Back to Future: Farm Bill Funding Issue Goes Back to Old Issue of Tapping USDA’s CCC

Vilsack and USDA’s NASS get lots of questions and complaints about cutting key reports

|

Today’s Digital Newspaper |

MARKET FOCUS

- Fed’s Powell pivots again

- ECB’s Lagarde expresses different stance vs Powell in interview with CNBC

- United Airlines takes $200 million charge over 737 Max 9

- Bank earnings features rebound in investment banking and surge in trading fees

- Yellen backs Biden: U.S. Steel deal should stay American-owned

- USDA meeting focuses on cuts to data reports

- NGFA urges USDA to preserve county estimates

- U.S. federal spending a big threat

- Metals analysts say central banks buying around 25% of annual gold production

- Biden admin likely to nix mining co’s bid to access $7.5 bil. copper deposit

- Weakened U.S. freight market evident in report from J.B. Hunt Transport Services

- Ag markets today

- Ag trade update

- NWS weather outlook

- Pro Farmer First Thing Today items

CONGRESS

- Rep. Marjorie Taylor Greene says Johnson's speakership coming to an end

- Senate subcommittee hearing today on Boeing

- House GOP forwards two articles of impeachment Mayorkas to Senate

- TikTok bill, passed by House, under Sen. Maria Cantwell's (D-Wash.) review

ISRAEL/HAMAS CONFLICT

- U.S. plans to impose new sanctions on Iran.

POLICY

- G.T. Thompson gets sensitive and critical regarding upcoming farm bill details

- Boozman’s farm bill timeline of this year ion target because of higher hurdles in 2025

- Republicans on Senate Ag to release farm bill framework soon after House panel acts

CHINA

- Biden asks trade officials to more than triple tariff rate on Chinese steel & aluminum

- Vilsack again cites China as factor U.S. ag trade deficit

- Congressional committee: Chinese subsidies fueling America’s opioid crisis

TRADE POLICY

- WTO chief: ‘Free for all’ under Trump’s tariff-hike plan

- IMF warns of rising protectionism threatening global trade

- Republicans skirmish with USTR Tai over trade policy

LIVESTOCK, NUTRITION & FOOD INDUSTRY

- Vilsack and NASS criticized for canceling key reports, especially July Cattle survey

- USDA assures minimal dairy trade disruptions amid HPAI concerns

- Lawmakers want oversight of U.S.-funded bird flu gain-of-function research in China

- Vilsack responds to dairy reduction criticism in WIC program

- Costco's CFO prioritizes efficiency in inventory management

POLITICS & ELECTIONS

- Sabato: Arizona's Senate race now leans towards Democrats, while AZ-6 a toss-up

|

MARKET FOCUS |

— Equities today: Asian and European stock indexes were mixed overnight. U.S. Dow opened up around 160 points higher. In Asia, Japan -1.3%. Hong Kong flat. China +2.1%. India closed. In Europe, at midday, London +0.5%. Paris +1.3%. Frankfurt +0.6%. The Fed will release its Beige Book on the economic conditions of its 12 central bank districts. Cleveland Fed president Loretta Mester and Fed board governor Michelle Bowman speak at public events later today. Key speeches include President Biden’s address at the United Steelworkers’ headquarters, while Treasury Secretary Janet Yellen meets with German Finance Minister Christian Lindner.

U.S. equities yesterday: The Dow rose 63.86 points, 0.17%, at 37,798.97. The Nasdaq fell 19.77 points, 0.12%, at 15,865.25. The S&P 500 eased 10.41 points, 0.21% at 5,051.41.

— United Airlines takes a $200 million charge over the 737 Max 9. The company, which reported an adjusted loss for the first quarter, said it would have been profitable if it weren’t for the grounding of the Boeing jets.

— The early report card on bank earnings features a rebound in investment banking and a surge in trading fees. But inflation concerns are clouding their outlooks.

— Yellen backs Biden: U.S. Steel deal should stay American-owned. Treasury Secretary Janet Yellen, leading a panel with authority over Japan's bid to purchase United States Steel Corp, aligns with President Biden's stance that the company should remain American-owned. While she refrained from discussing the review process, citing confidentiality, she underscored the panel's role in evaluating deals that could jeopardize U.S. national security. Yellen made the comments during a press conference Tuesday in Washington. She heads the Committee on Foreign Investment in the United States (CFIUS), a panel with the authority to review foreign acquisitions of U.S. companies; it can recommend that deals posing a threat to U.S. national security be blocked.

— Ag markets today: Corn, soybeans and wheat held in tight trading ranges during a quiet overnight session. As of 7:30 a.m. ET, corn futures were trading steady to a penny higher, soybeans were steady to 2 cents lower, SRW wheat was 3 to 4 cents higher, HRW wheat was fractionally to a penny higher and HRS wheat was 2 to 3 cents higher. The U.S. dollar index and front-month crude oil futures were both modestly weaker this morning.

Choice beef back below $300. Choice boxed beef prices fell $2.86 on Tuesday to $298.02, while Select firmed $1.30 to $292.64. The $300.00 level has become a pivot point for Choice beef of late, hovering within a couple dollars on either side of that level for the past two weeks. The back-and-forth trade suggests retailers are being selective buyers around that level.

Pork cutout back below $100. The pork cutout value dropped $4.05 to $99.55 on Tuesday, due almost entirely to a $22.78 plunge in primal bellies. That ended eight straight days with the cutout above the $100.00 level. While a short-term pullback wouldn’t be out of the question, wholesale pork prices should generally continue to strengthen seasonally into summer.

— Agriculture markets yesterday:

- Corn: May corn futures dipped 1/2 cent to $4.31 and near mid-range.

- Soy complex: May soybeans fell 13 1/4 cents to $11.45, while May soymeal fell $3.20 to $335.30. Both ended near session lows. May soyoil fell 56 points to 44.91 cents, the lowest close since Feb. 23.

- Wheat: May SRW futures fell 2 cents to $5.49 3/4, settling near the mid-point of today’s range. May HRW futures rose 3 1/2 cents to $5.87 1/2, nearer session highs. May HRS futures closed up 1 1/4 cents at $6.38 1/4.

- Cotton: May cotton fell 164 points to 81.29 cents, while the most-active July contract plunged 206 points to 83.09 cents, marking a 3-month low close.

- Cattle: June live cattle futures surged $1.90 to $175.725, settling on session highs. Nearby April futures rallied $1.20 to $181.50. May feeders surged $2.975 to $240.975.

- Hogs: June lean hogs closed up 37 1/2 cents at $102.825 though closed nearer the session low.

— USDA meeting focuses on cuts to data reports. At USDA's spring data users’ meeting, the decision to withhold county estimates for the 2024 growing season and discontinue the July Cattle report was a major topic. NASS officials explained these choices were driven by budget constraints rather than shifting funds to other projects. Despite a reduced budget for fiscal year (FY) 2024 compared to FY 2023, officials stated they were open to resuming these efforts if funding becomes available. They also noted that USDA's Risk Management Agency (RMA) provides county data, serving as a potential alternative.

Additionally, a representative from USDA's Foreign Agricultural Service discussed plans to overhaul the export sales reporting system, aiming for a 2025 rollout after addressing issues from a failed update in 2022. expects to roll out an upgraded system for its weekly export sales reporting program in late 2025, an official with the agency said on Tuesday. Exporters are required by law to report sales of U.S. agricultural commodities to the USDA's Foreign Agricultural Service, which reports weekly export sales each Thursday. The reports are closely watched by grain and livestock traders. USDA is still refining its new system, to be called the Export Sales Reporting and Query System (ESRQS), following a failed roll-out in August 2022 that sent traders scrambling and delayed export sales reports for three weeks. "We expect to launch the new system next year, in 2025, probably later in the year," Patrick Packnett, a deputy administrator with the USDA's Foreign Agricultural Service, said at a data users' meeting in Chicago. "There will be ample testing with the exporters before we attempt to launch the new system again," Packnett said.

Note: For a related item, see the Livestock section.

— NGFA urges USDA to preserve county estimates. The National Grain and Feed Association (NGFA) in a letter to USDA Secretary Tom Vilsack stresses the importance of National Agricultural Statistics Service (NASS) reports, particularly county estimates, in agribusiness operations. In the letter (link), NGFA highlights the critical role these reports play in supply and demand estimations, which are vital for operational planning and commodity sourcing. “For example, it would become more difficult for an exporter to participate in the export sales market without an accurate knowledge of how much grain is in their draw area. Also, processors and livestock feeders would have problems making appropriate purchase decisions to keep their operations continuously supplied,” the group said. NGFA expresses concerns about the discontinuation of county estimates and emphasizes the need for these data to ensure efficient supply chains. NGFA seeks to collaborate with USDA to address budgetary constraints while safeguarding the integrity of county estimates.

— Quotes of note:

- “China’s subsidies and other forms of support lead to exports flooding global markets at artificially low prices, undercutting American steel.” — Lael Brainard, the director of the White House’s National Economic Council.

- U.S. federal spending a big threat… According to Piper Sandler economists, U.S. federal spending poses the primary threat to disinflation and lower interest rates. They highlight a projected $1.8 trillion deficit for the 2024 fiscal year, amounting to 6.5% of GDP. The economists argue that high government spending at all levels is propping up GDP but also contributing to persistent inflation. They caution that ongoing deficits could hamper potential GDP, leading to lower incomes, diminished living standards, and increased poverty rates over time.

- "In fact, by many measures, global trade is a huge contributor to the climate problem." — John Podesta, a senior Biden administration on international climate policy.

— Federal Reserve Chairman Jerome Powell's recent statements indicate a cautious approach towards adjusting interest rates due to persistent inflationary pressures. Powell suggested the Fed may delay rate cuts, acknowledging that recent data has not increased their confidence in achieving their inflation targets promptly. He emphasized the importance of allowing current policy measures to continue working and relying on evolving economic data to guide future decisions.

Of note: While Powell indicated that rate increases were not under consideration, he also stated the Fed would keep rates at their current level for as long as necessary if inflation remains stubborn. This stance represents a shift from earlier indications that suggested the Fed was nearing a point where rate cuts could be considered.

Powell's message was reinforced by Fed Vice Chair Philip Jefferson, who echoed similar sentiments regarding the need for a patient approach. Jefferson emphasized the importance of monitoring upcoming data to assess the persistence of inflation and suggested that maintaining higher rates for longer might be necessary if inflation proves more enduring than anticipated. Jefferson's previous suggestion of potential rate cuts this year was omitted from his recent remarks, indicating a possible recalibration of the Fed's outlook on monetary policy in response to evolving economic conditions.

Market perspectives:

— Outside markets: The U.S. dollar index was weaker, with the euro, British pound and several other foreign currencies stronger versus the greenback. The yield on the 10-year U.S. Treasury note was weaker, trading around 4.65%, with a mixed tone in global government bond yields. Crude oil futures were lower ahead of U.S. gov’t inventory data due later this morning with U.S. crude around $84.90 per barrel and Brent around $89.50 per barrel. Gold and silver futures were narrowly mixed, with gold lower around $2,402 per troy ounce and silver higher around $28.53 per troy ounce.

— European Central Bank President Christine Lagarde expressed a different stance compared to Powell in an interview with CNBC. Lagarde indicated that the ECB is still planning to lower interest rates soon, barring any significant shocks. She emphasized the need to strengthen confidence in the disinflationary trend. Lagarde stated that if the process aligns with expectations and no major disruptions occur, the ECB will likely adjust its restrictive monetary policy. The ECB maintained its 4% deposit rate unchanged for the fifth consecutive meeting held on Thursday.

— Broker SP Angel reported that metals analysts say central banks are buying around 25% of annual gold production — the highest level since the early 1970s when the Bretton Woods accord unraveled.

— Biden administration is expected to block a mining company’s application to build a 211-mile road through Alaskan wilderness to reach an estimated $7.5 billion copper deposit. Link to details via the New York Times.

— Impact of a weakened U.S. freight market on carriers is evident in the latest earnings report from J.B. Hunt Transport Services for the first quarter. Domestic shipping demand has faltered, and pricing measures are declining. J.B. Hunt's revenue dropped by 9% to $2.94 billion, missing analyst forecasts, and its profit of $127.5 million is over 35% lower than the previous year. J.B. Hunt is a significant player in the freight industry, and its broad range of services across trucking and intermodal operations makes it a reliable indicator of market trends, the Wall Street Journal reports (link). The substantial declines across most business units paint a grim picture of the sector. Experts note that rates in both contract and spot markets have been decreasing this year, with truck supply exceeding demand. Even J.B. Hunt's typically stable dedicated contract business experienced setbacks last quarter.

— Ag trade update: South Korea purchased 70,000 MT of corn expected to be sourced from the U.S. or South America. Jordan tendered to buy up to 120,000 MT of optional origin milling wheat. Tunisia tendered to buy 25,000 MT of optional origin durum wheat.

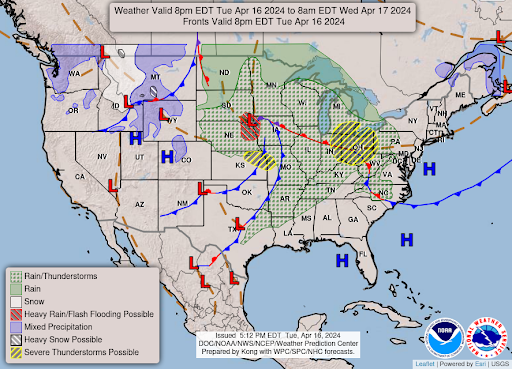

— NWS weather outlook: Severe weather and isolated flash flooding for the Lower Great Lakes/Ohio Valley Wednesday... ...Moderate to locally heavy mountain snowfall for the northern Rockies... ...Warm temperatures in the South and Desert Southwest; chillier weather for the Upper Great Lakes and northern Rockies.

Items in Pro Farmer's First Thing Today include:

• Quiet overnight grain trade

• France cuts non-EU wheat export forecast

• Eurozone inflation at 28-month low

• UK inflation drops to 30-month low

|

CONGRESS |

— Rep. Marjorie Taylor Greene (R-Ga.) is openly declaring that Rep. Mike Johnson's (R-La.) speakership is coming to an end, either imminently or if Republicans regain the House majority. She, along with Rep. Thomas Massie (R-Ky.), is leading an effort to remove Johnson from his position after he announced plans for votes on foreign aid bills. Despite Johnson's refusal to resign, Greene asserts that his speakership will inevitably end, indicating she won't be dissuaded by initial challenges. While some Democrats might support Johnson, Greene's strategy could repeatedly pressure him, particularly after an aid bill passage when he might be more vulnerable.

— A Senate subcommittee is conducting a hearing today following allegations made by a Boeing engineer, Sam Salehpour, who claimed that shortcuts were taken during the manufacturing of Boeing's 777 and 787 Dreamliner jets. Salehpour is the key witness, and the hearing may uncover new information regarding Boeing's safety and quality practices. This comes amid ongoing scrutiny of Boeing's commercial jets, particularly following two fatal crashes of the 737 Max in 2018 and 2019, resulting in 346 deaths and a lengthy grounding of the aircraft. Additionally, a recent incident involving a door plug on an Alaska Airlines flight has raised concerns about the safety culture within Boeing, with reports of employees feeling hesitant to raise safety issues for fear of retaliation.

— House Republicans have forwarded two articles of impeachment against Homeland Security Secretary Alejandro Mayorkas to the Senate. This move initiates a trial in the Senate and aims to draw attention to President Joe Biden's immigration policy. However, given the Democratic majority in the Senate, the charges are expected to be swiftly dismissed without a trial. House Republicans impeached Mayorkas in February, citing his handling of the southern border and attributing the high number of border crossings to him and the Biden administration. Democrats criticize the impeachment as a political maneuver, arguing that Republicans lack a legitimate rationale for the action.

— The TikTok bill, passed by the House, is now under Sen. Maria Cantwell's (D-Wash.) review. House Speaker Mike Johnson (R-La.) aims to include it in a larger bill with aid for Ukraine, Israel, and Taiwan. This unconventional approach reflects Congress' gridlock, where popular bills may hitch onto others with momentum. The TikTok bill's core aim remains: to force TikTok's divestment from Chinese-controlled ByteDance or face a U.S. ban. Cantwell considers extending the divestment period to 12 months from the original six.

|

ISRAEL/HAMAS CONFLICT |

— In response to Iran's aerial strikes on Israel, the U.S. plans to impose new sanctions on Iran. Israel's war cabinet is discussing potential responses, with the US expecting Israel's reaction to be limited. Iranian President Ebrahim Raisi issued a warning against actions perceived as against Iran's interests. Meanwhile, amid ongoing strikes in Gaza, the U.S. military conducted airdrops of aid, though humanitarian organizations criticize this method as inefficient for aid delivery.

|

POLICY UPDATE |

— House Ag Chair Thompson gets sensitive and critical regarding upcoming farm bill details. Speaking to ag journalists on Tuesday, House Ag Chair G.T. Thompson (R-Pa.) said this regarding a new farm bill: "A lot of this bill, quite frankly, has been written. We've found some pretty creative ways to be able to fund what I think would be a transformational and highly effective farm bill," Thompson said. Then he threw in this kicker: “Anyone who criticizes our funding framework is either being ignorant of the details or being disingenuous."

Thompson said his package, to be released a few days before the committee markup vote, would offer “a robust farm safety net” that is strengthened with money drawn from USDA’s CCC. “We’ll be able to accomplish that,” he said, crediting USDA Secretary Tom Vilsack for the idea.

House Republicans would require future USDA recalculations of the cost of a healthy diet to be budget neutral. Republicans charge the Biden administration unfairly boosted SNAP benefits by an average of 25% during a re-evaluation of the Thrifty Food Plan in 2021. “Not a single dollar will be cut from current SNAP beneficiaries,” Thompson told the North American Agricultural Journalists.

Comments: Congress has a long history of some lawmaker or staff self-describing their own legislation, which sometimes falls flat of early assessments, especially from its authors. As for the “pretty creative” funding mechanisms, why not release them so a fair and accurate assessment can be made?

— Boozman’s farm bill timeline of this year is on target because of higher hurdles in 2025. Sen. John Boozman (R-Ark.), ranking on the Senate Ag panel, nixed the idea that Republicans would rather delay a new farm bill for a potential Trump presidency to write a bill next year. He said a new administration would further delay a bill because of turnover in staff. "I would argue for farmers that we have as great a chance, an easier chance of getting a farm bill done this year rather than next year," Boozman said.

But there’s another likely more important reason why the turtle-like farm bill process should be completed this year. That reason comes from ag consultant Randy Russell of the Russell Group: “I think there are low odds the bill is done in 2024. It could come next year depending on the election outcome… could be large changes… personnel, etc. First item up for the new Congress and White House: the debt ceiling, which will trigger a debt/deficit debate. All of sudden we may not be talking about a budget neutral farm bill but rather a cost savings farm bill.”

— Republicans on the Senate Ag Committee plan to release a farm bill framework soon after the House Ag panel acts, but Senate Agriculture Chairwoman Debbie Stabenow (D-Mich.) cautioned, “We haven’t set an exact timeline” to move the bill.

|

CHINA UPDATE |

— President Biden mulls tripling tariffs on Chinese steel and aluminum. President Joe Biden is responding to concerns about the U.S. steel industry's viability amid intense competition from Chinese exports. In a move reminiscent of former President Donald Trump's trade policies, Biden is considering tripling tariffs on Chinese steel and aluminum imports under Section 301 of the Trade Expansion Act. This decision stems from worries that China's steel production, which exceeds half of global output, floods markets with cheap products, undercutting American steel. Notably, Chinese steel production lacks the environmental regulations imposed domestically in the U.S., contributing to its lower prices. The proposed tariffs aim to level the playing field and protect American steel jobs. Despite concerns about inflation, the administration believes the tariff increase won't exacerbate it. Biden's administration opposes the $14.9 billion sale of U.S. Steel to a Japanese corporation, expressing worries about its impact on the industry. The move on tariffs follows Treasury Secretary Janet Yellen's discussions with Chinese leaders, highlighting concerns about China's economic practices. The timing and implementation of the proposed tariffs remain uncertain pending a statutory review.

Details: A senior administration official said Tuesday that the increased tariffs (from the current. 7.5% to 25%) would protect jobs and not lead to higher inflation. Biden is expected to visit the United Steelworkers headquarters in Pittsburgh today, where he will call for the tariff hike.

Of note: The Biden administration will also investigate China's shipbuilding industry. At a House Ways and Means Committee hearing on Tuesday, USTR Tai testified that she is "closely reviewing" a Section 301 petition submitted from five national labor unions regarding China's acts, policies and practices in the critical maritime, logistics and shipbuilding sector. The 130-plus page petition, submitted in March, proposes imposing a port fee on every Chinese-built vessel that docks in the U.S. That fee could be set at $1 million per 20,000 TEU (twenty-foot equivalent unit) cargo ship, the petition suggested. "A hypothetical million-dollar port fee on a 20,000 TEU cargo ship, for example, would impose a cost of only $50 per container. Given that a single container can hold 10,000 pairs of blue jeans, the cost would be 0.5 cents per pair of blue jeans," the petition said. "Given that major U.S. ports handle over 10,000 incoming vessels per year, a hypothetical fee of even [$1 million] per vessel would generate billions of dollars in revenue," it said.

— USDA's Vilsack again cites China as factor in ag trade deficit. USDA Secretary Tom Vilsack attributes the record agriculture trade deficit in fiscal year (FY) 2023 and FY 2024 to several factors, including a stronger U.S. dollar and a robust domestic economy. However, he also highlights China's role in exacerbating the deficit, noting a $6 billion shortfall in agricultural trade with China in the first three months of FY 2024. Vilsack suggests that China's response may be linked to U.S. policies, such as restrictions on foreign ownership of farmland. He questions whether foreign ownership of farmland poses a greater risk compared to domestic investors owning large U.S. farm operations.

"Maybe it's just coincidental," Vilsack noted, but the U.S. trade deficit in agriculture for the first three months of FY 2024 was $6 billion. China purchased $6 billion less." He added that if the U.S. continues to "rap" its top market for agricultural exports, "it's not surprising that your number one customer would send you a signal about, 'hey, we're paying attention.'"

The "rap" Vilsack was referring to is state laws that limit foreign ownership of farmland. "What's a greater risk, Chinese ownership of farmland or the fact that Wall Street and investment banks own a third of the largest farm operations in the country, 50,000 farms or so owned by investors, not by farm families," he asked. "Which is a greater risk?"

— Congressional committee said that Chinese subsidies are fueling America’s opioid crisis. In findings released on Tuesday, it claimed that China is offering tax rebates for companies that produce ingredients used in fentanyl —s o long as they sell them abroad. Mike Gallagher, the Wisconsin Republican chair of the committee, accused China of wanting “chaos and devastation” in America.

|

TRADE POLICY |

— WTO chief: ‘Free for all’ under Trump’s tariff-hike plan. The head of the World Trade Organization (WTO), Ngozi Okonjo-Iweala, warns that former President Donald Trump's proposal to increase tariffs on U.S. imports could trigger a global trade "free for all." She predicts that other nations would retaliate in kind, leading to instability and unpredictability in trade. Trump's plan includes imposing 60% tariffs on imports from China and 10% other countries, which could potentially raise inflation above the Federal Reserve's target. “I think it will result most likely in a tit-for-tat approach — other members will also look to levy these kinds of charges in return,” Okonjo-Iweala said at a forum in Washington hosted by the Peterson Institute for International Economics. “Then, I think we will have a little bit of a free-for-all, which would upend the stability and predictability of trade.” Okonjo-Iweala hopes the tariff plan doesn't materialize, describing it as a "lose-lose" scenario. However, if it does, she urges WTO members to remain calm and avoid retaliation to preserve the stability of the world trading system.

— IMF warns of rising protectionism threatening global trade. The International Monetary Fund (IMF) warns of a rise in protectionist policies threatening global trade amid forecasts of stable but weak growth. With over 2,500 new industrial policies introduced last year, mainly to shield domestic businesses, tariffs and subsidies risk hampering international growth and exacerbating inflation. JPMorgan Chase's CEO, Jamie Dimon, and others echo concerns, suggesting such measures could hinder global trade. The Biden administration's actions, along with proposed measures by former President Trump and EU officials, reflect a broader trend towards protectionism.

— Republicans skirmish with USTR Tai over trade policy. Republicans and U.S. Trade Representative Katherine Tai clashed over Biden's trade policy during her appearance before the House Ways and Means Committee. The term "woke" was used to critique the administration's approach, with tensions rising as Tai faced sharp questions. Rep. Beth Van Duyne (R-Texas) criticized the perceived lack of a trade agenda, prompting Tai to express frustration. Despite the tense exchange, Tai emphasized a commitment to bipartisan dialogue. However, criticism persisted, with concerns raised over the record agriculture trade deficit forecast at $30.5 billion for fiscal year 2024 and the absence of new free trade agreements (FTAs). Tai's upcoming session with the Senate Finance Committee is expected to address similar issues.

|

LIVESTOCK, NUTRITION & FOOD INDUSTRY |

— Both Vilsack and USDA’s NASS are being criticized for canceling key reports, especially July Cattle survey. This isn’t the first time USDA/NASS has canceled the key Cattle survey, only to eventually get more funding from Congress. But this time, veteran ag stakeholders are asking questions such as:

- What did NASS propose as their funding level to USDA Secretary Tom Vilsack and was that funding level met or reduced and if so, by whom?

- Why did NASS pick the important July Cattle survey at a critical time when more information is needed by the cattle sector?

- Vilsack is pushing millions of dollars into expanding meat processing but on the other hand is not giving the cattle industry information it needs. What’s the logic in that?

- Vilsack can sometimes find billions of dollars for nutrition and so-called “climate-smart” funding but not enough for a well-established cattle survey?

Of note: During a USDA data users’ meeting this week, asked if the decisions were due to funding shifted to other projects or priorities within the Biden USDA, Statistics Division Director Troy Joshua flatly rejected that possibility. "We did not shift any money around due to pressure from above, sideways, or anywhere else," he said. "We received our appropriated level, albeit halfway through the year." Officials also stated that the fiscal year (FY) 2023 budget for NASS was $211.1 million while the FY 2024 figure was $187 million. "That places us in a difficult situation," Joshua stated. "We would love to get it in October, but when we get it in March, it is a difficult situation." He said the agency was re-evaluating the situation for FY 2025 and "if someone is willing to fund it, we will do it." He further said that if funding were arranged soon, the effort could be revived for 2024 crops. Officials also pointed out that USDA's Risk Management Agency (RMA) does release county data that could serve to fill in without the NASS data being available.

USDA Secretary Tom Vilsack also was asked about the NASS report situation in his testimony Monday on the FY 2025 USDA budget before the Senate Appropriations Agriculture subcommittee. He echoed the sentiments of NASS from the data users meeting that the fact the budget approved for USDA was delayed by five or six months and contained cuts for NASS and other areas at USDA. That delay in funding means "the ability and the options available for dealing with a cut in the budget are limited," he observed. But he did not offer any ways to address the situation other than urging lawmakers to get the funding decisions made on time, nor did lawmakers question Vilsack on whether other funding avenues could have been explored.

Meanwhile, American Farm Bureau Federation President Zippy Duvall is also criticizing the USDA decision to cut some reports. In a letter to USDA, Duvall says the decision to cancel the July cattle report “runs counter to previous commitments to improve fair, competitive and transparent markets.” By canceling the July Cattle report, “NASS cancelled one of the very tentpoles of cattle market transparency,” Duvall stressed, adding the decision could stymie Land Grant universities from conducting crop and livestock research. He urged NASS to “reconsider the decision to discontinue this critical reporting.”

— USDA assures minimal dairy trade disruptions amid HPAI concerns. USDA Secretary Tom Vilsack reassured that there haven't been significant disruptions in dairy trade despite the discovery of highly pathogenic avian influenza (HPAI) in U.S. dairy cattle. Vilsack stated that most trading partners haven't halted imports of U.S. dairy products, with only a few expressing concerns. He emphasized proactive outreach to assure partners of safety measures and low risks associated with U.S. milk. USDA plans extensive research to understand virus transmission and potential biosecurity measures needed.

— Lawmakers demand oversight of U.S.-funded bird flu gain-of-function research in China lab. In February, a White Coat Waste Project (WCW) investigation exposed how USDA wasted at least $1 million of taxpayers’ money on an ongoing collaboration with the Chinese Communist Party-controlled Chinese Academy of Sciences (the Wuhan animal lab’s parent organization) and a Wuhan lab white coat on dangerous bird flu gain-of-function experiments.

Now, 18 Republican and Democratic Congress members are demanding answers in a letter to USDA Secretary Tom Vilsack. The lawmakers cite WCW’s recent investigation and write, “We are disturbed by recent reports about USDA collaboration with the Chinese Communist Party (CCP)-linked Chinese Academy of Sciences (CAS) on bird flu research. This research, funded by American taxpayers, could potentially generate dangerous new lab-created virus strains that threaten our national security and public health.”

— Vilsack responds to dairy reduction criticism in WIC program. USDA Secretary Tom Vilsack has been questioned about the perceived reduction in dairy coverage under the WIC program, particularly in the recently released final rule for the program. Critics have pointed out a decrease in the level of milk provided. However, Vilsack clarified during a Senate Appropriations Ag subcommittee hearing that the reduction in fluid milk coverage was not accurate. He explained that while they did reduce the commitment to fluid milk, it was done to align with the supplemental nature of the WIC program. Under the previous rule, the program was providing 120% of the average daily milk consumption, which was deemed excessive. The new rule adjusts this down to around 78%, reflecting the supplemental nature of WIC.

Additionally, Vilsack emphasized that they have made it easier to include other dairy products like yogurt in the program, with the expectation that overall dairy consumption would increase. He projected an increase in milk sales by approximately 130 million quarts compared to the previous year, despite the decrease in the percentage of milk provided.

Bottom line: The final rule also increases the level of whole grains available and introduces new flexibilities for yogurt and cheese purchases. However, the allocation for milk is reduced from the current four to six gallons per month to three to four gallons per month.

— Costco's CFO prioritizes efficiency in inventory management. Richard Galanti, who served as chief financial officer at Costco Wholesale for nearly 40 years, emphasizes simplicity and efficiency in inventory management, aligning with Costco's no-frills approach. With only 3,800 items compared to the 50,000 to 100,000 items found in typical supermarkets or discount supercenters, Costco maintains streamlined inventory to keep prices low and maximize profitability. Galanti credits Costco's buying power for securing better prices, enabling the company to cap markups at 15% for Kirkland Signature products and 14% for others, significantly below supermarket standards. Link to details via the WSJ.

|

POLITICS & ELECTIONS |

— Sabato's Crystal Ball: Arizona's Senate race now leans towards Democrats, while AZ-6 is a toss-up. Says the election experts: “In Arizona’s open-seat Senate race, we now see the Democrats as a narrow favorite, so we’re pushing that race from Toss-up to Leans Democratic. And we also view the swing district AZ-6, held by first-term Rep. Juan Ciscomani (R), as a truly 50-50 proposition, so we’re moving it from Leans Republican to Toss-up.” Link for details.

Rep. Ruben Gallego (D) is likely to face Kari Lake (R) in the Senate race. Gallego has a fundraising advantage and is positioned to the left, while Lake faces challenges due to her hard-right reputation. Polls show Gallego leading, but Arizona's presidential race remains competitive. The publication says this boosts Democrats' Senate prospects, but Republicans still have an easier path to majority due to favorable terrain.

|

KEY LINKS |

WASDE | Crop Production | USDA weekly reports | Crop Progress | Food prices | Farm income | Export Sales weekly | ERP dashboard | California phase-out of gas-powered vehicles | RFS | IRA: Biofuels | IRA: Ag | | Russia/Ukraine war, lessons learned | | SCOTUS on WOTUS | SCOTUS on Prop 12 pork | New farm bill primer | | Gov’t payments to farmers by program | Farmer working capital | USDA Ag Outlook Forum |