Wholesale Price Index Surges 9.6% in November YOY, Fastest Pace on Record

Farm Bureau analyzes fertilizer price hikes, tax implications, planting impacts

In Today’s Digital Newspaper

Market Focus:

• Wholesale price index surge should get Fed’s attention during FOMC confab

• Hot inflation hits U.S. equities

• Above sticker price shock for car buyers

• Jason Furman tweet asks important question about inflation outlook

• Bank of America CEO: ‘U.S. consumer spending at a faster rate than I have ever seen’

• Toyota to shift more rapidly to EVs

• Oil surplus returns as supplies climb

• Farm Bureau analyzes fertilizer price hikes, tax implications

• Natural catastrophes caused insurance losses of $105 billion in 2021

• Ag demand update

• Quiet overnight session... Corn, soybean and wheat futures mildly weaker

• Consultant lowers Brazilian corn crop estimate, Paraguay soybean crop

• Egypt, Russia could form joint grains trading company in Egypt

• China’s cotton production shrinks 3%

• Choice beef still sputtering

• Cash hog market firms again

Policy Focus:

• Biden, Manchin talked Monday and will confer again later this week re: BBB

• BBB still under negotiation

• Schumer: Senate will vote today on debt ceiling increase; House on Wed.

• Little change in CFAP 1, 2 payments

• USDA’s Bonnie wants disaster relief focus in new farm bill

Personnel:

• BIF implementers announced

China Update:

• China’s cotton production shrinks 3%

• FDA urges U.S. food facilities to register by Dec. 17 to meet China reg shift Jan. 1

Energy & Climate Change:

• EPA publishes comment request on proposal to deny pending small refiner exemptions

• Russia blocks climate change as a threat to global peace “

• Canadian PM Trudeau: Several solutions on EV tax credit issue

• Administration action on EV charging stations ramping up

• California regulator looks to cut rooftop solar incentives in bid to boost battery storage

Livestock, Food & Beverage Industry Update:

• USDA launches pandemic aid hog market payment effort; no pay cap

• Corn refiners meet with OMB over ‘healthy’ labels

Coronavirus Update:

• Omicron impact update

• Pfizer Covid pill protects against severe disease, including from Omicron variant

• Hospitals drop vaccine mandate to keep workers

• Kroger removing paid emergency leave for unvaccinated employees who contract Covid-19

• 200,000 Britons a day being infected with Omicron variant of Covid-19

Politics & Elections:

• Jan. 6 committee update

• Politico: Fortenberry indictment raises questions about FBI tactics

Other Items of Note:

• Devastating series of tornados during the weekend killed at least 74 people in Kentucky

• Biden will survey tornado damage in Kentucky tomorrow

• Germany warns Russia re: Ukraine

• Court ruling on immigration

• Ag groups urge South African farmworkers be exempt from travel restrictions

• Bayer halting discussions to settle further claims over Roundup weedkiller

MARKET FOCUS

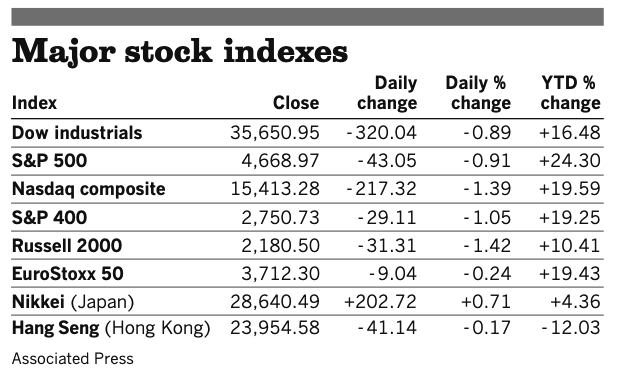

Equities today: Global stock markets were mixed in overnight trading, with European shares mostly up and Asian shares mostly down. U.S. stock indexes are also pointed toward weaker openings, especially following results of the latest Producer Price Index. Asian equities declined with an eye on coming central bank decisions this week. Japan’s Nikkei was off 207.85 points, 0.73% at 28,432.64. Hong Kong’s Hang Seng Index fell 318.63 points, 1.33%, at 23,635.95. European equities are seeing advances in early trade action. The Stoxx 600 was narrowly higher with most regional markets flat to seeing gains of up to 0.8%. However, German shares were slightly lower.

U.S. equities yesterday: The Dow fell 320.04 points, 0.89%, at 35,650.95. The Nasdaq lost 217.32 points, 1.39%, at 18,640.49. The S&P 500 was down 43.05 points, 0.91%, at 4,668.97.

On tap today (see detailed list of events and reports below):

• U.S. Producer Price Index for November is expected to increase 0.5% from the prior month. (8:30 a.m. ET) UPDATE: Wholesale prices increased at their quickest pace ever in November in the latest sign that the inflation pressures are still present, the Labor Department reported. The index increased 9.6% over the previous 12 months after rising another 0.8% in November. Economists had been looking for an annual gain of 9.2%, according to FactSet.

• FOMC: Federal Reserve begins its two-day policy meeting. See item below for more.

• USDA Secretary Tom Vilsack today will keynote the Food Supply Chain Finance Forum, a virtual event hosted by Business for Impact’s Rural Opportunity Initiative at Georgetown University’s McDonough School of Business. He will discuss the Food Supply Guaranteed Loan Program, USDA’s new $100 million guaranteed loan authority for the middle of the food supply chain.

• China's industrial output for November is expected to increase 3.7% from one year earlier, retail sales for November are forecast to rise 4.5% from one year earlier, and fixed-asset investment for January through November is forecast to advance 5.2% from the same period a year earlier. (9 p.m. ET)

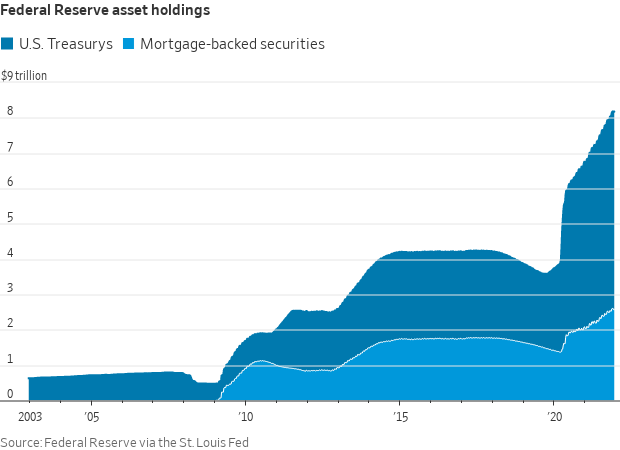

FOMC meeting begins today, announcements tomorrow. At a two-day meeting that begins today, officials are expected to rapidly reduce the amount of Treasury bonds and mortgage-backed securities the Fed has been buying, which would clear the way for interest rate increases as early as March, economists say. The move to accelerate the process would be the most concrete sign of their shifting inflation outlook.

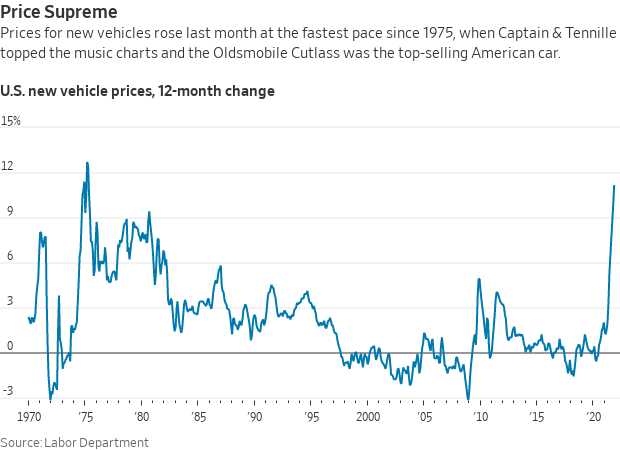

Inflation watch: cars… again. With dealership lots stripped of inventory, car buyers hunting for a bargain will be lucky if they end up paying the sticker price, the WSJ reports (link). The cost of a new vehicle continues to soar with the global auto industry now a year into a computer-chip shortage that has shown few signs of abating in 2022. In November, nearly 87% of all new vehicles bought by individual customers sold at or above the sticker price, according to research firm J.D. Power. That number is up from about 75% at the halfway point of the year, and well above the pre-pandemic average of about 36% of sales. The availability of both new and used vehicles is at historic lows, and car companies and dealers are responding by eliminating discounts and adding upcharges to the manufacturer’s suggested retail price.

Inflation watch what if: Link to a Jason Furman tweet.

“The U.S. consumer is spending money, a lot of money, spending at a faster rate than I have ever seen,” said Brian Moynihan, the CEO of Bank of America, in an interview with the Associated Press. Despite the rise in spending, a recent decline in consumer confidence revealed growing frustrations, he added.

Toyota says it will shift more rapidly to EVs. Toyota stepped up its commitment to battery electric vehicles, saying it would have 30 EV models available by 2030 and aimed to sell 3.5 million battery EVs globally by 2030.

Market perspectives:

• Outside markets: The U.S. dollar index is weaker with the euro and British pound both firmer against the greenback. The yield on the 10-year U.S. Treasury note has firmed to trade just under 1.44% with a firmer tone to global government bond yields. Gold and silver futures were under pressure ahead of U.S. economic data, with gold around $1,783 per troy ounce and silver around $22.10 per troy ounce.

• Crude oil futures are little changed ahead of U.S. trading, with U.S. crude around $71.30 per barrel and Brent around $74.35 per barrel. Futures were weaker in Asian action, with U.S. crude down 0.3% at $71.06 per barrel while Brent was down 0.15% at $74.28 per barrel.

• Oil surplus returns as supplies climb. Global oil markets have returned to surplus and face an even bigger oversupply early next year as the omicron variant impedes international travel, the International Energy Agency said. Supplies are rebounding around the world — from the current OPEC+ ramp-up and sales from strategic reserves, to record output in the U.S., Canada and Brazil next year — the IEA said. With jet fuel demand also faltering amid the new virus strain, global oil inventories could swell at a rate of 1.7 million barre ls a day in the first few months of 2022. The IEA trimmed its 2022 supply forecast from non-OPEC producers by 100,000 barrels a day and cut its demand forecast by the same amount. Meanwhile, OPEC left unchanged its global oil demand and supply forecasts for 2021 and 2022, saying the Omicron variant’s impact on oil markets won’t be as seismic as initially feared.

• Farm Bureau analyzes fertilizer price hikes, tax implications. There are many reasons fertilizer prices have skyrocketed, the American Farm Bureau Federation’s Market Intel service said in a report released on Monday (link). The report said farmers’ inability to purchase their fertilizer in 2021 for 2022 means they will likely face a higher tax bill in 2021.

As for 2022 planting intentions, the report said: “Given all these factors, fertilizer prices are expected to remain high through springtime, which may compel some farmers to shift planted acres away from corn to commodities that use fertilizer at a lower rate, like soybeans or wheat. With the price of ammonia about 85% correlated with the price of corn, farmers must consider whether the increased cost of fertilizer and other inputs can be recovered by cash receipts from crop revenues in order to break even. There are also expectations retailers will have to turn customers away because they will not be able to deliver fertilizer products on time, increasing the need for supply chain and infrastructure improvements.”

• Natural catastrophes caused insurance losses of $105 billion in 2021 according to an estimate from Swiss Re, a reinsurer. That is the fourth highest figure since 1970 and 17% higher than last year. Extreme weather events are becoming increasingly costly. The most expensive events this year were Hurricane Ida and winter storm Uri, in America, and flooding in Europe in July.

• Ag demand: Japan is seeking 228,783 MT of U.S. and Canadian wheat in its weekly tender. The Philippines tendered to purchase 120,000 MT of feed wheat from the U.S., Australia, Canada, Europe or the Black Sea region. Iran tendered to buy around 180,000 MT of milling wheat.

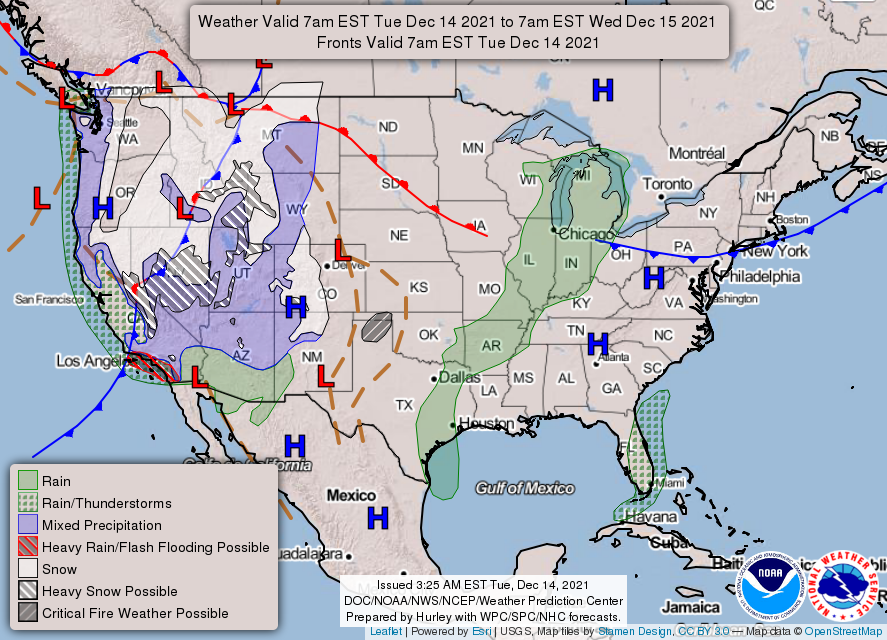

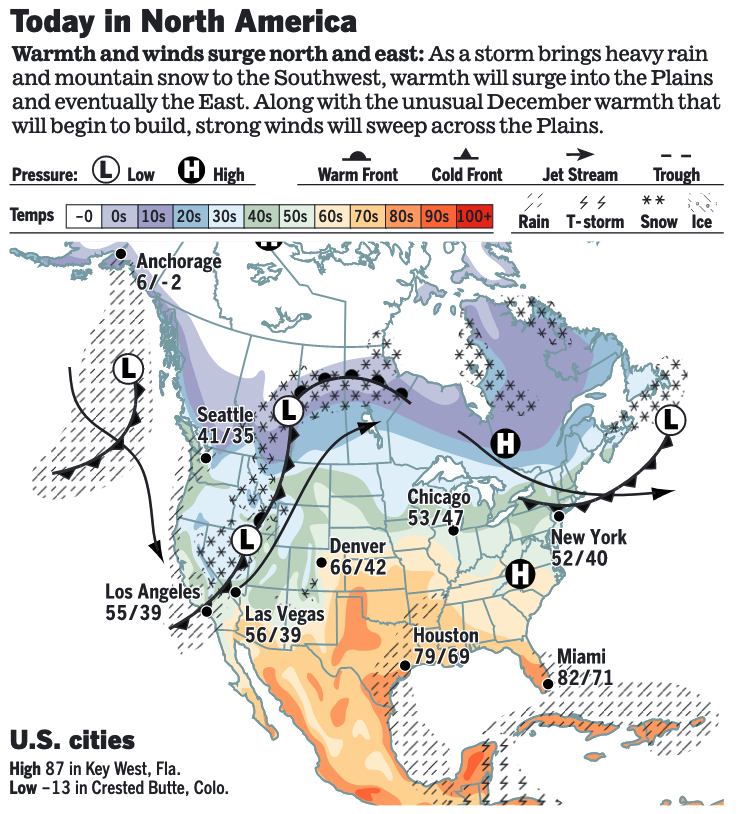

• NWS weather: There is a Slight Risk of excessive rainfall over parts of Southern California through Wednesday morning... ...Heavy snow over the Sierra Nevada Mountains and snow over the Cascades and Northern Rockies... ...Critical Fire Weather risk for parts of the Southern High Plains.

Items in Pro Farmer's First Thing Today include:

• Quiet overnight session... Corn, soybean and wheat futures are mildly weaker

• Consultant lowers Brazilian corn crop estimate, Paraguay soybean crop

• Egypt, Russia could form joint grains trading company in Egypt

• China’s cotton production shrinks 3%

• Choice beef still sputtering

• Cash hog market firms again

POLICY FOCUS

— Biden, Manchin talked Monday and will confer again later this week. Sen. Joe Manchin (D-W.Va.) indicated yesterday that a significant amount of work remains to be done to earn his support for President Joe Biden's social spending and climate change bill dubbed Build Back Better (BBB). A lot must be done to meet the before Christmas deadline of Senate Majority Leader Chuck Schumer (D-N.Y.).

Manchin spoke with Biden on Monday afternoon as the president tried to secure his support for the plan. But the senator is raising serious concerns, citing issues with the proposal's reliance on temporary programs and renewing concerns over inflation. “We’re just talking about different iterations, that’s all,” Manchin said about the call. “We’re engaged,” he added. White House spokesman Andrew Bates called the conversation “constructive.” Biden and Manchin, Bates said, “agreed to follow up with one another in the coming days.” Manchin said earlier yesterday that he has growing concerns about rising U.S. debt and soaring consumer prices, after a Friday economic report showed inflation hit the highest annual rate in four decades. As usual, Manchin’s remarks before and after his conversation with Biden gave something to all sides. Some note this Manchin refrain: “People have been in a hurry for a long time to do something, but I think, basically, we’re seeing things unfold that allows us to prepare better.”

BBB is still under negotiation. Senate Finance Committee Chair Ron Wyden (D-Ore.), said Monday that there are more than 20 issues that he is “litigating” with the parliamentarian. Also, Sen. Bernie Sanders (I-Vt.) and Sen. Robert Menendez (D-N.J.) continue to disagree on the SALT tax exemption.

— Schumer: Senate will vote today on debt ceiling increase. Senate Majority Leader Chuck Schumer (D-N.Y.) said Monday that the Senate will vote today to raise the federal government’s debt limit. Last week Schumer and Minority Leader Mitch McConnell (R-Ky.) agreed to pair a one-time change in the Senate rules that would allow Democrats to increase the debt ceiling without needing GOP votes to overcome a filibuster and provisions to stave off scheduled cuts to Medicare providers, lab services and physician reimbursements. Ultimately, 10 Republicans voted to pass the debt limit process bill. The House is expected to consider the measure on Wednesday.

— Little change in CFAP 1, 2 payments. Payments under the Coronavirus Food Assistance Program 2 (CFAP 2) effort totaled $19.04 billion as of Dec. 12, including $14.22 billion in original CFAP 2 payments and $4.82 billion in top-up payments, little changed from the prior week. CFAP 1 payments are now at $11.75 billion as of Dec. 12, down slightly from the prior week’s total, as the level of original CFAP 1 payouts was trimmed to $10.56 billion from $10.58 billion the prior week, with top-up payments steady at $1.19 billion.

— USDA’s Bonnie wants disaster relief focus in new farm bill. Robert Bonnie, USDA’s undersecretary for farm production and conservation, says discussions on how to reform and create new disaster aid programs should be part of negotiations over the next farm bill, Politico reports. Bonnie met with ag producers and advocates to discuss this year’s historic drought in the Pacific Northwest. “We will be as flexible as we can with what we got, but I think there is a conversation going into the next farm bill about this and how we make sure programs work as is intended,” Bonnie was quoted as saying during a roundtable discussion, where farm advocates noted that certain commodities and producers were left out of disaster aid programs following ice storms, record drought and a summer heat dome. Meanwhile, President Biden is launching a working group focused on droughts.

Comments: The problem with standing disaster is it can disincentivize crop insurance. The last standing disaster program was SURE and it did not work well, so it was discontinued. A better solution, sources advise, is for USDA’s RMA to aggressively use private submission process and other R&D available to optimize policies for all growers, commodities, and regions. Lift those coverage levels up. Etc.

PERSONNEL

— BIF implementers. The White House yesterday announced that Katie Thomson and Winnie Stachelberg — for the departments of Transportation, and Interior, respectively — will serve as implementation coordinators charged with leading their agency’s efforts to implement the bipartisan infrastructure framework (BIF) law. Stachelberg had been nominated as Interior’s assistant secretary for policy, management and budget.

CHINA UPDATE

— China’s cotton production shrinks 3%. China's 2021 cotton output fell 3% to 5.73 MMT (26.32 million bales), the country’s National Bureau of Statistics (NBS) said. USDA forecasts China’s cotton crop at 26.75 million bales. NBS says planted acreage fell by 4.4% to 3.03 million hectares while yields increased slightly from last year.

— FDA urges U.S. food facilities to register by Dec. 17 to meet China reg shift Jan. 1. The U.S. Food and Drug Administration (DFA) is asking U.S. companies that currently export certain food products to China to voluntarily submit an application to the U.S. agency by Dec. 17 as it seeks to build a list of those companies ahead of a January 1, 2022, shift in Chinese rules by the General Administration of Customs (GACC). GACC announced the new registration requirement in April 2021 that affects all overseas food manufacturers, processors, and storage facilities of certain food products that export to China. FDA said GACC will continue recognizing registrations for establishments that export meat and meat products, aquatic products, dairy and infant formula products and bird nests and bird nest products. The new requirement appears to touch on U.S. establishments that export to China foods such as eggs, edible oils, edible grains, nuts and seeds, vegetables, unroasted coffee, functional foods, milled grain products, condiments, dried fruits, foods for special dietary purposes, stuffed wheaten products, casings and bee products.

ENERGY & CLIMATE CHANGE

— EPA publishes comment request on proposal to deny pending small refiner exemptions. EPA today (Dec. 14) published in the Federal Register a document seeking public comment (link) on its proposal to deny all undecided/pending small refinery exemption (SRE) petitions under the Renewable Fuel Standard (RFS). The agency said their “thorough analysis” of the situation prompted their proposed decision, stating that even though SREs were allowed under the RFS, all refiners regardless of size “face the same costs to acquire RINs (Renewable Identification Numbers) regardless of whether the RINs are created through the act of blending renewable fuels or purchased on the open market.” Under the RFS, small refiners can petition EPA for an exemption from their RFS obligations if compliance would cause disproportionate economic harm (DEH).

Besides the denial, EPA said it wants public comment on its proposed change in the approach to SRE eligibility based on the original statutory exemption and their findings on RIN cost passthrough. Comments on the proposed action are due Feb. 7.

While EPA proposed to deny all pending/undecided SREs — 65 as of Nov. 18 covering the 2016 through 2021 compliance years — in their proposed RFS levels for 2020, 2021 and 2022, the agency repeatedly noted it was not clear whether there would be SREs granted or not.

— Russia wielded its veto power on the U.N.’s Security Council to thwart a resolution that would have identified climate change as a threat to global peace. India joined Russia in voting it down, against 12 countries who voted in favor; China abstained. Russian and Indian ambassadors argued that climate change should not be conflated with matters of war and peace.

— Canadian PM Trudeau insists there are a ‘number’ of solutions on EV tax credit issue. Canadian Prime Minister Justin Trudeau Monday indicated there are a “number of solutions” that Canada has suggested to the U.S. to rectify a brewing dispute over an electric vehicle (EV) tax credit in the Build Back Better (BBB) package. Trudeau said the gov’t is “working very hard” with the U.S. to get officials to understand that the potential tax credit for EVs made in the U.S. by union workers is not good for either the U.S. or Canada. “There are a number of solutions we've put forward,” he stated. “One of them would be to align our incentives in Canada and in the United States to make sure that there was no slippage or no unfair advantages on one side or the other. We are happy to do that.”

The less combative tone from Trudeau came after two top Canadian officials warned U.S. Senate leaders in a letter December 10 that Canada would pursue a case via the U.S.-Mexico-Canada Agreement (USMCA) if the provision were to become law and could impose retaliatory action on dairy and intellectual property protections.

— Administration action on EV charging stations ramping up. A joint office will be established between the Department of Energy (DOE) and Department of Transportation (DOT) under an agreement to be signed today as the Biden administration pushes ahead to establish a national electric vehicle (EV) charging network under the $7.5 billion in funding included in the Bipartisan Infrastructure Package (BIP).

A new Advisory Committee on Electric Vehicles will be set up in the first quarter of 2022. Link to White House Fact Sheet.

Background. The BIP included $5 billion in formula funding for states to help deploy a national charger network and $2.5 billion for communities and corridors in a competitive grant program for chargers. Guidance for states and cities is expected to come Feb. 11 for deploying EV charging stations with DOT expected to set standards for EV chargers on a national network by May 13. The effort is aimed at establishing a network of 500,000 EV chargers. There is also $3 billion in grants under the BIP for battery minerals and refined minerals aimed at accelerating a North American battery supply chain and $3 billion in competitive grants aimed at building, retooling or expanding the manufacture of batteries and battery components and recycling facilities.

Regarding critical minerals, the U.S. Geological Survey (USGS) announced a 32-day extension through Jan. 10, 2022, for public input on its 2021 draft list of critical minerals. USGS on Nov. 9 published its draft list of 50 minerals proposed for the 2021 critical minerals list, including cobalt and lithium, which are important components in electric vehicle batteries.

— California regulator looks to cut rooftop solar incentives in bid to boost battery storage. The California Public Utilities Commission (CPUC) is considering a proposal from Commissioner Martha Guzman Aceves that would cut incentives for rooftop solar. The first part of her proposal would phase out net metering — the billing of customers for their energy use less the power generated by their solar power system. While the state’s energy needs are highest in the evening — known as net peak — generation from rooftop solar usually tops out in the afternoon, leaving fossil-fuel fired plants to fill the resulting gap later in the day. Without net metering, customers with rooftop and small-scale solar would instead be incentivized to add battery storage to save excess energy for use later in the day, Guzman Aceves told the Los Angeles Times. “There’s a huge opportunity here for us to get more out of these customers to contribute to the net peak,” she said.

Other parts of the proposal include provisions that would allow homes and businesses to install much larger solar power systems than is currently permitted under net metering. The plan would compensate solar owners at what is called “avoided cost” — lower than the current retail rate of incentives. New customers could get a “market transition credit” that would last 10 years. The credit would decline annually over the next four years in a bid to get residents to install more solar capacity sooner and capture the higher credits. The plan adopts policies favored by the state’s major utilities, but drew swift backlash from solar groups, with the Solar Energy Industries Association dubbing it “the highest solar tax in the country.”

LIVESTOCK, FOOD & BEVERAGE INDUSTRY

— USDA launches pandemic aid hog market payment effort. USDA Monday announced (link) the launch of the Spot Market Hog Pandemic Program (SMHPP) to provide help to hog producers who sold animals through a negotiated sale from April 16, 2020, through Sept. 1, 2020, to address the reduction in market prices that occurred during that time period due to the pandemic. The agency said in a notice of funding availability (link) published in today’s Federal Register that prior pandemic aid had not “adequately addressed” the impact to those selling hogs on a negotiated basis which it said the industry describes as “a cash or spot market sale.”

USDA said it has determined a single payment rate of $54 per head for SMHPP by calculating the average daily difference in the negotiated sales price during the timeframe covered to the daily five-year average for negotiated sales prices during April 16-Sept. 1 for years 2015 through 2019. That average daily difference was $77 and the $54 payment rate reflects the Coronavirus Food Assistance Program 2 (CFAP 2) payments of $23 per head.

Producers can file SMHPP applications Dec. 15-Feb. 25. Payments will be made on the number of hogs sold from April 16-Sept. 1, 2020, and will not be made on more than 10,000 head and will be issued shortly after SMHPP applications are approved — there is no payment limit on the aid. Up to $50 million has been allocated for the payments. The payments are not available to contract growers.

— Corn refiners meet with OMB over ‘healthy’ labels. The White House Office of Management and Budget (OMB) is considering FDA’s propose rule that would update the nutrient content claim “healthy” on food labels sent to the White House Nov. 17. One of the meetings on the matter has been with the Corn Refiners Association (CRA) which shared research from Purdue University on consumer understanding of the term “healthy” and urged FDA to limit the use of the term for products with high amounts of sugar, which it says would not meet consumer expectations for the label. “Labeling claims and terms on product labels should meet consumer expectations to avoid consumer misunderstanding,” said John Bode, president and CEO of CRA, during the December 2 meeting. “This is why CRA strongly recommends that FDA require an accompanying statement when ‘healthy’ claims or symbols appear on product labels so that consumers know what that claim actually means, particularly that the term is based on nutrient content and not factors such as environmental impact or food safety.”

CORONAVIRUS UPDATE

— Summary: Global cases of Covid-19 are at 270,903,692 with 5,315,624 deaths, according to data compiled by the Center for Systems Science and Engineering at Johns Hopkins University. The U.S. case count is at 50,119,437 with 798,713 deaths. The Johns Hopkins University Coronavirus Resource Center said that there have been 485,359,746 doses administered, 202,246,698 have been fully vaccinated, or 61.61% of the U.S. population.

— Omicron impact update. The new Omicron variant is substantially more contagious and reduces the effectiveness of Covid-19 vaccines. But people who are fully vaccinated are still largely protected against severe disease, according to a new study.

— Pfizer says its Covid pill protects against severe disease, including from the Omicron variant. The research results will strengthen the company’s application for the FDA to authorize the pill, known as Paxlovid. If it’s approved, analysts estimate that the drug could bring in $24 billion in revenue next year.

— Hospitals drop vaccine mandate to keep workers. Some of the largest U.S. hospital systems have dropped Covid-19 vaccine requirements for staff after a federal judge temporarily halted a Biden administration mandate that healthcare workers get the shots. Hospital operators including HCA Healthcare and Tenet Healthcare as well as nonprofits AdventHealth and the Cleveland Clinic are dropping the mandates. Labor costs in the industry have soared, and hospitals struggled to retain enough nurses, technicians and even janitors to handle higher hospitalizations in recent months as the Delta variant raged. Vaccine mandates have been a factor constraining the supply of healthcare workers. Link to more via the Wall Street Journal.

— Kroger is removing paid emergency leave for unvaccinated employees who contract Covid-19 and adding a $50 monthly health surcharge for some staff. Meanwhile, the Supreme Court turned down emergency requests by New York healthcare workers for a religious exemption from state requirements to vaccinate against Covid-19.

— U.K. Health Security Agency estimated that 200,000 Britons a day are currently being infected with the Omicron variant of Covid-19 — 20% of cases. Britain’s home secretary said the country had recorded its (and the world’s) first confirmed death from the new strain and that ten people are currently in hospital with it, a number that is expected to rise drastically.

POLITICS & ELECTIONS

— Jan. 6 committee update. The committee charged with investigating the riot on America’s Capitol Hill recommended unanimously that then-president Donald Trump’s former chief of staff, Mark Meadows, be held in contempt of Congress for defying its subpoena. The committee divulged text messages from January 6th, when Fox News hosts and Donald Trump junior pleaded with the White House to condemn the violence.

— Politico: Fortenberry indictment raises questions about FBI tactics. The method in which the Federal Bureau of Investigation has pursued an indictment of Rep. Jeff Fortenberry (R-Neb.) has come into question, Politico reported (link). The indictment resulted in the removal of Fortenberry from his position as ranking member on the House Agriculture Appropriations Subcommittee.

OTHER ITEMS OF NOTE

— Devastating series of tornados during the weekend killed at least 74 people in Kentucky, with victims ranging in age from 5 months to 86 years, authorities said. At least 16 people were left dead in Illinois, Tennessee, Missouri and Arkansas. Thousands were left homeless. Satellite images (link) captured the devastation in Kentucky, Arkansas and Illinois in these shocking scenes of before and after.

President Biden said he will survey tornado damage in Kentucky tomorrow. “This is a narrow path and the devastation is just stunning,” the president said yesterday from the Oval Office, showing them maps of the damage after a briefing from federal emergency and homeland security officials. He declined to pin the blame on climate change, pointing also to the weather pattern in the Pacific. “We can’t say with absolute certainty it was because of climate change,” he said.

— Germany-Russia ties. Germany has warned Russia that any military action in Ukraine would jeopardize the operation of the Nordstream 2 pipeline, currently under consideration by German regulators. “In the event of further escalation this gas pipeline could not come into service,” Foreign Minister Annalena Baerbock told German media on Monday. Her comments follow those made by Chancellor Olaf Scholz, who said his country would “do anything” to ensure Ukraine remains a transit point for Russian gas exports to Europe, a position under threat by the new Russian pipeline.

— Court ruling on immigration. The 5th US Circuit Court of Appeals last night ruled against the Biden administration's bid to end the Trump-era "remain in Mexico" policy, which requires non-Mexican migrants to stay in Mexico until their U.S. immigration court dates. The administration relaunched the policy last week after a district court order required its revival. The Supreme Court had previously denied the administration's request that the program remain on hold while the case was appealed. Since the program was reinstated, 86 migrants have been returned to Mexico, according to the International Organization for Migration.

— Ag groups urge South African farmworkers be exempt from travel restrictions. With nearly 7,000 U.S. farmworkers originate from South Africa, the American Farm Bureau Federation, and more than 60 other agriculture groups, told the Biden administration on Monday that they should be exempted from travel restrictions related to the Covid-19 Omicron variant. The letter (link) requests flexibility in regard to the “Proclamation on Advancing the Safe Resumption of Global Travel During the Covid-19 Pandemic,” which limits entry into the U.S. to only those fully vaccinated with a CDC-approved vaccine with limited exceptions and requests that the agencies “ensure access to these essential members of the agricultural workforce by giving National Interest Exceptions to H-2A workers coming to the United States as outlined in the proclamations as an exception to the travel restrictions.” Workers should be able to travel directly to the U.S. and can be vaccinated here with a CDC-approved vaccine, the groups said. The letter noted that the majority of the South African workers arrive in the United States in February, March and April. “Many of these H-2A workers have a unique skillset, and American farmers are counting on their timely arrival as they make plans for their upcoming growing seasons,” the groups said.

— Bayer said it’s halting discussions to settle further claims over its Roundup weedkiller after the U.S. Supreme Court signaled interest in the company’s effort to end thousands of suits alleging the product causes cancer. Bayer is “encouraged” by the court’s call to hear the views of the Solicitor General on its case challenging a $25 million award to Edwin Hardeman, a California man who says decades of exposure to Roundup caused his non-Hodgkin’s lymphoma, the Germany-based company said in a statement yesterday. The company argues that federal approval of Roundup’s label meant Hardeman’s suit—and others like it — couldn’t go forward.

EVENTS AND REPORTS

Tuesday, Dec. 14

· FDA nomination. Senate Health, Education, Labor and Pensions Committee hearing on the nomination of Robert McKinnon Califf to be commissioner of the Food and Drug Administration.

· Plant protections. USDA’s Agricultural Marketing Service teleconference of the Plant Variety Protection Board to discuss a variety of topics including regulation updates, subcommittee activities, and program activities.

· Rural investment. Urban Institute webinar on "Re-envisioning Rural America: Supporting Asset-Based Rural Investment and Capacity Building."

· China WTO membership. Information Technology and Innovation Foundation virtual discussion on "China vs. The WTO: Two Decades of Dissembling and Dysfunction."

· China and Afghanistan. Center for Strategic and International Studies virtual debate on "China and Afghanistan," the third of the China's Power: Up for Debate series.

· National Petroleum Council. Energy Department teleconference of the National Petroleum Council.

· Hong Kong. National Endowment for Democracy virtual book discussion on "Freedom: How We Lose It and How We Fight Back," focusing on the Hong Kong democracy movement and discuss the importance of supporting democracy activists around the world."

· Stablecoins. Senate Banking, Housing and Urban Affairs Committee hearing on "Stablecoins: How Do They Work, How Are They Used, and What Are Their Risks?"

· Covid and other issues. National Press Club Newsmaker Program discussion on "challenges of reopening live theater amid the Covid-19 pandemic" and to release an Actor's Equity report on "how state and local grant policies and weaknesses in the National Endowment for the Arts guidelines affect efforts to increase diversity at arts organizations."

· FDIC board. Federal Deposit Insurance Corporation teleconference of the Board of Directors.

· Algal bloom. Environmental Protection Agency teleconference of the Board of Scientific Counselors to discuss the SSWR research program on nutrients and harmful algal blooms.

· Wall Street and carbon issues. Center for American Progress and the Sierra Club virtual discussion on "Wall Street's Carbon Bubble," focusing on "the enormous size of carbon emissions financed by the largest banks and asset managers in the United States."

· Summit for Democracy analysis. German Marshall Fund of the United States virtual discussion on "The Summit for Democracy: A Transatlantic Readout."

· Covid and tech issues. Bloomberg News virtual technology summit on "Pandemic Powers: Tech's Opportunities and Challenges," with remarks from Homeland Security Secretary Alejandro Mayorkas. Runs through Wednesday.

· Environmental enforcement. American Bar Association virtual conference on "National Environmental Enforcement," including remarks from Carlton Waterhouse, assistant EPA administrator in the Office of Land Management; Lawrence Starfield, acting assistant EPA administrator in the Office of Enforcement and Compliance Assurance.

· Supply chain security. Hudson Institute virtual discussion on "Safeguarding America's Critical Supply Chain Capabilities."

· U.S./China cooperation. Center for Strategic and International Studies virtual discussion on "U.S./China Health Security Cooperation: Time is of the Essence."

· Covid vaccines. House Oversight and Reform Coronavirus Crisis Subcommittee hearing on "A Global Crisis Needs a Global Solution: The Urgent Need to Accelerate Vaccinations Around the World."

· Future of work issues. Government Executive Media Group virtual discussion on "2021 and Beyond," focusing on "the expansion of hybrid work patterns and locations, the continued growth in hybrid modes of delivery of customer services, robotics, and the growth in cybersecurity threats.

· International nominations. Senate Foreign Relations Committee hearing on the nominations of Enoh Ebong to be director of the Trade and Development Agency; and Oren Whyche-Shaw to be U.S. director of the African Development Bank.

· Infrastructure and broadband. Punchbowl News virtual discussion on the future of infrastructure investments and the importance of broadband access.

· Economic reports. NFIB Small Business Optimism Index | PPI-FD

· Energy reports/events. API U.S. inventory report IEA Monthly Oil Market Report

· USDA reports. ERS: Feed Grains: Yearbook Tables