H&P Report: Negative vs Expectations | Litter Size at Record 11.53 Head

Debris clearing progress at Baltimore bridge collapse

|

Today’s Digital Newspaper |

MARKET FOCUS

- AT&T: Personal data from millions of customers recently leaked on dark web

- UPS to be primary air cargo provider for USPS, replacing FedEx

- Fed’s Powell: Economic resilience gives Fed more flexibility on cutting rates

- Nippon Steel pressing ahead with proposed $15 billion acquisition of U.S. Steel

- China's March 2024 Manufacturing PMI hits 13-month high

- U.S. SPR replenishment cost increasingly more

- Bets on Federal Reserve easing fueling surge in gold prices

- Ag markets today

- Soaring coffee prices will squeeze Asia’s café culture

- Soyoil for biofuels use falls below 1 billion pounds

- India mandates weekly reporting on wheat stocks to prevent hoarding

- Ag trade update

- NWS weather outlook

- Pro Farmer First Thing Today items

BALTIMORE BRIDGE COLLAPSE

- Temporary alternate channel around cleanup site for commercially essential vessels

- 2,000-yard safety zone around Francis Scott Key Bridge remains in effect

- Buttigieg urges Congress to authorize needed money to rebuild bridge

- Maritime industry preparing for significant financial repercussions

ISRAEL/HAMAS CONFLICT

- Netanyahu faces huge protest over weekend calling for his resignation

CHINA

- Behind China’s new-energy overcapacity as it raises stakes of competitiveness

- Washington Post: Preparing for a China war, Marines are retooling how they'll fight

TRADE POLICY

- UK and EU failed to reach tariff-free extension agreement

- FT commentary: China’s hypocrisy on trade.

- USTR releases 2024 report on global trade barriers

ENERGY & CLIMATE CHANGE

- WSJ opinion: How green energy makes us vulnerable to cyberattack

- RFA challenges EU's biofuel regulation; ethanol industry concerned

LIVESTOCK, NUTRITION & FOOD INDUSTRY

- Focus of debate in food industry shifting from plant-based products to lab-grown meat

POLITICS & ELECTIONS

- Recep Tayyip Erdogan suffered unprecedented defeat in Turkey’s municipal elections

- China’s advancing efforts to influence U.S. election raise alarms

OTHER ITEMS OF NOTE

- Argentina and the dollar

|

MARKET FOCUS |

— Equities today: Asian and European stock indexes were mixed to firmer overnight. Several European markets remained closed for the Easter holiday. U.S. Dow opened slightly lower and is currently down around 220 points. In Asia, Japan -1.4%. Hong Kong closed. China +1.2%. India +0.5%.

For the quarter and month of March: The major averages are coming off a winning first quarter. The S&P 500 jumped 10.2% for its best quarterly stretch since 2019, while the Dow added 5.6% for its best quarter since 2021. The Nasdaq Composite popped 9.1%. Markets also completed a winning March and their fifth consecutive positive month, with the S&P and Dow rising 3.1% and 2.1%, respectively. The Nasdaq edged up 1.8% for the month.

— AT&T said personal data from millions of customers was recently leaked on the dark web, and it had reset the passcodes of about 7.6 million account holders. Shares fell 2% in premarket trading. It is not yet known if the data-specific fields, which were leaked two weeks ago, originated from the company or one of its vendors. The hack included personal information such as social security numbers, as well as passcodes and possibly other data. AT&T, which has launched an investigation supported by internal and external cybersecurity experts, said the incident has not yet had a material impact on its operations.

— UPS will take over as the primary air cargo provider for the U.S. Postal Service (USPS), replacing FedEx. FedEx, which had listed USPS as its largest customer for its air-based express segment, sought a more profitable deal with USPS and indicated its willingness to terminate the relationship. FedEx has been the primary carrier for USPS for 22 years, with their current contract expiring on Sept. 29.

— On Wednesday, Walt Disney will hold its annual shareholder meeting in the middle of a proxy battle with activist investor Nelson Peltz’s Trian Partners.

— Notable earnings reports this week include Paychex on Tuesday, Levi Strauss on Wednesday, and Conagra Brands and Lamb Weston Holdings on Thursday.

— U.S. crude oil futures climbed 3.15% to $83.15 a barrel last week, surging 16.1% in the first quarter.

— Ag markets today: Soybeans posted solid gains amid corrective buying overnight, while corn and wheat futures pulled back from last Thursday’s gains. As of 7:30 a.m. ET, corn futures were trading 1 to 3 cents lower, soybeans were 3 to 5 cents higher, SRW wheat was mostly 7 cents lower, HRW wheat was 10 to 13 cents lower and HRS wheat was 4 to 7 cents lower. Front-month crude oil futures were modestly weaker, while the U.S. dollar index was trading just above unchanged.

H&P Report: Negative compared to expectations. USDA’s Hogs & Pigs Report last Thursday showed nearly all categories above the average pre-report estimates. USDA estimated the March 1 hog herd up 0.6% from year-ago, with the market hog inventory 0.8% bigger while the breeding herd declined 2.1%. The winter pig crop increased 1.9%. While winter farrowings declined 2.6%, litter size jumped 4.6% to a record 11.53 head. Pro Farmer expects price pressure on hog futures from the report data.

— Quotes of note:

- Fedspeak. Fed Chair Jay Powell says economic resilience gives the Federal Reserve more flexibility on when to start cutting rates. The Fed chair signaled Friday that robust consumer spending and a strong labor market allowed the central bank to be patient. He reiterated that it wanted to be more confident that inflation was coming down sustainably before taking action.

- Interest rate cuts in the U.S. are still anticipated by June, according to Paul Ashworth of Capital Economics. February's inflation data, particularly the core 12-month PCE gauge hitting 2.8%, surpassing the Fed's 2% target, supports this expectation. Despite higher inflation, the "unexpected strength of real consumption" indicates robust first-quarter GDP growth at 2.4%, while price rises are showing signs of moderation. This scenario allows the Fed to maintain rates in its May 1 meeting and potentially cut them in June. Currently, the probability of a 25-basis point cut in June stands at 61% on the CME's FedWatch tool, down slightly from 67% a week ago.

- Fresh statements from new Nippon Steel President Tadashi Imai show the company is pressing ahead with its proposed $15 billion acquisition of U.S. Steel. The Japanese powerhouse, which pledged no layoffs or facility closures, is also continuing talks with the United Steelworkers union to win support for the deal. President Biden, who was endorsed by USW for a second term, previously said U.S. Steel should retain American ownership, while Donald Trump has vowed to block the transaction if elected.

— The manufacturing purchasing managers' index (PMI) for China, as reported by Caixin, reached a 13-month high in March 2024. The PMI rose to 51.1, up from 50.9 in February, surpassing expectations of 51. This marks the highest level since February 2023. The increase is attributed to robust growth in output over the past 10 months, along with accelerated growth in both new orders and foreign sales. Additionally, business confidence reached its highest level in nearly a year. This data suggests a positive trend in China's manufacturing sector, indicating increased economic activity and optimism among businesses.

Market perspectives:

— Outside markets: The U.S. dollar index was firmer. The euro and British pound were weaker against the greenback. The yield on the 10-year U.S. Treasury note was slightly higher ahead of U.S. market action, trading around 4.23%, with European government bond markets mostly not trading. Crude oil futures were under pressure, with U.S. crude around $82.65 per barrel and Brent around $86.40 per barrel. Gold and silver futures were sharply higher after being closed Friday. Gold was trading around $2,264 per troy ounce and silver around $25.02 per troy ounce.

— U.S. SPR replenishment cost increasingly more. The latest round of Strategic Petroleum Reserve (SPR) stock replenishments in the U.S., totaling 2.8 million barrels in September, has seen the average price hit $81.32 per barrel, above the $79 per barrel threshold that the White House mandated for refilling crude SPRs.

— Bets on Federal Reserve easing are fueling a surge in gold prices, reaching a new record high. On Monday, bullion peaked at $2,265.73 an ounce, marking a 1.6% increase from Thursday's close, following a series of recent highs. Several factors, including heightened tensions in the Middle East and Ukraine, have contributed to gold's rise of approximately 14% since mid-February. Lower interest rates reduce the opportunity cost of holding bullion.

— Soaring coffee prices will squeeze Asia’s café culture. Extreme temperatures and droughts in big bean-producing countries have led to lower harvests. Link/paywall to Financial Times article.

— Soyoil for biofuels use falls below 1 billion pounds. Soybean oil used to produce biofuels in the U.S. fell to 960 million lbs. in January. That’s the first time it was below 1 billion lbs. since crossing that threshold in May of last year.

— India mandates weekly reporting on wheat stocks to prevent hoarding. India has asked traders, major retailers and food processors to declare wheat stocks every Friday from April to prevent hoarding and price spikes. A limit on how much wheat stock traders could hold expired on March 31. However, a limit could be reimposed if prices rise.

— Ag trade update: Saudi Arabia purchased 795,000 MT of optional origin wheat. Egypt purchased 150,000 MT of optional origin raw sugar.

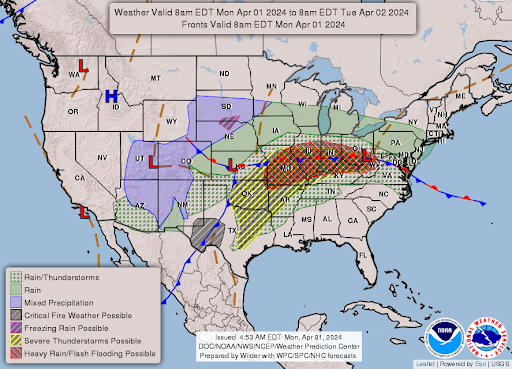

— NWS weather outlook: There is an Enhanced Risk of severe thunderstorms over parts of the Southern Plains, Middle Mississippi, and Ohio Valleys on Monday and over parts of the Ohio/Tennessee Valleys on Tuesday... ...There is a Sight Risk of excessive rainfall over parts of over parts of the Middle Mississippi and Ohio Valleys on Monday and over Eastern Ohio, Tennessee Valleys and Central Appalachians on Tuesday... ...Snow winds down over parts of the higher elevations of Wyoming, Nevada, Colorado, Utah, and Arizona on Monday; light to moderate snow over the northern half of the L.P. of Michigan on Tuesday.

Items in Pro Farmer's First Thing Today include:

• Beans firmer, corn and wheat weaker overnight

• Brazil’s safrinha corn areas get some rain

• Precip in central U.S.

• Stronger February soy crush, corn ethanol use expected

|

BALTIMORE BRIDGE COLLAPSE |

— A temporary alternate channel around the Key Bridge cleanup site in Baltimore is being set up for commercially essential vessels. The captain of the port is preparing to establish a temporary alternate channel on the northeast side of the main channel for commercially essential vessels, according to a news release Sunday night from the Unified Command. “This will mark an important first step along the road to reopening the port of Baltimore,” Coast Guard Capt. David O’Connell, the federal on-scene coordinator of the Key Bridge Response 2024, said in a release. “By opening this alternate route, we will support the flow of marine traffic into Baltimore.” Officials did not immediately respond to a question about when the channel would open. According to the release, the temporary channel will be marked with government-lighted aids to navigation and will have a controlling depth of 11 feet, a 264-foot horizontal clearance, and vertical clearance of 96 feet.

Meanwhile, a 2,000-yard safety zone around the Francis Scott Key Bridge remains in effect to protect personnel, vessels, and the marine environment. Link to other bridge updates included in The Week Ahead.

“I think everybody’s on the same page that the priority is to clear the channel.” — Sen. Chris Van Hollen, (D-Md.).

— Pete Buttigieg, the transportation secretary, yesterday urged Congress to authorize the needed money to rebuild the bridge, emphasizing that the bridge collapse could have an impact on the wider economy. With cost estimates of at least $2 billion, not everyone in Washington is on board, however. “Your district could be next, and this has historically been bipartisan,” Buttigieg told CBS News’ Face the Nation. Biden said last week that the federal government would pay “the entire cost” of rebuilding — the Transportation Department has secured a $60 million “down payment,” but that’s not enough to complete the work.

— The maritime industry is preparing for significant financial repercussions following what is described as one of the largest marine losses in history. John Neal, CEO of Lloyd’s of London, highlighted the magnitude of the disaster. Morningstar analysts estimate insurers could face costs of up to $4 billion. The collision has drawn attention to maritime safety and the trend towards larger vessel sizes. Larry Hogan, former Republican governor of Maryland and current U.S. Senate candidate, reportedly supported mega-ships during his tenure, despite concerns raised by insurers like Allianz regarding risk management issues associated with these large vessels.

|

ISRAEL/HAMAS CONFLICT |

— Benjamin Netanyahu, who faced a huge protest over the weekend calling for his resignation, said the military is preparing to move more than a million Palestinians out of Rafah. Concurrent political crises in Israel — one over hostages in Gaza, the other over drafting the ultra-Orthodox — are testing the limits of Prime Minister Benjamin Netanyahu’s political ties and skills. Meanwhile, Israel's military said it has withdrawn from Al-Shifa Hospital following a 14-day siege. Officials in the region told CNN the sprawling complex, which was Gaza's largest medical facility, had been "destroyed."

|

CHINA UPDATE |

— Behind China’s new-energy overcapacity as it changes the face of manufacturing and raises the stakes of competitiveness. Amid price slashing and Western threats, on-the-ground accounts reflect how China’s new productive push is creating forces to be reckoned with. Link to article in South China Morning Post.

— The Washington Post: Preparing for a China war, the Marines are retooling how they'll fight. U.S. troops are preparing for conflict on an island-hopping battlefield across Asia, against an enemy force that has home-field advantage. Link to article.

|

TRADE POLICY |

— Provisions allowing the UK to sell products containing European Union parts to Canada tariff-free will expire on Monday, after the two countries failed to reach an agreement on extensions.

— Commentary: China’s hypocrisy on trade. Complaining about US protectionism to the WTO while protecting your own economy is rich indeed. Link/paywall to Financial Times commentary.

— USTR releases 2024 report on global trade barriers. U.S. Trade Representative Katherine Tai announced release (link) of the 2024 National Trade Estimate Report on Foreign Trade Barriers (NTE Report), which details significant obstacles encountered by U.S. exports, foreign direct investment, and electronic commerce in key global markets. This report is utilized as a tool by the U.S. government to identify and address barriers to trade and investment, thereby opening markets for American workers, businesses, farmers, and communities.

Ambassador Tai emphasized the importance of returning the NTE Report to its original statutory purpose, which is to highlight legitimate barriers to trade and investment, rather than including measures that may be valid exercises of sovereign policy authority by other governments. The report aims to focus on significant trade barriers that could be addressed to expand market opportunities for the U.S. and foster economic growth.

This year's report covers barriers in 59 markets, including issues such as:

- Obstacles to U.S. agricultural exports, including opaque registration requirements and sanitary and phytosanitary measures not based on science.

- Failure of certain countries to recognize U.S. motor vehicle standards, hindering exports of FMVSS-compliant vehicles.

- Challenges faced by U.S. stakeholders in the European Union due to disparate policies across Member States.

- Non-market policies and practices of China, which provide unfair advantages to Chinese companies and distort global markets.

- Concerns about data policies, including data localization, which can infringe on civil liberties and pose compliance challenges.

The release of the 2024 NTE Report follows the earlier release of the 2024 President’s Trade Policy Agenda and 2023 Annual Report, with plans for the upcoming release of the annual Special 301 Report on intellectual property rights enforcement within 30 days.

|

ENERGY & CLIMATE CHANGE |

— Opinion: How green energy makes us vulnerable to cyberattack. EVs and other digital-controlled products open extra access to the grid, which enemies can exploit. Link to the opinion item by Allysia Finley of the Wall Street Journal.

— RFA challenges EU's biofuel regulation; ethanol industry concerned. The Renewable Fuels Association (RFA) is joining a legal challenge against the European Union's FuelEU Maritime Regulation, arguing that it unfairly penalizes the use of crop-based biofuels in the maritime sector. The regulation aims to reduce greenhouse gas emissions in shipping by 2% by 2030 and up to 80% by 2050, with incentives for renewable fuels of non-biological origin. However, opponents argue that the rules would disadvantage biofuels despite their lower emissions compared to conventional fuels.

RFA is supporting a challenge initiated by EU-based biofuels trade group ePure and biofuels firm Pannonia Bio, seeking to annul parts of the regulation. They argue that the regulation unfairly equates crop-based biofuels with the highest emitting fossil fuels, thereby excluding them from decarbonization objectives. U.S. ethanol producers also fear being shut out of the growing EU market due to the biased regulation.

RFA emphasizes that ethanol and other renewable fuels have lower greenhouse gas emissions than gasoline, as demonstrated by a report from the U.S. Department of Energy's Argonne National Laboratory. They argue that the regulation's bias against crop-based biofuels not only harms ethanol producers globally but also discourages the development and use of low-carbon marine fuels in the U.S. and beyond.

|

LIVESTOCK, NUTRITION & FOOD INDUSTRY |

— Focus of the debate in food industry is shifting from plant-based products to lab-grown meat, as several U.S. states (including Alabama, Arizona, Florida and Tennessee) consider legislation to outlaw this protein source. Arguments in favor of the ban cite safety concerns and the impact on traditional ranching, while opponents view such measures as protectionist and advocate for consumer choice.

Lab-grown meat, produced using cells from living animals in bioreactors, has attracted significant investment from startups and traditional producers like Cargill and Tyson. While some argue that it offers environmental benefits and addresses sustainability challenges, others raise questions about its acceptance by consumers, nutritional equivalence, environmental impact, and safety standards.

|

POLITICS & ELECTIONS |

— Recep Tayyip Erdogan suffered an unprecedented defeat in Turkey’s municipal elections as voters pushed back amid rampant inflation. Market impact: the Lira weakened as Erdogan suffers an historic loss in municipal elections. Erdogan’s AK Party fell behind the main opposition Republican People’s Party, known as CHP, in Sunday’s municipal elections for the first time ever, according to early results published by state broadcaster TRT. Support for AKP stood at 35.5%, while CHP was leading the race with 37.7%, with about 99.8% of the ballots counted, TRT reported.

Bottom line: The results are a blow to Erdogan, who had hoped to use this election to consolidate power and introduce a new constitution, probably designed to give him at least another term.

— China’s advancing efforts to influence the U.S. election raise alarms. China has adopted some of the same misinformation tactics that Russia used ahead of the 2016 election, researchers and government officials say. Link to NYT article for details.

|

OTHER ITEMS OF NOTE |

— Argentina and the dollar. Argentine President Javier Milei said he doesn’t see Argentina dollarizing the economy before next year’s mid-term elections. “I don’t think we’ll get there before next year’s mid-term elections, but the goal continues to exist,” Milei, who took office Dec. 10, told CNN en Espanol in a taped interview that aired Sunday night. Milei has previously said that dollarization would come after his government cleans up the central bank’s balance sheet and overhauls the country’s financial system, without detailing any dates. While Milei insisted during the interview that he’s advocating for a “free competition of currencies,” he conceded the U.S. dollar would likely be the strongest currency in circulation.

|

KEY LINKS |

WASDE | Crop Production | USDA weekly reports | Crop Progress | Food prices | Farm income | Export Sales weekly | ERP dashboard | California phase-out of gas-powered vehicles | RFS | IRA: Biofuels | IRA: Ag | | Russia/Ukraine war, lessons learned | | SCOTUS on WOTUS | SCOTUS on Prop 12 pork | New farm bill primer | | Gov’t payments to farmers by program | Farmer working capital | USDA Ag Outlook Forum |