U.S. Farm Groups Fret Possible House Move Against China Will Impact Ag Trade Ahead

HPAI in Ohio 'mega-flock,' 8 million birds depopulated | More disaster aid in 2024 | SAF guidance | Inflation better than expected

|

Today’s Digital Newspaper |

I am giving a speech at the MKC Co-op annual meeting in Newton, Kansas (and yes, it’s still very dry in Kansas).

— Equities: U.S. stock indexes are headed for slightly higher openings. In Asia, Japan +0.2%. Hong Kong +1.1%. China +0.4%. India -0.5%. In Europe, at midday, London +0.4%. Paris flat. Frankfurt -0.2%.

— Outside markets: The U.S. dollar index was weaker ahead of CPI data, with the euro and British pound both slightly firmer against the U.S. currency. The yield on the 10-year U.S. Treasury note fell, trading around 4.18%, with a negative tone in global government bond yields. Crude oil futures were under pressure ahead of U.S. market action, with U.S. crude around $70.70 per barrel and Brent around $75.35 per barrel. Gold futures and silver futures were up ahead of US trading, with gold around $2,005 per troy ounce and silver around $23.33 per troy ounce.

— USDA daily export sale: 198,000 MT soybeans to unknown destinations during the 2023-2024 marketing year.

— Ag markets: Soybean futures built on Monday’s gains during the overnight session, while corn and wheat firmed amid corrective buying. As of 7:30 a.m. ET, corn futures were trading mostly 1 to 2 cents higher, soybeans were 1 to 3 cents higher, SRW wheat was 1 to 2 cents higher, HRW wheat was around 4 cents higher and HRS wheat was fractionally to a penny higher. Front-month crude oil futures were modestly weaker, while the U.S. dollar index was down around 375 points.

Steady/lower cash cattle expectations. Last week’s cash cattle price averaged $169.94, down $4.51 from the previous week and the lowest level since the end of March. Traders will anticipate the cash market will continue to weaken until futures clearly signal a low has been posted. Live cattle futures have posted consecutive days of strong corrective gains, but haven’t yet signaled a low.

Cash hogs drop, pork cutout firms. The CME lean hog index is down another 83 cents to $67.93 (as of Dec. 8). December hogs finished Monday at a 32-cent premium to the cash index, while February futures fell to a 60.5-cent discount. The pork cutout value only held onto about half of Monday morning’s price strength but still firmed 95 cents, as a $10.86 jump in primal bellies more than offset weakness in all other cuts.

— Ag trade: Algeria purchased unknown quantities of corn expected to be sourced from Argentina and optional origin soymeal. Indonesia purchased 110,000 MT of rice from Pakistan and 80,000 MT of rice from Myanmar, with more purchases expected from the tender to buy up to 534,000 MT. Japan is seeking 102,493 MT of milling wheat in its weekly tender.

— Google loses epic court battle. Google faced an antitrust lawsuit from Fortnite maker Epic Games, and the outcome has significant implications for both Google and the mobile app industry. The federal jury in California ruled against Google, finding that the company has been intentionally exercising monopoly power through its Google Play Store. This verdict could potentially result in substantial financial losses for Google, running into billions of dollars. Furthermore, it has the potential to disrupt the entire mobile app economy. Notably, Epic Games had previously pursued a similar antitrust challenge against Apple two years ago but did not achieve a favorable outcome in that case.

— In November 2023, the annual inflation rate in the United States slowed to 3.1%, marking the lowest reading in five months. This decline from October's 3.2% rate aligns with market expectations. Several key factors contributed to this trend:

- Energy costs: Energy costs decreased by 5.4% (compared to -4.5% in October), with notable declines in gasoline (-8.9%), utility (piped) gas service (-10.4%), and fuel oil (-24.8%).

- Food prices: Prices for food increased at a softer pace, rising by 2.9% (down from 3.3% in October).

- Shelter: The rate of increase in shelter costs eased to 6.5% (compared to 6.7% in October).

- New vehicles: Prices for new vehicles increased at a slower rate, rising by 1.3% (compared to 1.9% in October).

- Apparel: Apparel prices increased by 1.1%, a decrease from the 2.6% rate in October.

- Used cars and trucks: Prices for used cars and trucks continued to decline but at a slower pace, registering -3.8% (compared to -7.1% in October).

- Medical care commodities: Prices for medical care commodities increased by 5%, up from 4.7% in October.

- Transportation services: Prices for transportation services rose at a faster rate, reaching 10.1% (compared to 9.2% in October).

On a monthly basis, consumer prices edged up by 0.1%, slightly exceeding expectations of a flat reading. This uptick in prices was primarily driven by higher shelter costs, offsetting a decline in the gasoline index.

Meanwhile, core inflation remained at 4%, and the monthly rate increased to 0.3% from 0.2%, in line with forecasts.

— The U.S. Treasury Department is expected to release guidance on sustainable aviation fuel (SAF) credits by the end of this week, as reported by Reuters, citing multiple sources. The guidance may address whether corn-based ethanol will qualify more easily for these credits. The ethanol industry has been advocating for the use of the Department of Energy's Greenhouse Gases, Regulated Emissions, and Energy Use in Technologies (GREET) model to measure greenhouse gas reductions, allowing fuels to qualify for SAF credits. Conversely, some support an international model that favors used cooking oil and animal fats.

To be eligible for SAF credits under the Inflation Reduction Act (IRA), applicants must demonstrate, using an approved scientific model, that their fuel produces 50% fewer greenhouse gas emissions compared to petroleum-based fuels. USDA Secretary Tom Vilsack has allocated funds to update the GREET model and has expressed expectations that ethanol will be permitted as an SAF feedstock, making it eligible for the credits.

— Argentina has temporarily suspended its grain export registry as the government prepares to announce expected economic policy changes under the leadership of President Javier Milei. The suspension, in place "until further notice," has been initiated in anticipation of economic measures and reforms. Previous suspensions of the grain export registry have typically preceded the announcement of such measures. President Milei is expected to unveil fiscal adjustments, reductions in social spending, and a potential devaluation of the Argentine peso. The new economy minister, Luis Caputo, is set to announce actions that Milei has promised will primarily impact the government rather than the private sector. Additionally, a new head of the Argentine central bank, Santiago Bausili, is anticipated to be appointed through a presidential decree, replacing the current chief, Miguel Pesce, as reported by Reuters.

— Efforts to develop a new text for approval at the conclusion of the UN COP28 conference have brought fossil fuels into the spotlight. The initial draft did not include a clear call for the phase-out of fossil fuels, which several countries were pushing for. In response, COP28 Director General Al Suwaidi released a Monday draft with the aim of soliciting countries' "red lines" on the text. The draft indicated that the consumption and production of fossil fuels should be reduced in a "just, orderly, and equitable manner." However, this wording faced criticism from some COP28 participants who deemed it too weak. The United Arab Emirates (UAE), which hosted the event, has encountered pressure from OPEC members like Saudi Arabia, who oppose any targeting of fossil fuels in the final text. The situation may lead to an extension of the COP28 session, reminiscent of past climate conferences that have experienced delays in concluding due to disagreements on key issues.

— The International Monetary Fund (IMF) agreed to release $900 million in financial assistance to Ukraine. This financial support comes at a crucial time when Ukraine's President, Volodymyr Zelenskyy, is urging the United States to resolve an impasse related to over $60 billion in military aid. In Ukraine's capital city, Kyiv, policymakers are actively exploring alternative funding options to sustain the country's ongoing war efforts in case their international allies are unable to provide the necessary support. This situation highlights the challenges faced by Ukraine in securing the resources it needs for its military operations.

President Joe Biden will host Zelenskyy at the White House today to discuss continued aid for the country in its fight against Russian invasion. Additional funding for Ukraine has become a point of contention among U.S. lawmakers in recent weeks, but Biden and others have maintained that a stop to aid could hand Moscow a victory over Ukraine. U.S. National Security Spokesman John Kirby said on Monday that he expects the White House to announce new security assistance for Ukraine ahead of what it has described as a critical year-end deadline.

House Speaker Mike Johnson (R-La.) is also scheduled to meet with Zelenskyy today as part of a push by Ukraine’s president for continued military aid. “I understand the necessity of ensuring that Vladimir Putin does not prevail in Ukraine and march through Europe,” Johnson said at a Wall Street Journal event on Monday: “And so I will explain to [Zelenskyy] that while we understand that, I’ve made my position very clear literally since the day I was handed the gavel that we have to take our care of our border first, and our country.” Johnson said that he had repeatedly tried to engage with the White House about what it would take to win Republican support, but that the Biden administration simply hadn’t addressed Republican concerns.

Sen. Alex Padilla (D-Calif.) and Rep. Nanette Barragán (D-Calif.) released a statement Monday warning President Biden it would be “unconscionable” to give into GOP demands regarding the border and its linkage to aid for Ukraine.

Speaking on the Senate floor Monday, Senate Majority Leader Chuck Schumer (D-N.Y.) said the Senate needs to get “serious” and that “If Republicans keep insisting on Donald Trump’s border policies, they will be at fault when a deal” falls apart. “Republicans would be giving Vladimir Putin the best gift he could ask for.” Senate Minority Leader Mitch McConnell (R-Ky.) highlighted the crisis at the border. He cited statements from Democratic elected officials emphasizing the “urgency” of addressing the issue. “When it comes to keeping America safe, border security is not a sideshow. It’s ground zero. Senate Republicans have no more spare time to explain this basic reality,” McConnell said. “The Senate has to act.”

— The House Select Committee on China is considering recommending the revocation of China's Permanent Normal Trade Relations (PNTR) status, which was granted to China by the U.S. in 2000 as part of its accession to the World Trade Organization (WTO). This potential move could have significant implications for the U.S./China relationship and the global economy. It could also have a significant negative impact on U.S. farm exports.

If China's PNTR status is revoked, it would result in significantly higher tariffs on hundreds of billions of dollars' worth of Chinese imports. This action would disrupt international trade rules and undermine the global economic system established after the Cold War.

The recommendation itself does not guarantee immediate congressional action. Former President Donald Trump has endorsed this policy, and his trade chief, Robert Lighthizer, has urged lawmakers to recommend revoking China's trade status. Some legislators have expressed regret over their past votes to grant China normal trade status.

Opposing the revocation of China's trade status could make Democrats vulnerable to accusations of being soft on Beijing, especially in Rust Belt states where tariffs are popular and anti-China sentiment is strong. Some swing state Democrats, including Sens. Sherrod Brown (D-Ohio) and Tammy Baldwin (D-Wis.), have refrained from taking a clear position on revoking China's trade status, despite their previous opposition to its granting. Others have opted for a wait-and-see approach.

Farm groups have sent a letter to the Select Committee. It expresses concerns about potential policy recommendations. Sixteen agricultural trade groups signed onto the letter. That includes the American Soybean Association, the National Corn Growers Association, the U.S. Dairy Export Council, the National Council of Farmer Cooperatives and Farmers for Free Trade, among others. Highlights of the letter (link):

- Background: In 2000, Congress granted China PNTR status when China was joining the World Trade Organization (WTO). At that time, the U.S. had limited food and agricultural exports to China, accounting for just 3% of total exports in this category.

- Economic growth: Over the past two decades, U.S. exports to China have increased significantly, reaching $38.11 billion in 2022, making China the largest buyer of U.S. food and agricultural products, constituting 19% of U.S. exports in this sector. This trade has been crucial for American farmers and rural communities.

- Trade frictions: Trade tensions between the U.S. and China, including the imposition of Section 232 and 301 tariffs and corresponding retaliatory tariffs, have affected U.S. farmers and food processors. China accounted for approximately 95% of the losses ($25.7 billion), with rural states heavily reliant on agriculture being hit the hardest.

- Concerns about revoking PNTR: The letter expresses concerns that revoking China's PNTR status would expose U.S. farmers and ranchers to further retaliation from China. An estimate by Oxford Economics suggests that this could result in over a 30% reduction in U.S. agricultural exports to China, with no other market capable of fully replacing this lost share.

- Market diversification: The letter advocates for a more sustainable approach to addressing concerns about China's trade practices. It suggests that members of Congress should work on providing alternative market access in the Asia-Pacific region, thereby reducing reliance on the Chinese market.

- Diplomatic tools: Expanding international trade in the Asia-Pacific region can be a diplomatic tool that helps build relationships and reduces China's global influence.

Bottom line: The letter respectfully urges the committee not to recommend the revocation of China's PNTR status, emphasizing the potential negative consequences for American farmers, ranchers, and food producers. It highlights that the economic impact on American workers and rural communities would be significant and long-lasting.

Comments: Farm groups are beginning to wake up to potentially very negative implications of potential U.S. trade policy moves. Former President Trump during his latest presidential campaign has said he would invoke at least a 10% tariff on all importers his first week in office should he win. The comprehensive trade war that would cause has not been addressed by Trump’s challengers in his own party, and relatively tepid responses from Democrats. Should Trump win and follow through on his threat, a recession, perhaps a deep one, would result, and not just in the ag sector.

— China’s Country Garden may avoid yuan bond default after deal. China’s Country Garden Holdings is likely to avoid its first default on yuan bonds after most holders of a local note agreed not to demand repayment this week, Bloomberg News reported, citing people familiar with the matter. The builder, which defaulted on a dollar bond for the first time in October, has also prepared cash to repay at least a couple holders of the local note who bucked the trend and still planned to exercise their options, the people said. In return for holders forgoing the put option, the two state-owned firms which sold the CDS contracts would issue additional swaps effective until the maturity of the security next December, the people said.

— Next Mexican president could be more open to resolving U.S./Mexico GMO corn dispute, Vilsack says. For months our sources have signaled that the lingering U.S./Mexico GMO corn for food ban proposal was largely a Mexican presidential initiative as he come from southern Mexico which is the leader in making tortillas. Our contacts said this largely domestic initiative could ease once Mexico’s Andrés Manuel López Obrador leaves in June next year.

Vilsack said talks with Mexico involved discussions around the ongoing USMCA dispute over Mexico’s decree phasing out imports of genetically modified (GMO) corn for human consumption, with new rules targeting animal feed a possibility in the future. Mexico’s June 2024 presidential election could mark a turning point for the dispute, Vilsack said. Obrador is term-limited, but Vilsack expressed hope that the current frontrunner to replace him, Claudia Sheinbaum, a member of López Obrador’s political party, could prove more flexible on the issue. “There's going to be a new administration … the leading candidate is a scientist,” he said referring to Sheinbaum. “My hope and belief is that as a result of the new administration, they will take a look at the science take a look at the fact that they are reliant on the U.S. for yellow corn and that the relationship with the U.S. is important.”

— Wisconsin's House members are urging the Biden administration to clarify its plans regarding access to the Canadian dairy market following a dispute settlement panel's rejection of the U.S. complaint against Canada's operation of its dairy tariff rate quotas (TRQs) under the U.S.-Mexico-Canada Agreement (USMCA).

Key points from the lawmakers' letter to USDA Secretary Tom Vilsack and US Trade Representative Katherine Tai:

- Evaluate all possible measures: The lawmakers call on officials to "evaluate all possible measures" to secure the level of market access to the Canadian dairy market that was negotiated through USMCA.

- Address dairy protein exports: They stress the importance of addressing Canada's expanding dairy protein exports designed to circumvent USMCA export caps.

- Share next steps: Since the U.S. cannot appeal the USMCA ruling, the lawmakers request that the administration shares its plan for the next steps following the dispute settlement panel's decision.

- Strategy for dairy trade: They also ask for the administration's strategy to address barriers to dairy trade and expand market access opportunities.

Bottom line: The lawmakers emphasize the significance of resolving these issues for Wisconsin dairy producers and processors and express concern about potential losses in this critical sector.

— Bipartisan bill seeks USDA investigation of fertilizer industry. A bipartisan bill, called the Fertilizer Research Act of 2023, is set to be introduced by Sens. Chuck Grassley (R-Iowa) and Tammy Baldwin (D-Wis.). This bill calls for USDA to investigate concentration within the fertilizer industry and assess any potential "anticompetitive impacts." The move comes as American farmers express concerns about the availability and cost fluctuations of crop nutrients, particularly following Russia's invasion of Ukraine, which disrupted global supply chains and led to record-high fertilizer prices.

Key points about the bill and the fertilizer industry:

- Scrutiny of concentration: The bill seeks to examine concentration within the fertilizer industry and assess whether it has led to anticompetitive practices.

- Transparency and pricing: It directs the USDA to investigate pricing transparency, imports, emerging technologies, and other relevant issues within the fertilizer industry.

- Support from farming groups: The bill has garnered support from groups representing Iowa corn and soybean farmers.

- Transparency advocated: The Fertilizer Institute, a trade organization for the industry, supports transparency through improved data collection and analysis. They also seek the re-establishment of a fertilizer economist at the USDA to serve as a liaison on crop nutrient matters.

- Global fertilizer production: As of 2021, North America held a 16% share of global fertilizer production, with the majority of usage occurring outside the United States.

- Industry response: Top fertilizer maker Nutrien Ltd. is reviewing the legislation, while other crop nutrient producers, CF Industries Holdings Inc. and The Mosaic Co., have not yet commented.

- Legislative path: Sen. Grassley aims to have this legislation included in next year's five-year farm bill reauthorization, but is open to other avenues for passage.

— Report warns of consequences if Congress fails to allocate $1 billion for WIC. A new report (link) from the Center on Budget and Policy Priorities highlights the potential consequences if Congress fails to allocate an additional $1 billion in supplemental funding for the Special Supplemental Nutrition Program for Women, Infants, and Children (WIC). The WIC program provides food benefits to children, pregnant women, and postpartum women. It plays a crucial role in ensuring access to essential nutrition for vulnerable populations.

The report warns that WIC may have to turn away as many as two million eligible individuals from receiving food assistance by September if Congress does not provide the additional $1 billion in funding. Advocates for WIC point to factors such as food inflation and increased participation in the program that have strained its resources, bringing it to a critical point where additional funding is essential.

The White House has requested an extra $1 billion in funding for WIC from Congress, recognizing the urgency of the situation. State administrators of the program have also stressed the severe consequences if increased funding is not allocated.

The supplemental funds for WIC have become a subject of partisan disagreement. Republicans, concerned about the nation's growing deficit, have reservations about the WIC supplemental funding, while Democrats insist on its inclusion in any legislation funding the government through fiscal year 2024.

Timeline issues. Complicating matters further, the current stopgap measure funding the Agriculture Department is set to expire on Jan. 19. Congress will need to pass outstanding appropriations bills by that date or consider another stopgap measure for the remainder of the fiscal year. This decision will likely be the last opportunity to attach the additional WIC funds to a legislative vehicle.

Meanwhile, the report provides estimates of how individual states would be affected. California is expected to be the most affected, followed closely by Texas. Florida and New York are also anticipated to face significant challenges if the additional funding is not provided.

— Payments under the Emergency Relief Program (ERP) have increased to a total of $8.27 billion as of Dec. 10. In the latest week, Phase 2 payments rose to $824.9 million, benefiting 10,145 recipients, up slightly from the prior week's $823 million. Phase 1 payments remained unchanged at $7.45 billion.

Meanwhile, USDA has set Dec. 13 as a deadline for FSA State Committee (STC) to act on relief requests under Phase 1 and Phase 2 of ERP with the deadline for relief requests to be submitted to Washington as Dec. 15.

— Congress is expected to shift its focus to domestic disaster relief once it addresses fiscal 2024 funding, according to Senator Martin Heinrich (D-N.M.), a member of the Appropriations Committee. Currently, lawmakers have been preoccupied with various pressing matters, including aid to Ukraine and Israel and upcoming spending deadlines in January and February.

President Biden in October requested an additional $23.5 billion for disaster relief related to extreme weather events, besides the $16 billion allocated in a previous continuing resolution to support FEMA in dealing with the rising costs of disaster aid. However, this domestic supplemental request has largely taken a backseat in Congress, despite its importance for both red and blue states with significant agricultural interests. An Appropriations subcommittee is holding a hearing today to address the implications of delayed disaster recovery funds.

— USDA confirms HPAI in Ohio 'mega-flock,' 8 million birds depopulated. USDA's Animal and Plant Health Inspection Service (APHIS) confirmed the presence of highly pathogenic avian influenza (HPAI) in a large commercial table egg layer operation in Hardin County, Ohio, consisting of 2,613,600 birds. This adds to the total number of commercial egg layers depopulated due to the HPAI outbreak in the fall of 2023, which now stands at 8 million birds. Additionally, APHIS reported HPAI cases in various locations, including Stanislaus County, California (258,600 commercial broilers), Darke County, Ohio (15,200 commercial turkey meat birds), Barron County, Wisconsin (70,000 commercial turkey meat birds), and Charles Mix County, South Dakota (32,400 turkey meat birds). Since early October, a total of 13.4 million birds have been depopulated because of the HPAI outbreak.

— USDA's FSIS sends voluntary labeling rule to OMB for review. USDA's Food Safety and Inspection Service (FSIS) sent its final rule, titled "Voluntary Labeling of FSIS-Regulated Products with U.S. Origin Claims," to the Office of Management and Budget (OMB) for review. This rule is part of the administration's efforts to provide recommendations for voluntary labeling of meat and poultry products with U.S. origin claims. The administration had previously indicated that the rule was slated for release in March. The primary goal of this rule, according to FSIS, is to address consumer confusion surrounding current voluntary US-origin labeling policies. While the U.S. industry is keenly interested in the final rule's content, Canada and Mexico are also closely monitoring the effort to ensure that it does not inadvertently lead to the creation of a mandatory country of origin labeling (COOL) program.

— Chinese hog futures rebound. China’s most active January hog futures jumped for the third consecutive session on Tuesday, as plunging temperatures and shrinking herd size fueled buying. The January contract rose 2.8% to 14,640 yuan, the highest level in nearly two weeks. The futures market tracked gains in cash prices, which rose to 14.14 yuan per kilogram.

Pork prices in China previously hit their lowest point in nearly 20 months, contributing to the country's ongoing issue with deflation. Recent data revealed that consumer prices experienced their sharpest decline in November in three years, attributed in part to an abundant supply of pork and subdued consumer demand. Pork holds a significant portion in China's Consumer Price Index (CPI) basket due to its popularity among local consumers.

Despite Beijing's announcement of its intention to purchase pork for strategic reserves, marking the third round of such purchases this year, the decline in pork prices has not been halted. This situation underscores the challenges China faces in addressing deflationary pressures and maintaining stable consumer prices.

— Ford is reducing its previously planned 2024 production of the F-150 Lightning electric pickup truck by half. This marks a significant shift in their approach to the electric vehicle (EV) that they have been promoting as a catalyst for widespread adoption. Ford now anticipates producing approximately 1,600 of these electric trucks per week on average at its Rouge Electric Vehicle Center in Dearborn, Michigan, next year, down from earlier production projections of around 3,200. Ford executives have emphasized the importance of aligning production levels with customer demand.

— CNN plans to host Republican presidential primary debates in Iowa on Jan. 10 and New Hampshire on Jan. 21. ABC has scheduled one for Jan. 18, also in New Hampshire.

— Donald Trump has expanded his lead over challengers for the GOP presidential nomination in Iowa, site of the first contest in the race, with a new poll showing he now has 51% support, the Des Moines Register reports (link).

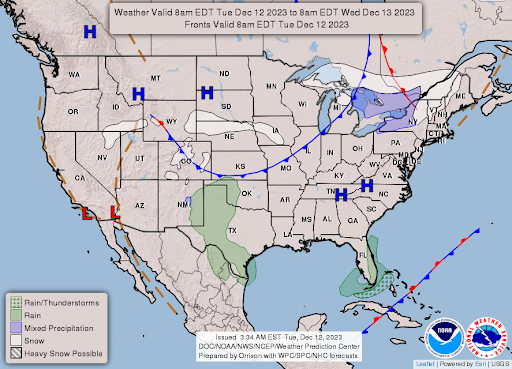

— NWS weather: Lake effect snow downwind of Great Lakes beginning today... ...Heavy Snow potential across parts of the Southern Rockies/High Plains.

|

KEY LINKS |

WASDE | Crop Production | USDA weekly reports | Crop Progress | Food prices | Farm income | Export Sales weekly | ERP dashboard | California phase-out of gas-powered vehicles | RFS | IRA: Biofuels | IRA: Ag | Student loan forgiveness | Russia/Ukraine war, lessons learned | Russia/Ukraine war timeline | Election predictions: Split-ticket | Congress to-do list | SCOTUS on WOTUS | SCOTUS on Prop 12 pork | New farm bill primer | China outlook | Omnibus spending package | Gov’t payments to farmers by program | Farmer working capital | USDA ag outlook forum | Debt-limit/budget package |