Yellen: Biden Should Push Ahead with Infrastructure Plans Even if it Boosts Inflation Into 2022

G7 nations support minimum global corporate tax rate of at least 15%, hurdles ahead

In Today’s Digital Newspaper

Market Focus:

• Yellen talks higher interest rates and a boost for inflation

• Baby Boomers own more than half of $50 trillion in total U.S. household financial assets

• G7 nations agree to support minimum global corporate tax rate of at least 15%

• Biden distances himself from enhanced unemployment benefits

• Severe drought has much of the Western half of the U.S. in its grip

• Soybean-oil futures have soared almost 70% this year

• Kremlin may ease more food exports to shield it from high prices

• CFTC report focus

• Ag demand update

• Grain, soy futures up sharply to start the week

• Rains possible this week, but dryness concerns persist

• Chinese soybean imports rise in May

• Chinese meat imports drop in May

• China’s imports hit more than a 10-year high in May

• Argentine grain customs workers plan short strike

• Russia assessing additional food price actions

• IKAR raises Russian wheat crop estimate by 500,000 MT, to 80 MMT

• Watching wholesale beef prices

• Cash fundamentals remain supportive for hogs

Policy Focus:

• Pandemic-related government aid is starting to go away

• Lawmakers press USDA on aid to contract growers

• Rancher sues Biden administration, claims 'discriminatory' Covid relief plan

China Update:

• China’s May exports up 27.9%, year-on-year; imports up 51.1%

• Chinese soybean imports rise in May

• Chinese meat imports drop in May

• China oil imports edge lower

• USTR Tai labels U.S./China trade relationship marked by ‘significant imbalance.’

Energy & Climate Change:

• Ukraine’s Zelensky ‘surprised’ and ‘disappointed’ by Biden pipeline move

Livestock, Food & Beverage Industry Update:

• USDA details plans for expanding network to aid hungry

Coronavirus Update:

• U.S. Covid-19 deaths fall to lowest point since March 2020

• France planning to allow U.S. visitors starting June 9 for first time in more than a year

Politics & Elections:

• New Jersey, Virginia to hold statewide primaries

• Lara Trump refrains from North Carolina Senate bid

• Georgia GOP approves resolution censuring Secretary of State Brad Raffensperger

• Georgia agriculture commissioner announces Senate bid against Warnock

Congress:

• Manchin to vote against election overhaul bill

Other Items of Note:

• Federal judge overturns California’s 32-year assault weapons ban

• Commerce secretary on cyberattacks against corporations: 'This is the reality’

• Blinken talks about how President Biden will confront Vladimir Putin over cyberattacks

• Mexico’s ruling party retains House majority

• Peru’s election

MARKET FOCUS

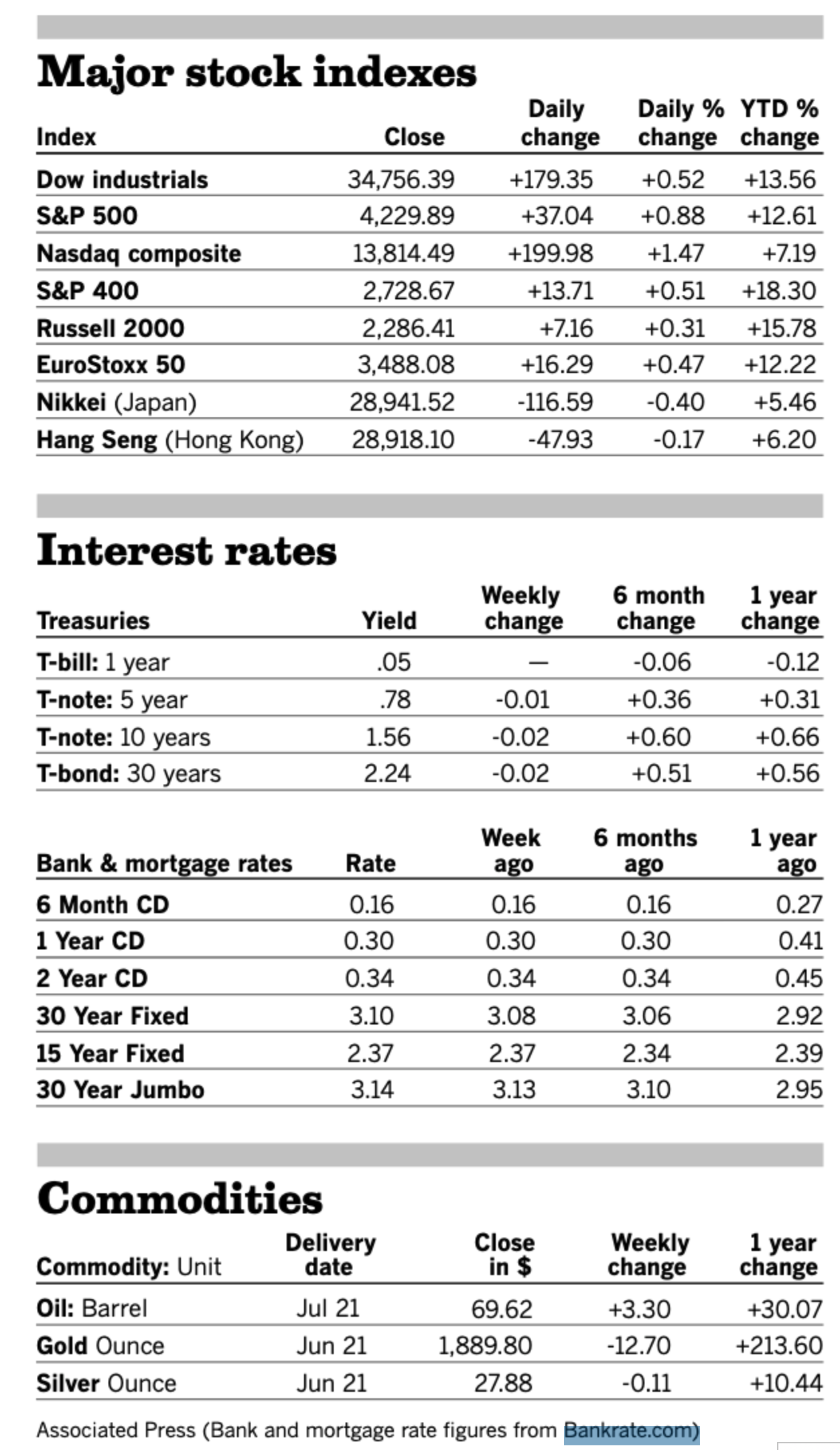

Equities today: Global stock markets were mixed overnight, with Asian shares mostly firmer and European shares flat. U.S. stock indexes are pointed toward narrowly mixed openings. In Asia, major benchmarks ended trading on a mixed note. The Shanghai Composite Index rose 0.2%. Japan’s Nikkei 225 added 0.3%, while Hong Kong’s Hang Seng Index declined almost 0.5%.

U.S. equities Friday: The Dow gained 179.35 points, 0.5%, to 34,756.39, finishing just below its all-time closing high hit last month. The S&P 500 added 37.04 points, 0.9%, to 4,229.89, also just missing a record, while the Nasdaq Composite advanced 199.98 points, 1.5%, to 13,814.49.

For the week, the Dow advanced 0.7%, the S&P 500 climbed 0.6% and the Nasdaq gained 0.5%.

U.S.-stock funds tracked by Refinitiv Lipper (including mutual funds and exchange-traded funds) squeaked out an average return of 0.5% in May, to push their year-to-date gain to 14.2%. It was the seventh straight monthly gain for U.S.-stock funds.

Baby Boomers, now between the ages of 57 and 75, own more than half the estimated $50 trillion in total U.S. household financial assets, according to Cerulli Associates. Of that $26 trillion, roughly a quarter, or $6.5 trillion, is invested on a do-it-yourself basis, Cerulli analyst Scott Smith says. A big majority of that DIY total resides at Vanguard, Fidelity and Schwab.

On tap today:

• USDA Grain Export Inspections report at 11:00 am ET.

• U.S. consumer credit is out at 3 p.m. ET.

• USDA Crop Progress report at 4:00 p.m. ET.

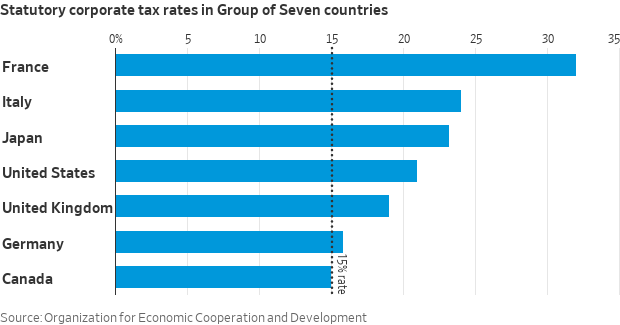

In Britain, the U.S. and other Group of Seven nations agreed on Saturday to support a minimum global corporate tax rate of at least 15% that would apply to multinational companies such as Amazon.com Inc. and Google. Facebook said it expected it would have to pay more in taxes, and in more countries, under the deal. The deal faces several hurdles regarding implementation. Next month, the Group of 7 countries must sell the concept to finance ministers from the broader Group of 20 nations that are meeting in Italy. If that is successful, officials hope that a final deal can be signed by Group of 20 leaders when they reconvene in October. Ireland, which has a tax rate of 12.5%, has come out against the global minimum tax, arguing that it would be disruptive to its economic model. Meanwhile, China refuses to be drawn into these negotiations because it wants to retain control over its tax policy as a tool to encourage more investment.

There are two “pillars” to the deal. The first would tax companies based on where they operate, and not just the location of their headquarters. This is important for big European countries, which have sparked trade tensions by imposing special digital taxes on American tech giants. The second would impose a 15 % minimum global tax rate on companies — a major priority for the U.S. — which would generate more revenue from taxes on American multinationals that use offshore havens to reduce their tax bills.

Bottom line: Full implementation could take years with a need for more countries to sign up and it’s still iffy as to whether or not this will succeed. The proposal will go before the Group of 20, which meets in Italy next month, and then an OECD-led group of around 140 countries negotiating tax policy. National governments would have to pass legislation to enact any changes to their tax laws, which means it could take years before this weekend’s agreement has a real-world impact. The Wall Street Journal notes that while the G7 agreement focuses on the headline rate for the new minimum tax, the OECD plan “comes with reams of harmonized fine print on matters such as credits or exemptions for capital investment and research and development. Suppressing tax competition is the main reason the Biden Administration broke with Washington’s long, bipartisan tradition of opposing a global minimum tax. Mr. Biden hopes to fund his domestic spending blowout by milking American companies for more revenue, and he’s figured out his tax increases will undermine American competitiveness unless other governments go along… American companies will be at a significant disadvantage until . . . other governments agree to hamstring their own firms.” And the NYT notes another hurdle ahead: “With a narrowly divided Congress and resistance from Republicans and business groups mounting, closing the deal at home may be an even bigger challenge.” In an interview on Sunday with the NYT, Yellen acknowledged the legislative challenge ahead and defended the Biden administration’s plans to raise taxes on corporations. She stood behind Biden’s proposal to raise the corporate tax rate in the United States to 28% from 21%. “We think it’s a fair way to collect revenues,” Yellen said on her flight back to the United States from London after attending two days of meetings with G7 finance ministers. “I honestly don’t think there’s going to be a significant impact on corporate investment.”

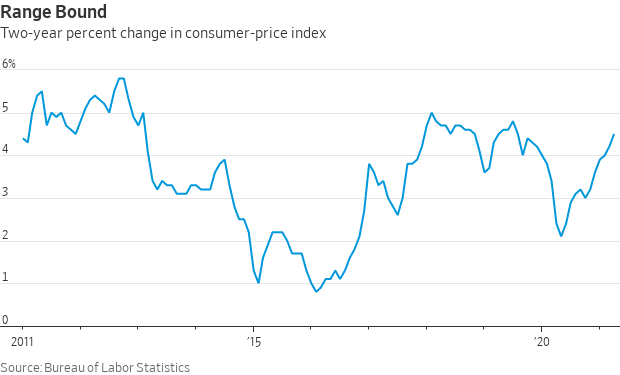

Treasury Secretary Janet Yellen said President Joe Biden should push forward with his $4 trillion spending plans even if they trigger inflation that persists into next year and higher interest rates. “If we ended up with a slightly higher interest rate environment it would actually be a plus for society’s point of view and the Fed’s point of view,” Yellen said Sunday in an interview with Bloomberg News during her return from the Group of Seven finance ministers’ meeting in London. Biden’s packages would add up to roughly $400 billion in spending per year, Yellen said, contending that’s not enough to cause an inflation over-run.

The consumer-price index was up 4.2% in April from a year earlier, about double the central bank’s inflation target of 2%. However, a Wall Street Journal item (link) notes the 4% comparison could provide an exaggerated snapshot of price pressures because it is from a deflated base in April 2020. “One simple way to get around the problem: Look at how the economy compares today with two years ago rather than one. This subdues the effects of the Covid-19 shock and shows how close activity is to normal.: On average, the consumer-price index rose 3.5% every two years during the decade before the Covid-19 crisis. That was within a range between 5.8% in 2012 and 0.8% in 2016. In April this year, the index was up 4.5% from two years earlier.

President Biden distances himself from enhanced unemployment benefits. Following Friday’s solid but unexceptional jobs report, Biden said he wouldn’t extend the $300-a-week payments, which expire in September. Many Republicans say the benefits deter people from seeking work; economists say the evidence is less clear.

Market perspectives:

• Outside markets: The U.S. dollar index is slightly higher. The yield on the benchmark 10-year U.S. Treasury note is presently fetching around 1.58%. Gold and silver futures are weaker ahead of US trading. Gold is trading under $1,889 per troy ounce and silver is trading around $27.70 per troy ounce.

• Crude oil prices remain under mild pressure ahead of U.S. trading. U.S. crude is trading around $69.45 per barrel while Brent is around $71.70 per barrel. Futures were weaker in Asian trade, with U.S. crude down 18 cents at $69.44 per barrel while Brent was down 29 cents at $71.60 per barrel.

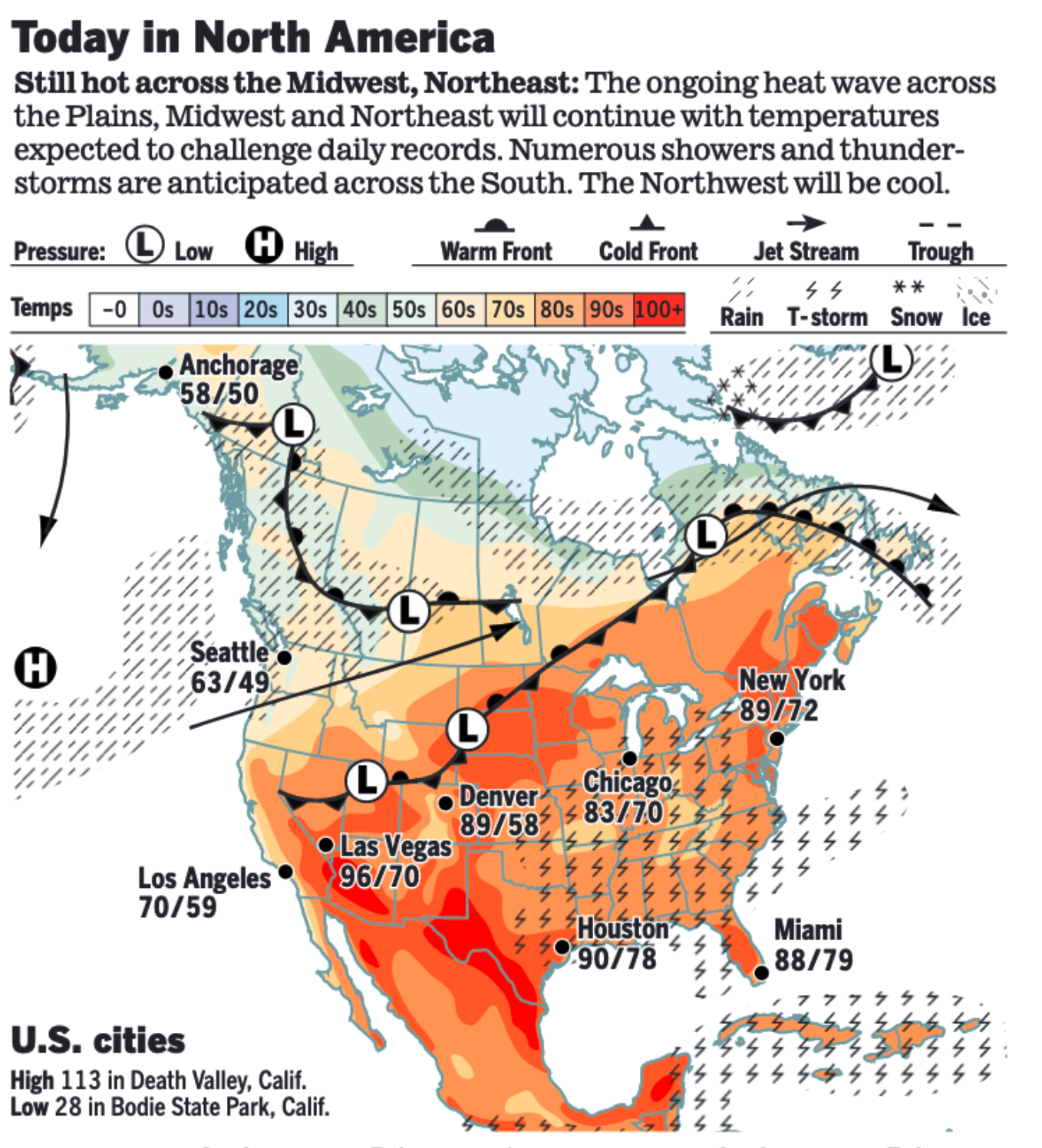

• Severe drought has much of the Western half of the U.S. in its grip. Nearly all of California, Oregon, Nevada, Arizona, New Mexico, Utah and North Dakota are in drought, and in large areas of those states conditions are “severe” or “exceptional.” Experts are concerned that this summer’s wildfires will be severe and widespread. Reservoirs in California hold about half as much water as usual for this time of year.

Speaking of hot and dry… the Northern Plains temperatures were as forecasted, 90 to 100, but the rain was below expectations. has been less. A center of high pressure is over the Western corn belt. Canada got some rain, the ECB got some rain, and the South got rain. Today’s corn condition report is estimated to decline two points; the first bean condition report is estimated to be in the 70% good to excellent category.

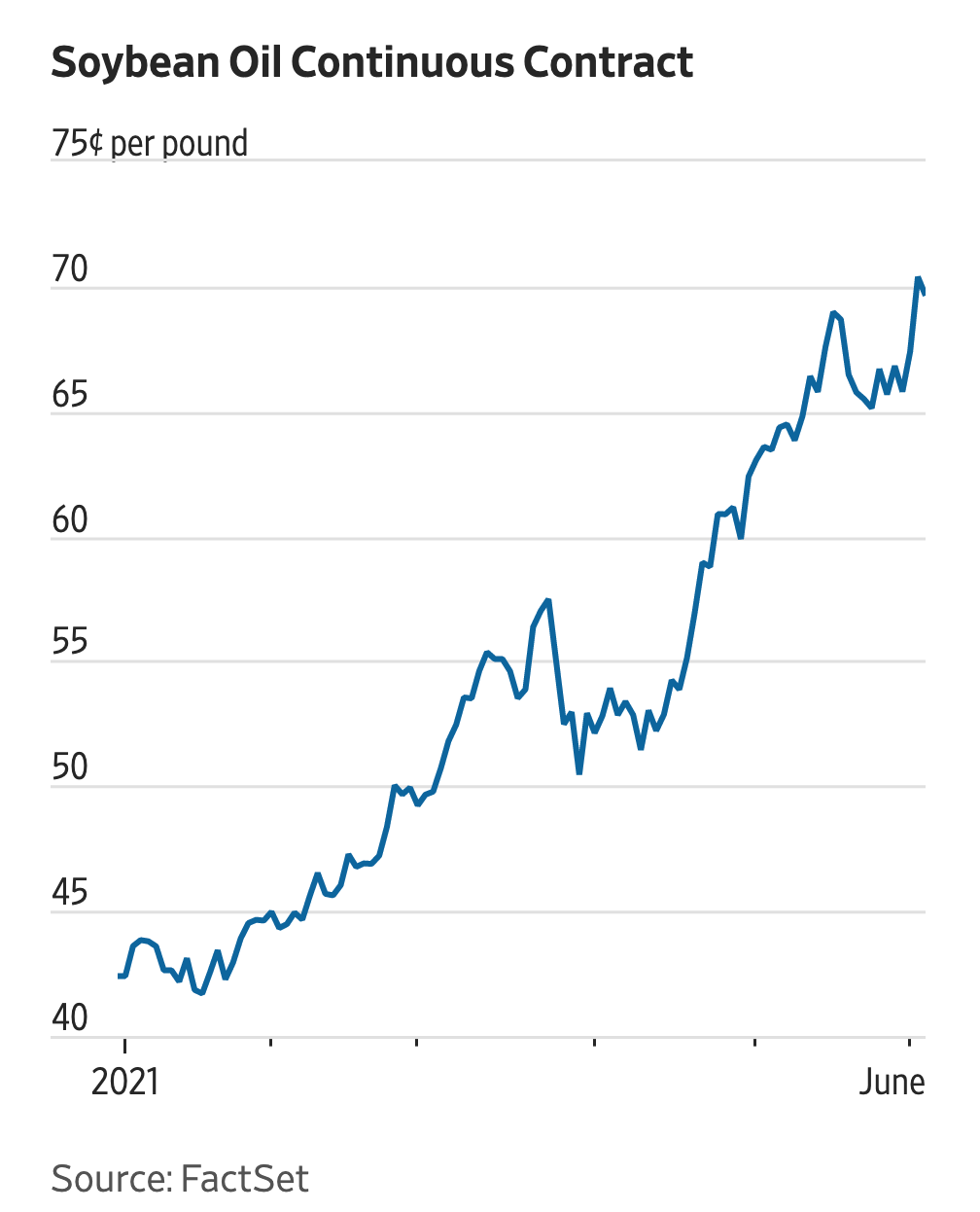

• Soybean-oil futures have soared almost 70% this year, closing at nearly 72 cents per pound on Friday. That topped the previous high hit in 2008. Biofuel, particularly renewable diesel, is a key driver of demand. USDA expects the biofuels sector to consume 12 billion pounds of soybean oil in the 2021-22 marketing year — up from an estimated 9.5 billion pounds in 2020-21, according to its monthly supply-and-demand report published in May. While other feedstocks, such as used animal fats, make better renewable fuel, there simply isn’t enough of those waste products available, Juan Sacoto, director of North American agribusiness consulting with IHS Markit Inc., told the Wall Street Journal (link). About 40% of all beef tallow and 80% of all reclaimed yellow cooking grease are already being sold for biofuels, constituting roughly two billion pounds of each. “There’s not enough of these fats and greases, so they turn to vegetable oil,” said Sacoto, adding that IHS projects that the biofuels industry will need 20 billion pounds of feedstock this year — a figure expected to double in the next five years.

• Kremlin may ease more food exports to shield it from high prices. Russia is warning it is prepared to continue with its export curbs on key food products after recent price rises prompted the Kremlin to cap the domestic cost of staple goods such as sugar and flour, the country’s economy minister said. Maxim Reshetnikov, minister of economic development, told the Financial Times (link/paywall) that Russia, one of the world’s biggest grain exporters, especially for wheat, was considering how to best support its food exports while protecting domestic consumers from rising prices. Reshetnikov said that Russia might expand the export measures to include a floating tariff of “flexible export duties” on additional goods, if prices continue to rise. As for domestic consumption, Russia was ending most of the price caps but would continue to subsidize certain staples, such as bread and flour. “There’s no guarantee that global food prices have stabilized and peaked,” Reshetnikov said. “Any news about crop forecasts can provoke… yet another rally for some foodstuffs, so we are constantly paying close attention to them and taking some measures when need be.”

• Ag demand: Algeria tendered to buy at least 50,000 MT of milling wheat from Europe, South America or Australia.

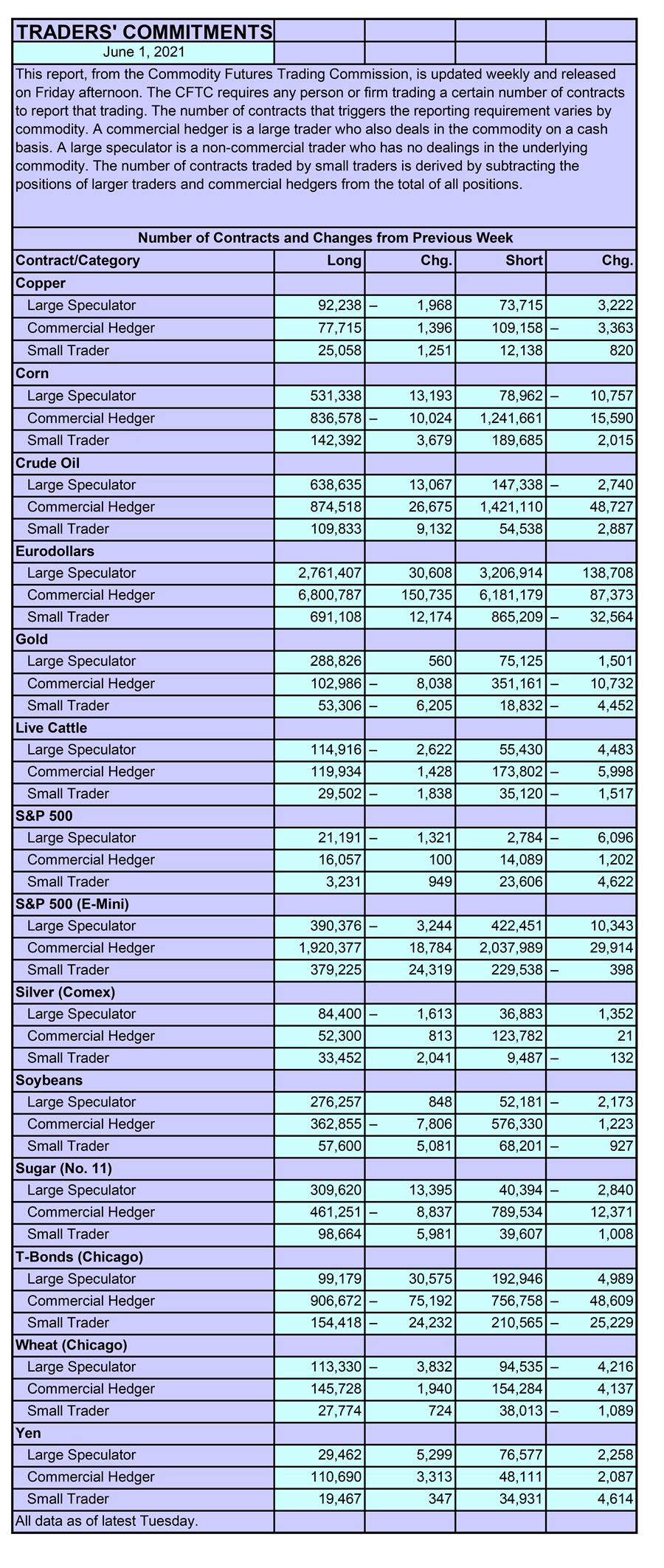

• CFTC report focus (source: Barron’s):

Items in Pro Farmer's First Thing Today include:

• Grain, soy futures up sharply to start the week

• Rains possible this week, but dryness concerns persist

• Chinese soybean imports rise in May

• Chinese meat imports drop in May

• China’s imports hit more than a 10-year high in May

• Argentine grain customs workers plan short strike

• Russia assessing additional food price actions

• IKAR raises Russian wheat crop estimate by 500,000 MT, to 80 MMT

• Watching wholesale beef prices

• Cash fundamentals remain supportive for hogs

POLICY FOCUS

— Pandemic-related government aid is starting to go away. Half of states, all of which are led by Republican governors, are ending the $300-a-week additional unemployment benefits from the federal government before they expire in September, with Maryland being the 25th state to announce such a move.

— Lawmakers tell USDA: Speed up Covid aid as promised. Seventeen senators and 41 House members from both parties called on USDA to speed rulemaking for distributing Covid-19 aid approved in December to poultry farmers who raise company-owned birds under contract. Link to letter. Contract growers, who raise chickens for poultry processing companies, have not yet received federal assistance during the pandemic. Many contract chicken growers suffered substantial losses when processing facilities were forced to reduce or suspend production during the pandemic threatening many smaller and family-owned farms. USDA has also suspended promised payments to contract hog producers.

The bill also included funding for USDA to provide direct payments for contract chicken growers who previously had been excluded from assistance provided by the CFAP.

— Rancher sues Biden administration, claims 'discriminatory' Covid relief plan. Leisl Carpenter, a sixth-generation rancher and owner of the Flying Heart Ranch in the Big Laramie Valley of Wyoming, has filed a lawsuit against the Biden administration, claiming the at least $4 billion American Rescue Plan Section 1005, which targets selected “socially disadvantaged” farmers and ranchers, violates equal protection laws under the U.S. Constitution and blatantly discriminates against white farmers and ranchers. Carpenter, who tends over 500 head of cattle on 2,400 acres of land, has dealt with debt since the beginning of her ranching career in her early 20s, and currently owes about $250,000 on her Farm Service Agency loan.

There are no conditions on farmers to receive this debt relief, unlike prior settlements. The Covid-19 package also gave the USDA $1 billion for structural equity reforms. The idea, USDA Secretary Tom Vilsack said, is to reshape agriculture policy with these farmers in mind. "We really have to do some very deep thinking about the structure of our programs, because...very, very few of them are designed for [socially disadvantaged farmers]," Vilsack said.

USDA estimates around 16,000 farmers of color qualify for this new relief program. That represents less than 10% of farmers of color in the U.S. as most don't seek credit from the USDA nowadays. In early May, USDA sent out forms to farmers to try to determine which borrowers qualify as members of a socially disadvantaged group. Now, the department is moving into a phase in which a second set of letters go out to about 13,000 individual farmers explaining that they are eligible for the program and checking the details of the loans they received from the federal government. Most of those debts could be erased within a couple of months. In a second wave, USDA plans to dispose of a few thousand guaranteed loans, which tend to be larger and more complex.

"This is a landmark civil rights case," Stephen Miller, head of America First Legal and Trump's White House senior policy adviser, said in a statement. "The stakes in this case could not be higher: the government must not be allowed to use its awesome authorities to punish, harm, exclude, prefer, reward or damage its citizens based upon their race or ethnicity."

A suit filed in Texas asks a federal judge to overturn not only that program but all agriculture laws that define social disadvantage in the same way. "The Court should declare unconstitutional any statute limiting the benefits of federal programs to 'socially disadvantaged farmers and ranchers,'" the plaintiffs write in their complaint.

USDA is racing to implement the debt-relief policy, according to Dewayne Goldmon, Vilsack's senior adviser for racial equity.

CHINA UPDATE

— China’s May exports were up 27.9%, year-on-year, while its imports in May were up 51.1%. Those numbers were not far from market expectations and reiterate China’s strong rebound from the pandemic. Chinese imports of $218.4 billion showed the fastest growth since January 2011. Its exports rose to $263.9 billion, though that was down from 32.3% growth in April. That left China with a trade surplus of $45.5 billion, up from $42.9 billion in April. China’s trade surplus with the U.S. rose to $31.8 billion from $28.1 billion in April.

— Chinese soybean imports rise in May. China imported 9.61 MMT of soybeans in May, up 29% from April and 2.4% more than last year. Through the first five months of this year, China imported 38.2 MMT of soybeans, up 12.8% from the same period last year.

— Chinese meat imports drop in May. China imported 790,000 MT of meat during May, down 14.4% from April and 3.3% less than May 2020. The preliminary import data doesn’t break down the individual category of meat imports. Through the first five months of the year, China brought in 4.34 MMT of meat, up 12.6% from the same period last year.

— China oil imports edge lower. China trade data out this morning shows that crude oil imports into China over the first five months of the year totaled 221mt, up 2.3% YoY. However, looking at imports over just May, they come in at around 9.69MMbbls/d, which is down from the 9.86MMbbls/d imported in April, and 14.6% down YoY. ING Economics says, “This suggests that Chinese refiners are reluctant to import at these higher prices, and instead prefer to draw down inventories. We will need to wait for industrial output data later in the month to see if this really is the case, but if it is, it would be the second month in a row, where we have seen Chinese inventories edge lower. Clearly, if we see Chinese refiners taking a step back from imports, this would be a bearish development for the market.”

— USTR Tai labels U.S./China trade relationship marked by ‘significant imbalance.’ The U.S./China trade relationship is one that has “significant imbalance,” according to U.S. Trade Representative Katherine Tai. “There are parts of this trade relationship that are unhealthy and have over time been damaging in some very important ways to the U.S. economy,” Tai told reporters over the weekend ahead of a virtual meeting between trade ministers from the Asia-Pacific Economic Cooperation (APEC) forum when asked whether the U.S. was going to maintain the Phase 1 agreement. “It’s a relationship in trade that has been marked by significant imbalance — that is in terms of performance, but also in terms of opportunity and openness of our markets to each other,” Tai stated. “The United States is committed to doing everything we can to bring balance back to the U.S./China trade relationship.”

From the Chinese side, Minister of Commerce Wang Wentao countered that China is continuing to open up its economy despite the challenges of the pandemic, listing several areas in which it had reduced controls on foreign investment and trade. Further, he also noted that China was “favorably considering” joining the Comprehensive and Progressive Trans-Pacific Partnership (CPTPP), the updated Trans-Pacific Partnership (TPP) agreement that Trump pulled out of three days into his presidency.

The U.S. continues to seek support from allies relative to its plan to address China policies but there has not been many details on how the administration plans to move forward on that front.

ENERGY & CLIMATE CHANGE

— Ukraine’s Zelensky ‘surprised’ and ‘disappointed’ by Biden pipeline move. Ukrainian President Volodymyr Zelensky told Axios that he learned through the press — not any direct heads-up — that President Biden had decided to stop trying to block a Russian pipeline that Ukraine sees as a dire national security threat. Zelensky used an hourlong Zoom interview on Friday to beseech Biden to meet with him face to face before a June 16 summit with Russian President Vladimir Putin, according to Axios. Zelensky offered to join Biden "at any moment and at any spot on the planet."

Russian gas currently flows through Ukraine en route to Europe. Nord Stream 2, a Russia-to-Germany natural gas pipeline, would allow Russia to circumvent and isolate Kyiv, Ukraine's capital. Zelensky said the U.S. is the only power capable of stopping Russia.

"This is a weapon, a real weapon ... in the hands of the Russian Federation," elensky said. "It is not very understandable ... that the bullets to this weapon can possibly be provided by such a great country as the United States."

Putin announced Friday the first of two lines is complete and said energy giant Gazprom is "ready to start filling Nord Stream 2 with gas."

LIVESTOCK, FOOD & BEVERAGE INDUSTRY

— USDA details plans for expanding network to aid hungry. USDA on Friday outlined a plan for boosting food banks and food purchases, using up to $1 billion from recent congressional spending packages. The information comes as USDA winds down the Trump administration’s nearly $4 billion Farmers to Families Food Box program, which while supported by many participants, got criticism from congressional Democrats who questioned criteria used to select vendors and who argued that it left many communities unserved.

Details: USDA said it will use nearly $500 million from recent spending packages to expand the network of providers through The Emergency Food Assistance Program (TEFAP) to aid food banks and local organizations in meeting ongoing needs in their communities. Another $400 million will be used by the Agricultural Marketing Service to expand the pool of local and regional farmers and ranchers, including minority farmers, servicing food bank networks. The agency will use cooperative agreements with state and tribal governments and local groups that encourage purchases from local, regional and socially disadvantaged producers. The Food and Nutrition Service will use $100 million for a new grant program to help food aid groups meet TEFAP requirements and expand their service to rural, remote and high poverty communities.

On Friday, the Agricultural Marketing Service issued a thank-you letter to participants in the Farmers to Families Food Box program for their work but said Congress and the Biden administration have expanded the safety net for low-income people with a temporary boost in food stamp benefits and expanded benefits to families with children who qualify for free or reduced-price school meals. “We now have an opportunity to address long-standing issues in the U.S. food system by building it back better,” the agency said.

Comments: One of the more astute use of funding is the $100 million that will help organizations afford the storage and refrigeration capacity needed to provide food assistance in underserved areas. This infrastructure glitch has been a frequent, multiyear complaint about food aid.

CORONAVIRUS UPDATE

— Summary: Global cases of Covid-19 are at 173,329,556 with 3,729,870 deaths, according to data compiled by the Center for Systems Science and Engineering at Johns Hopkins University. The U.S. case count is at 33,362,633 with 597,628 deaths. The Johns Hopkins University Coronavirus Resource Center said that there have been 301,638,578 doses administered, 138,969,323 have been fully vaccinated, or 42.3% of the total U.S. population.

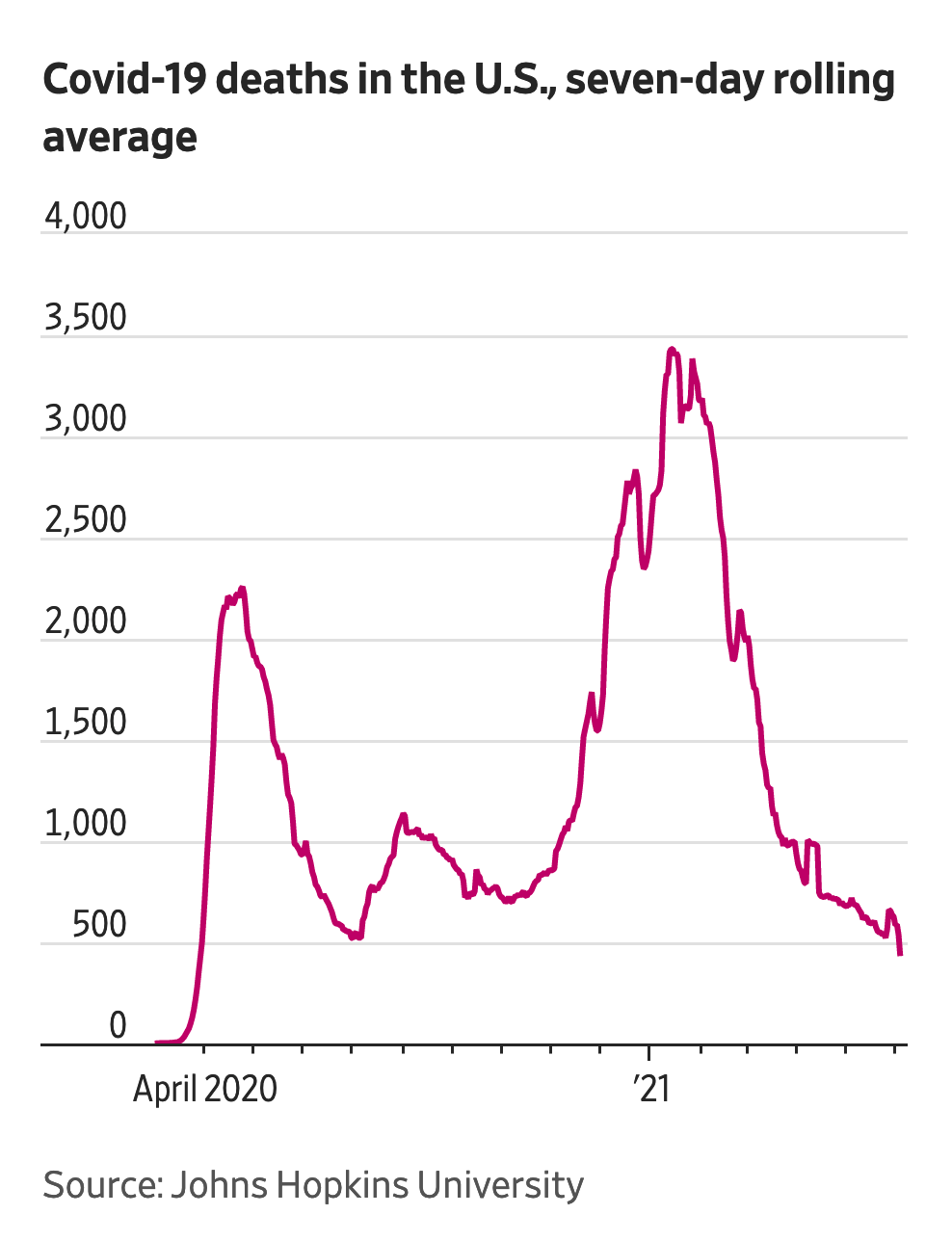

— U.S. Covid-19 deaths fall to lowest point since March 2020. As vaccinations rise, the seven-day average of reported deaths has dropped below 500. However, U.S. vaccination rates continue to drop. America is now averaging fewer than one million shots per day, even though everyone 12 and older is eligible. That is putting Biden’s goal of 70% of adults being vaccinated by July 4 increasingly out of reach.

— France is planning to allow U.S. visitors starting June 9 for the first time in more than a year. In Paris, many of the most attractions are outdoors. The Eiffel Tower won't be open for visits until mid-July. Elsewhere in France, the Avignon Festival will go on July 5-25 in Provence after being canceled in 2020.

POLITICS & ELECTIONS

— New Jersey, Virginia to hold statewide primaries. New Jersey and Virginia will both hold statewide primaries on June 8. New Jersey will hold primaries for governor, state Senate, and state House. Virginia will hold Democratic primaries for governor, lieutenant governor, and attorney general. Both parties will hold primaries for seats in the Virginia House of Delegates.

In New Jersey, incumbent Gov. Phil Murphy (D) faces a write-in candidate in the Democratic gubernatorial primary. Murphy defeated Lt. Gov. Kim Guadagno (R), 56% to 42%, in the 2017 general election to win his first term. Four candidates—Jack Ciattarelli, Brian Levine, Philip Rizzo, and Hirsh Singh—are competing for the Republican nomination. All 40 seats in the New Jersey State Senate and all 80 seats in the New Jersey General Assembly are up for election in 2021. Two local elections are also taking place, with Essex County holding a primary for county sheriff and Hudson County holding a primary for county register.

In Virginia, five candidates are running in the Democratic primary for governor, six in the Democratic primary for lieutenant governor, and two in the Democratic primary for attorney general. Glenn Youngkin defeated six candidates in the Republican Party of Virginia’s convention on May 8 to become that party's gubernatorial nominee. All 100 seats in the House of Delegates are up for election in 2021. The cities of Chesapeake, Norfolk, Richmond, and Virginia Beach will also hold municipal election primaries.

— Lara Trump refrains from North Carolina Senate bid, and Ted Budd wins former president's endorsement. Former President Donald Trump is backing Rep. Ted Budd for the Republican Senate nomination in North Carolina after his daughter-in-law, Lara Trump, announced she won't seek the open seat.

— Georgia GOP approves resolution censuring Secretary of State Brad Raffensperger. The Georgia GOP during a convention approved a resolution that says Raffensperger, a Republican, failed to perform his duties in “accordance with the laws of the Constitution of the State of Georgia,” WSB-TV reported. The document (link) says the failure stemmed from Raffensperger entering into a settlement agreement with the Democratic Party of Georgia, the Democratic Senatorial Campaign Committee, and the Democratic Congressional Campaign Committee. The agreement saw Raffensperger agree to promote and enforce regulations regarding prompt notification if a mail-in ballot was rejected and regarding county clerks’ signature reviews of absentee ballot envelopes and ballots. Raffensperger has said there is no evidence of widespread fraud occurring in the 2020 election. Raffensperger’s office told WSB-TV: “The secretary of state’s office, county election directors, and the tens of thousands of poll workers across the state worked to ensure that democracy was upheld. It is the job of counties to run elections and the secretary of state’s office’s job to report those election results — it is the job of the political parties to deliver wins for their candidates. Let’s not confuse the two.”

— Georgia agriculture commissioner announces Senate bid against Warnock. Politico reports Georgia Agriculture Commissioner Gary Black (R) on Friday launched a Senate bid, “becoming the highest-profile GOP candidate so far in the primary to face Democratic Sen. Raphael Warnock in one of next year’s key battleground races.” Politico highlights that the announcement “comes after several other high-profile Georgia Republicans have passed on running, with the field staying mostly frozen for months as the GOP waits on a decision from former NFL and University of Georgia football player Herschel Walker.”

CONGRESS

— Manchin to vote against election overhaul bill. Sen. Joe Manchin (D-W.Va.) said in an op-ed published early Sunday (link) that he will vote against a sweeping election reform overhaul bill, dubbed the For the People Act, putting the fate of the legislation in jeopardy in the evenly split Senate. “I believe that partisan voting legislation will destroy the already weakening blinds of our democracy, and for that reason, I will vote against the For the People Act," Manchin wrote. “The truth, I would argue, is that voting and election reform that is done in a partisan manner will all but ensure partisan divisions continue to deepen,” he added. Manchin also said he “will not vote to weaken or eliminate the filibuster,” which several leading Democrats have suggested in order to pass election reform. The House in March passed the For the People Act in a 220 to 210 vote. No House Republicans supported the measure, and one Democrat voted against the legislation. The bill would require states to offer mail-in ballots, a minimum of 15 days of early voting and online and same-day voter registration. Additionally, it calls for the creation of independent commissions to draw congressional districts in an effort to put an end to partisan gerrymandering. It would also provide additional resources to stave off foreign threats on elections, enable automatic voter registration, and would make Election Day a national holiday for federal workers. The legislation appears unlikely to attract the bipartisan 60 votes needed to overcome a Senate filibuster, or the 50 votes necessary to pass if the party decides to use the nuclear option.

OTHER ITEMS OF NOTE

— Calling it a “failed experiment,” a federal judge overturned California’s 32-year assault weapons ban. The judge, Roger T. Benitez, wrote in his ruling that the firearms banned under the state’s law were “fairly ordinary, popular, modern rifles,” describing the AR-15 assault rifle as “a perfect combination of home defense weapon and homeland defense equipment. The judge granted a 30-day stay to allow the state’s attorney general to appeal the decision, where it is likely to join a number of other closely watched gun rights cases on appeal. State Atty. Gen. Rob Bonta called the decision “fundamentally flawed” and said he would appeal. “There is no sound basis in law, fact, or common sense for equating assault rifles with Swiss Army knives — especially on Gun Violence Awareness Day and after the recent shootings in our own California communities,” Bonta said in a statement. California became the first state to ban the sale of assault weapons in 1989 in response to a shooting at a Stockton elementary school that left five students dead. The ban, signed into law by Republican Gov. George Deukmejian, has been updated multiple times since then to expand the definition of what is considered an assault weapon.

— Commerce secretary on cyberattacks against corporations: 'This is the reality.' Commerce Secretary Gina Raimondo said Sunday that companies should brace for the reality that cyberattacks have become the norm but stopped short of proposing that the Biden administration require businesses to secure their technology. Meanwhile, Sen. Mark Warner (D-Va.), chairman of the Senate Intelligence Committee, said on Sunday that it is worth debating whether to make paying ransoms illegal after cyberattacks disrupted operations at energy and meat production firms in the United States.

— Sec. of State Antony Blinken on how President Biden will confront Vladimir Putin over cyberattacks that disrupted meat and gas supplies and threatened public transportation. Blinken told Axios on HBO: “We would prefer to have a more stable, predictable relationship with Russia — we've made that clear. But we've made equally clear that if Russia chooses to act aggressively or recklessly toward us or toward our allies and partners, we'll respond.”

— Mexico’s ruling party retains House majority. President Andrés Manuel López Obrador’s party, along with two smaller allied parties, won a majority in the country’s lower house in midterm elections on Sunday, giving the populist leader a mandate to press ahead with his nationalist economic agenda. Obrador’s Morena party and its allies came with a reduced majority, dashing the president’s hopes of enacting constitutional changes — which require a two-thirds majority. Morena is still expected to hold between 265 and 292 seats in Mexico’s lower house, according to the national election body.

— Peru’s election. Peru’s ideologically polarized presidential election between socialist Pedro Castillo and conservative Keiko Fujimori is too close to call, according to unofficial results. A fast count by Ipsos showed Castillo ahead of Fujimori by 0.4%, while an earlier exit poll showed Fujimori ahead by 0.6%. With only 42% of votes counted, Fujimori leads Castillo by 52.9% to 47.1% in the official tally.