China’s Foreign Minister Lashes Out at U.S. on Several World Issues

Fed Chair Powell testifies before Senate Banking panel, but data will speak louder

|

In Today’s Digital Newspaper |

China’s foreign minister Qin Gang warned Tuesday that the U.S. and China are heading for “conflict and confrontation” unless Washington changes its approach toward Beijing. It’s the latest sign that tensions are mounting between the world’s two largest economies after President Xi Jinping rebuked U.S. policy Monday. Xi said Western countries, led by the U.S., have implemented “all-round containment, encirclement and suppression against us,” according to state media. Details in China section.

Most expect Fed chair Jerome Powell to be hawkish on inflation when he appears today before the Senate Banking Committee. He’s likely to reiterate that the central bank is not done raising interest rates, and that it’s premature to start contemplating cuts. Powell will have some good news to report — when he last testified before Congress in June, the inflation rate was at 40-year-highs, nearing 9%. Today, that rate has dropped to 6.4%, though it remains well above the Fed's annual target of 2%. Year-over-year inflation has declined for seven consecutive months.

The Biden administration plans to escalate its conflict with Mexico over the Latin American nation’s restrictions on genetically modified U.S. corn and other farm products with a request for formal consultations under their USMCA trade accord. While most applauded the move, some lawmakers said it took too long to get to this juncture while others noted the lengthy U.S. case against Canada’s dairy policy via a USMC dispute is still unresolved.

French unions plan to bring the country to a standstill in a sixth day of protests against President Emmanuel Macron’s plan to raise the minimum retirement age, with strikes are expected to cause severe disruption to transport. This could be what’s in store for the U.S. as efforts are underway to alter the U.S. Social Security System.

Stricter standards for ‘Product of USA’ label proposed. Details in Livestock section.

|

MARKET FOCUS |

Equities today: Global stock markets were mixed overnight. U.S. stock indexes are pointed toward slightly higher openings. In Asia, Japan +0.3%. Hong Kong -0.3%. China -1.1%. India +0.7%. In Europe, at midday, London +0.3%. Paris +0.2%. Frankfurt +0.2%.

U.S. equities yesterday: The Dow and S&P 500 avoided losses for the session even as both dipped into negative territory late in the session. The Dow ended up 40.47 points, 0.12%, at 33,431.44. The Nasdaq declined 13.27 points, 0.11%, at 11,675.74. The S&P 500 edged up 2.78 points, 0.07%, at 4,048.42.

Agriculture markets yesterday:

- Corn: May corn fell 2 3/4 cents to $6.37, marking a mid-range close.

- Soy complex: May soybeans rose 10 1/4 cents to settle at $15.29. May soybean meal made a new contract high after rising $12.10 settling at $493.4. May soyoil fell 74 points to close at 60.45 cents, near the session low.

- Wheat: May SRW wheat fell 13 1/4 cents at $6.95 1/4, nearer the session low and hit a contract low. May HRW wheat dropped 18 1/2 cents at $7.97 3/4, near the session low and hit a contract low. Spring wheat futures dropped 10 cents to $8.62 3/4.

- Cotton: May cotton rose 54 points to 84.71 cents, ending nearer the session high.

- Cattle: April live cattle rose 67 1/2 cents to $166.10, nearer the session high and hit a contract high. May feeder cattle gained $2.30 at $203.25, near the session high, also scoring a contract high.

- Hogs: April lean hogs fell $1.075 and closed on the session low at $83.475.

Ag markets today: Corn, soybean and wheat futures traded narrowly on both sides of unchanged in a lightly traded overnight session. As of 7:30 a.m. ET, corn futures were steady to fractionally lower in most contracts, soybeans were mostly 1 to 2 cents lower, winter wheat futures were 1 to 3 cents higher and spring wheat was steady to fractionally lower. Front-month crude oil futures were around 60 cents lower, and the U.S. dollar index was more than 200 points higher this morning.

Technical viewpoints from Jim Wyckoff:

Former Treasury Secretary Larry Summers said on CNN Monday that the Fed will likely have to return to larger rate hikes to stave off inflation as the economy continues to grow. "I don't think there's any question that we do not yet have inflation on a secure glide path anywhere near down to the 2% [Fed target] level," Summers said. "And until the Fed can be confident of that, it's going to have to be tightening rather than easing."

Summers said his best guess would be for the fed funds rate to grow from its current range (4.5% to 4.75%) to 5.5%, but noted he "wouldn't be amazed" if it were to hit 6%, given the uncertainties in the economy. "Hope for the best but plan for the worst, I think is the right advice," Summers said.

Market perspectives:

• Outside markets: The U.S. dollar index is slightly firmer. Nymex crude oil futures prices are slightly down and trading around $80.25 a barrel. The yield on the benchmark U.S. 10-year Treasury note is presently fetching 3.928% — down a bit after pushing above 4.0% last week.

• $11,026: Average daily rate for the largest dry-bulk capesize vessels on Monday, according to the Baltic Exchange, the first time the measure has been above $10,000 since mid-January.

• Ag trade: Jordan purchased 60,000 MT of optional origin hard milling wheat. Japan is seeking 80,570 MT of milling wheat in its weekly tender. Tunisia tendered to buy 100,000 MT of optional origin durum wheat.

• NWS weather outlook: xxx Multiple day heavy rain and flash flood threat to begin Tuesday night over Oklahoma, extending eastward into the Mississippi Valley Wednesday... ...Unsettled conditions across parts of the West will continue through mid-week with coastal rain and locally heavy snow in California... ...A couple rounds of moderate to locally heavy snowfall accumulations likely for portions of the Northern/Central Plains through mid-week.

NWS

Items in Pro Farmer's First Thing Today include:

• Light, two-sided grain trade overnight

• Argentine crop estimates cut again

• Mexico to allow Brazilian beef imports

• Packers bought a lot of cattle last week

• Cash hog index continues slow and steady climb

|

RUSSIA/UKRAINE |

— Summary: Ukraine is still fighting to hold an embattled eastern city. President Volodymyr Zelenskyy said last night that Ukraine will not retreat from Bakhmut, even though Russian forces have nearly surrounded it. Ukraine's top generals have vowed to keep defending the eastern city of Bakhmut, as Russian forces fought to tighten their siege and secure their first major battlefield gain in more than six months. Bakhmut holds little strategic significance, but capturing it would give Russia a symbolic win after months of setbacks.

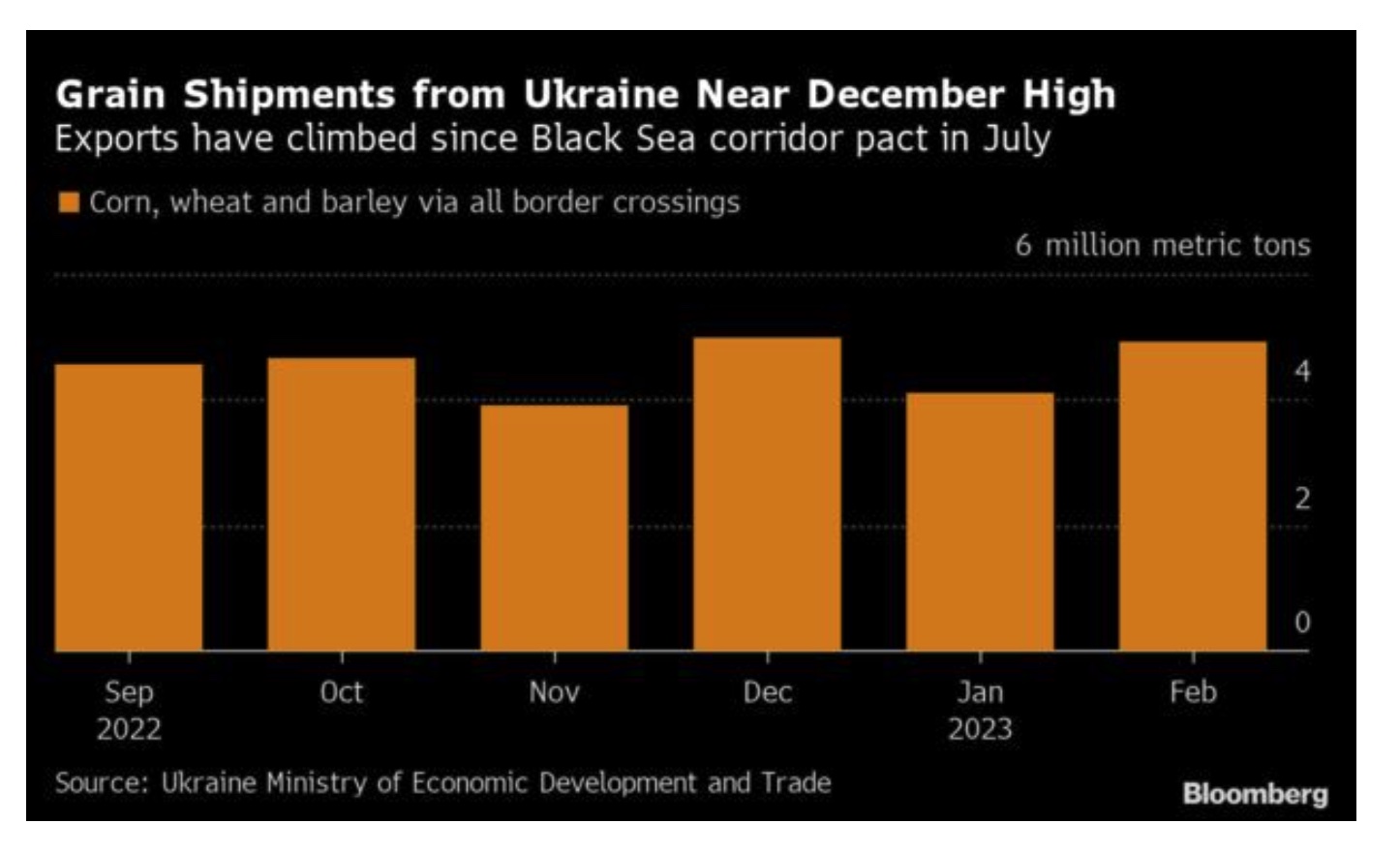

- Cargill Is optimistic Ukraine grain-export deal will be renewed. Cargill Inc. said rising grain exports from Ukraine are sparking optimism that a deal to keep ships sailing via the Black Sea will be renewed. The increase in Ukraine’s shipments of corn, wheat and barley is helping push down world food costs after they jumped to a record in 2022, giving Cargill Chairman David MacLennan confidence that last year’s landmark U.N.-brokered export pact — which is up renewal March 18 — will remain in force. “There is political support from around the world to keep the corridor open,” MacLennan said in an interview with Bloomberg at Cargill’s headquarters in Minnesota last week. “As long as that is the case, we will continue to help farmers and help product out of the country.”

Total Ukrainian shipments of corn, wheat and barley can reach 4 to 6 million tons per month with the corridor open, compared with just 2 million by rail, Cargill said. Grain exports hit 4.908 million tons in February via all means of transport, government data show. That’s just below the nearly 5 million shipped in December, the highest since the war began.

|

POLICY UPDATE |

— USDA aid payments show small changes. Payments under the Emergency Relief Program (ERP) were little changed for the week ended March 5, with total Phase 1 payments at $7.41 billion, up from $7.40 billion the prior week. The totals for non-specialty crops ($6.29 billion) and specialty crops ($1.12 billion) were essentially unchanged, and for Phase 2 only one payment for $2,000 continues to show, the maximum amount per producer that can be made under the program.

Similarly, totals for the Coronavirus Food Assistance Program 1 (CFAP 1) and CFAP 2 were basically steady at total CFAP 2 payments of $19.44 billion, original payments of $14.53 billion and top-up payments of $4.91 billion. CFAP 1 payouts remained at a total of $11.82 billion, including $10.63 billion in original payments and $1.19 billion in top-up payments.

— Biden Administration advances scrutiny of seed industry competition. The Biden administration is stepping up scrutiny of competition in the seed industry, according to a statement announcing plans for a working group including the Justice Department to improve market fairness. The four largest companies now control 95% of patents and other protected intellectual property for corn seeds, up from 41% controlled by the top four firms in 1990, according to a USDA report (link).

— President Joe Biden will propose raising the Medicare tax on high earners to help keep the federal insurance program solvent as part of his budget, the White House said. The tax increase is part of a package of proposals aimed at extending the solvency of the Medicare’s Hospital Insurance (HI) Trust Fund by at least 25 years.

The president’s budget, which will be released on Thursday, proposes raising Medicare taxes from 3.8% to 5% on annual income above $400,000, and eliminating a loophole business owners and higher-earners can exploit to avoid additional taxes, according to a White House fact sheet. The plan would also help bolster Medicare reserves through some $200 billion in prescription drug reforms over a decade by allowing the program to negotiate costs on more medications, and sooner, after they come to market.

Biden’s plan has little chance of becoming law, especially after Republicans took control of the House this year, but this and other coming announcements will help show differences between our two major political parties on a host of issues.

|

CHINA UPDATE |

— House Speaker McCarthy will not visit Taipei, reducing chance of Chinese military drills. Instead of House Speaker Kevin McCarthy (R-Calif.) visiting Taiwanese President Tsai Ing-wen in Taipei, Taiwan, in the spring, Tsai will meet with McCarthy in California in early April, the Financial Times reported on March 6. Taiwanese officials claim the decision comes after Taipei shared with McCarthy recent intelligence reports on China's military activities.

— Key Chinese official lashes out at the U.S. on Ukraine, rate rises and Taiwan. China’s Foreign Minister Qin Gang said China has not supplied weapons to Russia and took aim at the U.S. on several global problems. He said there seems to be an “invisible hand” pushing to escalate the crisis in Ukraine; U.S. interest rate rises are triggering debt crises; and the region does not need an Asia-Pacific version of NATO. The deterioration of China/U.S. relations must be stopped, he stressed. If the U.S. does not “hit the brakes, and continues on the wrong path, there will surely be conflict and confrontation.”

He talked up China’s ties with Russia, saying they “set a good example for international relations” and hinted at more currency cooperation with Russia, saying China will use whatever currency is “efficient, safe and credible.”

Qin was conciliatory on Europe, saying China will keep supporting “European integration” and hopes Europe will truly achieve “strategic autonomy” and “long-term security and stability” after the ordeal of the war in Ukraine.

Qin said concerns over China’s economic outlook are “unnecessary,” noting that China’s projected economic growth this year is around 5%, which is higher than many economies in the world.

On Taiwan, Qin said the U.S. needs to explain its plan for “the destruction of Taiwan.” He was referring to comments by Garland Nixon, an American radio program host, who, quoting a White House insider, said last month that President Joe Biden had a plan to destroy Taiwan. “Why can the United States talk about sovereignty and territorial integrity over Ukraine, but does not respect China’s sovereignty and territorial integrity over Taiwan?” He asked why the U.S. prevents other countries from supplying weapons to Russia while the U.S. arms Taiwan. If the Taiwan question cannot be handled well, it will shake the very foundation of China/U.S. relations, Qin concluded.

Qin took a softer approach when speaking about the American people, distinguishing them from U.S. politicians, saying the Americans he has met are just like the Chinese: “Friendly, kind and sincere… they want a better life and a better world.” He described his interactions with Americans, including port workers in Long Beach, California, who want the U.S. and China to work together, and farmers in the state of Iowa, who want to produce more food because many people are still living in hunger. Qin talked about an American student learning Chinese who “loves China” and university leaders who say international exchanges are critical for technological advancement.

Regarding the balloon saga, Qin said the passage of a balloon over U.S. territory earlier this year was an “unexpected incident”… the U.S. “acted with a presumption of guilt… overreacted, abused force and dramatized the incident.”

— China’s exports and imports continued to decline in the first two months of the year, clouding the outlook for the economy as it gradually begins recovering from Covid restrictions and infection waves. Meanwhile, Taiwan’s exports dropped for a sixth consecutive month.

Details: China's exports fell 6.8% to $506.3 billion, and imports shrank 10.2% year over year in January-February 2023 combined, underlining a slowdown in the global economy, deteriorating domestic demand, and lower commodity prices. The trade surplus for the two months of this year was $117 billion, a new record. Exports were down for a fourth consecutive month amid a continued weakness in foreign demand, adding to government concerns that a global slowdown will weigh on the country's recovery. By commodity, sales were down for unwrought aluminum and products (-14.8%) and rare earths (-5.7%), but were up for refined products (74.2%) and steel products (49%). Among major trade partners, exports to the U.S. tumbled 21.8%, while those to the EU and Japan fell 12.3% and 1.6%, respectively. Meanwhile, sales to ASEAN were up 9% and those to Russia rose 19.8%.

— Record Chinese soybean imports to start the year. China imported 16.17 MMT of soybeans during the first two months of the year, up 16.1% from the same period last year and the most ever for January and February combined. Importers actively took delivery of soybeans from the U.S. during the first two months of this year amid Brazilian soybean harvest delays.

— China’s meat imports surge to start 2023. China imported 1.3 MMT of meat in January and February combined, up 21.2% from the same period last year. China doesn’t break down meat imports by category in the preliminary data, but much of the strong year-over-year increase was likely driven by pork imports, which began to ramp up in late 2022.

— China’s pork production, imports expected to increase this year. USDA’s attaché in Beijing expects pork production and imports, along with beef production to increase this year. China’s pig crop in 2023 is forecast to decline 2% from last year to 700 million head but pork production is estimated at 55.5 MMT, up marginally from last year. The attaché expects China’s pork imports to rise 4% amid increased demand to 2.2 MMT. It expects beef production to increase 3% to 7.4 MMT, while beef imports are forecast to be slightly lower at 3.4 MMT.

|

TRADE POLICY |

— Biden administration to request formal USMCA consultations with Mexico over GMO corn dispute. The decision was expected and came too late for some GOP lawmakers. The decision comes after the U.S. repeatedly conveyed to Mexico serious concerns about the country’s biotechnology policies that threaten to disrupt billions of dollars in agricultural trade, U.S. Trade Representative Katherine Tai said in a statement.

The Mexican government has moved to limit imports and use of U.S. GMO corn, saying that it could pose a danger to the health of the nation’s citizens. The US counters that Mexico’s concerns aren’t based in science.

Mexico’s policies “will stifle the innovation that is necessary to tackle the climate crisis and food security challenges if left unaddressed,” Tai said. “We hope these consultations will be productive as we continue to work with Mexico to address these issues.”

Mexico’s Economy Ministry said it had received the USTR’s request to start the consultation process. The ministry will “demonstrate with data and evidence that there has not been an effect on trade” and that Mexico has acted in accordance with the U.S.-Mexico-Canada (USMCA) agreement. The ministry also said it doesn’t see the U.S. request as “contentious,” but rather as a preliminary step toward finding “a solution in a cooperative manner.”

Background: Mexico last month announced plans to eliminate a previous deadline to ban GMO corn for animals and manufactured products, with the phase-out instead depending on supply and establishing working groups with domestic and foreign businesses for an orderly transition. But Mexico will still prohibit the importation of GMO corn for flour and tortillas, as well as glyphosate, a commonly used pesticide.

Perspective: USMCA was supposed to accelerate dispute resolution, but the lengthy U.S. case against Canada’s dairy policy suggests otherwise. USDA Secretary Tom Vilsack said he was hopeful that Washington’s concerns can be fully addressed. “Absent that, we will continue to pursue all necessary steps to enforce our rights under the USMCA to ensure that U.S. producers and exporters have full and fair access to the Mexican market,” he said in a statement.

Next steps: Consultations under the USMCA’s chapter on food-safety measures are a pre-requisite for formal dispute resolution talks, like those that the U.S. and Mexico have already had on automobiles and energy. Those dispute talks could be requested if the technical discussions don’t take place or don’t lead to a resolution. U.S. officials have spoken with their Mexican counterparts for more than a year in a push to resolve the issue, including a virtual meeting at the end of February between Tai and Mexican Economy Minister Raquel Buenrostro.

|

ENERGY & CLIMATE CHANGE |

— House Republicans take on WOTUS via resolution, but Biden will veto. The Republican-led House is set to take up legislation to overturn a Biden administration rule expanding environmental protection for additional bodies of water under the Waters of the U.S. (WOTUS) rule. Republicans say it creates a regulatory burden on farmers, property owners, and small businesses. “This rule needs to be repealed so Americans across the country are protected from subjective regulatory overreach making it harder to farm, build and generate economic prosperity,” said Water Resources and Environment Subcommittee Chairman David Rouzer (R-N.C.) said following the House Transportation and Infrastructure Committee’s approval of the resolution on Feb. 28. However, White House sources say should the matter reach the White House, President Biden would veto it.

Meanwhile, the EPA hit back against Texas and other states suing to vacate the agency’s new WOTUS rule, saying the states have sued to halt a rule that isn’t much different from the status quo.

— The emerging market for renewable energy is reshaping manufacturing towns. A factory in a former oil town in upstate New York has pivoted to producing wind turbines and could serve as a model for other factory towns amid the nation’s shift to renewable energy. The Wall Street Journal reports (link) the Ljungström factory in Wellsville has sold parts to coal-fired power plants for 100 years. Now, workers are welding hulking steel components of wind turbines that are set to rise out of the ocean east of Long Island. The pivot to wind has prompted plant managers to hire 150 more people and to consider reopening a facility that has been dormant for several years. More places with historical ties to traditional energy markets may try their hand at renewables as the U.S. works to meet a goal of cutting greenhouse gas emissions in half by 2030 and as a new supply chain emerges around the materials.

|

LIVESTOCK, FOOD & BEVERAGE INDUSTRY |

— USDA unveils Product of USA voluntary labeling proposed rule. USDA’s Food Safety and Inspection Service (FSIS) announced a widely expected rule regarding the labeling claims of Product of USA and Made in USA which would allow the voluntary labeling claims to be used for animals born raised, slaughtered and processed in the United States. In the case of multi-ingredient products, the same requirements would apply and that additional ingredients in the product — except for spices and flavorings — be of domestic origin.

FSIS is proposing to allow “qualified claims” to be made on package labels which would specify that the product was, for example, “sliced and packaged in the United States using imported pork.”

If a state or region wants to put a label that would claim the products were made in that state/region, they would need to meet the proposed criteria for the Product of USA and Made in USA label.

FSIS says labels claiming U.S. origin would be subject to routine inspection tasks by FSIS inspection program personnel.

The proposed rule would apply to all products subject to mandatory FSIS inspection or eligible for voluntary inspection by FSIS. The agency said they believe there would be a one-time cost for updating labels, record keeping and market testing would be $3 million, with a range of $1.4 million to $6.7 million.

If the rule becomes final, FSIS will issue guidance “as needed” on recommended documentation to meet the requirements. FSIS also did not indicate there would be any transition period and that the compliance date would be the date the rule becomes final. FSIS said it considered a 42-month extended compliance period, which it said would reduce costs but that would reduce consumer benefits they say that would emerge with the proposed Product of USA and Made in USA label, with the benefit being consumers would make more-informed choices of the products they purchase.

Approximately 12% of meat, poultry and egg product retail labels had a Product of USA label, FSIS said.

The proposed rule has received mixed comments.

|

HEALTH UPDATE |

— Summary:

- Global Covid-19 cases at 676,125,671 with 6,877,999 deaths.

- U.S. case count is at 103,656,673 with 1,122,264 deaths.

- Johns Hopkins University Coronavirus Resource Center says there have been 672,076,105 doses administered, 269,554,116 have received at least one vaccine, or 81.81% of the U.S. population.

|

POLITICS & ELECTIONS |

— “Sore loser” laws would make independent general election bid by Trump difficult. Bloomberg reports (link) former President Donald Trump has suggested he will mount a third-party campaign if he doesn’t win the Republican presidential nomination. But “sore loser” laws in six states he would need to return to the White House mean “he can’t win that way either.” Bloomberg says, “Michigan, Ohio, Pennsylvania and Texas, as well as Arkansas and Alabama, have laws that bar a candidate defeated in a major-party primary from running as an independent or on a third-party ticket in the general election.” Thus, Trump would begin the general election campaign “with a deficit of 91 electoral votes of the 270 required to capture the White House.”

|

OTHER ITEMS OF NOTE |

— North Korea said any move to shoot down one of its test missiles would be considered a declaration of war and blamed a joint military exercise between the United States and South Korea for growing tensions, state media KCNA said.

— The White House is considering restarting the detention of migrant families caught crossing the U.S.-Mexico border, four current and former officials told Reuters. The Biden administration also is weighing reviving immigration arrests of migrant families within the U.S. who have been ordered deported. Link for details.

|

KEY LINKS |

WASDE | Crop Production | USDA weekly reports | Crop Progress | Food prices | Farm income | Export Sales weekly | ERP dashboard | California phase-out of gas-powered vehicles | RFS | IRA: Biofuels | IRA: Ag | Student loan forgiveness | Russia/Ukraine war, lessons learned | Russia/Ukraine war timeline | Election predictions: Split-ticket | Congress to-do list | SCOTUS on WOTUS | SCOTUS on Prop 12 | New farm bill primer | China outlook | Omnibus spending package | Gov’t payments to farmers by program | Farmer working capital | USDA ag outlook forum |