Yellen: Potential U.S. Sovereign Debt Default Could Come in Early June

Farm bill update | U.S./Canada trade officials to meet | Forbes on U.S./U.K. FTA

|

In Today’s Digital Newspaper |

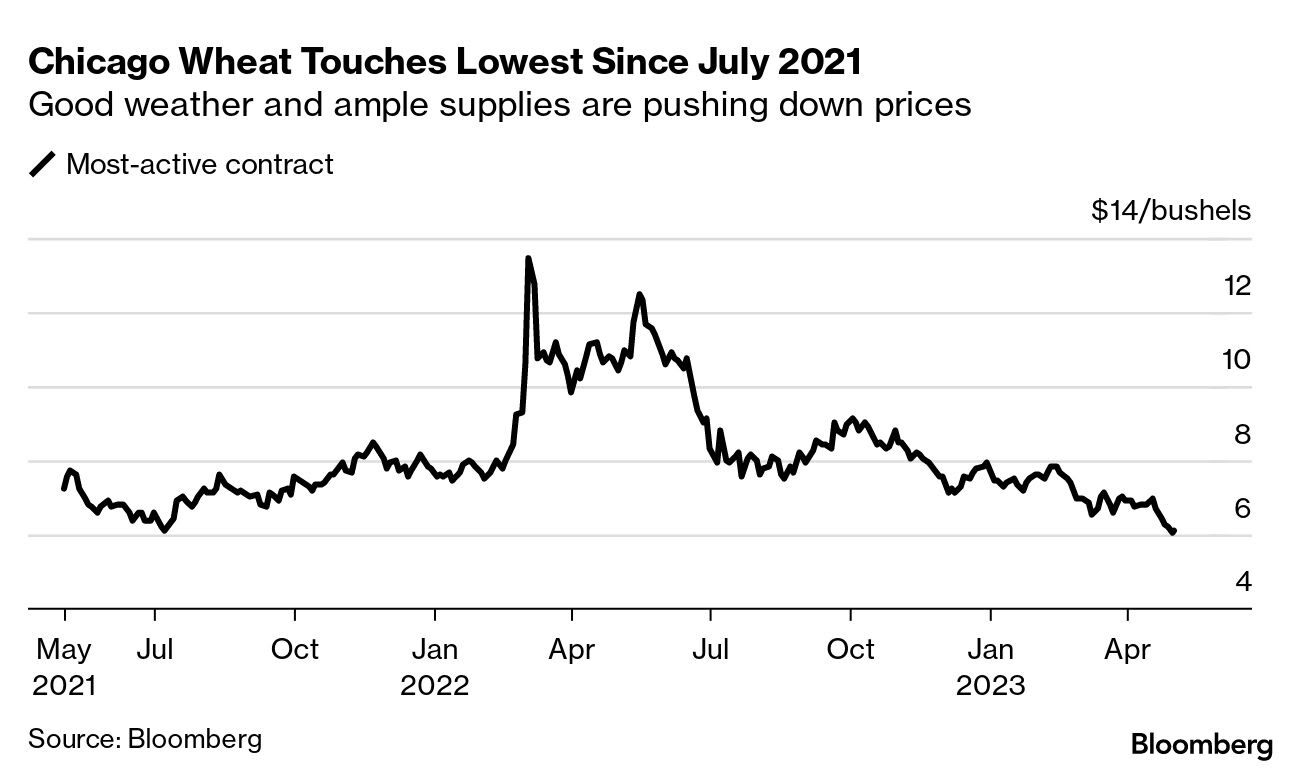

House Speaker Kevin McCarthy (R-Calif.) accepted an invitation to meet with President Joe Biden on May 9 about the debt ceiling. As noted, on Monday, Biden invited the top four congressional leaders, including McCarthy, to discuss a plan to make progress on debt ceiling talks, following months of an impasse between the president and House Republicans. Biden's calls came after Treasury Secretary Janet Yellen notified lawmakers on Monday that the U.S. could default on its debt by June 1. Biden has not met with McCarthy since Feb. 1

House Ag Chair G.T. Thompson (R-Pa.) continues to be passionate about finding ways to get a new farm bill accomplished, but acknowledged several hurdles continue but can be overcome with a bipartisan approach. More in Policy section.

Australia’s central bank unexpectedly resumed raising interest rates. Meanwhile, underlying Eurozone inflation eased and banks curbed lending, adding to the case for a smaller rate hike by the European Central Bank.

Both the New York Times and Wall Street Journal have perspective items on the recent fall of major banks. Details below.

Senior Ukrainian official tells Reuters that talks on the Black Sea Grain Initiative are currently set for today, with all sides taking part. Kremlin spokesman Dmitry Peskov reiterated Tuesday that portions of the Black Sea Grain Initiative regarding Russian interests were not being implemented. Further, the Kremlin said the window for continuation of the deal was shrinking and ongoing talks between the parties involved had not yet produced any results. Meanwhile, Ukraine’s grain exports could plunge to around 26 MMT in 2023-24, a senior ag ministry official told Reuters, as production is sharply reduced due to the war. More on both items in Russia/Ukraine section.

The IMF chief said China is shifting thinking about debt restructuring after getting burned by countries’ unpaid debts.

Steve Forbes, editor-in-chief for Forbes magazine, provides reasons why he thinks the U.S. should pursue a free trade agreement with the United Kingdom. Meanwhile, U.S. and Canada trade officials are meeting today. More in Trade Policy section.

|

MARKET FOCUS |

Equities today: Global stock markets were mixed overnight. Some European markets and mainland China remained closed for a holiday. U.S. stock indexes are pointed toward narrowly mixed openings. In Asia, Japan +0.1%. Hong Kong +0.2%. China closed. India +0.4%. In Europe, at midday, London -0.1%. Paris -0.5%. Frankfurt -0.3%.

U.S. equities yesterday: All three major indices ended with losses after slipping into negative territory in the final portion of trading. The Dow was down 46.46 points, 0.14%, at 34,051.70. The Nasdaq was down 13.99 points, 0.11%, at 12,212.60. The S&P 500 eased 1.61 points, 0.04%, at 4,167.87.

Agriculture markets yesterday:

- Corn: July corn fell 1/2 cent to $5.84 1/2, marking a high range close.

- Soy complex: July soybeans rallied 8 1/4 cents to $14.27 1/2, nearer the session high. July meal futures rose $1.2. closing at $433.6, just 3 ticks off the daily high. July soyoil settled at 51.81 cents, 14 points higher on the day.

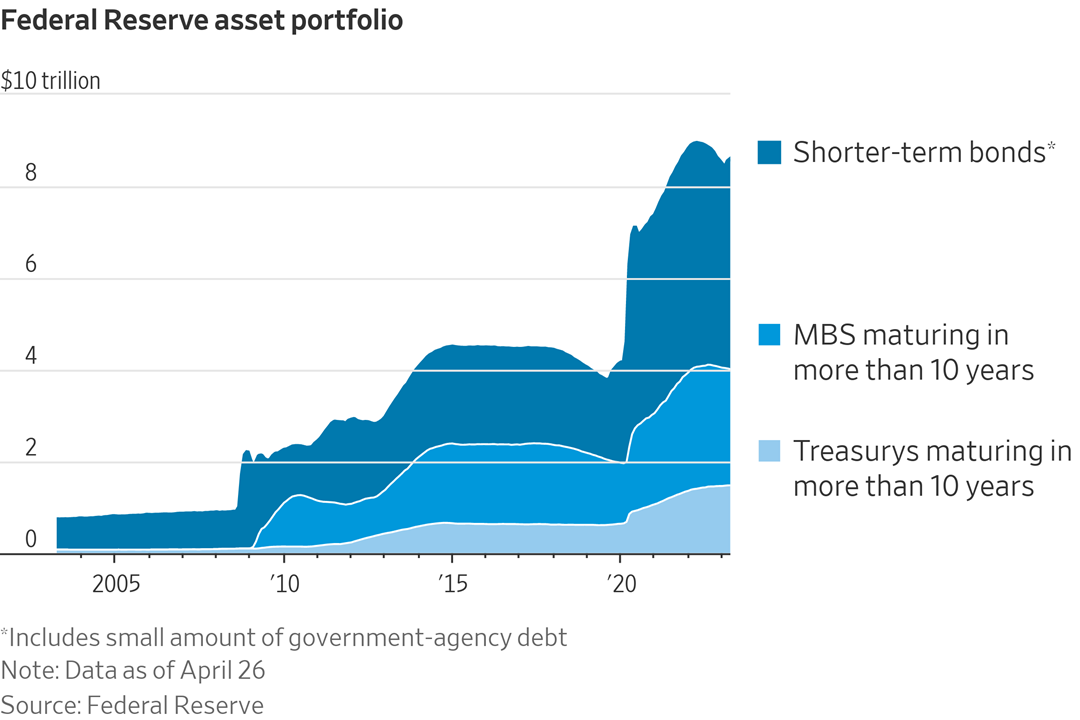

- Wheat: July SRW wheat fell 15 1/2 cents at $6.18 1/4. Prices closed nearer the session low and hit a 22-month low. July HRW wheat dropped 19 cents at $7.57 1/4.

- Cotton: July cotton rose 51 points to 81.31 cents, ending the session above the 10-day moving average.

- Cattle: June live cattle fell 60 cents to $164.875 and nearer the session low. May feeder cattle closed down $1.275 at $209.70, near the session low.

- Hogs: June lean hog futures fell $2.00 to settle at $89.70.

Ag markets today: Soybeans extended gains from the past two days during overnight trade, while corn and wheat firmed amid mild corrective buying. As of 7:00 a.m. ET, corn futures were trading 1 to 2 cents higher, soybeans were mostly 7 to 11 cents higher and wheat futures were 1 to 3 cents higher. Front-month crude oil futures were modestly weaker, and the U.S. dollar index was more than 100 points higher this morning.

Market quotes of note:

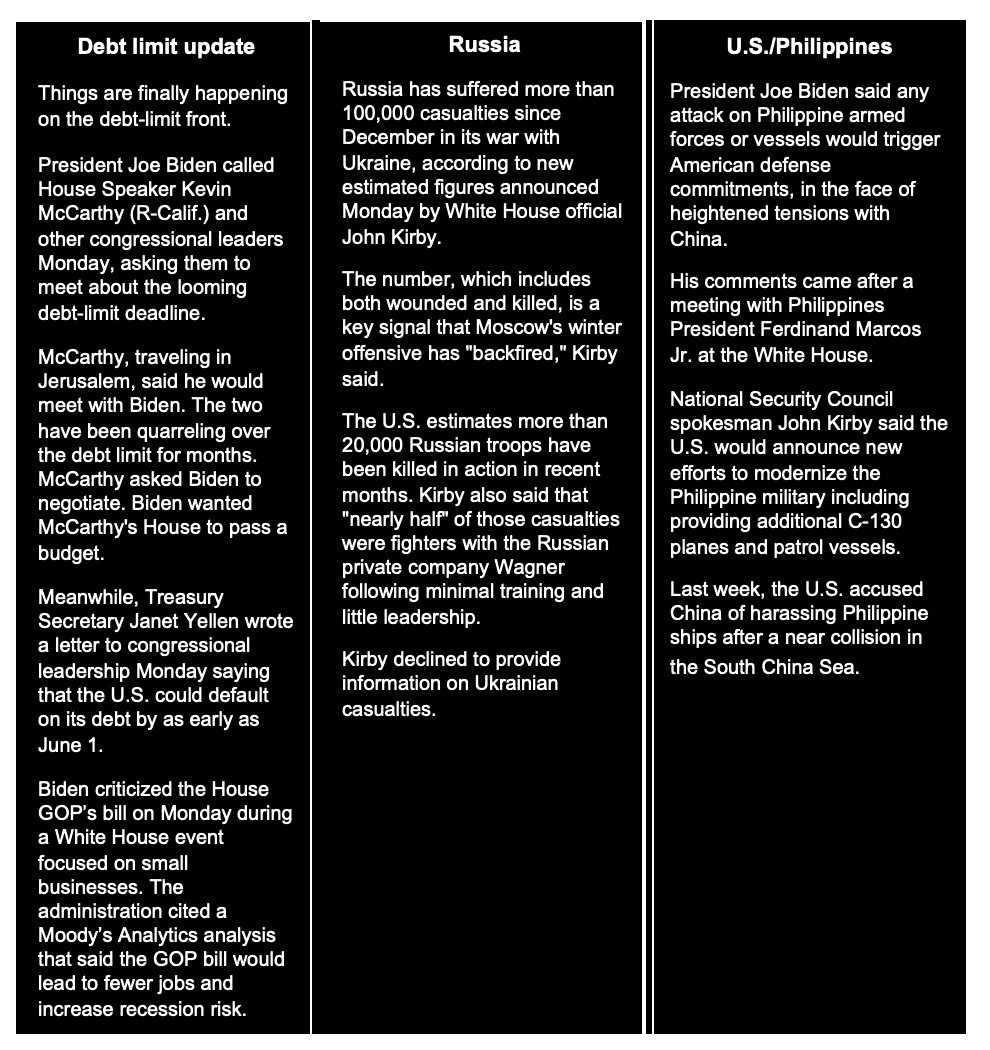

- New York Times on the recent fall of major banks: “Regulators seized First Republic Bank and sold it to the financial behemoth JPMorgan Chase yesterday. This deal — in which a bigger bank absorbs a struggling one — is typical during a crisis. What is less typical is the magnitude of this year’s failures. Combined, First Republic, Silicon Valley Bank and Signature Bank held more in inflation-adjusted assets than the 25 U.S. banks that collapsed in 2008.”

- WSJ on why First Republic Bank collapsed: “The collapse of First Republic Bank marks the second-biggest bank failure in U.S. history. It also spells the end of what was considered one of the most successful strategies in banking: luring wealthy depositors and giving them five-star service. The problem: The Federal Reserve’s rapid series of interest-rate increases, which led depositors to seek better returns elsewhere.” Link for details.

On tap today:

• U.S. job openings are expected to fall to 9.7 million in March from 9.9 million one month earlier. (10 a.m. ET)

• U.S. factory orders for March are expected to increase 1.3% from the prior month. (10 a.m. ET)

• Federal Reserve begins its two-day policy meeting (FOMC).

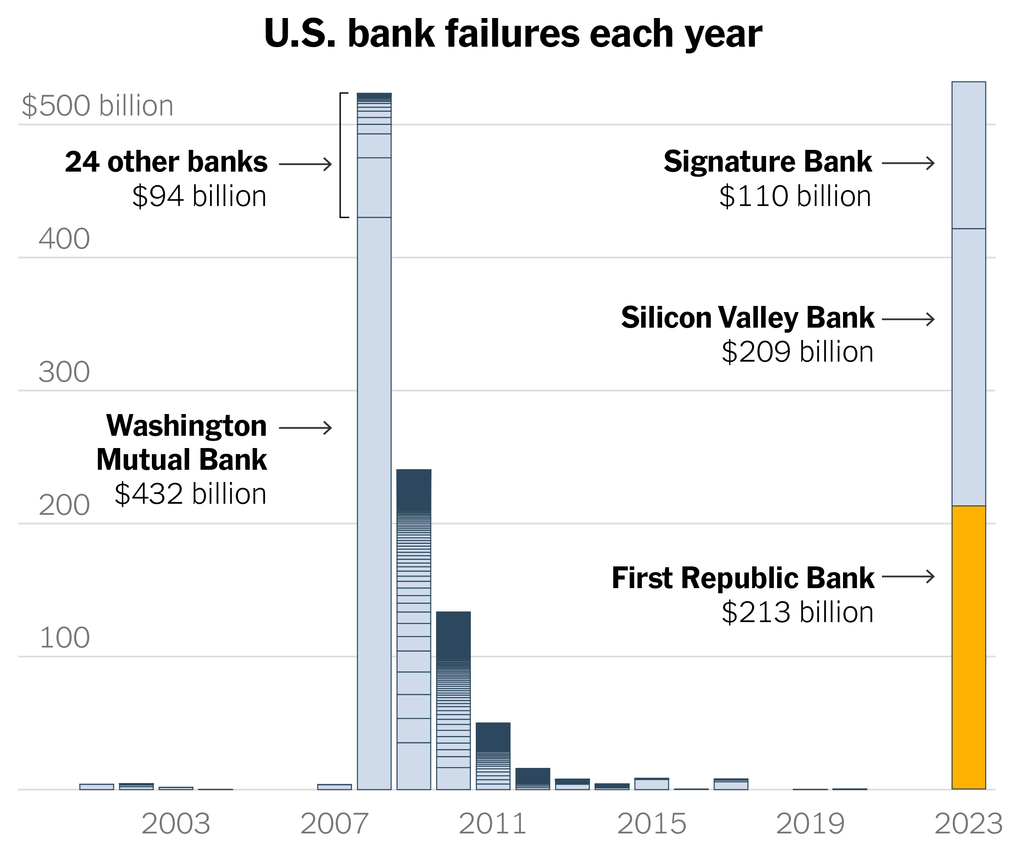

The Fed's reduction of its balance sheet is progressing slowly, which analysts say could be insulating Wall Street from the effects of interest-rate policy. The Fed has trimmed the balance sheet to below $8.6 trillion from a peak of $9 trillion a year ago by allowing some bonds to mature without reinvesting the proceeds into new securities.

Annual inflation in the Eurozone rose to 7% in April, from 6.9% in March, well above the European Central Bank’s 2% target. Separate data showed that banks have restricted lending and demand for loans has dropped, indicating an economic slowdown. This complicates the ECB’s interest-rate decision on Thursday: the former suggests continuing with tight monetary policy; the latter suggests the opposite.

Australia’s central bank shocked investors with a 25-basis-points hike Tuesday, also warning that more rises may be needed — sticky inflation was to blame. The market thought the Reserve Bank of Australia was done hiking after it paused rates at its April meeting. The Australian dollar and government bond yields surged Tuesday, while stocks fell.

Market perspectives:

• Outside markets: The U.S. dollar index was slightly higher with the euro, yen and British pound all weaker versus the greenback. The yield on the 10-year US Treasury note was weaker, trading around 3.53%, with a firmer tone in global government bond yields. Crude oil futures were lower, with U.S. crude around $75.45 per barrel and Brent around $79.15 per barrel. Gold and silver futures were mixed, with gold firmer around $1,995 per troy ounce and silver weaker at just under $25 per troy ounce.

• Russia’s ag sector squeezed. With farmers squeezed by rising costs and difficulties procuring seeds, sales of agricultural machinery in Russia fell in the first quarter and will continue to decline unless the state reduces export duties on grain or increases state support, newspaper Kommersant reports (link).

• Wheat prices have been dropping due to ample global supplies and favorable weather for the US crop, despite slow Black Sea exports from Ukraine amid operational problems tied to Russia’s invasion. With no more fears of shortages, Bloomberg reports (link) that money managers increased their bearish bets for Chicago wheat to the highest net-short position in five years.

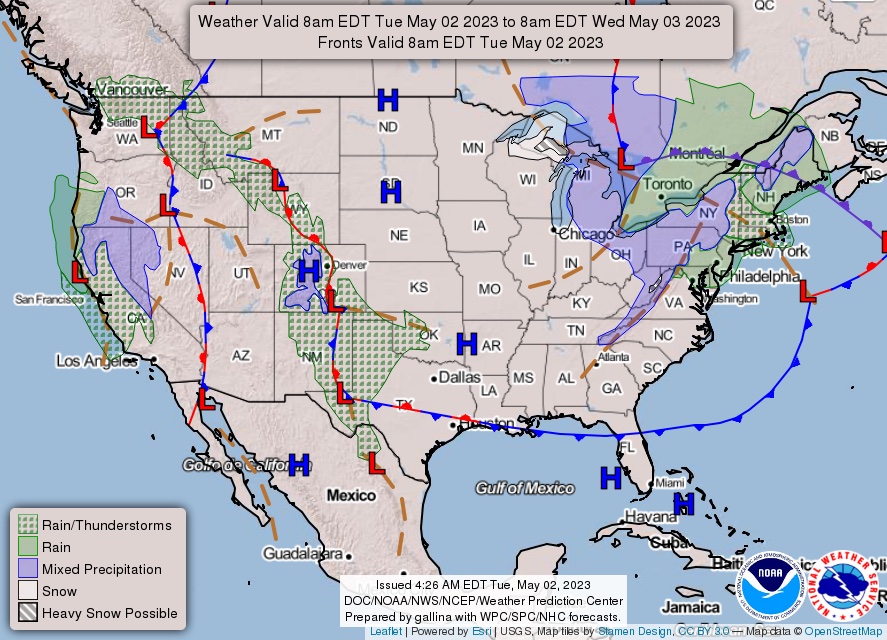

• NWS weather outlook: Much below average temperatures expected across Great Lakes/Midwest on Tuesday before spreading eastward into Northeast/Mid-Atlantic on Wednesday... ...Snow to diminish in Upper Peninsula of Michigan on Tuesday, while moderate to heavy snow continues across West Virginia Appalachians through Wednesday... ...Cool and unsettled weather for California and Southwest this week; Warm and dry conditions further north and inland throughout Pacific Northwest and Intermountain West.

Items in Pro Farmer's First Thing Today include:

• Modest grain price strength overnight.

• Winter wheat CCI ratings decline despite rise in USDA’s ratings

• Consultant leaves U.S. crop estimates unchanged

• No changes to South American estimates, either

• Retailers resisting high beef prices

• Hog premiums narrow but still wide

|

RUSSIA/UKRAINE |

— Reuters: Senior Ukrainian official says talks on the Black Sea Grain Initiative are currently set for Wednesday, with all sides taking part. “Hopefully there will be results,” the source told Reuters. Russia has continued to complain that not all portions of the deal have been implemented relative to bolstering Russian grain and fertilizer exports and they continue to call for the removal of what they say are restrictions imposed by the West on Russian agricultural exports. Russia said in March it would only allow the deal to run through May 18 and officials have continued to warn the deal could be ended in mid-May unless sanctions are removed on Russia..

— Ukraine officials warn their grain exports could fall to around 26 million tonnes for 2023-24 on a smaller grain harvest due to Russia’s invasion of the country. Ukrainian grain exports so far in 2022-23 have totaled 41.6 million tonnes and officials are hoping for a total of around 50 million tonnes. After a harvest of 53 million tonnes in 2022, Ukrainian officials are expecting production to be around 44 million tonnes for 2023, Taras Vysotskiy, first deputy minister at the Ukrainian Agriculture Ministry told Reuters. The combination of wheat production for 2023 at 17 million tonnes and carryover supplies would hopefully translate into 11 MMT to 12 MMT of wheat exports. Vysotskiy said corn production would likely to be around 22 MMT with exports of around 15 MMT.

|

POLICY UPDATE |

— G.T. Thompson: Leadership will provide additional farm bill funding. That’s what House Ag Chairman G.T. Thompson (R-Pa.) told us at a crop insurance agents’ event (CIPA) in Kansas City. He did not specify how much additional funding but was very complimentary of House Speaker Kevin McCarthy (R-Calif.), mentioning how the speaker participated during a California-based farm bill listening session. During the chairman’s presentation to CIPA, he was passionate about getting a farm bill done, but acknowledged several hurdles that he said could be overcome in a bipartisan approach.

Other options to providing more than baseline funding for the farm bill include clawing back some of the unspent Covid relief funding and restrictions on use of Commodity Credit Corporation Charter Act funding.

— ERP payments continue to edge higher. Payments under USDA’s Emergency Relief Program (ERP) continue to move slightly higher, with ERP Phase 1 payments now at $7.43 billion as of April 30, up from $7.42 billion the prior week. Within the Phase 1 payments, amounts for non-specialty crops ($6.29 billion) and specialty crops ($1.13 billion) were basically unchanged.

The payments for ERP Phase 2 total $293,904 as of April 30 with 153 recipients.

The Coronavirus Food Assistance Program (CFAP) payments remained basically unchanged in the latest week.

|

PERSONNEL |

— The White House is mulling promoting Fed Governor Philip Jefferson to vice chair and naming a Latino candidate to an open board slot, Bloomberg reports.

|

CHINA UPDATE |

— IMF raises Asia’s economic forecast amid China rebound, but warns of risks. The International Monetary Fund (IMF) raised its economic forecast for Asia as China’s recovery underpinned growth. Collectively, Asia’s economy is expected to expand 4.6% this year after a 3.8% increase in 2022, contributing around 70% of global growth, IMF said, upgrading its forecast by 0.3 point from October. China and India will be key drivers with an expansion of 5.2% and 5.9%, respectively, though growth in the rest of Asia is also expected to bottom out this year, the report said. IMF cut next year’s Asian growth forecast by 0.2 point to 4.4% and warned of risks to the outlook such as stickier-than-expected inflation, slowing global demand as well as the impact of U.S. and European banking-sector stress.

|

TRADE POLICY |

— Noted economist and former presidential candidate Steve Forbes urges U.S. FTA with United Kingdom. Steve Forbes is editor-in-chief for Forbes magazine. He writes that there is a “real possibility of something that will help shape a more prosperous — and more secure — future: a free trade agreement (FTA) between the U.S. and the U.K.,” which he says would spur other countries to pursue similar deals.

The commonsense arguments Forbes provides: a pact would mean richer economies for both countries. Prices for products and services would come down, te notes, because tariffs (taxes on them) would be cut or eliminated. Supply chains, he adds, would be “more resilient and reliable.”

But very importantly, Forbes stresses, harmonizing standards and regulations would make it far easier to produce goods and services for a much larger audience. “Britain is the sixth-largest economy in the world, with a GDP of more than $3 trillion,” Forbes details. “Having an FTA with the U.K. would be like adding the equivalent of the combined worth of the booming economies of Florida and Texas to the U.S. economy.”

A U.S./U.K. trade pact would also make it easier for the U.S. to procure weapons from the U.K. and vice-versa, he adds.

As for the U.S. Congress, Sens. Chris Coons (D-Del.) and John Thune (R-S.D.) have introduced a bill that would formally give President Biden the right to make a major FTA deal with Britain and have it presented to Congress with so-called fast-track authority so it couldn’t be impacted by special-interest amendments. A similar House measure is reportedly being considered.

— U.S./Canada trade officials to meet today. U.S. Trade Representative Katherine Tai will meet with Canada’s Minister of International Trade, Export Promotion, Small Business and Economic Development Mary Ng today. A key topic will be any updates regarding Canada’s implementation of their dairy tariff rate quotas (TRQs), which the U.S. complains are being implemented in a way that limits access for U.S. dairy products to the Canadian market.

|

POLITICS & ELECTIONS |

— Sen. Ben Cardin (D-Md.) announced Monday he will not seek re-election in 2024. While the seat is considered safe for Democrats, a primary to succeed him will likely follow. Cardin, 79 was first elected to the Maryland legislature in 1967. He won a Senate seat in 2006 after previously serving in the House for 20 years. A Republican hasn’t won a Senate race in Maryland in more than 40 years. On the Republican side, former Gov. Larry Hogan could be a formidable general election opponent should he run.

|

KEY LINKS |

WASDE | Crop Production | USDA weekly reports | Crop Progress | Food prices | Farm income | Export Sales weekly | ERP dashboard | California phase-out of gas-powered vehicles | RFS | IRA: Biofuels | IRA: Ag | Student loan forgiveness | Russia/Ukraine war, lessons learned | Russia/Ukraine war timeline | Election predictions: Split-ticket | Congress to-do list | SCOTUS on WOTUS | SCOTUS on Prop 12 | New farm bill primer | China outlook | Omnibus spending package | Gov’t payments to farmers by program | Farmer working capital | USDA ag outlook forum |