COP26: China & India Water Down Commitment to End Coal Use; U.S. Pulls Back

White House to host BIF signing ceremony | Biden/Xi to hold virtual summit this evening

In Today’s Digital Newspaper

Market Focus:

• Yellen on whether inflation will be down by midterm elections

• How White House is trying to deal with inflation now

• Consumer-sentiment index down to lowest level in a decade

• Inflation… From transitory… to sticky… to entrenched?

• Fed head decision time

• Deutsche Bank boss calls on ECB to tighten monetary policy as inflation surges

• Covid-19 created a childcare crisis, and big providers aim to fill the void

• A look at the U.S. soymeal market

• Wheat prices climbed above $8 a bushel for the first time in nearly nine years

Policy Focus:

• U.S. ag groups upset over EPA action

Biden Administration Personnel:

• Former New Orleans Mayor Landrieu to oversee distribution of infrastructure funding

• Senate Finance Committee holds confirmation hearing Tuesday morning

China Update:

• Xi Jinping and Joe Biden have their virtual summit this evening

• Treasury Sec. Yellen on tariffs

• Blinken expresses concerns over China action towards Taiwan

• Australia’s defense minister said country would join America in defending Taiwan

• China got some positive economic news

• Foreign direct investment in China has so far remained strong

Trade Policy:

• Biden's bid to host Asian summit in U.S. is blocked, presumably by Russia

Energy & Climate Change:

• COP26 reaches a watered-down agreement; side agreements main result

• China and India made last-minute objections, watering down language on coal

• U.S. backed off signing commitments to end coal use by 2030

• U.S. backed off efforts to phase-out gas- and diesel-powered cars

Livestock, Food & Beverage Industry Update:

• European Commission adds locusts to list of foods authorized for sale in EU

Coronavirus Update:

• Federal appeals court halts Biden administration’s vaccine requirement

• Surgeon General Vivek Murthy on a potential winter increase in Covid-19 cases

• Covid-19 cases climbing in upper Midwest, Southwest and parts of Northeast

• Comparing Covid cases in China and U.S.

• Xi Jinping says China had “overcome the impact of Covid-19”

Politics & Elections:

• Biden approval hits new low as economic discontent rises, Post-ABC poll finds

• In hypothetical presidential rematch in 2024, Trump leads Biden by 11 points in Iowa

• A look at the Hispanic vote in the U.S.

• Take a quiz to see which political group you are in

Other Items of Note:

• Cuba protest

• Poland may turn to NATO

MARKET FOCUS

Equities today: Global stock markets mostly up in overnight trading. The U.S. stock indexes are pointed to firmer openings. In China, online commerce giants Alibaba and JD.com, which both report earnings this week, each posted record sales from their Singles Day shopping extravaganza during the first eleven days of November. But the pace of growth was much slower than in previous years. Asian equities finished mostly higher as markets digested China data against inflation worries. The Nikkei was up 166.83 points, 0.56%, at 29,776.80. The Hang Seng Index was up 62.94 points, 0.25%, at 15,399.91. European equities are mostly higher with the FTSE under mild pressure. The Stoxx 600 was up 0.1% with most markets up 0.1% to 0.4% while the FTSE was down 0.2%.

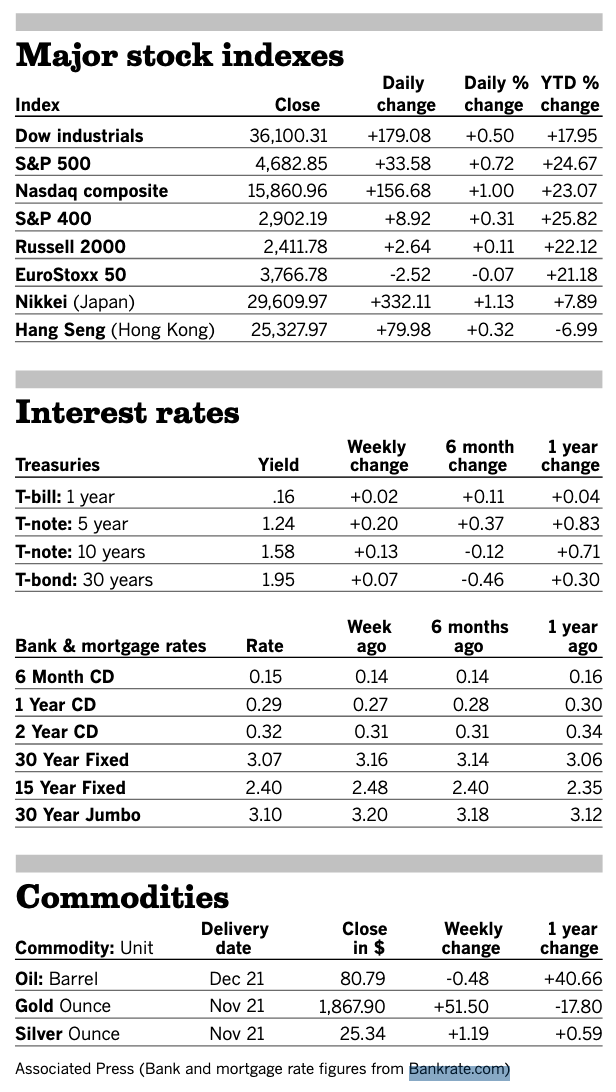

U.S. equities Friday: The Dow rose 179.08 points, 0.5%, to 36,100.31. The Nasdaq advanced 156.68 points, 1%, to 15,860.96. The S&P 500 added 33.58 points, 0.7%, to 4,682.85. All three benchmarks closed near their highs for the day but ended the week with losses of less than 1%, and all remain within striking distance of their all-time highs.

The yield on benchmark 10-year Treasury notes rose to 1.583% Friday, from 1.451% last week, the biggest one-week yield gain in around a month. Yields rise as bond prices fall. The yield on the two-year Treasury note, more sensitive to expectations for monetary policy, rose to 0.522% the past week and finished its largest one-week yield gain since October 2019.

On tap today (see detailed list of events and reports below):

• New York Fed's Empire State manufacturing survey is expected to rise to 22 in November from 19.8 the prior month. (8:30 a.m. ET)

• Bank of England Gov. Andrew Bailey appears before the Treasury Committee at 9:30 a.m. ET.

• USDA Grain Export Inspections report, 11 a.m. ET.

• White House signing ceremony for the bipartisan infrastructure framework (BIF) measure. 3 pm. ET.

• USDA Crop Progress report, 4 p.m. ET.

• U.S. President Biden and Chinese President Xi Jinping are scheduled to hold a virtual summit.

Treasury Secretary Janet Yellen on whether inflation will be down by the midterms, on CBS’ Face the Nation: “It really depends on the pandemic. The pandemic has been calling the shots for the economy and for inflation.”

How White House is trying to deal with inflation now. National Economic Council (NEC) Director Brian Deese on Sunday pointed to the Democrats’ social spending package as a solution to rising inflation in the United States. Asked by host Jake Tapper on CNN’s State of the Union how the White House plans to address inflation, Deese touted the party’s social spending package to lower costs for Americans across the nation. “Inflation is high right now and it is affecting consumers in their pocketbook and also in their outlook for the economy. But those concerns underscore why it's so important that we move forward on the Build Back Better legislation,” Deese said. “This, more than anything, will go at the cost that Americans face,” he added.

Deese said the spending package would help lower prices for prescription drugs, childcare and home ownership, all of which he argued would “go right at lowering costs for American families… This will lower prescription drug prices, put a cap on prescription drug costs for our seniors. Childcare [is] not only a big cost driver for families, but a big impediment for more parents and women to get back into the workforce. This bill will cut the cost of childcare by more than half for most working families. And housing, too, a big cost driver for families. This bill will build affordable homes all around the country to make it easier for families to afford housing, and also to move to places where the job opportunities are,” Deese said. He also underscored the claim from the White House that the bill “is fully paid for” by increasing taxes on the highest earners in the U.S. As a result, Deese said the bill would not “add to inflationary pressures.” He said it would be “quite the opposite because we’re going to pay for everything in this bill by raising taxes on big companies, large corporations and the highest income Americans.”

Concerns over rampant inflation dragged the University of Michigan’s consumer-sentiment index down to its lowest level in a decade in early November. Separately, 4.4 million American workers quit their jobs in September, the highest number since records began. Demand for labor remains high. There were 10.4m job openings at the end of September.

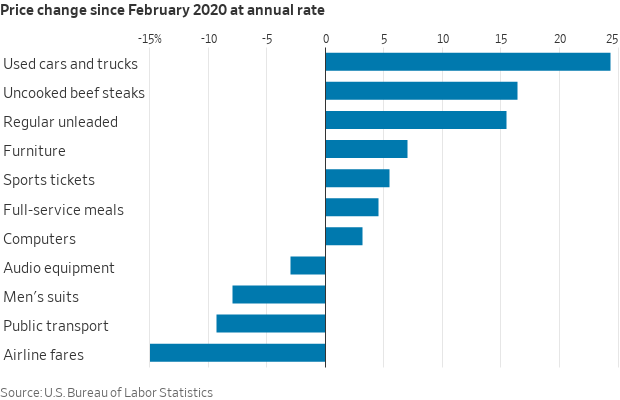

Inflation… From transitory… to sticky… to entrenched? The 6.2% year-over-year surge in consumer prices during October marked the fifth straight month that the consumer price index exceeded 5% and signaled the largest jump in consumer price inflation since July 1982.

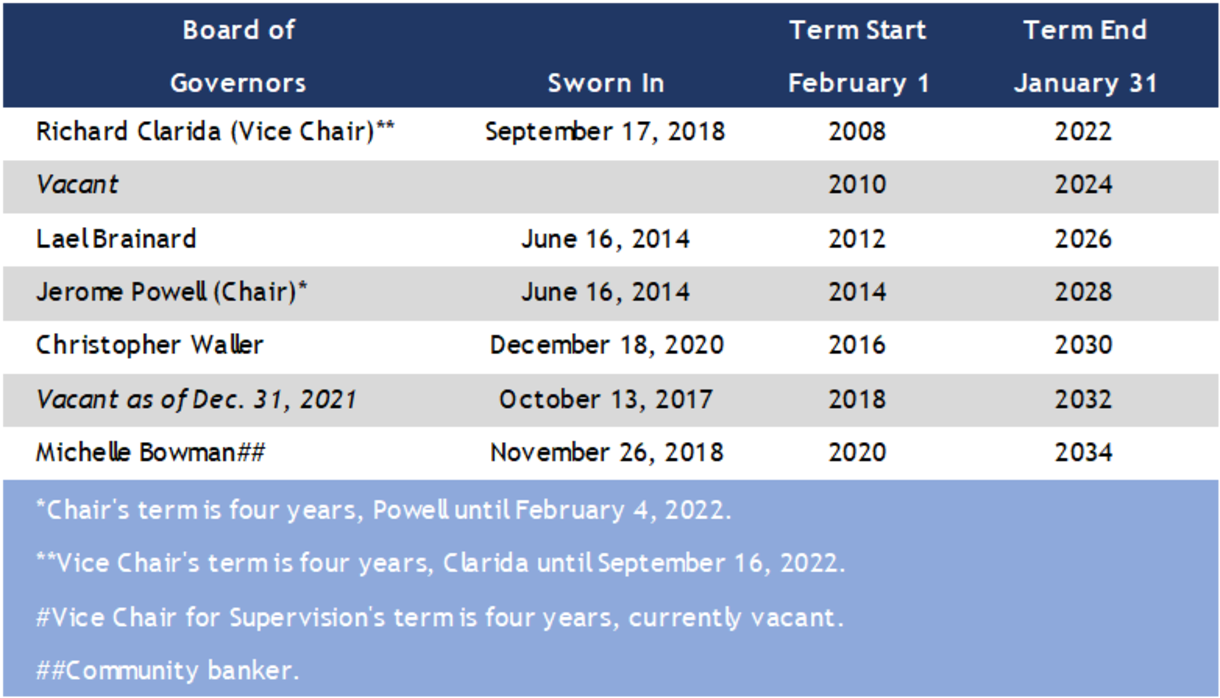

Fed head decision time. President Biden is expected to decide as soon as this week whether to appoint Federal Reserve Chairman Jerome Powell or governor Lael Brainard to a four-year term leading the central bank beginning next February, the Wall Street Journal reports (link). Because Brainard’s views on inflation and interest rates have been similar this year to Powell’s, policy continuity seems likely no matter who is chosen, the WSJ noted. Biden met separately to interview both candidates on Nov. 4. Members of Biden’s economic team and several Democratic lawmakers have favored Powell for a second term. But resistance from some progressive Democrats, who want someone more committed to toughening financial regulation and addressing climate change at the Fed, has complicated the White House’s calculus for months. Powell is a lawyer by training; Brainard is an economist.

Deutsche Bank boss calls on ECB to tighten monetary policy as inflation surges. The head of Germany’s biggest bank has called on central bankers to tighten monetary policy to provide “countermeasures” against surging inflation. Deutsche Bank chief executive Christian Sewing warned today that inflation was producing risky side effects and would last longer than policymakers expected.

Covid-19 created a childcare crisis, and big providers aim to fill the void. The industry's largest players are looking to expand their reach by buying up closed centers, reaching parents who lost care and signing contracts with employers. Link to WSJ for details.

Market perspectives:

• Outside markets: The U.S. dollar index was slightly weaker ahead of U.S. market action, with a mixed tone in global currencies against the greenback. The yield on the 10-year U.S. Treasury note was weaker, trading around 1.55%, with a lower tone in global government bond yields. Gold and silver futures were seeing losses ahead of U.S. action, with gold around $1,866 per troy ounce and silver around $25.32 per troy ounce.

• Crude oil was under pressure ahead of U.S. trading, with U.S. crude trading around $79.60 per barrel and Brent around $80.85 per barrel. Futures were weaker in Asian action, with U.S. crude down 57 cents at $80.22 per barrel and Brent down 58 cents at $81.59 per barrel.

• How Pro Farmer sizes up last week’s market: “Soybean futures rallied following USDA’s Nov. 9 crop reports as the crop estimate was unexpectedly lowered and ending stocks didn’t rise as much as feared. While the report triggered an upside price move, fundamentals are not bullish and the downtrend from the summer highs is still firmly intact. Corn futures also firmed, though the downtrend drawn off the May and June highs remained in place. SRW wheat futures firmed to their highest price since December 2012 on the continuation chart, while HRW futures topped $8 for the first time since May 2014. HRS futures also firmed but failed to clear their Nov. 2 highs. Cash cattle prices surged again on strong packer demand, but sideways price action in futures signaled traders may sense a short-term top is near. Hogs dropped on weak cash fundamentals.”

• The commodity which left the market questioning was the soybean meal move, says industry analyst and trader Richard Crow. He writes, “The bear of all bear markets, due to the soyoil demand, rose to the front of the bull market this week. If one is to explain the meal resurgent, the starting point may be the supply of lysine available for feeding. Supply caught in the logistic problems with containers along with price has moved lysine from some feeding and meal has replaced. The availability of transportation may have forced double buying. The meal basis is strong. With over 50% of the U.S. domestic meal being consumed in the Southeast, the crushing facilities in the Midwest, transportation becomes an issue. The export of meal has been good, and an early indicator three weeks ago when Denmark showed for a buyer of 45,000 ton of meal. The meal market has had an imbalance. The question is how long will the imbalance last. The soyoil demand is expected to last. Logistics need to lighten up and the amino acid issue resolved. The meal price is trading well over the high range of anyone's price projections.”

• Wheat prices climbed above $8 a bushel for the first time in nearly nine years, with demand for the commodity going strong and supplies expected to end the 2021-22 marketing year at their lowest in more than a decade. “Global demand remains robust, at record or near-record levels, with foreign buyers aggressively purchasing wheat supplies during the past several weeks,” says Sal Gilbertie, president and chief investment officer at Teucrium Trading, told Barron’s (link). USDA estimates that U.S. wheat ending stocks for 2021-22 will be 583 million bushels, the lowest since the 2007-2008 marketing year.

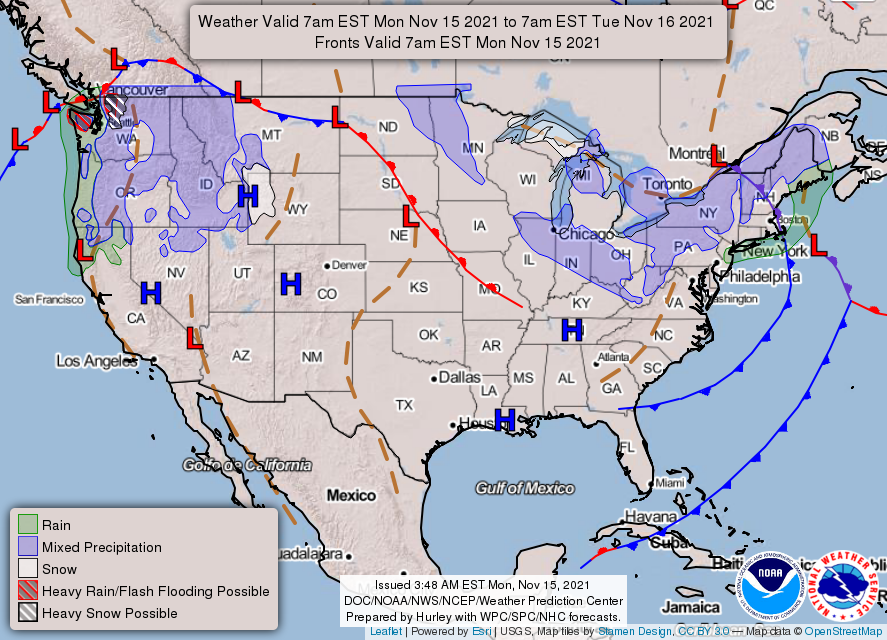

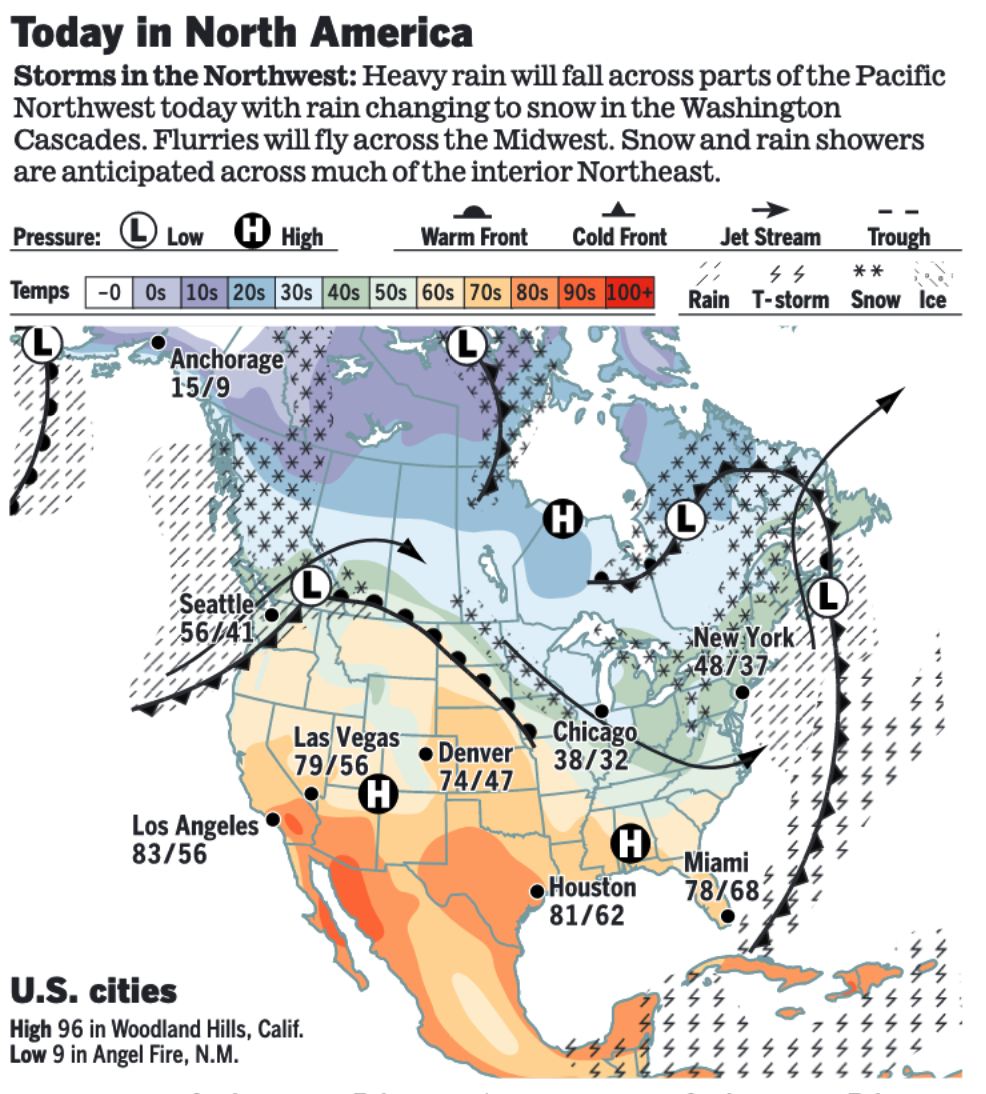

• NWS weather: Heavy rain and mountain snow culminate today over the Pacific Northwest before tapering off tonight.... ...A rapidly intensifying low pressure system will bring high winds across the northern Rockies today and through the northern Plains on Tuesday... ...Areas of rain/snow over the Northeast will gradually taper off as low pressure system exits New England.

POLICY FOCUS

— U.S. ag groups upset over EPA action. Grower groups are noting frustration that EPA recently did not use “the best available science and data,” as is required by law, in its endangered species biological evaluations (BE) for glyphosate, atrazine, and simazine released Nov. 12. As a result, EPA’s final BEs for these chemistries significantly inflate the number of species and habitats found likely to be adversely affected.

“The best available science and data.” It’s a phrase that carries heavy weight — or at least it should, as “the best available science and data” is the standard by which a regulatory agency is charged with conducting Endangered Species Act (ESA) decisions. It is also the standard on which the fate of farmers across the country and their continued ability to use vital crop protection tools hinges, wrote the American Soybean Association (ASA). It and the American Farm Bureau Federation have sought to provide the agency with “better, real-world data sources, including in comments on the draft BE — “comments that EPA opted not to incorporate into the final BE,” ASA said.

ASA provided an explanation of why they are agitated:

• The final BE for glyphosate also continues to assume soybean growers use 3.75 lbs./acre of glyphosate per application, whereas market research data and USDA survey data show the number is 1.00 lb./acre — “nearly four times less than the BE assumes.”

• The final BE for glyphosate also assumes growers reapply chemistry “a mere seven days after an initial application. This extraordinarily unrealistic assumption for any producer increases model exposure risks for species.”

ASA said growers provided these and other real-world examples and data sources to EPA in public comments, “which EPA chose not to incorporate into its final BE.”

More ASA comments. Kevin Scott, soybean farmer from South Dakota and president of the American Soybean Association, expressed frustration with EPA failing to use better data, saying, “The law is clear EPA must use the ‘best scientific and commercial data available’ for its endangered species assessments, but the agency has indicated it has no intent of doing so. What is more frustrating is that growers shared with EPA better and credible data, which it chose to ignore. These unrealistic findings will only fuel public distrust and risk grower access to glyphosate and other essential tools.”

American Farm Bureau Federation President Zippy Duvall said, “We are disappointed that the Environmental Protection Agency was presented with real-world evidence of limited pesticide use but failed to use the most accurate data in its biological evaluations. By overestimating the use of these crop protection tools, the EPA also overestimated the impact on species. Herbicides are vital tools in climate-smart farming because they enable farmers to use minimum tillage practices and fewer resources to raise their crops. EPA must take a well-rounded approach to its biological evaluations and use best available data when deciding on rules that will affect how farmers grow healthy crops,” Duvall commented.

Now what? EPA must now formally consult with Fish & Wildlife Service and the National Marine Fisheries Service on hundreds of additional species, which ASA said “would have been unnecessary had EPA used the best available data. This extra burden will likely further strain resource-strapped agencies, expand regulatory timeframes, and result in additional product restrictions that may do nothing to protect species.”

Comments: Ag groups were gaga when Michael Regan was announced as EPA administrator. But the aggressive EPA approach detailed above may have some of the ag groups reassessing Regan, whose agency is nearing a public announcement of Renewable Fuel Standard decisions.

BIDEN ADMINISTRATION PERSONNEL

— Biden appoints former New Orleans Mayor Mitch Landrieu as senior adviser responsible for overseeing distribution of infrastructure funding. Landrieu has promised to work closely with state and local governments to organize projects and create new jobs to support them. “One of our biggest responsibilities is to make sure all the money is used efficiently and effectively,” Biden said at a Cabinet meeting on Friday.

Background: The BIF to be signed into law today provides $110 billion for roads and bridges — bridges alone will garner around $40 billion, the largest single infusion of funding received in the history of the Interstate Highway System. The money will primarily be distributed to state government based on population and other factors. State officials will then decide how best to allocate the cash. Some amounts are reserved for specific projects and competitive grants. The largest state recipients: Calif. ($45 billion), Texas ($35 billion), N.Y. ($27 billion) and Florida ($19 billion). Largest on a per-capita basis: Alaska, Wyo., Vt. And Mont., all of which are slated to receive at least $3,500 per resident, versus $1,250 per resident for California.

Several readers have inquired about regulatory hurdles for infrastructure. The BIF tries to deal with this by codifying the Trump-era “one federal decision concept, which sets a two-year goal for completing federal permitting for highway projects. Another clause empowers federal energy regulators to overrule state and local objections to new transmission lines.

— Senate Finance Committee holds a confirmation hearing Tuesday morning on the nominations of Maria Lago to be Undersecretary of Commerce for International Trade, and Lisa Wang to be an Assistant Secretary of Commerce.

CHINA UPDATE

— Xi Jinping and Joe Biden have their virtual summit this evening. Taiwan and China's economic practices are set to be discussed, but a lifting of U.S. tariffs is off the table, according to latest reports. Aim for both sides: stopping the bilateral relationship from worsening.

Yellen on tariffs: Asked if the Biden administration lifting some tariffs on China — as Xi has called for would help ease rising inflation in the U.S., Yellen replied: “It would make some difference. Tariffs do tend to raise domestic prices.” Yellen added that USTR Katherine Tai is exploring ways to approve requests from U.S. companies to ease some tariffs.

— U.S. Secretary of State Antony Blinken expressed concerns over China’s continued military, diplomatic, and economic pressure on Taiwan in a phone conversation with Foreign Minister Wang Yi on Friday.

— Australia’s defense minister called it “inconceivable” that his country would fail to join America in defending Taiwan. Earlier last week, U.S. Sec. of State Antony Blinken promised that America would act should China attempt to bring Taiwan under its control by force. In September America, Australia and Britain signed a defense pact, AUKUS, to counter what they see as a growing threat from China in the Indo-Pacific region.

— China got some positive economic news when its industrial production in October was reported up 3.5%, year-on-year, which was higher than the 2.8% rise expected. Retail sales in October rose 4.9%, year-on-year — better than the 3.5% rise that was expected.

— Foreign direct investment in China has so far remained strong, thanks to the economy’s early recovery from the pandemic. And few multinationals are leaving, writes the Economist, which adds: “Some foreign firms may even localize activities done outside China to keep doing business there. Companies are “battening down the hatches”, according to the European Union Chamber of Commerce in Shanghai, bringing more of their supply chain onshore, because of geopolitical tensions, covid restrictions and new laws that limit data-sharing across borders. ‘Companies might be forced to have two different systems running: one for China, and one for the rest of the world,’ says Bettina Schön, the chamber’s vice-president. ‘This will be horribly expensive.’ It is not that the world is leaving China; more that China is becoming a world unto itself.”

TRADE POLICY

— Biden's bid to host Asian summit in U.S. is blocked, presumably by Russia. Leaders of the Asia-Pacific Economic Cooperation (APEC) forum failed to agree on President Biden's offer to host the regional forum in 2023 after concerns raised by one member nation, Russia, according to some reports. New Zealand Prime Minister Jacinda Ardern downplayed the impasse, telling reporters that she expected a decision on the issue in the coming weeks.

ENERGY & CLIMATE CHANGE

— All you need to know about COP26… they are already talking about COP27 in Egypt next year. The talk-and-commitment fest in Glasgow, Scotland, is over, and India, like they did with several WTO negotiations, played the spoiler again, this time in a late change, tempering language on cutting coal emissions, upsetting others. Meanwhile, the U.S. backed off signing commitments to end coal use by 2030 and to phase-out gas- and diesel-powered cars.

- India watered down language about coal, changing to “phase down,” rather than “phase out,” coal power, the single biggest source of greenhouse gas emissions. Indian Environment Minister Bhupender Yadav argued against a provision on phasing out coal, saying that developing countries were “entitled to the responsible use of fossil fuels.”

- Helen Mountford, vice president of the World Resources Institute think tank, said India’s demand may not matter as much as feared because the economics of cheaper, renewable fuel is already making coal increasingly obsolete. “Coal is dead. Coal is being phased out,” Mountford said. “It’s a shame that they watered it down.”

- The final communique, most admit, did not go far or fast enough to reach pre-meeting goals. Still, participants said the outcomes were better than nothing and provided incremental progress.

- The goal not achieved: Swiss environment minister Simonetta Sommaruga said the late coal language change would make it harder to achieve the international goal of limiting warming to 1.5 degrees Celsius, or 2.7 degrees Fahrenheit, since pre-industrial times. An analysis by the independent group Climate Action Tracker found that with all the short-term pledges, the world is likely to heat up by 2.4 degrees Celsius (4.3 degrees Fahrenheit) this century. That’s better than the path the world was on before the Paris agreement six years ago, when scientists predicted nearly 4 degrees Celsius (7.2 degrees Fahrenheit) of warming. But some noted the consequences would still be catastrophic, resulting in deadlier wildfires and floods, famine and the extinction of more species. The report by Climate Action Tracker found that of all the pledges countries have made to get to zero emissions, only four governments — Britain, Costa Rica, Chile and the EU — have detailed plans to achieve that.

- “Our fragile planet is hanging by a thread,” said U.N. Secretary-General António Guterres said in what some believe an overstatement. “We are still knocking on the door of climate catastrophe,” he added.

- Some noted these successes: Almost enough financial incentives to satisfy poorer nations and solving a long-standing problem to pave the way for carbon trading.

- Commitments at these events are also numerous, but will they be acted on? The agreement requires that big carbon polluting nations submit new, stronger emission-cutting pledges by the end of 2022.

- U.S. climate envoy labels COP26 a “very good deal for the world.” U.S. climate envoy John F. Kerry made that assessment to the Associated Press. “It’s got a few problems, but it’s all in all a very good deal,” he added.

- But key goals were not met. Ahead of the Glasgow talks, the United Nations had set three criteria for success, and none of them were achieved. The criteria included pledges to cut carbon dioxide emissions in half by 2030, and for rich nations to provide $100 billion in financial aid to poorer ones, half of which would go to helping the developing world adapt to the worst effects of climate change. “We did not achieve these goals at this conference,” Guterres said Saturday night. “But we have some building blocks for progress.” Note the word “progress” because that is the most frequently cited word in pronouncements about the confab.

- Environmental activists were not so glowing in assessments, and those were issued before India’s last-minute change. “It’s meek, it’s weak and the 1.5 C goal is only just alive, but a signal has been sent that the era of coal is ending. And that matters,” said Greenpeace International Executive Director Jennifer Morgan, a veteran of the U.N. climate talks known as the Conference of the Parties (COP).

- Lofty task ahead: To stay within the warming limit that nations agreed to six years ago in Paris, the world must cut carbon dioxide emissions essentially in half in 98 months.

- A quick recap of what was accomplished: Side agreements were the main result, such as:

— Methane: Nearly 100 countries joined a global pledge to limit emissions of methane.

— Deforestation: More than 100 countries signed a pact to prevent further deforestation by 2030.

— Regarding fossil-fuel vehicles, a coalition of countries, cities and automakers, including Ford, General Motors, Volvo and Mercedes-Benz, committed to phase out sales of new fossil-fuel vehicles by 2040 and by 2035 in “leading markets.” However, the U.S. did not sign the agreement to phase out gas- and diesel-powered cars, joining China and Japan in withholding support from a deal that could have a greater influence if all three — some of the largest car markets in the world — had backed it.

— More than 40 countries pledged to phase out coal by 2030 and stop building coal-fired power plants, helping eliminate the largest source of planet-warming gases globally. But some of the world’s largest coal-burning countries, including China, Australia and India, didn’t sign the pledge to phase out the fossil fuel. The White House did not join the pledge to phase out coal in the coming decades, even though coal’s decline as a source of power in America has accelerated significantly.

— South Africa reached a deal with the U.S., Britain, France, Germany and the European Union under which it would receive $8.5 billion over the next five years to transition away from coal.

— Shipping industry agreement: The U.S., Denmark and other countries agreed to work toward zeroing out emissions from the shipping industry by 2050 and creating at least six zero-emission shipping routes. If these changes are enacted, governments could require, for example, that only emission-free ships travel from Shanghai to Los Angeles.

— American and Chinese officials unveiled a statement in which they pledged to put aside their differences and “raise ambition in the 2020s” to address climate change. It mostly restated previous pledges. - Next year’s talks are scheduled to take place in the Egyptian Red Sea resort of Sharm el Sheik. Dubai, United Arab Emirates, will host the meeting in 2023.

LIVESTOCK, FOOD & BEVERAGE INDUSTRY

— European Commission has added locusts to its list of foods authorized for sale in the EU, the Washington Post reports (link). The insects will be considered a “novel food” when sold in frozen, dried and powdered forms.

CORONAVIRUS UPDATE

— Summary: Global cases of Covid-19 are at 253,431,979 with 5,102,855 deaths, according to data compiled by the Center for Systems Science and Engineering at Johns Hopkins University. The U.S. case count is at 47,074,109 with 763,092 deaths. The Johns Hopkins University Coronavirus Resource Center said that there have been 440,599,613 doses administered, 195,120,470 have been fully vaccinated, or 59.4% of the U.S. population.

— Federal appeals court halts Biden administration’s vaccine requirement. A federal appeals court in New Orleans has halted the Biden administration’s vaccine or testing requirement for private businesses, delivering another political setback to one of the White House’s signature public health policies. A three-judge panel of the U.S. Court of Appeals for the 5th Circuit, helmed by one judge who was appointed by President Ronald Reagan and two others who were appointed by President Donald Trump, issued the ruling Friday, after temporarily halting the mandate last weekend in response to lawsuits filed by Republican-aligned businesses and legal groups. Calling the requirement a “mandate,” the court said the rule, instituted through the Labor Department, “grossly exceeds OSHA’s statutory authority,” according to the opinion, written by Judge Kurt D. Engelhardt and joined by Judges Edith H. Jones and Stuart Kyle Duncan.

— Surgeon General Vivek Murthy on a potential winter increase in Covid-19 cases, on Fox News Sunday: “We should be prepared for the fact that there may be an uptick in cases that we see in various parts of the country with cold weather. But what has held true for the last year is still true, which is that vaccines still give you a high degree of protection, especially against the worst outcomes of Covid like hospitalization and death.”

Covid-19 cases are climbing in places like the upper Midwest, Southwest and parts of the Northeast, hindering the nation’s progress in ending a surge triggered by the Delta variant.

— Comparing Covid cases in China and U.S. According to the Economist: “In a country of 1.4 billion people, the official total death toll from the pandemic is under 6,000, compared with almost 808,000 excess deaths in America, which has less than one-quarter of China’s population. Some skepticism of China’s statistics is reasonable, given that officials in Wuhan, where the outbreak was first detected, concealed the virus for weeks in late 2019 and early 2020. Yet if large outbreaks were still being concealed today, control systems would start breaking down, for they rely on tracking and tracing fresh cases. Instead, life in much of China is relatively normal.”

Meanwhile, Xi Jinping said that China had “overcome the impact of Covid-19,” even though it is still struggling to maintain its “zero Covid” strategy. Link to details via the NYT.

POLITICS & ELECTIONS

— President Biden hits a new approval low in the Washington Post-ABC News poll. And Republicans enjoy their largest midterm lead over Democrats in the 40-year history of the poll (link). The poll was conducted Nov. 7-10 — after the passage of the bipartisan infrastructure package (BIF). Details:

- 51% of registered voters say that if midterms were held today, they’d vote for the GOP candidate in their district. 41% say the Democrat. "That’s the biggest lead for Republicans in the 110 ABC/Post polls that have asked this question since November 1981," ABC notes.

- 63% of respondents said Biden has accomplished “not very much” or “little or nothing” so far in his presidency. A full 45% said he’s done “little or nothing” — that’s worse than the numbers for then-Presidents Donald Trump, Barack Obama or Bill Clinton at comparable points in their presidencies.

- Just 31% said he’s kept most of his major campaign promises — also a worse figure than Trump, Obama or Clinton received.

- 70% rated the economy as “not so good” or “poor.”

- The poll is not all bad for Biden and the Democrats: 63% of respondents support the bipartisan infrastructure deal. And 58% support “spending about two trillion dollars to address climate change and to create or expand preschool, health care and other social programs.”

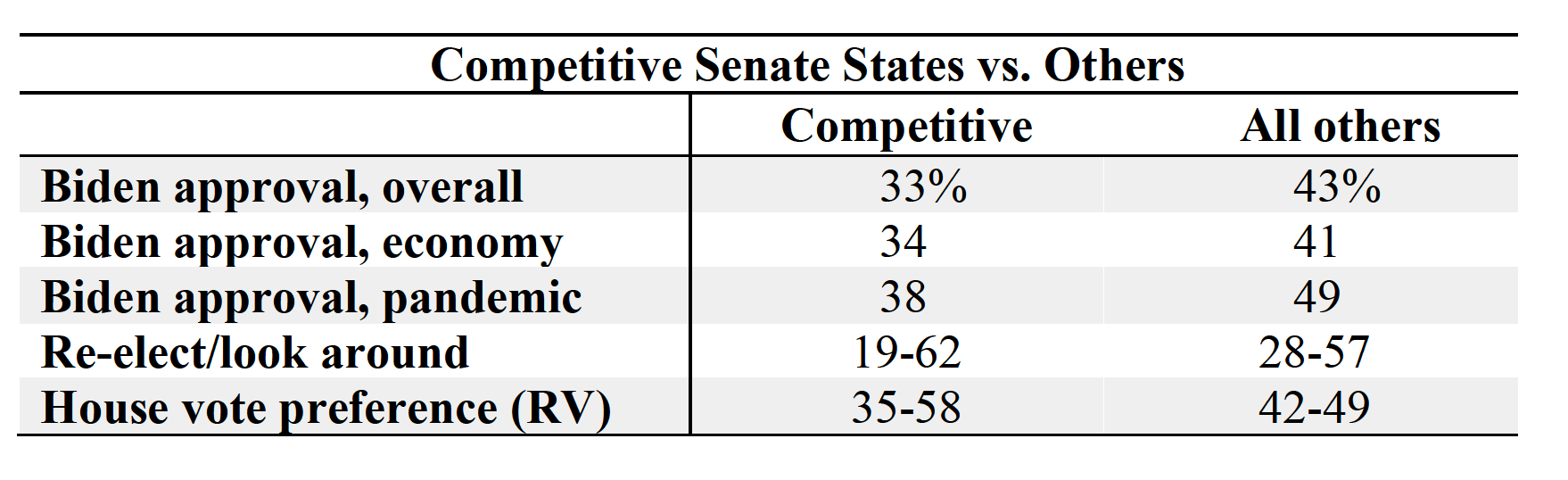

- Senate states: The 2022 vote question asks about generic Democratic or Republican candidate preferences for the U.S. House of Representatives. Also of interest is control of the closely divided U.S. Senate. Evaluating survey results in just eight states expected to have the most competitive Senate races — four currently held by Democrats, four by Republicans — raises further hope for the GOP and risk for the Democratic Party. In these states —Arizona, Florida, Georgia, Nevada, New Hampshire, North Carolina, Pennsylvania, and Wisconsin — Biden’s overall job approval rating is 33%, compared with 43% elsewhere. On his handling of the pandemic, his approval is 11 points lower than in the rest of the country. On the economy, the difference is a non-significant 7 points.

Residents of these states also are less inclined to back their incumbent House member rather than to look around for someone new to support, 19 vs. 28 percent. And registered voters in these states favor Republicans over Democrats for the House by a 23-point margin, 58-35%, vs. 7 points, 49-42%, in the rest of the country.

— A look at the Hispanic vote in the United States. According to an analysis by Catalist, a progressive political-data firm, former President Donald Trump won 37% of the Latino vote in 2020 — up from his 29% in 2016 and Mitt Romney’s 30% in 2012. If the trend continues, Republicans could soon get levels of support from Hispanics which they haven’t received since George W. Bush, who did unusually well with conservative immigrants in Texas and Florida, was president.

— In a hypothetical presidential rematch in 2024, Trump leads Biden by 11 points in Iowa — a 3-point improvement on his 2020 margin in the state — according to a new Des Moines Register/Mediacom Iowa Poll (link). That includes independents breaking for Trump by 8. Of note: 61% of Republicans say they’re more aligned with the GOP, whereas 26% say they’re more aligned with Trump.

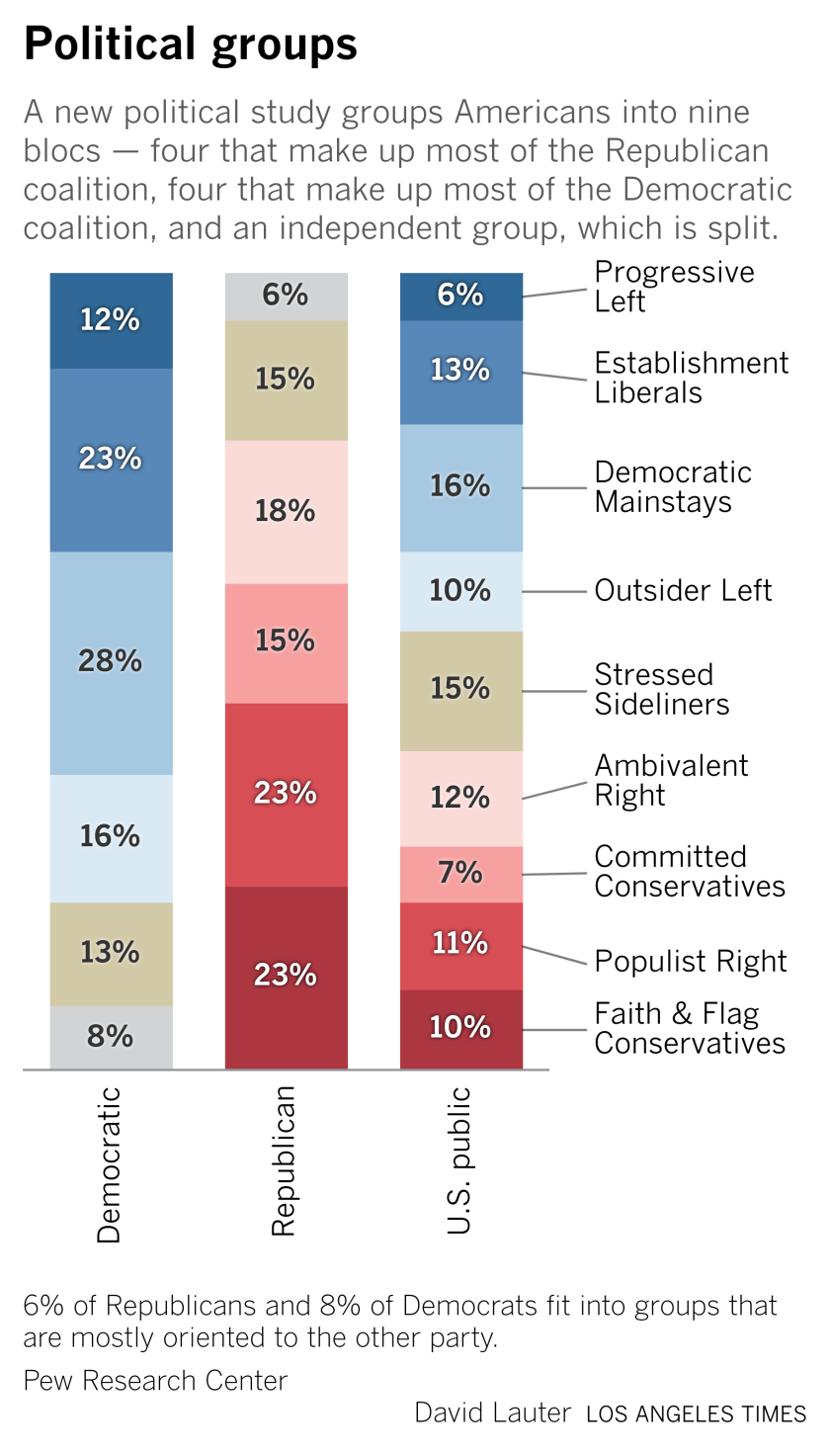

— Trying to understand political parties and intraparty skirmishes. The nonpartisan Pew Research Center recently released information that tries to why American politics works the way it does. Pew surveyed 10,221 American adults, asking each of them a series of questions about their political attitudes, values, and views of American society. Researchers took the results and put them in a cluster analysis to define groups that make up U.S. society.

The new typology divides Americans into nine such groups — four on the left, which make up the Democratic coalition, four on the right, making up the Republican coalition, and one in between whose members are largely defined by a lack of interest in politics and public affairs.

Nearly all the Democrats agree on wanting a larger government that provides more services; nearly all the Republicans want the opposite.

Nearly all Democrats believe that race and gender discrimination remain serious problems in American society that require further efforts to resolve. On the Republican side, the belief that little — if anything — remains to be done to achieve equality has become a defining principle.

On other issues, however, the parties have deep internal splits.

Where do you fit in? Take the quiz at this link.

OTHER ITEMS OF NOTE

— Cuba protest. Inflamed by persistent food shortages, young Cuban dissidents are calling for a rare national protest on Monday.

— Poland may turn to NATO. Poland, Lithuania and Latvia are considering asking NATO to hold emergency talks as they struggle to manage a tense migration standoff on their borders with Belarus, the Polish prime minister said Sunday. PM Mateusz Morawiecki said he and his two Baltic counterparts are discussing whether to ask for such talks under the NATO treaty, which allows any ally to request consultations if it believes its territorial integrity, political independence or security is threatened.

EVENTS AND REPORTS

Monday, Nov. 15

· President Joe Biden holds a ceremony to sign the Infrastructure Investment and Jobs Act. In the evening he will hold a virtual meeting with Chinese President Xi Jinping. See The Week Ahead for details.

· EPA farm and ranch panel. EPA’s teleconference of the Farm, Ranch, and Rural Communities Advisory Committee (FRRCC) to discuss topics of relevance to agriculture and rural communities, specifically the FRRCC's recommendations on creating a holistic pesticide program for the future and supporting inter-agency environmental benchmarks with interagency partners on the issues of water quality and quantity and food loss and waste. Runs through Tuesday.

· Energy issues. Washington Post Live virtual Protecting Our Planet discussion on "Energy Efficiency," examining "different models to promote energy efficiency and combat climate change across the country and around the world."

· U.S. Korea situation. Center for Strategic and International Studies and the Korea Foundation hold the virtual 2021 Republic of Korea (ROK)/U.S. Strategic Forum on "The Road Ahead After the Biden-Moon Summit."

· Transatlantic relations. Brookings Institution virtual discussion on "Do Trans-Atlantic Relations Need a Reset?"

· Covid and the holidays. Bipartisan Policy Center virtual discussion on " Covid-19: What's the Forecast for the Holidays, 2022 and Beyond?"

· Consumer rights and protections. German Marshall Fund of the United States virtual discussion on "Consumer Rights and Protections in an Automated Society."

· Supply chains. Hudson Institute virtual discussion on "Preventing the Next Supply Chain Disruption," focusing on commercial and military supply chains.

· Covid vaccine mandates. U.S. Chamber of Commerce virtual discussion on "The Role of Employers: Promoting Covid-19 Vaccines and Implementing Mandates."

· Legalizing marijuana. Rep. Nancy Mace (R-S.C.) news conference to discuss the introduction of the "States Reform Act," which seeks to legalize marijuana at the federal level.

· Holiday travel. Washington Post Live virtual discussion on "The Future of Travel," focusing on "how this holiday travel season is shaping up, how travelers are keeping safe and the overall state of the travel industry."

· Economic report. Empire State Manufacturing Survey

· Energy reports. EIA monthly Drilling Productivity Report | China output data (October)

· USDA reports. AMS. Export Inspections ERS: Vegetables and Pulses Data | Fruit & Tree Nut Data | Feed Grains: Yearbook Tables NASS: Crop Progress