U.S. PCE Price Index Up 0.3% in Feb. 2024, Core Inflation Slows to 2.8%

Final day for landowners to submit acres for CRP general signup

|

Today’s Digital Newspaper |

— Markets are closed in observance of Good Friday

— Equities: On Thursday, the Dow was up 47.29 points, 0.12%, at 39,807.37. The Nasdaq fell 20.06 points, 0.12%, at 16,379.46. The S&P 500 was up 5.86 points, 0.11%, at 5,254.35.

For the quarter, the Dow was up 5.6%, the Nasdaq gained 9.1%, and the S&P 500 rose 10.2% — that’s only the fourth time since the start of the millennium it has gained 8% or more in the first three months of the year, joining 2012, 2013, and 2019, when it rose 12%, 10%, and 13.1%, respectively. The S&P 500’s first-quarter rally comes on the heels of last year’s 24% surge.

Global stock markets recorded their best first quarter of the year since 2019. The MSCI World index, which tracks almost 1,500 companies globally, gained almost 8% between January and March.

— Agriculture markets yesterday and for the week:

- Corn: May corn futures closed 15 1/4 cents higher to $4.42, gaining 2 3/4 cents on the week.

- Soy complex: May soybeans fell a penny to $11.91 1/2 and ironically lost 1 cent on the week. May soymeal fell $1.30 to $337.70 and ended $1.40 lower from a week ago. May soyoil rose 28 points to 47.95 cents and gained 31 points on the week.

- Wheat: May SRW wheat futures rose 12 3/4 cents to $5.60 1/4, near mid-range and on the week down 5 1/2 cents. May HRW wheat gained 7 cents to $5.85 1/4, near mid-range and for the week down 5 1/4 cents. May spring wheat fell 4 1/2 cents to $6.46 1/2 but rose 5 1/2 cents on the week.

- Cotton: May cotton rose 61 points to 91.38 points but fell 15 points on the week.

- Cattle: June live cattle futures rose $1.575 to $180.25 and near the session high. For the week, June cattle fell $2.65. May feeder cattle futures gained 42 1/2 cents to $248.70, nearer the session high and for the week down $5.075.

- Hogs: Hog futures continued their seasonal advance again Thursday, with nearby April surging 52.5 cents to $86.625. Most-active June skid 15 cents to $101.45, but the close represented a $1.75 weekly advance.

— Of note: Interest payments for mortgages, car loans, or consumer debt are key elements of the cost of living, yet they’re not truly reflected in either the Consumer Price Index or the Personal Consumption Expenditure indices.

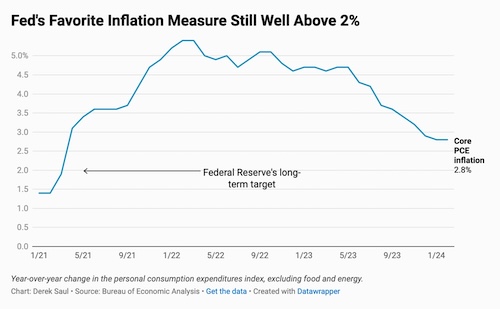

— U.S. PCE Price Index up 0.3% in Feb. 2024, core inflation slows. In February 2024, the Personal Consumption Expenditure (PCE) Price Index in the United States experienced a 0.3% increase compared to the previous month. This rise was slightly lower than the revised 0.4% increase observed in January and fell short of the predicted 0.4% increase. The annual rate of PCE inflation rose marginally from 2.4% to 2.5%, aligning with forecasts.

However, when considering the monthly Core PCE inflation, which excludes volatile components such as food and energy and is a preferred measure of inflation by the Federal Reserve, there was a deceleration. The core PCE inflation rate slowed to 0.3% from a revised 0.5% in January, matching the anticipated rate. Additionally, the core inflation rate decreased slightly from 2.9% to 2.8%.

In summary: While overall PCE inflation saw a modest increase and met expectations, core PCE inflation, excluding food and energy, slowed down, indicating potentially less pressure on underlying inflationary factors.

Of note: Fed chair Jerome Powell may give his reaction in a few hours. He's participating in a panel discussion at the San Francisco Fed at 11:30 a.m. ET. Powell said at his March 20 news conference that the Fed expected the monthly increase in the core PCE price index to be well below 3%, keeping the 12-month inflation rate at 2.8%.

Traders were pricing in about a 64% chance the Fed will move to cut rates by June as of Thursday afternoon, according to CME Group.

— In February 2024, personal spending in the U.S. surged by 0.8% compared to the previous month, marking the largest increase since January 2023. This growth surpassed both the 0.2% recorded in January and the anticipated 0.5%. The rise primarily reflects a $111.8 billion increase in spending on services, notably financial services and insurance (driven by financial service charges, fees, and commissions), transportation services (led by air transportation), and housing and utilities (led by housing). Additionally, spending on goods increased by $33.7 billion, with a significant portion allocated to motor vehicles and parts, particularly new light trucks.

— Gold held above $2,230 an ounce in holiday-thinned trade on Friday, hovering at all-time highs amid bets that major central banks would shift to interest rate cuts this year, while heightened geopolitical tensions boosted safe-haven demand for bullion. The metal is also on track to advance more than 9% for March.

— Baltimore bridge collapse: Experts note the rare occurrence of a cargo ship, the Dali, experiencing a total power and propulsion failure before colliding with Baltimore's Francis Scott Key Bridge. This incident resulted in the collapse of a portion of the bridge and the deaths of six construction workers. Maritime engineers and experts suggest that such a failure could be caused by either faulty equipment or contaminated fuel. The National Transportation Safety Board (NTSB) is investigating whether contaminated fuel played a role in the ship's systems failure. While it's unusual for all systems on a vessel to fail simultaneously, experts note that mechanical and electrical issues can occur. The exact cause of the Dali's failures remains unknown pending further investigation, with initial reports expected within a month and a full inquiry possibly lasting two years.

Large cargo vessels typically use diesel fuel for both engines and generators, with backup generators intended to kick in automatically if primary systems fail. However, if fuel becomes contaminated, it can lead to engine problems.

While onboard filtration systems aim to remove impurities, they are not foolproof. Observations of black smoke emitted from the ship suggest potential fuel-related issues. But other experts remain skeptical, suggesting that a main engine problem may have led to the power loss.

— The Transportation Dept. approved an initial $60 million emergency funding response following the tragic collapse of the Francis Scott Key Bridge. The new funds will serve as a “down payment toward initial costs” as Maryland’s government works on emergency repairs, design and reconstruction of the bridge, the federal agency said in a statement yesterday. However, there are indications that securing additional funding from Congress may face challenges. Some Republicans expressed hesitancy, while some Democrats suggested exploring insurance or seeking contributions from the shipping company before resorting to federal funds.

— Clearing the Baltimore port channel. Maryland Gov. Wes Moore (D) announced the Army Corps of Engineers is moving the largest crane on the Eastern Seaboard to help remove the wreckage of the bridge so work to clear the channel and reopen the key shipping route can begin, though he warned of a “very long road ahead” to recover from the loss of Baltimore’s Francis Scott Key Bridge.” The machine can lift up to 1,000 tons, and Sen. Chris Van Hollen (D-Md.) said a second crane with a 400-ton capacity could arrive Saturday. Van Hollen said that roughly 90% of the bridge’s reconstruction will be paid for via the Federal Highway Administration’s emergency fund.

Removing the ship. Bloomberg reports U.S. Coast Guard Vice Admiral Peter Gautier announced Resolve Marine, a salvage firm that helped contain the Deepwater Horizon oil spill and safely blow up part of New York’s Tappan Zee Bridge, is mobilizing resources to re-float and remove the ship that smashed into the Francis Scott Key Bridge, the Dali. Gautier asserted, “Consistent with the president’s direction to get the port up and running as soon as possible, the Coast Guard’s highest priority now is restoring the waterway for shipping, stabilizing the motor vessel Dali and removing it.”

While officials have yet to offer a timeline for how long it will take to clear the Patapsco River, infrastructure and salvage experts said the cleanup would pose a monumental challenge that includes frigid waters for divers having to cut steel beams and the 764 tons of hazardous materials that remain onboard the Dali.

— Link to Farm Bureau report on impact of Baltimore bridge collapse for agriculture.

— U.S. port security, safety, and funding needs will be the focus of a House field hearing next week at PortMiami in Florida. Witnesses will include representatives from shippers, ports, the Maritime Administration and the Coast Guard. The Transportation and Infrastructure Committee yesterday announced the joint April 5 hearing, which will be shared between its maritime transportation subcommittee and the maritime security panel on the Homeland Security Committee.

— Today is the final day for landowners to submit acres for the Conservation Reserve Program (CRP) general signup, which began on March 4. USDA also initiated signup for continuous enrollment, running until July 31 for contracts starting on Oct. 1. To ensure the program stays within the 27-million-acre cap for fiscal year (FY) 2024, USDA is employing a batched signup approach. The first batch, from Jan. 12 to March 15, is under consideration, with subsequent batches set for April (March 18-April 12) and May (April 15-May 10). Although USDA has reviewed offers from the initial batch, this information has not been made public yet. In FY 2023, USDA enrolled 695,879 acres through continuous signup, a decrease from previous years. Contracts for 482,327 acres expire on September 30, with most enrolled via general signups. Currently, there are 24.7 million acres enrolled in the CRP.

— USDA allocates $124 million for rural energy and fertilizer projects. USDA unveiled plans to allocate an additional $124 million through grants and loans to enhance rural renewable energy adoption and domestic fertilizer production. Of this sum, $120 million will be distributed among 541 projects under the Rural Energy for America Program (REAP), while an additional $4 million will be granted to support equipment upgrades at three Midwest dry fertilizer plants through the Fertilizer Production Expansion Program (FPEP). Most of the funding for these initiatives will be drawn from allocations set aside under the 2022 Inflation Reduction Act (IRA).

— Syngenta, a Swiss agricultural chemicals company, has canceled its plans for a $9 billion initial public offering (IPO) on the Shanghai Stock Exchange. This decision comes amid challenging conditions in China's stock markets following a significant downturn. Syngenta cited the industry environment and its own development strategy as reasons for withdrawing its application. The company also mentioned exploring alternative funding sources. The IPO, which aimed to raise $9 billion by selling 20% of the company's shares, faced complications due to fragile investor confidence and increased regulatory scrutiny in China.

ChemChina, a state-owned enterprise, acquired Syngenta in a $44 billion deal in 2017.

— In March, France experienced a year-on-year increase in consumer prices of 2.4%, marking the first instance in two-and-a-half years that the figure has dropped below 3%. This signals a slowdown in inflation across the Eurozone, fueling expectations that the European Central Bank (ECB) may soon start decreasing interest rates. Francois Villeroy de Galhau, the governor of the Bank of France, hinted that a rate cut could be implemented as early as April.

— EPA postpones biogas regulatory webinar to address stakeholder questions. EPA postponed its public webinar on the Biogas Regulatory Reform Rule (BRRR) provisions of the Renewable Fuel Standard (RFS) from April 4 to April 12. This delay is attributed to the need to address additional questions from stakeholders that have arisen since the original announcement. The BRRR provisions cover aspects such as registration, reporting, and updated regulations concerning the production, distribution, and utilization of biogas as a renewable fuel. During the webinar, EPA intends to provide an overview of the implementation and timeline for the BRRR, explain the registration process for biogas and renewable natural gas producers, RNG Renewable Identification Number (RIN) separators, and other relevant aspects. Additionally, there will be a dedicated question and answer session to address inquiries from participants. The agenda for the webinar will be released approximately one week before the scheduled date.

— Fertilizer industry's price surge raises competition concerns; more data and analysis needed. In 2021 and 2022, the fertilizer industry saw record-high prices, sparking concerns among agricultural producers and policymakers regarding industry concentration and its impact on competition. According to a report (link) from the Agricultural and Food Policy Center at Texas A&M University, research indicates that increases in natural gas prices accounted for less than 20% of the rise in fertilizer prices for producers in 2022. Additionally, the report confirms previous findings that the U.S. fertilizer industry is moderately to highly concentrated. The report’s authors say that further analysis is required to refine these estimates and thoroughly assess the industry's market power. To conduct this research effectively, they note, additional data, including both price and volume information, is necessary. Congress has the option to mandate price reporting to acquire this data. Should Congress choose this approach, the authors say it may also want to consider ensuring that USDA contracts independent analysts to analyze the data.

— Groups sue FDA over ractopamine use in farm animals. Several organizations including the Animal Legal Defense Fund, Center for Biological Diversity, Center for Food Safety, and Food Animal Concerns Trust have filed a lawsuit against the U.S. Food and Drug Administration (FDA) demanding a response to their rulemaking petitions regarding the use of ractopamine in farm animals. Ractopamine is a feed additive approved for use in pigs and beef cattle in the U.S. but is banned in many international markets due to concerns about its effects on human health and the environment. The plaintiffs seek a substantive response to their petitions, which urge for the reduction or elimination of ractopamine in farmed animals. They argue that the FDA's failure to provide final decisions on these petitions violates the Administrative Procedure Act, which requires federal agencies to decide on rulemaking petitions within a reasonable period.

The groups cite evidence linking ractopamine to various health and environmental issues, including heart and respiratory problems in meat consumers and farm workers, increased risk of pathogen contagion, and environmental pollution through seepage and runoff into water sources.

Despite previous legal challenges to the approval of ractopamine, which were largely dismissed on procedural grounds, the organizations are pushing for action from the FDA to address what they see as significant risks associated with the use of this feed additive.

Some major U.S. pork producers, including Hormel Foods, Tyson Fresh Meats, JBS USA, and Smithfield Foods, have voluntarily stopped using ractopamine in pig diets, potentially to expand export opportunities to markets where the additive is banned.

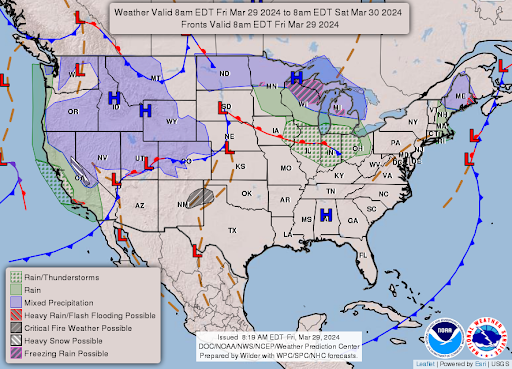

— NWS weather: Heavy snow over parts of the Sierra Nevada Mountains and the higher elevations of Wyoming, Colorado, Utah, and Northern Maine... ...Light to moderate snow over parts of the Upper Midwest... ...There is a Sight Risk of excessive rainfall over parts of Southern California on Friday and Saturday and Northern Maine on Friday.

|

KEY LINKS |

WASDE | Crop Production | USDA weekly reports | Crop Progress | Food prices | Farm income | Export Sales weekly | ERP dashboard | California phase-out of gas-powered vehicles | RFS | IRA: Biofuels | IRA: Ag | | Russia/Ukraine war, lessons learned | | SCOTUS on WOTUS | SCOTUS on Prop 12 pork | New farm bill primer | | Gov’t payments to farmers by program | Farmer working capital | USDA Ag Outlook Forum |