U.S. House Fate Still Uncertain with Most Analysts Signaling Very Modest GOP Control

More China moves on abandoning ‘zero Covid’; stimulus plan for residential real estate market

|

In Today’s Digital Newspaper |

There was still no certainty about which way the U.S. House of Representatives would fall, as glacial counts in several too-close-to-call races continued. The Republicans are six seats short of the 218 they would need for a majority. The Democrats are on 204. The final results may not be known for days, but veteran election watchers think the GOP will have a very modest control of the House.

As previously reported, over the weekend the Democrats secured control of the Senate, with wins in Arizona and Nevada. Even if the House flips Republican, Democratic control of the Senate will make it easier for Biden to appoint judges and new Cabinet members.

David Wasserman of the Cook Political Report with Amy Walter, in Twitter message Sunday night: “Between #AZ01, #AZ06 and #CA41, Dems' dreams of holding the House majority probably died tonight.”

Retaining Senate control is a huge boost to President Joe Biden and opens a clear path for Senate Democrats to reject bills passed by the House — which means they can set their own agenda.

Fed officials are cautioning that it could still take a while for the central bank to bring inflation to heel. “Quit paying attention to the pace and start paying attention to where the endpoint is going to be. Until we get inflation down, that endpoint is still a ways out there,” Fed Governor Christopher Waller said Sunday.

The G20 summit officially gets underway on the Indonesian island of Bali. The G20 is comprised of 19 of the world’s major economies — including Russia —and the European Union, but Russian President Vladimir Putin will not attend the summit in person. Putin’s decision saves him the embarrassment of being confronted -- or shunned -- by other world leaders over Russia’s invasion of Ukraine.

China dials back property restrictions. For much of the past year, China’s economy has been reeling under Xi Jinping’s dual campaigns to rein in soaring property prices and to stamp out any traces of Covid-19 within the country’s borders. Now, as he moves to loosen pandemic restrictions, China’s leader, Xi Jinping, is signaling a reversal of his real-estate crackdown, too, a tacit acknowledgment of the economic pain and public frustration that the two policies have engendered. “These property measures, on top of announcements of Covid loosening, are a clear indication that Beijing’s efforts to support growth are intensifying,” says Michael Hirson, head of China Research at 22V Research.

NASA officials are looking at Nov. 16 as the possible launch date for the Artemis I moon rocket, which was on the launchpad last week as Hurricane Nicole made landfall as a Category 1 storm roughly 70 miles south of the Kennedy Space Center in Florida.

Today is the birthday of King Charles III, who turns 74 on Nov. 14.

|

MARKET FOCUS |

Equities today: Global stock markets were mostly lower overnight. U.S. stock indexes are headed for weaker openings. In Asia, Japan -1.1%. Hong Kong +1.7%. China -0.1%. India -0.3%. In Europe, at midday, London +0.5%. Paris +0.2%. Frankfurt +0.2%.

Third-quarter earnings season for retailers arrives this week, besides results from several major tech firms. There will also be a bevy of economic indicators released. Tyson Foods reports on Monday, followed by Walmart, Home Depot, and Advance Auto Parts on Tuesday. Cisco Systems, Lowe’s, Nvidia, Target, and TJX announce results on Wednesday. Alibaba Group Holding and Applied Materials report on Thursday. General Motors and Procter & Gamble will both host investor days on Thursday.

Tuesday will bring the October Producer Price Index from the Bureau of Labor Statistics. The consensus estimate is for a 0.5% rise last month, for an annual gain of 8.3% for the headline index. The core PPI, which excludes food and energy components, is expected to have risen 0.4% in October and 7.2% from a year earlier.

U.S. equities Friday: The Dow finished up 32.49 points, 0.10%, at 33,747.86. The Nasdaq gained 209.18 points, 1.88%, at 11,323.33. The S&P 500 rose 36.56 points, 0.92%, at 3,992.93.

For the week, the S&P 500 surged 5.9%, while the Nasdaq Composite soared 8.1% as investors shook off a drop in cryptocurrencies to snap up oversold tech shares, and the Dow added 4.1%.

Agriculture markets Friday:

- Corn: December corn rose 4 3/4 cents to $6.58, down 23 cents for the week and the contract’s third lower weekly close in four.

- Soy complex: January soybeans rose 27 cents to $14.50, still down 12 1/4 cents for the week. December soymeal rose $3.30 to $407.40. December soyoil rose 88 points to 76.97 cents, after posting a five-month high of 78.64 cents.

- Wheat: December SRW wheat rose 10 1/4 cents to $8.13 3/4 but fell 34 cents for the week. December HRW wheat gained 18 1/4 cents to $9.43 1/2, down 9 3/4 cents for the week. December spring wheat gained 14 1/4 cents to $9.45 3/4.

- Cotton: December cotton rose 161 points to 87.99 cents, up 106 points cents for the week.

- Cattle: December live cattle fell $1.55 to $151.525, down 12.5 cents for the week. January feeder cattle fell $3.125 to $178.575.

- Hogs: December lean hog futures fell 52.5 cents to $84.35, up $1.375 on the week.

Ag markets today: Corn and soybean futures were pressured by outside markets and a surge in Chinese Covid cases. Wheat futures traded mixed overnight. As of 7:30 a.m. ET, corn futures were trading 2 to 4 cents lower, soybeans were 7 to 10 cents lower, SRW wheat was 3 to 4 cents lower, HRW wheat was 2 to 5 cents higher and HRS wheat was 4 to 6 cents higher. Front-month crude oil futures were around $1 lower and the U.S. dollar index was more than 850 points higher this morning.

Technical viewpoints from Jim Wyckoff:

On tap today:

• Federal Reserve speakers: Vice Chair Lael Brainard on the economic outlook at 11:30 a.m. ET, and New York's John Williams at the Economic Club of New York at 6 p.m. ET.

• Japan's gross domestic product for the third quarter is due out at 6:50 p.m. ET. Japan’s economy expanded at a 3.5% annual rate in the second quarter, driven by strong consumer spending and higher exports.

• China's industrial output, fixed-asset investment and retail sales for October are due out at 9 p.m. ET. Industrial production in China advanced 6.3% in September, the fastest pace of growth since February.

Fed official: 'A ways to go' on inflation. Federal Reserve governor Christopher Waller said the central bank needs to keep raising interest rates to get inflation under control, even after last week’s report that it slowed in October. “The market seems to have gotten way out in front on this,” Waller said. “Everybody should just take a deep breath — calm down. We have a ways to go yet.”

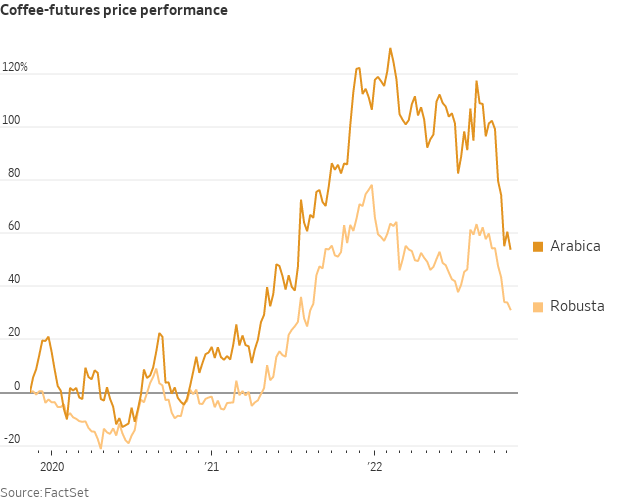

Coffee no longer perking. Coffee was one of the hottest commodities earlier this year, but it has now gone cold, with prices declining more than 20% in the past month. Wet weather in farming areas such as Brazil and Indonesia is raising the prospect of a good crop and bigger coffee supply. At the same time, a strong dollar this year has pressured prices of many commodities.

Market perspectives:

• Outside markets: The U.S. dollar index is sharply higher on a corrective bounce after hitting a nearly three-month low on Friday. The yield on the 10-year U.S. Treasury note firmed to trade around 3.88% ahead of U.S. market action; U.S. bond markets were closed Friday for a holiday. Crude was under pressure with U.S. crude around $87.80 per barrel and Brent around $94.90 per barrel. That reversed what had been gains in Asian trading. Gold and silver were under pressure, with gold around $1,761 per troy ounce and silver around $21.60 per troy ounce. Futures closed Friday at $1,769 per troy ounce and silver at $21.66 per troy ounce.

• Ag trade: Saudi Arabia purchased 1.009 MMT of optional origin milling wheat.

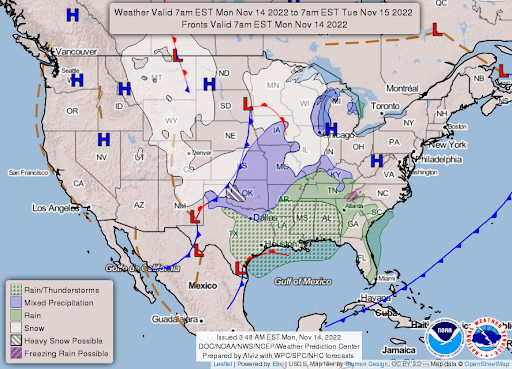

• NWS weather: Potent shortwave tracking across central Plains on Monday will produce region's first accumulating snow of the season... ...Coastal rain; inland mixed precipitation on Tuesday across Northeast and Mid-Atlantic as coastal low develops and moves up coast... ...Anomalously cold temperatures continue to grip the lower 48 through the work week... ...Santa Ana winds return across Southern California on Tuesday

Items in Pro Farmer's First Thing Today include:

• Corn and beans weaker, wheat mixed

• India wheat acreage up nearly 10%

• Chinese pork imports to rise (details in China section)

• Bullish cash cattle hopes

• Traders expect cash hog weakness to persist

|

RUSSIA/UKRAINE |

— Summary: Ukraine’s president, Volodymyr Zelenskyy, visited the liberated city of Kherson and addressed a crowd gathered in the main square. Zelenskyy reportedly said that Ukraine was “ready for peace.” Earlier he said that investigators have documented more than 400 war crimes committed by Russian troops around the city. Ukraine has also accused Russia of laying mines around critical infrastructure.

- Moscow on talks last week with the U.N. on the Black Sea grain deal: Fairly constructive.’ Kremlin spokesman Dmitry Peskov told reporters, "There were talks with the U.N. last week, fairly constructive talks. We have our interest in this deal, which was originally part of the whole mechanism of the deal.” Russia has criticized the deal for not opening up Russian grain and fertilizer exports and that much of the agricultural goods shipped from Ukraine have gone to Western nations, not the neediest countries around the globe. With the Nov. 19 deadline looming for the deal’s expiration, Peskov said that deadline was still a ways away “so work is ongoing.”

|

POLICY UPDATE |

— Democrats move to raise the debt ceiling soon. Speaker Nancy Pelosi (D-Calif.) suggested she would take action to push back a fight over government spending until after the 2024 election.

— What about extension of ERP? Following the surprising midterm election results, we checked with some congressional contacts regarding the likelihood of any extension of the Emergency Relief Program (ERP) for eligible 2020 crops and livestock. Most contacts said the odds were good for an extension.

|

CHINA UPDATE |

— China’s regulators cheered investors with a plan to rescue the country’s embattled property markets. The People’s Bank of China and its partners outlined 16 steps they would take to strengthen the sector, starting with extensions on debt repayments. At one point, shares in Country Garden, a developer, leapt by more than 50%; many firms enjoyed gains of 30% and more.

The move pushed Chinese stocks into a bull market, even as the Hang Seng China gauge holds on to a loss of more than 25% this year.

— President Joe Biden on Monday met face-to-face with his Chinese counterpart, Xi Jinping, for the first time since he moved into the White House in January 2021. “We need to find the right direction for the bilateral relationship going forward and elevate the relationship,” Xi said, while Biden stressed that the two countries can compete without it turning into a conflict.

— Chinese pork imports to rise. China will increase pork imports in the coming months, industry participants said, after losses for farmers last year caused a reduction in hog numbers that appears larger than official data suggests. A manager at a feed producer that supplies more than 100 mid-sized pig producers across China told Reuters, “I think there’s 25% to 30% less fatteners [hogs] than a year ago.” Pan Chenjun, senior analyst at Rabobank, said: “I expect more [pork] shipments to arrive in Q4," adding that 2023 imports will be higher than this year.

|

ENERGY & CLIMATE CHANGE |

— Methane regulations. The Biden administration on Friday proposed to tighten regulations on the oil and gas sector aimed at controlling emissions of a planet warming gas called methane. The Environmental Protection Agency (EPA) projects that in 2030, the requirements would cut 87% of methane emissions from the pollution sources that it regulates when compared to 2005 levels. The proposal strengthens a Biden administration proposal from last year that was expected to have cut methane emissions from regulated sources by 74% in 2030 compared to 2005 levels. EPA said that its two methane proposals would reduce about 36 million tons of methane emissions between 2023 and 2035, which it said is nearly the planet-warming equivalent of greenhouse gases emitted from all the country’s coal-fired power plants in 2020. Methane has a shorter lifespan than carbon dioxide, but is more than 25 times as potent.

— About $2 billion in carbon credits were sold last year, according to environmental markets data analyst Ecosystem Marketplace. Sales were up 11% in the first three quarters of 2022 compared with the same period last year, according to carbon-market data firm AlliedOffsets.

|

HEALTH UPDATE |

— Summary:

- Global Covid-19 cases at 635,217,802 with 6,610,338 deaths.

- U.S. case count is at 97,997,438 with 1,074,485 deaths.

- Johns Hopkins University Coronavirus Resource Center says there have been 646,524,294 doses administered, 268,032,055 have received at least one vaccine, or 81.04% of the U.S. population.

— U.S. will extend its Covid public health emergency through the spring of 2023 in anticipation of another winter surge. The emergency, first issued in January 2020, broadens eligibility for both Medicaid and the Children’s Health Insurance Program, and the gov’t estimates that around 15 million people will lose their benefits from those programs once it ends.

— Coloradans voted to decriminalize psychedelic mushrooms, but you’ll still need to be over 21 and under supervision at a “healing center” to get fungal.

|

POLITICS & ELECTIONS |

— Republican governors will be meeting Monday through Wednesday in Orlando, Fla., for their annual gathering. The session comes after the party had a less than stellar showing in elections for governor in 36 states.

— If Dem Sen. Raphael Warnock beats GOP challenger Hershel Walker, Senate committees will no longer be evenly split — they would have Dem control/majority on committees. That means no nominees or bills being deadlocked in committee. Democrats say that will speed things up — because ties in committee require discharge votes on the Senate floor — and allow the pace of judicial nominations to quicken. Walker’s odds are expected to narrow in a runoff when voters know the overall midterm results and turnout drops.

|

CONGRESS |

— Pelosi: Won’t decide if she’s running for leadership until majority is determined. “My decision will again be rooted in what the wishes of my family and the wishes of my caucus, but none of it will be very much considered until we see what the outcome of all of this is,” Speaker Nancy Pelosi (D-Calif.) said on CNN’s State of the Union when asked about her intentions by co-anchor Dana Bash.

Regarding a possible GOP House speaker for the new Congress being Rep. Kevin McCarthy (R-Calif.), Pelosi said: ““Why would I make a judgment about something that may or may not ever happen. No, I don’t think he has it. But that’s up to his own people to make a decision as to how they want to be led or otherwise.” McCarthy only needs a majority of Republicans present to win Tuesday’s vote, but in January he would need 218 votes on the House floor to secure the speaker role, and all signs at this juncture signal he does not have the 218 votes, and that sets up some gimme talks with Freedom Caucus members.

Meanwhile, Pelosi said President Biden should run for re-election in 2024, calling him a “great president for our country” who has “accomplished so much” for Americans.

— In the Senate, some Republicans believe this week’s leadership elections should be postponed until after the outcome of the Dec. 6 runoff contest in Georgia between Democratic Sen. Raphael Warnock and Republican Herschel Walker. A petition led by Sens. Ron Johnson (R-Wis.), Mike Lee (R-Utah) and Rick Scott (R-Fla.) called for a delay, saying, “We are all disappointed that a Red Wave failed to materialize” and “need to have serious discussions within our conference as to why and what we can do to improve our chances in 2024.” Scott, who ran the Senate GOP campaign arm this cycle, clashed with current GOP Senate leader Mitch McConnell (R-Ky.) over campaign strategy and whether the party should have had a more specific policy agenda.

— President Biden’s priorities during the upcoming lame-duck session include funding certainty for the overall government, continued backing for Ukraine against Russia and federal resources for natural disasters, said White House senior adviser Anita Dunn on Sunday. “We have to keep the government open and funded. That is obviously priority number one,” Dunn told CBS’s Face the Nation. “It’s going to take a little while still for lame-duck priorities to really be set.”

|

OTHER ITEMS OF NOTE |

— Mexico’s forceful protests. Tens of thousands of people demonstrated against Mexican President Andrés Manuel López Obrador’s proposed constitutional changes to transform the INE, Mexico’s electoral body, on Sunday. Protesters warn that he may be attempting to tighten his grip on power and weaken the country’s democracy.

— UAE influence operations. A new U.S. intelligence report outlines how the United Arab Emirates (UAE) —a longtime U.S. partner — has both legally and illegally attempted to influence U.S. politics and policy towards the Middle East, the Washington Post reported (link). The UAE’s efforts ranged from known influence campaigns to ones that “more closely resemble espionage,” according to the WaPo.

— Jeff Bezos commits to giving away most of his billions. The Amazon founder told CNN that he would donate the majority of his $124 billion fortune during his lifetime, including to groups focused on climate change. Earlier, Bezos announced a $100 million grant to the singer Dolly Parton to donate to charities of her choice.

|

KEY LINKS |

WASDE | Crop Production | USDA weekly reports | Crop Progress | Food prices | Farm income | Export Sales weekly | ERP dashboard | California phase-out of gas-powered vehicles | RFS | IRA: Biofuels | IRA: Ag | Student loan forgiveness | Russia/Ukraine war, lessons learned | Election predictions: Split-ticket | Congress to-do list | SCOTUS on WOTUS | SCOTUS on Prop 12 | New farm bill primer | China outlook |