How Can House GOP Balance Budget in 10 Years Sans Cuts for Defense, SS, Medicare? Whack Everything Else

President Biden to visit E. Palestine, Ohio, but does not say when

|

In Today’s Digital Newspaper |

Market rumors: China reportedly bought some U.S. corn and sorghum, but no confirmation yet.

WTI crude futures fell more than 2% to below $77 per barrel today, as lingering concerns about a recession-driven demand downturn offset prospects of tighter global supplies. The latest EIA report showed that US crude inventories rose by 1.166 million barrels last week, much higher than market forecasts for a 457,000-barrel increase. At the same time, the Wall Street Journal reported a growing rift between two of OPEC's biggest producers, Saudi Arabia and the United Arab Emirates, sparking fears of a crack in the cartel's policy which could lead to more supplies.

Two Fed policymakers -- Governor Christopher Waller and Atlanta Fed President Raphael Bostic — yesterday flagged recent stronger-than-expected economic data as a reason to push rates even higher. Walker said that “wishful thinking is not a substitute for hard evidence” for data on moderating inflation and the labor market. He didn’t say whether he’d support a half-point increase at the Fed’s next meeting on March 21-22.

The Biden administration added two dozen Chinese groups to a trade blacklist. The targeted companies include chipmakers accused of assisting China’s military and surveillance tech exporters.

The U.S. will announce a fresh round of military aid to Ukraine today. The new package will include mostly ammunitions and munitions that the Ukrainians will need for the systems they already have.

Russian forces say Bakhmut is “basically surrounded.” The founder of the Wagner Group paramilitary group spearheading the Russian offensive in the eastern city urged Kyiv to allow its troops to withdraw from the city, and said that only one road into Bakhmut remains accessible to Ukraine.

When German Chancellor Olaf Scholz arrives at the White House today, the challenge of how to maintain weapons supplies to Ukraine will be high on the agenda. The German leader may come under pressure from President Joe Biden over the struggle to produce enough ammunition for the front lines and the two leaders are likely to discuss ways to cooperate more on stepping up manufacturing. This will be Scholz’s second visit to the White House since taking office in 2021.

Of note: Britain, France and Germany are in favor of a public censure of Tehran over Iran’s production of near-weapons-grade uranium, while the Biden administration is reluctant to do that, according to diplomats involved in the discussions. So says the Wall Street Journal (link).

The future of agriculture is here… now. Forbes looks at the new industrial revolution in the ag sector. See Markets section for more.

FAO food price index drops again in February. The U.N. Food and Agriculture Organization (FAO) global food price index dropped for the 11th straight month in February and was 18.7% below the March 2022 peak. More in Food section.

In a major change, President Biden said he would support an effort by Congress to roll back changes to Washington, D.C.’s criminal code. The president's comments to Senate Democrats signal that he would side with federal lawmakers concerned about crime in the nation's capital over local officials. The Republican-led measure to overturn the criminal code changes passed the House with significant Democratic support, and Senate Republicans plan to force a vote as early as next week. Defenders of the law say Congress is improperly nosing into city affairs and effectively overruling the will of voters.

Sen. Dianne Feinstein (D-Calif.) said Thursday she’s been hospitalized in California with shingles and hopes to return to Washington to vote in the Senate later this month. It comes two weeks after the California Democrat — the oldest sitting senator at age 89 — announced she would retire at the end of her term next year.

In California, snow business is like show business. California’s wet and wild winter has freed up half of the state from drought, according to data from the U.S. Drought Monitor. Heavy snowfall amounts shut down highways, left people stranded in their homes and forced the closure of national parks.

A Whiskey fungus is pitting Tennessee locals against Jack Daniel’s. See last item for more.

|

MARKET FOCUS |

Equities today: Global stock markets were mostly firmer overnight. U.S. Dow opened around 120 points higher and is currently just over 60 points higher. In Asia, Japan +1.5%. Hong Kong +0.7%. China +0.5%. India +1.5%. In Europe, at midday, London +0.2%. Paris +0.7%. Frankfurt +1.1%.

U.S. equities yesterday: The Dow advanced 341.73 points, 1%, to 33,003.57. The S&P 500 rose 29.96 points, 0.8%, to 3,981.35. The Nasdaq gained 83.50 points, 0.7%, to 11,462.98.

Several large retailers issued tepid guidance for 2023. Macy’s and Best Buy said they expect sales to fall this year, after declining in 2022, as stubbornly high levels of inflation and other economic issues weigh on shoppers.

Agriculture markets yesterday:

- Corn: May corn fell 2 cents to $6.33 3/4, nearer the session low.

- Soy complex: May soybean futures gained 15 cents to $15.09 1/4 and nearer the session high. May soybean meal rose $2.00 at $472.30 and near mid-range. May bean oil rose 107 points to 61.90 cents and near the session high.

- Wheat: May SRW rose 2 3/4 cents to $7.12 3/4, a slight continued bounce from yesterday’s contract low. Mary HRW rose 9 3/4 cents to $8.26. May spring wheat futures rose 11 3/4 cents to close at $8.75 1/4, near the session high.

- Cotton: May cotton dropped 195 points at 83.71 cents, nearer the session low.

- Cattle: April live cattle futures continued yesterday’s decline another $1.025 to $164.1. March feeders clawed out a 27.5 gain to close at $188.75.

- Hogs: Nearby April hog futures sank $1.10 cents to $83.85 Thursday. Deferred futures traded mostly lower.

Ag markets today: Soybean and wheat futures continued to recoup sharp losses from earlier this week during overnight trade, while buyer interest was limited in corn. As of 7:30 a.m. ET, corn futures were trading fractionally to 2 cents lower, soybeans were mostly 3 to 5 cents higher and wheat futures were steady to 3 cents higher. Front-month crude oil futures were modestly weaker, and the U.S. dollar index was around 250 points lower this morning.

Technical viewpoints from Jim Wyckoff:

On tap today:

• S&P Global's U.S. services index for February is expected to hold at 50.5, unchanged from a preliminary reading. (9:45 a.m. ET)

• Institute for Supply Management's services index is expected to fall to 54.3 in February from 55.2 one month earlier. (10 a.m. ET)

• Baker Hughes rig count is out at 1 p.m. ET.

• CFTC Commitments of Traders report 3:30 p.m. ET.

• Federal Reserve speakers: Dallas's Lorie Logan at a Chicago Booth Workshop on Market Dysfunction at 11 a.m. ET, Atlanta's Raphael Bostic at a racial inequality conference at 11:45 a.m. ET, governor Michelle Bowman at a Chicago Booth Workshop on Market Dysfunction at 3 p.m. ET, and Richmond's Thomas Barkin on inflation at 4:15 p.m. ET.

• President Joe Biden meets Germany’s Olaf Scholz today at the White House with the challenge of how to maintain weapons supplies to Ukraine and relations with China high on the agenda. China joined Russia in refusing to agree to a G20 statement condemning the conflict.

Two Federal Reserve policymakers cautioned that recent stronger-than-expected readings on the U.S. economy could push them to raise interest rates by more than previously expected. In remarks Thursday, Governor Christopher Waller said that if payroll and inflation data cool after hot prints in January, “then I would endorse raising the target range for the federal funds rate a couple more times, to a projected terminal rate between 5.1% and 5.4%.”

Is the Fed too optimistic? Federal Reserve officials in their most recent Summary of Economic Projections (SEP) forecast that the unemployment rate would rise to 4.6% by the end of 2023 and inflation would fall to 2.1% by the end of 2025. Cleveland Fed economists think that's too optimistic. "Our model projects that conditional on the SEP unemployment rate path and a rapid deceleration of core goods prices, core PCE inflation moderates to only 2.75% by the end of 2025: inflation will be higher for longer. A deep recession would be necessary to achieve the SEP’s projected inflation path," Randal Verbrugge and Saeed Zaman write in a working paper (link).

The global economy is showing vigor, a sign that central banks' inflation fight may take longer than anticipated, according to the Wall Street Journal (link). Data from the U.S., China and Europe have shown surprising vitality in these regions’ economies since the start of 2023, confounding predictions from the World Bank and other economists that the global economy was set for one of its weakest years in recent decades. The WSJ item says that resilience may lead central bankers to pour more cold water on economies that are still running a little too hot.

Mortgage rates closing in on 7%. Mortgage application volume continued to slide last week as rates rose. It’s a bad sign for the spring selling season as 7% mortgage rates are in view once again. A leading gauge of buyer demand fell to a 28-year low last week as mortgage rates rose, the Mortgage Bankers Association said Wednesday. The trade group said that its seasonally adjusted measure of applications for a loan to purchase a home fell 6% from the previous week.

Eurozone producer inflation at 17-month low. The producer price inflation in the Eurozone slowed more than expected to 15% in January, the lowest since August 2021 and below market expectations of 17.7%. On a monthly basis, producer prices went down 2.8% as a 9.4% decline in energy prices more than offset increases in all other goods. Without energy, producer prices rose 1.1% month-on-month, the most since May 2022.

Self-driving tractors outfitted with sensors to monitor crop health. Robotic bee hives designed to monitor the needs of their resident bee colonies. Flying, autonomous robots outfitted with camera vision and algorithms to identify ripe fruit, pick it round the clock during day and night with high-suction arms, and deposit it into a conveyor. These aren’t examples of futuristic-sounding technologies for decades down the road. They’re examples of artificial intelligence-backed advances being deployed in fields right now. The machines coincide with the urgency to solve long-term challenges for food production, and illustrate other uses for AI-powered devices aside from products like ChatGPT and Tesla that constantly make headlines. Forbes (link) looks at how startups are aiming to solve big problems for agriculture, including labor and water shortages, climate-driven headaches and declining bee populations, by deploying such artificial intelligence, autonomous driving technology and robotics. “Climate change, drought and a persistent labor shortage are a threat to California's role as the main grower of fresh fruits and vegetables,” says Forbes Senior Editor Alan Ohnsman. “Farmers there, and across the U.S., are turning to high-tech solutions to help ensure the supply and affordability of produce doesn't decline.”

Market perspectives:

• Outside markets: The U.S. dollar index was weaker. The yield on the 10-year U.S. Treasury note fell to just under 4%, with a mixed-to-negative tone in global government bond yields. Crude is lower, with U.S. crude around $77.80 per barrel and Brent around $84.30 per barrel. Gold and silver were higher with gold around $1,851 per troy ounce and silver around $21.13 per troy ounce.

• Ag trade: Taiwan purchased 65,000 MT of corn that can be sourced from the U.S., Brazil, Argentina or South Africa.

• California has already received twice the average snowfall it normally sees by March, according to UC Berkeley researchers. Some mountainous regions have been slammed with 40 feet of snow since the start of winter. On Wednesday, Governor Gavin Newsom declared a state of emergency for 13 counties. Upshot: California’s wet and wild winter has freed up half of the state from drought, according to data from the U.S. Drought Monitor.

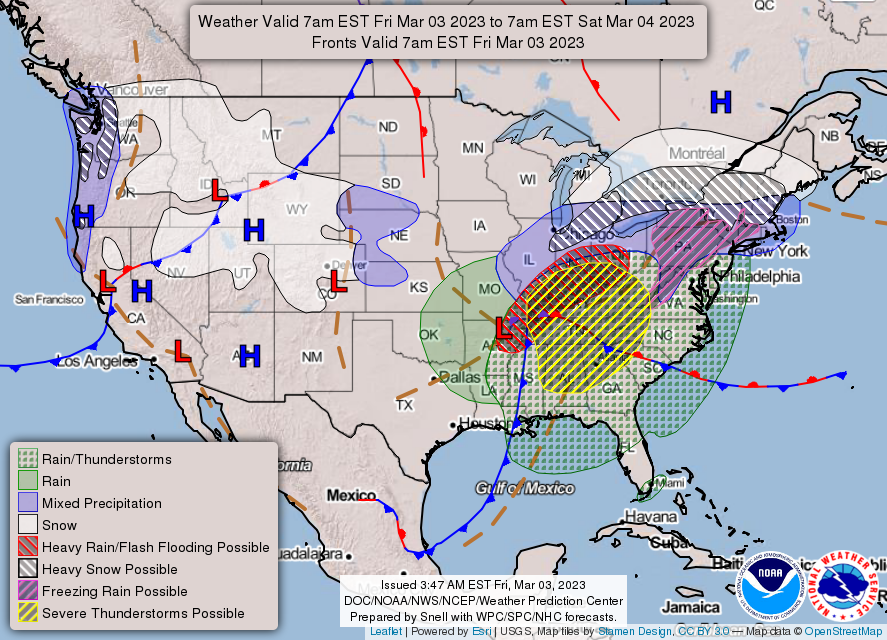

• NWS weather outlook: Deepening low-pressure system will produce a multitude of weather hazards across the eastern third of the country... ...Above-average temperatures return to eastern half of country this weekend, while the West remains cool and unsettled... ...Rain and additional heavy mountain snows to return to the West Coast on Saturday...

Items in Pro Farmer's First Thing Today include:

• Mostly firmer grain market tone this morning

• Markets refocusing on longer inflation battle

• Heatwave could trim India’s wheat crop

• PBOC will provide ‘forceful’ financial support for economy (details in China section)

• Still waiting for active cash cattle trade

• Hog futures’ premium to cash continues to narrow

|

RUSSIA/UKRAINE |

— U.N. Russian official warns of nuclear clashes. Speaking at a U.N. conference in Geneva on the subject of nuclear disarmament, Russian Deputy Foreign Minister Sergei Ryabkov warned that western support for Ukraine could lead to a nuclear conflict. Ryabkov blamed “the U.S. and NATO policy of fueling the conflict in Ukraine” and warned “increasing involvement in the military confrontation is fraught with a direct military clash of nuclear powers with catastrophic consequences.” That Russian President Vladimir Putin suspended Russian participation in the 2010 New START nuclear treaty was, Ryabkov stressed, a response to this involvement. Ryabkov did say that Russia would continue to respect caps on nuclear weapons under the treaty. Ryabkov also said that Russia would be forced to respond if the U.S. conducted nuclear tests, adding “No one should have dangerous illusions that the global strategic parity could be destroyed.”

— U.S. to announce new military aid package for Ukraine. The United States today will announce a new military aid package for Ukraine, worth roughly $400 million and comprised mainly of ammunition.

— U.S. to focus on making sanctions on Russia more effective. “The coming year will be about ensuring that our sanctions architecture is fully enforced and effective — in particular, by figuring out and cracking down on the ways Russia evades sanctions.” — Elizabeth Rosenberg, assistant Treasury secretary for terrorist financing and financial crimes, speaking to the Association of Women in International Trade.

— Oleg Deripaska, the Russian oligarch, warned that his country could run out of money next year (link). Meanwhile, Vladimir Putin is relying on a former Morgan Stanley banker to navigate energy sanctions (link).

— Funding for Ukraine grain storage and infrastructure. USAID said it will partner with the Grain Alliance, Kernel, and Nibulon to invest $44 million in storage and infrastructure for Ukraine’s agriculture sector, increasing its grain shipping capacity by more than 3 million tons annually. Link for details.

|

POLICY UPDATE |

— The clock is ticking on details re: how GOP House leaders will balance budget in 10 years. Says one veteran Washington observer: “I think the House budget proposal will be a wild one that I doubt will pass the House. How do you balance the budget in 10 years taking defense, SS, and Medicare off the table? Slash the heck out of everything else. It won’t go anywhere beyond the House if it passes, but it will sure embarrass Republicans.”

— Securities and Exchange Commission Chair Gary Gensler said he is open to changes to a set of proposed rules by the agency that would overhaul Wall Street trading regulations and practices to help individual investors receive more competitive services from brokerages. Gensler noted that while investment firms and institutions have provided ample feedback, the agency would also like to hear from individual investors, noting that the SEC's "client is the American public." Link to more via Bloomberg.

— Sometimes centrist Sen. Joe Manchin (D-W.Va.) urged his fellow Democrats to discuss spending cuts with the GOP ahead of a debt-ceiling deadline. Manchin said in a speech on the Senate floor that he wanted a short-term deal to bring down spending this year as well as a longer-term plan to tackle future fiscal challenges. The speech put him at odds with the White House and most Democrats, who have rejected Republicans’ demands for spending reductions as part of debt-ceiling talks. Said Manchin: “My Democratic friends don’t want to say a word about our out-of-control spending and are outright refusing to even talk to Republicans about reasonable and responsible reforms.”

|

PERSONNEL |

— Senate Finance Committee advanced the nomination of Danny Werfel as commissioner of the Internal Revenue Service. Werfel is likely on track for confirmation by the full Senate after receiving votes from three Republican committee members: Chuck Grassley (Iowa,), Todd Young (Ind.) and Bill Cassidy (La.)

|

CHINA UPDATE |

— U.S. officials are preparing a big sanctions push against Beijing if China starts supplying lethal weapons to Russia. Meanwhile, Politico reports that European Commission President Ursula von der Leyen is crossing the Atlantic next week to meet President Joe Biden and Canadian Prime Minister Justin Trudeau to discuss topics such as critical raw materials to Biden’s Inflation Reduction Act and the specter of Chinese arms supplies to Russia.

Meanwhile, the Biden administration put 28 Chinese groups on a trade blacklist for allegedly breaching U.S. sanctions by sending technology for nuclear and missile programs to third countries or procuring banned products for China’s military.

— PBOC will provide ‘forceful’ financial support for economy. China’s central bank will adjust monetary policy in a timely and appropriate manner. Cutting banks’ reserve requirements to release long-term liquidity will still be an effective tool to support the economy, top bank officials said. “PBOC will provide ‘forceful’ financial support for the stable and healthy development of the economy,’ People’s Bank of China Governor Yi Gang. China will not resort to “flood-like” stimulus. China also will step up international macro policy communication and coordination, Yi said.

— The annual meeting of China’s National People’s Congress, the rubber-stamp legislature, kicks off on Sunday and is set to confirm sweeping changes to the ranks of top government officials. Also high on the agenda: a host of new policy announcements and a new economic growth target for 2023.

Who’s in and who’s out? Here’s how a New York Times item answers that query: “Out are some prominent internet entrepreneurs who were once regulars — including Pony Ma, the founder of Tencent, China’s most valuable listed company. In their place: executives from the industries Xi wants to double down on, like semiconductors, electric vehicles, and artificial intelligence (including a chip expert who recently suggested ways to get around punishing U.S. sanctions targeting the sector.)”

Of note: The military budget will be announced against a backdrop of growing tensions over the future of Taiwan.

China could set a GDP growth target as high as 6% for 2023, Reuters reported on Thursday (link). That would be higher than the 2022 target of “around 5%.” And it would be double the dismal growth rate of 3% actually achieved in 2022 — the second lowest since 1976.

— China wants Canada to prevent ‘rumors’ after interference allegations. Chinese Foreign Minister Qin Gang has denied allegations that Beijing tried to interfere in Canada’s elections, and urged Ottawa to “take measures” to prevent “rumors” from disrupting bilateral ties. During a meeting with his Canadian counterpart Melanie Joly on the sidelines of the G20 foreign ministers’ gathering in New Delhi on Thursday, Qin also said Ottawa should help steer bilateral ties away from media “hype,” according to state news agency Xinhua. Canadian broadcaster Global News and the Globe and Mail newspaper have reported that Canadian Prime Minister Justin Trudeau was aware of secret intelligence briefings about alleged China’s influence activities, including spreading misinformation, getting certain Beijing-preferred candidates elected to parliament. Trudeau has acknowledged that there were interference attempts by China, but has insisted the outcomes of the votes were not altered.

|

ENERGY & CLIMATE CHANGE |

— House Oversight panel to hold March 8 hearing on SPR release. President Joe Biden’s decision to release a record 180 million barrels of oil from the nation’s emergency reserve will be the subject of a March 8 House Oversight and Accountability Committee hearing. The Subcommittee on Economic Growth, Energy Policy, and Regulatory Affairs will hold hearing on the administration’s “depletion” of the reserve and “investigate the policy decisions responsible for energy price spikes and supply shortages,” according to the panel’s statement.

— Iowa governor seeks Biden meeting on ethanol. Iowa Gov. Kim Reynolds (R) is requesting a meeting with Biden to make the case that the U.S. should expedite a plan to boost ethanol gasoline sales in a few months, instead of the planned effective date in April 2024.

— Resolution to EV tax credit rift coming soon. Energy Secretary Jennifer Granholm said she sees a resolution coming “within a short period of time” to complaints from the European Union and the U.K. over the U.S.’ domestic requirements for electric vehicle subsidies. Granholm said the administration was working on how to uphold the intent of the electric vehicle tax credit in the climate-and-tax law (IRA) without alienating U.S. allies.

|

LIVESTOCK, FOOD & BEVERAGE INDUSTRY |

— Vaccine makers are preparing for bird flu. Although most experts say bird flu is not an immediate threat to humans, efforts are underway to produce vaccines for H5N1 or another potential pandemic virus. Link for a background item on this topic. Bottom line: “It’s a really dangerous time to be a bird,” Andrew Pavia, chief of the division of pediatric infectious diseases at the University of Utah, says. “But as of today, the risk to humans remains very low. Our concern is what’s going to happen as it circulates more and more.”

— Taiwan imports 50,000 chickens as supermarkets impose rationing to crack severe egg shortage. Some 50,000 breeder chickens arrived on the island this week as part of government efforts to boost supply, Taiwan’s Council of Agriculture says. Carrefour and PX Mart supermarket chains are restricting the number of eggs customers can buy to prevent hoarding or panic buying. The new birds will help farmers “accelerate the phase-out of low-yielding hens”, the government-run Central News Agency said. Countries from Japan and South Korea to Britain and parts of the U.S. have also run short of eggs this year or watched prices surge, with bird flu the chief culprit.

— EPA commits to deadline for slaughterhouse wastewater rules. The Biden administration agreed to deadlines for EPA to update wastewater control standards for slaughterhouses, pleasing environmentalists who sued the agency for failing to address water pollution from poultry, pork and beef processing plants. Published this week in the Federal Register, the consent decree requires EPA to sign a notice of proposed rulemaking to revise the effluent limitation guidelines (ELG) by Dec. 13, 2023, and to take final action by Aug. 31, 2025. The announcement is the result of a 2019 lawsuit brought by the Environmental Integrity Group (EIG) and nine other environmental groups, who challenged EPA’s refusal to update the ELGs for direct discharges of wastewater from slaughterhouses.

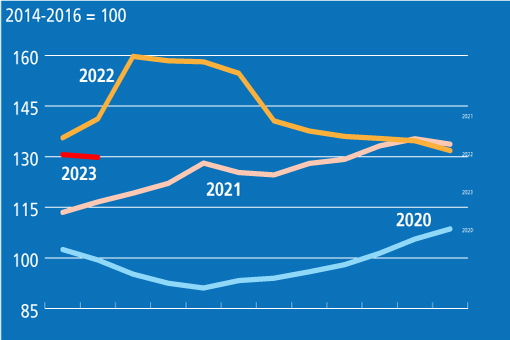

— FAO food price index drops again in February. The U.N. Food and Agriculture Organization (FAO) global food price index (link) dropped for the 11th straight month in February and was 18.7% below the March 2022 peak. The February decline was driven by a significant drop in the price of vegoils and dairy, along with small reductions in cereal grains and meat, which more than offset a steep rise in the price of sugar. Compared to year-ago, prices were up 1.4% for cereal grains and 13.1% for sugar, while they declined 1.7% for meat, 7.2% for dairy and 32.6% for vegoils.

|

HEALTH UPDATE |

— Summary:

- Global Covid-19 cases at 675,758,241 with 6,875,696 deaths.

- U.S. case count is at 103,584,626 with 1,121,667 deaths.

- Johns Hopkins University Coronavirus Resource Center says there have been 667,124,744 doses administered, 269,459,752 have received at least one vaccine, or 81.79% of the U.S. population.

— FDA reportedly rejected efforts by Elon Musk’s Neuralink to do human tests. The agency cited safety concerns in denying the start-up’s application to begin embedding its chips in the brains of paralyzed and blind patients to help them walk and see, according to Reuters (link). Some insiders are said to be skeptical that the company will ever win permission to start clinical trials.

— Health insurers are fighting a Biden administration proposal they say could cut payments for some private Medicare plans. In a continuing effort that included a Super Bowl ad, insurers and their allies argue that the administration plans a payment cut next year for the popular health plans, which are known as Medicare Advantage. Federal health officials counter that the plans would see an overall increase in payments next year under the proposal. Link for more via the WSJ.

|

POLITICS & ELECTIONS |

— What it will take to be the GOP presidential nominee. Compelling speeches and slick advertising won't be sufficient to win the 2024 Republican nomination. As Amy Walter of the Cook Political Report writes, strategic targeting of delegates will be what makes or breaks a campaign.

— Money still rules in election campaigns. Spending during the 2022 midterms surged to nearly $9 billion.

Average amount raised by Senate contestants was $13.5 million per general election candidate, up from $10.8 million (inflation-adjusted) in 2018. Many of the costliest Senate races were the most competitive. The Georgia Senate race was the costliest, at over $400 million.

House races were a bit less expensive in 2022 than 2018, with general election candidates raising $1.8 million, vs. $1.9 million in 2018.

Upshot: In most cases, the winning candidate also spends the most money: Around 94% of winning House candidates and 88% of winning Senate candidates spent more money than their opponents during the 2022 midterm cycle.

— A top-ten hit? Donald Trump and a group of people incarcerated for their alleged involvement in the Jan. 6, 2021, riot have collaborated on a song, proceeds from which are slated to benefit the families of those imprisoned for their alleged roles in the Capitol attack. Link for details.

|

CONGRESS |

— Sen. Dianne Feinstein hospitalized with shingles. Feinstein (D-Calif.), the oldest member of the Senate, has been admitted to a California hospital after contracting shingles. In a statement released to media Thursday, the 89-year-old Senator said she will hopefully recover and go back to work later this month. “I was diagnosed over the February recess with a case of the shingles,” Feinstein said. “I have been hospitalized and am receiving treatment in San Francisco and expect to make a full recovery. I hope to return to the Senate later this month.” Shingles, also called herpes zoster, is a disease that triggers a painful skin rash, according to the National Institute of Health. It is caused by the same virus as chickenpox, the varicella-zoster virus.

— Biden to Congress: Give me $1.6 billion to target pandemic fraud. The Biden administration asked Congress to agree to pay more than $1.6 billion to help clean up the mess of fraud against the massive government coronavirus pandemic relief programs. The administration called for money and more time to prosecute cases, to put into place new ways to prevent identity theft and to help people whose identities were stolen. On a call with reporters, White House American Rescue Plan coordinator Gene Sperling had hope that Congress... would see the spending as an investment. “It’s just so clear and the evidence is so strong that a dollar smartly spent here will return to the taxpayers, or save, at least $10,” Sperling said, pointing to recoveries that have already happened.”

— FY 2024 appropriations watch. Senate Appropriations Chair Patty Murray (D-Wash.) and ranking member Sen. Susan Collins (R-Maine) are planning to start spending bill markups in May. During Thursday’s meeting with their colleagues on the committee they also said they’re working on developing a topline spending target for the fiscal year (FY) 2024 spending measures that can then be used to write the dozen bills.

— Biden reverses course and says he’ll sign Republican D.C. crime bill. President Biden said he will now signal Republican legislation barring the government in Washington, D.C., from making changes to its own criminal code, reversing his earlier position in a move that has angered statehood advocates and others in the heavily Democratic city. According to an NBC News item, “Make no mistake: With Biden focused squarely on 2024, this was a political move. Just think of the attacks he might have faced – ‘Joe Biden supports lowering the penalty for carjackings’ – had he supported the D.C. bill, even though the sentencing revisions are complex and nuanced. Yet this was also the leader of the Democratic Party picking a side after three years of ‘defund the police,’ cash-bail reforms and debates about whether progressive prosecutors have struck the right balance on crime and punishment.

— The House ethics committee will investigate Representative George Santos. The inquiry into the embattled New York Republican will examine possible violations of rules governing campaign finance and conflicts of interest, as well as an accusation of sexual misconduct raised by a prospective congressional aide. It’s an escalation of bipartisan pressure on Santos, who has faced calls to resign following allegations that he fabricated much of his life story.

— Rep. Alexandria Ocasio-Cortez is under scrutiny by the House Ethics Committee for her participation in the Met Gala. The House Ethics Committee on Thursday released a report by the Office of Congressional Ethics that said the New York Democrat ran afoul of congressional rules, after she was slow to reimburse vendors for clothing and other expenses tied to her participation in the 2021 Met Gala.

|

OTHER ITEMS OF NOTE |

— Cotton AWP rises. The Adjusted World Price (AWP) for cotton rose to 72.73 cents per pound, effective today (Mar. 3), up from 70.78 cents per pound which was the lowest AWP since it was 65.46 cents per pound for the week of Nov. 4, 2022.

— Early bloom for D.C.’s cherry blossoms. Washington’s 3,700 cherry blossom trees are forecast to reach peak bloom this year from March 22 to 25. That’s several days earlier than observers and experts had expected. The early bloom, by itself, isn’t a huge problem, unless the temperatures drop suddenly again now that the blossoms are emerging.

— Whiskey fungus pits locals against Jack Daniel’s. A soot-like whiskey fungus is spreading in Tennessee and causing a rift between residents and famed whiskey-maker Jack Daniel’s. The fungus, named Baudoinia compniacensis after a distiller who first made note of it in the 1870s, feeds off of ethanol vapors released during the whiskey aging process. For months, residents of a rural Tennessee county where Jack Daniel’s has six barrelhouses (and plans to build up to 20) have complained that the fungus coats basically all outdoor surfaces, including trees, house siding, and patio furniture. Link for details.

|

KEY LINKS |

WASDE | Crop Production | USDA weekly reports | Crop Progress | Food prices | Farm income | Export Sales weekly | ERP dashboard | California phase-out of gas-powered vehicles | RFS | IRA: Biofuels | IRA: Ag | Student loan forgiveness | Russia/Ukraine war, lessons learned | Russia/Ukraine war timeline | Election predictions: Split-ticket | Congress to-do list | SCOTUS on WOTUS | SCOTUS on Prop 12 | New farm bill primer | China outlook | Omnibus spending package | Gov’t payments to farmers by program | Farmer working capital | USDA ag outlook forum |