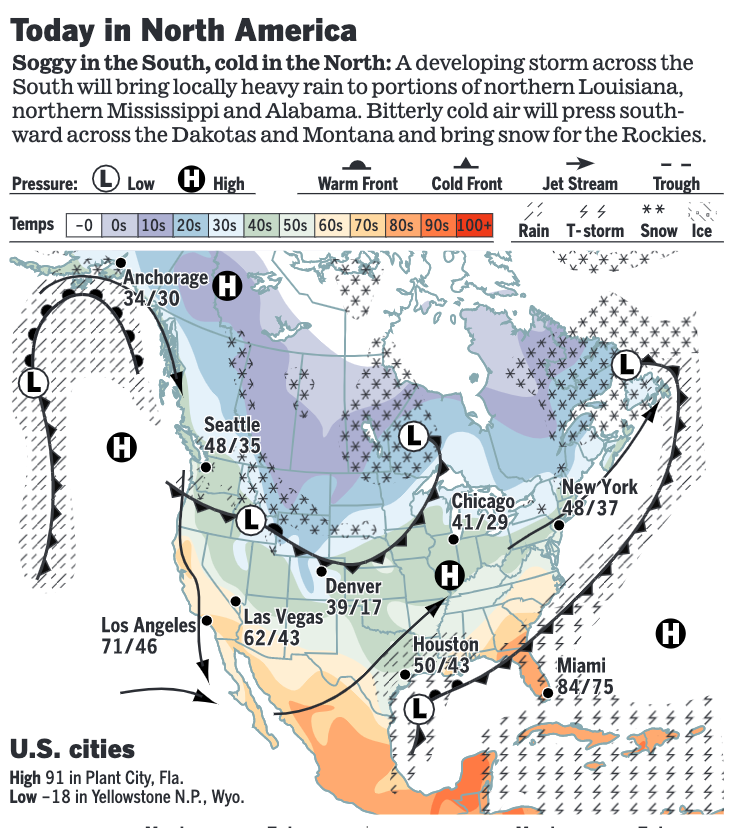

• NWS weather: Rain and scattered thunderstorms for the Deep South and Mid-Atlantic; Light Snow showers for parts of the Central Appalachians, Northeast and Mid-Atlantic... ...Heavy snow across the northwestern mountains today will spread into the Central Plains by Wednesday... ...Cold air spills into the Rockies and Great Plains through late-week; Critical Fire Weather Risk issued for portions of the Southern Plains on Wednesday.

Items in Pro Farmer's First Thing Today include:

• Wheat mostly lower in volatile overnight trade

• Surging prices encouraging Brazilian corn, wheat exports

• Consultant leaves South American crop estimates unchanged

• Boxed beef prices firm

• Cash hog index weakens again

|

RUSSIA/UKRAINE |

— Summary: Ukraine and Russia have agreed on one evacuation route so Ukrainians can safely leave the region. Several previous attempts to evacuate civilians failed earlier this week, with Western leaders accusing Russian forces of continuing to target pre-approved safe routes. The Biden administration is emphasizing that American troops won't engage directly with Russian forces, and NATO members have also pushed back on calls for a no-fly zone in Ukraine, warning that it could lead to a "full-fledged war in Europe." But things could swiftly change if Moscow’s attack spills into a NATO member nation — a move that would trigger the alliance’s Article 5 — the principle that an attack on one NATO member is an attack on all members.

- Volodymyr Zelenskyy, Ukraine’s president, said he was “not hiding” in a late night video showing himself in his office in Kyiv, the capital. Zelenskyy promised that the country would rebuild everything destroyed by Russian forces. Earlier on Monday, Zelenskyy warned that the war would spread beyond Ukraine. He once again stressed the need to secure the country’s airspace.

- Trade sanctions coming. Congressional trade leaders have agreed to pursue bipartisan legislation that aims to punish Putin for his invasion of Ukraine by suspending normal trade relations with Russia and imposing a ban on Russian energy imports. The bipartisan effort would allow President Biden to increase tariffs on products from Russia and Belarus, which would also see normal trade relations halted by the bill. Relations could be restored “subject to certain conditions and congressional disapproval.”

- Ukraine's infrastructure minister said the country has suffered about $10 billion in damage since Russia's invasion began.

- The World Bank approved $723 million in grants and loans to Ukraine, intended to keep the government and its services functioning throughout the conflict by, for example, paying pensions, hospital workers’ wages and providing aid. The package includes loans and grants from Britain, Denmark, Iceland, Japan, Latvia, Lithuania, the Netherlands and Sweden. The bank says it is working on a further $3 billion package and support for neighboring countries taking in Ukrainian refugees.

— Market impacts:

- Most of what Russia sends to the U.S. is not crude, but rather unfinished oils or heavy oil that refiners use for blending purposes. Refiners can find substitutes for heavy oil from places like Mexico, Ecuador, and Colombia, according to Ben Cahill, senior fellow at the energy program of the Center for Strategic and International Studies.

- Gas cut coming… $300 oil? Russian Deputy Prime Minister Alexander Novak warned his country could cut gas supplies to Europe and said it could lead to oil prices surging above $300 a barrel. Of note: Europe is importing more Russian natural gas than before the invasion.

- It’s not too late for Keystone XL pipeline: Alberta’s Premier. The pipeline could send almost 900,0000 barrels to U.S. daily, but the U.S. government would need to “de-risk” the project first. TC Energy Corp.’s Keystone XL crude pipeline could be built by the first quarter of next year if the Biden administration were to reverse its decision to cancel the project. Construction of the controversial pipeline had already begun when the project was scrapped last year by the U.S., Alberta Premier Jason Kenney said during a news conference. President Joe Biden canceled a key permit for Keystone XL on his first day in office, citing environmental concerns.

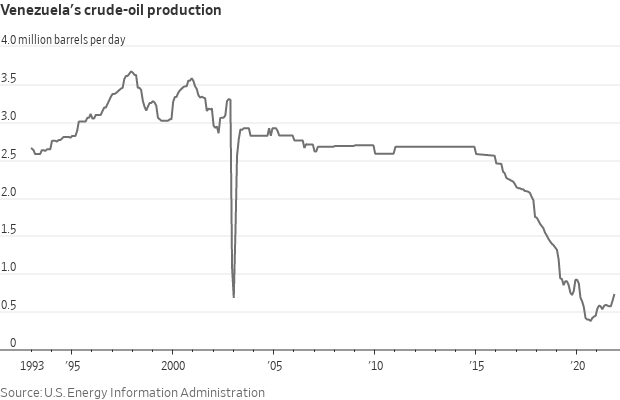

- The U.S. is considering lifting sanctions so Venezuela can get its oil flowing. But the reality is that the country’s oil sector is ill-prepared to start churning out more crude and lower fast-rising oil prices, the WSJ reports (link). Years of mismanagement, corruption and nationalization of oil ventures caused Venezuela’s oil industry — which in the 1990s produced 3.2 million barrels a day — to crash by 2020, when output fell to just one-tenth of what it had been. Production now is less than 1% of the 100 million barrels dozens of countries produce world-wide daily. People who work in, or who are familiar with the oil industry in Venezuela, describe a sector that is a shadow of what it once was when the country was one of the four main exporters of oil to the U.S.

- After years of trying to clamp down on genetically modified foods, the EU could temporarily lift a ban on imports of genetically modified grains to help farmers struggling with supply disruptions caused by Russia’s war on Ukraine, Bloomberg reports (link).

- If the war is a protracted one, countries that rely on affordable wheat exports from Ukraine could face shortages starting in July, International Grains Council Director Arnaud Petit said. That could create food insecurity and throw more people into poverty in places such as Egypt and Lebanon, where diets are dominated by government-subsidized bread. A prolonged conflict would have a big effect some 1,500 miles away in Egypt, the world’s largest wheat importer. Millions rely on subsidized bread made from Ukrainian grains to survive, with about one-third of people living in poverty. Egypt’s state procurer of wheat, which normally buys heavily from Russia and Ukraine, had to cancel two orders in less than a week: one for overpricing, the other because not enough companies offered to sell their supplies. Russia and Ukraine combine for nearly a third of the world’s wheat and barley exports. Ukraine also is a major supplier of corn and the global leader in sunflower oil, used in food processing.

The Associated Press details the following impacts and developments:

— African countries imported agricultural products worth $4 billion from Russia in 2020, and about 90% was wheat, said Wandile Sihlobo, chief economist for the Agricultural Business Chamber of South Africa. In Nigeria, flour millers believe a shortage of wheat supplies from Russia would affect the price of products like bread, a common food in Africa’s most populous country.

— Ukraine was Indonesia’s second-largest wheat supplier last year, providing 26% of wheat consumed. Rising prices for noodles, in turn, would hurt lower-income people, said Kasan Muhri, who heads the Indonesian Trade Ministry’s research division.

— Ukraine and Russia also combine for 75% of global sunflower oil exports, accounting for 10% of all cooking oils, IHS Markit said.

— Ukraine supplies the EU with just under 60% of its corn and nearly half of a key component in the grains needed to feed livestock. Russia, which provides the EU with 40% of its natural gas needs, is similarly a major supplier of fertilizer, wheat and other staples.

— Spain is feeling the pinch both in sunflower oil, which supermarkets are rationing, and grains for the important breeding industry. Those imported grains go to feed some 55 million pigs.

|

POLICY FOCUS |

— A look at the Conservation Reserve Program (CRP):

• USDA wants 25.5 mil. acres in CRP this year… cap rises to 27 mil. in FY 2023.

• CRP exit costs… cover must be destroyed with chemicals or tillage.

• Those with contracts expiring Sept. 30 can destroy cover on CRP acres before contract expires starting July 1 year contract expires. Must have approved conservation plan… cannot destroy cover during primary nesting season (varies) and annual CRP payment reduced from date of cover destruction through Sept. 30.

• CRP acres need extra fertilizer or nitrogen applied… may take two years to return land to productive state… typically less productive and return less than regular productive farm ground.

• As of Jan. 1, 22.1 mil. acres in CRP. Contracts on 4 mil. acres expire as of Sept. 30… 3.42 mil. acres enrolled via general signups and 560,000 acres via continuous signup… more environmentally sensitive.

• General CRP signup underway ends March 11 and contracts start Oct. 1… just 25,565 acres enrolled via continuous signup. CRP Grasslands signup runs April 4-May 13.

• With 4 mil. acres expiring Sept. 30, with no other changes, that would put CRP acres at 18 million. To meet USDA’s “goal” of 25.5 mil., would mean 7.5 mil. acres must be enrolled via general signup, CRP Grasslands or continuous signup… a tall order.

• Typically, more than 50% to 60% of contracts under general signup are via expiring CRP contracts offered for re-enrollment in program.

— CFAP payments move higher. Payments under the Coronavirus Food Assistance Program 2 (CFAP 2) moved up to $19.15 billion ($19.08 billion prior) as of March 6 on an increase in original CFAP 2 payments to $14.32 billion ($14.25 billion prior) while top-up payments remained little changed at $4.83 billion. Similarly, CFAP 1 payments now total $11.83 billion ($11.77 billion prior) as original CFAP 1 payments increased to $10.64 billion ($10.58 billion prior) and top-up payments remained mostly steady at $1.19 billion.

|

CHINA UPDATE |

— China favors Russia and censors Ukraine. The Chinese government is scrubbing the country's internet of sympathetic or accurate coverage of Russia's invasion of Ukraine, and systematically amplifying pro-Putin talking points, Axios notes. “China's use of its propaganda and censorship muscle helps insulate Beijing from domestic backlash against its support for Putin — and leaves its citizens with an airbrushed, false version of events, similar to what's seen in Putin's state-controlled Russia.” Chinese media outlets were told to avoid posting "anything unfavorable to Russia or pro-Western" on their social media accounts, and to only use hashtags started by Chinese state media outlets, according to a leaked censorship directive. Online comments expressing sympathy for Ukraine have been deleted.

Chinese President Xi Jinping has reportedly called for “maximum restraint” in Ukraine and says Beijing is “pained to see the flames of war reignited in Europe.” Speaking at a virtual meeting alongside French President Emmanuel Macron and German Chancellor Olaf Scholz, Xi said the three countries should jointly support peace talks between Moscow and Kyiv.

— Foreign companies in China are feeling less confident about investing in China, citing concerns of slowing economic growth and political tensions with the U.S., an annual survey by an American business group found. Less than one-half of members surveyed by the American Chamber of Commerce in China said they were optimistic that the Chinese government was committed to opening its market to more foreign investment over the next three years, down from 61% a year earlier. More than one-third said they would reduce investment in the country because of an uncertain policy environment.

|

ENERGY & CLIMATE CHANGE |

— The Biden administration proposed tightening limits on pollution from buses and commercial trucks. The draft rule would require cuts in nitrogen-oxide emissions starting in model year 2027 and would reduce such emissions by up to 60% by 2045. EPA Administrator Michael Regan said more than 70 million people live near truck freight routes in the U.S., populations who are “more likely to be people of color and those with lower income.” EPA officials said the new rules would benefit the public by reducing asthma and other health problems. Industry officials say the proposed requirement could significantly raise the cost of new vehicles, which could lead older vehicles to stay on the roads longer — running counter to the administration’s public-health goals.

Meanwhile, the White House announced $5.5 billion in federal aid to help states buy low-emission transit buses.

|

LIVESTOCK, FOOD & BEVERAGE INDUSTRY |

— HPAI confirmation in Iowa commercial flock. USDA’s Animal and Plant Health Inspection Service (APHIS) has confirmed highly pathogenic avian influenza (HPAI) in a commercial turkey flock in Buena Vista County, Iowa, with 50,000 birds being depopulated. Iowa Governor Kim Reynolds (R) signed a disaster proclamation to mobilize resources within the state to combat the outbreak. Authorities previously confirmed HPAI in a backyard mixed species flock (non-poultry) in Pottawattamie County, Iowa, which is not located near the HPAI case in Buena Vista County.

With new outbreaks in Iowa and Missouri, nearly 2.8 million birds — almost entirely chickens and turkeys — have died in one month due to HPAI, USDA said on Monday. The disease has been identified in 23 poultry farms and backyard flocks in a dozen states since Feb. 8.

— Treasury report signals wages are being held down by anti-competitive action by companies. The U.S. Treasury Department has released a report (link) which contends that practices deployed by companies have resulted in workers’ wages being some 20% below those that would be present “in a fully competitive market.” The food industry was cited as one of the areas where employers have deployed actions that lower wages.

The report is based on “a careful review of credible academic studies.”

More details. The report also concluded that workers being subjected to rules and agreements that limit their ability to switch jobs and occupations has also constrained “their bargaining power.” The report also stated that employers change the “structure of their own work relationships to lower their labor costs and undercut competition at the expense of workers.” They also tabbed the lower wages in part on “the decline in union density rates.”

|

CORONAVIRUS UPDATE |

— Summary: Global cases of Covid-19 are at 448,028,910 with deaths now more than 6 million at 6,008,426, according to data compiled by the Center for Systems Science and Engineering at Johns Hopkins University. The U.S. case count is at 79,339,497 with 960,314 deaths. The Johns Hopkins University Coronavirus Resource Center said that there have been 555,332,256 doses administered, 216,204,455 have been fully vaccinated, or 65.86% of the U.S. population.

— The U.S. has reported more Covid-19 deaths than any other country — about 960,000 total — but the CDC estimates that the actual figure is much higher. Separately, the White House is now rolling out its test-to-treat program, and more than 1,000 in-pharmacy clinics have registered to receive shipments of Covid-19 antiviral medications.

— China logged its highest daily total of locally transmitted Covid-19 infections in more than two years, with the highly transmissible Omicron variant posing a fresh test to China’s ability to quickly smother outbreaks.

|

POLITICS & ELECTIONS |

— Supreme Court let congressional maps for North Carolina and Pennsylvania stand, rejecting Republican challenges. AP reports: “In North Carolina, the map most likely will give Democrats an additional House seat in 2023. The Pennsylvania map also probably will lead to the election of more Democrats, the Republicans say, as the two parties battle for control of the U.S. House of Representatives in the midterm elections in November.”

|

CONGRESS |

— Free meal fight. Senate Minority Leader Mitch McConnell (R-Ky.) is opposing a provision in the omnibus spending bill that would extend a slew of waivers that have allowed schools to serve universal free meals during the pandemic. Of note: The Biden administration’s most recent budget requests to Capitol Hill did not include extending waivers. Nine out of every 10 schools are providing free meals to all students under USDA waivers.

— Omnibus talk continues while equities are in an omnibust. While appropriators continue to wrangle over final details of a growing omnibus budget package for a fiscal year that began Oct. 1, some said they were making “real progress.” House Majority Leader Steny Hoyer (D-Md.) said Monday (March 7) the House will vote on a government funding measure for fiscal year (FY) 2022 “no later than Wednesday.” Lawmakers have been working on filling in the details of the plan to cover spending for the balance of FY 2022 which ends September 30. It is still not clear if lawmakers can get the details worked out in time to avoid yet another short-term spending measure as the current stopgap spending resolution runs through March 11.

|

OTHER ITEMS OF NOTE |

— Iran talks on hold. European officials say negotiations with Iran are at a standstill after Iran’s chief negotiator at the talks in Vienna unexpectedly returned home Monday night.

— Highlight of California’s state fair? With cannabis a legal crop, the California State Fair will award prizes for plants with the highest concentration of terpenes, THC and CBD; critics say it is a wrongheaded contest. Link for details.