House Speaker Johnson to Bring Up Separate Bills Funding Ukraine, Israel and Taiwan

Sneak peek at what USTR Tai will tell lawmakers about Biden trade policy

|

Today’s Digital Newspaper |

MARKET FOCUS

- IMF's WEO: Solid global growth with declining inflation

- Emerging markets grappling with external shocks and internal economic adjustments

- China’s economy grew at faster than expected 5.3% rate in first quarter

- Yield on 10-year Treasury rose above 4.6%, highest point since November

- Fed’s Mary Daly: No urgency for rate cuts

- Bank of America first-quarter earnings exceeded analysts’ expectations

- Morgan Stanley's profit rose in first quarter

- Shares of Live Nation under pressure amid reports DOJ preparing antitrust lawsuit

- Citigroup: Gold set to reach $3,000 an ounce during next six to 18 months

- Ag markets today

- Ag trade update

- NWS weather outlook

- Pro Farmer First Thing Today items

CONGRESS

- Johnson to bring up separate bills funding Ukraine, Israel and Taiwan

- House imposes sanctions on Chinese financial institutions for purchasing Iranian crude

ISRAEL/HAMAS CONFLICT

- Israel signals retaliation

RUSSIA & UKRAINE

- Black Sea shipping deal between Russia, Ukraine, and Turkey collapses

POLICY

- No change in ERP payouts for the week ending April 14

- Vilsack plays the political card in new farm bill debate

CHINA

- China’s economy grew by 5.3% in first quarter, beating 4.6% forecast

- Fitch Ratings downgrades outlook for Chinese state-owned banks

- China’s Q1 pork production declines

TRADE POLICY

- What USTR Tai will tell Congress this week

ENERGY & CLIMATE CHANGE

- Bonnie: USDA plans expansion of conservation practices under IRA

LIVESTOCK, NUTRITION & FOOD INDUSTRY

- Vilsack proposes making WIC mandatory to ensure stable funding

- FSIS sets webinars on voluntary U.S.-origin labeling

- NASS’ proposal to cut ag data sparks concerns

OTHER ITEMS OF NOTE

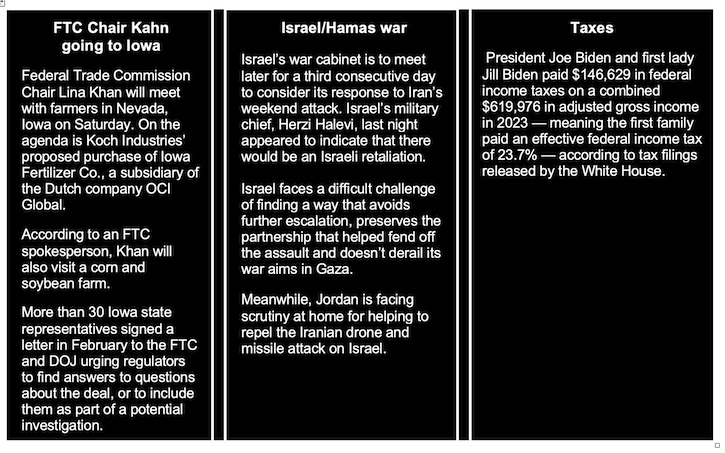

- FTC Chair Kahn going to Iowa

|

MARKET FOCUS |

— Equities today: Asian and European stock indexes were mostly lower overnight. U.S. Dow opened around 230 points higher but is not only up around 60 points. In Asia, Japan -1.9%. Hong Kong -2.1%. China -1.7%. India -0.6%. In Europe, at midday, London -1.4%. Paris -1.2%. Frankfurt -1.2%.

— Federal Reserve chair Jay Powell and vice chair Philip Jefferson will make what are likely to be their last public comments before the U.S. central bank’s next policy meeting on April 30-May 1. There are also several Fed speakers today. In chronological order they are: Jefferson (9:00 a.m. ET), Williams (12:30 p.m. ET), Barkin (1:00 p.m. ET), and most importantly, Powell (1:15 p.m. ET).

U.S. equities yesterday: All three major indices opened the week with losses after losing ground last week. The Down fell 248.13 points, 0.65%, at 37,735.11. The Nasdaq declined 290.08 points, 1.79%, at 15,885.02. The S&P 500 lost 61.59 points, 1.20%, at 5,061.82.

— Yield on the benchmark 10-year Treasury rose above 4.6%, its highest point since November. The CBOE Volatility Index closed at its highest level since October as tensions escalated in the Middle East following Iran’s missile and drone launch at Israel on Saturday.

— Bank of America reported first-quarter earnings Tuesday that exceeded analysts’ expectations for profit and revenue, helped by a surge in trading revenues and net interest income.

— Morgan Stanley's profit rose in the first quarter, lifted by a resurgence in investment banking led by equity underwriting where revenue more than doubled.

— Shares of Live Nation are under pressure amid reports that the DOJ is preparing to file an antitrust lawsuit against the concert promoter and its Ticketmaster unit as soon as next month. The stock is off nearly 8% in premarket trading, falling closer to the $90-level.

— Ag markets today: Corn, soybeans and wheat traded on both sides of unchanged overnight. As of 7:30 a.m. ET, corn futures were trading mostly a penny lower, soybeans were fractionally lower, winter wheat markets were 1 to 2 cents lower and spring wheat was 4 to 7 cents higher. Front-month crude oil futures were modestly lower, while the U.S. dollar index was trading just above unchanged.

Cash cattle continue recent retreat. Cash cattle prices averaged $183.84 last week, down $1.89 from the previous week. After posting an all-time high the week ended March 22, cash cattle prices have fallen for three straight weeks, with a $5.72 decline during that period. Given the rise in slaughter weights and slowdown in operating hours, strong gains in cattle futures and wholesale beef prices are likely needed to halt the slide in cash cattle prices.

Seasonal climb continues for cash hogs, pork cutout. The CME lean hog index is up another 17 cents to $90.73 as of April 12, though the pace of gain slowed notably from recent days. The pork cutout value firmed $2.40 on Monday to $103.60, fueled mostly by a $19.29 jump in primal bellies. Both the cash index and the pork cutout are at their highest levels since last August.

— Agriculture markets yesterday:

- Corn: May corn fell 4 cents to $4.31 1/2, ending the session below the 10- and 40-day moving averages.

- Soy complex: May soybeans dropped 15 3/4 cents to $11.58 1/4, settling nearer the session low. May meal futures sunk $5.90 to $338.50, closing near session lows. May bean oil skid 42 points to 45.47 cents.

- Wheat: May SRW wheat fell 4 1/4 cents at $5.51 3/4 and near mid-range. May HRW wheat lost 5 3/4 cents at $5.84. May spring wheat futures sunk 5 3/4 cents to $6.37.

- Cotton: May cotton rose 31 points to 82.93 cents and closed near the session low.

- Cattle: June live cattle closed up $2.35 at $173.825 and near mid-range. May feeder cattle rose $3.80 to $238.00 and nearer the session high.

- Hogs: June lean hog futures rallied 37.5 cents to $102.45, settling nearer the session high. Nearby May futures rose 45 cents to $94.325.

— Quotes of note:

- Federal Reserve Bank of San Francisco President Mary Daly stressed there’s no urgency for cuts given “remarkable” U.S. growth, a strong labor market and elevated inflation. Daly said she needs to be confident inflation is heading toward the Fed’s 2% target before reacting. The San Francisco Fed chief, who votes on monetary policy this year, repeated that policy is in a “good place.” Daily added: “The worst thing we can do right now is act urgently when urgency isn’t necessary.” During her comments Monday at an event at the Stanford Institute for Economic Policy Research, Daly said: “We’re in the ready position; we can respond as the economy evolves. The labor market’s not giving us any indication it’s faltering, and inflation is still above our target, and we need to be confident it is on path to come down to our target before we would feel the need — and I would feel the need — to react.”

- Oil being delivered. “From a physical perspective nothing has changed for the oil price, and oil is still being pumped in the Middle East and is able to leave the region unhindered.” — XTB research director Kathleen Brooks, on declining oil-price benchmarks following Iran’s attack against Israel.

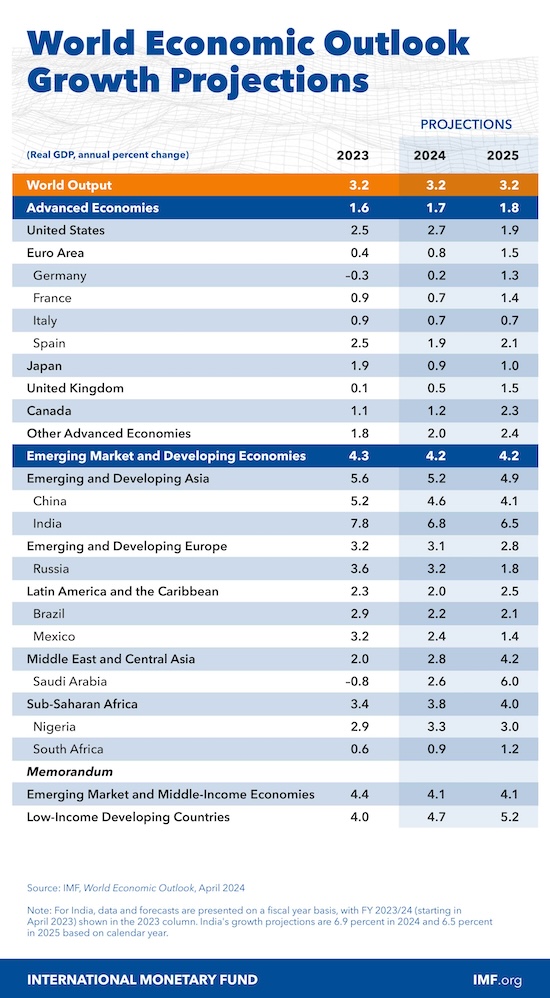

— IMF's latest World Economic Outlook paints a picture of solid global growth with declining inflation, largely driven by the strong performance of the United States. The U.S. economy is anticipated to grow by 2.7% this year, surpassing previous forecasts, though it is expected to moderate to a 1.9% growth rate in 2025. This growth is attributed to robust productivity, employment growth, and strong demand, albeit in an overheated economy. Link to report.

IMF Chief Economist Pierre-Olivier Gourinchas emphasizes the importance of the Federal Reserve adopting a gradual and cautious approach to reducing interest rates in response to this growth. He expresses concern about the fiscal policy in the U.S., stating it is unsustainable in the long term, which could hinder progress in lowering inflation and pose risks to financial stability.

Globally, the economy is projected to expand by 3.2%, maintaining the same pace as the previous year but below the average of the past two decades. Advanced G-7 economies are expected to experience modest growth improvements, with the euro area, UK, and Japan all showing varying degrees of growth. China's growth is anticipated to slow, while India's growth remains strong.

Inflation is expected to decrease, with major central banks likely to start reducing policy interest rates in the latter half of the year. Trade growth is predicted to remain subdued, influenced by increasing cross-border trade restrictions.

Bottom line: Overall, while the global economy is expected to continue growing, there are concerns about fiscal sustainability, inflation, and trade restrictions that could impact the trajectory of growth in the coming years.

— Emerging markets are grappling with external shocks and internal economic adjustments, which could have broader implications for global trade and economic stability. Multiple Asian emerging market currencies are facing depreciation due to a combination of geopolitical tensions and economic expectations. Of note:

- Surging U.S. dollar: The dollar is gaining strength, which typically puts pressure on emerging market currencies as capital flows towards perceived safer assets.

- Middle East tensions: Escalating conflicts in the Middle East, particularly Iran’s attacks on Israel, are contributing to global uncertainty, influencing foreign exchange and financial markets.

- Federal Reserve policy: Expectations that the U.S. Federal Reserve might delay interest rate cuts are also affecting currency values. Higher U.S. rates or the anticipation thereof can strengthen the dollar as investors seek higher returns.

Direct Interventions: In response to these pressures: - Indonesia: The central bank has actively intervened to support the Indonesian rupiah.

- India: The rupee has fallen to a record low, indicating severe market reactions possibly exacerbated by the external economic environment.

- South Korea and Malaysia: The Korean won and Malaysian ringgit also hit significant lows, underscoring widespread regional impact.

- Potential Policy responses: Central banks in these regions are considering raising interest rates to combat currency depreciation. Higher interest rates can attract foreign capital, stabilizing local currencies.

Market perspectives:

— Outside markets: The U.S. dollar index was higher, with most foreign rival currencies also higher against the greenback. The yield on the 10-year U.S. Treasury note was firmer, trading around 4.66%, with a higher tone in global government bond yields. Crude oil futures were lower, with US crude around $85.10 per barrel and Brent around $89.80 per barrel. Gold and silver futures were mixed, with gold firmer around $2,388 per troy ounce and silver weaker around $28.37 per troy ounce.

— Gold is set to reach $3,000 an ounce during the next six to 18 months on rising investor inflows amid expectations the Federal Reserve will cut interest rates, Citigroup Inc. said.

— Ag trade update: Japan is seeking 94,612 MT of milling wheat in its weekly tender. Egypt tendered to buy an unspecified amount of wheat from multiple origins and 50,000 MT of optional origin raw cane sugar.

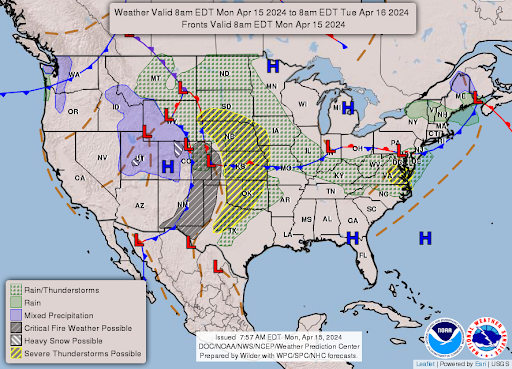

— NWS weather outlook: Storm system to bring the threat of severe weather and isolated flash flooding to the Mississippi Valley Tuesday and the Lower Great Lakes/Ohio Valley on Wednesday... ...Moderate to locally heavy snowfall expected over the next couple of days for the northern Rockies... ...Warm temperatures continue across the South and Desert Southwest, chillier weather expected for the Upper Great Lakes and northern Rockies.

Items in Pro Farmer's First Thing Today include:

• Choppy grain trade overnight

• HRW CCI rating posts notable decline but fully offset by SRW improvement

• Cordonnier cuts Argentine corn crop, raises Brazil soybean production

• France slightly raises wheat plantings estimate but still well below average

• China urges financial institutions to boost credit for advanced manufacturing

|

CONGRESS |

— House Speaker Mike Johnson (R-La.) said the chamber will vote this week on Ukraine and Israel aid. Johnson made his proposal for votes on four separate bills, including funding Taiwan and another that would impose more sanctions on Iran and allow Ukraine to cash in on profits from frozen Russian assets. “We have terrorists and tyrants and terrible leaders around the world like [Vladimir] Putin and Xi [Jinping] and in Iran, and they are watching to see if America will stand up for its allies and our own interests around the globe, and we will,” Johnson said after his meeting with fellow House Republicans yesterday evening.

Rep. Marjorie Taylor Greene (R-Ga.), who threatened to force a vote on deposing Johnson if the House considers any Ukraine aid, said last night she hasn’t decided whether to proceed with an overthrow attempt. A second House Republican told Mike Johnson on Tuesday that he will join Greene's attempt, meaning Johnson would almost certainly need Democratic votes to retain his gavel if his rivals move against him. According to reports, Rep. Thomas Massie (R-Ky.) said during a closed-door GOP meeting that he would back Greene amid rising frustration among conservatives with the speaker's proposed foreign aid package. Massie is the first Republican to commit to backing her.

Bottom line: Splitting the aid into separate packages could ease passage.

— The House imposed sanctions on Chinese financial institutions for purchasing Iranian crude, part of a package in response to Iran’s attack on Israel.

|

RUSSIA/UKRAINE |

— A potential deal regarding Black Sea shipping between Russia, Ukraine, and Turkey was almost finalized but ultimately fell through when Ukraine withdrew at the last minute, according to Reuters. After two months of negotiations, the deal was essentially reached in March. Ukrainian authorities initially allowed Turkish President Tayyip Erdogan to announce the agreement on March 30, indicating a tentative approval. Despite the initial agreement, Ukraine unexpectedly pulled out of the deal, leading to its cancellation. This decision surprised the negotiating parties, Reuters said, citing multiple sources.

The agreement would have authorized Turkey to ensure the "free and safe navigation of merchant vessels in the Black Sea," in line with the Montreux Convention concerning the regime of the straits. This convention regulates the passage of naval ships through the Bosporus and Dardanelles straits but also impacts commercial shipping under certain conditions. Both Russia and Ukraine were to provide security guarantees for merchant vessels operating in the Black Sea, agreeing not to attack or seize vessels that were either empty or carrying non-military cargo.

Of note: The reasons behind Ukraine's decision to not finalize the agreement remain unclear. This situation highlights the complex and ongoing negotiations between the conflicting parties, even as the conflict continues.

— Ukraine grain production to fall about 10%. Ukraine’s grain production is expected to fall to about 52 MMT this year, down 6 MMT (10.3%) from year-ago, due mostly to reduced plantings, according to the first official forecast from the ag ministry. The ministry expects the country to produce 27 MMT of corn, 19 MMT of wheat and 5 MMT of barley. Oilseed production is forecast at 12.5 MMT for sunseeds, 5.2 MMT for soybeans and 4 MMT for rapeseed. USDA’s ag attaché in Ukraine expects production of 26.6 MMT for corn, 21.1 MMT for wheat, 6.6 MMT for barley and 260,000 MT for rye.

|

POLICY UPDATE |

— No change in ERP payouts for the week ending April 14:

- Stability in ERP payments: The total payments made under the ERP for the referenced week amounted to $8.64 billion, with no fluctuations from the previous week.

- Phase 1 payments: Accounted for the majority, totaling $7.75 billion.

- Phase 2 payments: Smaller in volume, reaching $885.69 million.

- No week-to-week change: Both Phase 1 and Phase 2 payments remained stable compared to the prior week.

— Vilsack plays the political card in new farm bill debate. A majority of Republicans on the House Agriculture Committee, influenced by proposals aligned with the Republican Study Committee (RSC), are pushing for significant changes to farm policy, including cutting subsidies for wealthier farmers, altering crop insurance premiums, and ending enrollment in major land stewardship programs, USDA Secretary Tom Vilsack said Monday in comments to the North American Agricultural Journalists. Vilsack highlighted the challenge of passing a bipartisan farm bill amidst a closely divided Congress. He emphasized the need for bipartisan support, especially as Republicans hold a narrow margin in the House and Democrats have only a slight edge in the Senate. With farm bill negotiations stalled over issues like crop subsidies, climate funding, and SNAP, Vilsack proposed utilizing the Commodity Credit Corp. reserve to support farmers. He cautioned against the RSC's "radical" proposals, which could significantly reduce USDA spending on agricultural programs.

The RSC proposals include shutting off crop subsidies to farmers with more than $500,000 a year in adjusted gross income, requiring growers to pay a larger share of the premium for subsidized crop insurance, and ending enrollment in the two largest USDA land stewardship programs, the Conservation Reserve Program and the Conservation Stewardship Program.

The “pretty radical” RSC recommendations would result in “a pretty significant retreat” in USDA spending on agriculture programs, Vilsack said. “It’s going to be interesting to see how it’s playing with members of the House,” he said.

Comments: Here is what Vilsack did not tell the ag reporters, nor did they report this: Nobody takes the RSC budget seriously.

|

CHINA UPDATE |

— China’s economy grew by 5.3% in the first quarter against a year earlier, beating a 4.6% forecast in a Reuters poll and last year’s expansion of 5.2%. “Generally speaking, the national economy got off to a good start in the first quarter… laying a good foundation for achieving the goals and tasks for the whole year,” the National Bureau of Statistics said.

- Of note: This rate of growth is the fastest yearly growth since the second quarter of 2023.

- Government support and festive spending: The robust growth can be attributed to ongoing governmental support measures and increased spending during the Lunar New Year festival, which often boosts consumer and business activity.

- Investment growth: Investment was particularly strong, with fixed investment growing by 4.5% during the quarter, the highest rate in nearly three years and above the expected 4.3%. This suggests robust domestic economic activity and confidence in continued growth.

Mixed economic indicators:

- Industrial output and retail sales: Although the overall growth was strong, the March data indicated that both industrial output and retail sales increased less than anticipated, which could signal underlying weaknesses in these sectors.

- Employment concerns: The surveyed jobless rate in March was 5.2%, close to February's seven-month high of 5.3%. The report notably omitted recent data on youth unemployment, which had previously reached a record high of 21.3% in June 2023, highlighting ongoing challenges in the job market.

- Outlook: The statistics agency expressed optimism about the start of the year, suggesting it lays a solid foundation for achieving the government's GDP growth target of around 5% for the full year. However, the less-than-expected growth in industrial output and retail sales highlights the need for further policy easing to sustain economic momentum.

Bottom line: China’s big bet on manufacturing helped to counteract its housing slowdown in the first three months of the year, but other countries are worried about a flood of Chinese goods. While China's economy shows signs of robust expansion in early 2024, mixed performance in key sectors and employment challenges indicate that careful management and possibly more supportive policies will be necessary to maintain stability and achieve growth targets.

Of note: Chinese leader Xi says China’s exports are helping ease global inflation and warned German Chancellor Olaf Scholz against a “rise of protectionism.” China remains one of the most important markets for Germany’s export-driven economy, prompting a three-day visit by the German chancellor, who has stressed the importance of open markets.

— Fitch Ratings downgrades outlook for Chinese state-owned banks. Fitch Ratings has downgraded the outlook for six Chinese state-owned banks amid concerns about the government’s ability to support the sector in the event of stress.

— China’s Q1 pork production declines. China produced 15.83 MMT of pork during the first quarter of 2024, down 0.4% from the same period last year. That was the first annual decline in quarterly production since the second quarter of 2020. China slaughtered 194.6 million hogs during the first three months of the year, down 2.2% from last year. China’s hog herd declined 5.2% from last year to 408.5 million head at the end of March, while the sow herd fell 6.9% to 40.42 million head.

|

TRADE POLICY |

— U.S. Trade Representative Katherine Tai is set to address trade policies related to China during her testimony before the House Ways and Means Committee. Here are the main points from the upcoming discussions:

- Focus on China trade: Tai will emphasize the administration's strategic review of trade policies toward China, particularly examining the effectiveness of existing Section 301 tariffs implemented during the Trump era.

- Section 301 investigation request: Tai is also reviewing a request from U.S. labor groups to initiate a Section 301 investigation into China's shipbuilding sector, indicative of broader concerns about China's trade practices and their impact on American industries.

- Supply chain concerns: A significant part of her testimony will highlight vulnerabilities in U.S. supply chains due to dependencies on China, which pose risks to American workers and businesses.

- Digital trade at WTO: Lawmakers are expected to question Tai about shifts in digital trade policies at the World Trade Organization (WTO), reflecting evolving priorities under the Biden administration.

- What Tai will say regarding Biden trade policy focus: “We have shifted the conversation from focusing on the bigs to including and championing the interests of the smalls and the mediums. From trickle down to bottom up. From people as consumers only to people as workers also.” The Biden administration, she will note, is using trade policy to incentivize “a race to the top so that we are not pitting our workers against those in other countries and regions.”

- Criticism from lawmakers: House Ways and Means Committee Chair Jason Smith (R-Mo.) released on Op-Ed via Agri-Pulse which outlines what he said is a "failure to advocate for American agriculture on the world stage." Tai and USDA Secretary Tom Vilsack have sought to blame the massive trade deficit in agriculture in fiscal year (FY) 2023 of $16.7 billion ($21 billion on a calendar-year basis) on a strengthening U.S. economy with consumers seeking more goods grown or produced outside the U.S. Smith said his discussions with farmers across the country found a different reason. "American farmers and ranchers face not only poor economic conditions and rising prices, but trade barriers across the world that block them from being able to compete fairly in foreign markets," he wrote. He cited Thailand hitting U.S. beef with a 50% tariff as one of those limits, saying such a barrier is in place because “the Biden administration has not prioritized the interests of American agriculture producers by demanding our trading partners eliminate unfair tariffs and non-tariff barriers to U.S. food. It’s time for the administration to stop passing the blame."

- Trade agreement concerns: Smith also accuses the administration of avoiding formal trade agreements that could reduce tariffs and instead opting for less formal, unenforceable trade engagements. Smith said, "it is bypassing Congress to negotiate fake, unenforceable trade dialogues, working groups, compacts, and handshakes on an ad hoc basis —zero strategy whatsoever." Tai, in excerpts of her prepared statement this week released by USTR, boasts that the Biden administration “has won over $21 billion worth of new agricultural market access in the last three years.”

Bottom line: Tai's testimony is expected to address both the strategic direction of U.S. trade policy, particularly with China, and respond to congressional criticisms regarding the administration’s approach to international trade and its impact on various American sectors.

|

ENERGY & CLIMATE CHANGE |

— USDA could continue expanding the list of conservation practices that qualify for financial support via the Inflation Reduction Act, said Robert Bonnie, undersecretary for farm production and conservation. Bonnie addressed plans to expand eligible conservation practices during a panel at the annual meeting of the North American Agricultural Journalists. Key comments, according to press reports:

- Expansion of supported practices: USDA plans to continue expanding the list of conservation practices that qualify for financial assistance, building on the expansions already made in 2024. This is aimed at broadening the scope of activities that can receive funding under the IRA.

- Climate mitigation requirement: Any new practices added to the list must be accompanied by a robust climate mitigation analysis. This ensures that the practices are genuinely beneficial in combating climate change and are not merely nominal measures.

- Criticism from lawmakers and environmental groups: Some progressive lawmakers and environmental organizations have criticized USDA for including practices in the IRA funding that they believe have questionable effectiveness in reducing greenhouse gas emissions or addressing environmental injustices. Concerns specifically pointed to the inclusion of certain agricultural practices like parts of industrial manure management systems, which might have limited environmental benefits.

- Significant funding increase: The IRA has significantly boosted funding for farm bill conservation programs, with a $20 billion increase. This funding is crucial as it addresses the high demand for financial support in key USDA programs.

- Response to concerns: In response to criticisms, USDA claims to have a rigorous process for assessing the climate impacts of supported practices. More detailed information and scientific backing for these practices are expected to be released during the summer.

- Ongoing discussions and development: USDA’s approach suggests an ongoing evaluation of what constitutes effective climate action within agricultural practices, balancing the expansion of support with the need for environmental accountability.

|

LIVESTOCK, NUTRITION & FOOD INDUSTRY |

— Vilsack proposes making WIC mandatory to ensure stable funding. In remarks to reporters Monday at the North American Agricultural Journalists annual meeting, USDA Secretary Tom Vilsack suggested that Congress could potentially alleviate budgetary challenges and avoid contentious debates by converting the Special Supplemental Nutrition Program for Women, Infants, and Children (WIC) from a discretionary program to a mandatory one. Currently, WIC's funding is subject to negotiation and estimation, which can lead to uncertainty and challenges in budgeting. By making WIC mandatory, its funding would be more stable and predictable, like the Supplemental Nutrition Assistance Program (SNAP).

Vilsack said estimating the cost of WIC is difficult due to fluctuations in participation, making it challenging to accurately predict its budgetary needs. Currently, WIC consumes a significant portion of USDA's discretionary budget.

While WIC has received bipartisan support, it has recently become a contentious issue during budget discussions, particularly when determining the $1 billion needed for full funding, especially amidst high food prices. Making WIC mandatory could potentially remove it from the annual budget negotiation process, providing more stability and security for the program's funding.

— FSIS sets webinars on voluntary U.S.-origin labeling. The Food Safety and Inspection Service (FSIS), a branch of USDA, has scheduled two webinars regarding the implementation of the "Voluntary Labeling of FSIS-Regulated Products with U.S.-Origin Claims" final rule, which was issued in March. These webinars are set to take place on April 30 and May 15, and they will be conducted using the Teams platform. The purpose of these webinars is likely to provide guidance and information to stakeholders about the requirements and procedures associated with the voluntary labeling program. It's noteworthy that compliance with this voluntary program is slated to begin on Jan. 1, 2026, indicating a future timeline for when companies must adhere to the regulations outlined in the final rule.

— NASS’ proposal to cut ag data sparks concerns. USDA's National Agricultural Statistics Service (NASS) has proposed discontinuing several data reports, affecting both the livestock and crop sectors. This proposal has raised concerns among livestock and meat economists, as some of the reports slated for elimination are deemed crucial for market efficiency. Among these reports, the July Cattle Inventory report, while smaller in scope compared to the January report, provides valuable supply information that is vital for understanding the dynamics of the cattle market, especially regarding herd expansion and calf prices. A Southern Ag Today article (link) says “This report will be very valuable over the next several years. If this report had to be discontinued, now is the worst time to do it.”

The proposal also includes dropping certain state-level data, such as beef cow inventory in states like Louisiana, Mississippi, and others in the South, which are significant in supplying feeder cattle to feedlots. Additionally, the elimination of annual county estimates of beef cows and cattle would hinder the analysis of natural disaster impacts on agriculture, such as wildfires and hurricanes.

Furthermore, proposed changes extend to other livestock data, like dropping Virginia and Maryland from state-level estimates in the Chickens and Eggs report, which could affect research on animal diseases and disease control effectiveness.

The article says that while recognizing USDA's budget constraints, there's a concern that reducing available information could negatively impact market efficiency. The reports highlighted in the article offer tangible benefits to farmers and ranchers, prompting the argument for their retention.

|

KEY LINKS |

WASDE | Crop Production | USDA weekly reports | Crop Progress | Food prices | Farm income | Export Sales weekly | ERP dashboard | California phase-out of gas-powered vehicles | RFS | IRA: Biofuels | IRA: Ag | | Russia/Ukraine war, lessons learned | | SCOTUS on WOTUS | SCOTUS on Prop 12 pork | New farm bill primer | | Gov’t payments to farmers by program | Farmer working capital | USDA Ag Outlook Forum |