Moffitt: USDA Focused on Eradicating Bird Flu, Preventing ASF from Reaching U.S.

World’s first carbon import tax approved by EU lawmakers

|

In Today’s Digital Newspaper |

Members of the Crop Insurance Professionals Association (CIPA) are in DC for a “fly-in,” visiting more than a few lawmakers’ offices this week, ahead of a group meeting in a few weeks in Kansas City. CIPA is visiting 200 offices on the Hill this week, calling for a stronger farm safety including strengthening crop insurance and correcting a harmful flaw in A&O that threatens to undermine vital private sector delivery. Here is a link to what CIPA members are giving lawmakers and their staff regarding crop insurance.

House Speaker Kevin McCarthy (R-Calif.) said a debt-ceiling bill will be ready soon.

Details remain unclear, even as Republican House leaders started looking for the 218 votes needed to pass it. GOP lawmakers still have questions over whether the plan would increase the limit or suspend it; which policy components would be included; and whether it would move through committees or be brought directly to the floor. Republicans said they expect to see the bill soon and vote on it next week, before the start of a recess in May. Others say that is an optimistic timeline.

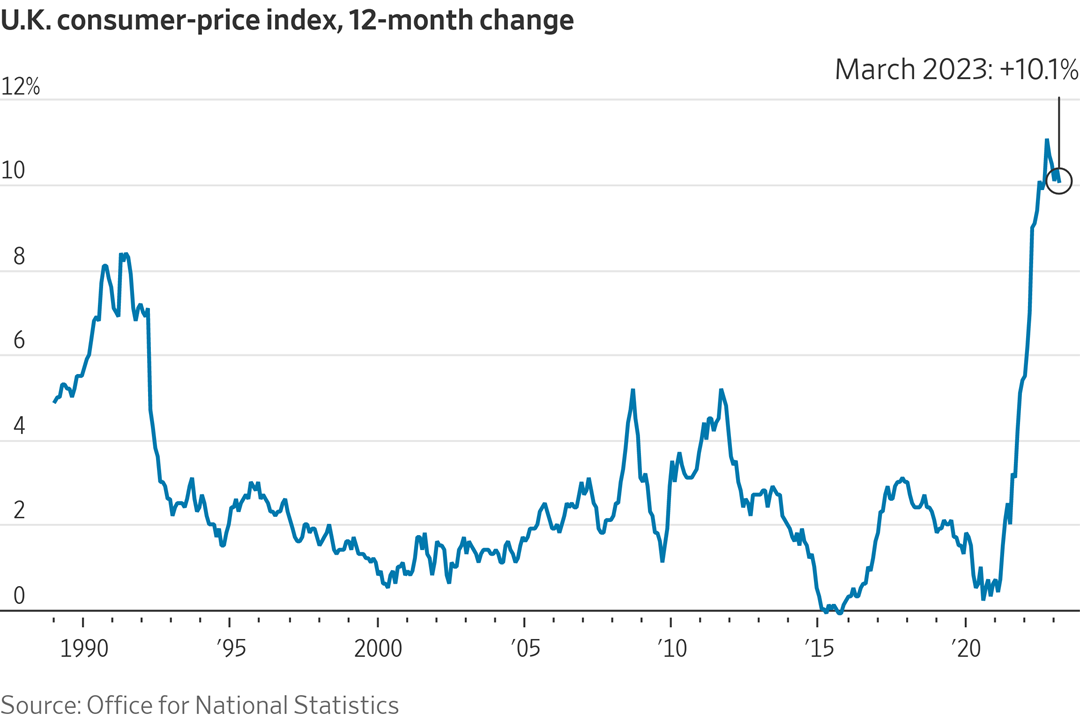

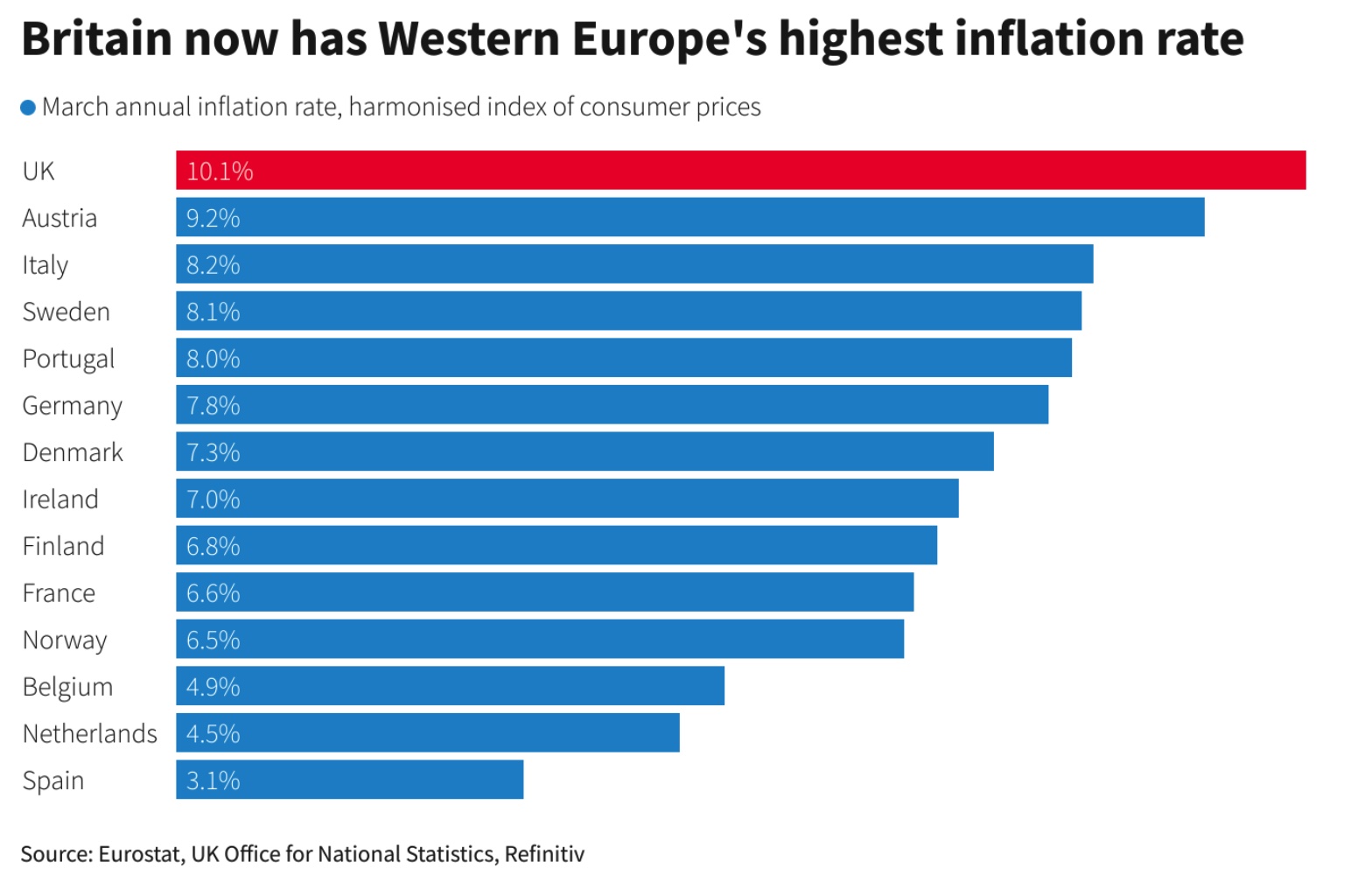

Consumer prices cooled in Britain last month, but still came in above expectations. Inflation there continues to run hotter than in many European countries and in the U.S., prompting some analysts to speculate that the Bank of England will raise interest rates next month to help bring prices under control.

WSJ reporter Evan Gershkovich will remain in pretrial detention at a Moscow prison.

After a closed hearing Tuesday, a court denied bail and ordered Gershovich held until May 29, pending trial on espionage charges that the Journal and the U.S. government vehemently deny. Authorities can seek to extend his detention, and legal experts say a trial could be many months off.

Tesla reduced prices on some of its best-selling electric vehicle models in the U.S. for the sixth time this year, once again showing a willingness to put building market share ahead of profit margin. The move comes just hours before Tesla is set to release quarterly results. The latest reductions would bring the Model 3 down to $39,900 and chop another $3,000 off the Model Y price tag. The company has cut prices in Europe and Asia in recent days, too.

The European Union has agreed to a $47 billion subsidy plan to bolster chip making in the bloc.

World’s first carbon import tax approved by EU lawmakers. Details in Energy & Climate Change section.

Today’s dispatch begins a series of looking back at some major past farm bills. See Policy section for details.

A USDA official during a hearing focused on eradicating bird flu, preventing ASF from reaching U.S. Details in Livestock section.

President Biden today will push back against GOP efforts to reduce food aid and health care funding/availability.

We have several updates on the Ukraine grain export situation in Russia & Ukraine section.

A GOP-led attempt to overrule President Biden on clean water regulation failed as expected in the House.

|

MARKET FOCUS |

Equities today: Global stock markets were lower. U.S. Dow opened around 100 points lower. The Stoxx Europe 600 declined 0.4%, while France’s CAC 40 slipped 0.2% after closing at a record high a day earlier. Japan’s Nikkei 225 edged down 0.2%. Hong Kong’s Hang Seng index declined 1.4%.

Morgan Stanley tops analysts’ expectations on better-than-expected trading results.

U.S. equities yesterday: The Dow fell 10.6 points, less than 0.1%, to 33,976.63. The S&P 500 advanced 3.6 points, 0.1%, to 4,154.87. The Nasdaq slipped 4.3 points, less than 0.1%, to 12,153.41, posting an eighth loss in 11 trading days.

Agriculture markets yesterday:

- Corn: May corn futures rose 1 cent to $6.77 1/2 and near mid-range.

- Soy complex: May soybeans rose 2 1/4 cents after trading to the highest level since March 8, while May soymeal fell $4.60 to $461.10. May soyoil rose 79 points to 55.36 cents.

- Wheat: May SRW wheat gained 1 1/2 cents, closing at $6.98. Prices closed near mid-range and hit a two-week high. May HRW wheat fell 8 1/2 cents to $8.81 1/4, nearer the session low. Spring wheat futures fell 3 1/2 cents to $8.85 1/2.

- Cotton: May cotton rose 125 points to 84.55, marking the highest close since March 6.

- Cattle: Expiring April live cattle futures rallied 72.5 cents to $176.475 Tuesday, while most-active June futures rose 32.5 cents to $165.20. The expiring April feeder contract advanced 37.5 cents to $205.925, whereas most-active May surged 75 cents to $211.50.

- Hogs: June lean hog futures saw extensive selling and closed $2.425 lower at $85.75.

Ag markets today: Corn, soybean and wheat futures pulled back from gains earlier this week amid corrective selling overnight and negative outside markets. As of 7:30 a.m. ET, corn futures were trading 3 to 4 cents lower, soybeans were 4 to 6 cents lower and wheat futures were 7 to 11 cents lower. Front-month crude oil futures were more than $1.50 lower and the U.S. dollar index was around 450 points higher this morning.

Market quotes of note:

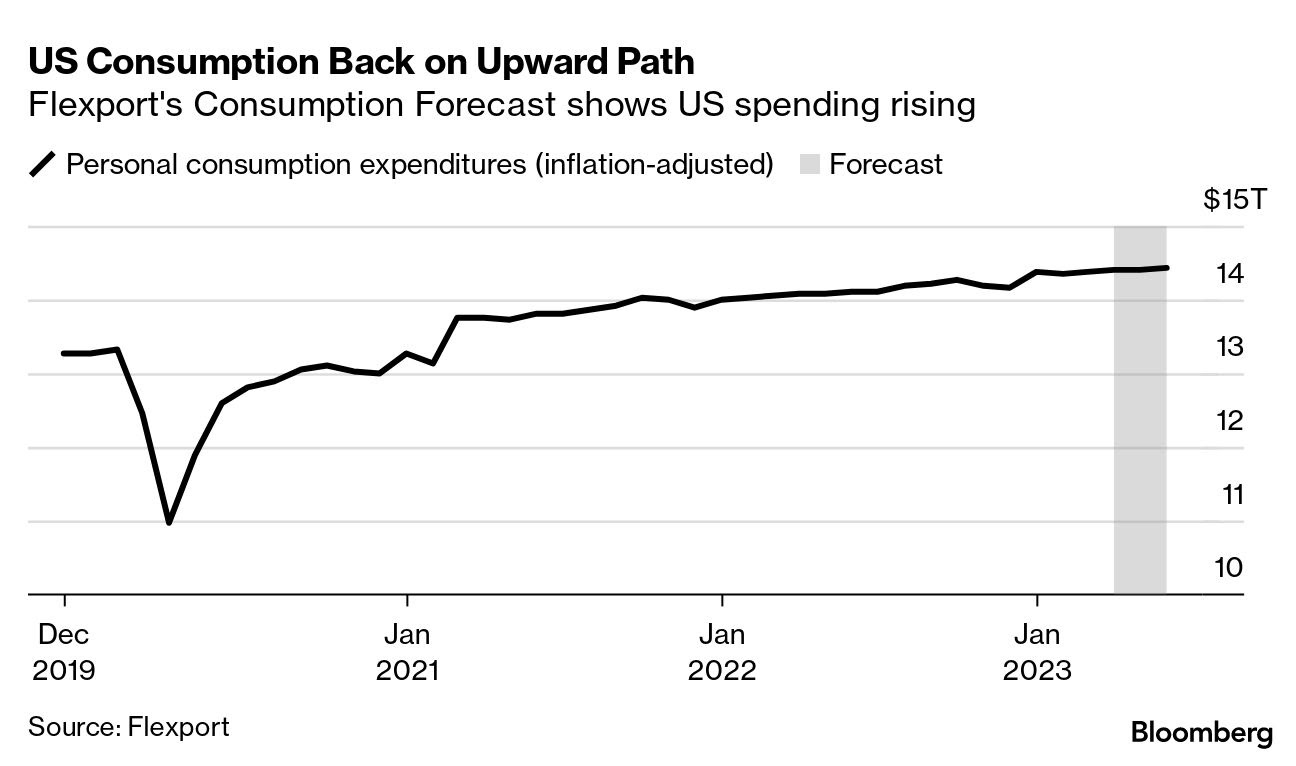

- “A recession may well be on the way, but from the latest data, we’re not seeing it arriving in the next few months,” said Phil Levy, chief economist for supply-chain technology firm Flexport. Flexport’s Trade Activity Forecast — which augments traditional economic techniques for predicting U.S. merchandise trade with the company’s proprietary data — shows the recent decline in imports bottoming out and then modestly rebounding by the end of the summer, Levy said.

- Federal Reserve Bank of St. Louis President James Bullard said yesterday that recession fears are overblown despite recent banking turmoil, and that more interest-rate hikes are needed to counter persistent inflation.

- Flying high. U.S. airline passenger levels this summer are projected to be “comfortably above” pre-pandemic numbers, the head of the Transportation Security Administration said.

- "Q1 isn't about Q1," wrote Bank of America strategists Savita Subramanian and Ohsung Kwon in a recent note. They expect a quarter that's largely in-line with estimates, but "the focus will be on guidance and tighter credit conditions," they said. As of this week, FactSet data forecasts that Q1 earnings of the S&P 500 will decline by 6.5% on average, year-on-year. That would mark the second quarterly earnings decline in a row and the largest across the index since the second quarter of 2020. This week, companies from a broad range of sectors will report their first quarter results, accounting for 26% of all earnings. By the end of the week, 60% of earnings from financial companies should be out.

On tap today:

• Federal Reserve releases its Beige Book report at 2 p.m. ET, offering an anecdotal glimpse at economic conditions in its regional banks across the country. The report should provide more insights into bank lending activities during the past few weeks.

• Federal Reserve speakers: Chicago's Austan Goolsbee interviewed on Marketplace at 5:30 p.m. ET, and New York's John Williams on the economic outlook at 7 p.m. ET.

• President Biden is scheduled to depart the White House at 1:20 p.m. ET for Accokeek, Md., where he is set to deliver remarks on the economy at 2:30 p.m. ET.

Annual inflation in Britain fell to 10.1% in March, down from 10.4% in February. But that was still higher than expected. Though gasoline and diesel prices dropped, food prices climbed steeply. The prices of some goods, such as bread and cereals, rose at a record-high pace. The figures — the last significant inflation data before the Bank of England’s next meeting, in early May — increase the possibility of further interest rate rises.

Market impact: U.K. government bond yields jumped after hotter-than-expected inflation data. The yield on the 10-year gilt rose to as high as 3.851%.

The EU agreed to a €43 billion ($47.2 billion) plan to invest in the production of semiconductors. Europe currently produces around 10% of the world’s semiconductors, but the EU wants that share to reach 20% by 2030. The European Chips Act follows a similar plan signed by President Joe Biden last year, which aims to boost manufacturing of microchips in America and to curtail production in China.

Mortgage applications in the U.S. declined 8.8% in the week ended April 14, reversing from a 5.3% rise in the previous week, data from the Mortgage Bankers Association showed. Applications to purchase a home sank 10% and those to refinance a home loan went down 5.8%.

Meanwhile, the average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($726,200 or less) jumped by 13bps to 6.43%, the first increase in six weeks compared to two-month lows of 6.3% in the previous period. “Affordability challenges persist and there is limited for-sale inventory in many markets across the country, so buyers remain selective on when they act,” Joel Kan, MBA’s chief economist said.

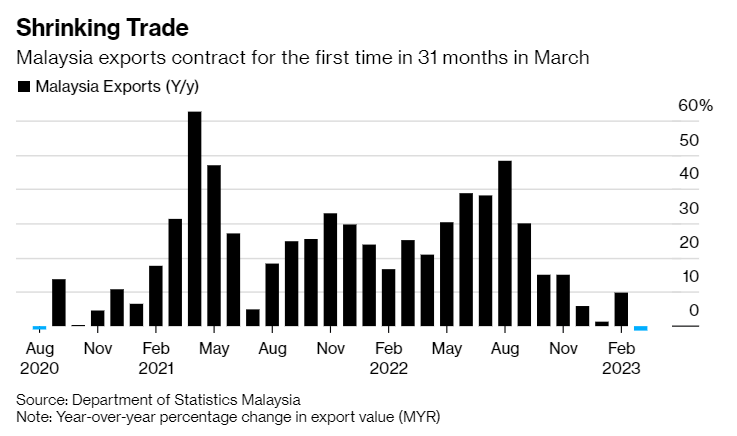

Malaysia’s exports declined in March, marking the first contraction since August 2020 amid slowing global demand. Outbound shipments fell 1.4% from a year ago to 129.7 billion ringgit ($29.3 billion), according to a statement from the Ministry of Investment, Trade and Industry. Exports of electrical and electronics products, which accounted for 39% of the Southeast Asian nation’s total, fell 4.4% year-over-year, while palm oil and related agricultural products sagged 14.2%.

Market perspectives:

• Outside markets: The U.S. dollar index was around 450 points higher this morning. Yields on U.S. government bonds gained. The yield on the 10-year Treasury note rose to 3.610%, from 3.571% Tuesday. Oil weakened as Brent, the global benchmark, was down 1.8% at $83.25 a barrel. Gold prices softened, with the most-actively traded gold futures contract declining1.6% to around $1987.50, retreating further after closing in on record levels last week. Silver was around $24.78 per troy ounce.

• Ag trade: Jordan tendered to buy up to 120,000 MT of optional origin milling wheat.

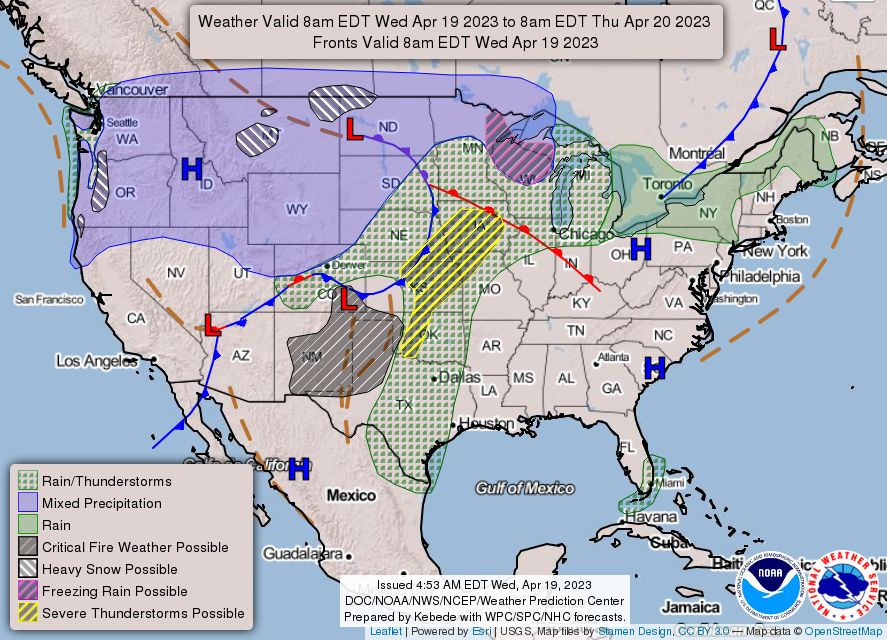

• NWS weather outlook: There is a Slight Risk of severe thunderstorms over parts of the Central/Southern Plains and Middle Mississippi Valley on Wednesday and over Middle/Lower Mississippi Valley and Southern Plains on Thursday... ...There is a Marginal Risk of excessive rainfall over parts of the Central Plains, Upper/Middle Mississippi Valley, and Upper Great Lakes on Wednesday; there is a Slight Risk of excessive rainfall over parts of the Middle/Lower Mississippi Valley and the Southern Plains... ...Snow over the Cascades, Northern Intermountain Region, and Northern/Central Rockies on Wednesday and Thursday; moderate snow over parts of the Northern Plains/Upper Mississippi Valley on Thursday.

Items in Pro Farmer's First Thing Today include:

• Corrective grain market selling overnight

• Wholesale beef prices continue to climb

• Pork firms

|

RUSSIA/UKRAINE |

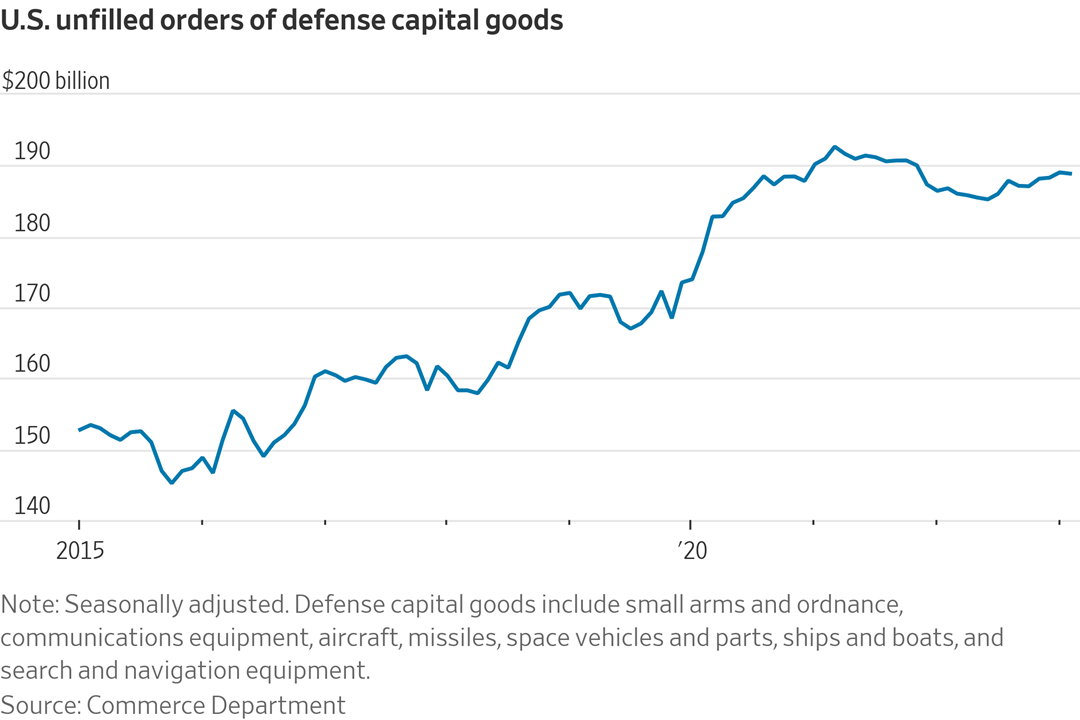

— Supply-chain snarls are still hindering efforts by weapons makers to produce more arms for Ukraine and refill stocks for the U.S. and its allies. Lockheed Martin said Tuesday that sales of its long-range missiles known as the Guided Multiple Launch Rocket System, or GMLRS, fell in the latest quarter from a year ago. The U.S. has shipped hundreds to Ukraine, where they have been widely used against invading Russian forces. Big U.S. arms makers are taking longer than expected to boost production despite billions of dollars in support from the Pentagon, the Wall Street Journal reports (link).

— Ukraine says grain inspections resuming. Inspections of vessels carrying grains from Ukrainian ports have resumed at Turkey's Bosphorus Strait after two days of discussions between Kyiv and Moscow, a spokesperson for the Joint Coordination Center in Istanbul said on Wednesday. Ukrainian Agriculture Minister Mykola Solsky said Moscow was increasing difficulties for Ukraine at a time when three eastern European countries have banned imports of Ukrainian grain and food products. “Obviously, the Russians could not fail to take advantage of these nuances on the western (Ukrainian) border,” Solsky said. RIA news agency quoted the Russian foreign ministry as on Wednesday as saying Ukraine and the United Nations were causing difficulties with the ship inspections.

— EU plans farmer support for Ukraine grain imports. The European Union is preparing 100 million euros ($109.32 million) of compensation for farmers in countries bordering Ukraine and plans to introduce restrictions on imports of Ukrainian grain. The European Commission, which oversees trade policy in the 27-nation European Union, will take what it described as “preventative measures” for certain categories of grain and oil seeds – particularly, wheat, maize, sunflower seeds and rape seed. The European Union can limit the import of products into the whole or part of the bloc, while still allowing transit.

European Commission President Ursula von der Leyen will reportedly present three proposals. European Trade Commissioner Valdis Dombrovskis is set to discuss the plans later today with ministers from the affected countries — Bulgaria, Hungary, Poland, Romania and Slovakia — and with Ukrainian counterparts.

— Bulgaria introduces temporary ban on Ukraine grain imports. Bulgaria temporarily banned imports of grain from Ukraine except those in transit to other countries. “Over the past year, a significant amount of food has remained in the country and disrupted food chains,” Prime Minister Galab Donev said.

— Poland, Ukraine reach deal on grain transit. Poland reached an agreement on restarting transit of Ukrainian grains through its country as of Friday, Polish Agriculture Minister Robert Telus said. He noted trucks carrying Ukrainian grain will be sealed and monitored by GPS as they pass through Poland.

|

POLICY UPDATE |

— House Republicans are planning to vote next week on a bill to tackle the U.S. debt ceiling and enact deep cuts to spending, but are still modifying the measure to meet conservative lawmakers’ demands. “We have an outline of a plan, and there is still input coming in,” Rules Committee Chair Tom Cole (R-Okla.) said. “I am confident we will pass it.” The bill would either suspend the debt ceiling until May 2024 or raise the cap by a dollar amount estimated to cover U.S. expenditures until then. Hern said the debt ceiling increase would be about $2 trillion.

Upshot: The vote timeline appears optimistic to some congressional watchers. Meanwhile, President Joe Biden — who spoke earlier Tuesday with Senate Majority Leader Chuck Schumer (D-N.Y.) and House Minority Leader Hakeem Jeffries (D-N.Y.) about the Republican effort — says the party’s leadership is united in opposition to negotiating over the debt ceiling, according to a White House statement.

— A look back at highlights of the 2018 Farm Bill. The 2018 Farm Bill was formally known as the Agriculture Improvement Act of 2018. It was signed into law on Dec. 20, 2018. Here are some key highlights of the bill:

- Commodity Programs: The bill maintained the Price Loss Coverage (PLC) and Agricultural Risk Coverage (ARC) programs that provide financial support to farmers in case of low crop prices or revenue losses. It also increased loan rates for certain commodities, such as peanuts and cotton, to provide better support. The 2018 Farm Bill did make some changes related to cotton, such as the inclusion of "seed cotton" (unginned cotton that includes both the lint and seed) as a covered commodity under Title I, making it eligible for PLC and ARC programs. Prior to the 2018 Farm Bill, cotton was put back into the Title 1 program via a funding bill (cotton was taken out of Title I in the 2014 Farm Bill).

- Dairy Programs: The bill created the Dairy Margin Coverage (DMC) program, which replaced the previous Margin Protection Program (MPP). This new program offers improved coverage and more affordable premiums for dairy farmers.

- Conservation: The Conservation Reserve Program (CRP) acreage cap was increased from 24 million to 27 million acres, with a focus on incentivizing environmentally beneficial practices. The bill also streamlined and consolidated various conservation programs, such as the Environmental Quality Incentives Program (EQIP) and the Conservation Stewardship Program (CSP).

- Hemp Legalization: The 2018 Farm Bill removed hemp from the list of controlled substances, making it an agricultural commodity and allowing farmers to grow, process, and sell hemp products, such as CBD oil.

- Trade and Exports: The bill strengthened export promotion programs, such as the Market Access Program (MAP) and the Foreign Market Development (FMD) program, to help expand market opportunities for American agricultural products.

- Nutrition: The bill maintained the Supplemental Nutrition Assistance Program (SNAP), such as increased funding for employment and training programs. It did not include the stricter work requirements initially proposed by some legislators. The 2018 Farm Bill required USDA to re-evaluate the Thrifty Food Program (TFP) by 2022 and every five years thereafter; TFP represents the lowest cost of a nutritious diet for a “reference” household. The cost of TFP is used to determine the maximum SNAP benefit; 2021 re-evaluation resulted in a 21% increase. Top Republicans on the House and Senate Ag panels slammed the TFP increase.

- Rural Development: The bill provided funding for rural broadband initiatives, aiming to improve internet access in rural areas. It also supported programs addressing rural opioid abuse and rural mental health issues.

- Research and Innovation: The bill provided increased funding for agricultural research, including the creation of new research initiatives such as the Agriculture Advanced Research and Development Authority (AGARDA).

|

ENERGY & CLIMATE CHANGE |

— World’s first carbon import tax approved by EU lawmakers. The European Union’s parliament approved legislation to tax imports based on the greenhouse gases emitted to make them, clearing the final hurdle before the plan becomes law and enshrines climate regulation in the rules of global trade for the first time. Tuesday’s vote caps nearly two years of negotiations aimed at pushing economies around the world to put a price on carbon-dioxide emissions while shielding the EU’s manufacturers from countries that aren’t regulating greenhouse-gas emissions as strictly, or at all. Link for details via Reuters.

— Securities and Exchange Commission (SEC) head Gary Gensler faces intensifying pressure over looming rules that will force public companies to disclose emissions and climate-related risks. Big issue: Whether the SEC will force disclosure of "Scope 3" emissions — CO2 from the use of companies' products in the economy. Progressive Rep. Ayanna Pressley (D-Mass.), at a House hearing Tuesday, urged Gensler to ensure Scope 3 mandates survive in the final rule. "This is not the time to backtrack and to weaken regulations. Now is the time for action and to put people over polluters," she said at a Financial Services Committee hearing. But a new letter to the SEC from major agriculture groups (link) says Scope 3 reporting would have "devastating consequences for farmers and ranchers."

Upshot: It's a bid to "weaponize the SEC to push through radical climate change policies that are unable to pass through Congress," West Virginia GOP Rep. Alexander Mooney told Gensler.

|

LIVESTOCK, FOOD & BEVERAGE INDUSTRY |

— President Biden today to push back against GOP efforts to reduce food aid and health care funding/availability. The president will make the remarks during an address at the International Union of Operating Engineers Local 77 training center, his first public rebuke of House Speaker Kevin McCarthy’s (R-Calif.) plan to expand SNAP work requirements beyond previous levels to rein in the program’s spending as part of the coming battle over the debt limit. Let’s be clear, this is a non-starter,” said Senate Ag Chair Debbie Stabenow (D-Mich.) about the GOP SNAP work requirement plans.

‑— Moffitt: USDA focused on eradicating bird flu, preventing ASF from reaching U.S. USDA Undersecretary for Marketing and Regulatory Programs Jenny Lester Moffitt told lawmakers USDA remains focused on eradication to tackle the ongoing Highly Pathogenic Avian Influenza (HPAI) outbreak. “At this stage of the outbreak, continuing our current strategy of eradication or ‘stamping out’ HPAI is our best and most effective option,” she said during a House Agriculture Subcommittee on Livestock, Dairy and Poultry hearing Tuesday (April 18). Link to video of hearing and Moffitt testimony.

Moffitt said USDA has devoted $1.3 billion to quell a 14-month-old outbreak of HPAI and to keep African Swine Fever (ASF) out of the country. A record 58.7 million birds, mostly egg-laying hens and turkeys being raised for meat, have died of bird flu since outbreaks began in February 2022, helping cause a surge in egg prices.

She noted USDA’s Agricultural Research Service (ARS) continues to work on developing a vaccine effective against the currently circulating strains of the virus. “This work is ongoing, and it will still be a while before a vaccine could be commercially available and easily applied. Even then, there would be many factors we would weigh before authorizing its use, especially with respect to the likely trade impacts of a vaccination campaign,” she said, adding that discussions with stakeholders and trade partners on the issue are ongoing. It would be 18-24 months before a vaccine would be available and there are many factors to weigh about using it, Moffitt stressed.

Key quote: “At this stage of the outbreak, continuing our current strategy of eradication or ‘stamping out’ HPAI is our best and most effective option,” said Moffitt in testimony at a House Agriculture subcommittee hearing. “We continue to stress more than anything else the importance of strong biosecurity to every producer.”

Regionalization agreements have proven to be an effective tool for mitigating the trade impacts of the current outbreak, Moffitt noted. Around 15% of U.S. poultry meat is exported. The issue: U.S. trading partners would have to agree to accept meat from vaccinated birds and the U.S. would have to prove the meat was free of the virus. Problem: HPAI tests currently do not easily distinguish between infected and vaccinated birds, so a new protocol may be needed.

As for ASF, efforts by USDA and other federal agencies including Customs and Border Protection (CBP) to prevent the disease from spreading from the Caribbean to herds in the mainland U.S. have been successful, Moffitt revealed. “We will continue to work with animal health officials in the region in further developing those plans and do everything we can to keep this high consequence disease out of the country,” she stated.

|

HEALTH UPDATE |

— J&J, a bellwether for the health industry, slightly lowered its pharmaceutical sales target for 2025 (though it raised its overall guidance). The company's executives said on a call that currency headwinds are to blame. Foreign exchange hiccups, they said, cost their pharmaceutical business about $3 billion last year.

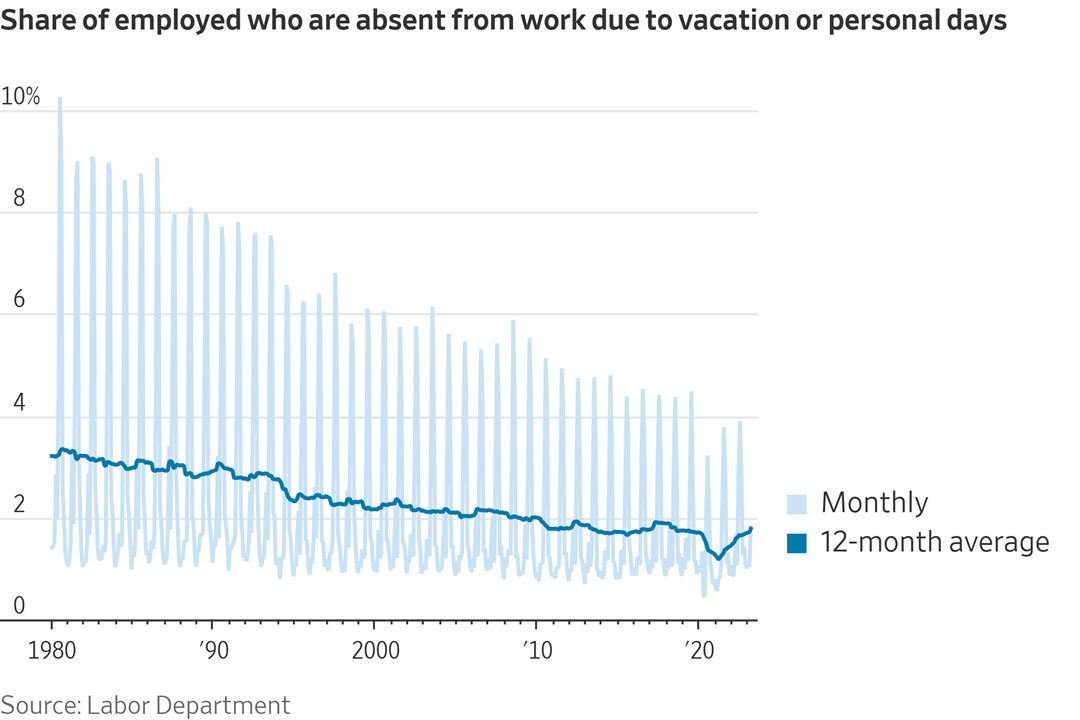

— More companies are carving out extra personal days for workers, not for a doctor’s appointment or to run errands, but because of stressful events outside of the workplace. The decision to offer these types of personal days is one of several moves company executives say they are making to address concerns about employees’ mental health. They are also offering companywide mental-health days and on-site respite rooms. The moves reflect executives’ belief that addressing mental health directly with their workers is a crucial way to retain and attract the best employees in a tight labor market, the Wall Street Journal reports (link).

— The Supreme Court is expected to issue an order as soon as today that could determine the availability of the widely used abortion pill mifepristone for at least the next several months.

|

CONGRESS |

— EPA Administrator Michael Regan will testify before the House Ag Committee today, where GOP lawmakers will likely hammer regulations they say hurt farmers. Key issues include (1) the WOTUS rule, (2) biofuels and (3) pesticide regulation under the Federal Insecticide, Fungicide and Rodenticide Act, including proposed restrictions on the herbicide atrazine and other crop protection chemicals.

— The Senate Finance Committee holds a hearing with IRS Commissioner Danny Werfel on the agency’s budget request and plan for spending $80 billion from last year’s tax and climate law. Meanwhile, the House Ways and Means Committee will examine provisions of the tax code that Republicans say subsidize “green corporate handouts and the Chinese Communist Party.”

— A GOP-led attempt to overrule President Biden on clean water regulation failed as expected in the House on Tuesday on a 227-196 roll call that fell well short of the two-thirds majority needed for passage. While the Biden administration's waters of the United States (WOTUS) rule remains on the books, it has been halted in 26 states via court action.

|

OTHER ITEMS OF NOTE |

— A curious toddler on Tuesday earned the title of one of the tiniest White House intruders after he squeezed through the metal fencing on the north side of the executive mansion. Link` to more via the Associated Press.

|

KEY LINKS |

WASDE | Crop Production | USDA weekly reports | Crop Progress | Food prices | Farm income | Export Sales weekly | ERP dashboard | California phase-out of gas-powered vehicles | RFS | IRA: Biofuels | IRA: Ag | Student loan forgiveness | Russia/Ukraine war, lessons learned | Russia/Ukraine war timeline | Election predictions: Split-ticket | Congress to-do list | SCOTUS on WOTUS | SCOTUS on Prop 12 | New farm bill primer | China outlook | Omnibus spending package | Gov’t payments to farmers by program | Farmer working capital | USDA ag outlook forum |