State Department Orders Departure from U.S. Embassy in Kyiv, Ukraine

More info on coming WHIP+ | Did Vilsack commit to 15 bil. gallons ethanol mandate?

|

In Today’s Digital Newspaper |

Congress is out on another recess. The Washington focus this week comes Wednesday with the conclusion of the two-day FOMC meetings, where the Fed will likely signal rate hikes ahead. On the geopolitical front, the Russia/Ukraine tussle is fast developing, with the Biden administration announcing several actions. On the policy front, we have more info regarding the coming WHIP+ program, and some comments from USDA Sec. Tom Vilsack last week that signaled a commitment to a 15-billion-gallon mandate for conventional ethanol for the 2022 RFS.

|

MARKET FOCUS |

Equities today: Market turbulence is likely to continue in the week ahead as the Federal Reserve (FOMC) meets and the biggest of big tech — Apple (Thursday) and Microsoft (Tuesday) — report earnings. Tesla reports Wednesday. International stock markets were mixed, with U.S. futures reversing earlier gains. Asian equites finished mixed as the focus shifted to the coming U.S. Fed meeting and worries about U.S. equity markets. The Nikkei ended up 66.11 points, 0.24%, at 27,588.37. The Hang Seng Index fell 309.09 points, 1.24%, at 24,656.46. European equities are broadly lower in early trading. The Stoxx 600 was down more than 2% while regional markets were down 1.2% to 2.2%.

U.S. equities Friday: The Dow lost 450 points, 1.3%, to 34,265.37. The Nasdaq was off 385.1 points, 2.7%, to 13,768.92. The S&P 500 fell 84.79 points, 1.9%, to 4,397.94.

Both the S&P and Dow closed out their third straight week of losses, down 5.7% and 4.6% respectively, while the Nasdaq Composite plunged 2.7% Friday and 7.6% for the week, its worst weekly decline since March 2020 — the Nasdaq has fallen 15.5% from its high and is off to its worst start to the year, through the first 14 trading days, since 2008, according to FactSet. The Dow had its worst weekly performance since October 2020.

The benchmark 10-year Treasury yield touched 1.9% in the middle of the week before slipping back to 1.76% Friday.

Market perspectives:

• Outside markets: The U.S. dollar index is firmer ahead of U.S. trading amid weakness in the euro and British pound. The yield on the 10-year U.S. Treasury note was slightly weaker, trading around 1.73%. Gold was higher while silver was weaker ahead of U.S. economic updates. Gold was trading around $1,839 per troy ounce while silver was under $24.10 per troy ounce.

• Bitcoin stabilized, trading at about $35,200, according to CoinDesk. The cryptocurrency has been swept up in the recent stock-market selloff and traded below $35,000 over the weekend. Bitcoin is down 47% from its record in November 2021. Bitcoin shed 16% last week and Ethereum lost 24%.

• Crude oil futures were seeing mild losses, with U.S. crude around $85 per barrel and Brent around $87.85 per barrel. Futures had been higher in Asian action, with U.S. crude up 63 cents at $85.77 per barrel and Brent up 72 cents at $88.61 per barrel.

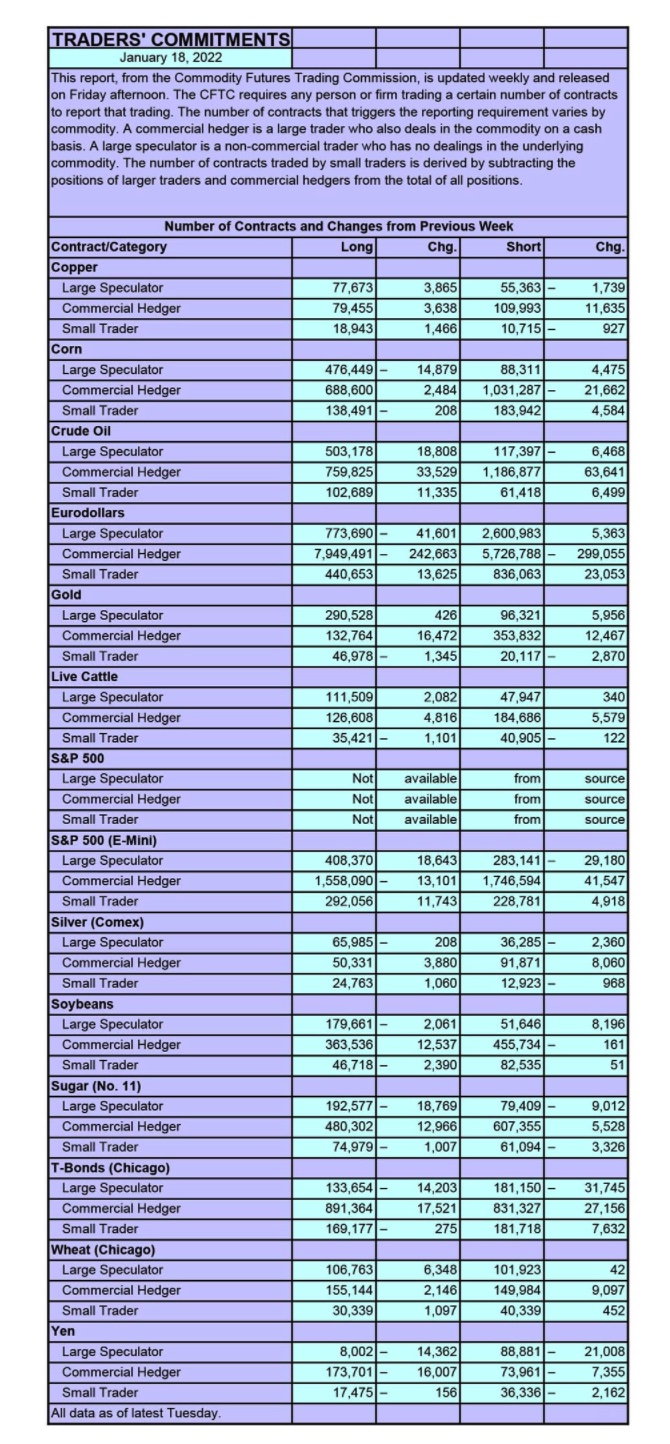

• CFTC Commitments of Traders report (Source: Barron’s):

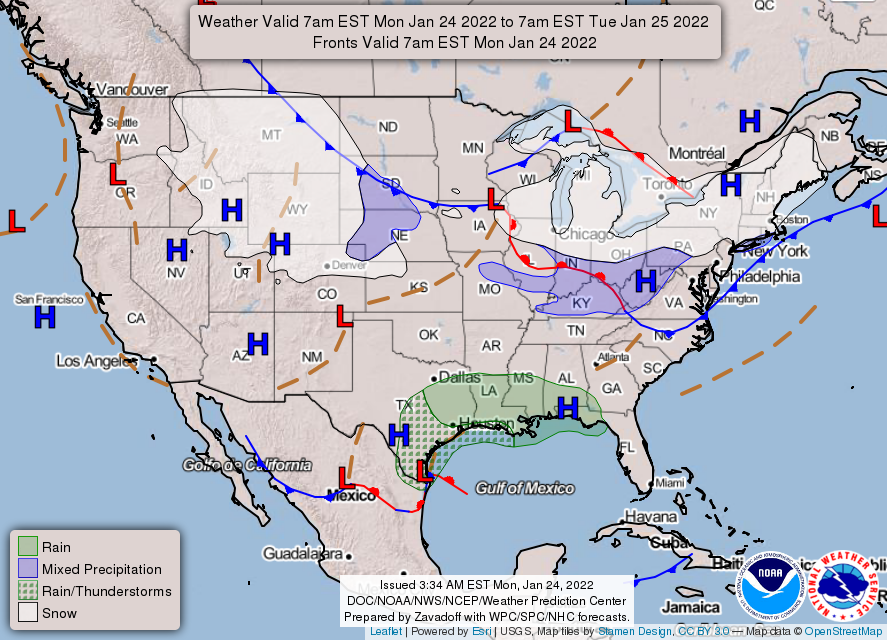

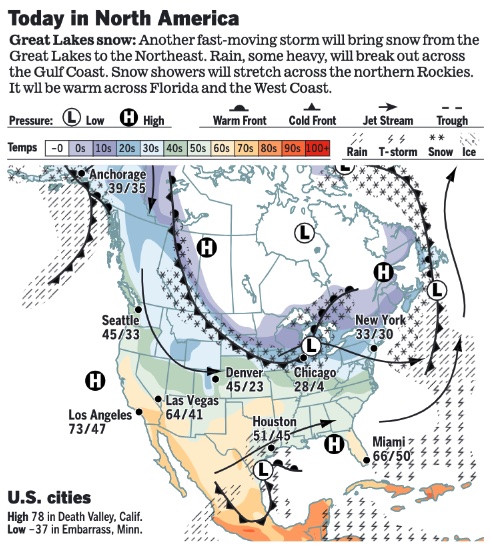

• NWS weather: Periods of light to moderate snow spreading across the northern tier states... ...Low pressure system to bring showers and thunderstorms to the Gulf Coast today into Tuesday, reaching Florida Peninsula later on Tuesday... ...Moderating temperatures across much of the southern and eastern U.S. but mild afternoons over the Northern/Central Plains will be followed by arctic air intrusion Monday and Tuesday.

|

POLICY FOCUS |

— Biden and Democratic congressional leaders want more Covid aid. The Committee for a Responsible Federal Budget’s Covid spending tracker says $5.6 trillion has been spent or distributed to deal with the virus — while another $1 trillion of appropriated money hasn’t been deployed. Despite this, Congress is talking about appropriating more money, this time a less amount and targeted to certain areas like restaurants, bars, nursing homes and the airline industry.

— Update on what Vilsack said last Thursday regarding WHIP+. WHIP+ payouts initially are coming in April or May via the Wildfire and Hurricane Indemnity Program-Plus (WHIP+) program, which Congress authorized $10 billion for over four months ago with instructions to make the program less complex and to implement accelerated payments versus the lengthy payment process for eligible 2018 and 2019 ag disasters. The coming program impacts eligible 2020 and 2021 crops, livestock and dairy… $750 million for the livestock industry.

Payments will likely be split in two tranches… the first tranche “based on information we already have,” Vilsack said. They would be pre-filled applications for grain producers (and) livestock forage data… and then a second tranche to basically make up for whatever the first tranche didn’t cover, or for those who didn’t have NAP… Noninsured Crop Disaster Assistance Program) information or crop insurance information. USDA would then leverage the data it already has on file to calculate the benefit.

FSA and RMA will work together. The program will still be administered by FSA but the Risk Management Agency (RMA) would calculate the payment for insured producers and pass that dollar amount to FSA to pre-fill an application and apply payment limitations and eligibility provisions, etc.

The second tranche would include opportunities for shallow losses and quality. A producer that receives a pre-filled application under the first tranche could be eligible to apply under the second.

On the livestock side, under the first phase, USDA would leverage LFP data and this would not require a producer to file an application; rather, FSA would just generate a payment based on the information submitted for LFP. Under the second tranche for livestock, USDA would be looking at what other gaps there may be to close them. This approach, meant to avoid FSA having to manual key in information already held by RMA, will save time in getting help out to producers.

|

CHINA UPDATE |

— China begins review of distillers’ grain duties. China’s Commerce Ministry will decide whether to renew its steep anti-dumping and countervailing duties on U.S. dried distillers grains (DDGS) with or without solubles. China is accepting public comment through Feb. 7, according to USDA’s Foreign Agricultural Service. China was the largest foreign market for DDGS from the U.S. before the Commerce Ministry levied the steep anti-dumping and countervailing duties. The U.S. exported 6.5 million metric tons of DDGs to China in 2015, worth $1.6 billion, according to the U.S. Grains Council.

— Some 39 Chinese aircraft entered Taiwan’s air defense identification zone on Sunday, the highest figure since October, the island’s defense ministry reported. Taiwan scrambled its own fighter jets in response to the flights, which came close to the Pratas Islands.

|

ENERGY & CLIMATE CHANGE |

— Biofuels policy questions elicit strong pledge from Vilsack. During last Thursday’s hearing at the House Ag Committee, USDA Secretary Tom Vilsack bristled at suggestions the Biden administration has not been supportive of the biofuel industry and by extension farmers, countering they have been very supportive of the biofuel industry. He pointed out that there are “800 million reasons why we're doing that: $800 million provided the biofuel industry in terms of support during the pandemic, as well as the $100 million dollars to expand access to higher blends, the ability to have consumers have access to higher blends.”

Is the RFS mandate for 2022 a solid 15 billion gallons? Some lawmakers noted that the 15-billion-gallon level for conventional biofuels was a positive from the administration relative to the Renewable Fuel Standard (RFS), with one lawmaker recounting a recent Reuters report that the EPA was considering lowering the mark for 2022 relative to conventional ethanol. Vilsack said the 15-billlion-gallon figure was a “real number” that will provide stability for the industry. “The stability comes not just in setting a number but in making sure that that number is real,” he stressed, noting that the prior Trump administration set the conventional ethanol level at 15 billion gallons but used small refinery exemptions to reduce that figure. “EPA basically said 65 waivers… not going to grant them, not going to approve them. The number we're giving you is a real number, and you can count on it. And I think the stability is going to be very helpful to this industry.”

|

LIVESTOCK, FOOD & BEVERAGE INDUSTRY |

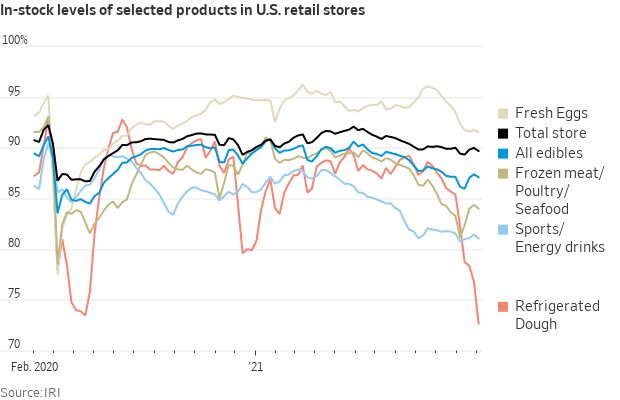

— U.S. food system is under renewed strain as Covid-19’s Omicron variant stretches workforces from processing plants to grocery stores, leaving gaps on supermarket shelves, the Wall Street Journal reports (link). Food-industry executives and analysts warn that the situation could persist for weeks or months, even as the current wave of Covid-19 infections eases. Recent virus-related absences among workers have added to continuing supply and transportation disruptions, keeping some foods scarce.

— Farm Bureau supports Cattle Transparency Act, except mandatory cash sales. American Farm Bureau Federation announced its support of the Cattle Price Discovery and Transparency Act of 2021, with the exception of the bill's establishment of mandatory minimums for negotiated purchases. AFBF delegates voted to revise 2022 Farm Bureau policy. While Farm Bureau supports robust negotiated sales, delegates voted to oppose government mandates that force livestock processing facilities to purchase a set percentage of their live animal supply via cash bids. AFBF President Zippy Duvall said, "The Cattle Price Discovery and Transparency Act takes positive steps toward ensuring fairness for America's farmers and ranchers as they work to feed this country's families. We support the majority of this legislation, but we cannot support mandatory cash sales. We are committed to working with the sponsors of the bill to make revisions to ensure it aligns with the priorities outlined by our membership."

Background. The Cattle Price Discovery and Transparency Act is sponsored by Sen. Deb Fischer (R-Neb.) and Sen. Chuck Grassley (R-Iowa), and co-sponsored by 14 other senators from both sides of the aisle. The legislation would also equip farmers with more information by establishing a cattle contract library, updating mandatory price reporting and increasing fines for companies that violate the Packers and Stockyards Act.

|

CORONAVIRUS UPDATE |

— Summary: Global cases of Covid-19 are at 351,752,346 with 5,597,569 deaths, according to data compiled by the Center for Systems Science and Engineering at Johns Hopkins University. The U.S. case count is at 70,700,678 with 866,540 deaths. The Johns Hopkins University Coronavirus Resource Center said that there have been 534,608,709 doses administered, 210,358,008 have been fully vaccinated, or 64.08% of the U.S. population.

— A federal judge in Texas blocked the Biden administration’s vaccine mandate for federal workers nationwide, a ruling that concluded the government had overstepped its authority.

— A political look at vaccination rates. A year into the Biden administration, counties that voted for Biden in the 2020 election still have higher vaccination rates than counties that voted for former President Donald Trump, according to a Kaiser Family Foundation analysis published this month and based on Covid-19 vaccination data from the U.S. Centers for Disease Control and Prevention. How much higher? 65% of people in Biden counties are fully vaccinated, compared to 52% of those in Trump counties. This is *the largest gap* seen in the three times this data has been collected. In June, the difference was less than nine percentage points.

|

POLITICS & ELECTIONS |

— The Arizona Democratic Party's executive board formally censured Sen. Kyrsten Sinema (D-Ariz.) for voting to maintain the Senate's filibuster rules, effectively blocking Democrats' voting rights legislation, a key priority for the party. Donors are threatening to walk away. Several groups are already collecting money for an eventual primary challenge, even though she’s not on the ballot until 2024.

|

OTHER ITEMS OF NOTE |

— Ukraine crisis talks to extend into this week. The U.S. and Russia have agreed to continue negotiations triggered by Moscow's military buildup near the Ukrainian border, and each side is moving to beef up their military capabilities in the region in the meantime. Meanwhile, Russia’s Foreign Ministry on Sunday rejected a British claim that President Vladimir Putin is seeking to replace Ukraine’s government with a pro-Moscow administration. Britain’s Foreign Office claimed on Saturday that former Ukrainian Member of Parliament Yevheniy Murayev is a Kremlin-backed candidate to replace Ukrainian President Volodymyr Zelensky. Other politicians were also listed by the office, which claimed some of them "have contact with Russian intelligence officers currently involved in the planning for an attack on Ukraine.” Murayev told the Associated Press the British claim “looks ridiculous and funny.” He also said he has been denied entry to Russia since 2018. “Everything that does not support the pro-Western path of development of Ukraine is automatically pro-Russian,” Murayev told the news service.

Putin’s team acknowledged the increasing likelihood of additional conflict in Ukraine on Thursday, a day after Biden threatened sanctions on Russia. The country also warned Japan to stay out of the brewing Ukraine crisis after U.S. officials touted a “close alignment” with Japanese Prime Minister Fumio Kishida. Meanwhile, Estonia, Lithuania, and Latvia announced on Friday that the Biden administration allowed the three Baltic states to donate U.S.-made weapons to the Ukrainian military. British officials have also provided new armaments, and Western officials, including Biden, have vowed to impose new economic sanctions on Russia if Putin proceeds.

The State Department on Sunday ordered the departure of eligible family members from the U.S. Embassy in Kyiv, Ukraine, and said American citizens in the country should consider departing now. “There are reports Russia is planning significant military action against Ukraine,” the State Department said in a statement. “The security conditions, particularly along Ukraine’s borders, in Russia-occupied Crimea, and in Russia-controlled eastern Ukraine, are unpredictable and can deteriorate with little notice.”

In a major development, while the U.S. renewed warnings that Russia could send forces into Ukraine at any time, the New York Times reported (link) that President Biden is considering deploying troops to eastern Europe and the Baltics.

On Friday, reports noted that Germany was blocking NATO ally Estonia from transferring German-origin howitzer artillery to Ukraine, while off-the-cuff remarks from Germany’s navy chief Kay-Achim Schönbach — saying that Crimea would not return to Ukraine and that Russian President Vladimir Putin deserved respect — forced his resignation over the weekend. German Foreign Minister Annalena Baerbock made no secret of the country’s hesitancy to provide arms that may be used in a future war. “Our restrictive position is well known and is rooted in history,” Baerbock said last week. The speedy departure of Schönbach also shows Germany has no desire to be seen as a Russian pawn.

— Iran talks. The U.S. appeared to tie the success of a nuclear deal with Iran to the release of four U.S. citizens currently held by Iran. Asked about the Vienna negotiations and Americans, U.S. special envoy for Iran Robert Malley told Reuters that the two issues were “separate” but “it is very hard for us to imagine getting back into the nuclear deal while four innocent Americans are being held hostage by Iran.”