Fed Watcher: ‘Major Focus Needs to Be on Growth and Whether Growth Can Hold Up’

FOMC details | Hearing on China | Billions for microchips | Tax bill fate | Second minibus

|

Today’s Digital Newspaper |

MARKET FOCUS

- FOMC: What was announced and what it means

- Biden unveils $8.5 billion chip manufacturing investment in Arizona

- DOJ reportedly preparing to file antitrust lawsuit against Apple

- Bank of England maintains Bank Rate at 5.25%, highest level since 2008

- CBO's March 2024 Long-Term Budget Outlook warns of significant debt increase

- Gold prices surged above $2,200 per ounce on Thursday

- Ag markets today

- Ag trade update

- NWS weather outlook

- Pro Farmer First Thing Today items

CONGRESS

- House and Senate leaders release six-bill, 1,012-page second minibus package

- Senate Dems push House tax bill onto Senate calendar, facing GOP resistance

- House Speaker Johnson facing significant decisions on several fronts

ISRAEL/HAMAS CONFLICT

- Axios: House GOP weighs inviting Netanyahu to address Congress

- U.S. submits draft UN Security Council resolution calling for ceasefire in Gaza

RUSSIA & UKRAINE

- National security advisor assures U.S. aid passage in Kyiv visit

- EU decision to prolong free trade measures with Ukraine sparks discontent

PERSONNEL

- Norfolk Southern making significant efforts to secure John Orr as next COO

CHINA

- More China wheat cancellations confirmed in weekly USDA update

- China’s grain/soy imports to remain near record high despite cancellations

- China wants crushers to use more domestic soybeans

- Attaché expects steady China soybean imports in 2024-25

- China on track to be ready to invade Taiwan by 2027: Top U.S. admiral

TRADE POLICY

- House Ag hearing addresses concerns about China's purchases of U.S. farmland

ENERGY & CLIMATE CHANGE

- Granholm: LNG export study to finish sooner

- Biden administration finalizes strict emissions rules for cars, pushing EV transition

POLITICS & ELECTIONS

- Washington Post-University of Maryland poll: Hogan leads Maryland Senate race

|

MARKET FOCUS |

— Equities today: Asian and European stock indexes were mixed overnight. U.S. Dow opened around 130 points higher and is currently up over 200 points. In Asia, Japan +2%. Hong Kong +1.9%. China -0.1%. India +0.8%. In Europe, at midday, London +0.9%. Paris -0.3%. Frankfurt +0.3%.

U.S. equities yesterday: Stock indices moved between losses and gains ahead of the US Fed meeting conclusion, but then put up solid gains with markets taking note of Fed officials thinking that 3 rate cuts were likely to be appropriate this year, unchanged from their expectation in December. The Dow gained 401.37 points, 1.03%, at 39,512.13. The Nasdaq was up 202.62 points, 1.25%, 16,369.41. The S&P 500 rose 46.11 points, 0.89%, at 5,224.62. Markets clearly seized on 3 rate cuts same as Dec. not so much on what Powell said because he really didn't say anything different. The expectation had been they might scale back rate cuts.

— Department of Justice (DOJ) is reportedly preparing to file an antitrust lawsuit against Apple, potentially as early as this month, according to sources familiar with the matter. The lawsuit is expected to focus on Apple's core business model, particularly concerning the iPhone and its App Store ecosystem. It alleges that Apple engages in anticompetitive practices that disadvantage its tech rivals by creating barriers to competition and increasing costs for them. Representatives from Apple have reportedly met with officials from the DOJ's antitrust division to prevent litigation, but the discussions have not yielded an agreement, with significant differences between the two sides. While the exact timing of the lawsuit remains uncertain, Bloomberg previously reported that it could be filed as soon as Thursday. Apple and the Department of Justice have declined to comment on the matter. Following news of the potential lawsuit, Apple's shares experienced a 1.3% decline in aftermarket trading, after a 1.5% increase during regular trading hours. Overall, Apple's stock has seen a 7.2% decrease in value this year.

— Ag markets today: Soybeans posted followthrough buying to Wednesday’s strong gains during overnight trade, while corn and wheat mildly favored the upside. As of 7:30 a.m. ET, corn futures were trading 2 to 3 cents higher, soybeans were 5 to 7 cents higher, SRW wheat was 2 to 3 cents higher, HRW wheat was fractionally to a penny higher and HRS wheat was 4 to 7 cents higher. Front-month crude oil futures were around 50 cents lower, and the U.S. dollar index was down more than 300 points.

Limited cash cattle trade. Cash sources reported light cash cattle trade at steady prices in Kansas, though most feedlots in the Southern Plains passed on those bids in hopes of steady/firmer prices. Bids were relatively nonexistent in the northern market, where prices have moved premium to the Southern Plains. Northern feedlots are expecting fully firmer cash prices this week.

Cash hogs firm, pork cutout slips. The CME lean hog index is up another 39 cents to $83.21 as of March 19 and has now firmed $18.16 from the seasonal low posted at the beginning of the year. As of Wednesday’s close, the premium in April lean hog futures dropped to $2.09 to today’s cash quote.

— Agriculture markets yesterday:

- Corn: May corn fell 1/2 cent to $4.39 but ended near the session high.

- Soy complex: May soybeans rose 24 cents to $12.09 1/2. May soybean meal gained $8.60 to $342.50. May bean oil closed up 86 points at 49.00 cents today.

- Wheat: May SRW wheat closed 7 1/2 cents lower at $5.45, but finished in the upper trading range, while May HRW fell 2 1/4 cents to $5.80 1/2, ending near the session high. May spring wheat fell 3/4 cent to $6.55.

- Cotton: May cotton fell 116 points to 92.18 cents and nearer the session low.

- Cattle: Cattle futures slipped Wednesday, with the nearby April live cattle contract dipping 25 cents of $187.80. The expiring March feeder cattle contract dropped 42.5 cents to $250.25, while next-nearby April slid 15 cents to $254.925.

- Hogs: April lean hog futures lost 52.5 cents to $85.30, settling nearer session lows.

— Quotes of note:

- Sevens Report on FOMC actions: “If there was a ‘beneath the surface’ takeaway from the Fed, it’s that the major focus for investors right now needs to be on growth and specifically whether growth can hold up. There were some small hints that Powell and the Fed may be a bit more worried on growth than the market currently expects but the bottom line is that the market is not getting more than three rate cuts in 2024 unless growth rolls over and at that point, it’s too late anyway. That matters because it implies that rates are indeed going to be mostly higher for longer and higher rates will continue to act as a headwind on growth. Put differently, the relief from high rates that investors keyed on during the Q4 rally is not coming. Yes, there will be two-to-three cuts barring a growth roll over but we’re still going to exit 2024 with fed funds over 4.5%... Bottom line, with Fed policy known and major relief on rates not coming in 2024, we must focus on growth and make sure we see, as early as possible, any evidence of a rollover because if that happens, it’s a major problem for this market.”

- Chipping away. “We can’t just design chips, we have to make them in America.” — U.S. Commerce Secretary Gina Raimondo.

- “There is increasing evidence that PRC drone manufacturers are selling dual-use [unmanned aerial vehicles] to Russia in a way that actively supports Russia’s illegal invasion of Ukraine.” — A bipartisan group of U.S. lawmakers in a letter to the Biden administration, calling for several measures to be taken to counter China's drone industry.

— During its March meeting, the Bank of England opted to maintain the Bank Rate at 5.25%, the highest level since 2008. This decision was made as policymakers awaited clearer indications that the country's persistent inflationary pressures had eased. The Monetary Policy Committee voted 8-1 in favor of keeping rates unchanged, with one member advocating for a 25-basis point decrease.

Contrary to market expectations, the decision deviated slightly, with projections anticipating a 7-2 vote and one member advocating for a rate cut while another favored a hike. The announcement followed the release of data indicating that the country's Consumer Price Index (CPI) had decreased to 3.4%, its lowest level in almost two-and-a-half years.

Governor Bailey expressed optimism about Britain's economic trajectory, suggesting favorable conditions for the central bank to begin reducing interest rates. However, he emphasized the need for greater certainty regarding the economy's ability to manage price pressures effectively.

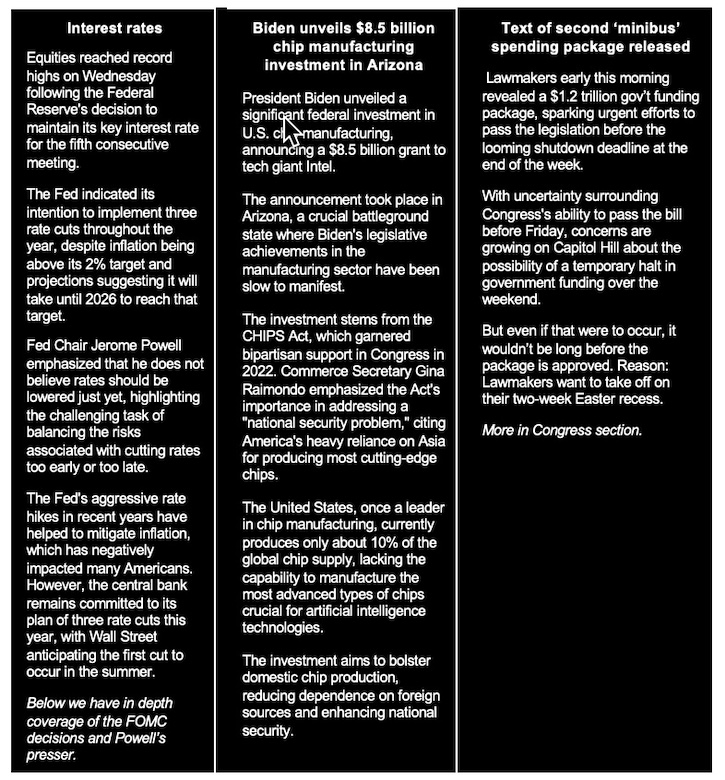

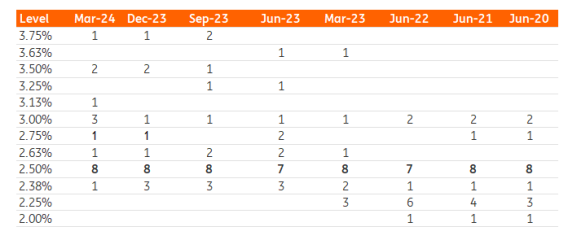

— Federal Reserve still anticipates three interest-rate cuts this year, maintaining its lower-rate outlook despite recent economic growth and higher-than-expected inflation. The central bank's projections show a steady plan for rate reductions. Central bankers unanimously left the benchmark interest rate steady at between 5.25% and 5.5%, as was widely expected.

The Fed’s dot plot showed that a growing number of officials were coalescing around the view that rates would end 2024 at 4.5% to 4.75%, equivalent to three 25 quarter-point cuts, in line with December’s dot plot. However, fewer committee members are anticipating more than three cuts. In December, five officials expected four or more quarter-point cuts in 2024. This time round, just one member did. Nine officials now expect three cuts, compared with six in December. The number expecting two remained the same, at five.

The Fed now thinks core inflation will end the year higher — and unemployment slightly lower — than it predicted in December. It also sharply upgraded its gross domestic product projections for 2024.

The FOMC expects the U.S. economy to expand by 2.1% between the final quarter of 2023 and the closing three months of this year, compared with December’s estimate of 1.4%.

They also predict inflation will end the year at 2.4% — in line with previous estimates — and won’t hit the Fed’s 2% target until 2026, while unemployment will edge up to 4% from 3.9%.

The Committee reaffirmed its ongoing pace of balance sheet runoff, commonly referred to as quantitative tightening (QT), but Chair Powell's comments in the post-meeting press conference suggested that changes are coming. Powell stated that it is the Committee's view that it would be appropriate to slow the pace of asset runoff "fairly soon."

Says Wells Fargo: “While risks to the FOMC beginning to cut the fed funds rate skew toward later in the year, balance sheet normalization looks likely to occur somewhat earlier. In light of Powell's comments at Wednesday’s press conference, we think an announcement to slow the pace of quantitative tightening is coming at the May 1 meeting, although we would not be surprised if it slipped to the following meeting on June 12.

The next key macro report will be the core PCE deflator on March 29 (Good Friday, market conditions will be thin).

Market impacts: CME Fed funds futures put odds for a steady rate decision at the May 1 meeting at over 90%, with odds for a 25-basis-point trim at the June 12 meeting now up to 65% after hovering at just over 50% ahead of the Fed meeting. Probabilities for a steady rate call in June are around 25%.

Bottom line: Powell heavily focused on the inflation data and suggested strong employment growth would not be enough to see the Fed delaying rate cuts. Verdict: A dovish Powell.

|

Key comments from Fed Chairman Jerome Powell

|

— CBO's March 2024 Long-Term Budget Outlook warns of significant debt increase and escalating deficits over the next 30 years. The Congressional Budget Office (CBO) has released its March 2024 Long-Term Budget Outlook, projecting the nation's fiscal and economic trajectory over the next thirty years. The report forecasts a significant increase in federal debt held by the public, reaching 166% of Gross Domestic Product (GDP) by the end of 2054, more than double pre-pandemic levels.

Under this outlook, deficits are expected to escalate rapidly over time, with the budget deficit projected to grow from 5.6% of GDP in fiscal year (FY) 2024 to 8.5% of GDP ($7.3 trillion) in 2054. This represents over two times the historical average of 3.7% of GDP.

The persistent gap between spending and revenue is cited as the primary driver of the projected debt and deficits. Spending is expected to rise significantly, particularly in areas such as Social Security, healthcare, and interest costs, growing from 23.1% of GDP in FY 2024 to 27.3% in 2054. Meanwhile, revenue growth is projected to be more gradual, increasing from 17.5% of GDP to 18.8% over the same period.

CBO also warns of the exhaustion of reserves in four major federal trust funds over the next three decades, including the Highway Trust Fund, Social Security, and Medicare. This depletion of reserves poses additional challenges to the long-term fiscal outlook.

Of note: CBO's projections are based on current law assumptions, which include the phasing out or expiration of certain tax and spending provisions. However, alternative scenarios could result in even faster debt growth.

Rising debt levels carry various risks and threats to the budget and economy, including slower income growth, increased interest payments, upward pressure on interest rates, limited fiscal space for emergencies, and a burden on future generations.

Market perspectives:

— Outside markets: The U.S. dollar index was firmer, with the euro, yen, and British pound all firmer against the greenback. The yield on the 10-year U.S. Treasury note was weaker, trading around 4.23%, with a mixed tone in global government bond yields. Crude oil futures moved lower, with US crude around $81 and Brent around $85.60 per barrel. Gold and silver were sharply higher, with gold around $2,210 per troy ounce (see next item) and silver around $25.65 per troy ounce.

— Gold prices surged above $2,200 per ounce on Thursday, building upon gains from the previous session and reaching unprecedented levels. This surge came as the U.S. Federal Reserve affirmed its projection for three interest rate cuts throughout the year. In its March meeting, the central bank opted to maintain interest rates at their current levels, a decision widely anticipated by the market. Furthermore, the Fed reiterated its intention for three rate reductions in the year, although it anticipates one fewer cut in 2025. Earlier in the week, the People’s Bank of China chose to keep its one- and five-year loan prime rates steady at 3.45% and 3.95%, respectively. Concurrently, the Bank of Japan made significant policy shifts by discontinuing its negative rate policy and ceasing yield curve controls on Tuesday. Meanwhile, the Reserve Bank of Australia opted to maintain its current interest rates. With these developments in mind, investors are now focusing on the decision by the Bank of England that kept its rate unchanged (see related item for details).

— Ag trade update: Japan purchased 119,345 MT of milling wheat via its weekly tender, including 65,375 MT U.S., 24,790 MT Canadian and 29,180 MT Australian. Egypt purchased 110,000 MT of wheat – 50,000 MT Bulgarian and 60,000 MT Romanian.

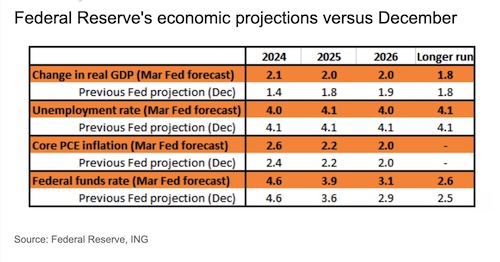

— NWS weather outlook: Gusty winds and snow showers linger across Maine today as the next winter storm approaches northern New England by Saturday... ...Swath of light to moderate snow spreads from the northern Plains to the Great Lakes by Friday; strong winter storm expected this weekend... ...Thunderstorms and heavy rain return to the Gulf Coast today before unsettled weather shifts to the Southeast and Mid-Atlantic.

Items in Pro Farmer's First Thing Today include:

• Grains mostly firmer overnight

• PBOC official says China has room to further cut RRR

• Eurozone business activity close to stabilizing in March

|

CONGRESS |

— House and Senate leaders released the six-bill, 1,012-page second minibus package just before 3 a.m. ET. They are now “rushing” to get a floor vote in the House Friday (Speaker Mike Johnson is waiving the 72-hour rule to avert a shutdown), followed by a Senate vote to avoid a partial gov’t shutdown at midnight Friday. Democrats got a win via 12,000 Special Immigrant Visas for Afghans who helped the United States during the long war in that embattled country, as well as more money for childcare. Republicans are touting language saving gas stoves, increasing the number of ICE detention beds, more border patrol agents, cuts to foreign aid and preventing the State Department from flying non-sanctioned flags at U.S. diplomatic compounds.

Links: Spending text | Summary via House Appropriations Dems | Summary via House GOP

— Senate Dems push House tax bill onto Senate calendar, facing GOP resistance. Senate Democrats, led by Senator Chris Van Hollen (D-Md.), initiated a procedure (Rule 14) to place the House-approved tax bill on the Senate's calendar. This move could streamline the process for a floor vote on the legislation. However, simply adding the bill to the calendar does not guarantee a vote. Senate Majority Leader Chuck Schumer (D-N.Y.) would have the opportunity to prompt a procedural vote on the bill, likely after the Senate's scheduled two-week recess.

Senate Republicans remain opposed to the bipartisan tax package, with resistance growing stronger, which presents obstacles for the bill's passage. The Senate Finance Committee’s top Republican, Sen. Mike Crapo of Idaho, told his fellow Republicans that he doesn’t want to pass a tax bill this year.

Senate Finance Chair Ron Wyden (D-Ore.) disclosed that Republicans proposed changes to the legislation that would have effectively killed it, referred to as "poison pills." In response, Democrats offered to address concerns about the child tax credit "lookback" provision, a key issue for Senate Republicans. Senate Minority Whip John Thune (R-S.D.) noted that despite discussions among Republicans about potential adjustments to the bill, much of the GOP remains against the $78 billion package of business and child tax breaks.

Bottom line: Wyden and Crapo both rejected each other’s proposals last week. Unless there is an unexpected negotiating development, this legislative proposal appears dead for this Congress.

— House Speaker Johnson facing significant decisions on several fronts. Some key issues ahead of House Speaker Mike Johnson (R-La.):

- Foreign aid: Firstly, he is focused on facilitating the consideration of foreign aid to Ukraine, Israel, and Taiwan in the House. While options such as moving the bills separately or converting them into loans have been considered, Johnson must navigate this issue carefully, especially considering the Senate's passage of its bill with strong bipartisan support. Pressure is mounting from backers of Ukraine and Israel, with two discharge petitions already in motion, requiring Johnson to act decisively.

- FISA: The federal government's surveillance authority under the Foreign Intelligence Surveillance Act (FISA) is set to expire in April. Johnson has been attempting to mediate between conflicting factions within the GOP to craft a compromise FISA bill.

- Fundraising: Johnson faces challenges in fundraising for the National Republican Congressional Committee (NRCC). With the DCCC significantly outpacing the NRCC in fundraising, Johnson's campaign committee must work to bridge this gap and secure necessary financial support.

|

ISRAEL/HAMAS CONFLICT |

— Axios: House GOP weighs inviting Netanyahu to address Congress. An address to Congress would give the Israeli leader a high-profile chance to respond to criticism from Democrats including Sen. Chuck Schumer (D-N.Y.) over his handling of the war in Gaza, according to Axios.

— U.S. submitted a draft UN Security Council resolution calling for a ceasefire in Gaza. The pause would be “linked to the release of hostages”, said Antony Blinken, America’s secretary of state. America has vetoed previous Security Council resolutions urging a ceasefire.

|

RUSSIA/UKRAINE |

— National security advisor assures U.S. aid passage in Kyiv visit. Jake Sullivan, the National Security Advisor, made an unexpected visit to Kyiv, Ukraine, where he assured reporters that the U.S. House of Representatives would pass a $60 billion aid package for Ukraine. He expressed confidence in achieving this plan and emphasized that there was no need to consider alternative options.

Sullivan's visit aimed to reassure Ukraine about the status of U.S. aid, which has faced delays. House Speaker Mike Johnson has refused to act on a $95 billion aid package passed by the Senate, which includes support for Ukraine, Taiwan, and Israel.

The White House recently announced $300 million in military assistance for Ukraine, but Sullivan highlighted the urgency of addressing the aid delays.

Sen. Lindsey Graham (R-S.C.) also visited Kyiv and suggested that former President Donald Trump's proposal of providing aid as a no-interest waivable loan might be the most feasible option moving forward.

— European Union's decision to prolong free trade measures with Ukraine has sparked discontent among grain producers across Europe, from Poland to France. The provisional agreement reached on Wednesday entails the suspension of duties and quotas for an additional year, enabling Ukraine to maintain its wheat sales in the EU's single market of 27 countries. This discontent poses a dilemma for politicians, who must navigate domestic priorities while demonstrating support for Kyiv, particularly with European elections looming in June.

|

PERSONNEL |

— Norfolk Southern is making significant efforts to secure John Orr as its next Chief Operations Officer (COO), evident by the substantial steps they are taking, the Wall Street Journal reports (link). The freight railroad is willing to pay a one-time fee of $25 million to rival Canadian Pacific Kansas City to waive Orr's non-competition agreement, indicating the high value they place on his appointment. This move underscores Orr's crucial role in addressing Norfolk Southern's operational challenges, especially amidst a brewing battle for control of the company.

Norfolk Southern is currently facing pressure from activist investor Ancora Holdings, which aims to remove the company's board and top executives. Ancora Holdings asserts that Norfolk Southern's operations are inefficient and that it has failed to meet financial targets. In response, Norfolk Southern contends that Ancora's proposed changes would harm the company's long-term value.

John Orr brings considerable experience to the table as a seasoned rail industry professional. He previously served as the Chief Transformation Officer at Canadian Pacific Kansas City, where he played a key role in revitalizing the railroad's operations in Mexico. Norfolk Southern is banking on Orr's expertise to help navigate their operational challenges and drive improvements.

|

CHINA UPDATE |

— More China wheat cancellations confirmed in weekly USDA update. USDA weekly Export Sales figures for the week ended March 14 included confirmation of additional sales of U.S. wheat to China that had been announced via the daily export sales reporting system. Activity for China for 2023-24 included net reductions of 262,738 metric tons, net reductions of 228 metric tons of sorghum, net sales of 304,447 metric tons of soybeans, and 2,194 running bales of upland cotton. For 2024, activity included net sales of 2,111 metric tons of beef and 1,319 metric tons of pork.

— China’s grain/soy imports to remain near record high despite cancellations. China’s grain and oilseed imports will remain near record highs this year despite a recent spate of cancellations as lower global prices and a domestic output shortfall prompt purchases. China recently canceled a combined 1.5 MMT of Australian and U.S. wheat purchases, raising concerns about reduced demand. But traders told Reuters the cancellations will not impact overall demand as lower wheat prices will spur buying, along with more government funds allocated to boost grain and oilseed stockpiles.

— China wants crushers to use more domestic soybeans. China may ask its soybean crushers to prioritize local supplies as it seeks to reduce the reliance on imports. Beijing is discussing plans for some crushers to process specific amounts of domestic beans this year, people familiar with the matter told Bloomberg (link). However, the plan isn’t yet finalized and might still change, said the people. China has increased its domestic soybean production in recent years but still imports more than 80% of its consumption needs.

— Attaché expects steady China soybean imports in 2024-25. USDA’s attaché in China projects the country will import 103 MMT of soybeans in 2024-25, unchanged from its forecast for the current marketing year, though 2 MMT less than the official forecast for 2023-24 in the March WASDE Report. The attaché noted, “Increased soybean meal inclusion rates due to competitive prices, stable demand in the poultry sector and growing demand in aquaculture is expected to offset weaker demand in the swine sector due to forecast declining production in 2023-24 and 2024-25.”

— China on track to be ready to invade Taiwan by 2027: Top U.S. admiral. China is building its military and nuclear arsenal on a scale not seen since World War II and all signs suggest it’s sticking to ambitions to be ready to invade Taiwan by 2027, a top U.S. admiral testified. Link to details via Bloomberg.

|

TRADE POLICY |

— House Ag Committee held a hearing Wednesday addressing concerns about China's purchases of U.S. farmland, with both Democrats and Republicans expressing worry about potential threats to national security. Although there was no consensus on how to address the issue, measures have been taken, such as including provisions in a fiscal 2024 spending bill to better track foreign purchases of agricultural land, particularly those from China, Russia, North Korea, and Iran.

Concerns were raised about the risks posed by such purchases near military installations. Despite bipartisan agreement on the issue, there were differences in approach, with Republicans emphasizing the need to protect U.S. interests while Democrats cautioned against overreaction that could lead to discrimination.

A warning issued. Nova Daly, former deputy assistant secretary for investment security at the Treasury Department under President George W. Bush, warned lawmakers that farmland purchases near U.S. military installations “present clear and pressing risks to US national security.” Improved tracking of such foreign purchases under the fiscal 2024 spending measure was a good first step, Daly said, highlighting provisions adding the agriculture secretary to the Committee on Foreign Investment in the United States, an interagency panel tracking foreign transactions. But Congress should strengthen those provisions to give that foreign investment committee more tools to prioritize “time sensitive” purchases where they pose significant national security concerns, he testified at the committee hearing.

Foreign investors held interest in more than 43.4 million acres of US agricultural land in 2022, according to USDA — up 3.4 million acres from the year before. China accounts for a very small portion of those reported purchases — about 1% of foreign-owned land — but such figures “should be interpreted as a minimum,” USDA said, because purchasing records only detail the primary investor.

South Dakota Gov. Kristi Noem told the panel to be vigilant about Chinese ownership of farmland in the U.S. “Over the years, I have witnessed this hostile communist country work to systematically take over more of America’s vital food supply chain,” said Noem, a Republican who has signed into law strict restrictions on select foreign entities buying farmland in her state. Noem said that she is unsure if China owns farmland in her state — in part due to a lack of reporting. According to federal records, there are no Chinese-owned lands in South Dakota, but there is a Chinese-owned meatpacking plant in Sioux Falls.

House Ag Chairman G.T. Thompson (R-Pa.) said, “These last few years have seen China steal U.S. intellectual property, hack critical cybersecurity and related infrastructure, weaponize agricultural trade, and acquire American farmland at an alarming rate. Each of these disrupt our national security, our rural communities and our resiliency.”

Supply chain offshored. The U.S. also is increasingly vulnerable to what former U.S. Ambassador to the UN Agencies for Food and Agriculture Kip Tom said has been a gradual offshoring of key agriculture tools including pesticides and crop nutrients. Nearly 40% of the world’s phosphate and 28% of global nitrogen is produced in China, Tom said, a market that continues to grow.

The debate also touched on the broader implications for trade relations with China and the potential impact on U.S. agriculture. However, there are concerns within the agriculture industry about the potential for a trade war and the negative impact it could have on exports, particularly soybeans.

Josh Gackle, President of the American Soybean Association (ASA), emphasized the importance of maintaining economic ties with China while addressing geopolitical concerns. Soybeans are a significant U.S. export, with China being the largest market. Gackle highlighted the devastating effects of tariffs imposed during the trade war, which led to a sharp decline in soybean exports to China and significant financial losses for farmers. Despite the resumption of shipments through tariff exclusions, uncertainties remain, posing risks to farmers and exporters. Gackle urged policymakers to protect market access in China and pursue measures to support U.S. agriculture, including maintaining China's Permanent Normal Trade Relations (PNTR) status, passing a comprehensive farm bill, and engaging in negotiations for free trade agreements. He emphasized the importance of certainty for soybean growers amid ongoing geopolitical issues and trade uncertainties.

Background. The Senate last year added an amendment in an annual defense measure to curb farmland purchases by China, Iran, North Korea and Russia. The top Democrat on the committee, Rep. David Scott of Georgia, said he was concerned about some of the rhetoric toward China, and urged committee members to focus on policy. “Some of the rhetoric surrounding this topic may derail us from tackling the real issues at hand and may contribute to violence against Asian Americans,” Scott said in his opening statement.

Scott asked Noem her opinion on the trade tariff proposal from former President Donald Trump, the presumptive GOP nominee in the presidential election, to levy a 60% tariff on imports from China. Scott said that farmers would be the ones to “face the potential consequences.” Noem did not say whether she agreed with that proposal, but said “that is a proposal that people are still looking at and having conversations about.” Noem attended a rally with Trump last weekend in Ohio, and is considered a potential running mate for the former president.

Democratic Rep. Elissa Slotkin of Michigan said it’s important to make distinctions when it comes to foreign entities making major purchases in the U.S. She said in her state, the biggest foreign land purchasers are Canada and the Netherlands. “I’m not real stressed about the Canadians buying land in the state of Michigan,” she said. Slotkin said Congress should not just think about foreign transactions when it comes to farmland but to other infrastructure sites such as manufacturing. “If you have a company coming in to do a huge purchase of our infrastructure like hog slaughter, you should be putting that through that same intelligence community process to help us understand if that’s a strategic threat to us,” she said.

Ag sector next China target? GOP Rep. Mike Gallagher of Wisconsin, who chairs the Select Committee on the Chinese Communist Party, said he believes the agriculture sector is China’s next target. “The CCP’s acquisition of land in the United States, its investments in U.S. agricultural technology, and its collection of U.S. farm data and trade secrets represent offensive maneuvers designed to degrade U.S. preparedness and competitiveness,” he said.

|

ENERGY & CLIMATE CHANGE |

— Granholm: LNG export study to finish sooner. Energy Secretary Jennifer Granholm announced that the Biden administration's study on liquefied natural gas (LNG) exports will be completed much sooner than previous analyses. Granholm expressed confidence that the study will be concluded "close to this calendar year." Her statement came in response to a question from Rep. Julia Letlow (R-La.) during testimony before a House Appropriations Committee subcommittee. Granholm's assurance suggests an accelerated timeline for the completion of the LNG export study.

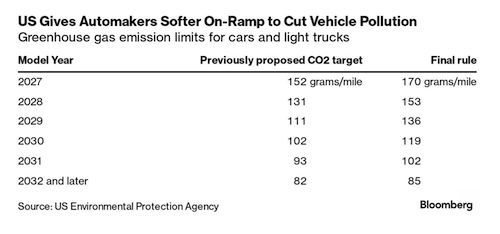

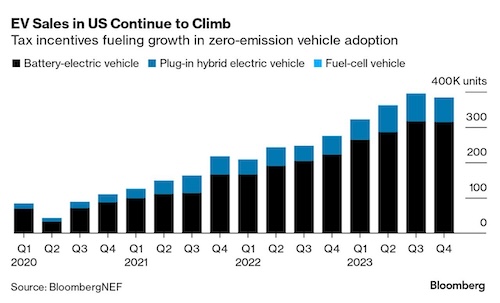

— Biden administration finalizes strict emissions rules for cars, pushing EV transition. The Biden administration implemented stringent emissions limits for passenger cars and light trucks, aiming to accelerate the transition to electric vehicles (EVs). The Environmental Protection Agency (EPA) finalized regulations requiring automakers to increase EV sales while reducing carbon emissions from gasoline-powered vehicles. Link to rule.

Notably, the rule offers flexibility for automakers, delaying stricter EV requirements until after 2030 to address concerns from labor unions. The new rules apply to light-duty vehicles — cars, sport-utility vehicles and most pickup trucks — for model years 2027 through 2032. For model-year 2032, though, the EPA stuck to the endpoint it originally proposed, which requires that carbon emissions from new vehicles be cut nearly in half from those that went on sale in 2026.

The new rule allows manufacturers to include hybrid EVs and plug-in hybrids for meeting the requirements, in addition to battery powered EVs.

EPA estimates that the rule will prevent billions of metric tons of carbon emissions and save thousands of lives annually from reduced air pollution. To hit the targets for model-year 2030, for example, an estimated 31% to 44% of new light-vehicle sales would need to be electric, rather than the 60% mark originally proposed. The total percentage would depend on the level of tailpipe pollutants from the rest of the vehicles sold, which would be a combination of gas-electric hybrids and traditional gas- or diesel-powered vehicles.

Despite anticipated legal challenges from Republican-led states and fossil fuel companies, industry groups have generally welcomed the delayed EV targets.

Of note: U.S. EV sales have slowed, prompting some automakers to adjust their production plans.

EPA's decision follows contentious negotiations with the United Auto Workers (UAW) over potential impacts on jobs in the auto industry. California regulators have also struck a deal with automaker Stellantis to comply with the state's EV sales requirements. While the fossil fuel industry opposes the new regulations, proponents see them as crucial for combating climate change and promoting cleaner transportation options.

Reaction: Toyota Motor, the world’s largest automaker and No. 2 U.S. seller behind General Motors, called the rules “aggressive,” adding that it will comply with regulations. “Serious challenges around affordability, charging infrastructure and supply chain will need to be addressed before this mandate is realized,” the Japanese car company said in a statement.

Automakers that can’t meet the emissions targets can buy credits from those that are in compliance. Under EPA rules, if credits aren’t available for purchase, car companies could be forced to reduce sales of gas-powered vehicles.

Up next: In the next few weeks, the Department of Transportation is expected to finalize new emissions standards for heavy-duty vehicles such as buses and freight-carrying trucks.

Bottom line: The EPA measure is one of several rules governing vehicle pollution and fuel economy. Automakers also must hit fuel-economy requirements established by the Transportation Department, with EVs getting credit based on a just-updated Energy Department formula.

|

POLITICS & ELECTIONS |

— Washington Post-University of Maryland poll: Hogan leads Maryland Senate race, Trone ahead in Democratic primary. The Washington Post-University of Maryland poll reveals that former Maryland Governor Larry Hogan leads both Democratic contenders in the Maryland Senate race. While Hogan enjoys a double-digit lead over potential Democratic rivals, the primary contest among Democrats remains tight. Rep. David Trone leads slightly ahead of Prince George’s County Executive Angela Alsobrooks, with a significant portion of voters undecided.

The poll suggests that Maryland voters prefer Democratic control of the Senate by a 20-point margin, despite Hogan's lead in the race. Trone leads the Democratic primary race, but many voters remain undecided. Hogan's entry into the race has shifted the dynamics, prompting Democrats to emphasize the importance of maintaining Democratic control of the Senate.

Despite Hogan's popularity and bipartisan appeal, Trone and Alsobrooks still have significant portions of voters unfamiliar with them. The primary remains open, with neither candidate having secured a clear advantage.

The poll highlights Hogan's favorable perception among voters, especially compared to Trone and Alsobrooks. However, the race's outcome remains uncertain, with Democrats yet to rally behind a single nominee.

The poll's findings suggest a complex political landscape in Maryland, with voters weighing various factors, including party affiliation and candidates' track records. The primary will likely play a crucial role in determining the eventual Senate nominee and could impact the broader political dynamics leading up to the general election.

|

KEY LINKS |

WASDE | Crop Production | USDA weekly reports | Crop Progress | Food prices | Farm income | Export Sales weekly | ERP dashboard | California phase-out of gas-powered vehicles | RFS | IRA: Biofuels | IRA: Ag | | Russia/Ukraine war, lessons learned | | SCOTUS on WOTUS | SCOTUS on Prop 12 pork | New farm bill primer | | Gov’t payments to farmers by program | Farmer working capital | USDA Ag Outlook Forum |