Vilsack and Grassley Should Read Report on U.S. Cattle Market Before Testifying Thursday

Debt limit debate a key political game of who blinks first | Cotton, energy prices surging

In Today’s Digital Newspaper

Market Focus:

• Global trade flows forecast to continue rapid rebound from pandemic this year and next

• Did some Fed officials violate inside-trading rules?

• SEC Chair Gensler to testify today on his aggressive regulatory agenda

• Oil prices hit seven-year high

• India has only four days of coal reserves left, German power plants running out of fuel

• Oil drilling and output yet to return to pre-pandemic levels

• High natural gas prices prompting American utilities to switch to coal this year

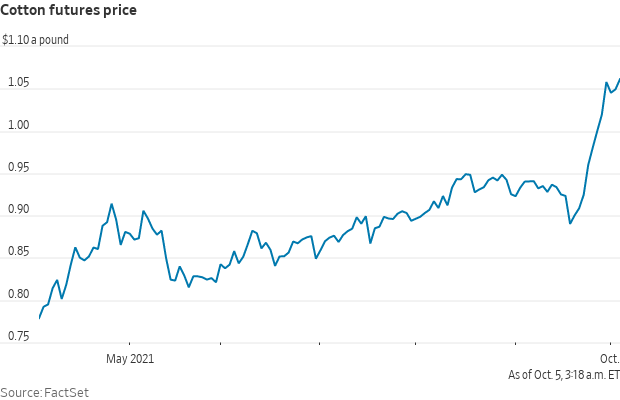

• Cotton futures trading at highest price in a decade

• Ag demand update

• Pressure overnight

• Crop Progress & Condition Report highlights

• Soybean CCI ratings improves a little

• Cordonnier maintains U.S. crop estimates and notes ‘surprisingly good’ bean yields

• StoneX boosts U.S. corn and soybean production estimates

• Rain and snow forecast for Northern Plains next week

• Russian wheat prices still climbing

• Choice beef remains under pressure

• Lackluster starts to the week for pork and cash hog markets

Policy Focus:

• Total CFAP 2 payments edge up

• Biden hammers GOP on failing to cooperate in dealing with debt ceiling

• Biden warns of economic calamity if debt ceiling not resolved

• Biden open to means-testing some social spending ahead

• Manchin will not commit to Oct. 31 deadline for social spending bill

Biden Administration Personnel:

• USAID vote

• Top Homeland Security lawyer confirmed

• NIH Director Francis Collins nears retirement announcement

• Energy-related nominations forwarded to the Senate

China Update:

• Another Chinese developer has fallen into crisis: Fantasia Holdings

• China’s top diplomat Yang Jiechi will hold talks with U.S. national security adviser

Trade Policy:

• Biden administration started defining its China trade policy Monday

Energy & Climate Change:

• Growth Energy calls for Supreme Court review of lower court E15 ruling

• Canada elevates Line 5 pipeline dispute by invoking 1977 Treaty

Livestock, Food & Beverage Industry Update:

• Vilsack touts new loan guarantee program to target ‘middle of the food chain’

• USDA still working on expanding meat processing capacity

• Report on U.S. cattle market published for Congress, USDA

Coronavirus Update:

• J&J submits booster data to FDA

Politics & Elections:

• Yang has left Democratic Party

• Nikki Haley embraces Trump, comments about her GOP future

Other Items of Note:

• New Japanese Prime Minister Fumio Kishida speaks with Biden

MARKET FOCUS

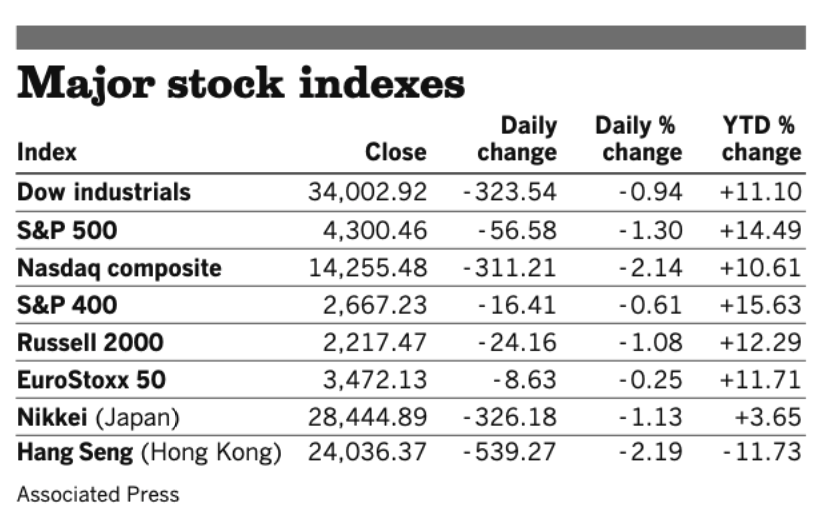

Equities today: Global stock markets were mixed in overnight trading. The U.S. Dow opened over 100 points higher. Asian equities were under pressure on spillover from US losses registered Monday, though some markets lifted off their lows by the close. China’s Shanghai Composite remains closed until Friday for a holiday. The Nikkei fell 622.77 points, 2.19%, at 27,822.12. The Hang Seng Index finished up 67.78 points, 0.28%, at 24,104.15. European equities have moved higher in early action, with the Stoxx 600 up 0.7% while regional markets are up 0.6% to 1.3%.

U.S. equities yesterday: The Dow fell 323.54 points, 0.94%, at 34,002.92. The Nasdaq lost 311.21 points, 2.14%, at 14,255.48. The S&P 500 was down 56.58 points, 1.30%, at 4,300.46.

On tap today (see detailed list of events and reports below):

• U.S. trade deficit is expected to widen to $70.7 billion in August from $70.05 billion one month earlier. (8:30 a.m. ET)

• IHS Markit's U.S. services index is expected to hold at 54.4 in September, unchanged from a preliminary reading. (9:45 a.m. ET)

• Institute for Supply Management's services index is expected to fall to 60 in September from 61.7 one month earlier. (10 a.m. ET)

• European Central Bank President Christine Lagarde speaks to a Frankfurt business group at 11 a.m. ET.

• Federal Reserve Vice Chairman Randal Quarles speaks on Libor transition at 1:15 p.m. ET.

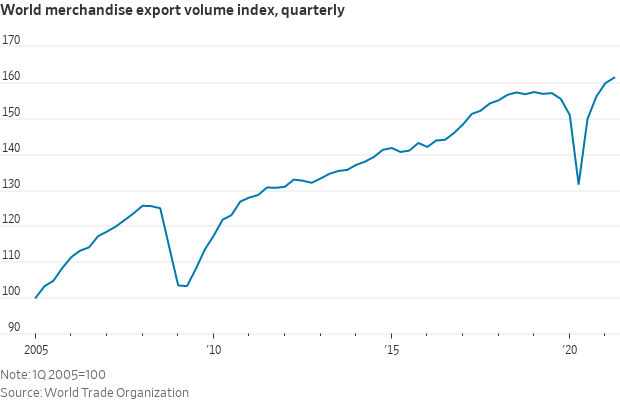

Global trade flows will continue their rapid rebound from the pandemic this year and next, with Asia seeing the strongest gains in exports, the World Trade Organization (WTO) said. The Geneva-based body’s new forecasts underline the unequal nature of Covid-19’s economic impact, with poorer countries set to suffer the weakest trade recovery, partly because they lack access to vaccines.

Did some Fed officials violate inside-trading rules? Sen. Elizabeth Warren (D-Mass.) asked the SEC to investigate whether personal financial investments by senior Federal Reserve officials violated insider-trading rules. Hours later, the Fed said that it had asked its Office of Inspector General to conduct an independent review. The Federal Reserve said that its internal watchdog plans to open an investigation into trading activity by senior U.S. central bank officials, following revelations about transactions in 2020. “As part of our comprehensive review, we began discussions last week with the Office of Inspector General for the Federal Reserve Board to initiate an independent review of whether trading activity by certain senior officials was in compliance with both the relevant ethics rules and the law,” the Fed said in a statement Monday. “We welcome this review and will accept and take appropriate actions based on its findings.”

Securities and Exchange Commission Chair Gary Gensler testifies to the House Financial Services Committee today. Gensler has outlined an aggressive regulatory agenda that threatens to squeeze the financial industry’s profit margins. He is working on tougher rules for high-speed trading firms, private-equity managers, mutual funds and online brokerages. Gensler says he wants to make the capital markets less costly for companies raising money as well as for ordinary investors saving for retirement.

Market perspectives:

• Outside markets: The U.S. dollar index was slightly higher ahead of U.S. economic updates, with the euro slightly weaker against the greenback. The yield on the 10-year U.S. Treasury note is firmer, trading around 1.49%. Gold and silver futures are seeing losses as selling emerged ahead of U.S. trading. Gold is trading around $1,757 per troy ounce and silver around $22.57 per troy ounce.

• Oil prices hit a seven-year high after OPEC+ agreed Monday to maintain its schedule of gradual monthly production increases. Ministers ratified the 400,000 barrel-a-day supply hike scheduled for November after speculation going into the talks that they could opt for a larger supply increase. Prices for West Texas Intermediate crude, the U.S. benchmark, hit their highest levels since 2014 while Brent, the international gauge, recorded its highest settling price in three years.

Meanwhile, India has warned it has only four days of coal reserves left, German power plants are running out of fuel and China just unloaded an Australian coal shipment despite an import ban and icy relations.

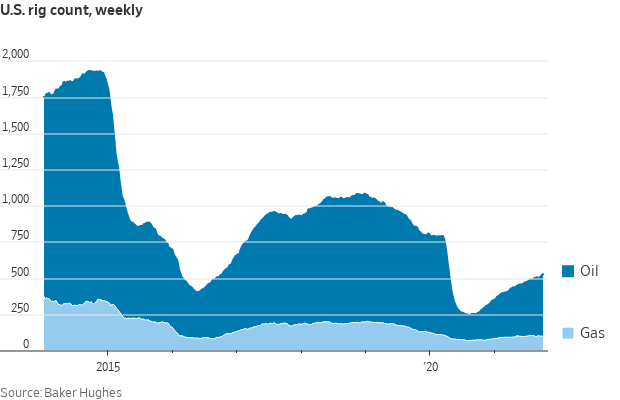

According to the EIA, average daily crude production in the U.S. has been 6.7% lower than last year, while commercial stockpiles of crude, excluding the Strategic Petroleum Reserve, are off by 15% compared to 2020.

Bottom line: Analysts expect tight supplies to continue to push up prices through the end of the year.

Oil drilling and output are yet to return to pre-pandemic levels The last time that domestic crude prices were so high, there were roughly 1,100 more rigs drilling for oil than the 428 at work last week, according to oil-field-services firm Baker Hughes.

• High natural gas prices are prompting American utilities to switch to coal this year, but their supply is constrained by miners that have cut capacity by 40% over the last six years. This past week, coal from the central Appalachia region rose $2.20 to $73.25, up 35% YTD and the highest level since May 2019.

• Crude oil has continued to move higher ahead of U.S. trading, with U.S. crude around $78.40 per barrel and Brent around $82.20 per barrel. Futures rose in Asian action in the wake of the OPEC+ decision, with U.S. up 35 cents at $77.97 per barrel and Brent up 47 cents at $81.73 per barrel.

• Cotton futures are trading at their highest price in about a decade, with growing Chinese demand being met in part by rising U.S. exports to China. Last year, then President Donald Trump banned U.S. imports of clothing and other products made of cotton from the Xinjiang region, China’s largest cotton-producing area. The administration said at the time that there was evidence that the products were made with forced labor by the Uyghur ethnic group. U.S. companies still can import cotton products made in China if the cotton itself is from somewhere else. So, China is importing cotton — much of it from the U. S. — to make goods and ship them back. The pace of U.S. export sales of cotton to China since the start of the new marketing year on Aug. 1 is 83% higher than this time last year, according to USDA.

• Ag demand: Japan’s ag ministry is seeking a total of 130,963 MT of food quality wheat from the U.S., Canada and Australia in a regular tender.

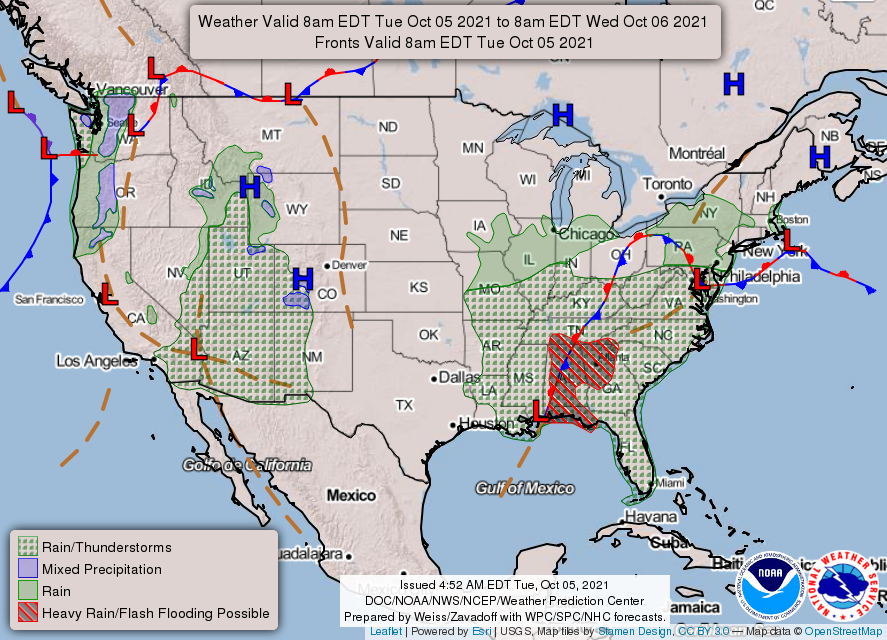

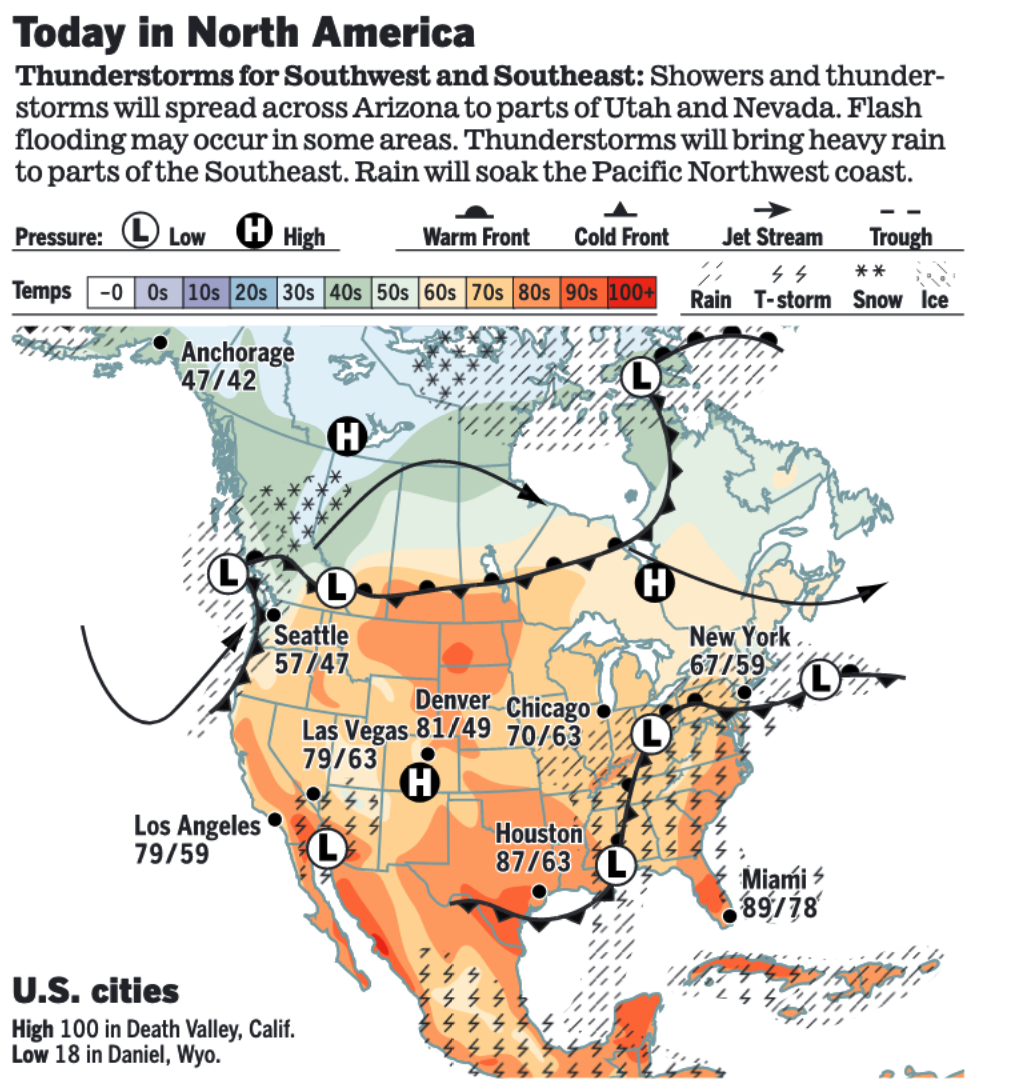

• NWS weather: There is a moderate risk of excessive rainfall over parts of the Central Gulf Coast through Wednesday morning... ...Air Quality Alerts over the San Joaquin Valley through Wednesday... ...Temperatures will be 10 to 25 degrees above average over parts of the Northern/Central High Plains; there is an elevated risk of fire weather over the Northern High Plains into parts of the Pacific Northwest.

Items in Pro Farmer's First Thing Today include:

• Pressure overnight

• Crop Progress & Condition Report highlights

• Soybean CCI ratings improves a little

• Cordonnier maintains U.S. crop estimates and notes ‘surprisingly good’ bean yields

• StoneX boosts U.S. corn and soybean production estimates

• Rain and snow forecast for Northern Plains next week

• Russian wheat prices still climbing

• Choice beef remains under pressure

• Lackluster starts to the week for pork and cash hog markets

POLICY FOCUS

— Total CFAP 2 payments edge up. Coronavirus Food Assistance Program 2 (CFAP 2) payments now total $18.66 billion as of Oct. 3, up slightly from the prior week, with the original CFAP 2 payments at $13.86 billion and the top-up payments for acreage-based commodities that started to be made April 2 totaling $4.81 billion.

Of the total payments, $11.09 billion have been made for acreage-based commodities, $3.46 billion for livestock, $2.83 billion for sales commodities, $1.22 billion for dairy, and $65.94 million for eggs/broilers.

CFAP 1 payments stood at $10.6 billion as of Oct. 3, little changed from the prior week.

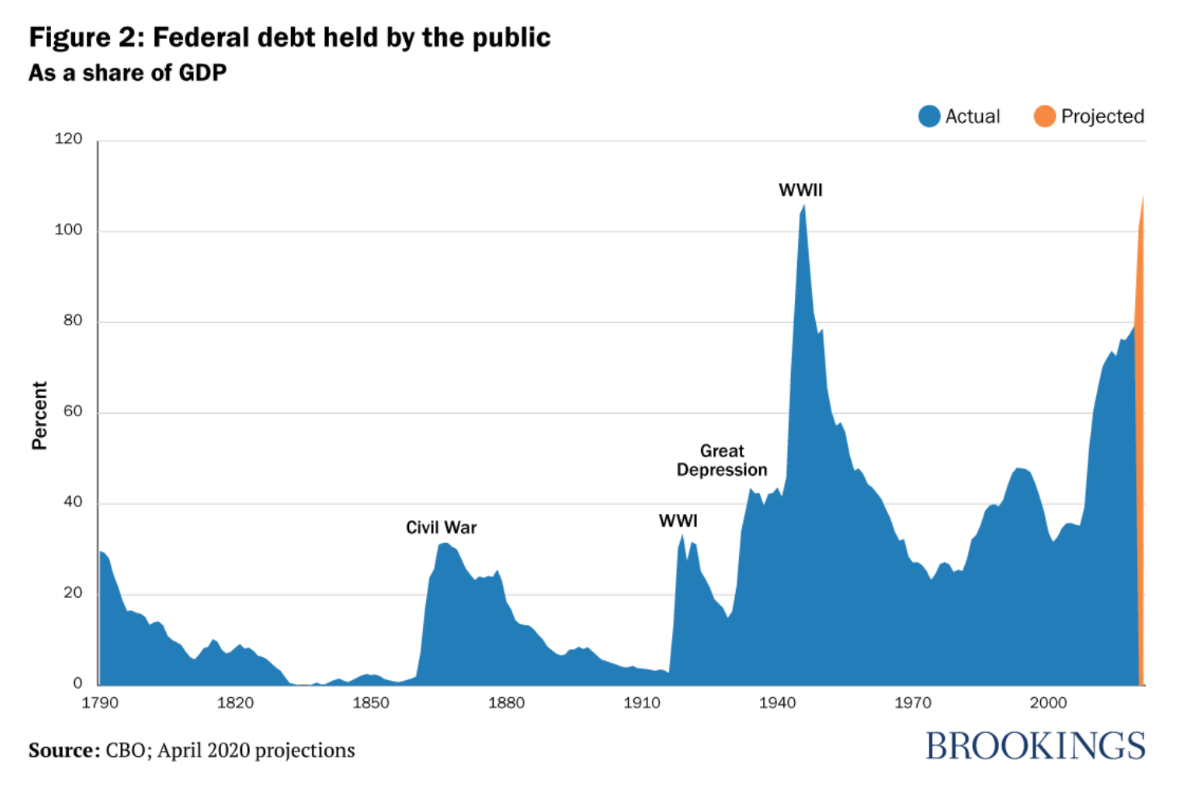

— President Joe Biden warned that the U.S. government is at risk of breaching the legal limit on its debt in two weeks, blaming Senate Republican Leader Mitch McConnell (R-Ky.) for what he described as a “meteor” headed for the economy. Biden demanded that Republicans stop blocking Democratic efforts to suspend the debt ceiling, while Republicans urged Democrats to use the reconciliation legislative procedure to boost the limit without any Republican votes.

Biden said he can’t guarantee the U.S. would not breach the debt limit on Oct. 18, saying, That’s up to Mitch McConnell.” Biden slammed Republicans as “reckless and dangerous” for vowing to block a majority vote to raise the ceiling.

Biden revealed he had just received a letter from McConnell in which the Senate minority leader prodded him to pressure his party to raise the limit with only Democrats. Biden said he planned “on talking to Mitch about it.” Political observers note the importance that McConnell sent the letter to Biden and not to Democratic congressional leaders. PDF Link to letter.

As for the possibility of default? “I don't believe that” will happen, Biden said. “But can I guarantee it? If I could, I would, but I can't.”

Senate Majority Leader Chuck Schumer (D-N.Y.) said he wants to pass a debt ceiling bill by the end of the week, without providing details on how that will unfold. In a “Dear Colleague” letter, he said Senate Democrats would be discussing it at their caucus lunch today. PDF Link to letter.

Next step comes Wednesday. That’s when the senate has a cloture vote on a debt-limit increase until Dec 2022. Republicans are going to vote against it, blocking consideration of the legislation.

Market impact: While investors still see little chance of a default, the yield on Treasury bills coming due close to the end of the month are significantly higher than those maturing earlier or later.

— Biden is open to means-testing some social spending ahead. President Joe Biden told a group of progressives and members of House leadership yesterday he is open to setting income limits for some of the programs in his social-spending bill, to lower the price tag. During the virtual meeting, Biden also reiterated that he expects the legislation would eventual fall in the range of $1.9 trillion to $2.2 trillion — from the $3.5 trillion originally proposed, based on what he sees centrist Sens. Joe Manchin (D-W.Va.) and Kyrsten Sinema (D-Ariz.) accepting.

House Speaker Nancy Pelosi (D-Calif.) reiterated in a “Dear Colleague” (link) to members Monday night that top Democrats were working together this week to narrow the size of their package: “[Biden] indicated that we would be working with a lower topline number, and decisions must therefore be made regarding the size and scope of the reconciliation bill.”

Senate Majority Leader Chuck Schumer (D-N.Y.) Schumer reiterated that the final package would ultimately deliver "bold action" on climate change, expanded health care access and higher taxes on the rich. "I'm confident we'll be proud of the end result," he said.

Meanwhile, Monday evening congressional leaders met with White House officials. House Speaker Nancy Pelosi (D-Calif.) and Senate Majority Leader Chuck Schumer (D-N.Y.) met on Capitol Hill with Biden’s economic adviser Brian Deese, domestic policy adviser Susan Rice and legislative liaison Louisa Terrell. They discussed the economic package. More meetings on planned for today.

President Biden is scheduled to meet virtually with moderate House Democrats this morning to discuss their plans. House progressives (liberals) had a similar call with Biden on Monday, where Biden stressed that Democrats needed to fit as much as they possibly could into the social policy and climate change package. The president later today travels to Michigan, where he will deliver remarks on his economic agenda.

— Manchin will not commit to Oct. 31 deadline for social spending bill. Centrist Sen. Joe Manchin (D-W.Va.) on Monday “pushed back on several politically sensitive positions his party leaders are taking at a crucial time for President Joe Biden’s domestic agenda.” Speaking to reporters, Manchin would not commit to the new timeline set by party leaders to find a deal on the social safety net expansion by Oct. 31. And he resisted calls from progressives and other top Democrats to raise his $1.5 trillion price tag for the package. In addition, Manchin indicated the package must include a prohibition against using federal funds for most abortions. “The Hyde Amendment is a red line,” he said.

BIDEN ADMINISTRATION PERSONNEL

— USAID vote. The Senate is scheduled to vote on Biden’s nominee to be deputy administrator of the U.S. Agency for International Development, followed by a vote on a judicial nomination.

— Top Homeland Security lawyer confirmed. The Department of Homeland Security will get a new top lawyer, with the Senate confirmation yesterday of Jonathan Meyer as general counsel. Meyer, who was confirmed in a 51-47 vote, will play a major role in shaping and defending the Biden administration’s immigration, cybersecurity, and counterterrorism policies as the department’s chief legal official. He was deputy general counsel and senior counselor at DHS during the Obama administration and most recently worked in private practice at Sheppard, Mullin, Richter & Hampton.

— NIH Director Francis Collins nears retirement announcement. Francis Collins, the doctor and geneticist who has led the U.S. National Institutes of Health (NIH) through three presidential administrations, is expected to soon announce plans to retire, people familiar with the matter said. The move would leave a key position to fill in the government’s pandemic response team. An announcement is expected as soon as today. Collins has been at the NIH for almost three decades and is the agency’s longest-serving director.

— Energy-related nominations forwarded to the Senate. The White House has sent additional nominations to the U.S. Senate, including four related to energy posts in the U.S. government. They include Joseph DeCarolis to be administrator of the Energy Information Administration; Maria Duaime Robinson to be an assistant secretary of energy in the Office of Electricity; Henry Christopher Frey to be an assistant administrator of the Environmental Protection Agency; and Mary Lucille Jordan to be a member of the Federal Mine Safety and Health Review Commission.

CHINA UPDATE

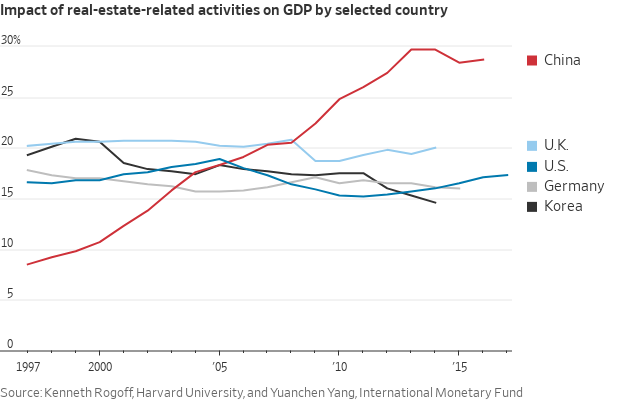

— Another Chinese developer has fallen into crisis. Fantasia Holdings Group failed to repay a maturing bond, adding to the strains of the nation’s heavily leveraged property firms following industry giant China Evergrande’s debt woes. Fantasia, a developer of luxury apartments in China, said it didn’t make a $206 million U.S. dollar bond payment that was due Oct. 4, adding to the malaise surrounding the country’s highly indebted property companies. The country’s junk dollar bonds are seeing the biggest selloff in at least eight years, with the closure of mainland Chinese markets for a week-long holiday only serving to exacerbate liquidity problems in the sector.

Meanwhile, trading in shares of Evergrande remain suspended at the firm’s request. That is in the expectation of an announcement that it will offload part of its troubled business to Hopson Development, a competitor.

— China’s top diplomat Yang Jiechi will hold talks with U.S. national security adviser Jake Sullivan in Switzerland this week, according to sources cited by the South China Morning Post. The talks between the pair — said to take place most likely on Wednesday —will come less than a month after a telephone call between the two nations’ presidents, Xi Jinping and Joe Biden. Relations between Beijing and Washington have been blighted by differences over a range of issues, including the South China Sea, Hong Kong, Xinjiang and the origins of Covid-19. Beijing has also been angered by U.S. support for Taiwan. China’s military planes have been busy over the last few days flying sorties into Taiwan’s air defense identification zone. On Friday, 38 planes flew into the area — a new record. On Saturday, 39 planes. And on Monday another record: 56 planes in a 24-hour period. Responding to a U.S. statement that the moves were both “provocative” and “destabilizing,” China’s foreign ministry accused the U.S. of creating its own tensions through its arms sales to Taiwan and by sending U.S. navy ships through the Taiwan strait.

TRADE POLICY

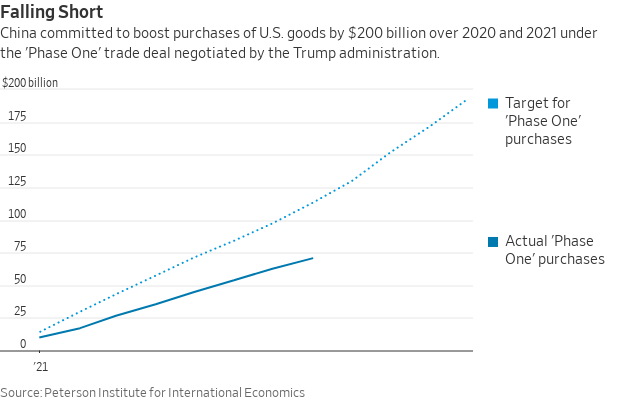

— Biden administration started defining its China trade policy Monday, saying it aims to launch new talks with Beijing but will keep existing tariffs in place. In a speech to the Center for Strategic and International Studies outlining the Biden administration’s trade policy toward China, U.S. Trade Representative Katherine Tai said that Trump-era tariffs would remain in place, but a mechanism for U.S. companies to seek exemptions from the tariffs would reopen. Link to details.

The policy largely builds on the China trade policy initiated by former President Donald Trump. Tai said the U.S. would press China to carry out pledges it made as part of the Phase 1 accord signed in early 2020 — including by maintaining steep tariffs put in place by Trump. This is one of the rare instances that the Biden administration has not either totally removed or mostly removed or changed programs and agreements left by the Trump administration.

ENERGY & CLIMATE CHANGE

— Growth Energy calls for Supreme Court review of lower court E15 ruling. The U.S. Supreme Court is being requested by Growth Energy to review a decision by the DC Circuit Court of Appeals that vacated EPA’s approval of selling E15 fuel year-round, arguing that the decision is at odds with the statutory interpretation of the law that has been established by the court and the action will stymie expansion of higher-ethanol fuel blends in the future.

Background. EPA’s decision to approve the Reid vapor pressure (RVP) waiver for E15 fuel that previously was applied only to E10, was changed in 2019 as the agency acknowledged its interpretation of the RVP waiver “made no sense and undermined Congress’s objectives.”

Growth Energy argued that E15 was not available when the initial EPA decision was made to apply the RVP only to E10 fuel. They further stated that the statute “at most” is “ambiguous” and that EPA’s interpretation of the law is “reasonable.”

The DC Circuit Court of Appeals denied a rehearing request on the matter in September. Growth Energy argued the Supreme Court is the only body that can now intervene and their failure to do so will mean that the current and future administration’s will be bound by the DC Circuit Court of Appeals decision.

— Canada elevates Line 5 pipeline dispute by invoking 1977 Treaty. Canada has raised the dispute over the Line 5 pipeline to the national level by invoking Article Six of the 1977 Transit Pipelines Treaty, with Canadian Foreign Affairs Minister Marc Garneau announcing the action. "Today, Canada is formally invoking the dispute settlement provision of the 1977 Agreement to ensure its full application," Garneau said.

Background. Article Six of the treaty is a dispute resolution provision. Canada also asked courts to halt any efforts by Michigan to shut down the Line 5 pipeline while the matter is ongoing. Line 5 is operated by Enbridge and carries 540,000 barrels per day (bpd) of crude oil and refined products from Superior, Wisconsin, to Sarnia, Ontario. The state of Michigan has sought to shut down the pipeline out of concern that the four-mile section that runs under the Straits of Mackinac could leak. Enbridge has fought the Michigan request and the Canadian government action now triggers bilateral negotiations between the U.s. and Canada.

Not surprisingly, Michigan Governor Gretchen Whitmer (D) expressed disappointment in Canada’s action and vowed to keep up her push to shut the pipeline down.

The Monday filing in U.S. District Court with Judge Janet Neff was made by Gordon Griffin, former U.S. ambassador to Canada who is now acting as counsel for the government of Canada. Neff has been weighing whether Michigan’s case against the pipeline should be moved back to state court after Enbridge moved it to federal court. The action likely means the pipeline will continue to operate given that it elevates the matter to a nation-to-nation level, and it also means the pipeline will remain operational at least through the winter, keeping an energy-supply line open for crude and natural gas products that are used in both Canada and the U.S.

LIVESTOCK, FOOD & BEVERAGE INDUSTRY

— Vilsack touts new loan guarantee program to target ‘middle of the food chain’; USDA still working on expanding meat processing capacity. USDA Secretary Tom Vilsack announced a $100 million loan guarantee effort that seeks to address supply chain bottlenecks. While details of the effort are yet to come, Vilsack said the $100 million program is aimed at the “middle of the supply chain” and targeting entities that “aggregate, process, manufacture, wholesale or distribute food.” Vilsack also suggested the loan guarantees can help jumpstart additional investments to bolster the food supply chain. Funding for the effort came via the March Covid aid package.

Regarding expanding meat processing capacity, USDA is reviewing around 500 comments it received on the $500 million effort it announced earlier this year to boost meat and poultry processing capacity. Vilsack said a framework for that effort should be in place near the end of this year with grants and proposals submitted during the first quarter of 2022. Earlier this year USDA announced $500 million to increase competition and capacity meat and poultry processing markets and $150 million for existing small and very small processing facilities to help them weather Covid, compete in the marketplace and get the support they need to reach more customers.

Among the areas that the loan guarantee program could address are mobile units that travel in remote rural areas for processing and processing by co-ops, Vilsack said. Lenders are not always as familiar with those processing methods, he said.

Vilsack said he was “not sure” the processing loan guarantees would be limited to meat and poultry, but could also help the fruit and vegetable industry, which has also talked about the importance of cold storage capacity.

— Report on U.S. cattle market published for Congress, USDA. Responding to a request from Congress and USDA, the Agricultural and Food Policy Center, AFPC, at the Department of Agricultural Economics in the Texas A&M College of Agriculture and Life Sciences have completed an extensive report on the U.S. cattle market, including information on supply chain disruptions. The 180-plus page book, titled The U.S. Beef Supply Chain: Issues and Challenges can be viewed on the AFPC website at https://afpc.tamu.edu. It is the result of proceedings from an AFPC-hosted workshop on cattle markets held June 3-4 in Kansas City, Missouri.

The book puts into context several disruptions in the cattle market, including the 2019 fire that took the nation’s second-largest beef packing plant offline for four months and the Covid-19 pandemic’s effect on packing plants and significant disruption of beef supply chains. “This is the product of a collaboration between the AFPC and the Office of the Chief Economist at the USDA,” Bart Fischer, Ph.D., co-director of AFPC and one of the book’s editors, told AgriLife. The work originated from a request by the bipartisan leadership of the Committee on Agriculture in the U.S. House of Representatives during the 116th Congress.

AFPC commissioned papers from noted experts around the country on several topics. Fischer noted that while the book is “admittedly very technical and assumes a working knowledge of the industry,” a definition of technical terms has been provided wherever possible.

While the book is focused primarily on fed cattle pricing, Congress also asked about packing capacity issues. “In many ways, packing capacity and fed cattle pricing are inextricably linked. As a result, capacity is addressed in a number of places throughout the book,” Fischer said.

Packer concentration. While economists offer explanations typically tied to supply and demand relationships, others view such events as evidence the system is broken, particularly as it relates to fed cattle pricing, said Joe Outlaw, Ph.D., AFPC co-director and an editor for the book. Outlaw said systemic issues have led to renewed concerns about packer concentration and lack of transparency in fed cattle pricing and insufficient packing capacity. “This has also brought about an abundance of legislative proposals from policymakers attempting to address constituent concerns,” he said.

“With respect to fed cattle pricing, research shows that alternative marketing arrangements do not create market power because they do not change underlying supply and demand fundamentals,” the report stated.

Although not necessarily a popular position, most research confirms that the benefits to cattle producers due to economies of size in packing largely offset the costs associated with any market power exerted by packers. Research indicates that there is market power, but its effect has been small.

The cyclical nature of the cattle business must be emphasized. “While cattle supplies have outpaced available packing capacity, that will not always be the case,” the report noted. “As a result, anyone who decides to build additional capacity must understand those market dynamics and be aware that packer margins can plummet with that cycle.”

The report also noted the decline in packing capacity is not a recent event but has occurred over several decades. ”Expansion of small and regional packing capacity needs to be done in a way that is sustainable and economically viable,” it states.

The book offers a research perspective on the “30/14” and “50/14” proposals that have been circulated and supported by various organizations of cattlemen and state producer associations. Here is what the book says about that topic:

“The short-term impact, for a policy most like that being considered, is a $2.5 billion negative impact in the first year and a cumulative negative impact of $16 billion over 10 years, inflated to 2021 dollars. This cost is leveled mainly on cattle producers. The 50/14 proposal would have these negative impacts and the 30/14 would have similar negative impacts albeit approximately halved.”

The book has 10 chapters:

- How We Got Here: A Historical Perspective on Cattle and Beef Markets.

- Price Determination and Price Discovery in the Fed Cattle Market.

- How Market Institutions, Risks and Agent Incentives Affect Price Discovery.

- Enhancing Supply Chain Coordination through Marketing Agreements.

- Another Look at Alternative Marketing Arrangement Use by the Cattle and Beef Industry.

- Market Reporting and Transparency.

- What Can the Cattle Industry Learn from Other Agricultural Markets That Have Limited Negotiated Trade?

- Implications of Fed Cattle Pricing Changes on the Cow-Calf Sector.

- Examining Negotiated Cash Trade Targets.

- Workshop Discussion Summary.

The book’s release is timely because USDA Secretary Tom Vilsack and Iowa Sen. Chuck Grassley (R-Iowa) will be the lead-off witnesses at a House Agriculture hearing on Thursday on the state of the U.S. livestock industry.

CORONAVIRUS UPDATE

— Summary: Global cases of Covid-19 are at 235.472,589 with 4,810,784 deaths, according to data compiled by the Center for Systems Science and Engineering at Johns Hopkins University. The U.S. case count is at 43,852,265 with 703,285 deaths. The Johns Hopkins University Coronavirus Resource Center said that there have been 396,919,564 doses administered, 185,788,098 have been fully vaccinated, or 56.6% of the U.S. population.

— J&J submits booster data to FDA. Johnson & Johnson (J&J) submitted data to the Food and Drug Administration to support use of a booster shot of its Covid-19 vaccine in individuals 18 years of age and older, according to a statement. The firm also plans to submit the data — which it says showed the booster dose increased protection to 94% efficacy — to other regulators, the World Health Organization and National Immunization Technical Advisory Groups worldwide.

POLITICS & ELECTIONS

— Andrew Yang leaves Democratic Party. Andrew Yang, who ran as a Democrat for both New York City mayor and in the party’s 2020 presidential primaries, said that he’s changed his voting registration to independent. “I’ve been a Democrat my entire adult life,” Yang wrote in a statement posted on his website. “And yet, I’m confident that no longer being a Democrat is the right thing.”

— Nikki Haley embraces Trump, comments about her GOP future. Nikki Haley calls Donald Trump a friend and says she would consult with him before embarking on a White House bid, but the former United Nations ambassador disagrees with the former president when it comes to the outcome of the 2020 election. “There was fraud in the election, but I don’t think that the numbers were so big that it swayed the vote in the wrong direction,” Ms. Haley said in an interview ahead of a Tuesday evening appearance at the Ronald Reagan Presidential Library in Simi Valley, California. Link for more via the WSJ.

OTHER ITEMS OF NOTE

— New Japanese Prime Minister Fumio Kishida said he spoke with Biden in his first call with a foreign leader since taking office and the two agreed to hold an in-person summit soon. Kishida told reporters in Tokyo he and Biden had agreed they would closely cooperate as they work on security challenges posed by China and North Korea and global issues such as climate change and the coronavirus pandemic. Kishida became prime minister yesterday.

EVENTS AND REPORTS

Tuesday, Oct. 5

· Federal Reserve. Fed Vice Chair for Supervision Randal Quarles to deliver remarks.

· Hurricane Ida. House Oversight and Reform Committee hearing on "Hurricane Ida and Beyond: Readiness, Recovery, and Resilience,” with Federal Emergency Management Agency Administrator Deanne Criswell.

· Global economic prospects. Peterson Institute for International Economics virtual discussion on "Global Economic Prospects: Fall 2021."

· U.S. withdrawal from Afghanistan. House Foreign Affairs Committee hearing on "Afghanistan 2001-2021: Evaluating the Withdrawal and U.S. Policies - Part II."

· COP26 conference. Henry L. Stimson Center and the British Embassy virtual discussion on "Achieving Climate Ambition at COP26 (U.N. Climate Change Conference) and Beyond."

· China economy. Atlantic Council's GeoEconomics Center virtual discussion on the launch of the China Pathfinder Project, "an interactive analysis of the Chinese economic system designed to answer a complex question: Where does China's system stand relative to open market economies?"

· Energy issues and economic recovery. Inter-American Dialogue virtual Fifth Annual Latin America Energy Conference with the theme "Transition and Recovery."

· Climate policy. Final day of the Breakthrough Institute conference on "Ecomodernism 2021: Quiet Climate Policy.”

· Afghanistan issues. Senate Banking, Housing and Urban Affairs Committee hearing on "Afghanistan's Future: Assessing the National Security, Humanitarian and Economic Implications of the Taliban Takeover."

· U.. mining law. Senate Energy and Natural Resources Committee hearing to examine and consider updates to the Mining Law of 1872.

· U.N. WHO. The American Enterprise Institute for Public Policy Research virtual discussion on "Do We Still Need the U.N. and World Health Organization?"

· Iran nuclear situation. Hudson Institute virtual discussion on "The Iran Nuclear Showdown: What's Next?"

· SEC oversight. House Financial Services Committee hearing on "Oversight of the Securities and Exchange Commission: Putting Investors and Market Integrity First,” with SEC Chairman Gary Gensler.

· U.S. debt limit. Brookings Institution virtual discussion on "The Debt Limit: What If." Schedule: Panel discussion on "The View From Wall Street" and Panel discussion on "What Can the Treasury and Fed Do?"

· Business resiliency. Washington Post Live virtual "Path Forward" discussion on "Resiliency in Business" with Michael Dell, chair and CEO of Dell Technologies and author of "Play Nice But Win: A CEO's Journey from Founder to Leader."

· Libor issues. Fed Vice Chair for Supervision Randal Quarles delivers remarks on "LIBOR (London Inter-Bank Offered Rate) transition" at the Structured Finance Association's SFVegas 2021 conference.

· CPTPP. Global Business Dialogue virtual discussion on "Comprehensive and Progressive Agreement for Trans-Pacific Partnership (CPTPP): Performance, Promise and Outlook, Part 1," focusing on private sector views.

· Economic reports. International Trade | PMI Composite Final | ISM Services Index

· Energy reports. API US inventory report