GOP Leaders Make Last-Minute Changes to Debt-Limit Bill, Including Biofuel Provisions

China leader Xi calls Ukraine’s president | Russia again comments on Black Sea grain pact

|

In Today’s Digital Newspaper |

The U.S is amid a "freight recession," meaning there's fewer trucks delivering goods around the country. The American Trucking Association's for-hire contract truck tonnage index dropped to its lowest level since August 2021, and domestic demand for diesel is down 8.4% since last year. The New York Fed's Recession Probabilities Model puts the odds of a downturn at 57%, the highest mark since 1982. Details below, along with a report that box sales signal a weakening economy.

Diesel fuel prices in the U.S. have plunged in recent months and are about half of what they were one year ago.

The European Union agreed to set binding targets for airlines in Europe to increase their use of sustainable aviation fuels, to kickstart a market for green fuels and cut the aviation sector's carbon footprint. Details in Energy & Climate Change section.

Iowa-based Summit Carbon Solutions said it struck deals to sell carbon-removal credits via a project to build a pipeline to remove carbon from ethanol production in the Midwest.

Russia’s foreign minister, Sergey V. Lavrov, added to the uncertainty facing the soon-to-expire Black Sea grain deal, saying on Tuesday that the initiative had failed to deliver any benefits for his country, referring to it as in “deadlock.” More in Russia/Ukraine section.

China's Xi calls Zelenskyy, in first contact since Putin launched war on Ukraine.

Microsoft’s video-game bet suffers a huge blow. Britain’s mergers regulator today blocked Microsoft’s $69 billion takeover bid for Activision Blizzard, ruling that buying the maker of “Call of Duty” would give the tech giant too much control of the thriving market for cloud-based video games. Microsoft pledged to plow ahead, with its president, Brad Smith, saying that the company would appeal. “This decision appears to reflect a flawed understanding of this market and the way the relevant cloud technology actually works,” he said in a statement. the European Commission is expected to rule on the takeover by May 22. Microsoft had previously set a deadline of July 18 to close the deal, though it could seek to push that back pending the appeal.

Consumers remained willing to pay more for burgers, soda, diapers and other everyday items in the beginning of the year, lifting sales of companies including McDonald’s, PepsiCo and Kimberly-Clark. Some executives have expressed caution about consumers’ endurance as the labor market softens and the threat of a recession looms. More in Food section.

The U.S. and South Korea reach a nuclear accord. Ahead of a meeting between South Korean President Yoon Suk Yeol and President Biden at the White House today, the U.S. agreed to give Seoul a long-sought place at the table on the potential use of U.S. nuclear forces to defend the country from a North Korean attack, U.S. officials said. In return, South Korea would restate its commitment not to develop its own nuclear arsenal.

Midwest cities led the WSJ/Realtor.com Emerging Housing Markets Index in the first quarter.

Small cities in the Midwest topped the index, a sign that buyer demand for affordable homes remains robust even as activity in the broader market slows. Lafayette, Ind., led the index for the second consecutive quarter, and two other Indiana cities — Elkhart and Fort Wayne — stayed in the top five, joined by Bloomington, Ill., and Lebanon, Pa. Link for details.

A proposed bill would require the Supreme Court to create a code of conduct.

Following media reports that raise questions about whether Justices Clarence Thomas and Neil Gorsuch properly disclosed their financial activities, two senators will propose bipartisan legislation today that would require the high court to create its own code of conduct within a year. Democrats have introduced similar proposals, but sponsors of the new bill say their approach is more targeted and has bipartisan support, unlike the earlier bills, giving it a greater chance of passage.

On the regulatory front, USDA unveils plan to declare salmonella contaminant in some uncooked chicken products. Details in Food section.

On the trade policy front, Canada warns on ‘Product of USA’ regulation.

|

MARKET FOCUS |

Equities today: Global stock markets were mixed to weaker overnight. The Dow opened up around 35 points higher. In Asia, Japan -0.7%. Hong Kong +0.7%. China flat. India +0.3%. In Europe, at midday, London -0.3%. Paris -0.9%. Frankfurt -0.6%.

Microsoft and Google parent Alphabet rose in premarket trading after posting earnings that topped projections. Microsoft’s results showed resilient corporate cloud-computing demand, and the company gave an upbeat outlook for AI services. Of note this morning: U.K. regulators blocked Microsoft’s $75 billion deal for video game company Activision Blizzard. Meanwhile, Alphabet added to optimism on the sector, with its cloud unit turning a profit for the first time.

Midsized U.S. banks rallied in premarket after PacWest Bancorp said deposits stabilized toward the end of March and “rebounded nicely” in April, easing worries over the lender’s health after earlier banking turmoil. First Republic Bank also paced gains, after yesterday’s sharp slump fueled by its worse-than-forecast drop in deposits. The lender is considering divesting $50 billion to $100 billion of assets, to reduce the mismatch between its assets and liabilities, Bloomberg reports, citing people familiar with the matter.

U.S. equities yesterday: The Dow was down 344.57 points, -1.02%, at 33,530.83. The S&P 500 slid 65.41 points, -1.58% at 4,071.63. The Nasdaq dropped 238.05 points, -1.98% at 11,799.16. The S&P 500 and the Dow declines marked the largest single-day declines for both indexes since March 22. The Nasdaq Composite saw its biggest decline since March 9.

Agriculture markets yesterday:

- Corn: July corn futures rose 1/4 cent to $6.07 3/4 and nearer the session high.

- Soy complex: May soybeans fell 20 cents to $14.45 1/4, the lowest close since March 27, while May meal ended $4.70 lower at $434.80. May soyoil closed 85 points lower at 51.71 cents.

- Wheat: July SRW wheat fell 4 cents to $6.53, near mid-range and hit a 22-month low. July HRW wheat fell 14 1/2 cents to $8.03, nearer the session low, and hit a four-week low. July HRS wheat closed 4 1/4 cents lower at $8.36 1/2.

- Cotton: July cotton fell 207 points to 78.62 cents, the lowest close since March 24.

- Cattle: June live cattle futures saw losses of 52.5 cents before closing at $164.025. Expiring April live cattle futures closed unchanged at $174.30 on the day. May feeder futures closed $1.325 lower at $209.425 while expiring April futures closed 47.5 cents lower at $202.075.

- Hogs: June lean hog futures slid 30 cents to $87.05 Tuesday, with the low-range close implying continued struggles for the hog and pork complex.

Ag markets today: Corn and soybeans posted mild corrective gains overnight, while wheat traded on both sides of unchanged. As of 7:30 a.m. ET, corn futures were trading fractionally to 4 cents higher, soybeans were 1 to 3 cents higher, SRW wheat was around 2 cents higher, HRW wheat was steady to fractionally higher and HRS wheat was steady to a penny lower. Front-month crude oil futures were modestly weaker, while the U.S. dollar index was more than 500 points lower.

Market quotes of note:

- Strong demand for workers in the eurozone could boost consumption and support economic growth in the region even as bank lending slows, RBC Capital Markets analysts say in a note. "There is a possibility that structurally tight labor markets could help to support consumption, and hence GDP even as lending slows." The eurozone is likely to avoid a severe downturn as there is little sign of softening in the labor market, they say. However, RBC revised down its 2024 growth forecast for the eurozone to 0.3%, reflecting the impact of tighter credit conditions.

- Box sales signal weakening economy. "The shift of consumer buying preferences, more towards service-oriented spending, persistent inflation and higher interest rates continued to negatively impact consumers' purchases of both durable and non-durable goods," said Thomas Hassfurther, an executive VP at Packaging Corporation of America. The packager reported weaker-than-expected results on Tuesday, sending its share price down 7%. Meanwhile, United Parcel Service (UPS) chief executive Carol Tomé told analysts, "We saw a shift in consumer spending. Disposable income is shifting away from goods to services."

- Widespread breaches of the Group of Seven oil price cap likely took place in Asia in the first quarter, according to researchers who analyzed official data on Russia’s foreign trade alongside shipping information. Link to more via Bloomberg.

- U.S. builders are benefiting from the low level of previously owned homes on the market. Sales of new single‐family houses rose to an annual pace of 683,000 in March, the highest level in a year, the Commerce Department said Tuesday. "The extremely tight supply of existing homes has prospective buyers turning toward new homes instead," said Mark Palim, deputy chief economist at Fannie Mae.

On tap today:

• U.S. durable goods orders for March are expected to rise 0.5% from the prior month. (8:30 a.m. ET) UPDATE: U.S. durable goods orders rise more than forecast. New orders for U.S. manufactured durable goods rose by 3.2% in March, recovering from a revised 1.2% decline in February and easily beating market expectations of 0.7% growth. Demand for transportation equipment led the increase after two consecutive monthly falls, boosted by orders for both civilian and defense aircraft.

• U.S. advance economic indicators for March are out at 8:30 a.m. ET.

• WSJ Live Q&A: Ahead of the Federal Reserve’s May meeting, WSJ chief economics correspondent Nick Timiraos and lead markets writer Gunjan Banerji sit down with finance editor Charles Forelle to discuss the impact the Fed’s actions could have on financial markets. 1 p.m. ET.

• President Biden holds joint press conference at 12:30 pm ET with South Korean President Yoon, and then hosts a state dinner for him in the evening.

The Federal Reserve will release an internal review of its supervision of the failed Silicon Valley Bank on Friday at 11 a.m. ET. The review will include policy recommendations and confidential supervisory information that normally isn’t disclosed.

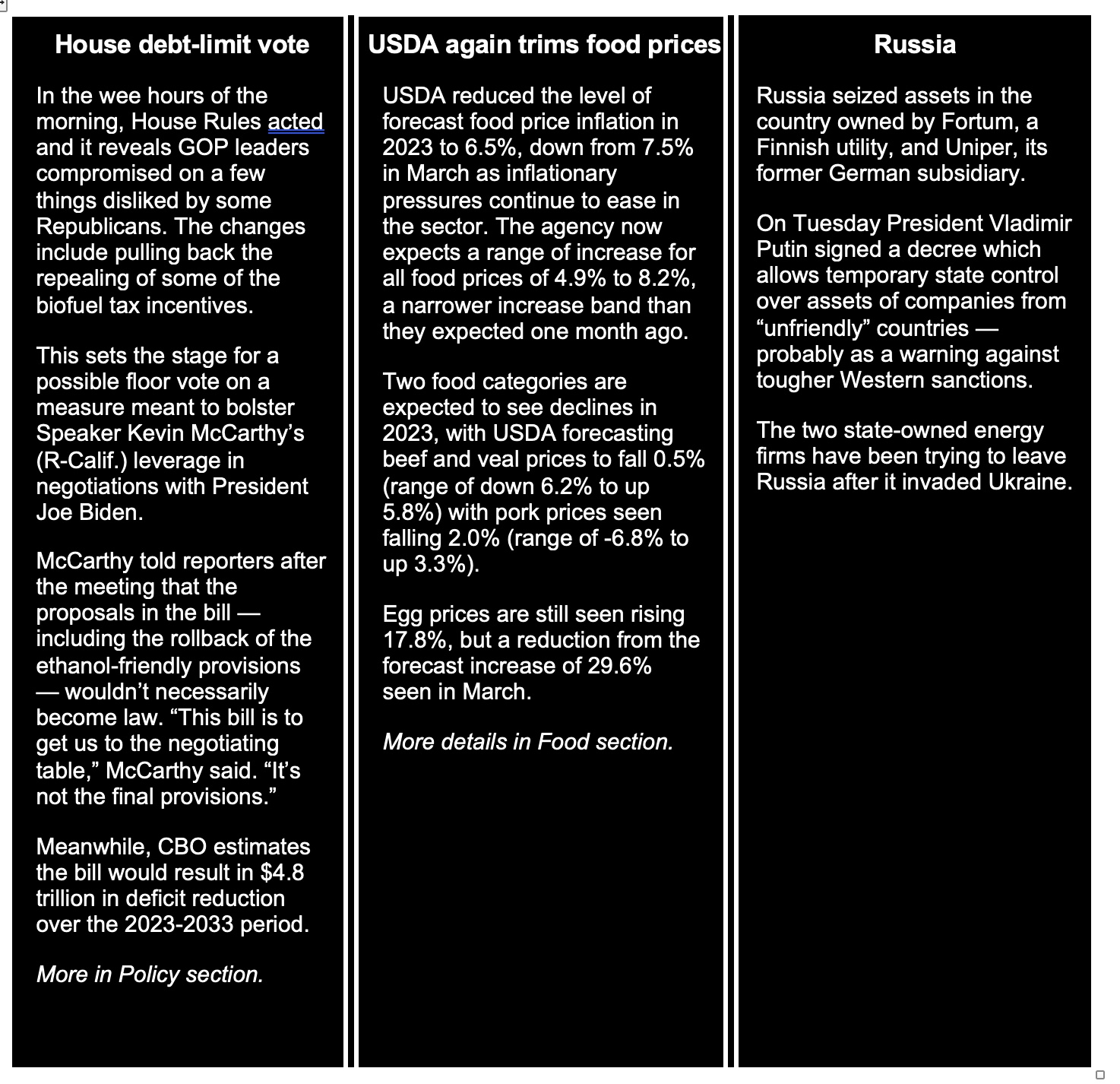

Home prices rise for first time since June. Home prices rose in February from the prior month, snapping a seven-month streak of declines, as buyers competed for a limited number of homes for sale. The S&P CoreLogic Case-Shiller National Home Price Index, which measures home prices across the nation, rose 0.2% in February compared with January on a seasonally adjusted basis. After rising to 20-year highs last fall, mortgage rates declined in December and early this year, bringing some home buyers back into the market. The inventory of homes for sale also remained unusually low, keeping the market competitive in some parts of the country, the Wall Street Journal reports (link).

Mortgage applications in the U.S. rose 3.7% in the week ended April 21, 2023, rebounding from an 8.8% fall in the previous week, Mortgage Bankers Association data showed. The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($726,200 or less) jumped by 12bps to 6.55%, following a 13bps increase in the previous period. Applications to purchase a home rose 4.6% and those to refinance a home loan went up 1.7%. “Although incoming data points to a slowdown in the U.S. economy, markets continue to expect that the Fed will raise short-term rates at its next meeting, which have pushed Treasury yields somewhat higher,” wrote Joel Kan, MBA’s deputy chief economist. “As a result of the higher yields, mortgage rates increased for the second straight week to their highest level in over a month.

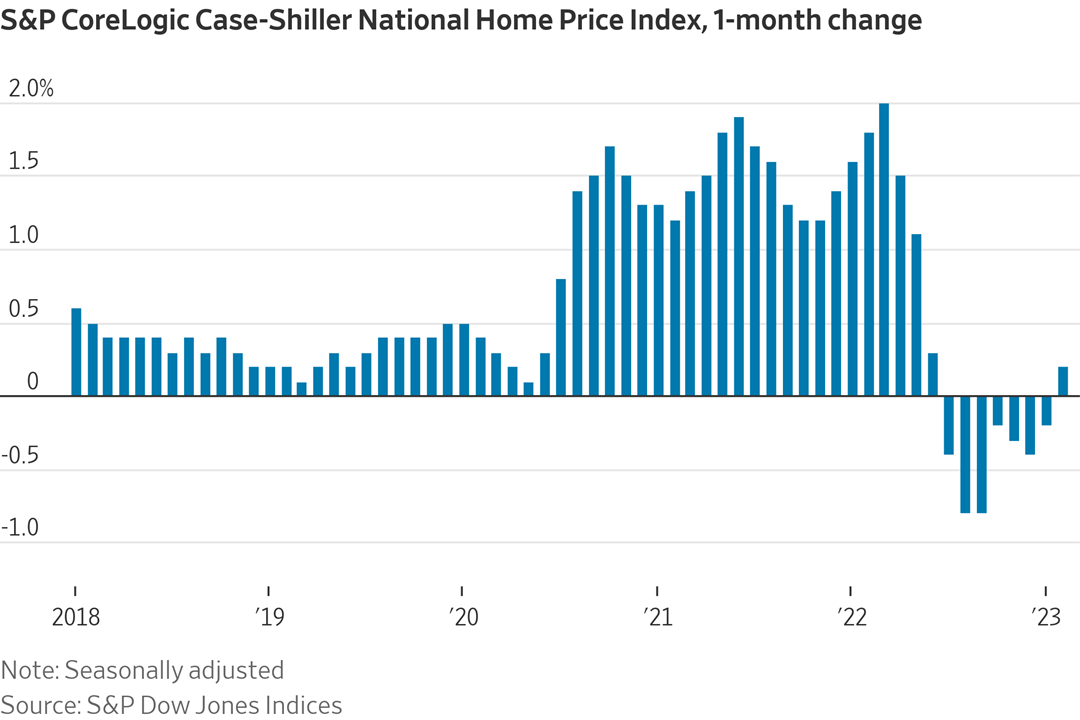

Higher prices are pinching consumer budgets, prompting many to walk away or trade down on high-priced goods and services. "As inflation continues to grow at an elevated rate for services, consumers are pulling back on spending on most services categories. Spending declined substantially for education, restaurants and airfare, all of which have seen their annual inflation levels continue to grow and remain elevated from last year," Morning Consult economist Sofia Baig said in a new report (link) measuring U.S. consumer spending and inflation last month.

Market perspectives:

• Outside markets: The U.S. dollar index was weaker, with the euro, yen and British pound firmer against the greenback. The yield on the 10-year U.S. Treasury note was firmer, trading around 3.41%, with a mixed tone in global government bond yields. Crude oil shifted lower ahead of U.S. gov’t inventory data due later this morning, with U.S. crude around $76.70 per barrel and Brent around $80 per barrel. Gold and silver futures were edging higher, with gold around $2,005 per troy ounce and silver around $25.11 per troy ounce.

• Keystone XL rupture caused by pipeline fatigue. Canada’s TC Energy said that the 14,000-barrel oil spill that limited pipeline throughput into the U.S. because of a leak in rural Kansas was caused by progressive fatigue crack, raising hopes that things would get back to normal soon.

• The American Trucking Association's for-hire contract truck tonnage index dropped to its lowest level since August 2021, and domestic demand for diesel is down 8.4% since last year. JB Hunt reported a bad earnings miss, and executives said a recovery for trucking looks uncertain. "It's just a question of when and what position will we be in when our customers start ringing our phone again in ways that they have in the past," JB Hunt CEO John Roberts said.

• Diesel fuel prices in the U.S. have plunged in recent months and are about half of what they were one year ago. Such suggests a slowdown in the commercial transportation sector that could be a signal of a slowing U.S. economy.

• Iron ore traded below $100 a ton in Singapore for the first time since early December, highlighting a frail recovery for China’s commodities demand during what’s meant to be the busiest construction period of the year. The steelmaking material had surged from late last year on hopes that China’s post-Covid reopening, and government stimulus would fire up furnaces.

• Wheat farmers are calling for the Canadian government to allow outside workers to weigh and inspect grain at a Vancouver port as a massive strike by public sector workers threatens shipments. The protests could further tighten global supplies. Link for details.

• Link to StatsCanada’s seedings report. Link to table.

• Ag trade: Iraq tendered to buy a nominal 50,000 MT of wheat that can be sourced from the U.S., Australia or Canada.

• Weather woes: Temperatures surged to a record in Thailand this month, while hotter weather in India boosted electricity demand to an all-time high. China’s Yunnan province started power rationing, and Spain is bracing for a heat wave.

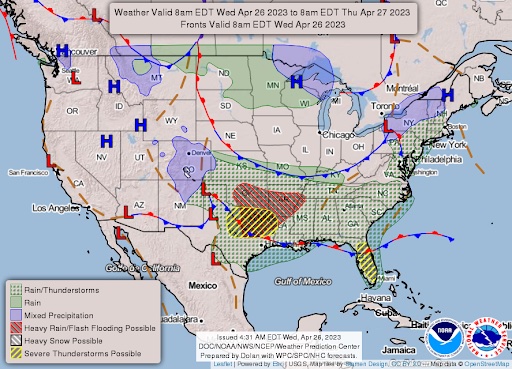

• NWS weather outlook: Heavy rain and severe weather expected to spread across portions of the Central/Southern Plains today; then across the lower Mississippi Valley and the central to eastern Gulf Coast on Thursday... ...Heavy wet snow over central Colorado is expected to taper off later today but more wet snow is expected by Thursday night... ...Below average temperatures for large portions of the nation to the east of the Rockies, while above average temperatures expand across the West... ...Elevated fire weather danger across the southern Rockies to southern \High Plains; slight risk of severe thunderstorms for central Florida today.

Items in Pro Farmer's First Thing Today include:

• Quiet grain trade overnight

• Indonesia to raise CPO reference price, keep export taxes unchanged

• Cold Storage data highlights supportive supply fundamentals for beef, struggles for pork

• Beef movement picks up

• Cash hog index ticks up

|

RUSSIA/UKRAINE |

— Lavrov: Grain deal gives nothing to Russia, adding to doubts that it will agree to an extension. Russia’s foreign minister, Sergey V. Lavrov, added to the uncertainty facing the soon-to-expire Black Sea grain deal, saying on Tuesday that the initiative had failed to deliver any benefits for his country, referring to it as in “deadlock.” Speaking at a news conference at the United Nations, Lavrov repeated complaints that Russia continued to face obstacles in selling its own grain and fertilizer because of Western sanctions on its financial transactions. “The grain deal rapidly went from a humanitarian initiative to a commercial initiative,” Lavrov said, asserting that only some of the grain Ukraine was exporting was reaching poor countries. In March, Russia refused to agree to another 120-day extension, limiting its current term to March 18.

Of note: António Guterres, the organization’s secretary general, is scheduled to travel to Washington today to meet with Secretary of State Antony Blinken and members of Congress, according to Stéphane Dujarric, a United Nations spokesman. Among the topics on the agenda are the war in Ukraine and the grain deal. “We are at a very delicate time in the renewal of the Black Sea initiative,” Dujarric said. He added that the United Nations was working to push forward a parallel part of the deal relating to Russia’s “ammonia pipeline” for selling fertilizers and grain, but said that several obstacles still remained.

Guterres gave Lavrov a letter to Russia’s president, Vladimir Putin, that laid out a new proposal for extending and expanding the deal. The United Nations added that the same letter had been sent to the other signatories to the deal, the presidents of Ukraine and Turkey. On Tuesday, Lavrov said Putin had not yet had a chance to review the letter and formulate a response.

— Poland will ban Ukrainian grain imports through year-end. Poland will keep in place a ban on imports of Ukrainian grains at least until the end of the year. A government official said the country “will not repeal” the ban until the European Commission works out a broader deal and the “situation stabilizes.”

— President Vladimir Putin signed a decree establishing temporary control of assets of two foreign energy firms, the Finnish energy group Fortum and its former German subsidiary Uniper, sowing confusion over the fate of other Western companies in the country. Moscow has reacted angrily to reports that Group of Seven nations are considering a near-total ban on exports to Russia. Link for details.

— China's Xi calls Zelenskyy, in first contact since Putin launched war on Ukraine. “I had a long and meaningful phone call with [Chinese] President Xi Jinping,” Zelenskyy tweeted. “I believe that this call, as well as the appointment of Ukraine’s ambassador to China, will give a powerful impetus to the development of our bilateral relations.” Zelenskyy’s spokesman Sergii Nikiforov said in a Facebook post the discussion lasted for almost an hour, adding that he would reveal details later.

|

POLICY UPDATE |

— House Rules Committee voted at 2:20 a.m. ET to send the altered GOP debt-limit measure to the floor for a final vote that could come as soon as today. The measure advanced to the floor with a last-minute amendment that appears to incorporate changes sought by some of the House GOP’s most conservative members, including Reps. Andy Biggs (R-Ariz.) and Matt Gaetz (R-Fla.). The new provisions include accelerating a plan to impose work requirements on those receiving federal benefits including food stamps and cutting more Inflation Reduction Act programs.

Of note to biofuel proponents, the revised bill would still repeal the tax credits on clean fuels, but would now include an exception to allow the tax perk to continue for those in binding contracts or locked into investments for sustainable aviation fuel or for producing other “clean” fuel before April 19. The amendment would also kill changes in the incentive structure for renewable diesel, second generation biofuel, carbon dioxide sequestration and biodiesel. When the House votes to clear the rule, the changes to the debt limit measure would be deemed as approved, without the need for a separate vote.

Rep. Kelly Armstrong (R-N.D.) also told reporters yesterday that he had tried to reassure Midwestern holdouts that the repeal of the biofuels credits probably wouldn’t be included in the 2023 Farm Bill.

Upshot: GOP leaders can afford to lose just four Republican votes, assuming no Democratic House member votes for the package. The House is scheduled to be in through Friday then break for a recess until mid-May. House Speaker Kevin McCarthy (R-Calif.) will be traveling over the weekend with a bipartisan delegation to Israel, where he’s scheduled to address the Knesset on Monday.

What’s next: Republicans remain confident that they’ll pass the measure by week’s end. If the House passes a debt ceiling bill, there will be big pressure on the Senate to pass. They need Republicans to do it. Hence there will have to be a bargain in the Senate. Even if McCarthy succeeds in getting the legislation passed, President Biden yesterday threatened to veto the measure if it makes it to his desk. The impasse increases the odds of an emergency measure to temporarily suspend the debt limit for a few weeks. The Biden administration could act unilaterally to avoid default and that is a constitutional one that U.S. credit cannot be doubted. But any such move would likely face court challenges.

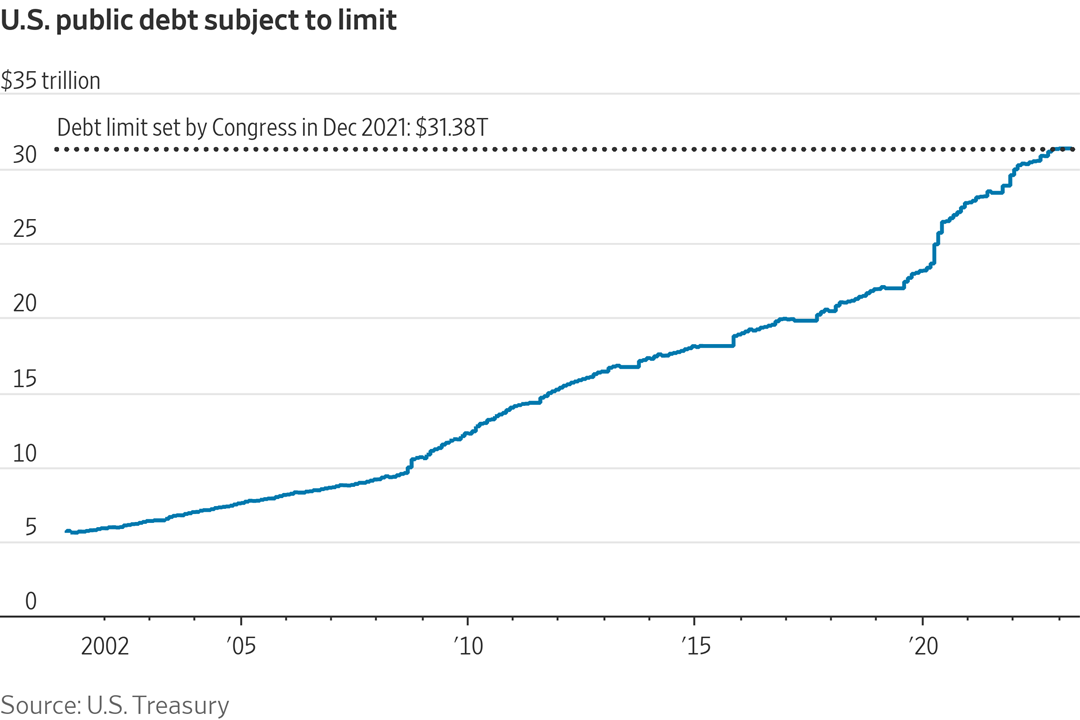

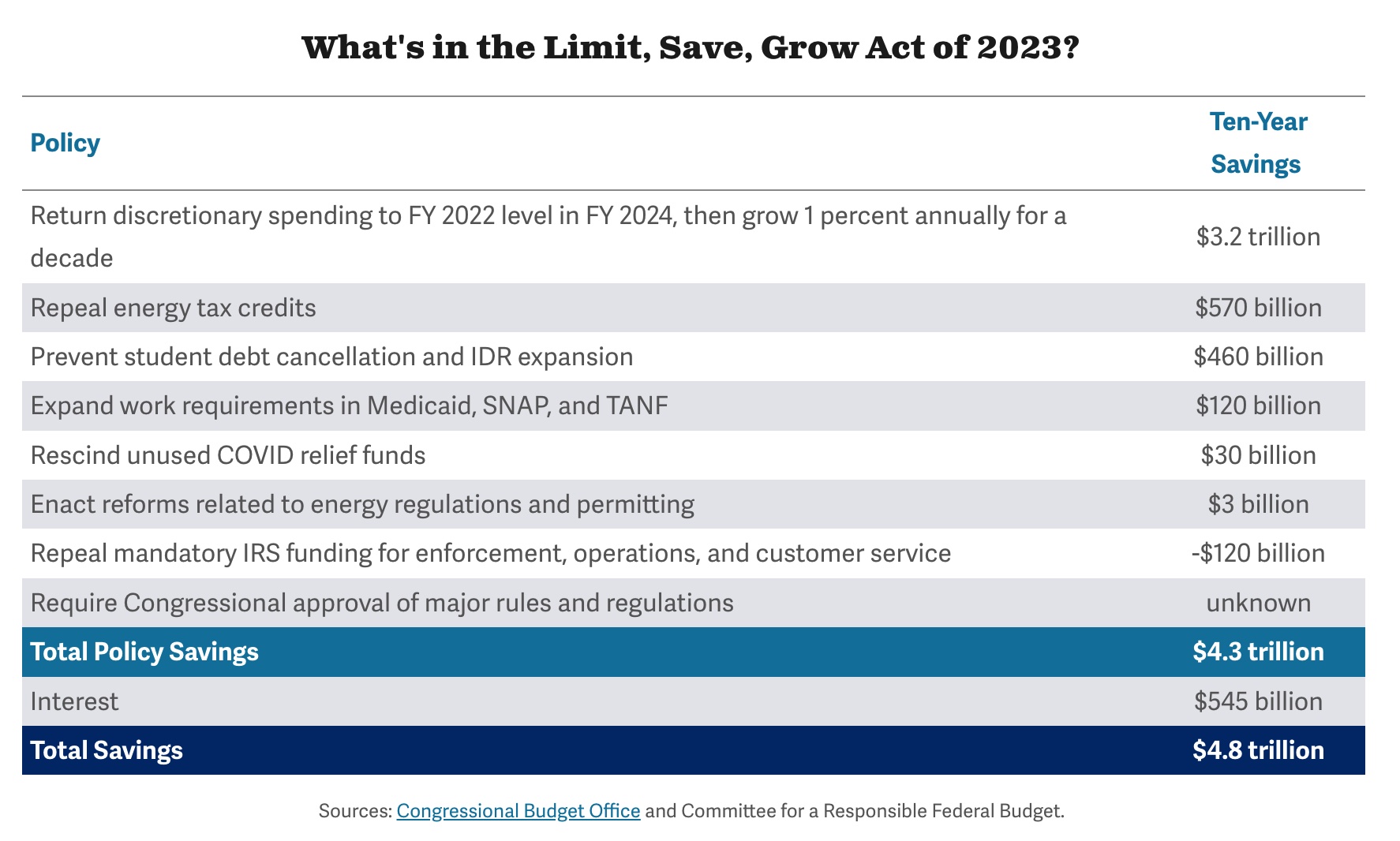

— CBO: House debt ceiling bill cuts deficits by $4.8 trillion over 10 years. The Congressional Budget Office (CBO) released its official score of House Republicans' Limit, Save, Grow Act of 2023 — a bill to address the debt ceiling and reduce federal spending. The bill would suspend the debt ceiling through either March 31, 2024, or a $1.5 trillion increase from the current $31.4 trillion ceiling — whichever comes first. CBO finds the bill would save $4.8 trillion through FY 2033, with about $4.3 trillion of policy savings and $545 billion of interest savings.

The measure would return total discretionary spending to the Fiscal Year (FY) 2022 level in FY 2024 and cap annual growth at 1% for a decade thereafter; rescind unspent Covid relief funds; repeal most of the Inflation Reduction Act's (IRA) energy and climate tax credit expansions; rescind the IRA's increased Internal Revenue Service (IRS) funding; make changes to energy, regulatory, and permitting policies; impose or expand work requirements in several federal safety net programs, including SNAP; and prevent implementation of President Biden's student debt cancellation and Income-Driven Repayment (IDR) expansion.

|

CHINA UPDATE |

— Some 87% of U.S. companies in China are pessimistic about the relationship between the two countries, an American Chamber of Commerce in China survey found. That’s 14 percentage points higher than the chamber’s previous poll as tensions escalate.

— China announced a third round of solar and wind energy projects as part of President Xi Jinping’s vision to boost the world’s largest renewable power fleet with vast developments across inland deserts and other unpopulated areas.

|

TRADE POLICY |

— Canada warns on ‘Product of USA’ regulation. Arun Alexander, Canada’s deputy ambassador in Washington, said Tuesday, “We are concerned about the real-world consequences” of changing the rules on the voluntary “Product of USA” label. In early March, the USDA proposed the label be restricted to meat, poultry and eggs that are born, raised, slaughtered and processed in the United States. Currently, foreign meat that is processed in U.S. plants can be labeled “Product of USA.” Alexander made his comments in remarks to the North American Agricultural Journalists.

Alexander said the integrated livestock market “is a real reflection of the value and importance of local and regional food systems.” With animals from both nations available to processors, plants can operate at full capacity, he said. “Small and medium-sized processors are the ones that can least afford to segregate products.”

Alexander said with the voluntary “Product of USA” label, “I think we have to look at the specific products to make sure we don’t disrupt those effective supply chains. And so we are willing to work together with the United States to implement measures that achieve the objective but also not disrupting those supply chains.”

Upshot: Canada “will participate in USDA’s consultation process” on the regulation, said Alexander. The public comment period on the proposal runs through June 11.

|

ENERGY & CLIMATE CHANGE |

— U.S. refiners flag E15 cost risks. According to a study funded by U.S. refiners, the government’s suggestion that some states retain year-round sales of 15% ethanol-containing gasoline would cost consumers up to $1 billion, translating into an extra 8-12 cents per U.S. gallon.

— Electric vehicle sales surpassed more than 10 million last year, a rise of 55% compared with 2021, with China accounting for about 60% of the market, according to an International Energy Agency report. The IEA estimates more than 26 million electric vehicles were on the road across the globe in 2022, a 60% increase compared with 2021.

— The European Union agreed to set binding targets for airlines in Europe to increase their use of sustainable aviation fuels, to kickstart a market for green fuels and cut the aviation sector's carbon footprint. Fuel suppliers must ensure that 2% of fuel made available at EU airports is SAF in 2025, rising to 6% in 2030, 20% in 2035 and gradually to 70% in 2050. From 2030, 1.2% of fuels must also be synthetic fuels, rising to 35% in 2050. Synthetic fuels are made using captured CO2 emissions, which proponents say balances out the CO2 released when the fuel is combusted in an engine. This week EU countries also approved sweeping changes to the region's carbon trading scheme and emissions laws. Link for details via Reuters.

— GM is pulling the plug on the Chevy Bolt. Sales of the Bolt, GM’s first EV and one of the cheapest on the market, are still robust, but its batteries are growing outdated, the company said.

— Summit Carbon Solutions cuts deals on carbon-removal credits. Iowa-based Summit Carbon Solutions said it struck deals to sell carbon-removal credits via a project to build a pipeline to remove carbon from ethanol production in the Midwest. The company said it would sell credits valued at up to $30 million to NexGen CDR Facility and to climate consultancy South Pole. Combined with two other deals announced by the company, Summit said they will equal one-quarter of all certified carbon removals to date.

Background. Summit is seeking to build a carbon pipeline across five Midwest states, and reports said the company has more than two-thirds of the landowner approvals it needs. However, it is still facing resistance from some landowners based on safety and property rights. Summit aims to have the pipeline operational in the first half 2025 with a goal of storing 18 million tons of emissions from ethanol plants and other carbon emissions.

— A United Nations-backed regulator is preparing to consider the world's first commercial deep-sea mining application to feed growing demand for minerals to fuel the energy transition, raising environmental fears, according to the Financial Times (link/paywall).

|

LIVESTOCK, FOOD & BEVERAGE INDUSTRY |

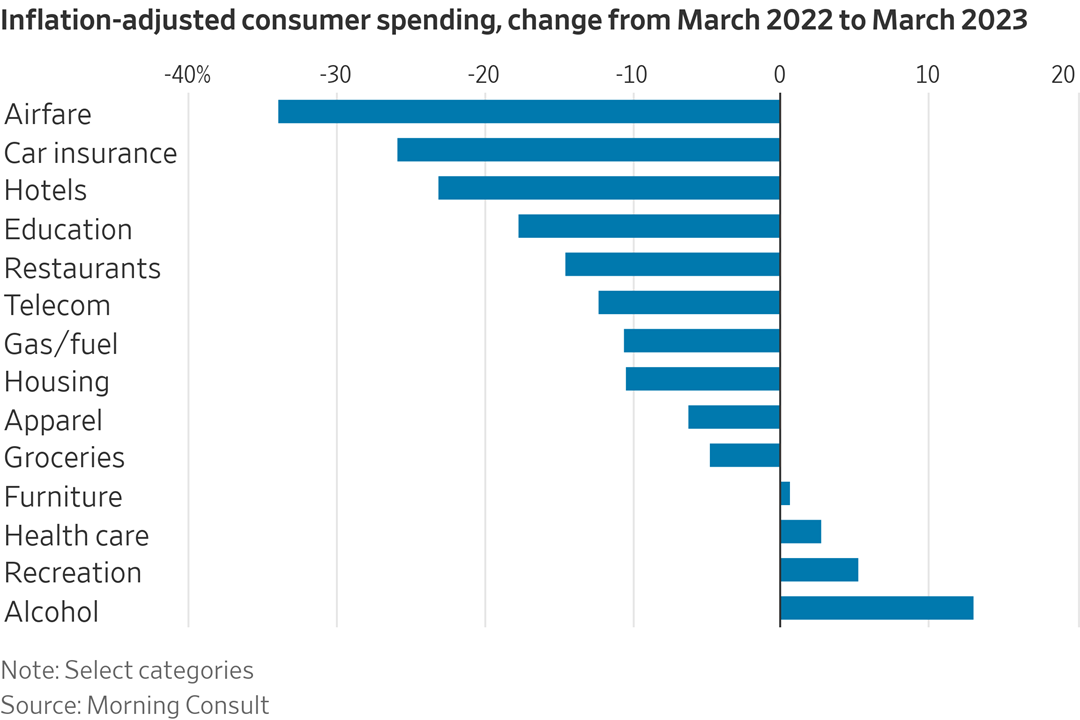

— USDA continues to lower food price outlook. USDA now forecasts food prices will rise 6.5% in 2023 (range of 4.9% to 8.2%), down from an expected 7.5% increase last month. The cut came mostly from a lower forecast for food-at-home (grocery store) prices, which are now expected to rise 6.6% (range of 4.4% to 8.8%), down from the 7.8% jump projected last month. USDA trimmed its food-away-from-home (restaurant) forecast to 8.2% (range of 7.3% to 9.0%), down from 8.3% last month.

USDA noted retail egg prices decreased 10.9% in March 2023 following a 6.7% decline in February but remained 36.0% above March 2022 prices. Egg prices are predicted to increase 17.8% in 2023, with a prediction range of 5.1% to 32.9%. The wide forecast range reflects volatility in retail prices caused by the outbreak of highly pathogenic avian influenza.

USDA forecasts prices are predicted to increase for other meats (5.9%), poultry (2.8%), dairy products (4.95), fats and oils (12.8%), processed fruits and vegetables (9.9%), sugar and sweets (10.1 %), cereals and bakery products (11.7%), nonalcoholic beverages (9.9%), and other foods (9.2%).

Beef and veal prices are forecast to decrease 0.5% in 2023 (range of -6.2% to 5.8%), with pork prices predicted to decrease 2.0% (range of -6.8% to 3.3%). Fresh fruits prices are now expected to decrease 0.5% this year (range of -4.3% to 3.7%.

At the farm level, USDA forecasts cattle prices will increase 13.8% (range of 2.5% to 27.2%) and egg prices will jump 24.4% (range of -18.3% to 111.3%), while milk prices will fall 23.9% (range of -37.0% to -6.0%). USDA projects wholesale prices will rise 3.6% for beef (range of -9.3% to 19.4%). Wholesale prices are expected to decline 4.8% for pork (range of -12.9% to 4.7%), 9.8% for poultry (range of -16.8% to -1.8%) and 5.9% for dairy (range of -12.5% to 1.5%).

— Consumers are still swallowing price hikes among household essentials. Nestlé, the world’s largest food company, raised average prices nearly 10% in the first quarter, approaching its fastest pace in 30 years, yet it sacrificed only a modest slice of sales volume.

— McDonald’s beat first-quarter earnings and sales estimates, but expects consumers to pull back in response to persistently high inflation. Comparable-store sales grew 12.6% because of strategic menu price increases and positive traffic growth, CEO Chris Kempczinski said. McDonald’s maintained its financial forecasts for fiscal 2023, but executives expect economic challenges to continue, with inflation expected to stay in the mid-to-high single digits and the potential for a recession in the U.S. and Europe.

— Cargill signals it will take months to shift cleaning at meat plants. The head of Cargill’s meat business said Tuesday that it will take the company several months to cut ties with Packers Sanitation Services Inc. (PSSI) in the wake of PSSI paying $1.5 million in penalties to the U.S. Department of Labor for employing more than 100 teenagers in dangerous jobs at meat packing plants. “We made the decision to terminate the agreements with PSSI,” Hans Kabat told Reuters in an interview. “It’s really important to understand that that will take time.”

Cargill notified PSSI in March it was ending the use of its services at the Dodge City, Kansas, plant and then ended all contracts with the firm. "It will be a while to get the remaining facilities out," Kabat said. "These are challenging issues, and we want to make sure that we understand fully how to manage that —g etting the plants cleaned, keeping people safe and still making sure that requirements around employment and age verification are all 100%."

Other meat packers such as JBS USA have also ended contracts with PSSI in the wake of the labor revelations.

— USDA unveils plan to declare salmonella contaminant in some uncooked chicken products. USDA’s Food Safety and Inspection Service (FSIS) proposed (link) a determination to declare Salmonella an adulterant in breaded stuffed raw chicken products when they exceed a very low level of Salmonella contamination. FSIS would consider any breaded stuffed raw chicken products that include a chicken component that tested positive for Salmonella at 1 colony forming unit (CFU) per gram prior to stuffing and breading to be adulterated.

FSIS is also proposing to carry out verification procedures, including sampling and testing of the chicken component of breaded stuffed raw chicken products prior to stuffing and breading, to ensure producing establishments control Salmonella in these products.

The National Chicken Council criticized the USDA move, saying the new requirements would cause economic harm to the industry and cited efforts already undertaken to reduce the illnesses linked to the chicken products that can appear to be pre-cooked even though they are not.

Consumer advocates welcomed the USDA action, saying that it will continue to reduce Salmonella illness rates. Once published in the Federal Register, there will be a 60-day comment period.

|

HEALTH UPDATE |

— Prescription drug prices. Sens. Bernie Sanders (I-Vt.) and Bill Cassidy (R-La.) said a bipartisan deal has been reached to advance legislation that will lower prescription drug prices and reform pharmacy benefit managers. The Senate Committee on Health, Education, Labor and Pensions will hold a markup on four bills on May 2.

|

POLITICS & ELECTIONS |

— Ex-White House doctor Ronny Jackson demands Biden take cognitive test or drop out of 2024 race. Rep. Ronny Jackson (R-Texas), who was a White House physician, is demanding that President Biden take a cognitive test or drop out of the 2024 race.

|

CONGRESS |

— The U.S. Supreme Court sees no need for a formal code of conduct, according to a statement signed by all nine justices. Chief Justice John Roberts refused a request to testify before a Senate committee. Sens. Angus King (I-Maine) and Lisa Murkowski (R-Alaska) will introduce legislation requiring the court to create its own code of conduct within a year, the Wall Street Journal reported.

Meanwhile, a real-estate sale by Neil Gorsuch is drawing fresh ethics concerns. Revelations that the Supreme Court justice sold a vacation property to the head of Greenberg Traurig, a major law firm that argues cases before the court, brought more worries about justices’ financial entanglements.

— The office of U.S. climate envoy John Kerry is facing a subpoena threat from House Oversight Committee Chairman James Comer (R-Ky.), who has requested documents related to Kerry's climate diplomacy work. In a letter to Secretary of State Antony Blinken, Comer asked for documents containing information about Kerry's travel, budget, personnel and third-party communications. Link to more from The Hill.

|

KEY LINKS |

WASDE | Crop Production | USDA weekly reports | Crop Progress | Food prices | Farm income | Export Sales weekly | ERP dashboard | California phase-out of gas-powered vehicles | RFS | IRA: Biofuels | IRA: Ag | Student loan forgiveness | Russia/Ukraine war, lessons learned | Russia/Ukraine war timeline | Election predictions: Split-ticket | Congress to-do list | SCOTUS on WOTUS | SCOTUS on Prop 12 | New farm bill primer | China outlook | Omnibus spending package | Gov’t payments to farmers by program | Farmer working capital | USDA ag outlook forum |